Key Insights

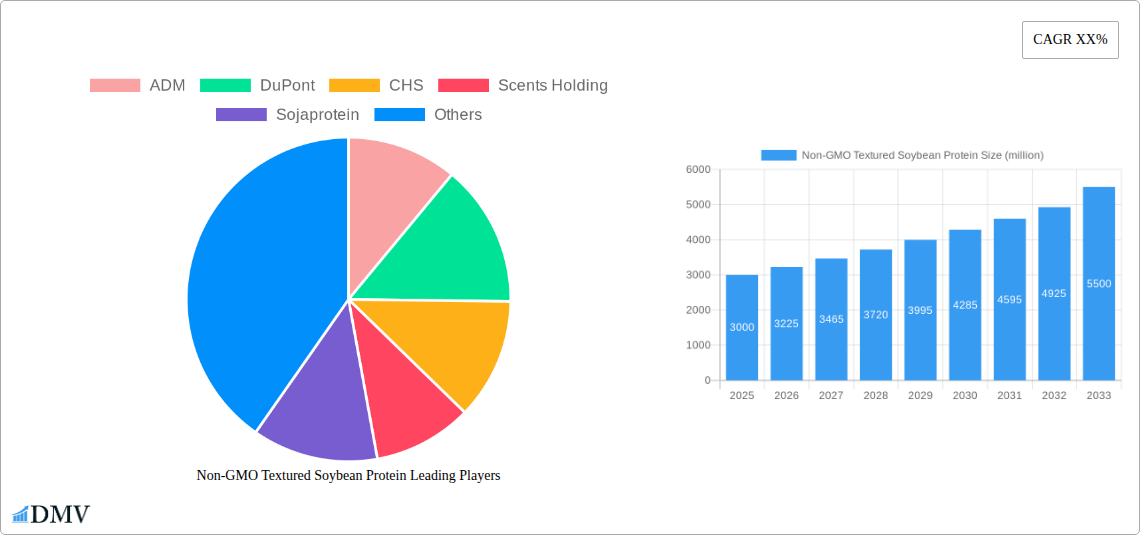

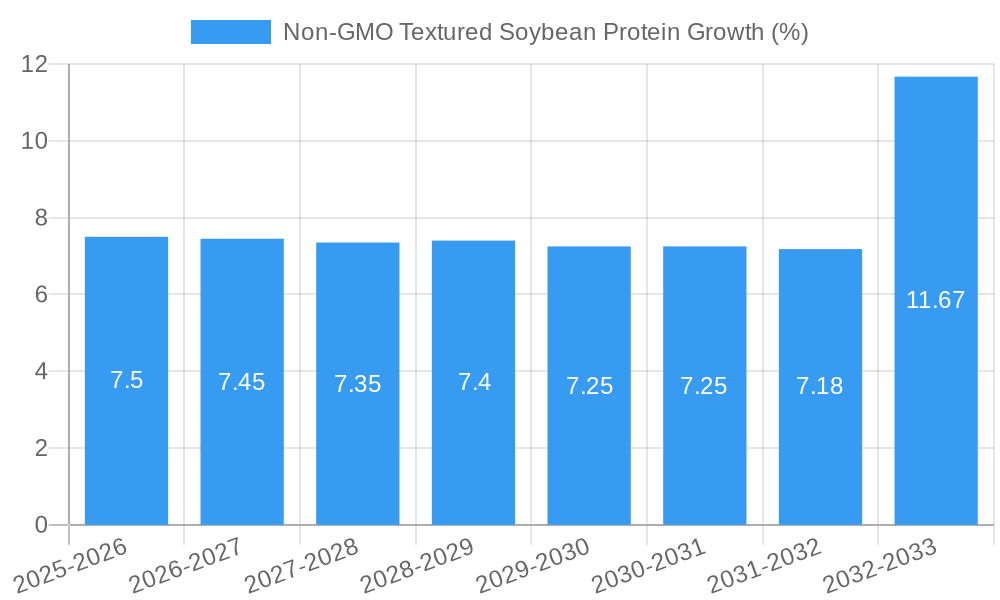

The global Non-GMO Textured Soybean Protein market is poised for substantial growth, projected to reach approximately $5,500 million by 2033, driven by a robust Compound Annual Growth Rate (CAGR) of around 7.5%. This expansion is largely fueled by increasing consumer demand for plant-based protein alternatives, stemming from health consciousness, ethical concerns regarding animal agriculture, and environmental sustainability. The "Drivers" section highlights key factors propelling this market, including the growing popularity of vegetarian and vegan diets, the perceived health benefits associated with soy protein (such as heart health and muscle building), and the versatility of textured soybean protein in various food applications. Furthermore, advancements in processing technologies are enhancing the texture, flavor, and functionality of soy protein, making it a more attractive substitute for traditional meat products. The market is segmented into various applications, with "Ground Meat and Poultry" and "Formed Meat Products" dominating due to their direct replacement of animal-based ingredients in popular food items like burgers, sausages, and plant-based patties. The "Vegetarian and Analogs" segment also shows significant traction as manufacturers increasingly incorporate non-GMO textured soy protein into a wider range of meat-free products.

The market's trajectory is further shaped by prevailing trends and certain restraints. Key trends include the rising demand for clean-label products, leading manufacturers to prioritize non-GMO and minimally processed ingredients, and the increasing innovation in product development, leading to novel applications beyond traditional meat substitutes, such as in nutrition bars, cereals, and snacks. The "Types" segmentation, differentiating between Textured Soybean Protein Flour and Concentrate, indicates a growing preference for concentrates due to their higher protein content and improved functional properties. However, the market faces restraints such as fluctuating raw material prices, consumer perception issues related to soy allergies or perceived processing, and regulatory hurdles in certain regions. Despite these challenges, the strong underlying demand for sustainable and healthy protein sources, coupled with ongoing product innovation and increasing global acceptance of plant-based diets, indicates a promising future for the Non-GMO Textured Soybean Protein market. Leading companies like Cargill, ADM, and DuPont are actively investing in research and development and expanding their production capacities to cater to this burgeoning global demand.

Unlock the Future of Plant-Based Proteins: Comprehensive Non-GMO Textured Soybean Protein Market Report

This in-depth market research report provides a definitive analysis of the global Non-GMO Textured Soybean Protein market, meticulously examining trends, opportunities, and growth drivers from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this report offers critical insights for stakeholders looking to navigate the evolving landscape of sustainable and health-conscious food ingredients. Explore market concentration, innovation, and the dynamic shifts influencing demand for this versatile plant-based protein.

Non-GMO Textured Soybean Protein Market Composition & Trends

The global Non-GMO Textured Soybean Protein market is characterized by moderate concentration, with key players like ADM, DuPont, and Cargill holding significant market share. Innovation in processing technologies and product development continues to be a primary catalyst, driving the expansion of applications beyond traditional meat analogs. The regulatory landscape, particularly concerning non-GMO labeling and sustainability certifications, plays a crucial role in shaping market entry and consumer trust. Substitute products, including pea protein and other plant-based isolates, present a competitive challenge, but the established functionality and cost-effectiveness of textured soybean protein maintain its strong market position. End-user profiles are increasingly diverse, encompassing not only vegetarian and vegan consumers but also flexitarians and health-conscious individuals seeking to reduce meat consumption without compromising on protein intake or culinary experience. Mergers and acquisitions (M&A) activities are expected to shape market consolidation, with past deals valued in the hundreds of millions of dollars.

- Market Share Distribution: The top five players collectively hold approximately 60% of the global market share.

- Innovation Catalysts: Focus on improved texture, flavor profiles, and enhanced nutritional fortification.

- Regulatory Landscapes: Increasing demand for clear non-GMO labeling and sustainable sourcing practices.

- Substitute Products: Competition from pea protein, fava bean protein, and other emerging plant-based sources.

- End-User Profiles: Growing adoption by flexitarians, health-conscious consumers, and the food service industry.

- M&A Activities: Strategic acquisitions aimed at expanding product portfolios and market reach, with an estimated cumulative deal value of over $200 million historically.

Non-GMO Textured Soybean Protein Industry Evolution

The Non-GMO Textured Soybean Protein industry has witnessed remarkable evolution, driven by a confluence of escalating consumer demand for plant-based alternatives, significant technological advancements, and a growing awareness of environmental sustainability. The historical period from 2019 to 2024 saw consistent market growth, averaging an annual rate of approximately 8% as awareness and acceptance of meat alternatives surged. This trajectory is projected to continue, with the forecast period from 2025 to 2033 anticipating a compound annual growth rate (CAGR) of over 9%. This sustained expansion is fueled by innovation in extrusion technologies, which allow for the creation of diverse textures and forms of textured soybean protein (TSP), closely mimicking the mouthfeel of traditional animal proteins. Furthermore, advancements in ingredient processing have led to improved flavor profiles, addressing a key concern for many consumers. The shift in consumer demand is not merely a trend but a fundamental change in dietary habits, with a growing segment of the population actively seeking to reduce their consumption of animal products for health, ethical, and environmental reasons. This paradigm shift has propelled the demand for plant-based proteins like non-GMO TSP as a versatile and nutritious staple. The base year of 2025 marks a significant point, with market revenues estimated to reach $3.5 billion globally, a testament to its increasing adoption across various food categories. The estimated year of 2025 reinforces this upward trend, with projections indicating continued strong performance. The market's evolution is further shaped by the increasing focus on clean labels and transparent sourcing, with non-GMO certification becoming a critical differentiator and a driving factor for consumer preference, ensuring trust and confidence in the product's origin and processing.

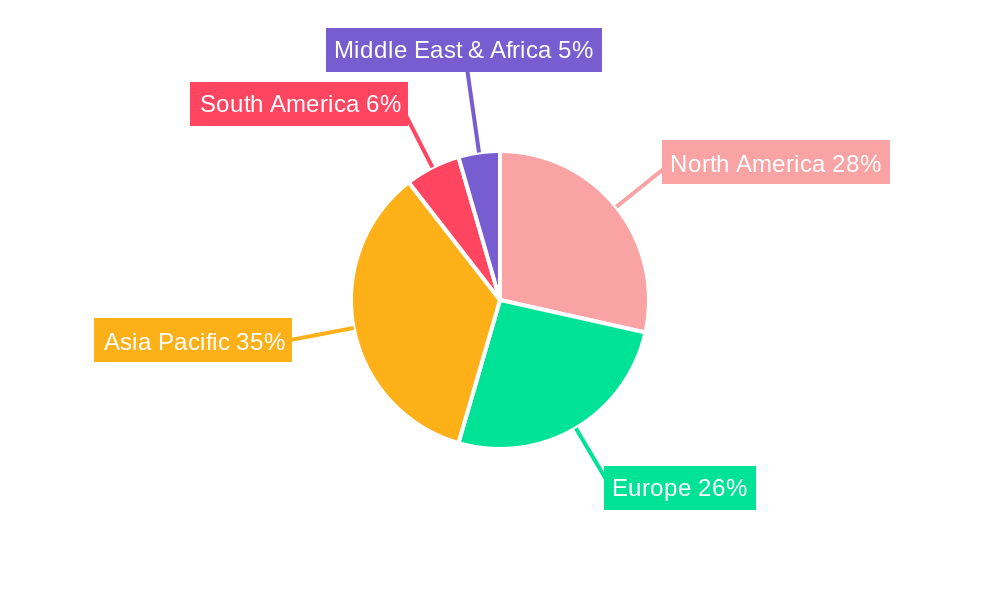

Leading Regions, Countries, or Segments in Non-GMO Textured Soybean Protein

The Non-GMO Textured Soybean Protein market exhibits regional and segmental dominance driven by distinct consumer preferences, regulatory frameworks, and the presence of key industry players. North America, particularly the United States, stands out as a leading region due to its well-established food processing infrastructure, high consumer receptiveness to plant-based diets, and robust demand for protein-rich ingredients. The country’s significant meat consumption per capita also translates to a large market for meat alternatives.

Key Drivers of Dominance in North America:

- Investment Trends: Substantial investments by major food companies and ingredient manufacturers in R&D and production capacity.

- Regulatory Support: Favorable non-GMO labeling regulations and growing support for sustainable agriculture.

- Consumer Acceptance: High consumer awareness and adoption rates for plant-based diets and meat analogs.

- Food Service Innovation: Widespread integration of plant-based options in fast-food chains and restaurants.

Within applications, Vegetarian and Analogs represents the most dominant segment, accounting for an estimated 35% of the market share in 2025. This segment's growth is propelled by the burgeoning demand for plant-based burgers, sausages, and other meat substitutes that offer comparable taste, texture, and nutritional profiles. The ability of non-GMO TSP to mimic the fibrous structure of meat makes it an ideal ingredient for these products.

In terms of types, Textured Soybean Protein Concentrate commands a larger market share, estimated at 65% in 2025, due to its higher protein content and versatility in various food formulations. Its ability to absorb flavors and retain moisture makes it a preferred choice for a wide range of applications, including formed meat products and processed foods.

The market is also witnessing significant growth in Asia-Pacific, particularly in China, driven by a rising middle class, increasing health consciousness, and government initiatives promoting plant-based protein consumption. Europe follows closely, with a strong emphasis on sustainability and clean labeling driving demand for non-GMO ingredients.

Non-GMO Textured Soybean Protein Product Innovations

Product innovation in the Non-GMO Textured Soybean Protein sector is rapidly advancing, focusing on enhancing sensory attributes and expanding application versatility. Manufacturers are developing novel forms of TSP with improved bite, chewiness, and juiciness, closely replicating the experience of traditional meat. Innovations include advanced extrusion techniques to create fibrous structures, as well as the incorporation of natural flavor enhancers and colorants to meet clean label demands. Performance metrics such as water-holding capacity, fat absorption, and protein digestibility are continuously being optimized. Furthermore, research into synergistic blends with other plant proteins is creating hybrid ingredients with superior nutritional profiles and functional properties, catering to a broader spectrum of consumer needs and dietary preferences, ultimately driving higher adoption rates across the food industry.

Propelling Factors for Non-GMO Textured Soybean Protein Growth

Several key factors are propelling the growth of the Non-GMO Textured Soybean Protein market. Technologically, advancements in extrusion and processing techniques have enabled the creation of TSP with superior textures and mouthfeels, closely mimicking animal proteins. Economically, the increasing affordability and accessibility of non-GMO soybeans, coupled with the rising cost of animal protein production, make TSP a more viable and cost-effective ingredient. Regulatory shifts, including clear labeling requirements for non-GMO products, are fostering consumer trust and driving demand. Furthermore, growing global awareness of the environmental impact of animal agriculture and the health benefits associated with plant-based diets are significant drivers, encouraging a wider adoption of TSP as a sustainable and nutritious alternative.

- Technological advancements in processing for enhanced texture and taste.

- Economic viability and competitive pricing compared to animal proteins.

- Favorable regulatory frameworks promoting non-GMO labeling.

- Increasing consumer consciousness regarding health and environmental sustainability.

- Growing demand for vegetarian, vegan, and flexitarian food options.

Obstacles in the Non-GMO Textured Soybean Protein Market

Despite robust growth, the Non-GMO Textured Soybean Protein market faces several obstacles. Consumer perception, particularly in certain demographics, can be a challenge, with some associating soy protein with potential allergens or being unfamiliar with its culinary applications. The complexity of global supply chains, especially for certified non-GMO soybeans, can lead to price volatility and availability issues. Competition from other emerging plant-based protein sources like pea, fava bean, and algae protein also presents a significant challenge as these alternatives gain traction. Furthermore, while regulatory landscapes are often supportive, differing national standards for non-GMO certification can create trade barriers and necessitate complex compliance measures for international market expansion, potentially impacting market access and increasing operational costs for manufacturers.

- Consumer perception and a lack of awareness regarding soy protein's benefits and applications.

- Supply chain complexities and potential price fluctuations for certified non-GMO soybeans.

- Intensifying competition from alternative plant-based protein sources.

- Divergent international regulations and standards for non-GMO certification.

Future Opportunities in Non-GMO Textured Soybean Protein

The future of the Non-GMO Textured Soybean Protein market is ripe with opportunities. The expansion into emerging economies, particularly in Asia and Africa, where plant-based diets are gaining traction, presents a significant untapped market. Technological innovations in creating even more sophisticated textures and flavors will unlock new culinary applications, potentially moving beyond traditional meat analogs into areas like seafood and dairy alternatives. The development of protein isolates with enhanced functional properties for specific dietary needs, such as high-protein, low-carbohydrate formulations, will cater to niche markets. Furthermore, increased focus on sustainable sourcing and the development of circular economy models within the soybean supply chain will offer a unique selling proposition and resonate with environmentally conscious consumers and businesses.

- Expansion into developing markets with growing demand for plant-based foods.

- Development of novel textures and flavor profiles for a wider range of food products.

- Creation of specialized protein isolates for specific nutritional and functional requirements.

- Emphasis on sustainable sourcing and circular economy practices.

Major Players in the Non-GMO Textured Soybean Protein Ecosystem

- ADM

- DuPont

- CHS

- Scents Holding

- Sojaprotein

- Cargill

- Gushen Biological

- Wonderful Industrial Group

- FUJIOIL

- Shandong Sanwei Soybean Protein

- Shansong Biological

- Sonic Biochem

- Goldensea Industry

- Soja Austria

- Bremil Group

Key Developments in Non-GMO Textured Soybean Protein Industry

- 2023 July: ADM introduces a new line of plant-based protein solutions with enhanced texture and functionality for meat analog applications.

- 2023 April: DuPont announces strategic investments to expand its soy protein processing capabilities, focusing on non-GMO sourcing.

- 2022 December: Sojaprotein unveils innovative textured pea and soy protein blends, offering improved nutritional profiles and cost-effectiveness.

- 2022 September: Cargill expands its portfolio with new textured vegetable proteins, emphasizing sustainability and traceability.

- 2021 November: The Global Non-GMO Food Association reports a 15% year-over-year increase in demand for certified non-GMO ingredients.

- 2021 August: Gushen Biological launches a new generation of high-protein textured soy flour for expanded food applications.

- 2020 October: FUJIOIL invests in advanced extrusion technology to enhance the textural diversity of its textured soy protein offerings.

Strategic Non-GMO Textured Soybean Protein Market Forecast

The strategic forecast for the Non-GMO Textured Soybean Protein market is exceptionally positive, driven by a confluence of powerful growth catalysts. The continuous rise in global demand for plant-based foods, fueled by health, environmental, and ethical considerations, will remain the primary growth engine. Technological innovations in processing will further enhance the appeal of TSP by improving its sensory attributes and functional versatility, making it an indispensable ingredient for food manufacturers. Regulatory tailwinds, including clear non-GMO labeling initiatives, will continue to build consumer confidence and encourage wider adoption. Emerging markets present significant untapped potential, offering substantial growth opportunities for market expansion. The market is projected to achieve a revenue of approximately $6.5 billion by 2033, reflecting a sustained and robust growth trajectory driven by these strategic factors.

Non-GMO Textured Soybean Protein Segmentation

-

1. Application

- 1.1. Ground Meat and Poultry

- 1.2. Formed Meat Products

- 1.3. Vegetarian and Analogs

- 1.4. Nutrition Bars, Cereals & Snacks

- 1.5. Others

-

2. Types

- 2.1. Textured Soybean Protein Flour

- 2.2. Textured Soybean Protein Concentrate

Non-GMO Textured Soybean Protein Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Non-GMO Textured Soybean Protein REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Non-GMO Textured Soybean Protein Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Ground Meat and Poultry

- 5.1.2. Formed Meat Products

- 5.1.3. Vegetarian and Analogs

- 5.1.4. Nutrition Bars, Cereals & Snacks

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Textured Soybean Protein Flour

- 5.2.2. Textured Soybean Protein Concentrate

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Non-GMO Textured Soybean Protein Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Ground Meat and Poultry

- 6.1.2. Formed Meat Products

- 6.1.3. Vegetarian and Analogs

- 6.1.4. Nutrition Bars, Cereals & Snacks

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Textured Soybean Protein Flour

- 6.2.2. Textured Soybean Protein Concentrate

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Non-GMO Textured Soybean Protein Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Ground Meat and Poultry

- 7.1.2. Formed Meat Products

- 7.1.3. Vegetarian and Analogs

- 7.1.4. Nutrition Bars, Cereals & Snacks

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Textured Soybean Protein Flour

- 7.2.2. Textured Soybean Protein Concentrate

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Non-GMO Textured Soybean Protein Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Ground Meat and Poultry

- 8.1.2. Formed Meat Products

- 8.1.3. Vegetarian and Analogs

- 8.1.4. Nutrition Bars, Cereals & Snacks

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Textured Soybean Protein Flour

- 8.2.2. Textured Soybean Protein Concentrate

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Non-GMO Textured Soybean Protein Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Ground Meat and Poultry

- 9.1.2. Formed Meat Products

- 9.1.3. Vegetarian and Analogs

- 9.1.4. Nutrition Bars, Cereals & Snacks

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Textured Soybean Protein Flour

- 9.2.2. Textured Soybean Protein Concentrate

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Non-GMO Textured Soybean Protein Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Ground Meat and Poultry

- 10.1.2. Formed Meat Products

- 10.1.3. Vegetarian and Analogs

- 10.1.4. Nutrition Bars, Cereals & Snacks

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Textured Soybean Protein Flour

- 10.2.2. Textured Soybean Protein Concentrate

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ADM

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DuPont

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CHS

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Scents Holding

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sojaprotein

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cargill

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gushen Biological

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Wonderful Industrial Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 FUJIOIL

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Shandong Sanwei Soybean Protein

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Shansong Biological

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sonic Biochem

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Goldensea Industry

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Soja Austria

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Bremil Group

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 ADM

List of Figures

- Figure 1: Global Non-GMO Textured Soybean Protein Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Non-GMO Textured Soybean Protein Revenue (million), by Application 2024 & 2032

- Figure 3: North America Non-GMO Textured Soybean Protein Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Non-GMO Textured Soybean Protein Revenue (million), by Types 2024 & 2032

- Figure 5: North America Non-GMO Textured Soybean Protein Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Non-GMO Textured Soybean Protein Revenue (million), by Country 2024 & 2032

- Figure 7: North America Non-GMO Textured Soybean Protein Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Non-GMO Textured Soybean Protein Revenue (million), by Application 2024 & 2032

- Figure 9: South America Non-GMO Textured Soybean Protein Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Non-GMO Textured Soybean Protein Revenue (million), by Types 2024 & 2032

- Figure 11: South America Non-GMO Textured Soybean Protein Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Non-GMO Textured Soybean Protein Revenue (million), by Country 2024 & 2032

- Figure 13: South America Non-GMO Textured Soybean Protein Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Non-GMO Textured Soybean Protein Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Non-GMO Textured Soybean Protein Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Non-GMO Textured Soybean Protein Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Non-GMO Textured Soybean Protein Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Non-GMO Textured Soybean Protein Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Non-GMO Textured Soybean Protein Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Non-GMO Textured Soybean Protein Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Non-GMO Textured Soybean Protein Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Non-GMO Textured Soybean Protein Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Non-GMO Textured Soybean Protein Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Non-GMO Textured Soybean Protein Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Non-GMO Textured Soybean Protein Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Non-GMO Textured Soybean Protein Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Non-GMO Textured Soybean Protein Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Non-GMO Textured Soybean Protein Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Non-GMO Textured Soybean Protein Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Non-GMO Textured Soybean Protein Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Non-GMO Textured Soybean Protein Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Non-GMO Textured Soybean Protein Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Non-GMO Textured Soybean Protein Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Non-GMO Textured Soybean Protein Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Non-GMO Textured Soybean Protein Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Non-GMO Textured Soybean Protein Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Non-GMO Textured Soybean Protein Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Non-GMO Textured Soybean Protein Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Non-GMO Textured Soybean Protein Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Non-GMO Textured Soybean Protein Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Non-GMO Textured Soybean Protein Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Non-GMO Textured Soybean Protein Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Non-GMO Textured Soybean Protein Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Non-GMO Textured Soybean Protein Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Non-GMO Textured Soybean Protein Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Non-GMO Textured Soybean Protein Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Non-GMO Textured Soybean Protein Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Non-GMO Textured Soybean Protein Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Non-GMO Textured Soybean Protein Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Non-GMO Textured Soybean Protein Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Non-GMO Textured Soybean Protein Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Non-GMO Textured Soybean Protein?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Non-GMO Textured Soybean Protein?

Key companies in the market include ADM, DuPont, CHS, Scents Holding, Sojaprotein, Cargill, Gushen Biological, Wonderful Industrial Group, FUJIOIL, Shandong Sanwei Soybean Protein, Shansong Biological, Sonic Biochem, Goldensea Industry, Soja Austria, Bremil Group.

3. What are the main segments of the Non-GMO Textured Soybean Protein?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Non-GMO Textured Soybean Protein," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Non-GMO Textured Soybean Protein report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Non-GMO Textured Soybean Protein?

To stay informed about further developments, trends, and reports in the Non-GMO Textured Soybean Protein, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence