Key Insights

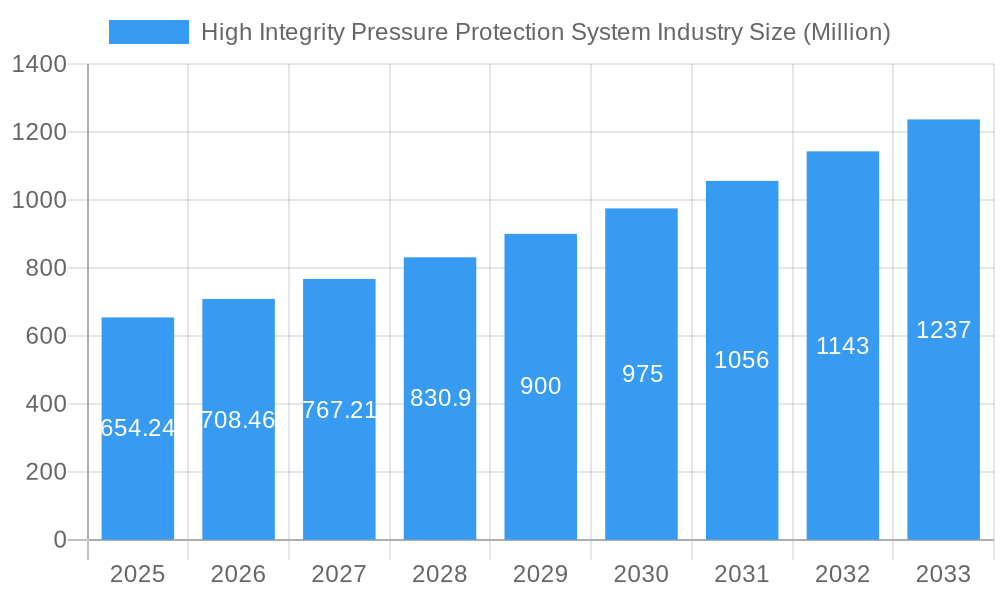

The High Integrity Pressure Protection System (HIPPS) market is poised for robust growth, projected to reach a substantial USD 654.24 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 8.22% during the forecast period of 2025-2033. This expansion is primarily driven by an increasing emphasis on operational safety and regulatory compliance across critical process industries. The inherent risks associated with high-pressure environments in sectors like Oil & Gas, Chemicals, and Power necessitate sophisticated protection systems to prevent catastrophic failures, fires, and explosions. Consequently, investments in advanced HIPPS solutions, designed to automatically detect and mitigate overpressure events, are escalating. The market's trajectory is further bolstered by technological advancements, including the integration of smart sensors, advanced diagnostics, and predictive maintenance capabilities, which enhance system reliability and reduce downtime.

High Integrity Pressure Protection System Industry Market Size (In Million)

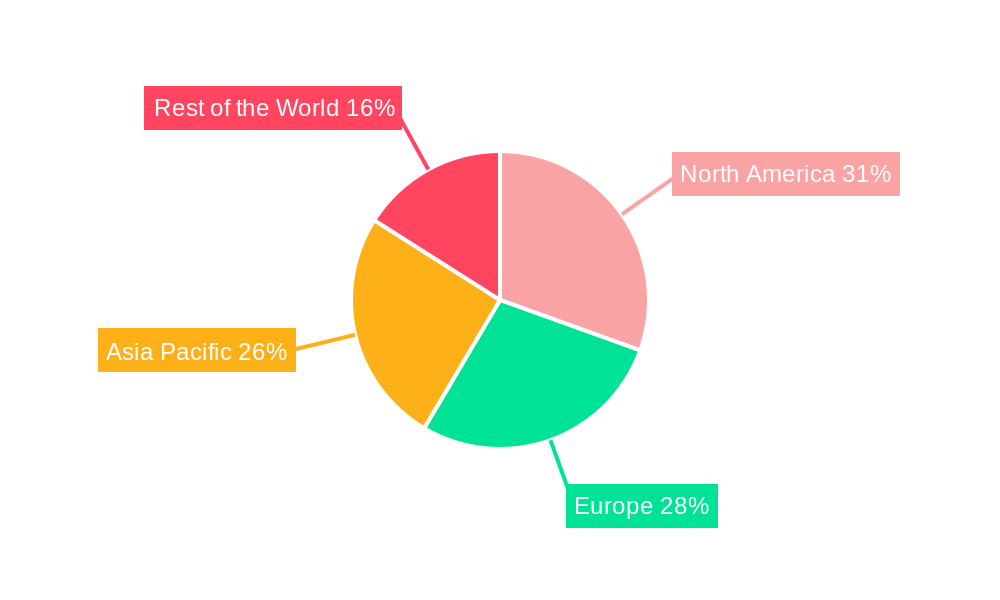

The market segmentation reveals a significant demand for both HIPPS Components, such as sensors, logic solvers, and actuators, and Services, encompassing installation, maintenance, and consulting. End-user industries like Oil and Gas and Chemicals are expected to remain dominant consumers of HIPPS, owing to their inherently hazardous operational environments. The Power and Metal and Mining sectors also represent substantial growth avenues as they increasingly adopt stringent safety protocols. While significant growth is anticipated across all regions, North America and Europe are likely to continue leading in market share due to established industrial infrastructure and stringent safety regulations. However, the Asia Pacific region is projected to exhibit the fastest growth, fueled by rapid industrialization and a burgeoning manufacturing base that prioritizes safety. Restraints, such as the high initial investment cost and the need for specialized expertise for implementation and maintenance, are being gradually overcome by the long-term cost savings derived from preventing accidents and ensuring business continuity.

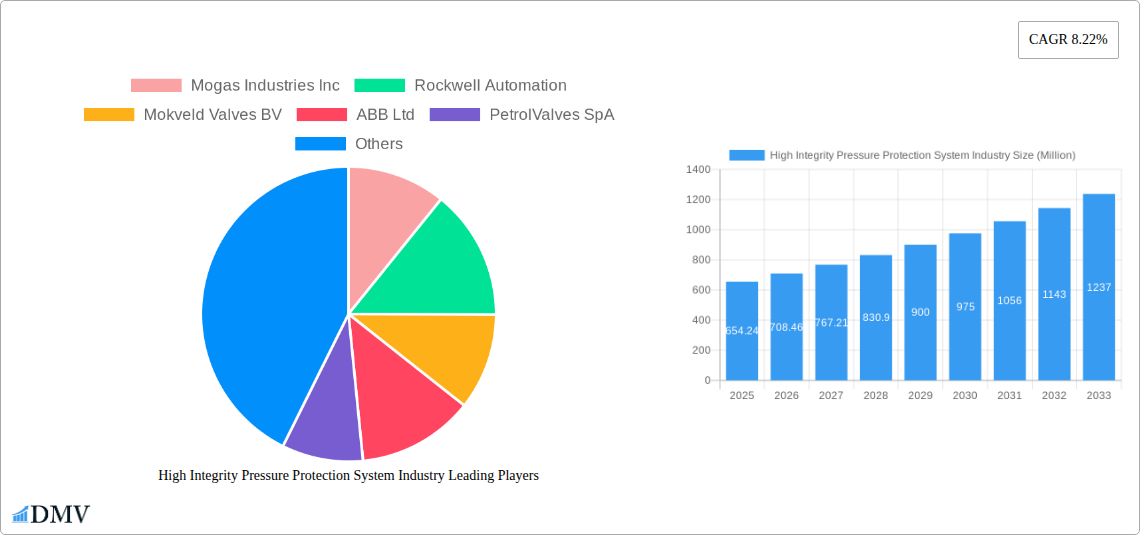

High Integrity Pressure Protection System Industry Company Market Share

High Integrity Pressure Protection System Industry Market Composition & Trends

This comprehensive report delves into the dynamic High Integrity Pressure Protection System (HIPPS) industry, providing an in-depth analysis of its market composition and evolving trends. The global HIPPS market is characterized by a moderate concentration, with key players like Siemens AG, Emerson Electric Co, and ABB Ltd holding significant market share. Innovation remains a crucial catalyst, driven by the increasing demand for enhanced safety and regulatory compliance across various process industries. The regulatory landscape, particularly stringent safety standards in the oil and gas and chemical sectors, significantly influences market growth and product development. Substitute products, such as basic safety valves and relief systems, exist but lack the sophisticated, integrated nature of HIPPS. End-user profiles reveal a strong reliance on the Oil and Gas sector, followed by Power, Chemicals, and Metal and Mining. Mergers and acquisitions (M&A) activities are also shaping the market, with strategic consolidations aimed at expanding product portfolios and geographical reach. For instance, the acquisition of BEL Valves' Milan operations by OMB Valves SpA in June 2020 signals a consolidation trend within the valve manufacturing segment, impacting the broader HIPPS ecosystem. The M&A deal value for the historical period (2019-2024) is estimated at $500 Million, indicating strategic investments and restructuring.

- Market Concentration: Moderate, with top players dominating a significant portion of the market.

- Innovation Catalysts: Stringent safety regulations, demand for operational efficiency, and technological advancements.

- Regulatory Landscape: Driven by international safety standards (e.g., IEC 61508, IEC 61511) and regional compliance mandates.

- Substitute Products: Basic safety valves, pressure relief valves, rupture discs.

- End-User Industry Dominance: Oil and Gas (estimated XX% market share), Power, Chemicals, Metal and Mining, Food and Beverages, Other Process Industries.

- M&A Activities: Strategic acquisitions and partnerships aimed at market consolidation and portfolio expansion. Estimated M&A Deal Value (Historical): $500 Million.

High Integrity Pressure Protection System Industry Industry Evolution

The High Integrity Pressure Protection System (HIPPS) industry has witnessed a remarkable evolution, driven by an unwavering commitment to industrial safety and operational reliability. The market has experienced a consistent upward trajectory in growth, largely fueled by the increasing complexity of industrial processes and the escalating stringency of safety regulations globally. Over the Study Period: 2019–2033, the market is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5%. This robust growth is underpinned by significant technological advancements in sensing, logic solvers, and actuation technologies, which collectively enhance the performance and reliability of HIPPS solutions. From sophisticated digital sensors capable of precise pressure monitoring to advanced programmable logic controllers (PLCs) and fail-safe actuators, the technological sophistication of HIPPS has advanced exponentially.

Consumer demand has shifted dramatically from basic safety measures to integrated, intelligent protection systems. End-users now seek comprehensive solutions that not only prevent catastrophic pressure excursions but also provide real-time data for predictive maintenance and operational optimization. This has led to a greater adoption of smart HIPPS, incorporating features like remote diagnostics, cyber security protocols, and seamless integration with distributed control systems (DCS). The Base Year: 2025 is expected to see a market size of $3,500 Million, with projections indicating a significant leap to $7,000 Million by the Forecast Period: 2025–2033. Historical data from 2019–2024 shows a steady increase in adoption rates, with HIPPS becoming a standard requirement in new plant constructions and significant retrofits across high-risk industries. The increasing emphasis on asset integrity and risk reduction further propels the market, as companies recognize the substantial financial and reputational costs associated with pressure-related incidents. The industry's evolution is a testament to its critical role in safeguarding personnel, the environment, and valuable assets in the face of increasingly demanding industrial operations.

Leading Regions, Countries, or Segments in High Integrity Pressure Protection System Industry

The global High Integrity Pressure Protection System (HIPPS) market is witnessing dominant growth and adoption driven by specific regional strengths and segment preferences. In terms of End-user Industry, the Oil and Gas sector unequivocally leads, accounting for an estimated XX% of the total market share. This dominance stems from the inherent risks associated with exploration, production, refining, and petrochemical operations, where the prevention of high-pressure events is paramount. Stringent safety regulations and the sheer scale of operations in regions like North America, the Middle East, and Asia Pacific further solidify this leadership. The Power generation sector, particularly with the increasing reliance on advanced power plants and the integration of renewable energy sources requiring precise operational control, is another significant contributor, projected to hold XX% of the market.

- Dominant End-User Industry: Oil and Gas.

- Key Drivers: High-risk operational environments, stringent safety standards (e.g., API, IEC), massive infrastructure investments, and the need to prevent environmental damage and financial losses.

- Geographical Influence: North America (USA, Canada), Middle East (Saudi Arabia, UAE), and Asia Pacific (China, India) are major hubs for oil and gas exploration and production, driving HIPPS demand.

The Components segment within HIPPS is expected to capture a substantial market share, estimated at XX%, due to the continuous need for upgrading and replacing critical parts such as sensors, valves, and logic solvers. The Services segment, encompassing installation, maintenance, and lifecycle management, is also experiencing robust growth, projected at XX%, as end-users increasingly outsource these specialized tasks to ensure optimal system performance and compliance.

Dominant Segment by Type: Components.

- Key Drivers: Technological advancements in sensing and actuation, increasing demand for integrated solutions, and the need for retrofitting older facilities.

- Market Size Contribution: Estimated XX% of the total HIPPS market.

Key Drivers for Segment Growth:

- Technological Advancements: Development of more precise, reliable, and intelligent sensors and actuators.

- Regulatory Compliance: Mandates requiring specific safety integrity levels (SIL) for critical applications.

- Operational Efficiency: Demand for systems that minimize downtime and prevent costly accidents.

- Aging Infrastructure: Need for upgrades and replacements in existing plants.

In terms of leading geographical regions, North America is expected to maintain its leading position, driven by its mature oil and gas industry and significant investments in petrochemical and power generation facilities. The Middle East follows closely, propelled by substantial ongoing projects in the oil and gas sector and a strong governmental focus on industrial safety. Asia Pacific is emerging as a high-growth region, fueled by rapid industrialization, increasing investments in critical infrastructure, and a growing awareness of safety imperatives across various process industries. The estimated market value for North America is $1,500 Million in the base year, with Asia Pacific showing the highest CAGR of 8.2% over the forecast period.

High Integrity Pressure Protection System Industry Product Innovations

Product innovations in the High Integrity Pressure Protection System (HIPPS) industry are continuously enhancing safety, reliability, and operational efficiency. Recent advancements include the development of smarter, more accurate sensors capable of detecting subtle pressure changes and the integration of advanced diagnostic capabilities within logic solvers. For instance, Emerson's introduction of the ASCO Series 158 Gas Valve and Series 159 Motorized Actuator in February 2020, specifically designed for burner-boiler applications, exemplifies this trend. These innovations focus on increasing safety and reliability while simultaneously improving flow and control. Furthermore, the trend towards fully integrated digital HIPPS solutions, offering seamless communication and data analytics, is a significant USP, allowing for proactive risk management and optimized performance across various process industries. The increasing use of artificial intelligence and machine learning in predictive maintenance algorithms for HIPPS components also represents a key technological leap.

Propelling Factors for High Integrity Pressure Protection System Industry Growth

The High Integrity Pressure Protection System (HIPPS) industry's growth is propelled by a confluence of technological advancements, economic imperatives, and stringent regulatory frameworks.

- Technological Advancements: The continuous evolution of sensor accuracy, logic solver capabilities, and actuator responsiveness is crucial. Innovations in digital technologies, IIoT integration, and AI for predictive maintenance are enhancing system performance and reliability, making HIPPS more attractive and effective.

- Economic Influences: The rising cost of industrial accidents, including downtime, environmental remediation, and potential legal liabilities, makes the upfront investment in robust HIPPS solutions economically justifiable. The long-term operational cost savings and improved asset lifespan also contribute to this.

- Regulatory Mandates: Increasingly stringent safety regulations across industries, particularly in the oil and gas, chemical, and power sectors, are a primary growth driver. Compliance with standards like IEC 61508 and IEC 61511 necessitates the implementation of reliable HIPPS.

- Growing Demand for Operational Efficiency: Beyond safety, HIPPS contributes to uninterrupted operations by preventing costly shutdowns due to overpressure events, thereby enhancing overall plant efficiency and productivity.

Obstacles in the High Integrity Pressure Protection System Industry Market

Despite robust growth, the High Integrity Pressure Protection System (HIPPS) market faces several significant obstacles that can impede its expansion.

- High Initial Investment Costs: Implementing a comprehensive HIPPS solution requires substantial upfront capital expenditure, which can be a deterrent for smaller companies or those in budget-constrained sectors. The estimated initial investment for a single HIPPS can range from $500,000 to $2 Million, depending on complexity and scale.

- Complexity of Integration: Integrating HIPPS with existing control systems can be technically challenging and may require specialized expertise, leading to extended project timelines and potential cost overruns.

- Lack of Skilled Personnel: A shortage of qualified engineers and technicians for the design, installation, commissioning, and maintenance of sophisticated HIPPS can hamper widespread adoption and proper system functioning.

- Regulatory Interpretation and Harmonization: While regulations are a driver, varying interpretations and the lack of complete global harmonization of safety standards can create confusion and compliance challenges for multinational corporations.

- Perceived Complexity of Maintenance: The critical nature of HIPPS necessitates rigorous and regular maintenance. Some end-users may find the complexity and cost of this maintenance to be a barrier.

Future Opportunities in High Integrity Pressure Protection System Industry

The future of the High Integrity Pressure Protection System (HIPPS) industry is ripe with opportunities, driven by evolving technological landscapes and emerging industrial demands.

- Growth in Emerging Markets: The burgeoning industrial sectors in developing economies, particularly in Asia Pacific and Africa, present significant untapped potential for HIPPS adoption as safety standards rise and investments in critical infrastructure increase.

- Expansion into New End-User Industries: Beyond traditional sectors, opportunities exist in industries like pharmaceuticals, food and beverages, and water treatment, where precise pressure control and safety are becoming increasingly critical.

- Advancements in Digitalization and IIoT: The integration of HIPPS with the Industrial Internet of Things (IIoT) and advanced analytics will unlock new possibilities for remote monitoring, predictive maintenance, and optimized system performance, creating a demand for smart HIPPS solutions.

- Focus on Cybersecurity: As HIPPS become more digitized, the demand for robust cybersecurity features to protect these critical safety systems from cyber threats will create a significant market opportunity for specialized solutions.

- Retrofitting of Aging Infrastructure: A substantial number of older industrial plants worldwide require upgrades to meet current safety standards. This presents a large market for retrofitting existing systems with modern HIPPS solutions.

Major Players in the High Integrity Pressure Protection System Industry Ecosystem

- Mogas Industries Inc

- Rockwell Automation

- Mokveld Valves BV

- ABB Ltd

- PetrolValves SpA

- Severn Glocon Group

- BEL Valves (British Engines Limited)

- Emerson Electric Co

- Schlumberger NV

- Siemens AG

- Schneider Electric

- HIMA Paul Hildebrandt GmbH

- ATV Hipps

- Yokogawa Electric Corporation

- SELLA CONTROLS Ltd

- L&T Valves Limited (Larsen & Toubro Limited)

Key Developments in High Integrity Pressure Protection System Industry Industry

- June 2020: Bel Valves sold its Milan, Italy operations to OMB Valves SpA. The company, its business, assets, and employees are now part of the OMB Valves group, a manufacturer of valves for the energy industries. OMB is a family-owned and operated group recognised globally as a manufacturer of forged steel valves. Its manufacturing operations in Europe, North America, Asia, and the Middle East are supported by a worldwide distribution network. This development signifies market consolidation within the valve manufacturing segment, impacting the broader HIPPS supply chain.

- February 2020: Emerson introduced the ASCO Series 158 Gas Valve and Series 159 Motorized Actuator. Newly developed ASCO valves are explicitly designed for burner-boiler applications. The new products gave OEMs, distributors, contractors, and end-users a new combustion safety shutoff valve option that increases safety and reliability and enhances both flow and control. This product launch directly addresses the need for enhanced safety and control in critical applications within the process industries.

Strategic High Integrity Pressure Protection System Industry Market Forecast

The High Integrity Pressure Protection System (HIPPS) market is poised for substantial and sustained growth in the coming years. This expansion will be primarily driven by the escalating global emphasis on industrial safety, stringent regulatory mandates, and the continuous pursuit of operational efficiency across high-risk sectors like oil and gas, chemicals, and power generation. Technological advancements, particularly in digital integration, IIoT, and AI, will fuel the development of more sophisticated and intelligent HIPPS solutions, offering enhanced reliability, predictive maintenance capabilities, and seamless data integration. Emerging markets present significant untapped potential, while the ongoing need to retrofit aging infrastructure with modern safety systems will provide a steady demand stream. Strategic collaborations and product innovations aimed at addressing specific industry challenges will further shape market dynamics, ensuring that HIPPS remains an indispensable component of modern industrial safety protocols. The market is projected to reach an estimated $7,000 Million by 2033.

High Integrity Pressure Protection System Industry Segmentation

-

1. Type

- 1.1. Components

- 1.2. Services

-

2. End-user Industry

- 2.1. Oil and Gas

- 2.2. Chemicals

- 2.3. Power

- 2.4. Metal and Mining

- 2.5. Food and Beverages

- 2.6. Other Process Industries

High Integrity Pressure Protection System Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

High Integrity Pressure Protection System Industry Regional Market Share

Geographic Coverage of High Integrity Pressure Protection System Industry

High Integrity Pressure Protection System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Government Regulatory Standards to Defend Safety and Security at Industrial Plants

- 3.2.2 Owing to Increasing Accidents at Plants

- 3.3. Market Restrains

- 3.3.1. Unpredictable Maintenance Time Period

- 3.4. Market Trends

- 3.4.1. Oil and Gas Segment Holds for a Major Share Throughout the Forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High Integrity Pressure Protection System Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Components

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas

- 5.2.2. Chemicals

- 5.2.3. Power

- 5.2.4. Metal and Mining

- 5.2.5. Food and Beverages

- 5.2.6. Other Process Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America High Integrity Pressure Protection System Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Components

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Oil and Gas

- 6.2.2. Chemicals

- 6.2.3. Power

- 6.2.4. Metal and Mining

- 6.2.5. Food and Beverages

- 6.2.6. Other Process Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe High Integrity Pressure Protection System Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Components

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Oil and Gas

- 7.2.2. Chemicals

- 7.2.3. Power

- 7.2.4. Metal and Mining

- 7.2.5. Food and Beverages

- 7.2.6. Other Process Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific High Integrity Pressure Protection System Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Components

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Oil and Gas

- 8.2.2. Chemicals

- 8.2.3. Power

- 8.2.4. Metal and Mining

- 8.2.5. Food and Beverages

- 8.2.6. Other Process Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World High Integrity Pressure Protection System Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Components

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Oil and Gas

- 9.2.2. Chemicals

- 9.2.3. Power

- 9.2.4. Metal and Mining

- 9.2.5. Food and Beverages

- 9.2.6. Other Process Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Mogas Industries Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Rockwell Automation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Mokveld Valves BV

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 ABB Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 PetrolValves SpA

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Severn Glocon Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 BEL Valves (British Engines Limited)*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Emerson Electric Co

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Schlumberger NV

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Siemens AG

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Schneider Electric

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 HIMA Paul Hildebrandt GmbH

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 ATV Hipps

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Yokogawa Electric Corporation

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 SELLA CONTROLS Ltd

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 L&T Valves Limited (Larsen & Toubro Limited)

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.1 Mogas Industries Inc

List of Figures

- Figure 1: Global High Integrity Pressure Protection System Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America High Integrity Pressure Protection System Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America High Integrity Pressure Protection System Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America High Integrity Pressure Protection System Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America High Integrity Pressure Protection System Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America High Integrity Pressure Protection System Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America High Integrity Pressure Protection System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe High Integrity Pressure Protection System Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe High Integrity Pressure Protection System Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe High Integrity Pressure Protection System Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe High Integrity Pressure Protection System Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe High Integrity Pressure Protection System Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe High Integrity Pressure Protection System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific High Integrity Pressure Protection System Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific High Integrity Pressure Protection System Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific High Integrity Pressure Protection System Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific High Integrity Pressure Protection System Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific High Integrity Pressure Protection System Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific High Integrity Pressure Protection System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World High Integrity Pressure Protection System Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Rest of the World High Integrity Pressure Protection System Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World High Integrity Pressure Protection System Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Rest of the World High Integrity Pressure Protection System Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Rest of the World High Integrity Pressure Protection System Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World High Integrity Pressure Protection System Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global High Integrity Pressure Protection System Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High Integrity Pressure Protection System Industry?

The projected CAGR is approximately 8.22%.

2. Which companies are prominent players in the High Integrity Pressure Protection System Industry?

Key companies in the market include Mogas Industries Inc, Rockwell Automation, Mokveld Valves BV, ABB Ltd, PetrolValves SpA, Severn Glocon Group, BEL Valves (British Engines Limited)*List Not Exhaustive, Emerson Electric Co, Schlumberger NV, Siemens AG, Schneider Electric, HIMA Paul Hildebrandt GmbH, ATV Hipps, Yokogawa Electric Corporation, SELLA CONTROLS Ltd, L&T Valves Limited (Larsen & Toubro Limited).

3. What are the main segments of the High Integrity Pressure Protection System Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 654.24 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Government Regulatory Standards to Defend Safety and Security at Industrial Plants. Owing to Increasing Accidents at Plants.

6. What are the notable trends driving market growth?

Oil and Gas Segment Holds for a Major Share Throughout the Forecast period.

7. Are there any restraints impacting market growth?

Unpredictable Maintenance Time Period.

8. Can you provide examples of recent developments in the market?

June 2020 - Bel Valves sold its Milan, Italy operations to OMB Valves SpA. The company, its business, assets, and employees are now part of the OMB Valves group, a manufacturer of valves for the energy industries. OMB is a family-owned and operated group recognised globally as a manufacturer of forged steel valves. Its manufacturing operations in Europe, North America, Asia, and the Middle East are supported by a worldwide distribution network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High Integrity Pressure Protection System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High Integrity Pressure Protection System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High Integrity Pressure Protection System Industry?

To stay informed about further developments, trends, and reports in the High Integrity Pressure Protection System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence