Key Insights

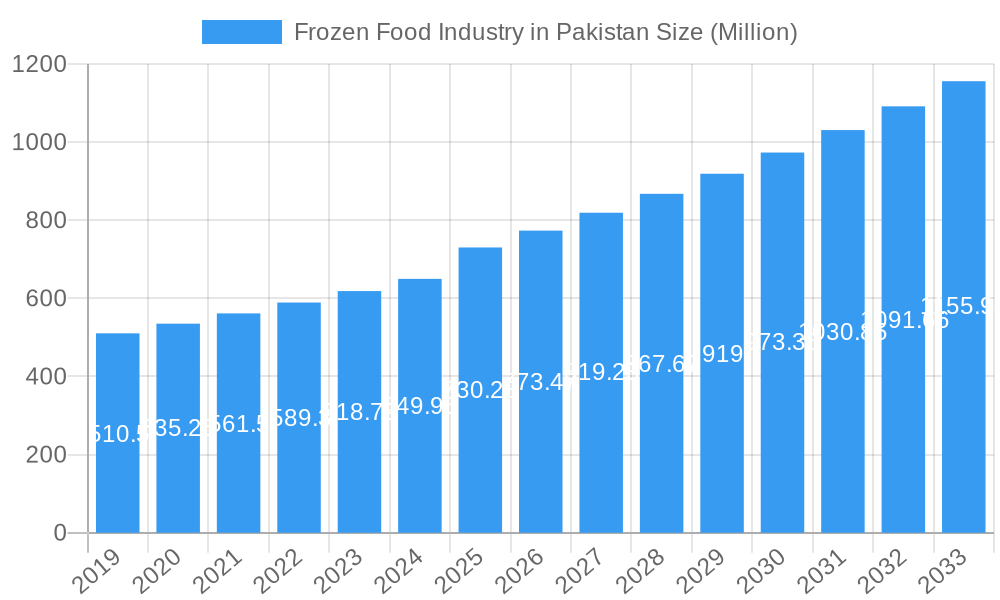

The Pakistani frozen food market is poised for substantial growth, projected to reach $730.23 million in value by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 5.81% anticipated between 2025 and 2033. This expansion is primarily fueled by evolving consumer lifestyles, increasing disposable incomes, and a growing demand for convenient and ready-to-eat meal solutions. As urbanization accelerates and nuclear families become more prevalent, the need for time-saving food options is intensifying. The market is witnessing a significant shift towards convenience-focused categories such as Ready-to-Cook and Ready-to-Eat meals, driven by busy schedules and a desire for restaurant-quality meals at home. The penetration of modern retail formats like supermarkets and hypermarkets, alongside the burgeoning online grocery sector, is further simplifying access to frozen food products, thereby acting as a key enabler of market expansion. This accessibility is crucial for tapping into a wider consumer base and driving consistent sales.

Frozen Food Industry in Pakistan Market Size (In Million)

The product landscape is diversifying to cater to a broader spectrum of consumer preferences. While Frozen Fruits and Vegetables remain a staple, growth is particularly strong in Frozen Meat and Fish due to increased protein consciousness and a wider availability of processed and seasoned options. Frozen-cooked Ready Meals are also gaining traction, offering unparalleled convenience. The adoption of advanced freezing techniques like Individual Quick Freezing (IQF) is enhancing product quality and shelf life, addressing consumer concerns about texture and taste. Key players like McCain Foods, along with prominent local companies, are actively investing in innovation and expanding their product portfolios to capture market share. Despite the optimistic outlook, challenges such as cold chain infrastructure limitations in certain regions and consumer perceptions regarding the nutritional value of frozen foods need to be strategically addressed to ensure sustained and robust market development.

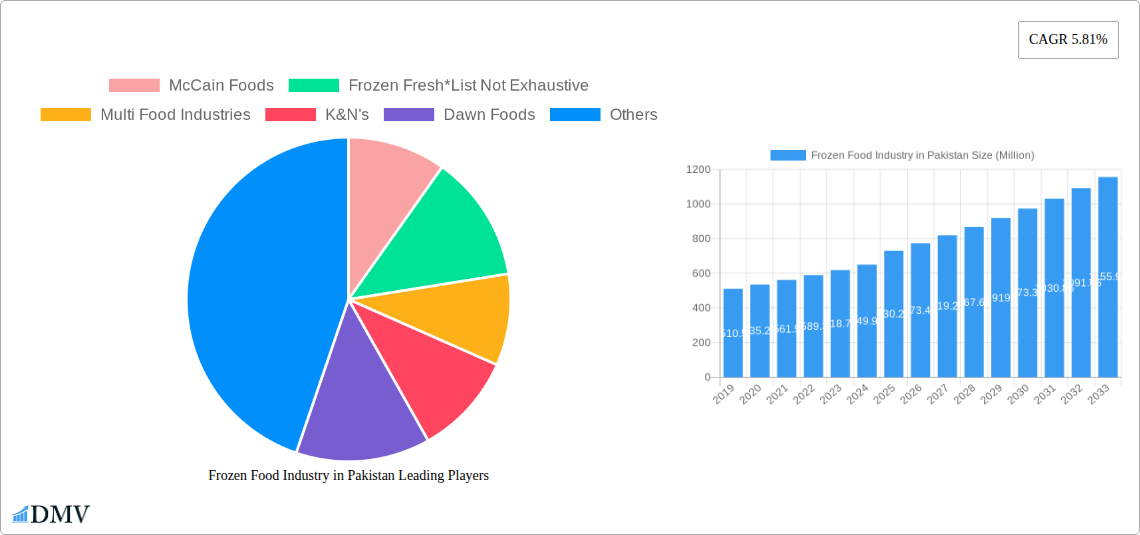

Frozen Food Industry in Pakistan Company Market Share

Frozen Food Industry in Pakistan Market Analysis Report 2023-2033

Uncover the dynamic frozen food market in Pakistan with this comprehensive report, meticulously analyzing trends, opportunities, and competitive landscapes from 2019 to 2033. This in-depth study targets stakeholders seeking to understand the growth drivers, market size, and future outlook of the Pakistani frozen food sector. We dissect key segments including ready-to-eat, ready-to-cook, frozen fruits and vegetables, frozen meat and fish, and frozen snacks, while examining the impact of Individual Quick Freezing (IQF) and other advanced freezing techniques. Explore distribution channels from traditional supermarkets to burgeoning online frozen food stores and understand the strategic moves of major players like McCain Foods, K&N's, and Al-Shaheer Corporation.

Frozen Food Industry in Pakistan Market Composition & Trends

The Pakistani frozen food industry is experiencing a notable shift towards convenience and quality, driven by evolving consumer lifestyles and increased disposable incomes. Market concentration is moderate, with a few key players holding significant shares, particularly in segments like frozen meat and fish and frozen snacks. Innovation is a critical catalyst, with companies investing in new product development and improved freezing technologies. The regulatory landscape, while evolving, is increasingly focused on food safety and quality standards, creating a more formalized environment for frozen food manufacturers in Pakistan. Substitute products, such as fresh or canned alternatives, pose a competitive challenge, but the extended shelf-life and convenience of frozen options are gaining traction. End-user profiles are diversifying, encompassing busy professionals, families seeking quick meal solutions, and a growing segment of health-conscious consumers opting for frozen fruits and vegetables. Mergers and acquisitions (M&A) activities, though not yet widespread, are anticipated to increase as companies seek to expand their product portfolios and market reach.

Frozen Food Industry in Pakistan Industry Evolution

The frozen food industry in Pakistan has witnessed a remarkable evolutionary trajectory, transforming from a niche market to a significant contributor to the nation's food sector. Over the historical period of 2019–2024, the market experienced steady growth, fueled by increasing urbanization, a burgeoning middle class, and a growing preference for convenience. This period saw the initial adoption of advanced freezing techniques, most notably Individual Quick Freezing (IQF), which revolutionized the quality and texture of frozen products, particularly frozen fruits and vegetables and frozen meat and fish. Technological advancements played a pivotal role, with investments in modern processing and packaging technologies enhancing product safety and extending shelf life. Consumer demand shifted from basic frozen staples to a wider array of value-added products, including ready-to-eat meals and ready-to-cook items. The base year of 2025 marks a pivotal point, with the market poised for accelerated expansion. The forecast period (2025–2033) anticipates continued robust growth, driven by greater market penetration, the introduction of innovative product categories like frozen desserts, and a stronger emphasis on health and nutritional benefits of frozen foods. Growth rates are projected to climb steadily, supported by increasing per capita income and a greater understanding among consumers of the advantages of frozen foods, such as reduced food waste and preserved nutritional value. The adoption of blast freezing and belt freezing technologies alongside IQF will further enhance the efficiency and quality of production, catering to the ever-increasing demand for high-quality frozen food products in Pakistan.

Leading Regions, Countries, or Segments in Frozen Food Industry in Pakistan

The frozen food industry in Pakistan exhibits distinct leadership across various segments, driven by localized consumer preferences and strategic market penetration by key companies.

Product Category Dominance:

- Ready-to-Cook: This segment is a significant growth engine, with consumers actively seeking convenient meal solutions that require minimal preparation. The increasing number of dual-income households and busy lifestyles strongly favor these products.

- Key Drivers: Growing disposable incomes, demand for convenience, extensive marketing by leading brands.

- Ready-to-Eat: While still developing, this category is poised for substantial growth, especially in urban centers. Its appeal lies in its ultimate convenience, catering to the fast-paced modern consumer.

- Key Drivers: Urbanization, changing eating habits, increasing acceptance of processed foods.

Product Type Leadership:

- Frozen Meat and Fish: This segment currently holds a dominant position due to established players and the cultural significance of meat consumption in Pakistan. Brands like K&N's and Big Bird have carved out strong market presence.

- Key Drivers: Protein-rich diet preference, expanding product ranges, improved cold chain infrastructure.

- Frozen Fruits and Vegetables: Witnessing considerable expansion, driven by health consciousness and the availability of diverse produce. Companies are increasingly focusing on preserving the nutritional value of these items.

- Key Drivers: Health and wellness trend, availability of agricultural resources, growing demand for natural and organic options.

- Frozen Snacks: A rapidly growing segment, fueled by convenience and impulse purchasing. Products like frozen samosas and spring rolls are highly popular.

- Key Drivers: Young demographic, social gatherings, affordability and variety.

Freezing Technique Impact:

- Individual Quick Freezing (IQF): This technique is increasingly adopted for premium products, particularly frozen fruits and vegetables and frozen meat and fish, ensuring individual piece integrity and preserving quality.

- Key Drivers: Demand for premium quality, enhanced product appeal, technological advancements.

- Blast Freezing: Widely used for large-scale production and rapid chilling, crucial for maintaining the freshness of various product types.

- Key Drivers: Cost-effectiveness for bulk production, efficiency in processing.

Distribution Channel Dynamics:

- Supermarkets/Hypermarkets: These remain the primary distribution channels, offering wide product variety and accessibility to a large consumer base.

- Key Drivers: Widespread presence, consumer trust, one-stop shopping experience.

- Online Stores: Experiencing a significant surge in popularity. The COVID-19 pandemic accelerated the adoption of e-commerce for groceries, including frozen goods.

- Key Drivers: Convenience, wider reach, digital penetration, specialized online frozen food delivery services.

Frozen Food Industry in Pakistan Product Innovations

The Pakistani frozen food industry is increasingly characterized by innovative product development aimed at meeting evolving consumer demands. Key innovations include the introduction of a wider variety of ready-to-cook meals featuring ethnic and international cuisines, catering to diverse palates. Advancements in Individual Quick Freezing (IQF) technology are enabling the preservation of superior texture and flavor in frozen fruits and vegetables and frozen meat and fish. Furthermore, there's a growing focus on healthier options, with brands launching reduced-fat, low-sodium, and plant-based frozen snacks and frozen desserts. The application of advanced packaging techniques ensures extended shelf-life and enhanced consumer appeal, distinguishing products in a competitive market.

Propelling Factors for Frozen Food Industry in Pakistan Growth

Several key factors are propelling the frozen food industry in Pakistan towards substantial growth. The rising disposable incomes and a growing middle class are significantly increasing purchasing power for convenience-oriented products. Urbanization and the fast-paced lifestyle of modern consumers are creating a robust demand for ready-to-eat and ready-to-cook food options. Technological advancements in freezing, preservation, and logistics, such as improved cold chain infrastructure, are enhancing product quality and expanding market reach. Moreover, increased health consciousness is driving demand for frozen fruits and vegetables and other nutritious frozen options, supported by evolving consumer perceptions about the nutritional value of frozen foods. The government's focus on promoting the food processing sector through favorable policies also plays a crucial role in market expansion.

Obstacles in the Frozen Food Industry in Pakistan Market

Despite robust growth prospects, the frozen food industry in Pakistan faces several significant obstacles. Inadequate cold chain infrastructure in remote areas and unreliable electricity supply pose major challenges to maintaining product integrity and preventing spoilage, impacting distribution channels beyond major urban centers. Stringent and sometimes inconsistent regulatory frameworks, particularly concerning food safety standards and import/export policies, can create compliance hurdles for manufacturers and distributors. High import duties on specialized machinery and raw materials can increase operational costs. Furthermore, consumer awareness regarding the quality and safety of frozen foods is still developing in some segments, leading to price sensitivity and a preference for fresh alternatives. Intense competition from both local and international players also necessitates continuous innovation and cost management.

Future Opportunities in Frozen Food Industry in Pakistan

The frozen food industry in Pakistan presents numerous exciting future opportunities. The untapped potential in the ready-to-eat and ready-to-cook segments, especially for niche cuisines and healthier alternatives, is significant. Expanding the reach of online frozen food stores and last-mile delivery solutions to Tier-2 and Tier-3 cities offers a vast untapped consumer base. Innovations in plant-based and organic frozen foods, aligning with global health trends, can capture a growing market segment. Developing value-added products from abundant agricultural resources like frozen fruits and vegetables presents substantial export potential. Furthermore, strategic partnerships and collaborations, particularly with international players for technology transfer and market access, can accelerate industry growth and diversification.

Major Players in the Frozen Food Industry in Pakistan Ecosystem

- McCain Foods

- Multi Food Industries

- K&N's

- Dawn Foods

- Icepac Limited

- Big Bird

- PK Meat & Food Company

- Al-Shaheer

- Seasons Foods

- Frozen Fresh

Key Developments in Frozen Food Industry in Pakistan Industry

- December 2021: PK Meat launched 'The PK Meat Shop' to extend its delivery service to more regions across Pakistan. This initiative diversified their offerings with ready-to-cook, ready-to-eat, crispy-coated, vegetarian, and flour products, available through an integrated eCommerce site and major retail outlets, enhancing the customer experience and product accessibility.

- July 2021: Al-Shaheer Corporation (ASC), renowned for its 'Meat One' brand, entered the frozen meat product segment with its 'Chef One' brand, focusing on ready-to-cook and ready-to-eat meat products. This strategic move broadened their product portfolio and addressed the growing demand for convenient meat solutions.

- February 2020: Doughstory, a venture from Dawn Foods, commenced global manufacturing and launch of its popular frozen parathas, naans, and snacks like samosas. Adherence to international food standards in their production facilities signals a commitment to quality and a focus on expanding their reach into international markets.

Strategic Frozen Food Industry in Pakistan Market Forecast

The frozen food industry in Pakistan is strategically positioned for substantial growth in the coming years. Key growth catalysts include the persistent demand for convenience driven by evolving lifestyles, increasing urbanization, and a rising disposable income base. The forecast period is expected to witness significant expansion in product categories like ready-to-eat and ready-to-cook meals, alongside a continued surge in frozen fruits and vegetables and frozen meat and fish driven by health consciousness and protein demand. Investments in modernizing cold chain infrastructure and expanding the reach of online frozen food stores will further unlock market potential. The industry's ability to innovate with healthier and more diverse product offerings, coupled with favorable government support for the food processing sector, will pave the way for sustained market expansion and increased export opportunities.

Frozen Food Industry in Pakistan Segmentation

-

1. Product Category

- 1.1. Ready-to-Eat

- 1.2. Ready-to-Cook

- 1.3. Ready-to-Drink

- 1.4. Other Product Categories

-

2. Product Type

- 2.1. Frozen Fruits and Vegetables

- 2.2. Frozen Meat and Fish

- 2.3. Frozen-cooked Ready Meals

- 2.4. Frozen Desserts

- 2.5. Frozen Snacks

- 2.6. Other Product Types

-

3. Freezing Technique

- 3.1. Individual Quick Freezing (IQF)

- 3.2. Blast freezing

- 3.3. Belt freezing

- 3.4. Other Freezing Techniques

-

4. Distribution Channel

- 4.1. Supermarkets/Hypermarkets

- 4.2. Convenience Stores

- 4.3. Specialty Stores

- 4.4. Online Stores

- 4.5. Other Distribution Channels

Frozen Food Industry in Pakistan Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

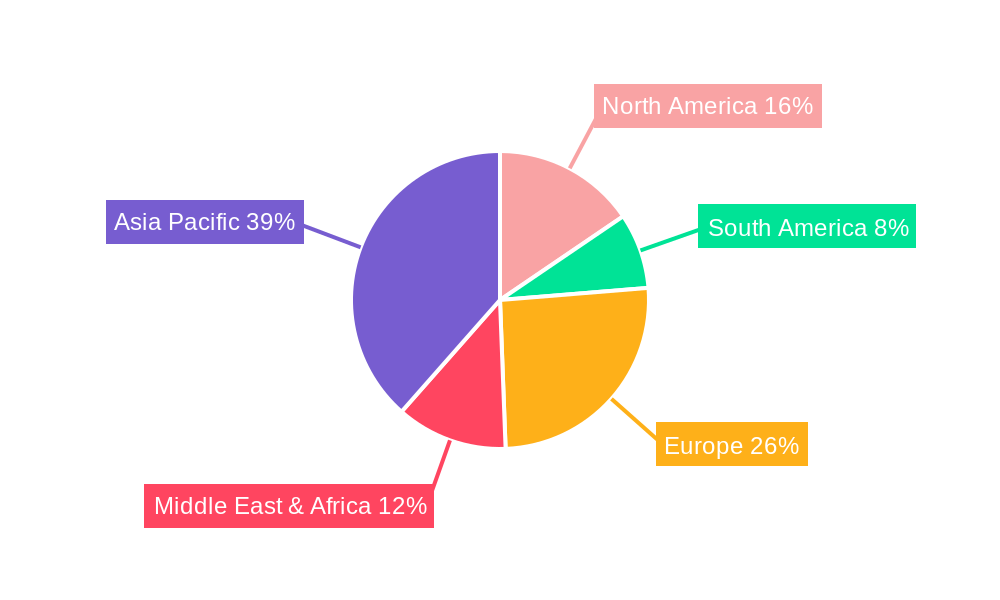

Frozen Food Industry in Pakistan Regional Market Share

Geographic Coverage of Frozen Food Industry in Pakistan

Frozen Food Industry in Pakistan REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Awareness Regarding Natural Products; Growing Demand for Anthocyanin in Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Synthetic Food Colorant

- 3.4. Market Trends

- 3.4.1. Rising Demand for Convenience Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Frozen Food Industry in Pakistan Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Category

- 5.1.1. Ready-to-Eat

- 5.1.2. Ready-to-Cook

- 5.1.3. Ready-to-Drink

- 5.1.4. Other Product Categories

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Frozen Fruits and Vegetables

- 5.2.2. Frozen Meat and Fish

- 5.2.3. Frozen-cooked Ready Meals

- 5.2.4. Frozen Desserts

- 5.2.5. Frozen Snacks

- 5.2.6. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Freezing Technique

- 5.3.1. Individual Quick Freezing (IQF)

- 5.3.2. Blast freezing

- 5.3.3. Belt freezing

- 5.3.4. Other Freezing Techniques

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Supermarkets/Hypermarkets

- 5.4.2. Convenience Stores

- 5.4.3. Specialty Stores

- 5.4.4. Online Stores

- 5.4.5. Other Distribution Channels

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Category

- 6. North America Frozen Food Industry in Pakistan Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Category

- 6.1.1. Ready-to-Eat

- 6.1.2. Ready-to-Cook

- 6.1.3. Ready-to-Drink

- 6.1.4. Other Product Categories

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Frozen Fruits and Vegetables

- 6.2.2. Frozen Meat and Fish

- 6.2.3. Frozen-cooked Ready Meals

- 6.2.4. Frozen Desserts

- 6.2.5. Frozen Snacks

- 6.2.6. Other Product Types

- 6.3. Market Analysis, Insights and Forecast - by Freezing Technique

- 6.3.1. Individual Quick Freezing (IQF)

- 6.3.2. Blast freezing

- 6.3.3. Belt freezing

- 6.3.4. Other Freezing Techniques

- 6.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.4.1. Supermarkets/Hypermarkets

- 6.4.2. Convenience Stores

- 6.4.3. Specialty Stores

- 6.4.4. Online Stores

- 6.4.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Category

- 7. South America Frozen Food Industry in Pakistan Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Category

- 7.1.1. Ready-to-Eat

- 7.1.2. Ready-to-Cook

- 7.1.3. Ready-to-Drink

- 7.1.4. Other Product Categories

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Frozen Fruits and Vegetables

- 7.2.2. Frozen Meat and Fish

- 7.2.3. Frozen-cooked Ready Meals

- 7.2.4. Frozen Desserts

- 7.2.5. Frozen Snacks

- 7.2.6. Other Product Types

- 7.3. Market Analysis, Insights and Forecast - by Freezing Technique

- 7.3.1. Individual Quick Freezing (IQF)

- 7.3.2. Blast freezing

- 7.3.3. Belt freezing

- 7.3.4. Other Freezing Techniques

- 7.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.4.1. Supermarkets/Hypermarkets

- 7.4.2. Convenience Stores

- 7.4.3. Specialty Stores

- 7.4.4. Online Stores

- 7.4.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Category

- 8. Europe Frozen Food Industry in Pakistan Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Category

- 8.1.1. Ready-to-Eat

- 8.1.2. Ready-to-Cook

- 8.1.3. Ready-to-Drink

- 8.1.4. Other Product Categories

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Frozen Fruits and Vegetables

- 8.2.2. Frozen Meat and Fish

- 8.2.3. Frozen-cooked Ready Meals

- 8.2.4. Frozen Desserts

- 8.2.5. Frozen Snacks

- 8.2.6. Other Product Types

- 8.3. Market Analysis, Insights and Forecast - by Freezing Technique

- 8.3.1. Individual Quick Freezing (IQF)

- 8.3.2. Blast freezing

- 8.3.3. Belt freezing

- 8.3.4. Other Freezing Techniques

- 8.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.4.1. Supermarkets/Hypermarkets

- 8.4.2. Convenience Stores

- 8.4.3. Specialty Stores

- 8.4.4. Online Stores

- 8.4.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Category

- 9. Middle East & Africa Frozen Food Industry in Pakistan Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Category

- 9.1.1. Ready-to-Eat

- 9.1.2. Ready-to-Cook

- 9.1.3. Ready-to-Drink

- 9.1.4. Other Product Categories

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Frozen Fruits and Vegetables

- 9.2.2. Frozen Meat and Fish

- 9.2.3. Frozen-cooked Ready Meals

- 9.2.4. Frozen Desserts

- 9.2.5. Frozen Snacks

- 9.2.6. Other Product Types

- 9.3. Market Analysis, Insights and Forecast - by Freezing Technique

- 9.3.1. Individual Quick Freezing (IQF)

- 9.3.2. Blast freezing

- 9.3.3. Belt freezing

- 9.3.4. Other Freezing Techniques

- 9.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.4.1. Supermarkets/Hypermarkets

- 9.4.2. Convenience Stores

- 9.4.3. Specialty Stores

- 9.4.4. Online Stores

- 9.4.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Category

- 10. Asia Pacific Frozen Food Industry in Pakistan Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Category

- 10.1.1. Ready-to-Eat

- 10.1.2. Ready-to-Cook

- 10.1.3. Ready-to-Drink

- 10.1.4. Other Product Categories

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Frozen Fruits and Vegetables

- 10.2.2. Frozen Meat and Fish

- 10.2.3. Frozen-cooked Ready Meals

- 10.2.4. Frozen Desserts

- 10.2.5. Frozen Snacks

- 10.2.6. Other Product Types

- 10.3. Market Analysis, Insights and Forecast - by Freezing Technique

- 10.3.1. Individual Quick Freezing (IQF)

- 10.3.2. Blast freezing

- 10.3.3. Belt freezing

- 10.3.4. Other Freezing Techniques

- 10.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.4.1. Supermarkets/Hypermarkets

- 10.4.2. Convenience Stores

- 10.4.3. Specialty Stores

- 10.4.4. Online Stores

- 10.4.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Category

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 McCain Foods

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Frozen Fresh*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Multi Food Industries

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 K&N's

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dawn Foods

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Icepac Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Big Bird

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PK Meat & Food Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Al-Shaheer

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Seasons Foods

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 McCain Foods

List of Figures

- Figure 1: Global Frozen Food Industry in Pakistan Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Frozen Food Industry in Pakistan Revenue (Million), by Product Category 2025 & 2033

- Figure 3: North America Frozen Food Industry in Pakistan Revenue Share (%), by Product Category 2025 & 2033

- Figure 4: North America Frozen Food Industry in Pakistan Revenue (Million), by Product Type 2025 & 2033

- Figure 5: North America Frozen Food Industry in Pakistan Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Frozen Food Industry in Pakistan Revenue (Million), by Freezing Technique 2025 & 2033

- Figure 7: North America Frozen Food Industry in Pakistan Revenue Share (%), by Freezing Technique 2025 & 2033

- Figure 8: North America Frozen Food Industry in Pakistan Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 9: North America Frozen Food Industry in Pakistan Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Frozen Food Industry in Pakistan Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Frozen Food Industry in Pakistan Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America Frozen Food Industry in Pakistan Revenue (Million), by Product Category 2025 & 2033

- Figure 13: South America Frozen Food Industry in Pakistan Revenue Share (%), by Product Category 2025 & 2033

- Figure 14: South America Frozen Food Industry in Pakistan Revenue (Million), by Product Type 2025 & 2033

- Figure 15: South America Frozen Food Industry in Pakistan Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: South America Frozen Food Industry in Pakistan Revenue (Million), by Freezing Technique 2025 & 2033

- Figure 17: South America Frozen Food Industry in Pakistan Revenue Share (%), by Freezing Technique 2025 & 2033

- Figure 18: South America Frozen Food Industry in Pakistan Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 19: South America Frozen Food Industry in Pakistan Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 20: South America Frozen Food Industry in Pakistan Revenue (Million), by Country 2025 & 2033

- Figure 21: South America Frozen Food Industry in Pakistan Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Frozen Food Industry in Pakistan Revenue (Million), by Product Category 2025 & 2033

- Figure 23: Europe Frozen Food Industry in Pakistan Revenue Share (%), by Product Category 2025 & 2033

- Figure 24: Europe Frozen Food Industry in Pakistan Revenue (Million), by Product Type 2025 & 2033

- Figure 25: Europe Frozen Food Industry in Pakistan Revenue Share (%), by Product Type 2025 & 2033

- Figure 26: Europe Frozen Food Industry in Pakistan Revenue (Million), by Freezing Technique 2025 & 2033

- Figure 27: Europe Frozen Food Industry in Pakistan Revenue Share (%), by Freezing Technique 2025 & 2033

- Figure 28: Europe Frozen Food Industry in Pakistan Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Europe Frozen Food Industry in Pakistan Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Europe Frozen Food Industry in Pakistan Revenue (Million), by Country 2025 & 2033

- Figure 31: Europe Frozen Food Industry in Pakistan Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa Frozen Food Industry in Pakistan Revenue (Million), by Product Category 2025 & 2033

- Figure 33: Middle East & Africa Frozen Food Industry in Pakistan Revenue Share (%), by Product Category 2025 & 2033

- Figure 34: Middle East & Africa Frozen Food Industry in Pakistan Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Middle East & Africa Frozen Food Industry in Pakistan Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Middle East & Africa Frozen Food Industry in Pakistan Revenue (Million), by Freezing Technique 2025 & 2033

- Figure 37: Middle East & Africa Frozen Food Industry in Pakistan Revenue Share (%), by Freezing Technique 2025 & 2033

- Figure 38: Middle East & Africa Frozen Food Industry in Pakistan Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Middle East & Africa Frozen Food Industry in Pakistan Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Middle East & Africa Frozen Food Industry in Pakistan Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East & Africa Frozen Food Industry in Pakistan Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific Frozen Food Industry in Pakistan Revenue (Million), by Product Category 2025 & 2033

- Figure 43: Asia Pacific Frozen Food Industry in Pakistan Revenue Share (%), by Product Category 2025 & 2033

- Figure 44: Asia Pacific Frozen Food Industry in Pakistan Revenue (Million), by Product Type 2025 & 2033

- Figure 45: Asia Pacific Frozen Food Industry in Pakistan Revenue Share (%), by Product Type 2025 & 2033

- Figure 46: Asia Pacific Frozen Food Industry in Pakistan Revenue (Million), by Freezing Technique 2025 & 2033

- Figure 47: Asia Pacific Frozen Food Industry in Pakistan Revenue Share (%), by Freezing Technique 2025 & 2033

- Figure 48: Asia Pacific Frozen Food Industry in Pakistan Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 49: Asia Pacific Frozen Food Industry in Pakistan Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 50: Asia Pacific Frozen Food Industry in Pakistan Revenue (Million), by Country 2025 & 2033

- Figure 51: Asia Pacific Frozen Food Industry in Pakistan Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Product Category 2020 & 2033

- Table 2: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Freezing Technique 2020 & 2033

- Table 4: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Product Category 2020 & 2033

- Table 7: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Freezing Technique 2020 & 2033

- Table 9: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Product Category 2020 & 2033

- Table 15: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Product Type 2020 & 2033

- Table 16: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Freezing Technique 2020 & 2033

- Table 17: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Brazil Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Product Category 2020 & 2033

- Table 23: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Product Type 2020 & 2033

- Table 24: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Freezing Technique 2020 & 2033

- Table 25: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 26: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Country 2020 & 2033

- Table 27: United Kingdom Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: France Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Italy Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Spain Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Russia Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Benelux Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Nordics Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Product Category 2020 & 2033

- Table 37: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Product Type 2020 & 2033

- Table 38: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Freezing Technique 2020 & 2033

- Table 39: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 40: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Turkey Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Israel Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: GCC Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: North Africa Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: South Africa Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Product Category 2020 & 2033

- Table 48: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Product Type 2020 & 2033

- Table 49: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Freezing Technique 2020 & 2033

- Table 50: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 51: Global Frozen Food Industry in Pakistan Revenue Million Forecast, by Country 2020 & 2033

- Table 52: China Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: India Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: South Korea Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: ASEAN Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Oceania Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Frozen Food Industry in Pakistan Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Frozen Food Industry in Pakistan?

The projected CAGR is approximately 5.81%.

2. Which companies are prominent players in the Frozen Food Industry in Pakistan?

Key companies in the market include McCain Foods, Frozen Fresh*List Not Exhaustive, Multi Food Industries, K&N's, Dawn Foods, Icepac Limited, Big Bird, PK Meat & Food Company, Al-Shaheer, Seasons Foods.

3. What are the main segments of the Frozen Food Industry in Pakistan?

The market segments include Product Category, Product Type, Freezing Technique, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 730.23 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Awareness Regarding Natural Products; Growing Demand for Anthocyanin in Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Rising Demand for Convenience Food.

7. Are there any restraints impacting market growth?

Easy Availability of Synthetic Food Colorant.

8. Can you provide examples of recent developments in the market?

December 2021: PK Meat launched 'The PK Meat Shop' to extend theirits delivery service to more regions across Pakistan. PK Meat Shop currently offers dissimilar types of meat products to suit the taste of all categories of consumers, with the products available in all major retail outlets. The eCommerce site features ready-to-cook, ready-to-eat, crispy-coated, and vegetarian and flour products, offering an all-inclusive experience to shoppers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Frozen Food Industry in Pakistan," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Frozen Food Industry in Pakistan report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Frozen Food Industry in Pakistan?

To stay informed about further developments, trends, and reports in the Frozen Food Industry in Pakistan, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence