Key Insights

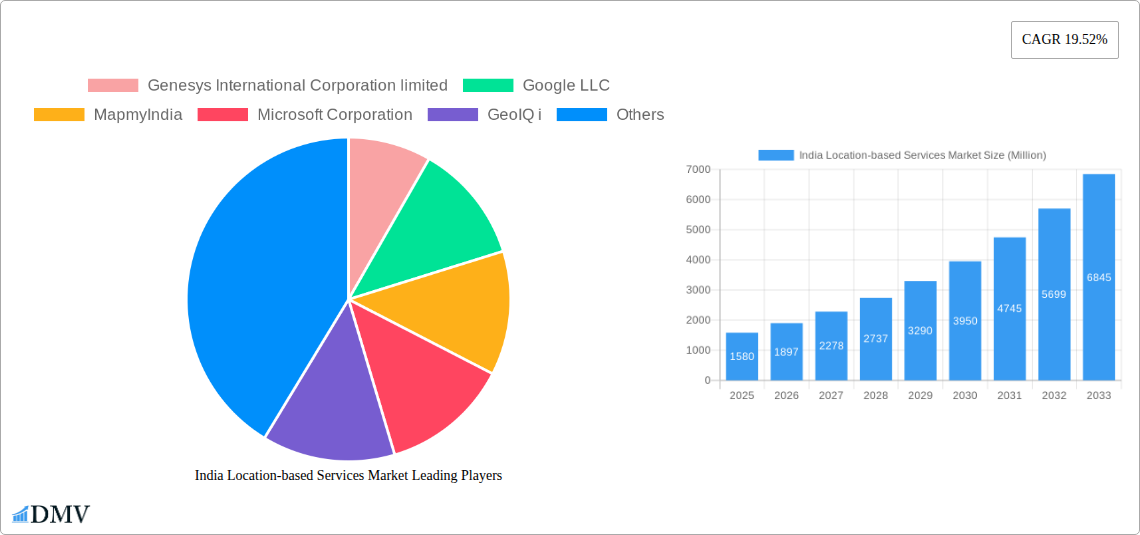

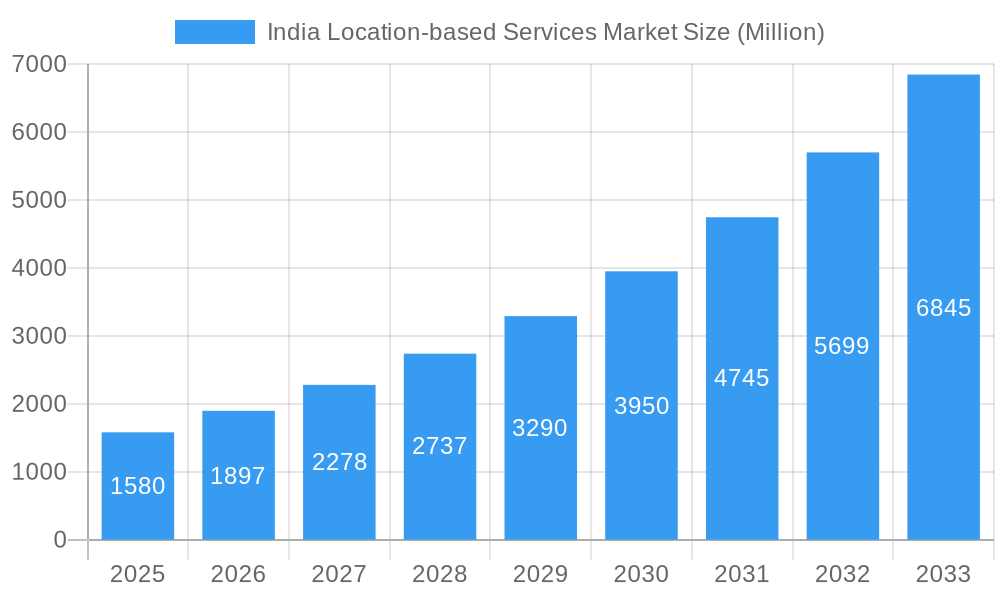

The India Location-based Services (LBS) market is poised for remarkable expansion, projected to reach a substantial USD 1.58 billion in 2025. This growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 19.52% throughout the forecast period of 2025-2033. Key drivers propelling this surge include the increasing adoption of smartphones and mobile internet, the burgeoning demand for real-time navigation and mapping solutions, and the growing integration of LBS in diverse industry verticals such as transportation and logistics, retail, and government services. The evolving digital landscape in India, coupled with government initiatives promoting smart cities and digital infrastructure, further solidifies the trajectory for robust LBS market growth.

India Location-based Services Market Market Size (In Billion)

The market segmentation reveals a dynamic interplay between components, locations, applications, and end-users. Hardware, software, and services are all anticipated to witness significant advancements, with software and services likely to lead in terms of innovation and revenue generation due to the increasing complexity and customization of LBS solutions. Both indoor and outdoor applications are set to benefit from technological advancements, with outdoor LBS dominating current market share due to its widespread use in navigation and tracking. The application landscape is diverse, with Mapping and Navigation, Business Intelligence and Analytics, and Location-based Advertising emerging as prominent segments. In terms of end-users, Transportation and Logistics, IT and Telecom, and Healthcare are expected to be major contributors, driven by the transformative potential of LBS in optimizing operations, enhancing customer experiences, and improving service delivery.

India Location-based Services Market Company Market Share

Unlock the potential of India's burgeoning Location-based Services (LBS) market with this in-depth report. Covering a study period from 2019 to 2033, with 2025 as the base and estimated year, this analysis provides critical insights into market dynamics, technological advancements, and future growth trajectories. Dive deep into market segmentation, key players, and strategic developments to inform your business decisions.

India Location-based Services Market Market Composition & Trends

The India Location-based Services (LBS) market is characterized by a dynamic blend of established technology giants and agile local players, fostering a competitive yet innovative landscape. Market concentration is moderate, with significant contributions from global LBS leaders alongside robust growth from domestic innovators. Key innovation catalysts include the increasing adoption of smartphones, the proliferation of IoT devices, and the government's push towards smart cities and digital infrastructure. The regulatory environment, while evolving, is increasingly supportive of data privacy and geospatial data utilization, paving the way for responsible LBS deployment. Substitute products, such as manual navigation methods, are rapidly losing ground to sophisticated LBS solutions. End-user profiles are diverse, ranging from individual consumers seeking personalized experiences to enterprises leveraging LBS for operational efficiency. Mergers and acquisitions (M&A) activities are expected to accelerate as companies seek to consolidate market share and acquire complementary technologies. For instance, the acquisition of specialized LBS startups by larger tech firms is a likely trend, with estimated deal values ranging from tens to hundreds of millions of dollars, driven by the strategic importance of location intelligence.

- Market Share Distribution: Analysis of key players' market share within specific segments like mapping, navigation, and location analytics.

- M&A Deal Values: Projections for M&A activities and their potential impact on market consolidation, with estimated values in the millions.

- Innovation Drivers:

- 5G network expansion enabling faster data transfer for real-time LBS.

- Advancements in Artificial Intelligence (AI) and Machine Learning (ML) for predictive location analytics.

- Growing demand for hyper-local services and personalized user experiences.

- Regulatory Landscape: Examination of data protection laws and geospatial policy framework influencing LBS adoption.

India Location-based Services Market Industry Evolution

The evolution of the India Location-based Services (LBS) market is a compelling narrative of rapid technological advancement and shifting consumer and enterprise demands. Historically, the market began with basic mapping and navigation functionalities, primarily driven by the automotive sector and early GPS adoption. The study period's historical trajectory (2019-2024) reveals a significant surge in LBS adoption, propelled by the widespread penetration of smartphones and the increasing availability of affordable data plans. This era saw the transition from simple GPS tracking to more sophisticated applications, including location-based advertising and social networking integrations.

The base year, 2025, marks a pivotal point where LBS are no longer a niche technology but an integral part of daily life and business operations. The forecast period (2025-2033) anticipates exponential growth, driven by several key factors. Firstly, technological advancements are continuously enhancing the capabilities of LBS. The integration of AI and ML is enabling more accurate predictive analytics, personalized recommendations, and intelligent routing. The expansion of 5G networks is crucial, facilitating real-time data processing for applications such as autonomous vehicles, augmented reality (AR) experiences, and advanced IoT solutions that rely on precise, instantaneous location data. The introduction of India’s own navigation satellite system, like NVS-01 by ISRO, is a game-changer, promising enhanced accuracy, reliability, and reduced dependence on foreign systems, estimated to boost market growth significantly.

Furthermore, shifting consumer demands are playing a vital role. Users now expect seamless, context-aware location-based services that cater to their immediate needs, whether it's finding nearby services, optimizing commute times, or engaging with location-specific content. The surge in e-commerce and food delivery services, which are heavily reliant on LBS for efficient delivery management, has further solidified their importance. For enterprises, the adoption of LBS is transforming operational paradigms. Businesses are leveraging location intelligence for supply chain optimization, fleet management, workforce tracking, customer behavior analysis, and targeted marketing campaigns. The “smart city” initiatives championed by the Indian government are a significant driver, creating a fertile ground for LBS deployment in areas like urban planning, traffic management, public safety, and utility monitoring. The Bentley Systems and Genesys International collaboration on 3D City Digital Twins exemplifies this trend, aiming to revolutionize urban governance and citizen services through advanced geospatial solutions. The market is projected to witness a compound annual growth rate (CAGR) of over XX% during the forecast period, with market size expected to reach several billion dollars by 2033. Adoption metrics for LBS in various sectors are steadily rising, with over XX% of businesses in logistics and transportation now utilizing LBS for critical operations. The continuous innovation in sensor technology, data analytics, and platform development ensures that the India LBS market will remain at the forefront of digital transformation.

Leading Regions, Countries, or Segments in India Location-based Services Market

The India Location-based Services (LBS) market is a multifaceted ecosystem, with dominance varying across its intricate segments. From a Component perspective, Software is emerging as the leading segment. This is primarily due to the increasing sophistication of LBS applications, the growing demand for analytics platforms, and the development of advanced algorithms that power real-time location intelligence. Software solutions enable personalized user experiences, optimize business processes, and drive data-driven decision-making. The Services segment, encompassing integration, consulting, and support, also holds significant sway, as businesses require expert assistance to implement and leverage LBS effectively. While Hardware, such as GPS chips and sensors, is foundational, its growth is often tied to the adoption of software and services.

In terms of Location, Outdoor LBS commands a larger market share. This is attributed to the widespread use of GPS and other satellite-based navigation systems for navigation, mapping, and tracking in open environments. The development of smart cities and the expansion of transportation networks further fuel the demand for outdoor LBS. However, the Indoor LBS segment is poised for substantial growth, driven by advancements in Wi-Fi triangulation, Bluetooth beacons, and ultra-wideband (UWB) technologies. Applications in retail, healthcare, and logistics for indoor navigation and asset tracking are expected to accelerate its expansion.

Analyzing Application, Mapping and Navigation remains a dominant force, forming the bedrock of many LBS offerings. However, Business Intelligence and Analytics is rapidly gaining traction. Companies are increasingly recognizing the value of location data in understanding customer behavior, optimizing supply chains, and identifying market opportunities. This segment is projected to experience the highest growth rate. Location-based Advertising is also a significant contributor, enabling businesses to deliver highly targeted and contextually relevant marketing messages.

Across End-Users, Transportation and Logistics is a primary driver of the LBS market. Efficient fleet management, route optimization, and real-time tracking are critical for this sector. The IT and Telecom sector is another major consumer, utilizing LBS for network planning, infrastructure management, and location-based services for their subscribers. The Government sector is increasingly adopting LBS for smart city initiatives, disaster management, urban planning, and public safety, showcasing significant investment trends and regulatory support. The BFSI sector is leveraging LBS for fraud detection and customer profiling, while Hospitality uses it for personalized guest experiences and localized marketing. Manufacturing is adopting LBS for supply chain visibility and asset tracking.

Key Drivers for Dominance:

- Mapping and Navigation: Ubiquitous smartphone penetration, demand for real-time traffic updates, and increasing vehicle connectivity.

- Business Intelligence and Analytics: Growing realization of the strategic value of location data for competitive advantage and operational efficiency.

- Transportation and Logistics: Essential for route optimization, fleet management, and supply chain visibility, leading to significant cost savings and improved service delivery.

- Government Sector: Proactive smart city initiatives and the need for efficient urban governance and public service delivery.

- Software Segment: Continuous innovation in AI/ML for advanced analytics and the development of user-friendly LBS platforms.

India Location-based Services Market Product Innovations

The India Location-based Services (LBS) market is experiencing a wave of transformative product innovations, pushing the boundaries of what is possible with location intelligence. A key advancement is the integration of Artificial Intelligence (AI) and Machine Learning (ML) into LBS platforms. This enables hyper-personalized user experiences, such as predictive navigation that anticipates traffic changes, and context-aware recommendations for retail and hospitality. For example, LBS applications are now capable of analyzing user behavior patterns in real-time to offer tailored promotions or alert them to nearby points of interest based on their current activity and historical preferences. Furthermore, the development of high-precision indoor positioning systems, leveraging technologies like UWB and advanced Wi-Fi sensing, is revolutionizing applications in smart retail, warehousing, and healthcare, allowing for centimeter-level accuracy in asset tracking and navigation. The continuous refinement of geospatial data processing techniques allows for richer, more dynamic digital twins of urban environments, enhancing urban planning and management capabilities.

Propelling Factors for India Location-based Services Market Growth

The India Location-based Services (LBS) market is propelled by a confluence of powerful factors. The relentless growth of smartphone penetration and mobile internet usage provides a massive user base for LBS applications. Government initiatives like "Digital India" and the development of smart cities are creating significant demand for LBS in urban planning, infrastructure management, and citizen services. The proliferation of IoT devices, from smart wearables to connected vehicles, is generating vast amounts of location data, fueling the need for sophisticated LBS platforms to process and analyze this information. Furthermore, the increasing adoption of cloud computing and big data analytics technologies allows for the scalable and efficient deployment of complex LBS solutions. The economic imperative for businesses across sectors like logistics, retail, and finance to optimize operations and gain a competitive edge through location intelligence is a significant growth driver.

Obstacles in the India Location-based Services Market Market

Despite its robust growth trajectory, the India Location-based Services (LBS) market faces certain obstacles. Data privacy and security concerns remain paramount, with stringent regulations and user apprehension about the collection and use of personal location data. Inconsistent network coverage and quality, particularly in rural and remote areas, can hinder the seamless operation of real-time LBS. High implementation costs for advanced LBS solutions, especially for smaller enterprises, can be a significant barrier. Furthermore, a shortage of skilled professionals with expertise in geospatial analytics, AI/ML for LBS, and data engineering can slow down market development and adoption. Interoperability challenges between different LBS platforms and data standards also present a hurdle to widespread integration.

Future Opportunities in India Location-based Services Market

The future of the India Location-based Services (LBS) market is ripe with opportunities. The rapid expansion of 5G networks will unlock new possibilities for real-time, high-bandwidth LBS applications, including advanced autonomous driving features, immersive augmented reality (AR) experiences, and enhanced drone delivery services. The ongoing smart city development across India will continue to drive demand for LBS in areas like traffic management, public safety, and utility monitoring. The burgeoning e-commerce and on-demand services sector will further fuel the need for efficient location-aware logistics and delivery solutions. Moreover, the increasing sophistication of indoor positioning technologies opens up significant potential in retail, healthcare, and industrial environments for enhanced navigation and asset management. The integration of LBS with emerging technologies like blockchain could also offer new avenues for secure and transparent data sharing.

Major Players in the India Location-based Services Market Ecosystem

- Genesys International Corporation limited

- Google LLC

- MapmyIndia

- Microsoft Corporation

- GeoIQ

- Roam ai

- Aruba Networks

- LocationIQ

- Pert Telecom Solutions Pvt Ltd

- Mapsense Technologies (OPC) Private Limited

Key Developments in India Location-based Services Market Industry

- May 2023: ISRO introduced India's version of GPS with the next-generation navigational satellite NVS-01, which would offer real-time timing and positioning services across India and a region around 1,500 km throughout the mainland. This series primarily incorporates L1 band signals additionally to broaden the services. This would drive the demand for the market's growth significantly.

- September 2022: Bentley Systems, Incorporated, the infrastructure engineering software company, and Genesys International, a provider of advanced geospatial and mapping content services, declared that Genesys' 3D City Digital Twin Solution for Urban India would be powered by OpenCities 365, which is Bentley's infrastructure digital twin solution for campuses and cities. These 3D city digital twins would allow local governments to improvise public services, including disaster management, urban governance, emergency response, and tourism. Additionally, it would help and assist governments in providing more sustainable as well as resilient environments for their citizens through advanced urban development, optimized rail, road, utility, and water network upgrades, location-based services, and other smart city initiatives.

Strategic India Location-based Services Market Market Forecast

The strategic outlook for the India Location-based Services (LBS) market is exceptionally promising, driven by sustained technological advancements and increasing market adoption. The continued expansion of 5G infrastructure, coupled with the ongoing government push for digital transformation and smart city development, will serve as significant growth catalysts. The increasing demand for sophisticated data analytics and AI-powered LBS solutions across sectors like transportation, retail, and BFSI will further fuel market expansion. Emerging trends such as the metaverse, the Internet of Things (IoT), and the continued growth of the digital economy present substantial opportunities for innovative LBS applications. The market is poised for robust growth, with projections indicating a significant increase in market value, reaching several tens of billions by 2033, driven by continuous innovation and a widening array of applications catering to both consumer and enterprise needs.

India Location-based Services Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Location

- 2.1. Indoor

- 2.2. Outdoor

-

3. Application

- 3.1. Mapping and Navigation

- 3.2. Business Intelligence and Analytics

- 3.3. Location-based Advertising

- 3.4. Social Networking and Entertainment

- 3.5. Other Applications

-

4. End-User

- 4.1. Transportation and Logistics

- 4.2. IT and Telecom

- 4.3. Healthcare

- 4.4. Government

- 4.5. BFSI

- 4.6. Hospitality

- 4.7. Manufacturing

- 4.8. Other End-Users

India Location-based Services Market Segmentation By Geography

- 1. India

India Location-based Services Market Regional Market Share

Geographic Coverage of India Location-based Services Market

India Location-based Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Geo-based Marketing; Emerging Use-cases for LBS due to High Penetration of Social Media and Location-based App Adoption

- 3.3. Market Restrains

- 3.3.1. Rise in the privacy and security issues

- 3.4. Market Trends

- 3.4.1. The Increasing Adoption of Smartphones and Other Mobile Devices

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Location-based Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Location

- 5.2.1. Indoor

- 5.2.2. Outdoor

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Mapping and Navigation

- 5.3.2. Business Intelligence and Analytics

- 5.3.3. Location-based Advertising

- 5.3.4. Social Networking and Entertainment

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. Transportation and Logistics

- 5.4.2. IT and Telecom

- 5.4.3. Healthcare

- 5.4.4. Government

- 5.4.5. BFSI

- 5.4.6. Hospitality

- 5.4.7. Manufacturing

- 5.4.8. Other End-Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Genesys International Corporation limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Google LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MapmyIndia

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Microsoft Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GeoIQ i

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Roam ai

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Aruba Networks

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 LocationIQ

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pert Telecom Solutions Pvt Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mapsense Technologies (OPC) Private Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Genesys International Corporation limited

List of Figures

- Figure 1: India Location-based Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Location-based Services Market Share (%) by Company 2025

List of Tables

- Table 1: India Location-based Services Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: India Location-based Services Market Revenue Million Forecast, by Location 2020 & 2033

- Table 3: India Location-based Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: India Location-based Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 5: India Location-based Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Location-based Services Market Revenue Million Forecast, by Component 2020 & 2033

- Table 7: India Location-based Services Market Revenue Million Forecast, by Location 2020 & 2033

- Table 8: India Location-based Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: India Location-based Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 10: India Location-based Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Location-based Services Market?

The projected CAGR is approximately 19.52%.

2. Which companies are prominent players in the India Location-based Services Market?

Key companies in the market include Genesys International Corporation limited, Google LLC, MapmyIndia, Microsoft Corporation, GeoIQ i, Roam ai, Aruba Networks, LocationIQ, Pert Telecom Solutions Pvt Ltd, Mapsense Technologies (OPC) Private Limited.

3. What are the main segments of the India Location-based Services Market?

The market segments include Component, Location, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.58 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Geo-based Marketing; Emerging Use-cases for LBS due to High Penetration of Social Media and Location-based App Adoption.

6. What are the notable trends driving market growth?

The Increasing Adoption of Smartphones and Other Mobile Devices.

7. Are there any restraints impacting market growth?

Rise in the privacy and security issues.

8. Can you provide examples of recent developments in the market?

May 2023: ISRO introduced India's version of GPS with the next-generation navigational satellite NVS-01, which would offer real-time timing and positioning services across India and a region around 1,500 km throughout the mainland. This series primarily incorporates L1 band signals additionally to broaden the services. This would drive the demand for the market's growth significantly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Location-based Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Location-based Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Location-based Services Market?

To stay informed about further developments, trends, and reports in the India Location-based Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence