Key Insights

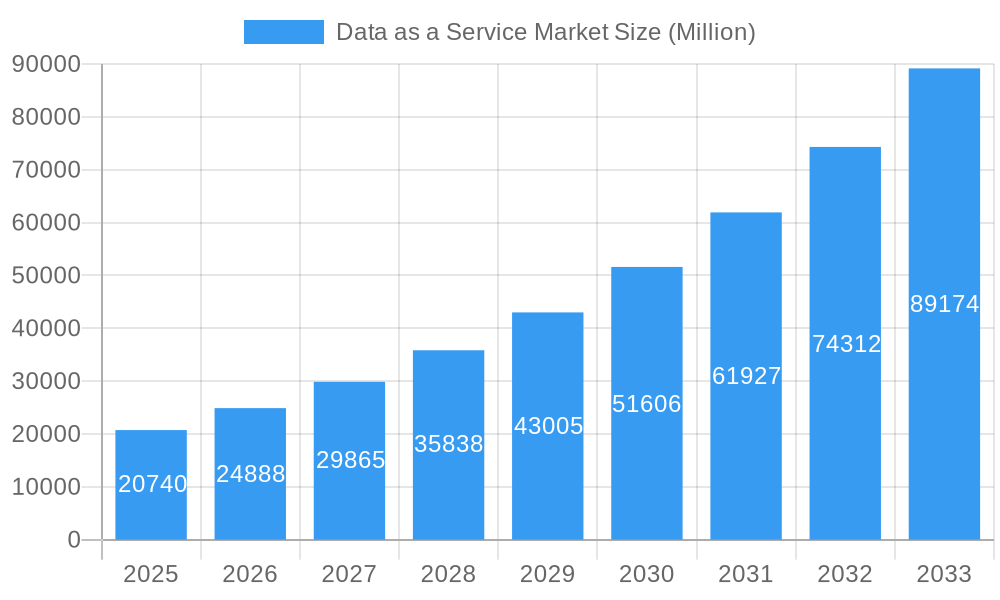

The Data as a Service (DaaS) market is poised for exceptional growth, projected to reach a substantial USD 20.74 billion by 2025. This robust expansion is fueled by a remarkable Compound Annual Growth Rate (CAGR) of 20.00% during the forecast period of 2025-2033. The core drivers propelling this surge include the escalating need for real-time, accurate, and accessible data across diverse industries, alongside the burgeoning adoption of big data analytics and cloud computing. Businesses are increasingly recognizing DaaS as a critical enabler for informed decision-making, enhanced operational efficiency, and improved customer engagement. The shift towards data-driven strategies is paramount, with organizations leveraging DaaS to gain competitive advantages, optimize resource allocation, and unlock new revenue streams. The market's trajectory is further bolstered by the continuous innovation in data processing, storage, and delivery technologies, making sophisticated data solutions more accessible and affordable.

Data as a Service Market Market Size (In Billion)

The DaaS market's expansive reach is evident in its diverse end-user segments, with BFSI, IT and Telecommunications, and Government sectors leading the charge in adoption. These industries, characterized by high data volumes and stringent regulatory requirements, are strategically utilizing DaaS to manage complex datasets, ensure compliance, and drive digital transformation initiatives. The Retail sector is also a significant contributor, leveraging DaaS for personalized marketing, inventory management, and enhanced customer experiences. Emerging trends such as the integration of AI and machine learning into DaaS platforms, the increasing demand for specialized data sets, and the growing emphasis on data governance and security are shaping the market landscape. While the market exhibits strong growth, potential restraints could include data privacy concerns, the complexity of data integration, and the need for skilled professionals to manage and interpret DaaS solutions. Nevertheless, the overwhelming benefits and the continuous evolution of the DaaS ecosystem are expected to overcome these challenges, paving the way for sustained and dynamic market expansion.

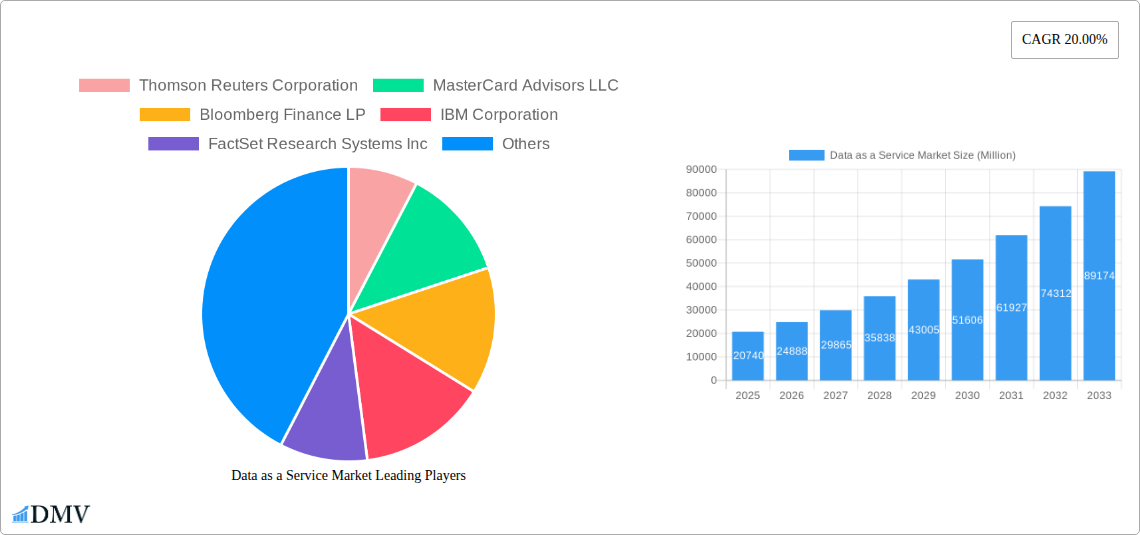

Data as a Service Market Company Market Share

This comprehensive report delves into the dynamic Data as a Service (DaaS) market, providing an in-depth analysis of its current landscape, historical trends, and future trajectory. With a study period spanning from 2019 to 2033, the report leverages the base year of 2025 to offer critical insights into the estimated market size and forecast. Stakeholders will gain a strategic understanding of market concentration, innovation drivers, competitive dynamics, and the burgeoning opportunities within this rapidly evolving sector. The report emphasizes DaaS market growth, data monetization strategies, cloud-based data solutions, and the critical role of big data analytics in driving business intelligence and informed decision-making.

Data as a Service Market Market Composition & Trends

The Data as a Service (DaaS) market is characterized by a moderate to high degree of concentration, with key players investing heavily in research and development to gain a competitive edge. Innovation catalysts are primarily driven by the increasing demand for real-time data, advanced analytics, and the proliferation of cloud infrastructure. Regulatory landscapes, particularly concerning data privacy and security (e.g., GDPR, CCPA), are shaping market strategies and fostering the development of compliant DaaS solutions. Substitute products, such as traditional data warehousing and on-premise data management systems, are gradually being phased out as organizations embrace the flexibility and scalability of DaaS.

End-user profiles highlight the significant adoption across various sectors:

- BFSI: Driven by fraud detection, risk management, and personalized customer experiences.

- IT and Telecommunications: Leveraging DaaS for network optimization, service improvement, and customer analytics.

- Government: Utilizing DaaS for public service delivery, policy-making, and urban planning.

- Retail: Employing DaaS for inventory management, customer segmentation, and predictive marketing.

- Education: Benefiting from DaaS for personalized learning, administrative efficiency, and research analytics.

- Oil and Gas: Using DaaS for exploration, production optimization, and predictive maintenance.

- Other End Users: Including healthcare, manufacturing, and media, all seeking to harness data for competitive advantage.

Mergers and acquisitions (M&A) are a notable trend, with an estimated M&A deal value of over $5,000 million in the historical period. These activities are consolidating market share and enabling companies to expand their service offerings and geographical reach. The market share distribution indicates a significant portion held by the top five players, with ongoing efforts to capture incremental market share through strategic partnerships and product differentiation.

Data as a Service Market Industry Evolution

The Data as a Service (DaaS) market has witnessed a remarkable industry evolution, driven by a confluence of technological advancements, shifting consumer demands, and the ever-increasing volume and velocity of data generated globally. Over the historical period (2019-2024) and continuing into the forecast period (2025-2033), the market growth trajectory has been consistently upward, fueled by the realization of data as a critical strategic asset for businesses of all sizes. The estimated Compound Annual Growth Rate (CAGR) for the forecast period is projected to be approximately 18.5%.

Technological advancements have been pivotal in this evolution. The widespread adoption of cloud computing has provided the foundational infrastructure for DaaS, enabling scalable, cost-effective, and accessible data storage and processing capabilities. The rise of big data analytics, artificial intelligence (AI), and machine learning (ML) has further augmented the value proposition of DaaS. These technologies allow organizations to not only store and access vast datasets but also to derive actionable insights, predict future trends, and automate complex decision-making processes. The integration of AI/ML into DaaS platforms has unlocked new applications, from predictive maintenance in the oil and gas sector to personalized recommendations in retail and advanced fraud detection in BFSI.

Shifting consumer demands have also played a crucial role. In today's hyper-connected world, consumers expect personalized experiences, real-time interactions, and seamless service delivery. Businesses are increasingly relying on DaaS to understand their customers better, anticipate their needs, and deliver tailored solutions. This has led to a surge in demand for DaaS offerings that can provide granular customer insights, enabling businesses to optimize marketing campaigns, improve customer service, and enhance product development. The adoption of digital quality measures (dQMs) in healthcare, as exemplified by IMAT Solutions' recent offering, underscores the growing need for standardized, digital data for improved reporting and outcomes. Furthermore, the increasing emphasis on data security and privacy has spurred the development of advanced DaaS solutions that offer robust protection and compliance features, as seen with Asigra Inc.'s integration of Content Disarm & Reconstruction (CDR) for enhanced data security. The market's evolution is marked by a continuous drive towards more sophisticated, secure, and value-driven data services.

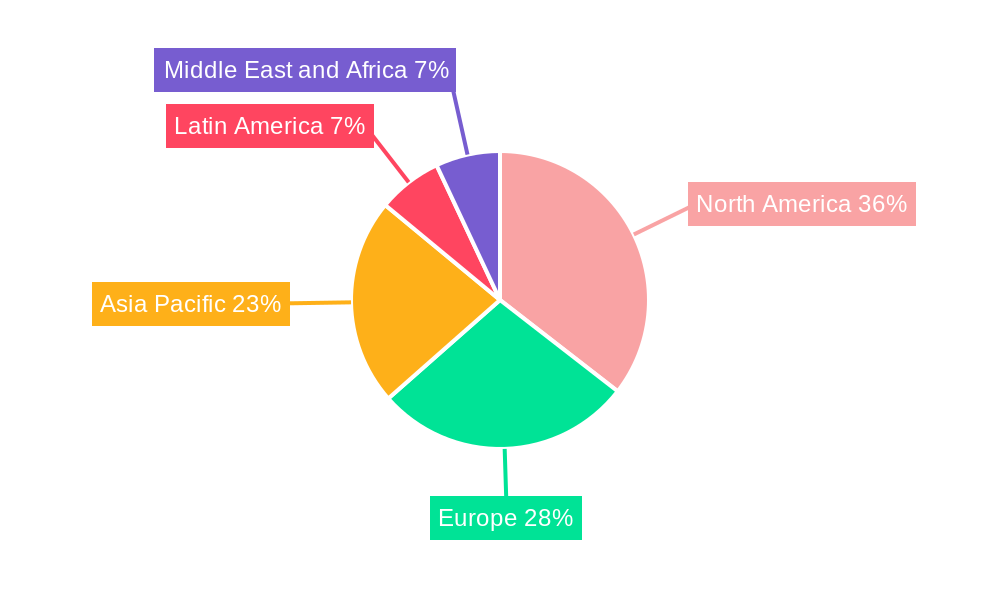

Leading Regions, Countries, or Segments in Data as a Service Market

The dominance within the Data as a Service (DaaS) market is not confined to a single region or country but is rather a dynamic interplay of technological maturity, economic strength, and strategic regulatory frameworks. However, North America consistently emerges as a leading region, driven by its robust technological infrastructure, high concentration of innovative technology companies, and a strong appetite for data-driven decision-making across its diverse economic sectors. The United States, in particular, spearheads this dominance due to significant investments in cloud computing and AI, coupled with a proactive approach to embracing new technologies.

Within the IT and Telecommunications segment, the adoption of DaaS is exceptionally high, making it a leading segment. This sector is intrinsically data-intensive, requiring constant analysis of network performance, customer behavior, and service utilization. Key drivers for its leadership include:

- Massive Data Generation: Telecommunication companies generate petabytes of data daily from network usage, customer interactions, and device telemetry. DaaS provides the scalable infrastructure to manage and analyze this data effectively.

- Need for Real-time Analytics: To optimize network efficiency, personalize service offerings, and proactively address customer issues, real-time data processing is critical. DaaS solutions facilitate this by providing on-demand access to and analysis of live data streams.

- Competitive Landscape: The highly competitive nature of the IT and telecommunications industry necessitates a data-first approach to customer retention and acquisition. DaaS enables granular customer segmentation and targeted marketing campaigns, driving significant ROI.

- Technological Advancements: The continuous evolution of network technologies (e.g., 5G, IoT) generates even more complex datasets, requiring advanced DaaS solutions for their management and interpretation.

- Cost Efficiency: Cloud-based DaaS models offer significant cost savings compared to maintaining on-premise data infrastructure, allowing these companies to allocate resources more strategically.

The BFSI sector also demonstrates substantial leadership and growth within the DaaS market. Driven by stringent regulatory requirements, the need for robust security, and the pursuit of enhanced customer experiences, BFSI organizations are leveraging DaaS for a multitude of critical functions. Investment trends in this segment are heavily geared towards fraud detection and prevention, risk management, algorithmic trading, and personalized financial advisory services. Regulatory support for data standardization and digital transformation initiatives further bolsters DaaS adoption.

The Government sector, while perhaps slower to adopt initially due to legacy systems and data privacy concerns, is increasingly recognizing the immense potential of DaaS for improving public services, optimizing resource allocation, and enabling data-informed policy-making. Initiatives aimed at digitizing government operations and promoting open data practices are creating significant growth avenues for DaaS providers.

Data as a Service Market Product Innovations

Product innovations in the Data as a Service (DaaS) market are revolutionizing how organizations leverage their data. Companies are focusing on developing AI-powered analytics platforms that offer predictive insights and automated decision-making capabilities. Unique selling propositions include enhanced data security features, such as the integration of Content Disarm & Reconstruction (CDR) by Asigra Inc., ensuring data integrity and protection against advanced threats. Technological advancements are also enabling real-time data processing and integration across disparate sources, facilitating a holistic view of business operations. Performance metrics are being redefined by faster query response times, improved data accuracy, and the quantifiable business outcomes achieved through data-driven strategies.

Propelling Factors for Data as a Service Market Growth

Several key growth drivers are propelling the Data as a Service (DaaS) market forward.

- Explosive Data Growth: The exponential increase in data volume, variety, and velocity from various sources (IoT devices, social media, transactions) necessitates scalable data management solutions like DaaS.

- Cloud Computing Adoption: The widespread migration of businesses to cloud environments provides a fertile ground for DaaS, offering flexibility, scalability, and cost-effectiveness.

- Advancements in AI and Machine Learning: These technologies enhance DaaS capabilities by enabling sophisticated analytics, predictive modeling, and automated insights, unlocking greater data value.

- Demand for Real-time Insights: Businesses require immediate access to data for agile decision-making, competitive advantage, and responsive customer service, which DaaS effectively delivers.

- Cost Optimization: DaaS eliminates the need for significant upfront investment in hardware and infrastructure, offering a pay-as-you-go model that reduces operational costs.

Obstacles in the Data as a Service Market Market

Despite its robust growth, the Data as a Service (DaaS) market faces certain obstacles.

- Data Security and Privacy Concerns: Stringent data privacy regulations (e.g., GDPR, CCPA) and the increasing threat of cyberattacks necessitate advanced security measures, which can increase costs and complexity.

- Data Integration Challenges: Integrating data from disparate and often legacy systems can be complex and time-consuming, hindering the seamless delivery of DaaS.

- Vendor Lock-in: Organizations may be concerned about becoming too reliant on a single DaaS provider, leading to potential difficulties in migrating data or services.

- Talent Gap: A shortage of skilled data scientists and analysts capable of effectively utilizing and interpreting DaaS offerings can slow down adoption and ROI.

- Regulatory Compliance: Navigating the evolving and often country-specific regulatory landscape for data governance and cross-border data transfers presents a significant challenge.

Future Opportunities in Data as a Service Market

The future of the Data as a Service (DaaS) market is brimming with opportunities. The burgeoning Internet of Things (IoT) ecosystem will generate unprecedented volumes of data, creating a massive demand for DaaS solutions capable of managing and analyzing this influx. The continued advancements in AI and ML will further enable hyper-personalized services and predictive analytics across all industries. Emerging markets in Asia-Pacific and Latin America are poised for significant DaaS adoption as their digital infrastructure matures. Furthermore, the growing emphasis on sustainability and ESG (Environmental, Social, and Governance) reporting will drive demand for DaaS solutions that can track and analyze relevant data for compliance and strategic initiatives. The development of federated learning and privacy-preserving analytics will also unlock new avenues for data utilization.

Major Players in the Data as a Service Market Ecosystem

- Thomson Reuters Corporation

- MasterCard Advisors LLC

- Bloomberg Finance LP

- IBM Corporation

- FactSet Research Systems Inc

- Environmental Systems Research Institute

- Moody's Investors Service Inc

- Morningstar Inc

- Oracle Corporation

- Equifax Inc

- SAP SE

- Dow Jones & Company Inc

Key Developments in Data as a Service Market Industry

- September 2022: Asigra Inc., an ultra-secure backup and recovery pioneer, declared the general availability of Tigris Data Protection software with Content Disarm & Reconstruction (CDR). The addition of CDR makes Asigra the most security-forward backup and recovery software platform available, adding to its extensive suite of security features, enhancing data security within DaaS offerings.

- June 2022: IMAT Solutions, a real-time healthcare data management and population health reporting solutions provider, announced the launch of a new Data-as-a-Service (DaaS) offering for health payers. The new DaaS solution meets the new Centers for Medicare & Medicaid Services (CMS) effort to transition all quality measures used in its reporting programs to digital quality measures (dQMs), signaling a shift towards standardized digital data in healthcare DaaS.

Strategic Data as a Service Market Market Forecast

The strategic Data as a Service (DaaS) market forecast indicates continued robust growth driven by several key catalysts. The increasing reliance on data for competitive differentiation and operational efficiency across all industries will fuel sustained demand. Advancements in AI and ML will unlock more sophisticated analytics and predictive capabilities, making DaaS indispensable for businesses aiming to gain deeper insights and automate decision-making. The expanding adoption of cloud-native architectures and the proliferation of IoT devices will create new markets and demand for scalable data management solutions. Furthermore, the growing awareness of data as a strategic asset, coupled with government initiatives promoting digital transformation and data utilization, will solidify DaaS as a core component of modern business strategies, ensuring significant market potential for years to come.

Data as a Service Market Segmentation

-

1. End User

- 1.1. BFSI

- 1.2. IT and Telecommunications

- 1.3. Government

- 1.4. Retail

- 1.5. Education

- 1.6. Oil and Gas

- 1.7. Other End Users

Data as a Service Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Data as a Service Market Regional Market Share

Geographic Coverage of Data as a Service Market

Data as a Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Penetration of Data-based Decisions Among Enterprises; Transformation of Enterprises Leading to Real-time Analytics Demand

- 3.3. Market Restrains

- 3.3.1. Concerns Regarding Privacy and Security

- 3.4. Market Trends

- 3.4.1. BFSI Sector to Witness High Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Data as a Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. BFSI

- 5.1.2. IT and Telecommunications

- 5.1.3. Government

- 5.1.4. Retail

- 5.1.5. Education

- 5.1.6. Oil and Gas

- 5.1.7. Other End Users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Data as a Service Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. BFSI

- 6.1.2. IT and Telecommunications

- 6.1.3. Government

- 6.1.4. Retail

- 6.1.5. Education

- 6.1.6. Oil and Gas

- 6.1.7. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe Data as a Service Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. BFSI

- 7.1.2. IT and Telecommunications

- 7.1.3. Government

- 7.1.4. Retail

- 7.1.5. Education

- 7.1.6. Oil and Gas

- 7.1.7. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific Data as a Service Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. BFSI

- 8.1.2. IT and Telecommunications

- 8.1.3. Government

- 8.1.4. Retail

- 8.1.5. Education

- 8.1.6. Oil and Gas

- 8.1.7. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Latin America Data as a Service Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. BFSI

- 9.1.2. IT and Telecommunications

- 9.1.3. Government

- 9.1.4. Retail

- 9.1.5. Education

- 9.1.6. Oil and Gas

- 9.1.7. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Middle East and Africa Data as a Service Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. BFSI

- 10.1.2. IT and Telecommunications

- 10.1.3. Government

- 10.1.4. Retail

- 10.1.5. Education

- 10.1.6. Oil and Gas

- 10.1.7. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Thomson Reuters Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MasterCard Advisors LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bloomberg Finance LP

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IBM Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 FactSet Research Systems Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Environmental Systems Research Institute

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Moody's Investors Service Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Morningstar Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Oracle Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Equifax Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SAP SE

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Dow Jones & Company Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Thomson Reuters Corporation

List of Figures

- Figure 1: Global Data as a Service Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Data as a Service Market Revenue (Million), by End User 2025 & 2033

- Figure 3: North America Data as a Service Market Revenue Share (%), by End User 2025 & 2033

- Figure 4: North America Data as a Service Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Data as a Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Data as a Service Market Revenue (Million), by End User 2025 & 2033

- Figure 7: Europe Data as a Service Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: Europe Data as a Service Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Data as a Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Data as a Service Market Revenue (Million), by End User 2025 & 2033

- Figure 11: Asia Pacific Data as a Service Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Asia Pacific Data as a Service Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Data as a Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Data as a Service Market Revenue (Million), by End User 2025 & 2033

- Figure 15: Latin America Data as a Service Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: Latin America Data as a Service Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Data as a Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Data as a Service Market Revenue (Million), by End User 2025 & 2033

- Figure 19: Middle East and Africa Data as a Service Market Revenue Share (%), by End User 2025 & 2033

- Figure 20: Middle East and Africa Data as a Service Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Data as a Service Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Data as a Service Market Revenue Million Forecast, by End User 2020 & 2033

- Table 2: Global Data as a Service Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Data as a Service Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Data as a Service Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Data as a Service Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Data as a Service Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Data as a Service Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global Data as a Service Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Data as a Service Market Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Global Data as a Service Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Data as a Service Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Data as a Service Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Data as a Service Market?

The projected CAGR is approximately 20.00%.

2. Which companies are prominent players in the Data as a Service Market?

Key companies in the market include Thomson Reuters Corporation, MasterCard Advisors LLC, Bloomberg Finance LP, IBM Corporation, FactSet Research Systems Inc, Environmental Systems Research Institute, Moody's Investors Service Inc, Morningstar Inc, Oracle Corporation, Equifax Inc, SAP SE, Dow Jones & Company Inc.

3. What are the main segments of the Data as a Service Market?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Penetration of Data-based Decisions Among Enterprises; Transformation of Enterprises Leading to Real-time Analytics Demand.

6. What are the notable trends driving market growth?

BFSI Sector to Witness High Growth.

7. Are there any restraints impacting market growth?

Concerns Regarding Privacy and Security.

8. Can you provide examples of recent developments in the market?

September 2022: Asigra Inc., an ultra-secure backup and recovery pioneer, declared the general availability of Tigris Data Protection software with Content Disarm & Reconstruction (CDR). The addition of CDR makes Asigra the most security-forward backup and recovery software platform available, adding to its extensive suite of security features.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Data as a Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Data as a Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Data as a Service Market?

To stay informed about further developments, trends, and reports in the Data as a Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence