Key Insights

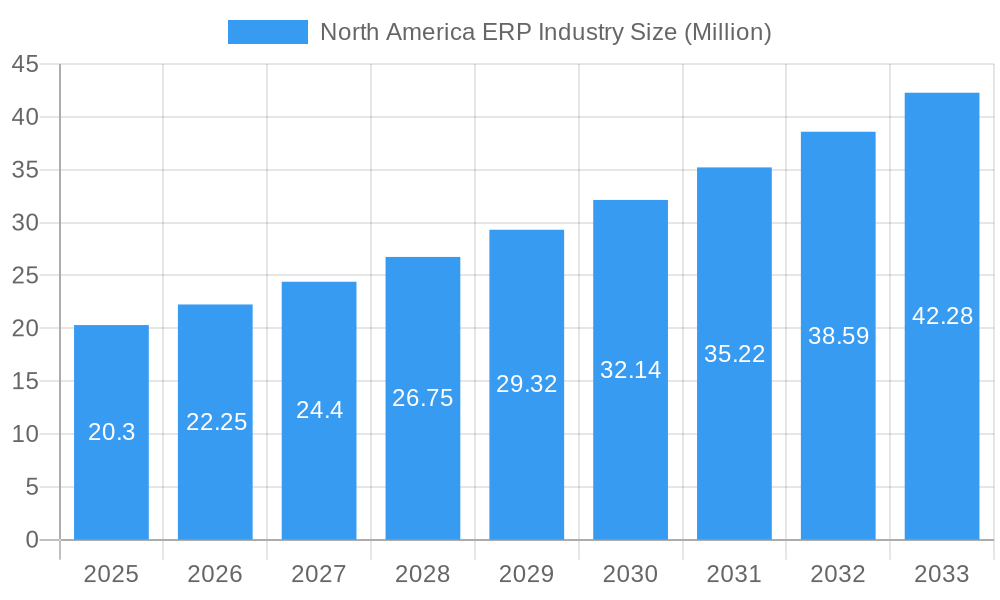

The North American Enterprise Resource Planning (ERP) market is poised for significant expansion, driven by a robust combination of technological advancements and evolving business needs. With an estimated market size of $20.30 million and a projected Compound Annual Growth Rate (CAGR) of 9.51%, the industry is expected to witness substantial growth from 2025 through 2033. This upward trajectory is fueled by the increasing demand for integrated business management solutions that enhance operational efficiency, streamline workflows, and provide real-time data analytics for better decision-making. Key drivers include the ongoing digital transformation initiatives across industries, the growing adoption of cloud-based ERP solutions offering scalability and flexibility, and the imperative for businesses to maintain a competitive edge in a dynamic global landscape. Furthermore, the surge in mobile accessibility and the integration of social and AI capabilities within ERP systems are creating new avenues for innovation and user engagement.

North America ERP Industry Market Size (In Million)

The market is segmenting across various deployment models, with cloud and hybrid solutions gaining significant traction due to their cost-effectiveness and agility, especially among Small and Medium-sized Businesses (SMBs) and Large Enterprises alike. The application landscape is diverse, with critical sectors like Retail, Manufacturing, BFSI, Government, and Telecom leading the adoption of advanced ERP functionalities to manage complex operations, ensure compliance, and drive customer satisfaction. While the market is robust, certain restraints such as the high initial implementation costs and the complexity of integrating legacy systems with new ERP platforms need to be strategically addressed by vendors. Nevertheless, the proactive adoption of ERP by industries like Education & Research, Transport & Logistics, and Military & Defense underscores the universal applicability and critical role of these systems in modern business operations. Leading companies such as SAP SE, Oracle Corporation, Microsoft Corporation, and Workday Inc. are at the forefront, innovating and expanding their offerings to meet the escalating demands of the North American ERP market.

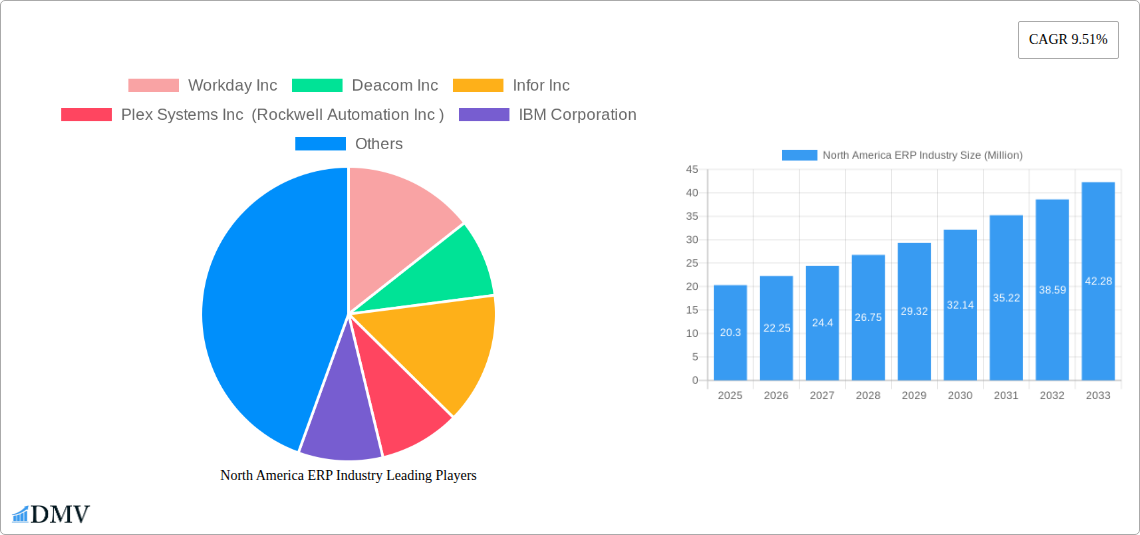

North America ERP Industry Company Market Share

North America ERP Industry Market Composition & Trends

The North America ERP industry is characterized by a dynamic market composition, driven by continuous innovation and evolving business demands. Market concentration analysis reveals a competitive landscape with several key players vying for significant market share, projected to reach $XXX Billion by 2033. Innovation catalysts, including the increasing adoption of cloud-based solutions and the integration of Artificial Intelligence (AI) and Machine Learning (ML), are reshaping the industry's trajectory. Regulatory landscapes, while generally supportive of digital transformation, introduce compliance considerations for data security and privacy. Substitute products, such as specialized departmental software, pose a challenge, but the comprehensive integration offered by ERP systems maintains their dominance. End-user profiles span across Small and Medium-sized Businesses (SMBs) seeking efficiency gains and Large Enterprises requiring robust, scalable solutions for complex operations. Mergers and Acquisitions (M&A) activities continue to be a significant trend, with deal values anticipated to reach $XX Billion during the forecast period. This strategic consolidation aims to expand product portfolios, enhance technological capabilities, and capture greater market share.

- Market Share Distribution: Dominated by cloud-native ERP solutions, with on-premise solutions holding a decreasing, yet still relevant, share, particularly within legacy systems. Hybrid deployments are also gaining traction.

- M&A Deal Values: Expected to see significant growth, driven by strategic acquisitions of niche ERP providers and technologies.

- Innovation Catalysts: AI-driven automation, advanced analytics, and enhanced user experience are primary drivers of new product development.

North America ERP Industry Industry Evolution

The North America ERP industry has undergone a remarkable evolution, transitioning from monolithic, on-premise systems to agile, cloud-first, and integrated solutions. This transformation, spanning from the historical period of 2019–2024 and projecting through the forecast period of 2025–2033, is underpinned by rapid technological advancements and a fundamental shift in consumer and business demands. The market growth trajectory has been consistently upward, spurred by the digital imperative faced by businesses of all sizes. Early in the study period, on-premise ERP systems were the standard, offering significant control but demanding substantial IT infrastructure and maintenance. However, the advent of cloud computing democratized access to sophisticated ERP functionalities, drastically reducing upfront costs and enabling scalability and flexibility. This shift accelerated adoption rates, with cloud ERP deployments now representing the majority.

Technological advancements have been relentless. The integration of AI and ML has moved beyond basic automation to offer predictive analytics, intelligent forecasting, and proactive problem-solving capabilities. Mobile ERP solutions have become essential, allowing real-time data access and operational management from anywhere, anytime, catering to the increasingly distributed workforce. Social ERP features, while less prominent than core functionalities, are being integrated to enhance collaboration and knowledge sharing. Two-Tier ERP strategies, which combine a corporate-level ERP with subsidiary-specific solutions, have gained traction for organizations with diverse operational needs.

Shifting consumer demands have played a crucial role. Businesses now expect ERP systems to be intuitive, user-friendly, and capable of providing real-time insights to inform strategic decision-making. The demand for seamless integration with other business applications, such as CRM, supply chain management, and e-commerce platforms, is paramount. Furthermore, the emphasis on data security and compliance has intensified, leading to the development of more robust security features within ERP solutions. The industry's evolution is a testament to its adaptability, with vendors continuously innovating to meet the ever-increasing expectations of businesses striving for efficiency, agility, and competitive advantage. The projected market size for the North America ERP industry is estimated to reach $XXX Billion by 2033, reflecting sustained growth driven by these ongoing evolutionary forces. The Base Year and Estimated Year of 2025 further solidify this analysis within a contemporary context.

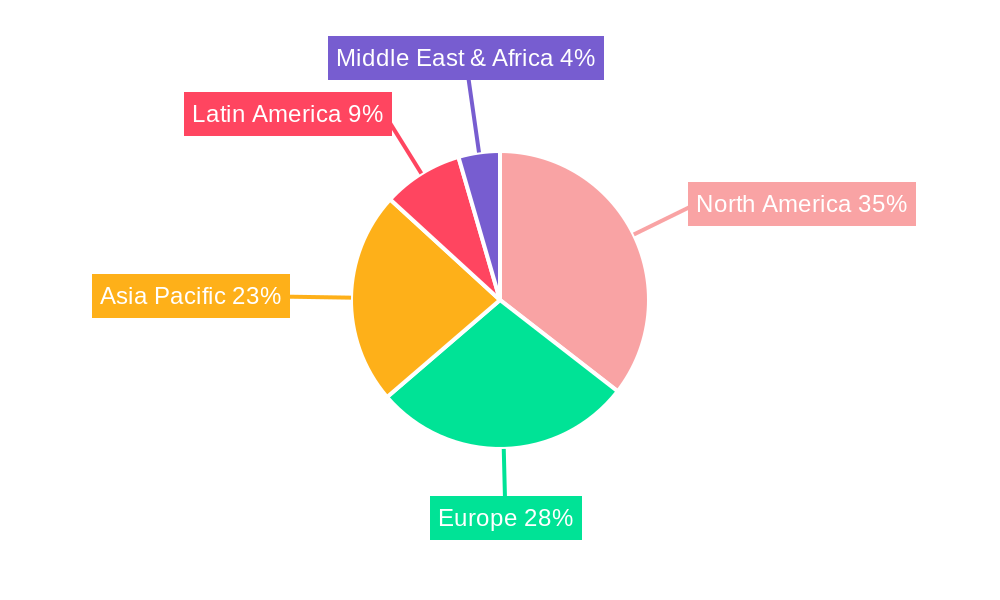

Leading Regions, Countries, or Segments in North America ERP Industry

The North America ERP Industry exhibits significant dominance in the Cloud deployment segment, and among Large Enterprises, with the Manufacturing application sector emerging as a primary driver of adoption and innovation. The United States, as the largest economy in the region, naturally leads in terms of market size and investment, closely followed by Canada. The sheer volume of businesses and the advanced digital infrastructure in the US create fertile ground for comprehensive ERP solutions.

Dominant Deployment: Cloud: The shift towards cloud ERP is largely irreversible, driven by its inherent benefits:

- Scalability and Flexibility: Cloud solutions allow businesses to scale their operations up or down without significant capital investment in hardware. This is particularly crucial for Large Enterprises experiencing fluctuating demands.

- Reduced IT Overhead: Businesses can offload the burden of managing complex IT infrastructure, focusing on core competencies.

- Faster Deployment and Updates: Cloud ERP systems can be implemented more quickly, and vendors push updates and new features automatically, ensuring users always have the latest technology.

- Enhanced Accessibility: Cloud-based ERP enables remote access, supporting the growing trend of hybrid and remote workforces.

Dominant Size of Business: Large Enterprises: While SMBs are increasingly adopting ERP, Large Enterprises remain the primary consumers due to their complex operational needs:

- Intricate Business Processes: Large organizations have multifaceted workflows across multiple departments and geographies, requiring robust and integrated ERP systems to manage them effectively.

- Data Volume and Complexity: The sheer volume of data generated by large businesses necessitates powerful data management and analytical capabilities offered by enterprise-grade ERP.

- Compliance and Reporting: Large enterprises face stringent regulatory compliance requirements, which are better addressed by comprehensive ERP solutions.

- Strategic Integration: For large corporations, ERP acts as the central nervous system, integrating various functions and providing a unified view of business operations crucial for strategic decision-making.

Dominant Application: Manufacturing: The manufacturing sector has consistently been a major adopter of ERP solutions, driven by its inherent complexity and the need for operational efficiency:

- Production Planning and Scheduling: ERP systems are critical for managing production schedules, optimizing resource allocation, and ensuring timely delivery of goods.

- Inventory Management: Accurate tracking and control of raw materials, work-in-progress, and finished goods are vital for cost-effectiveness and avoiding stockouts.

- Supply Chain Integration: Manufacturing ERPs facilitate seamless integration with suppliers and distributors, optimizing the entire supply chain.

- Quality Control: ERP systems help implement and monitor quality control processes, ensuring product integrity and compliance.

- Industry 4.0 Adoption: The ongoing digital transformation in manufacturing, including the adoption of IoT, automation, and AI, is driving the demand for advanced ERP solutions that can integrate these technologies.

While other segments like Retail and BFSI are also significant, the confluence of cloud adoption, the demands of large enterprises, and the operational intricacies of manufacturing solidifies these as the leading segments within the North America ERP industry.

North America ERP Industry Product Innovations

The North America ERP industry is witnessing significant product innovations, primarily focused on enhancing intelligence, user experience, and integration capabilities. AI and ML are being embedded to automate routine tasks, provide predictive analytics for better decision-making, and personalize user interfaces. Cloud-native architectures continue to evolve, offering greater flexibility, scalability, and faster deployment cycles. Furthermore, advancements in mobile ERP ensure that critical business functions are accessible and manageable on any device, fostering real-time operational agility. Innovations in embedded analytics and business intelligence are providing deeper insights into operational performance, driving efficiency and strategic advantage. The integration of IoT data streams into ERP systems is enabling real-time monitoring of assets and processes, particularly in manufacturing and logistics.

Propelling Factors for North America ERP Industry Growth

The North America ERP industry's growth is propelled by several key factors. The ongoing digital transformation across all sectors necessitates robust and integrated enterprise resource planning systems to manage complex operations efficiently. The increasing adoption of cloud ERP solutions, driven by their cost-effectiveness, scalability, and accessibility, is a major catalyst. Furthermore, the demand for real-time data analytics and business intelligence to inform strategic decision-making is pushing companies to upgrade their ERP infrastructure. Government initiatives promoting digital adoption and data security also play a role, encouraging businesses to invest in compliant and secure ERP solutions. Finally, the continuous innovation in AI, ML, and IoT integration within ERP platforms is enhancing their value proposition, making them indispensable tools for modern businesses.

Obstacles in the North America ERP Industry Market

Despite robust growth, the North America ERP industry faces several obstacles. High implementation costs and the complexity of integrating ERP systems with existing legacy infrastructure can be a significant barrier, especially for SMBs. Data security and privacy concerns remain paramount, with businesses wary of potential breaches and the need for stringent compliance with regulations like GDPR and CCPA. Resistance to change within organizations, coupled with the need for extensive employee training to adopt new ERP systems, can lead to implementation delays and reduced ROI. Furthermore, the shortage of skilled IT professionals capable of managing and maintaining complex ERP environments poses a challenge. Finally, economic uncertainties and potential supply chain disruptions can impact business investment decisions in ERP solutions.

Future Opportunities in North America ERP Industry

Emerging opportunities in the North America ERP industry are abundant, driven by technological advancements and evolving business needs. The continued expansion of cloud ERP, particularly in hybrid models, offers significant potential. The integration of advanced AI and ML for predictive analytics, hyper-personalization, and intelligent automation presents a major growth avenue. The burgeoning IoT ecosystem provides opportunities for ERP systems to connect with a wider array of devices, enabling real-time operational visibility and control, especially in sectors like manufacturing and logistics. Furthermore, the growing demand for specialized ERP solutions tailored to niche industries and the increasing focus on sustainability and ESG reporting will create new market segments. The development of more intuitive user interfaces and low-code/no-code customization options will also broaden ERP accessibility and adoption.

Major Players in the North America ERP Industry Ecosystem

- Workday Inc

- Deacom Inc

- Infor Inc

- Plex Systems Inc (Rockwell Automation Inc )

- IBM Corporation

- Epicor Software Corporation

- FinancialForce com Inc

- Microsoft Corporation

- Oracle Corporation

- The Sage Group PLC

- Deltek Inc

- SAP SE

- Unit4 NV

Key Developments in North America ERP Industry Industry

- October 2022: The city of Lancaster, California, and Tyler Technologies, Inc. have agreed to use Tyler's Enterprise ERP solution suite, powered by Munis. The management of the city's finances, personnel, income and expenditures, enterprise assets, content management, and controlled detection and reaction will all be handled by Tyler's solutions for the city.

- July 2022: Meridian has chosen Oracle NetSuite to assist with updating and optimizing its business procedures to serve its members better. Meridian is the second-largest credit union in Canada and the biggest in Ontario. Meridian will benefit from an effective integrated finance system with NetSuite to support its expansion and digital transformation.

Strategic North America ERP Industry Market Forecast

The strategic North America ERP industry market forecast anticipates continued robust growth, driven by the sustained digital transformation imperative across all business sectors. The increasing adoption of cloud-native ERP solutions, offering unparalleled scalability and flexibility, will remain a primary growth catalyst. The integration of advanced AI and Machine Learning capabilities will further enhance the value proposition of ERP systems, enabling predictive analytics, intelligent automation, and hyper-personalized user experiences. Opportunities lie in leveraging IoT data for real-time operational insights and in developing specialized ERP solutions for emerging industries and niche markets. The focus on sustainability and ESG reporting will also create new demand for integrated ERP functionalities. Overall, the market is poised for expansion as businesses prioritize agility, efficiency, and data-driven decision-making.

North America ERP Industry Segmentation

-

1. Deployment

- 1.1. On-premise

- 1.2. Cloud

- 1.3. Hybrid

-

2. Size of Business

- 2.1. SMB's

- 2.2. Large Enterprises

-

3. Type

- 3.1. Mobile

- 3.2. Cloud

- 3.3. Social

- 3.4. Two-Tier

-

4. Application

- 4.1. Retail

- 4.2. Manufacturing

- 4.3. BFSI

- 4.4. Government

- 4.5. Telecom

- 4.6. Military and Defense

- 4.7. Education & Research

- 4.8. Transport & Logistics

- 4.9. Other End-user Industries

North America ERP Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America ERP Industry Regional Market Share

Geographic Coverage of North America ERP Industry

North America ERP Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.51% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Real Time Decision Making; Rapid Adoption of Cloud Based ERP Solutions

- 3.3. Market Restrains

- 3.3.1. Difficulties in Customization According to Business Needs

- 3.4. Market Trends

- 3.4.1. Cloud ERP To Be a Major Market Attraction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America ERP Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-premise

- 5.1.2. Cloud

- 5.1.3. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by Size of Business

- 5.2.1. SMB's

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Mobile

- 5.3.2. Cloud

- 5.3.3. Social

- 5.3.4. Two-Tier

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Retail

- 5.4.2. Manufacturing

- 5.4.3. BFSI

- 5.4.4. Government

- 5.4.5. Telecom

- 5.4.6. Military and Defense

- 5.4.7. Education & Research

- 5.4.8. Transport & Logistics

- 5.4.9. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Workday Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Deacom Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Infor Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Plex Systems Inc (Rockwell Automation Inc )

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IBM Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Epicor Software Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 FinancialForce com Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Microsoft Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oracle Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Sage Group PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Deltek Inc *List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 SAP SE

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Unit4 NV

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Workday Inc

List of Figures

- Figure 1: North America ERP Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America ERP Industry Share (%) by Company 2025

List of Tables

- Table 1: North America ERP Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 2: North America ERP Industry Revenue Million Forecast, by Size of Business 2020 & 2033

- Table 3: North America ERP Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: North America ERP Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 5: North America ERP Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America ERP Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 7: North America ERP Industry Revenue Million Forecast, by Size of Business 2020 & 2033

- Table 8: North America ERP Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 9: North America ERP Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: North America ERP Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States North America ERP Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada North America ERP Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America ERP Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America ERP Industry?

The projected CAGR is approximately 9.51%.

2. Which companies are prominent players in the North America ERP Industry?

Key companies in the market include Workday Inc, Deacom Inc, Infor Inc, Plex Systems Inc (Rockwell Automation Inc ), IBM Corporation, Epicor Software Corporation, FinancialForce com Inc, Microsoft Corporation, Oracle Corporation, The Sage Group PLC, Deltek Inc *List Not Exhaustive, SAP SE, Unit4 NV.

3. What are the main segments of the North America ERP Industry?

The market segments include Deployment, Size of Business, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Real Time Decision Making; Rapid Adoption of Cloud Based ERP Solutions.

6. What are the notable trends driving market growth?

Cloud ERP To Be a Major Market Attraction.

7. Are there any restraints impacting market growth?

Difficulties in Customization According to Business Needs.

8. Can you provide examples of recent developments in the market?

October 2022: The city of Lancaster, California, and Tyler Technologies, Inc. have agreed to use Tyler's Enterprise ERP solution suite, powered by Munis. The management of the city's finances, personnel, income and expenditures, enterprise assets, content management, and controlled detection and reaction will all be handled by Tyler's solutions for the city.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America ERP Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America ERP Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America ERP Industry?

To stay informed about further developments, trends, and reports in the North America ERP Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence