Key Insights

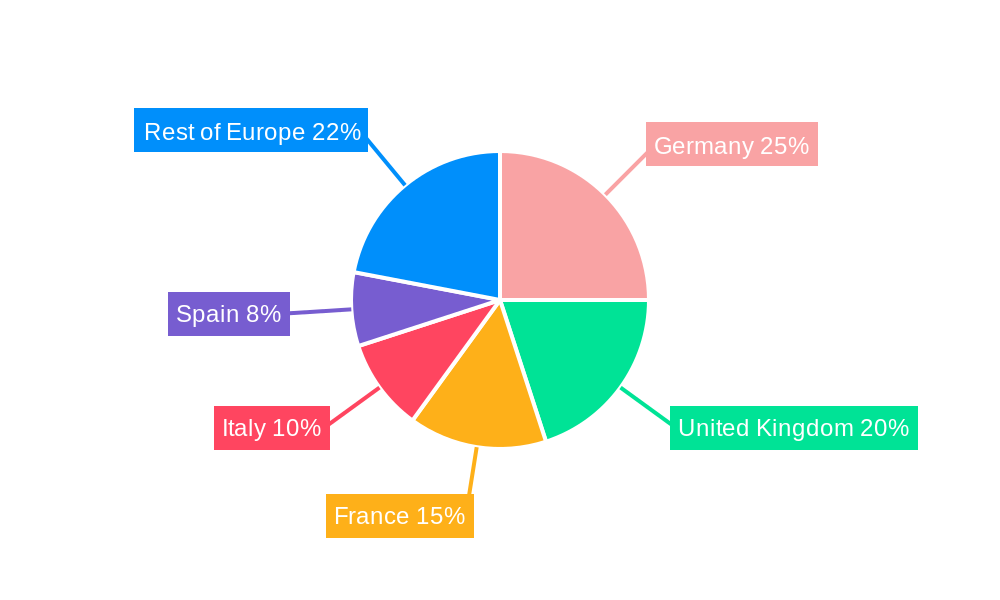

The European probiotics market, valued at €13.78 billion in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 3.49% from 2025 to 2033. This growth is fueled by several key factors. Increasing consumer awareness of gut health and its connection to overall well-being is a primary driver. The rising prevalence of digestive disorders and the increasing adoption of functional foods and dietary supplements are also significantly contributing to market expansion. Furthermore, the growing demand for natural and organic products is bolstering the market, as consumers seek healthier alternatives to conventional medicine. Germany, the United Kingdom, and France represent the largest national markets within Europe, driven by high consumer spending on health and wellness products and a robust healthcare infrastructure. The market is segmented by product type (functional food and beverages, dietary supplements, and animal feed) and distribution channels (supermarkets/hypermarkets, pharmacies/health stores, convenience stores, and other channels). Competition is fierce, with established players like Nestlé SA, Danone SA, and PepsiCo Inc. alongside specialized probiotics manufacturers such as BioGaia and Chr. Hansen. The market's growth trajectory is expected to be influenced by factors such as fluctuating raw material prices, stringent regulatory frameworks, and evolving consumer preferences.

The continued expansion of the European probiotics market is anticipated to be driven by innovation in product development, including the introduction of novel probiotic strains with enhanced efficacy and targeted health benefits. The market is likely to see increased investment in research and development, leading to more sophisticated probiotic formulations. Furthermore, strategic partnerships between probiotics manufacturers and food and beverage companies are expected to broaden product availability and reach new consumer segments. The rise of e-commerce is also expected to positively impact market growth, facilitating direct-to-consumer sales and expanding market reach beyond traditional retail channels. However, challenges such as ensuring the stability and efficacy of probiotics during storage and transportation, as well as addressing potential consumer concerns regarding safety and efficacy, will need to be carefully managed to sustain market growth. The market will likely see increased emphasis on transparency and labeling, aiming to build consumer trust and confidence in probiotic products.

Europe Probiotics Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the European probiotics industry, encompassing market size, trends, leading players, and future projections from 2019 to 2033. The study period covers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033). It's an invaluable resource for stakeholders seeking to understand the dynamics of this rapidly evolving market and capitalize on emerging opportunities. The estimated market value in 2025 is XX Million.

Europe Probiotics Industry Market Composition & Trends

This section delves into the intricate composition of the European probiotics market, offering insights into market concentration, innovation drivers, regulatory landscapes, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. The market is characterized by a mix of large multinational players and smaller specialized companies. Market share distribution shows a concentration among key players like Nestlé SA, Danone SA, and Chr. Hansen, although the precise figures for 2025 are still being calculated. However, we predict that the top 5 players hold approximately xx% of the market share in 2025.

- Market Concentration: Highly concentrated with major players holding significant market share. We project a xx% concentration ratio for the top five players in 2025.

- Innovation Catalysts: Growing consumer demand for gut health solutions and advancements in probiotic strain development and delivery systems.

- Regulatory Landscape: Stringent regulations regarding food safety and labeling, impacting product development and market access.

- Substitute Products: Prebiotics and other functional foods compete with probiotics for market share.

- End-User Profiles: Consumers increasingly seeking natural and functional foods, including those with probiotics, leading to strong demand in the functional food and beverage segment.

- M&A Activities: Significant M&A activity in recent years, with deal values totaling an estimated XX Million in the last five years, driven by consolidation and expansion strategies of key players.

Europe Probiotics Industry Industry Evolution

The European probiotics market has experienced substantial growth over the past few years, driven by several key factors. Increased consumer awareness of gut health benefits, rising demand for functional foods and dietary supplements, and technological advancements in probiotic strain development and delivery systems have all contributed to this growth. The market's compound annual growth rate (CAGR) from 2019 to 2024 was approximately XX%, and it is projected to grow at a CAGR of XX% during the forecast period (2025-2033). This growth trajectory reflects a shift towards preventive healthcare and the incorporation of probiotics into mainstream consumer diets. Technological advancements, such as the development of new probiotic strains with enhanced efficacy and stability, have also significantly influenced market expansion. Furthermore, evolving consumer preferences, including a preference for natural and sustainable products, are influencing the market's trajectory.

Leading Regions, Countries, or Segments in Europe Probiotics Industry

Germany, the United Kingdom, and France currently dominate the European probiotics market, collectively accounting for a significant portion ([Insert precise percentage with source citation]) of the total market value in 2023. This leadership is primarily driven by the robust performance of the functional food and beverage segment, fueled by rising consumer demand for probiotic-enriched products. However, emerging markets within Europe are showing promising growth potential.

- Key Drivers for Dominant Regions/Segments:

- Germany: A strong regulatory framework fosters consumer trust, coupled with a high level of health and wellness awareness among the population.

- United Kingdom: The large population size, combined with a high level of health consciousness and a well-developed retail infrastructure, creates a fertile ground for probiotic product sales.

- France: High per capita consumption of dairy products provides ample opportunities for integrating probiotics into existing food categories, offering convenient avenues for consumer uptake.

- Functional Food & Beverages: The ease of incorporating probiotics into daily diets, alongside a growing preference for natural health solutions, is a key factor driving market growth.

- Supermarkets/Hypermarkets: These channels provide extensive product reach, maximizing exposure to a large consumer base. The rise of e-commerce is also expanding distribution and access.

- Emerging Markets: [Mention specific countries or regions showing significant growth, and briefly explain the driving factors behind their expansion. Example: "The Scandinavian countries are experiencing rapid growth due to a high health-conscious population and early adoption of innovative probiotic products."]

The sustained dominance of these regions and segments is further supported by factors such as higher disposable incomes, increasing health awareness campaigns, supportive regulatory environments, and well-established, efficient distribution networks. However, the market is dynamic, with emerging trends and new players constantly shaping its landscape.

Europe Probiotics Industry Product Innovations

Recent innovations are significantly impacting the European probiotics market, focusing on enhancing the efficacy, stability, and delivery methods of probiotic strains. Key advancements include the use of encapsulated probiotics to improve survival rates during passage through the digestive system, and the development of novel strains specifically targeting particular health benefits, such as improved immunity, gut microbiome balance, and even skin health. These advancements directly respond to consumer demand for highly effective and conveniently accessible probiotic solutions. The incorporation of probiotics into novel product formats, including functional beverages, snacks, and even skincare products, broadens the market appeal and reaches new consumer segments.

Propelling Factors for Europe Probiotics Industry Growth

Several factors fuel the growth of the European probiotics industry. These include increasing consumer awareness of the gut-health link to overall wellness, coupled with a rise in demand for natural and functional foods. Technological advancements in strain development and delivery systems, allowing for improved efficacy and stability, contribute significantly to market expansion. Furthermore, supportive regulatory frameworks in several European countries facilitate market access and growth.

Obstacles in the Europe Probiotics Industry Market

The industry faces several challenges including stringent regulations regarding labeling and efficacy claims, impacting product development and launch timelines. Supply chain disruptions, particularly those related to raw materials and manufacturing, can lead to increased production costs and potential shortages. Furthermore, intense competition among established players and new entrants creates pricing pressure and necessitates continuous innovation.

Future Opportunities in Europe Probiotics Industry

The future of the European probiotics market is bright, presenting several lucrative opportunities. Expanding into new market segments, such as personalized nutrition (probiotics tailored to individual genetic profiles and gut microbiomes) and targeted probiotic therapies for specific health conditions (e.g., inflammatory bowel disease), holds immense potential. Further research and development of novel probiotic strains with enhanced efficacy and functionalities, coupled with improved delivery systems, will also drive significant growth. Moreover, integrating probiotics into innovative food and beverage formats that align with evolving consumer preferences (e.g., plant-based options, sustainable packaging) will be crucial for market expansion. The growing interest in the gut-brain axis and the role of probiotics in mental health is also an emerging opportunity.

Major Players in the Europe Probiotics Industry Ecosystem

- Nestlé SA

- Chr. Hansen

- PepsiCo Inc

- Danone SA

- BioGaia

- Lifeway Foods Inc

- Archer Daniels Midland

- Yakult Honsha

- Daflorn MLM5 Ltd

- Bio-K Plus International Inc

Key Developments in Europe Probiotics Industry Industry

- August 2022: BioGaia announced expanding its product line with fresh bacterial strains created in collaboration with its wholly-owned subsidiary MetaboGen. This expands their product portfolio and reinforces their commitment to innovation.

- September 2022: BioGaia partnered with Skinome to research and develop a probiotic concentrate for skin health. This diversification into skincare applications broadens the market reach of probiotics.

- February 2021: Perrigo and Probi signed a pan-European agreement to launch probiotic products across 14 countries. This strategic partnership significantly increases market penetration for both companies.

Strategic Europe Probiotics Industry Market Forecast

The European probiotics market is projected to experience substantial growth throughout the forecast period (2024-2033), driven by factors such as increased consumer health awareness, technological advancements leading to improved product efficacy, and the expansion of probiotic applications into diverse product categories. Continuous product innovation, strategic partnerships aimed at market penetration, and the exploration of underserved regional markets are expected to contribute significantly to this growth trajectory. The projected Compound Annual Growth Rate (CAGR) indicates substantial potential for investment and expansion within the industry. [Insert precise CAGR figures with source citation]

Europe Probiotics Industry Segmentation

-

1. Product Type

- 1.1. Functional Food and Beverage

- 1.2. Dietary Supplements

- 1.3. Animal Feed

-

2. Distribution Channel

- 2.1. Supermarkets/ Hypermarkets

- 2.2. Pharmacies/Health Stores

- 2.3. Convenience Stores

- 2.4. Other Distribution Channels

Europe Probiotics Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Probiotics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.49% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Demand for Specialty

- 3.2.2 Organic

- 3.2.3 and Green Coffee; Growing In-House Production of Coffee in the Country

- 3.3. Market Restrains

- 3.3.1. Change in Climatic Conditions Impacting Coffee Plantations

- 3.4. Market Trends

- 3.4.1. Growing Demand for Functional Food and Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Functional Food and Beverage

- 5.1.2. Dietary Supplements

- 5.1.3. Animal Feed

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/ Hypermarkets

- 5.2.2. Pharmacies/Health Stores

- 5.2.3. Convenience Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Nestlé SA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 CHR Hansen

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 PepsiCo Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Danone SA

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 BioGaia

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Lifeway Foods Inc *List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Archer Daniels Midland

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Yakult Honsha

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Daflorn MLM5 Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Bio-K Plus International Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Nestlé SA

List of Figures

- Figure 1: Europe Probiotics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Probiotics Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Probiotics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Probiotics Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Europe Probiotics Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Europe Probiotics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Probiotics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Probiotics Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Europe Probiotics Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Europe Probiotics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Probiotics Industry?

The projected CAGR is approximately 3.49%.

2. Which companies are prominent players in the Europe Probiotics Industry?

Key companies in the market include Nestlé SA, CHR Hansen, PepsiCo Inc, Danone SA, BioGaia, Lifeway Foods Inc *List Not Exhaustive, Archer Daniels Midland, Yakult Honsha, Daflorn MLM5 Ltd, Bio-K Plus International Inc.

3. What are the main segments of the Europe Probiotics Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Specialty. Organic. and Green Coffee; Growing In-House Production of Coffee in the Country.

6. What are the notable trends driving market growth?

Growing Demand for Functional Food and Beverages.

7. Are there any restraints impacting market growth?

Change in Climatic Conditions Impacting Coffee Plantations.

8. Can you provide examples of recent developments in the market?

September 2022: BioGaia announced its partnership with Skinome to research and develop a probiotic concentrate with living bacteria that will support the skin microbiome and improve skin health.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Probiotics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Probiotics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Probiotics Industry?

To stay informed about further developments, trends, and reports in the Europe Probiotics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence