Key Insights

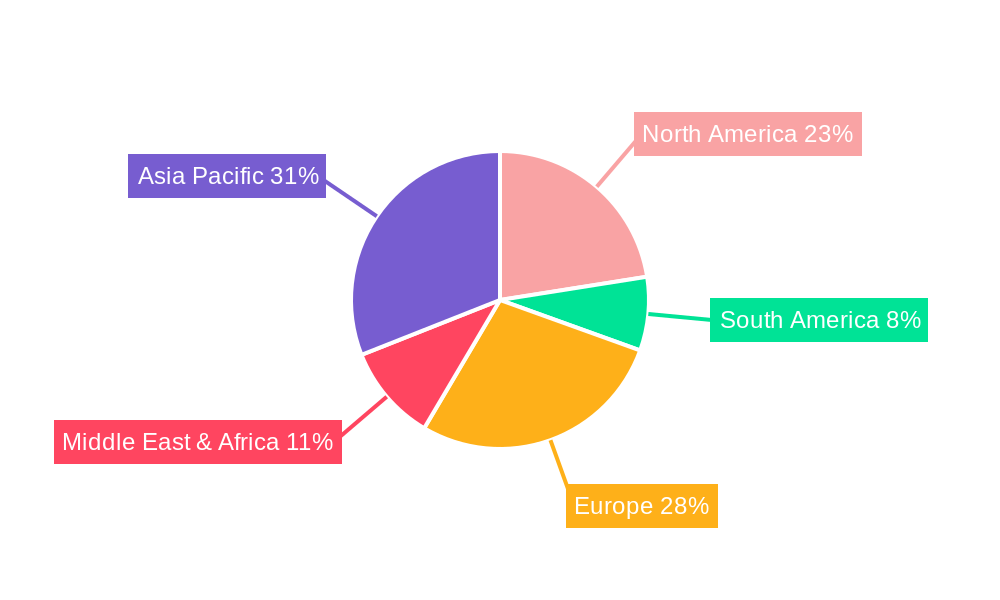

The global alginates market is experiencing robust growth, projected to reach a substantial market size in the coming years, driven by increasing demand across diverse applications. The food and beverage sector stands out as a primary consumer, leveraging alginates for their thickening, stabilizing, and emulsifying properties in products like dairy, confectionery, and processed foods. Pharmaceutical applications are also on the rise, with alginates utilized in drug delivery systems, wound care, and as excipients, benefiting from their biocompatibility and gelling capabilities. The industrial segment further contributes to market expansion, employing alginates in applications such as textiles, paper manufacturing, and metal casting due to their film-forming and binding characteristics. Emerging economies, particularly in the Asia Pacific region, are presenting significant growth opportunities, fueled by rising disposable incomes and evolving consumer preferences for convenience foods and advanced pharmaceutical formulations.

The market's upward trajectory is further propelled by ongoing research and development focused on enhancing the functionalities and sustainability of alginate production. Innovations in extraction techniques and the exploration of new raw material sources are expected to improve efficiency and reduce costs. However, the market faces certain restraints, including the volatility in raw material prices, primarily seaweed, and stringent regulatory compliances in specific regions. Despite these challenges, the inherent versatility and beneficial properties of alginates position the market for continued expansion. Key players are actively engaged in strategic partnerships, mergers, and acquisitions to strengthen their market presence and broaden their product portfolios, anticipating a dynamic and competitive landscape in the foreseeable future.

Alginates Market: Comprehensive Analysis & Future Outlook (2019–2033)

This in-depth report offers a detailed examination of the global alginates market, providing critical insights for stakeholders navigating this dynamic sector. Covering the historical period from 2019 to 2024, the base year of 2025, and projecting through to 2033, this research meticulously analyzes market trends, growth drivers, competitive landscapes, and future opportunities. We delve into the intricate details of alginates' applications across food and beverage, industrial, pharmaceutical, and other sectors, while also exploring their diverse functionalities as thickeners, emulsifiers, stabilizers, and acidity regulators. With an estimated market value projected to reach several million dollars, this report is an indispensable resource for manufacturers, suppliers, investors, and regulatory bodies seeking to understand and capitalize on the evolving alginates industry.

Alginates Market Composition & Trends

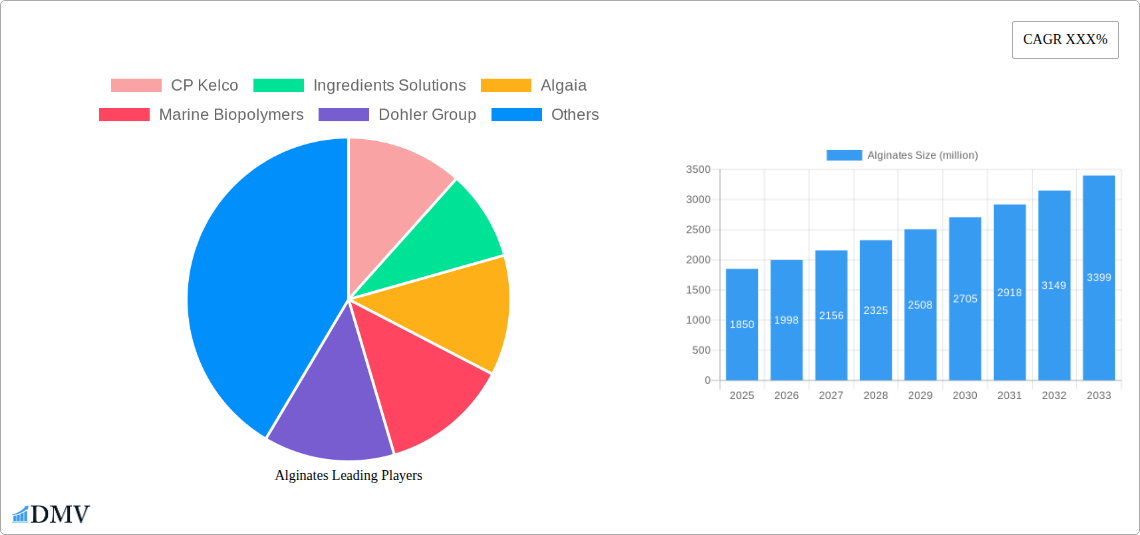

The global alginates market, valued at approximately $XXX million in the base year of 2025, exhibits a moderate to high level of concentration, with key players like CP Kelco and DuPont (Danisco) holding substantial market shares, estimated to be in the range of 20-30% and 15-20% respectively. Innovation is a significant catalyst, driven by advancements in extraction technologies and novel applications, particularly in the burgeoning pharmaceutical and nutraceutical sectors. The regulatory landscape is continuously evolving, with stringent quality control measures and food safety standards influencing product development and market entry. Substitute products, such as hydrocolloids like carrageenan and xanthan gum, present ongoing competition, albeit with distinct functional properties and price points. End-user profiles range from large-scale food manufacturers requiring bulk stabilizers to niche pharmaceutical companies developing advanced drug delivery systems. Mergers and acquisitions (M&A) are strategic maneuvers to consolidate market position and expand product portfolios. Notable M&A activities in recent years have involved deals valued in the tens of millions of dollars, aiming to secure critical raw material access and technological expertise.

- Market Share Distribution (Estimated):

- CP Kelco: 20-30%

- DuPont (Danisco): 15-20%

- Algaia: 8-12%

- FMC Corporation: 7-10%

- Others: Remaining share

- Key Innovation Drivers:

- Development of high-purity alginates for pharmaceutical applications.

- Encapsulation technologies for controlled release of active ingredients.

- Sustainable sourcing and extraction methods.

- Regulatory Landscape:

- FDA (Food and Drug Administration) approvals for food additives.

- EMA (European Medicines Agency) guidelines for pharmaceutical excipients.

- Compliance with REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations.

- Substitute Products:

- Carrageenan

- Xanthan Gum

- Guar Gum

- Pectin

- M&A Deal Values (Approximate):

- Recent deals: $10 million - $50 million.

Alginates Industry Evolution

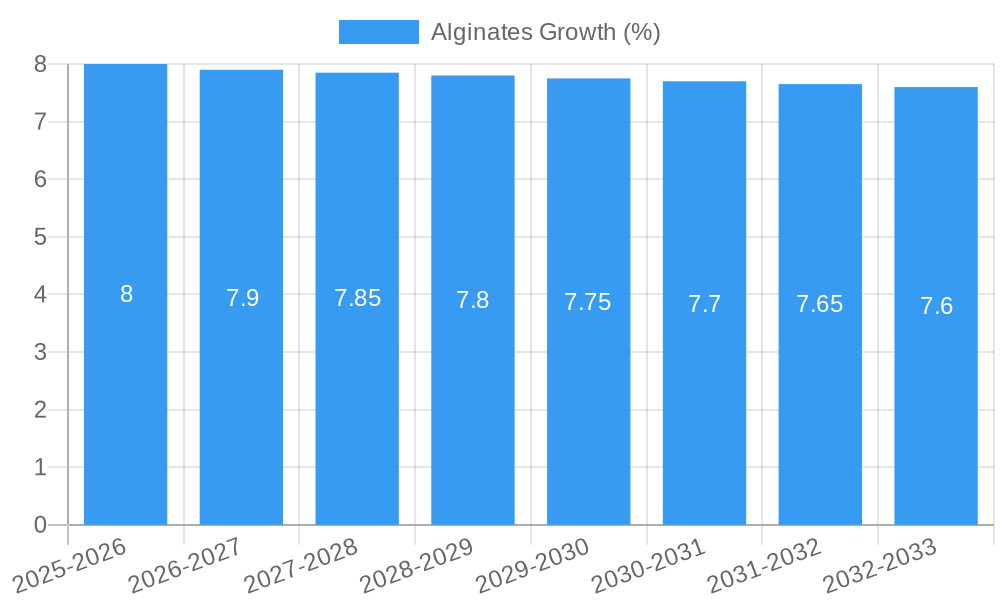

The alginates industry has witnessed a significant evolutionary trajectory from 2019 to the present, driven by persistent research and development, a growing awareness of the functional benefits of alginates, and an increasing demand for natural and sustainable ingredients. During the historical period (2019-2024), the market experienced a compound annual growth rate (CAGR) of approximately 4.5% to 5.5%, fueled by the food and beverage sector's insatiable appetite for texture modifiers and stabilizers. Technological advancements in seaweed cultivation and processing have been instrumental in ensuring a consistent and higher quality supply of raw materials. Furthermore, the pharmaceutical industry's exploration of alginates for drug delivery systems, wound healing, and tissue engineering has opened up lucrative new avenues. Consumer demand for clean-label products and ingredients derived from natural sources has further propelled the adoption of alginates, positioning them as a preferred choice over synthetic alternatives. The base year, 2025, marks a critical juncture where the market is poised for accelerated growth, projected to expand at a CAGR of 5.8% to 6.8% during the forecast period (2025-2033). This robust growth is underpinned by expanding applications in the industrial sector, particularly in textiles and paper manufacturing, where alginates are used for printing pastes and paper coatings, respectively. The increasing focus on sustainable packaging solutions is also anticipated to drive demand for alginates as biodegradable alternatives. The estimated market value is projected to reach over $XXX million by 2033, reflecting the enduring appeal and versatility of alginate-based solutions.

Leading Regions, Countries, or Segments in Alginates

The Food & Beverage segment stands as the dominant force within the global alginates market, accounting for an estimated 50-60% of the total market share in 2025. This dominance is driven by the widespread use of alginates as natural thickeners, stabilizers, and gelling agents in a vast array of food products, including dairy items, confectionery, bakery goods, and convenience foods. The growing consumer preference for natural ingredients and clean-label products further solidifies alginates' position in this sector. Within this segment, key drivers include evolving consumer tastes, demand for improved product texture and shelf-life, and the increasing popularity of plant-based and low-fat food options.

Geographically, Europe currently leads the alginates market, propelled by a strong emphasis on food innovation, stringent quality standards that favor natural ingredients, and a well-established pharmaceutical industry. Countries like Norway and the UK, with their extensive coastlines, are significant producers and exporters of high-quality seaweed, the primary source of alginates.

Dominant Application Segment: Food & Beverage

- Key Drivers:

- Consumer Demand for Natural Ingredients: Growing preference for clean-label, plant-derived ingredients.

- Texture and Stability Enhancement: Alginates provide desirable mouthfeel and shelf-life extension in various food products.

- Innovation in Processed Foods: Use in dairy alternatives, baked goods, and confectionery.

- Growth in Plant-Based Diets: Alginates are crucial for texture in vegan and vegetarian products.

- Regulatory Approvals: Widely accepted and approved as food additives globally.

- Market Share Contribution (Estimated): 50-60% in 2025.

- Sub-segments of Importance within Food & Beverage: Dairy products, bakery and confectionery, processed foods, beverages.

- Key Drivers:

Leading Regional Market: Europe

- Key Drivers:

- Strong Food Manufacturing Base: Significant demand from major food processing companies.

- Advancements in Pharmaceutical Research: Extensive use of alginates in drug delivery and medical devices.

- Sustainable Sourcing Initiatives: Focus on environmentally friendly seaweed harvesting.

- Favorable Regulatory Environment: Supportive policies for natural food ingredients.

- High Consumer Awareness: Educated consumers actively seek natural and functional food additives.

- Market Share Contribution (Estimated): 30-35% in 2025.

- Key Countries within Europe: Norway, United Kingdom, Ireland, France.

- Key Drivers:

Dominant Type of Alginate Functionality: Thickener & Stabilizer

- Key Drivers:

- Versatility in Application: Ability to modify viscosity and prevent phase separation across diverse products.

- Cost-Effectiveness: Efficient thickening and stabilizing properties at low concentrations.

- Synergistic Effects: Often used in combination with other hydrocolloids for optimized performance.

- Market Share Contribution (Estimated): Approximately 70-80% combined in 2025.

- Key Drivers:

Alginates Product Innovations

Alginates are at the forefront of innovation, with recent developments focusing on enhanced purity for pharmaceutical applications, controlled-release functionalities, and bio-based materials. Companies are developing high-viscosity alginates for improved texture in dairy-free products and low-viscosity alginates for use as viscosity modifiers in low-calorie beverages. Novel microencapsulation techniques utilizing alginates are enabling targeted delivery of probiotics and active pharmaceutical ingredients (APIs), boasting an encapsulation efficiency of over 95% in some instances. Furthermore, the development of edible films and coatings from alginates is enhancing the shelf-life and visual appeal of fruits and vegetables, reducing food waste. These innovations are driven by a commitment to sustainable sourcing and the creation of high-performance, naturally derived ingredients.

Propelling Factors for Alginates Growth

The alginates market is propelled by several interconnected factors, notably the burgeoning demand for natural and sustainable ingredients, driven by increasing consumer consciousness regarding health and environmental impact. Technological advancements in seaweed cultivation and extraction processes are leading to improved yields and higher quality alginates, making them more accessible and cost-effective. The pharmaceutical industry's increasing adoption of alginates for novel drug delivery systems, wound care, and regenerative medicine presents significant growth opportunities. Furthermore, favorable regulatory frameworks in many regions support the use of alginates as safe and effective food additives and excipients, fostering wider market acceptance.

Obstacles in the Alginates Market

Despite robust growth, the alginates market faces several obstacles. Fluctuations in the availability and price of raw seaweed, influenced by environmental conditions and harvesting seasons, can lead to supply chain disruptions and price volatility, impacting market stability. Stringent and evolving regulatory requirements, particularly in pharmaceutical applications, necessitate significant investment in research, development, and compliance, potentially delaying product launches. Intense competition from established hydrocolloids like carrageenan and xanthan gum, which often have lower production costs, poses a significant challenge. Furthermore, the perceived complexity in sourcing and processing alginates can be a barrier for smaller manufacturers.

Future Opportunities in Alginates

The future of the alginates market is rife with opportunities. The expanding demand for plant-based and alternative protein products will continue to drive alginate use as a texture enhancer and stabilizer. Emerging applications in biodegradable packaging and bioplastics offer a significant avenue for growth, aligning with global sustainability initiatives. The pharmaceutical sector's continued exploration of alginates for advanced therapies, including regenerative medicine and controlled drug release, represents a high-value opportunity. Furthermore, untapped markets in developing economies, coupled with a growing awareness of natural ingredients, present substantial potential for market expansion.

Major Players in the Alginates Ecosystem

- CP Kelco

- Ingredients Solutions

- Algaia

- Marine Biopolymers

- Dohler Group

- Danisco (part of DuPont)

- FMC Corporation

- Kimica Corporation

- IRO Alginate Industry

- SNAP Natural & Alginate Products

Key Developments in Alginates Industry

- 2023: Algaia announces expansion of its alginate production capacity to meet growing demand.

- 2022: FMC Corporation launches a new line of high-purity alginates for pharmaceutical applications.

- 2021: CP Kelco introduces innovative alginate-based solutions for plant-based dairy alternatives.

- 2020: Marine Biopolymers secures significant investment for research into novel alginate applications.

- 2019: Danisco (DuPont) highlights advancements in sustainable seaweed sourcing for alginate production.

Strategic Alginates Market Forecast

The strategic forecast for the alginates market indicates sustained and robust growth, driven by the increasing integration of alginates across diverse industries. The confluence of rising consumer demand for natural and sustainable products, coupled with significant advancements in technological applications within food, pharmaceutical, and industrial sectors, positions alginates for a prosperous future. The market is expected to witness an estimated CAGR of 5.8% to 6.8% from 2025 to 2033, reaching a value exceeding $XXX million. Continued investment in research and development, coupled with strategic collaborations and potential M&A activities, will further fortify market expansion and innovation, solidifying alginates as an indispensable ingredient in the global marketplace.

Alginates Segmentation

-

1. Application

- 1.1. Food & Beverage

- 1.2. Industrial

- 1.3. Pharmaceutical

- 1.4. Others

-

2. Type

- 2.1. Thickener

- 2.2. Emulsifier

- 2.3. Stabilizer

- 2.4. Acidity Regulator

- 2.5. Others

Alginates Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Alginates REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Alginates Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food & Beverage

- 5.1.2. Industrial

- 5.1.3. Pharmaceutical

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Thickener

- 5.2.2. Emulsifier

- 5.2.3. Stabilizer

- 5.2.4. Acidity Regulator

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Alginates Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Food & Beverage

- 6.1.2. Industrial

- 6.1.3. Pharmaceutical

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Thickener

- 6.2.2. Emulsifier

- 6.2.3. Stabilizer

- 6.2.4. Acidity Regulator

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Alginates Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Food & Beverage

- 7.1.2. Industrial

- 7.1.3. Pharmaceutical

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Thickener

- 7.2.2. Emulsifier

- 7.2.3. Stabilizer

- 7.2.4. Acidity Regulator

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Alginates Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Food & Beverage

- 8.1.2. Industrial

- 8.1.3. Pharmaceutical

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Thickener

- 8.2.2. Emulsifier

- 8.2.3. Stabilizer

- 8.2.4. Acidity Regulator

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Alginates Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Food & Beverage

- 9.1.2. Industrial

- 9.1.3. Pharmaceutical

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Thickener

- 9.2.2. Emulsifier

- 9.2.3. Stabilizer

- 9.2.4. Acidity Regulator

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Alginates Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Food & Beverage

- 10.1.2. Industrial

- 10.1.3. Pharmaceutical

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Thickener

- 10.2.2. Emulsifier

- 10.2.3. Stabilizer

- 10.2.4. Acidity Regulator

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 CP Kelco

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ingredients Solutions

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Algaia

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Marine Biopolymers

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dohler Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Danisco

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 FMC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kimica

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 IRO Alginate Industry

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SNAP Natural & Alginate Products

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 CP Kelco

List of Figures

- Figure 1: Global Alginates Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Alginates Revenue (million), by Application 2024 & 2032

- Figure 3: North America Alginates Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Alginates Revenue (million), by Type 2024 & 2032

- Figure 5: North America Alginates Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Alginates Revenue (million), by Country 2024 & 2032

- Figure 7: North America Alginates Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Alginates Revenue (million), by Application 2024 & 2032

- Figure 9: South America Alginates Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Alginates Revenue (million), by Type 2024 & 2032

- Figure 11: South America Alginates Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Alginates Revenue (million), by Country 2024 & 2032

- Figure 13: South America Alginates Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Alginates Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Alginates Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Alginates Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Alginates Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Alginates Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Alginates Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Alginates Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Alginates Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Alginates Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Alginates Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Alginates Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Alginates Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Alginates Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Alginates Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Alginates Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Alginates Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Alginates Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Alginates Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Alginates Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Alginates Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Alginates Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Alginates Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Alginates Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Alginates Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Alginates Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Alginates Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Alginates Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Alginates Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Alginates Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Alginates Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Alginates Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Alginates Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Alginates Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Alginates Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Alginates Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Alginates Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Alginates Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Alginates Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Alginates Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Alginates Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Alginates Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Alginates Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Alginates Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Alginates Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Alginates Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Alginates Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Alginates Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Alginates Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Alginates Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Alginates Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Alginates Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Alginates Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Alginates Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Alginates Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Alginates Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Alginates Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Alginates Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Alginates Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Alginates Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Alginates Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Alginates Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Alginates Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Alginates Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Alginates Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Alginates Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Alginates?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Alginates?

Key companies in the market include CP Kelco, Ingredients Solutions, Algaia, Marine Biopolymers, Dohler Group, Danisco, FMC, Kimica, IRO Alginate Industry, SNAP Natural & Alginate Products.

3. What are the main segments of the Alginates?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Alginates," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Alginates report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Alginates?

To stay informed about further developments, trends, and reports in the Alginates, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence