Key Insights

The Spain Sodium Reduction Ingredient Market is projected for substantial expansion, with an estimated market size of €1.9 billion by 2025. This growth is fueled by rising consumer consciousness of health risks associated with high sodium intake and proactive government initiatives to reduce consumption. Food manufacturers are investing in innovative solutions to meet consumer demand for healthier options. The market's Compound Annual Growth Rate (CAGR) of 11.7% highlights this strong upward trend. Key drivers include a growing preference for natural and clean-label products, emphasizing transparency and minimal artificial additives. The increasing incidence of lifestyle diseases, such as hypertension, further compels regulatory bodies and consumers to prioritize sodium reduction, creating a favorable market environment.

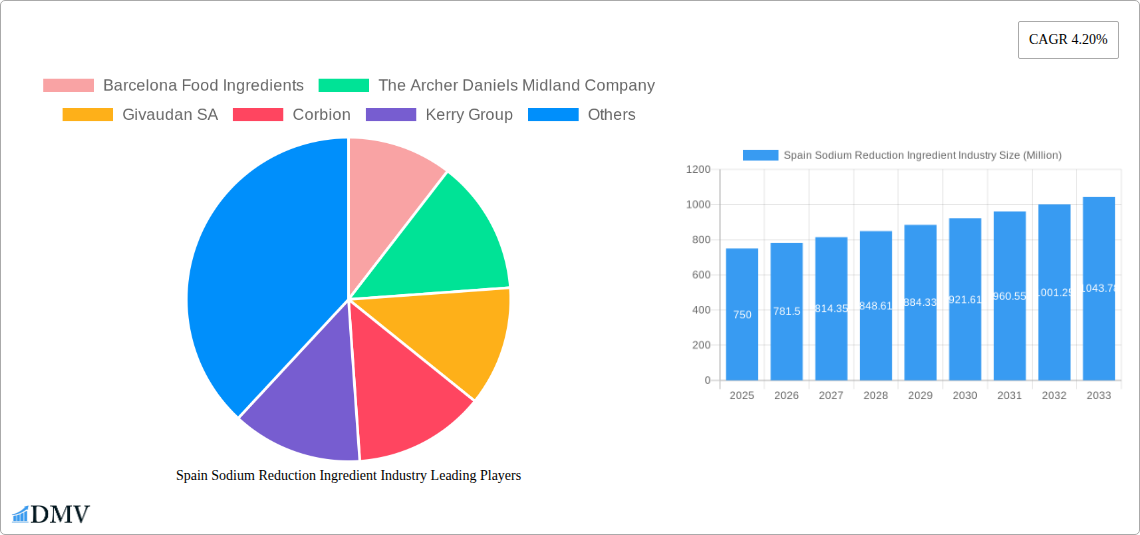

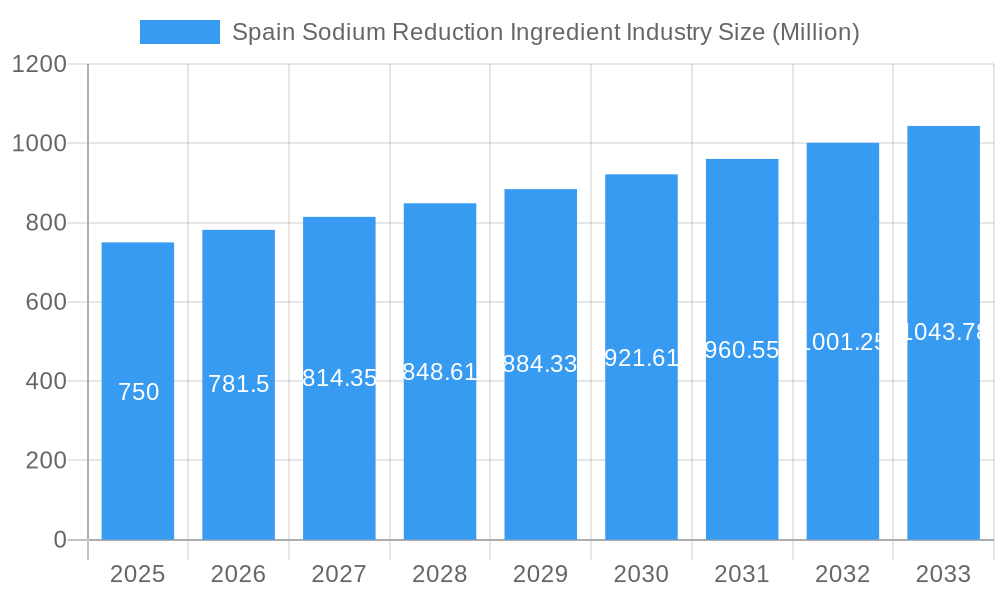

Spain Sodium Reduction Ingredient Industry Market Size (In Billion)

Emerging trends, including sophisticated flavor-enhancing ingredients that replicate the taste of salt without adverse health effects, will shape industry growth. Yeast extracts and mineral salts are anticipated to be pivotal in developing versatile solutions for diverse food applications. While the market outlook is positive, challenges such as the cost-effectiveness of advanced reduction technologies and maintaining taste profiles in processed foods require attention. However, the expanding application segments—bakery, confectionery, condiments, seasonings, sauces, dairy, frozen foods, and meat products—indicate broad market appeal. Leading companies are actively developing novel ingredients and technologies to meet evolving industry demands, ensuring continued market development and consumer well-being.

Spain Sodium Reduction Ingredient Industry Company Market Share

Spain Sodium Reduction Ingredient Market Analysis: Trends, Forecasts & Opportunities

Gain critical insights into the Spanish market for sodium reduction ingredients. This comprehensive report details the dynamic landscape of ingredients designed to lower sodium content in food products. Driven by increasing consumer health awareness, stringent regulations, and food reformulation efforts, the Spain sodium reduction ingredient market is experiencing significant growth. Our analysis covers historical performance, a detailed base year of 2025, and an extensive forecast period. We provide granular data on market segmentation, key players, product innovations, and future growth trajectories, enabling informed strategic decisions.

Spain Sodium Reduction Ingredient Industry Market Composition & Trends

The Spain sodium reduction ingredient market exhibits a moderate concentration, with a few dominant players holding substantial market share. Key innovation catalysts include the rising global focus on cardiovascular health and the subsequent demand for low-sodium food alternatives. Regulatory landscapes, particularly government initiatives aimed at reducing population-wide sodium intake, are shaping product development and market penetration. Substitute products, such as potassium chloride and natural flavor enhancers, are present but often face challenges in replicating the sensory profiles of sodium. End-user profiles are diverse, spanning major food and beverage manufacturers, private label producers, and specialized health food companies. Merger and acquisition (M&A) activities are evident, driven by the strategic imperative for companies to expand their portfolios and gain a competitive edge in this evolving sector. For instance, recent M&A deals in the broader European context suggest an average deal value of XX Million, indicating significant strategic investment. Market share distribution is influenced by the efficacy and cost-effectiveness of different sodium reduction ingredient types.

Spain Sodium Reduction Ingredient Industry Industry Evolution

The Spain sodium reduction ingredient industry has undergone a substantial evolution driven by a confluence of health-conscious consumerism and proactive governmental policies. Over the historical period of 2019-2024, the market witnessed a steady upward trajectory, fueled by increasing awareness of the detrimental health effects of excessive sodium consumption, particularly concerning hypertension and cardiovascular diseases. This growing health consciousness among Spanish consumers has directly translated into a heightened demand for food products with reduced sodium content, prompting manufacturers to actively seek and implement effective sodium reduction solutions. Technological advancements have played a pivotal role in this evolution, with continuous innovation in ingredient formulation and processing techniques enabling the development of sodium reducers that maintain or enhance the palatability and texture of food products. For example, advancements in encapsulation technologies and the discovery of novel flavor modulators have significantly broadened the application range of these ingredients. The base year of 2025 represents a critical juncture, with the market poised for accelerated growth. During the forecast period of 2025-2033, industry growth is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately XX%. This robust growth is underpinned by several factors, including the increasing adoption of sodium reduction strategies by a wider array of food manufacturers, the expansion of product portfolios by ingredient suppliers, and the ongoing refinement of regulatory frameworks that incentivize sodium reduction. Shifting consumer demands are also a significant driver; consumers are not only seeking lower sodium options but are also demanding transparency in ingredient labeling and a preference for natural or naturally derived sodium reduction solutions. This has spurred innovation in areas like yeast extracts and mineral salt blends that offer clean-label profiles. Furthermore, the industry's ability to adapt to evolving dietary trends, such as the burgeoning plant-based movement, will also dictate future market dynamics and the successful integration of sodium reduction ingredients into a wider variety of food categories. The overall industry evolution is characterized by a proactive response to health imperatives, a relentless pursuit of technological excellence, and a keen understanding of nuanced consumer preferences.

Leading Regions, Countries, or Segments in Spain Sodium Reduction Ingredient Industry

Within the Spain sodium reduction ingredient industry, the Amino Acids and Glutamates segment, particularly Monosodium Glutamate (MSG) alternatives and specialty amino acids, is emerging as a dominant force. This dominance is driven by their versatile flavor-enhancing properties, ability to provide umami taste, and their perceived efficacy in replacing a significant portion of sodium without compromising palatability. Their application breadth across Condiments, Seasonings and Sauces, Meat and Meat Products, and Snacks further solidifies their leading position.

- Dominant Segment: Amino Acids and Glutamates

- Key Drivers:

- Flavor Enhancement Efficacy: Proven ability to deliver umami taste and improve overall flavor profiles, crucial for sodium reduction.

- Versatile Applications: Broad applicability across diverse food categories, including savory dishes, processed meats, and snack foods.

- Technological Advancements: Ongoing research and development leading to improved purity, solubility, and cost-effectiveness.

- Consumer Acceptance: Growing acceptance of glutamates as safe and effective flavor enhancers, overcoming past controversies.

- Market Penetration: High adoption rates in the bakery and confectionery sector for flavor enhancement and in condiments and seasonings for taste improvement. The meat and meat products sector also shows significant uptake due to the need for taste restoration after sodium reduction.

- Key Drivers:

Beyond Amino Acids and Glutamates, Mineral Salts, primarily potassium chloride-based blends, are also experiencing substantial growth, particularly in applications where a salt-like flavor is paramount. However, their mineral aftertaste can sometimes limit their widespread adoption compared to glutamates.

The Application segment of Condiments, Seasonings and Sauces represents another area of significant market activity. This is attributed to the inherent high sodium content of many of these products, making them prime targets for reformulation efforts. The demand for healthier, low-sodium versions of ketchup, soy sauce, salad dressings, and marinades is a constant driver for the adoption of sodium reduction ingredients.

- Dominant Application Segment: Condiments, Seasonings and Sauces

- Key Drivers:

- High Sodium Baseline: These products typically contain high levels of sodium, making them ideal candidates for reduction.

- Consumer Demand for Healthier Options: Strong consumer preference for reduced-sodium versions of popular condiments and sauces.

- Regulatory Pressure: Targeted regulations and public health campaigns often focus on high-sodium processed foods, including sauces and condiments.

- Brand Differentiation: Companies are using sodium reduction as a competitive differentiator to attract health-conscious consumers.

- Market Penetration: Widespread adoption by major food manufacturers seeking to reformulate best-selling products and introduce new low-sodium lines.

- Key Drivers:

The Meat and Meat Products segment is also a significant contributor to market growth, as manufacturers strive to meet regulatory targets and consumer expectations for healthier processed meats, sausages, and charcuterie. The Bakery and Confectionery segment, while perhaps smaller in absolute sodium content per serving, is also a growing area, with manufacturers looking to reduce sodium in bread, biscuits, and pastries.

Overall, the dominance is shared between ingredient types and application areas that offer the most effective and palatable solutions for sodium reduction, aligning with both consumer desires and regulatory imperatives. The Spain sodium reduction ingredient industry is witnessing a dynamic interplay between ingredient innovation and application-specific reformulation needs, with Amino Acids and Glutamates and the Condiments, Seasonings and Sauces segment at the forefront.

Spain Sodium Reduction Ingredient Industry Product Innovations

Innovation in the Spain sodium reduction ingredient industry is primarily focused on developing ingredients that effectively replace sodium's taste, texture, and preservative functions while minimizing off-flavors. Breakthroughs include advanced fermentation techniques for yeast extracts that yield potent umami profiles, synergistic blends of mineral salts and natural flavors, and novel amino acid compounds designed for enhanced taste modulation. Performance metrics like sensory acceptance scores and sodium reduction percentages exceeding XX% are key benchmarks. Unique selling propositions often revolve around clean-label formulations, non-GMO status, and allergen-free properties, catering to increasingly discerning consumers.

Propelling Factors for Spain Sodium Reduction Ingredient Industry Growth

The Spain Sodium Reduction Ingredient Industry is propelled by several interconnected factors. Regulatory pressure from governmental bodies advocating for reduced population sodium intake remains a primary driver, often mandating reformulation targets. Growing consumer health consciousness regarding cardiovascular health and hypertension fuels demand for low-sodium food alternatives. Technological advancements in flavor modulation, ingredient synthesis, and processing techniques enable more effective and palatable sodium reduction. Furthermore, the increasing global prevalence of chronic diseases linked to high sodium intake incentivizes food manufacturers worldwide to invest in and adopt sodium reduction strategies, creating a robust market ecosystem.

Obstacles in the Spain Sodium Reduction Ingredient Industry Market

Despite robust growth, the Spain Sodium Reduction Ingredient Industry faces significant obstacles. Taste perception challenges remain paramount, as accurately replicating the complex salty taste of sodium without introducing off-flavors or altering texture is difficult. Regulatory hurdles and differing national guidelines can create complexity for international manufacturers. Supply chain disruptions and fluctuations in raw material costs can impact ingredient availability and pricing. Furthermore, consumer skepticism regarding the efficacy and safety of certain sodium substitutes and intense competition among ingredient suppliers can create price pressures and market saturation.

Future Opportunities in Spain Sodium Reduction Ingredient Industry

Emerging opportunities in the Spain Sodium Reduction Ingredient Industry are multifaceted. The expansion of plant-based food alternatives presents a significant avenue, as these products often require careful flavor balancing and sodium reduction. Advancements in biotechnology and fermentation are expected to yield novel, highly effective sodium reduction ingredients with clean-label appeal. Furthermore, the increasing demand for personalized nutrition and specialized dietary solutions for individuals with specific health conditions opens up niche markets. Collaborations between ingredient manufacturers and food product developers to create innovative, ready-to-use sodium reduction solutions will also drive market expansion.

Major Players in the Spain Sodium Reduction Ingredient Industry Ecosystem

- Barcelona Food Ingredients

- The Archer Daniels Midland Company

- Givaudan SA

- Corbion

- Kerry Group

- Cargill Inc

- Ajinomoto

Key Developments in Spain Sodium Reduction Ingredient Industry Industry

- 2023/06: Launch of a new range of yeast-derived savory flavor enhancers by Kerry Group, offering enhanced umami taste and sodium reduction capabilities.

- 2023/04: Corbion announces strategic investment in R&D for bio-based lactic acid derivatives, targeting improved saltiness perception in food products.

- 2023/02: Givaudan SA expands its savory solutions portfolio with novel taste modulation ingredients designed for meat and dairy applications.

- 2022/11: Cargill Inc. introduces a potassium chloride-based salt replacer with improved mouthfeel and reduced bitterness.

- 2022/09: The Archer Daniels Midland Company acquires a significant stake in a European specialty ingredient producer focused on sodium reduction technologies.

- 2022/05: Ajinomoto Co., Inc. launches a new amino acid-based seasoning that significantly reduces sodium content while enhancing overall flavor complexity.

- 2021/10: Barcelona Food Ingredients partners with a leading Spanish research institution to develop next-generation mineral salt blends for sodium reduction.

Strategic Spain Sodium Reduction Ingredient Industry Market Forecast

The strategic forecast for the Spain Sodium Reduction Ingredient Industry is overwhelmingly positive. Growth catalysts include continued regulatory impetus, escalating consumer demand for healthier food options, and ongoing technological innovation. The market is expected to witness substantial expansion driven by the development of more sophisticated and palatable sodium reduction solutions. Emerging markets and a growing emphasis on clean-label ingredients will further fuel this trajectory. The sustained focus on cardiovascular health and the increasing integration of these ingredients across a wider spectrum of food applications position the Spain sodium reduction ingredient market for robust and sustained growth through 2033.

Spain Sodium Reduction Ingredient Industry Segmentation

-

1. Product Type

- 1.1. Amino Acids and Glutamates

- 1.2. Mineral Salts

- 1.3. Yeast Extracts

- 1.4. Other Product Types

-

2. Application

- 2.1. Bakery and Confectionery

- 2.2. Condiments, Seasonings and Sauces

- 2.3. Dairy and Frozen Foods

- 2.4. Meat and Meat Products

- 2.5. Snacks

- 2.6. Other Applications

Spain Sodium Reduction Ingredient Industry Segmentation By Geography

- 1. Spain

Spain Sodium Reduction Ingredient Industry Regional Market Share

Geographic Coverage of Spain Sodium Reduction Ingredient Industry

Spain Sodium Reduction Ingredient Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Vegan Food & Beverages Driving the Market; Intolerance and Allergies Associated with Animal Protein Products

- 3.3. Market Restrains

- 3.3.1. High Market Penetration of Animal Protein

- 3.4. Market Trends

- 3.4.1. The Prevalence of Processed Food Consumption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Sodium Reduction Ingredient Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Amino Acids and Glutamates

- 5.1.2. Mineral Salts

- 5.1.3. Yeast Extracts

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery and Confectionery

- 5.2.2. Condiments, Seasonings and Sauces

- 5.2.3. Dairy and Frozen Foods

- 5.2.4. Meat and Meat Products

- 5.2.5. Snacks

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Barcelona Food Ingredients

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Archer Daniels Midland Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Givaudan SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Corbion

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kerry Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cargill Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ajinomoto*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Barcelona Food Ingredients

List of Figures

- Figure 1: Spain Sodium Reduction Ingredient Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Spain Sodium Reduction Ingredient Industry Share (%) by Company 2025

List of Tables

- Table 1: Spain Sodium Reduction Ingredient Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Spain Sodium Reduction Ingredient Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Spain Sodium Reduction Ingredient Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Spain Sodium Reduction Ingredient Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Spain Sodium Reduction Ingredient Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Spain Sodium Reduction Ingredient Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Sodium Reduction Ingredient Industry?

The projected CAGR is approximately 11.7%.

2. Which companies are prominent players in the Spain Sodium Reduction Ingredient Industry?

Key companies in the market include Barcelona Food Ingredients, The Archer Daniels Midland Company, Givaudan SA, Corbion, Kerry Group, Cargill Inc, Ajinomoto*List Not Exhaustive.

3. What are the main segments of the Spain Sodium Reduction Ingredient Industry?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Vegan Food & Beverages Driving the Market; Intolerance and Allergies Associated with Animal Protein Products.

6. What are the notable trends driving market growth?

The Prevalence of Processed Food Consumption.

7. Are there any restraints impacting market growth?

High Market Penetration of Animal Protein.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Sodium Reduction Ingredient Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Sodium Reduction Ingredient Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Sodium Reduction Ingredient Industry?

To stay informed about further developments, trends, and reports in the Spain Sodium Reduction Ingredient Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence