Key Insights

The Italy soy protein market, valued at approximately €[Estimate based on regional proportion of European market; e.g., if Europe holds 20% of the 35.73 million market, Italy's share might be around €7 million in 2025], is projected to experience robust growth throughout the forecast period (2025-2033). This growth is fueled by several key factors. The increasing demand for plant-based protein sources within the food and beverage sector, driven by health consciousness and vegetarian/vegan dietary trends, is a significant driver. Furthermore, the expanding animal feed industry in Italy, seeking sustainable and cost-effective protein alternatives, is further bolstering market expansion. The prevalence of soy protein isolates and concentrates in various applications, from meat alternatives and protein bars to animal feed supplements, further contributes to this positive trajectory. Italy's strong agricultural sector and established food processing capabilities also create a favorable environment for market growth. However, potential restraints include price volatility of soy commodities, competition from other plant-based protein sources (like pea or wheat protein), and potential consumer concerns regarding genetically modified organisms (GMOs) used in soy production. A strategic focus on non-GMO soy products and clear labeling could mitigate this last concern.

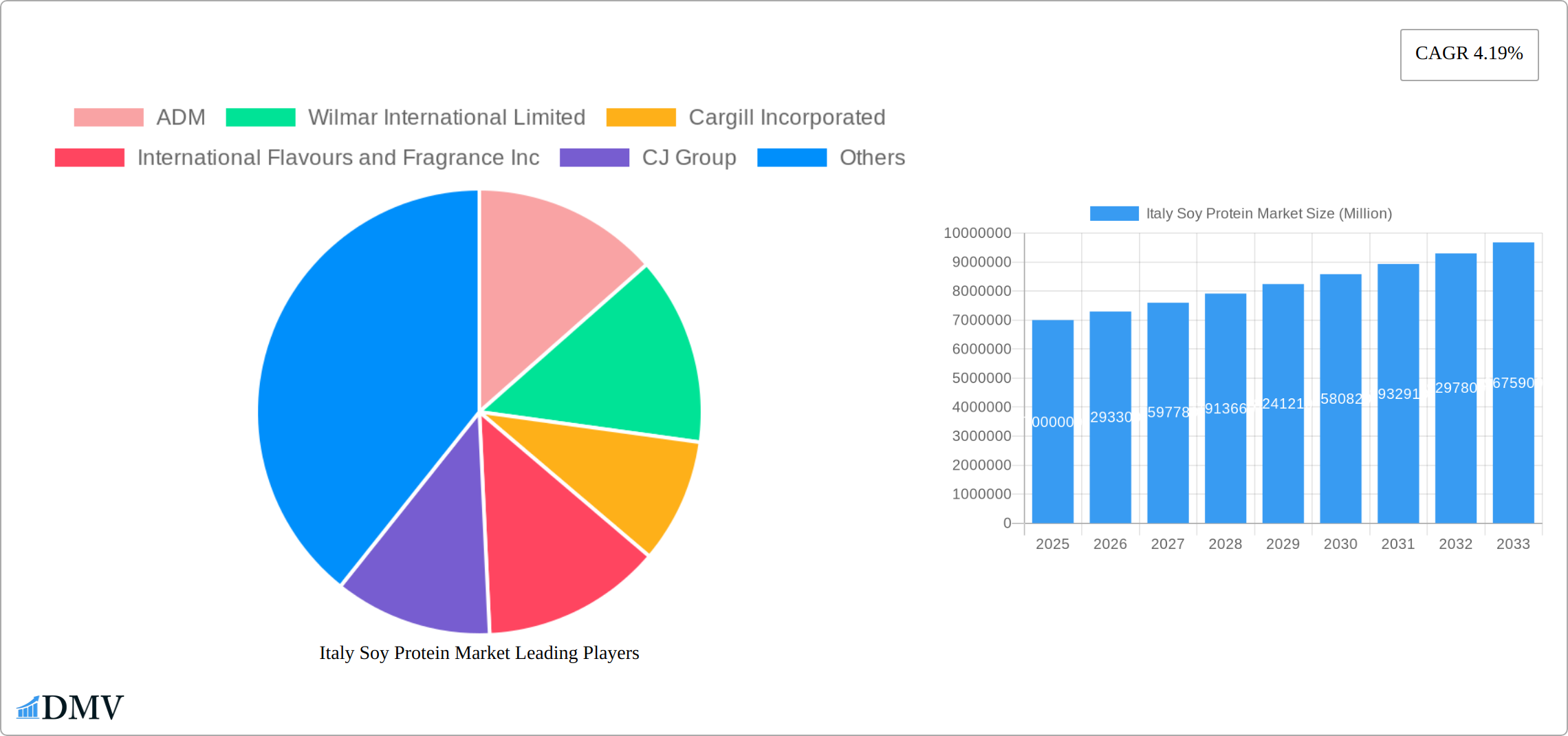

Within the market segmentation, the isolates segment is anticipated to maintain a strong position due to its superior functional properties, making it highly desirable for use in food processing. The animal feed segment will likely continue to constitute a sizable portion of the market, driven by the growing livestock industry. Key players like ADM, Cargill, and others are likely to dominate the market through strategic partnerships, innovation in soy protein formulations, and strong distribution networks. The projected Compound Annual Growth Rate (CAGR) of 4.19% suggests a steady and predictable market trajectory, although external factors such as economic conditions and regulatory changes could influence the pace of growth in the coming years. Growth strategies for market players should focus on product differentiation, targeted marketing efforts toward health-conscious consumers and food manufacturers, and investment in sustainable and ethical sourcing of soy.

Italy Soy Protein Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Italy soy protein market, encompassing market size, growth trajectory, competitive landscape, and future opportunities. From 2019 to 2033, we delve into the dynamics shaping this crucial sector, offering invaluable insights for stakeholders across the value chain. The report leverages extensive data analysis and expert perspectives to deliver actionable intelligence for strategic decision-making. With a base year of 2025 and a forecast period spanning 2025-2033, this study illuminates the path forward for the Italian soy protein market. The total market value is predicted to reach xx Million by 2033.

Italy Soy Protein Market Composition & Trends

The Italian soy protein market exhibits a moderately concentrated structure, with key players like ADM, Cargill Incorporated, and Bunge Limited holding significant market share. However, the presence of regional players like A Costantino & C spa suggests opportunities for niche players. Innovation is primarily driven by the increasing demand for plant-based proteins, prompting the development of novel soy-based ingredients and applications. Stringent EU food safety regulations and sustainability concerns significantly impact market dynamics. Substitute products, such as pea protein and wheat protein, exert competitive pressure, while the rise of veganism and flexitarianism boosts demand. Mergers and acquisitions (M&A) are shaping the landscape, with notable deals influencing market consolidation and technological advancements.

- Market Share Distribution (2024): ADM (25%), Cargill Incorporated (20%), Bunge Limited (15%), Others (40%)

- Recent M&A Activity: Bunge's merger with Viterra (June 2023) valued at xx Million significantly alters the competitive landscape.

Italy Soy Protein Market Industry Evolution

The Italian soy protein market has witnessed robust growth over the historical period (2019-2024), driven by rising consumer demand for plant-based foods and animal feed. Technological advancements, such as the development of more sustainable and efficient soy processing technologies, have contributed to market expansion. Consumer preference shifts towards healthier, more sustainable food options further fuel growth. The market is expected to maintain a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is propelled by increasing adoption of soy protein in various applications like food and beverages, animal feed, and personal care products. The increasing focus on sustainable sourcing and production practices is also driving innovation and market growth. The partnerships between Cargill and Benson Hill, and the introduction of Benson Hill’s TruVail™ highlight the industry's commitment to innovation and sustainability. This evolution is shaped by technological advancements in soy processing, leading to improved protein quality and functionality. Consumer demand for convenient, healthier, and plant-based food options further stimulates growth.

Leading Regions, Countries, or Segments in Italy Soy Protein Market

Within the Italian soy protein market, the Food and Beverages segment dominates, driven by the increasing popularity of plant-based meat alternatives, dairy substitutes, and protein-enriched foods. The Animal Feed sector also represents a significant portion of the market, reflecting the importance of soy protein as a cost-effective and nutritious feed ingredient for livestock. Concentrates currently hold the largest share of the Form segment due to their cost-effectiveness, but isolates are gaining traction due to their higher protein content and functional properties.

- Key Drivers for Food & Beverages:

- Growing demand for plant-based alternatives.

- Increasing consumer awareness of health and nutrition.

- Regulatory support for sustainable food production.

- Key Drivers for Animal Feed:

- Rising demand for animal protein.

- Cost-effectiveness of soy protein as an animal feed ingredient.

- Stringent regulations concerning animal feed quality and safety.

The dominance of these segments stems from factors including strong consumer demand, established supply chains, and significant investments in research and development.

Italy Soy Protein Market Product Innovations

Recent innovations include the development of soy protein ingredients with enhanced functional properties (e.g., improved solubility, emulsification, and texture) to cater to diverse food and beverage applications. This includes the launch of new soy protein isolates and concentrates with improved nutritional profiles and sustainability credentials. Technological advancements in soy processing have led to the production of more sustainable and efficient soy protein ingredients, further enhancing market competitiveness. The introduction of TruVail™ by Benson Hill exemplifies the drive towards innovative, sustainable, and high-protein soy solutions.

Propelling Factors for Italy Soy Protein Market Growth

The Italian soy protein market is propelled by several factors. Firstly, the growing preference for plant-based diets, fueled by health consciousness and environmental concerns, boosts demand for soy protein as a key ingredient in vegetarian and vegan products. Secondly, the animal feed industry's reliance on soy protein for livestock nutrition ensures a consistently high demand. Finally, technological advancements leading to improved soy protein extraction and processing methods enhance efficiency and quality, making it a more cost-effective and attractive option.

Obstacles in the Italy Soy Protein Market

Challenges include fluctuating raw material prices impacting soy protein production costs and potential supply chain disruptions. Furthermore, competition from other plant-based protein sources, such as pea and wheat protein, presents a constraint. The stringent regulatory environment governing food safety and labeling in Italy can impose additional costs and compliance burdens on producers. These factors can create uncertainty in pricing and availability.

Future Opportunities in Italy Soy Protein Market

The Italian soy protein market is poised for significant growth, driven by several key factors. The increasing demand for plant-based alternatives to traditional animal proteins, fueled by health consciousness and sustainability concerns among Italian consumers, presents a major opportunity. This trend is particularly evident in the burgeoning vegan and vegetarian food sectors, where soy protein is a crucial ingredient. Further growth is anticipated through the development of innovative soy protein applications in emerging food segments such as functional foods and beverages enriched with protein and other beneficial nutrients. This includes the creation of novel food products tailored to specific dietary needs and preferences within the Italian market. Furthermore, advancements in processing technologies are leading to soy protein ingredients with improved texture, flavor profiles, and functionalities, making them more appealing and versatile for food manufacturers. Sustainable and ethical sourcing practices, emphasizing transparency and environmental responsibility throughout the supply chain, are becoming increasingly important to Italian consumers, offering a competitive advantage to companies prioritizing these aspects. This includes the exploration of locally sourced soy whenever feasible, reducing environmental impact associated with transportation and supporting domestic agriculture.

Major Players in the Italy Soy Protein Market Ecosystem

- ADM

- Wilmar International Limited

- Cargill Incorporated

- International Flavours and Fragrance Inc

- CJ Group

- DuPont de Nemours Inc

- Bunge Limited

- Kerry Group

- Brenntag

- A Costantino & C spa

Key Developments in Italy Soy Protein Market Industry

- June 2023: The merger of Bunge and Viterra created a global agricultural powerhouse with significant implications for the Italian soy protein market. This consolidation strengthens Bunge's position as a major supplier and potentially influences pricing and market dynamics within Italy.

- August 2022: Cargill's strategic alliance with Benson Hill, focusing on the development of ultra-high protein soy solutions, signifies a significant investment in innovation within the soy protein sector. This collaboration aims to meet the increasing consumer demand for higher-protein foods and could lead to new product formulations in the Italian market.

- February 2022: Benson Hill's launch of TruVail™, a range of sustainable, non-GMO plant-based protein ingredients, including high-protein soy flour and texturized proteins, provides Italian food manufacturers with access to innovative and ethically sourced ingredients. This expands the availability of diverse soy protein options and supports the growing demand for sustainable and plant-based food products.

- [Add other relevant recent developments here, including specific Italian market related news, new product launches, regulatory changes etc.]

Strategic Italy Soy Protein Market Forecast

The Italian soy protein market is poised for continued growth, driven by sustained demand for plant-based foods, technological advancements, and the increasing focus on sustainability. The market's expansion will be influenced by innovative product development, strategic partnerships, and evolving consumer preferences. The forecast period promises opportunities for both established players and new entrants to capitalize on the burgeoning demand for high-quality, sustainable soy protein ingredients.

Italy Soy Protein Market Segmentation

-

1. Form

- 1.1. Concentrates

- 1.2. Isolates

- 1.3. Textured/Hydrolyzed

-

2. End-User

- 2.1. Animal Feed

- 2.2. Personal Care and Cosmetics

-

2.3. Food and Beverages

- 2.3.1. Bakery

- 2.3.2. Breakfast Cereals

- 2.3.3. Condiments/Sauces

- 2.3.4. Dairy and Dairy Alternative Products

- 2.3.5. Meat/Poultry/Seafood and Meat Alternative Products

- 2.3.6. RTE/RTC Food Products

- 2.3.7. Snacks

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

Italy Soy Protein Market Segmentation By Geography

- 1. Italy

Italy Soy Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.19% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Health and Wellness Trends Drives the Market; Increased Use in Food and beverage Sector Drives The Market

- 3.3. Market Restrains

- 3.3.1. High Competition from Other Protein Sources

- 3.4. Market Trends

- 3.4.1. Growing Demand for Protein Rich Food is Persuading the Production of Soy in Italy

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Soy Protein Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Concentrates

- 5.1.2. Isolates

- 5.1.3. Textured/Hydrolyzed

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Animal Feed

- 5.2.2. Personal Care and Cosmetics

- 5.2.3. Food and Beverages

- 5.2.3.1. Bakery

- 5.2.3.2. Breakfast Cereals

- 5.2.3.3. Condiments/Sauces

- 5.2.3.4. Dairy and Dairy Alternative Products

- 5.2.3.5. Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.3.6. RTE/RTC Food Products

- 5.2.3.7. Snacks

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Germany Italy Soy Protein Market Analysis, Insights and Forecast, 2019-2031

- 7. France Italy Soy Protein Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Italy Soy Protein Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Italy Soy Protein Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Italy Soy Protein Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Italy Soy Protein Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Italy Soy Protein Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 ADM

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Wilmar International Limited

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Cargill Incorporated

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 International Flavours and Fragrance Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 CJ Group

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 DuPont de Nemours Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Bunge Limited

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Kerry Group

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Brenntag

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 A Costantino & C spa

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 ADM

List of Figures

- Figure 1: Italy Soy Protein Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italy Soy Protein Market Share (%) by Company 2024

List of Tables

- Table 1: Italy Soy Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italy Soy Protein Market Revenue Million Forecast, by Form 2019 & 2032

- Table 3: Italy Soy Protein Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Italy Soy Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Italy Soy Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Italy Soy Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Italy Soy Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Italy Soy Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Italy Soy Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Italy Soy Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Italy Soy Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Italy Soy Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Soy Protein Market Revenue Million Forecast, by Form 2019 & 2032

- Table 14: Italy Soy Protein Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 15: Italy Soy Protein Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Soy Protein Market?

The projected CAGR is approximately 4.19%.

2. Which companies are prominent players in the Italy Soy Protein Market?

Key companies in the market include ADM, Wilmar International Limited, Cargill Incorporated, International Flavours and Fragrance Inc, CJ Group, DuPont de Nemours Inc, Bunge Limited, Kerry Group, Brenntag, A Costantino & C spa.

3. What are the main segments of the Italy Soy Protein Market?

The market segments include Form, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.73 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Health and Wellness Trends Drives the Market; Increased Use in Food and beverage Sector Drives The Market.

6. What are the notable trends driving market growth?

Growing Demand for Protein Rich Food is Persuading the Production of Soy in Italy.

7. Are there any restraints impacting market growth?

High Competition from Other Protein Sources.

8. Can you provide examples of recent developments in the market?

June 2023: Bunge mergered with Viterra, marking a pivotal moment in the global grain industry. This strategic partnership positions Bunge to emerge as one of the world's foremost grain companies. The merger between Bunge and Viterra holds the potential to expedite Bunge's overarching mission, which centers on connecting farmers to consumers and ensuring the delivery of vital food, feed, and fuel resources worldwide, including in Italy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Soy Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Soy Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Soy Protein Market?

To stay informed about further developments, trends, and reports in the Italy Soy Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence