Key Insights

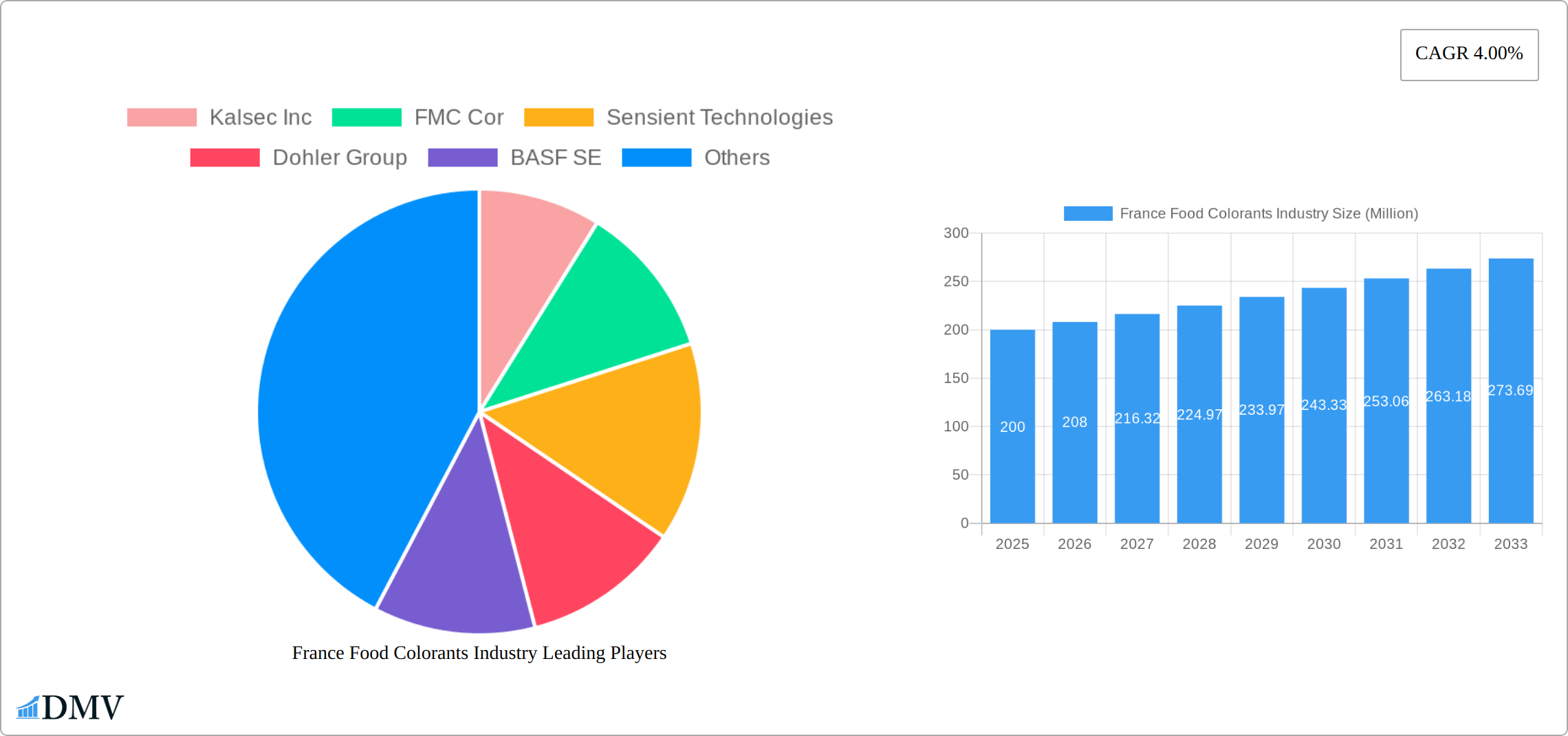

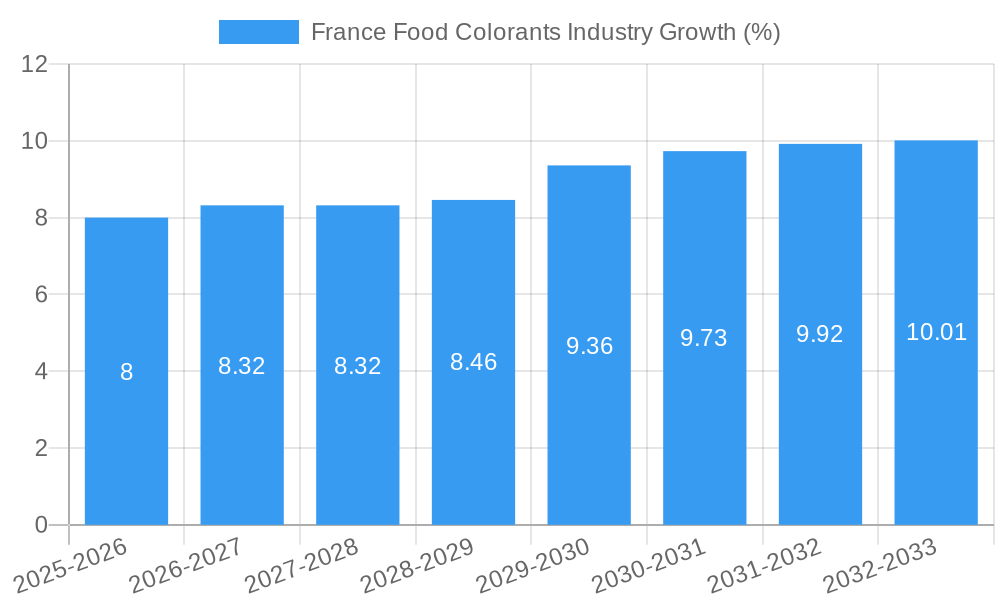

The France food colorants market, valued at approximately €200 million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 4.00% from 2025 to 2033. This growth is fueled by several key drivers. The increasing demand for processed foods, particularly within the confectionery, bakery, and beverage sectors, is a significant factor. Consumer preference for visually appealing food products drives the adoption of both natural and synthetic colorants. Furthermore, the growing popularity of convenience foods and ready-to-eat meals contributes to the market's expansion. Innovation within the food colorant industry, including the development of more sustainable and naturally-sourced options, also plays a crucial role. However, stringent regulations concerning the use of certain synthetic colorants and increasing consumer awareness regarding potential health implications pose challenges to market growth. The market segmentation reveals a strong demand for both natural and synthetic colorants across various applications, reflecting diverse consumer preferences and manufacturer requirements. Leading players like Kalsec Inc, FMC Corporation, and Sensient Technologies are actively engaged in research and development, aiming to introduce innovative and compliant products to meet evolving market demands. The competitive landscape is characterized by both established multinational corporations and regional players.

The forecast period (2025-2033) will likely see continued growth, though the pace may fluctuate slightly depending on economic conditions and evolving consumer trends. The increasing focus on clean-label products and the growing interest in natural food ingredients are expected to stimulate higher demand for natural colorants. While synthetic colorants are anticipated to maintain a significant market share, due to their cost-effectiveness and vibrant colors, the segment focusing on natural colorants is projected to experience faster growth. The market is influenced by both regional regulations concerning food additives and the broader European Union food safety standards. A strategic focus on product innovation, sustainability, and compliance with regulations will be crucial for companies seeking to thrive in this dynamic market.

France Food Colorants Industry: Market Analysis & Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the France food colorants industry, offering valuable insights into market dynamics, competitive landscape, and future growth prospects. The study covers the period from 2019 to 2033, with 2025 as the base year and forecast extending to 2033. The report is essential for stakeholders including manufacturers, suppliers, distributors, and investors seeking to understand and capitalize on the opportunities within this dynamic market. The market size is estimated to be XX Million in 2025, poised for significant growth throughout the forecast period.

France Food Colorants Industry Market Composition & Trends

The France food colorants market exhibits a moderately concentrated structure, with key players like Kalsec Inc, FMC Corporation, Sensient Technologies, Dohler Group, BASF SE, Chr. Hansen AS, DD Williamson & Co, and Koninklijke DSM NV holding significant market share. The combined market share of these leading companies is estimated at approximately xx%. Innovation in natural colorants, driven by increasing consumer preference for clean-label products, is a major catalyst for market growth. Stringent EU food safety regulations significantly influence product development and manufacturing practices. Competition from substitute products, such as natural plant extracts, also plays a role. End-user demand is primarily driven by the beverage, confectionery, and dairy & frozen products sectors. Mergers and acquisitions (M&A) activity in the industry has been moderate in recent years, with total deal values estimated at approximately XX Million between 2019 and 2024.

- Market Share Distribution: Kalsec Inc (xx%), FMC Corporation (xx%), Sensient Technologies (xx%), Others (xx%)

- M&A Activity: Significant M&A activity was observed in 2022-2023, largely driven by consolidation within the natural colorants segment.

- Regulatory Landscape: Strict compliance requirements related to labeling and safety regulations drive innovation in natural colorants.

- Substitute Products: Growing consumer preference for natural alternatives poses a challenge to synthetic colorants.

France Food Colorants Industry Industry Evolution

The French food colorants industry has demonstrated robust and consistent growth throughout the historical period (2019-2024). This upward trend has been significantly propelled by the escalating consumer preference for processed foods and beverages, alongside a growing awareness and demand for enhanced visual appeal in food products. Concurrently, substantial advancements in both the extraction and synthesis of food colorants have markedly improved production efficiency, boosted product quality, and expanded the range of available shades and functionalities. A pivotal shift is observable in consumer preferences, with a strong and increasing inclination towards healthier, more natural, and 'clean-label' food options. This has consequently spurred a substantial surge in the demand for natural colorants derived from botanical sources. The market experienced a notable Compound Annual Growth Rate (CAGR) of approximately XX% between 2019 and 2024, reflecting a dynamic and expanding sector. This positive growth trajectory is projected to persist, with an anticipated CAGR of XX% from 2025 to 2033. This future growth will be primarily driven by the continued expansion of the food processing industry, an ongoing demand for visually captivating food products, and the increasing integration of sustainable and eco-friendly colorant production methods, mirroring a broader industry commitment to environmental responsibility. Furthermore, ongoing innovation in encapsulation technologies, designed to enhance color stability, extend shelf-life, and improve overall functionality within diverse food matrices, is a key contributor to the industry's ongoing evolution and appeal.

Leading Regions, Countries, or Segments in France Food Colorants Industry

The largest segment within the France food colorants market is the synthetic colorants segment. This is primarily due to the cost-effectiveness and wide availability of synthetic colorants, their versatility in various food applications. However, the natural colorants segment is witnessing robust growth driven by increasing consumer demand for natural and clean-label products.

- By Product Type:

- Synthetic Color: Key drivers include cost-effectiveness and wide availability.

- Natural Color: Strong growth is driven by increasing consumer preference for clean-label products.

- By Application:

- Beverage: High consumption of soft drinks and juices fuels demand.

- Confectionery: The vibrant colors enhance the visual appeal of candies and chocolates.

- Dairy and Frozen Products: Colorants are used to enhance the visual appeal and mask discoloration.

The Île-de-France region dominates the market due to its high concentration of food processing facilities and proximity to major distribution networks.

France Food Colorants Industry Product Innovations

Recent advancements in the France food colorants industry are predominantly centered on the development and refinement of natural colorants. A key focus is on enhancing their stability, intensifying their color output, and improving their functional properties for broader application. Cutting-edge extraction techniques are being actively employed to optimize the yield and purity of natural colorants, making them more commercially viable and effective. Microencapsulation technology continues to be a crucial area of innovation, significantly boosting the stability and extending the shelf-life of colorants when incorporated into a wide array of food and beverage products. Moreover, a significant emphasis is placed on the creation of novel color solutions that directly address specific consumer desires for healthier, more natural, and transparently sourced ingredients, positioning major players at the forefront of market innovation.

Propelling Factors for France Food Colorants Industry Growth

Several factors are driving growth in the France food colorants market. Technological advancements in color extraction and synthesis are improving efficiency and quality. Economic growth and rising disposable incomes are increasing consumer spending on processed foods. Favorable regulatory frameworks are fostering innovation and promoting safe practices. The growing demand for visually appealing food products fuels the demand for high-quality colorants.

Obstacles in the France Food Colorants Industry Market

The France food colorants industry navigates several significant challenges that impact its operational landscape. Foremost among these are the increasingly stringent regulatory frameworks governing food additives, which elevate compliance costs and necessitate ongoing adaptation of production processes. Supply chain vulnerabilities, particularly concerning the sourcing of natural raw materials, can lead to production inefficiencies and price volatility. The competitive environment is also highly dynamic, characterized by the presence of established market leaders and the emergence of new players, exerting considerable pressure on pricing strategies and overall profitability. Furthermore, fluctuations in the cost of raw materials directly influence production expenses, posing an ongoing hurdle for manufacturers.

Future Opportunities in France Food Colorants Industry

The France food colorants industry is poised to capitalize on several burgeoning opportunities. The accelerating consumer demand for natural, clean-label, and plant-based colorants presents a significant growth avenue. Investments are increasingly being directed towards the research and development of sustainable and eco-friendly colorant production methods, aligning with global environmental initiatives. Expanding the application of colorants into novel food categories and actively exploring and penetrating emerging international markets offer substantial growth potential. The growing trend of personalized nutrition, coupled with the development of targeted and functional color solutions, also represents a promising frontier for future innovation and market expansion.

Major Players in the France Food Colorants Industry Ecosystem

- Kalsec Inc

- FMC Corporation

- Sensient Technologies

- Dohler Group

- BASF SE

- Chr. Hansen AS

- D D Williamson & Co

- Koninklijke DSM NV

Key Developments in France Food Colorants Industry Industry

- 2022 Q4: Kalsec Inc. launched an innovative new range of natural colorants expertly derived from premium plant extracts, catering to the growing demand for natural ingredients.

- 2023 Q1: FMC Corporation announced a significant strategic partnership aimed at substantially expanding its distribution network within the French market, enhancing its reach and accessibility.

- 2023 Q3: Sensient Technologies completed the strategic acquisition of a smaller, specialized French colorant manufacturer. While precise financial figures are undisclosed, the acquisition is estimated to be valued in the range of XX Million, indicating consolidation and strategic growth within the sector.

Strategic France Food Colorants Industry Market Forecast

The France food colorants market is projected to experience significant growth over the forecast period (2025-2033). This growth will be driven by a combination of factors including increasing demand for processed foods, the growing preference for natural colorants, and ongoing technological advancements in colorant production. Opportunities exist in developing innovative and sustainable color solutions to cater to evolving consumer preferences. The market's potential is significant, with substantial growth expected across various segments and applications.

France Food Colorants Industry Segmentation

-

1. Product Type

- 1.1. Natural Color

- 1.2. Synthetic Color

-

2. Application

- 2.1. Beverage

- 2.2. Dairy and Frozen Products

- 2.3. Bakery

- 2.4. Meat, Poultry, and Seafood

- 2.5. Confectionery

- 2.6. Other Applications

France Food Colorants Industry Segmentation By Geography

- 1. France

France Food Colorants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth

- 3.4. Market Trends

- 3.4.1. Natural Food Colorants Dominates the Overall Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Food Colorants Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Natural Color

- 5.1.2. Synthetic Color

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Beverage

- 5.2.2. Dairy and Frozen Products

- 5.2.3. Bakery

- 5.2.4. Meat, Poultry, and Seafood

- 5.2.5. Confectionery

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Kalsec Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FMC Cor

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sensient Technologies

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dohler Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BASF SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chr Hansen AS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 D D Williamson & Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Koninklijke DSM NV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Kalsec Inc

List of Figures

- Figure 1: France Food Colorants Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Food Colorants Industry Share (%) by Company 2024

List of Tables

- Table 1: France Food Colorants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Food Colorants Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: France Food Colorants Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: France Food Colorants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: France Food Colorants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: France Food Colorants Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: France Food Colorants Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 8: France Food Colorants Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Food Colorants Industry?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the France Food Colorants Industry?

Key companies in the market include Kalsec Inc, FMC Cor, Sensient Technologies, Dohler Group, BASF SE, Chr Hansen AS, D D Williamson & Co, Koninklijke DSM NV.

3. What are the main segments of the France Food Colorants Industry?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth.

6. What are the notable trends driving market growth?

Natural Food Colorants Dominates the Overall Market.

7. Are there any restraints impacting market growth?

Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Food Colorants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Food Colorants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Food Colorants Industry?

To stay informed about further developments, trends, and reports in the France Food Colorants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence