Key Insights

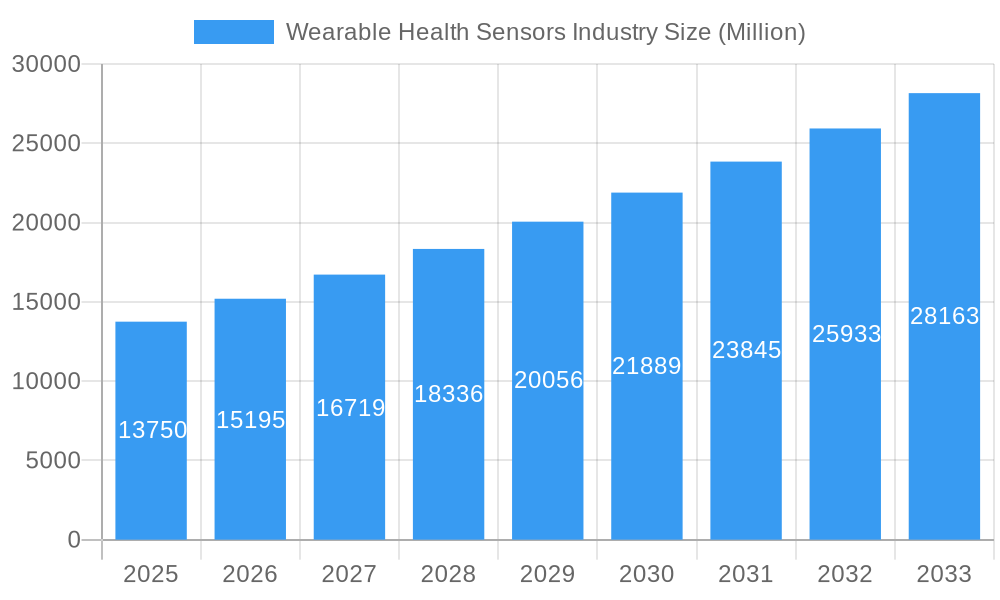

The Wearable Health Sensors Industry is poised for substantial growth, with a projected market size of approximately $13,750 million by 2025. Driven by a Compound Annual Growth Rate (CAGR) of 10.50%, this expansion is fueled by an increasing consumer demand for proactive health management, the rising prevalence of chronic diseases, and continuous technological advancements in miniaturization and sensor accuracy. Key drivers include the integration of sophisticated sensors like pressure, temperature, and position sensors into smartwatches, fitness trackers, and medical wearables. These devices empower individuals with real-time health data, facilitating early detection, remote patient monitoring, and personalized wellness interventions. The healthcare sector is a significant end-user industry, leveraging wearable sensors for applications ranging from chronic disease management to post-operative care. Additionally, the burgeoning consumer electronics market, particularly in sports and fitness, is adopting these technologies at an unprecedented rate, further accelerating market penetration. The industry is also witnessing a trend towards multi-functional sensors and the development of non-invasive monitoring solutions.

Wearable Health Sensors Industry Market Size (In Billion)

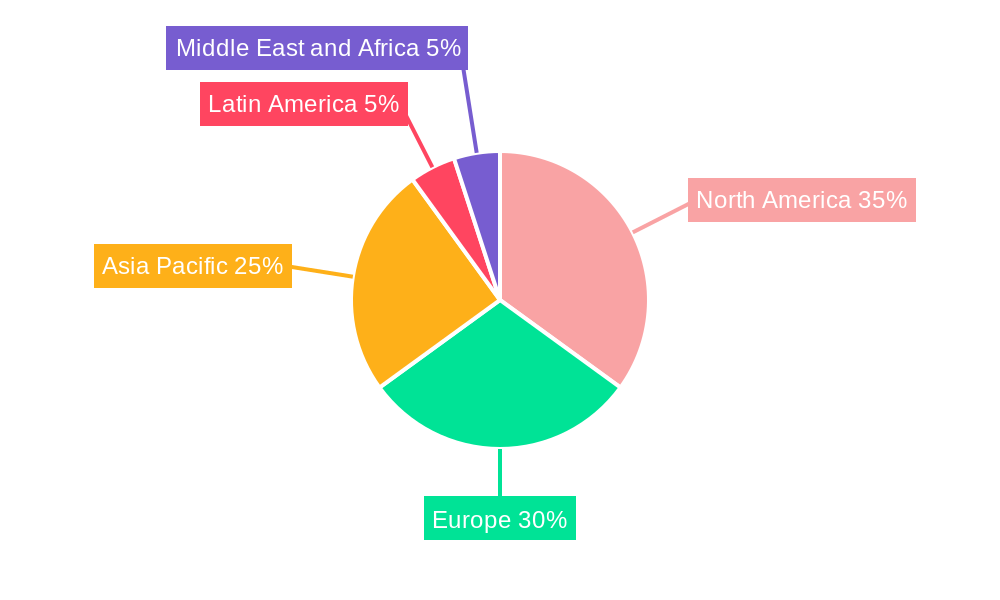

Despite the robust growth trajectory, certain restraints could impact the pace of expansion. These include stringent regulatory approvals for medical-grade devices, data privacy and security concerns, and the relatively high cost of advanced wearable health sensors, which may limit adoption in price-sensitive markets. However, ongoing research and development are focused on overcoming these challenges through improved manufacturing processes, enhanced data encryption, and the development of more affordable sensor technologies. Geographically, North America and Europe currently dominate the market due to high disposable incomes and advanced healthcare infrastructures. The Asia Pacific region is expected to emerge as a rapidly growing market, driven by increasing healthcare expenditure, a large population adopting connected devices, and favorable government initiatives promoting digital health. The competitive landscape is characterized by the presence of established technology giants and specialized sensor manufacturers, all striving for innovation and market leadership in this dynamic sector.

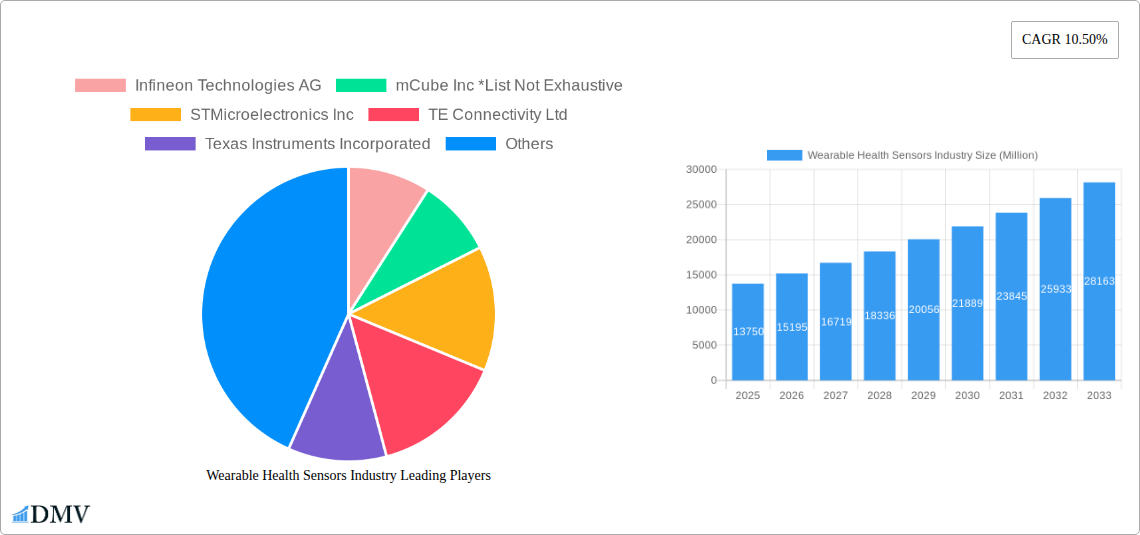

Wearable Health Sensors Industry Company Market Share

This comprehensive report delves into the dynamic wearable health sensors market, providing an in-depth analysis of market composition, trends, industry evolution, product innovations, and future opportunities. Covering the period from 2019–2033, with a base year of 2025, this study offers critical insights for stakeholders including manufacturers, technology providers, healthcare professionals, and investors. We meticulously examine the impact of pressure sensors, temperature sensors, position sensors, and other advanced sensor types across healthcare, consumer electronics, and sports/fitness end-user industries.

Wearable Health Sensors Industry Market Composition & Trends

The wearable health sensors market is characterized by a dynamic landscape influenced by continuous innovation and strategic collaborations. Market concentration is moderately fragmented, with key players like Infineon Technologies AG, STMicroelectronics Inc, and Texas Instruments Incorporated holding significant shares. Innovation catalysts include the miniaturization of components, advancements in biometric sensors, and the integration of artificial intelligence (AI) for predictive analytics. Regulatory landscapes are evolving, with a growing emphasis on data privacy and device certification, particularly for medical-grade applications. Substitute products, such as standalone diagnostic devices, are present but struggle to match the continuous monitoring capabilities of wearables. End-user profiles are expanding beyond tech-savvy consumers to include aging populations and individuals managing chronic conditions. Mergers and acquisitions (M&A) are a significant trend, with notable activities such as Nitto Denko Corporation's acquisition of Bend Labs, Inc. (now Nitto Bend Technologies) in June 2022, aiming to bolster next-generation sensor technology portfolios. M&A deal values in the sector are projected to reach several hundred million.

- Market Share Distribution: Top 5 players collectively hold approximately 45% of the market in 2025.

- Innovation Focus: Miniaturization, power efficiency, and AI integration for enhanced data interpretation.

- Regulatory Landscape: Increasing scrutiny on data security (HIPAA, GDPR) and performance validation for medical devices.

- End-User Segmentation:

- Healthcare: Chronic disease management, remote patient monitoring, post-operative care.

- Consumer Electronics: Wellness tracking, personal health insights, integrated smart device ecosystems.

- Sports/Fitness: Performance optimization, injury prevention, personalized training regimes.

Wearable Health Sensors Industry Industry Evolution

The wearable health sensors industry has witnessed a remarkable evolution, driven by rapid technological advancements and a growing global demand for proactive health management solutions. From its nascent stages, the market has expanded exponentially, projecting a Compound Annual Growth Rate (CAGR) of approximately 18% during the forecast period (2025–2033). This growth trajectory is fueled by the increasing sophistication of wearable technology, enabling continuous and unobtrusive monitoring of vital physiological parameters. Early adoption was primarily driven by the sports and fitness segment, where devices focused on activity tracking and basic performance metrics. However, a significant shift has occurred towards the healthcare sector, with a surge in demand for medical-grade wearable sensors designed for remote patient monitoring, chronic disease management, and early detection of health issues.

Technological advancements have been pivotal in this evolution. The development of smaller, more power-efficient, and highly accurate sensors has allowed for the creation of discreet and comfortable wearable devices. Innovations in biometric sensor technology, including advanced PPG (photoplethysmography) for heart rate and SpO2 monitoring, ECG (electrocardiogram) sensors for cardiac rhythm analysis, and temperature sensors for fever detection, have broadened the scope of health data that can be collected. Furthermore, the integration of machine learning and AI algorithms within wearable devices is transforming raw sensor data into actionable health insights, enabling predictive analytics and personalized interventions.

Consumer demand has also played a crucial role. As awareness of the benefits of continuous health monitoring grows, individuals are increasingly investing in wearable devices to gain a deeper understanding of their own well-being. The COVID-19 pandemic further accelerated this trend, highlighting the importance of remote health monitoring and early symptom detection. This shift in consumer behavior has created a fertile ground for the proliferation of diverse wearable health solutions, ranging from consumer-friendly fitness trackers to sophisticated medical devices prescribed by healthcare professionals. The integration of these sensors into everyday objects, such as smartwatches, fitness bands, and even smart clothing, underscores their pervasive influence and ongoing evolution within the broader digital health ecosystem.

- Market Growth Trajectory: Projected CAGR of 18% from 2025 to 2033.

- Technological Advancements: Miniaturization of sensors, improved accuracy, power efficiency, and AI integration.

- Shifting Consumer Demands: Increased focus on chronic disease management, remote patient monitoring, and preventative healthcare.

- Adoption Metrics: Wearable device penetration in the global population is expected to reach over 35% by 2025, with a significant portion dedicated to health monitoring.

Leading Regions, Countries, or Segments in Wearable Health Sensors Industry

The wearable health sensors industry is experiencing robust growth across various regions and segments, with North America currently leading in market share due to its advanced healthcare infrastructure, high disposable income, and early adoption of cutting-edge technologies. The United States, in particular, is a dominant force, driven by significant investments in digital health and a strong presence of leading technology and healthcare companies.

Within the Type segment, Other Types of sensors, encompassing advanced biometric sensors like continuous glucose monitors (CGMs) and sophisticated ECG sensors, are witnessing the fastest growth. However, Pressure Sensors are crucial for applications like blood pressure monitoring, and Temperature Sensors are vital for fever detection and thermal management in wearable devices. Position Sensors are increasingly integrated for fall detection and gait analysis, particularly in elder care.

The End User Industry segment paints a clear picture of dominance. Healthcare is the largest and fastest-growing segment, propelled by the increasing adoption of remote patient monitoring (RPM) solutions, the aging population's need for continuous health oversight, and the management of chronic diseases. The demand for clinically validated wearable health sensors that can provide accurate and reliable data for medical professionals is immense. The Sports/Fitness segment remains a significant contributor, driven by the ongoing trend of health-conscious lifestyles and the desire for performance optimization. Consumer electronics, while substantial, is increasingly intertwined with health features, blurring the lines between general wellness and dedicated health monitoring.

Several factors contribute to the dominance of these regions and segments. In North America, favorable regulatory environments for medical devices (though stringent) and robust reimbursement policies for telehealth and remote monitoring services encourage innovation and adoption. High levels of R&D spending by companies like Analog Devices Inc and Maxim Integrated Products Inc also contribute to market leadership. In the Healthcare segment, the imperative to reduce healthcare costs, improve patient outcomes, and manage an increasing burden of chronic diseases makes wearable health sensors an indispensable tool. The ability of these sensors to provide early warnings, as exemplified by Abbott's Cardio MEMS HF System, which expanded eligibility to an additional 1.2 million US patients, underscores their value in preventing adverse health events. Investment trends are heavily skewed towards companies developing advanced sensor technologies and integrated platforms for clinical use.

- Dominant Region: North America, particularly the United States.

- Key Drivers: Advanced healthcare infrastructure, high disposable income, strong regulatory support for digital health innovation, substantial R&D investments.

- Leading Type Segment: Other Types (advanced biometric sensors like CGMs, advanced ECG).

- Dominance Factors: Expanding capabilities for chronic disease management and personalized health insights.

- Leading End User Industry: Healthcare.

- Key Drivers: Growth of remote patient monitoring (RPM), aging global population, chronic disease management initiatives, demand for early detection and intervention.

- Investment Trends: Significant capital flowing into companies developing AI-powered diagnostic wearables and sensors for unobtrusive health monitoring.

Wearable Health Sensors Industry Product Innovations

Product innovation in the wearable health sensors industry is rapidly advancing, focusing on enhancing accuracy, miniaturization, and the breadth of physiological parameters that can be monitored. Breakthroughs include the development of non-invasive continuous glucose monitoring (CGM) sensors that eliminate the need for finger pricks, revolutionizing diabetes management. Advanced ECG sensors are now integrated into everyday devices, offering continuous heart rhythm monitoring for early detection of arrhythmias like atrial fibrillation. Furthermore, innovations in temperature sensors are enabling more precise core body temperature tracking for illness detection and cycle tracking. The integration of multi-sensor fusion techniques allows for a more holistic understanding of an individual's health, combining data from various sensors to provide comprehensive insights and predictive analytics, thereby improving user experience and clinical utility.

Propelling Factors for Wearable Health Sensors Industry Growth

The wearable health sensors industry is experiencing robust growth fueled by several key factors. Technologically, the continuous miniaturization of components, coupled with advancements in power efficiency, enables the creation of more discreet, comfortable, and long-lasting wearable devices. The integration of AI and machine learning algorithms is transforming raw sensor data into actionable health insights, driving adoption for personalized health management. Economically, the rising global healthcare expenditure and the increasing consumer willingness to invest in preventative health solutions are significant drivers. Regulatory bodies are also playing a role by streamlining approval processes for innovative digital health technologies, encouraging market entry and expansion. The growing prevalence of chronic diseases globally necessitates continuous monitoring solutions, further boosting demand.

Obstacles in the Wearable Health Sensors Industry Market

Despite the promising growth, the wearable health sensors industry faces several obstacles. Regulatory hurdles, particularly for medical-grade devices, can lead to lengthy approval times and high compliance costs, slowing down market penetration. Data privacy and security concerns remain paramount, as wearable devices collect sensitive personal health information, requiring robust cybersecurity measures. Supply chain disruptions, exacerbated by global events, can impact the availability and cost of essential components. Furthermore, the high cost of some advanced wearable health sensors can limit adoption among price-sensitive consumers and in developing economies. Intense competition and the need for continuous innovation also put pressure on companies to invest heavily in R&D.

Future Opportunities in Wearable Health Sensors Industry

The wearable health sensors industry is poised for significant future opportunities. The expanding applications in remote patient monitoring (RPM) for chronic disease management, particularly for conditions like heart failure and diabetes, represent a vast untapped market. Advancements in AI and machine learning will enable more sophisticated predictive diagnostics and personalized treatment recommendations based on real-time sensor data. The integration of wearables into the broader Internet of Medical Things (IoMT) ecosystem will create new avenues for seamless data exchange and interoperability between devices and healthcare providers. Emerging markets in Asia-Pacific and Latin America, with their growing middle classes and increasing health awareness, offer substantial growth potential. The development of specialized wearables for niche applications, such as mental health monitoring and drug adherence tracking, will further diversify the market.

Major Players in the Wearable Health Sensors Industry Ecosystem

- Infineon Technologies AG

- mCube Inc

- STMicroelectronics Inc

- TE Connectivity Ltd

- Texas Instruments Incorporated

- Arm Limited

- TDK Corporation

- Fraunhofer IIS

- Analog Devices Inc

- Maxim Integrated Products Inc

Key Developments in Wearable Health Sensors Industry Industry

- June 2022: Nitto Denko Corporation agreed to acquire Bend Labs, Inc. In line with this acquisition, Bend merged into the Nitto Group from June 1, 2022, to continue its business operations as Nitto Bend Technologies. As a result of this merger agreement, Bend's sensor device technologies were combined with Nitto's strengths for developing a next-generation technologies and products portfolio and new businesses utilizing sensor-acquired data.

- February 2022: Abbott announced that the US Food and Drug Administration (FDA) had approved an expanded indication for its Cardio MEMS HF System to support the care of people with heart failure. As a result, an additional 1.2 million US patients are now eligible to benefit from advanced monitoring with the company's sensor, which marks a significant increase over the current addressable population. The sensor provides an early warning system enabling doctors to protect against worsening heart failure.

Strategic Wearable Health Sensors Industry Market Forecast

The strategic wearable health sensors market forecast anticipates sustained and robust growth through 2033, driven by an increasing global emphasis on proactive health management and preventative care. Key growth catalysts include the continued advancements in sensor technology, leading to more accurate, less invasive, and feature-rich devices across healthcare, consumer electronics, and sports/fitness segments. The expanding integration of AI for personalized health insights and early disease detection will further fuel market expansion. The growing adoption of remote patient monitoring solutions, particularly for chronic conditions, and favorable regulatory environments for digital health technologies are expected to create significant market opportunities. Strategic investments in R&D and potential M&A activities among major players like STMicroelectronics Inc and Texas Instruments Incorporated will shape the competitive landscape and drive innovation, solidifying the industry's pivotal role in the future of healthcare.

Wearable Health Sensors Industry Segmentation

-

1. Type

- 1.1. Pressure Sensor

- 1.2. Temperature Sensor

- 1.3. Position Sensor

- 1.4. Other Types

-

2. End User Industry

- 2.1. Healthcare

- 2.2. Consumer Electronic

- 2.3. Sports/Fitness

- 2.4. Other End User Industries

Wearable Health Sensors Industry Segmentation By Geography

- 1. Asia Pacific

- 2. Europe

- 3. Latin America

- 4. Middle East and Africa

- 5. North America

Wearable Health Sensors Industry Regional Market Share

Geographic Coverage of Wearable Health Sensors Industry

Wearable Health Sensors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need for Continuous Monitoring In Healthcare Services; Rising Growth toward Advanced Functions Sensors in Smart Gadgets; Miniaturization of Physiological Sensors

- 3.3. Market Restrains

- 3.3.1. Dearth of Common Standards and Interoperability Issues

- 3.4. Market Trends

- 3.4.1. Healthcare Industry Holds a Dominant Share in Wearable Health Sensors Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wearable Health Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Pressure Sensor

- 5.1.2. Temperature Sensor

- 5.1.3. Position Sensor

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. Healthcare

- 5.2.2. Consumer Electronic

- 5.2.3. Sports/Fitness

- 5.2.4. Other End User Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. Europe

- 5.3.3. Latin America

- 5.3.4. Middle East and Africa

- 5.3.5. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Wearable Health Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Pressure Sensor

- 6.1.2. Temperature Sensor

- 6.1.3. Position Sensor

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End User Industry

- 6.2.1. Healthcare

- 6.2.2. Consumer Electronic

- 6.2.3. Sports/Fitness

- 6.2.4. Other End User Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Wearable Health Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Pressure Sensor

- 7.1.2. Temperature Sensor

- 7.1.3. Position Sensor

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End User Industry

- 7.2.1. Healthcare

- 7.2.2. Consumer Electronic

- 7.2.3. Sports/Fitness

- 7.2.4. Other End User Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Latin America Wearable Health Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Pressure Sensor

- 8.1.2. Temperature Sensor

- 8.1.3. Position Sensor

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End User Industry

- 8.2.1. Healthcare

- 8.2.2. Consumer Electronic

- 8.2.3. Sports/Fitness

- 8.2.4. Other End User Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Wearable Health Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Pressure Sensor

- 9.1.2. Temperature Sensor

- 9.1.3. Position Sensor

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End User Industry

- 9.2.1. Healthcare

- 9.2.2. Consumer Electronic

- 9.2.3. Sports/Fitness

- 9.2.4. Other End User Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Wearable Health Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Pressure Sensor

- 10.1.2. Temperature Sensor

- 10.1.3. Position Sensor

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End User Industry

- 10.2.1. Healthcare

- 10.2.2. Consumer Electronic

- 10.2.3. Sports/Fitness

- 10.2.4. Other End User Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Infineon Technologies AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 mCube Inc *List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 STMicroelectronics Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TE Connectivity Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Texas Instruments Incorporated

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Arm Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TDK Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fraunhofer IIS

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Analog Devices Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Maxim Integrated Products Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Global Wearable Health Sensors Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Wearable Health Sensors Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: Asia Pacific Wearable Health Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Wearable Health Sensors Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 5: Asia Pacific Wearable Health Sensors Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 6: Asia Pacific Wearable Health Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Wearable Health Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Wearable Health Sensors Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Wearable Health Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Wearable Health Sensors Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 11: Europe Wearable Health Sensors Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 12: Europe Wearable Health Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Wearable Health Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Wearable Health Sensors Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Latin America Wearable Health Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Latin America Wearable Health Sensors Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 17: Latin America Wearable Health Sensors Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 18: Latin America Wearable Health Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Latin America Wearable Health Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Wearable Health Sensors Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East and Africa Wearable Health Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East and Africa Wearable Health Sensors Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 23: Middle East and Africa Wearable Health Sensors Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 24: Middle East and Africa Wearable Health Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Wearable Health Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Wearable Health Sensors Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: North America Wearable Health Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: North America Wearable Health Sensors Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 29: North America Wearable Health Sensors Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 30: North America Wearable Health Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: North America Wearable Health Sensors Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wearable Health Sensors Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Wearable Health Sensors Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 3: Global Wearable Health Sensors Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Wearable Health Sensors Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Wearable Health Sensors Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 6: Global Wearable Health Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Wearable Health Sensors Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Wearable Health Sensors Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 9: Global Wearable Health Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Wearable Health Sensors Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Wearable Health Sensors Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 12: Global Wearable Health Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Wearable Health Sensors Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Wearable Health Sensors Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 15: Global Wearable Health Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Wearable Health Sensors Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Wearable Health Sensors Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 18: Global Wearable Health Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wearable Health Sensors Industry?

The projected CAGR is approximately 10.50%.

2. Which companies are prominent players in the Wearable Health Sensors Industry?

Key companies in the market include Infineon Technologies AG, mCube Inc *List Not Exhaustive, STMicroelectronics Inc, TE Connectivity Ltd, Texas Instruments Incorporated, Arm Limited, TDK Corporation, Fraunhofer IIS, Analog Devices Inc, Maxim Integrated Products Inc.

3. What are the main segments of the Wearable Health Sensors Industry?

The market segments include Type, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for Continuous Monitoring In Healthcare Services; Rising Growth toward Advanced Functions Sensors in Smart Gadgets; Miniaturization of Physiological Sensors.

6. What are the notable trends driving market growth?

Healthcare Industry Holds a Dominant Share in Wearable Health Sensors Market.

7. Are there any restraints impacting market growth?

Dearth of Common Standards and Interoperability Issues.

8. Can you provide examples of recent developments in the market?

June 2022 : Nitto Denko Corporation agreed to acquire Bend Labs, Inc. In line with this acquisition, Bend merged into the Nitto Group from June 1, 2022 to continue its business operations as Nitto Bend Technologies. As a result of this merger agreement, Bend's sensor device technologies were combined with Nitto's strengths for developing a next-generation technologies and products portfolio and new businesses utilizing sensor-acquired data.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wearable Health Sensors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wearable Health Sensors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wearable Health Sensors Industry?

To stay informed about further developments, trends, and reports in the Wearable Health Sensors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence