Key Insights

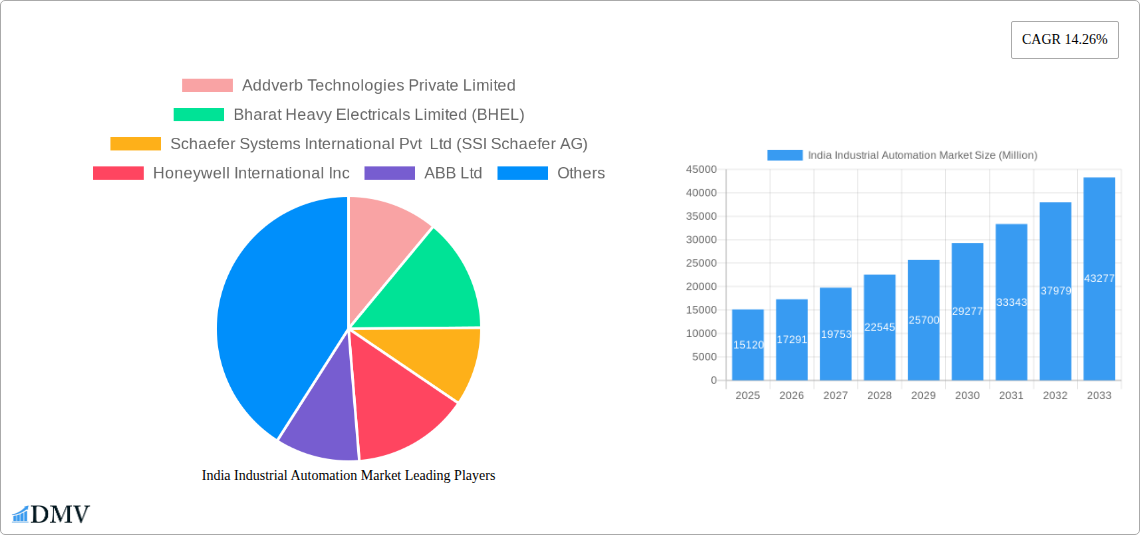

The India Industrial Automation Market is experiencing a significant growth trajectory, projected to reach USD 15.12 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 14.26% during the forecast period of 2025-2033. This expansion is primarily propelled by a confluence of factors, including the government's strong emphasis on boosting domestic manufacturing capabilities through initiatives like 'Make in India' and the Production Linked Incentive (PLI) schemes. These policies are driving substantial investment in advanced manufacturing technologies, leading to increased adoption of both automated material handling solutions and factory automation systems. The demand for increased efficiency, enhanced product quality, reduced operational costs, and improved workplace safety are further fueling this market surge. Furthermore, the escalating need for real-time data analytics and seamless integration across the production lifecycle, from design to manufacturing and beyond, is spurring the adoption of sophisticated software solutions like MES and PLM.

India Industrial Automation Market Market Size (In Billion)

The market is broadly segmented into Automated Material Handling Solutions and Factory Automation Solutions, each encompassing a diverse range of hardware and software components. Within Automated Material Handling, conveyor and sortation systems, Automated Storage and Retrieval Systems (AS/RS), and mobile robots are witnessing heightened demand. The Factory Automation segment is characterized by the widespread deployment of Industrial Control Systems (ICS) like DCS, SCADA, and PLCs, alongside an increasing integration of Industrial Robots, Sensors, and Field Devices. Key end-user industries contributing to this growth include Manufacturing (across various sub-sectors like automotive, pharmaceuticals, and food & beverage) and Non-manufacturing sectors like healthcare and general merchandise. Leading players are actively investing in research and development to offer innovative and customized solutions, catering to the evolving needs of Indian industries and solidifying the market's upward momentum.

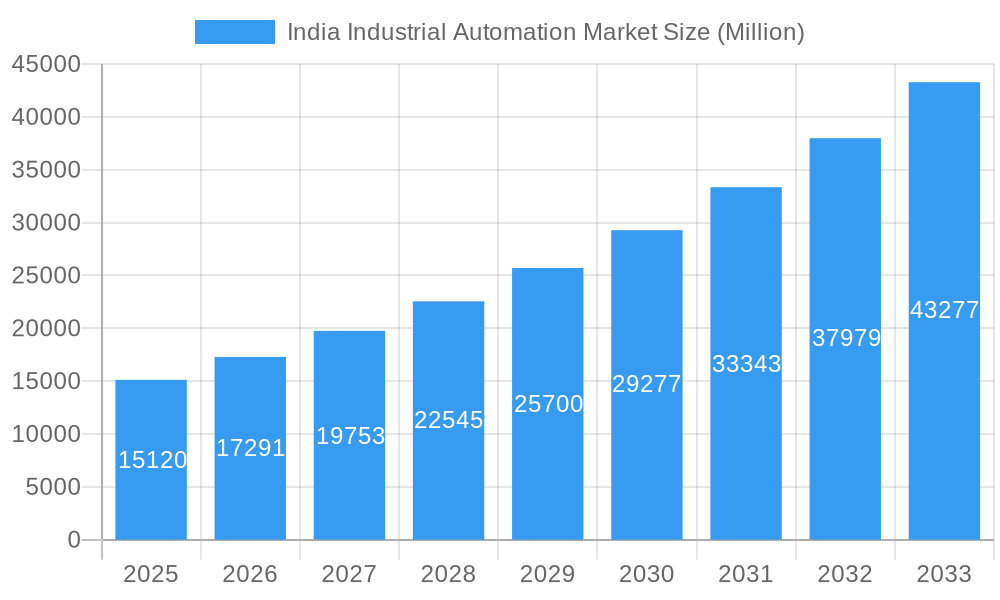

India Industrial Automation Market Company Market Share

India Industrial Automation Market: Comprehensive Report & Future Outlook (2019-2033)

Unlock the potential of India's rapidly evolving industrial automation landscape. This in-depth report provides a critical analysis of the India Industrial Automation Market, offering unparalleled insights for stakeholders seeking to capitalize on burgeoning opportunities. Covering the extensive study period of 2019–2033, with a meticulous focus on the base year 2025 and a robust forecast period of 2025–2033, this report is your definitive guide to market dynamics, technological advancements, and strategic growth. Discover key trends in factory automation solutions, automated material handling solutions, and industrial control systems, and understand the impact of Industry 4.0 and digital transformation on sectors ranging from automotive and pharmaceuticals to FMCG/non-durable goods.

This comprehensive market research report delves into the intricate workings of the Indian automation industry, exploring the latest innovations, competitive strategies of leading players, and the crucial regulatory frameworks shaping its trajectory. Whether you are an investor, manufacturer, technology provider, or policymaker, this report equips you with the data-driven intelligence to navigate this dynamic sector and secure a competitive edge.

India Industrial Automation Market Market Composition & Trends

The India Industrial Automation Market is characterized by a moderate to high concentration, with a mix of global giants and emerging domestic players vying for market share. Innovation is largely driven by the increasing adoption of Industry 4.0 technologies such as the Industrial Internet of Things (IIoT), Artificial Intelligence (AI), and Machine Learning (ML), enabling predictive maintenance and optimized production cycles. The regulatory landscape is progressively supportive, with government initiatives like "Make in India" and the Production Linked Incentive (PLI) scheme fostering domestic manufacturing and technological advancement. While substitute products exist in less automated segments, the superior efficiency, accuracy, and safety offered by industrial automation solutions continue to drive their adoption. End-user profiles are diversifying, with increased demand from traditional sectors like automotive and manufacturing, alongside significant growth in healthcare, general merchandise, and FMCG/non-durable goods for automated material handling solutions. Merger and acquisition (M&A) activities are on the rise, driven by the need for technological integration and market expansion. For instance, acquisitions aimed at bolstering capabilities in robotics and AI-driven software solutions are prevalent, with deal values often in the tens to hundreds of Million. Key M&A trends include:

- Acquisitions of niche software providers by larger automation vendors to enhance their digital offerings.

- Strategic partnerships to develop integrated solutions for specific industry verticals.

- Consolidation among domestic players to achieve economies of scale and expand geographical reach.

India Industrial Automation Market Industry Evolution

The India Industrial Automation Market has witnessed a profound evolutionary journey, driven by a confluence of technological advancements, economic imperatives, and shifting consumer demands. From its nascent stages of basic mechanization, the market has rapidly transitioned towards sophisticated factory automation solutions and highly integrated automated material handling solutions. The historical period of 2019–2024 saw an accelerated adoption curve, fueled by the need for increased productivity, reduced operational costs, and enhanced product quality. The base year 2025 represents a pivotal point, where the market is poised for significant expansion, propelled by the widespread implementation of digital transformation initiatives across various industries.

Market growth trajectories are consistently upward, with projected Compound Annual Growth Rates (CAGR) expected to be in the double digits for the forecast period of 2025–2033. Technological advancements have been the primary catalyst for this evolution. The integration of Industrial Control Systems (ICS), including Distributed Control Systems (DCS), Supervisory Control and Data Acquisition (SCADA), Programmable Logic Controllers (PLC), and Human-Machine Interfaces (HMI), has become standard practice in modern manufacturing facilities. Furthermore, the proliferation of Field Devices, such as sensors and transmitters, electric AC drives, servo motors, inverters, and industrial robots, has enabled unprecedented levels of precision and control. The emergence of Manufacturing Execution Systems (MES) and Product Lifecycle Management (PLM) software has further streamlined operations, optimizing production scheduling, quality control, and product development cycles.

Shifting consumer demands, particularly the growing preference for personalized products and faster delivery times, have compelled manufacturers to embrace agile and responsive production processes. This has directly translated into a greater demand for flexible and scalable automation solutions. The non-manufacturing sector, including healthcare and general merchandise, is increasingly adopting automation, particularly for logistics and warehousing, highlighting a significant diversification of end-user applications. The adoption metrics for advanced automation technologies are steadily increasing, with a notable surge in the deployment of Automated Storage and Retrieval Systems (AS/RS) and mobile robots within distribution centers. The impact of global trends, such as supply chain resilience and sustainability, is also shaping the industry's evolution, driving investments in automation technologies that can optimize resource utilization and reduce environmental impact.

Leading Regions, Countries, or Segments in India Industrial Automation Market

The India Industrial Automation Market exhibits distinct leadership across various segments and end-user industries, driven by diverse investment trends and regulatory support.

Dominant Segments by Type of Solution:

Factory Automation Solutions: This segment consistently leads due to its fundamental role in enhancing manufacturing efficiency and competitiveness.

- Industrial Control Systems:

- PLC: Ubiquitous across industries for discrete control and automation tasks, experiencing steady growth.

- DCS & SCADA: Crucial for process industries like Oil and Gas, Power, and Petrochemicals and Fertilizers, where continuous monitoring and control are paramount.

- HMI: Integral for user interaction and operational oversight, with increasing demand for sophisticated graphical interfaces.

- Field Devices:

- Sensors and Transmitters: Their pervasive use in data acquisition and process monitoring makes them a foundational component of factory automation, with robust growth fueled by IIoT integration.

- Industrial Robots: Significant adoption in the automotive sector for assembly, welding, and painting, with expanding applications in electronics and general manufacturing.

- Electric AC Drives & Inverters: Essential for energy efficiency and precise motor control, witnessing strong demand across all manufacturing verticals.

- Software Solutions (MES & PLM): Growing adoption as industries seek integrated solutions for optimized production planning, execution, and product lifecycle management.

- Industrial Control Systems:

Automated Material Handling Solutions: This segment is experiencing exceptional growth, driven by e-commerce expansion and the need for efficient inventory management.

- Hardware:

- Automated Storage and Retrieval System (AS/RS): Critical for optimizing warehouse space and retrieval efficiency, particularly in FMCG/Non-durable Goods and General Merchandise sectors.

- Conveyor/Sortation Systems: Essential for efficient movement of goods within manufacturing plants and distribution centers.

- Mobile Robots: Rapidly gaining traction for flexible and autonomous material movement within warehouses and manufacturing floors.

- Software: Integrated with hardware for intelligent warehouse management and optimization.

- Hardware:

Dominant End-User Markets:

- Manufacturing: Remains the largest consumer of industrial automation, with key sub-sectors driving demand:

- Automotive: A consistent leader, leveraging automation for complex assembly lines, quality control, and robotics.

- Food and Beverage: Driven by increasing demand for packaged goods, hygiene standards, and efficient production lines.

- Pharmaceutical: High adoption rates due to stringent quality control, regulatory compliance, and the need for precision in drug manufacturing.

- Textiles: Growing automation for improved efficiency and quality in spinning, weaving, and garment manufacturing.

- Non-manufacturing: Rapidly emerging as a significant growth area:

- General Merchandise & FMCG/Non-durable Goods: Driven by the boom in e-commerce and the need for faster order fulfillment and efficient warehousing.

- Healthcare: Increasing automation in logistics for medical supplies, pharmaceutical distribution, and laboratory processes.

Key Drivers of Dominance:

- Investment Trends: Significant capital expenditure in manufacturing and logistics infrastructure, particularly in developing economies and expanding urban centers.

- Regulatory Support: Government initiatives promoting domestic manufacturing, digital adoption, and skill development for the automation workforce.

- Technological Advancements: The continuous innovation in AI, IIoT, and robotics makes automation solutions more accessible and impactful.

- Cost Reduction & Efficiency Gains: The inherent ability of automation to reduce labor costs, minimize errors, and increase throughput is a primary driver across all sectors.

India Industrial Automation Market Product Innovations

Product innovations in the India Industrial Automation Market are rapidly transforming operational efficiencies and enabling new manufacturing paradigms. Key advancements include the development of more intelligent and collaborative robots capable of working alongside human operators, enhancing safety and productivity in tasks such as assembly and packaging. Furthermore, the integration of AI and Machine Learning into Industrial Control Systems and MES is leading to predictive maintenance capabilities, significantly reducing downtime and optimizing resource allocation. The emergence of modular and scalable automation solutions caters to the evolving needs of small and medium-sized enterprises (SMEs), making advanced technologies more accessible. Innovations in vision systems and automatic identification and data capture (AIDC) are enhancing quality control and inventory tracking accuracy. These advancements collectively contribute to higher throughput, reduced operational costs, and improved product quality across diverse industries.

Propelling Factors for India Industrial Automation Market Growth

The India Industrial Automation Market is propelled by a robust set of factors, including:

- Government Initiatives: Programs like "Make in India" and Production Linked Incentive (PLI) schemes are encouraging domestic manufacturing and technology adoption.

- Rising Labor Costs and Skill Shortages: Automation offers a viable solution to mitigate increasing labor expenses and address the shortage of skilled personnel in certain manufacturing roles.

- Demand for Increased Productivity and Efficiency: Businesses are increasingly investing in automation to enhance output, reduce waste, and improve overall operational efficiency.

- Technological Advancements: The continuous evolution of Industry 4.0 technologies, including IIoT, AI, robotics, and cloud computing, is making automation more powerful, accessible, and cost-effective.

- Growth of E-commerce and Logistics: The surge in online retail necessitates advanced automated material handling solutions for efficient warehousing and order fulfillment.

- Focus on Quality and Precision: Automation ensures consistent product quality and high levels of precision, critical for sectors like pharmaceuticals and automotive.

Obstacles in the India Industrial Automation Market Market

Despite its rapid growth, the India Industrial Automation Market faces several obstacles:

- High Initial Investment Costs: The upfront cost of implementing sophisticated automation systems can be a significant barrier, particularly for SMEs with limited capital.

- Lack of Skilled Workforce: A shortage of trained professionals capable of designing, installing, operating, and maintaining advanced automation systems hinders widespread adoption.

- Integration Challenges: Integrating new automation solutions with existing legacy systems can be complex and time-consuming, requiring specialized expertise.

- Cybersecurity Concerns: The increasing reliance on connected systems raises concerns about data security and potential cyber threats, necessitating robust security protocols.

- Fragmented Market and Lack of Standardization: The presence of numerous vendors and varying standards can lead to compatibility issues and make it challenging for businesses to choose the right solutions.

- Resistance to Change: Traditional mindsets and resistance to adopting new technologies can slow down the pace of automation implementation.

Future Opportunities in India Industrial Automation Market

The India Industrial Automation Market presents significant future opportunities, driven by:

- Expansion into Tier 2 and Tier 3 Cities: As awareness and affordability increase, automation adoption is expected to grow in smaller industrial clusters.

- Growth in Emerging Sectors: Increased automation in sectors like renewable energy, defense, and aerospace will open new avenues.

- Advancements in AI and Machine Learning: Further integration of AI for predictive analytics, autonomous operations, and enhanced decision-making will drive demand for sophisticated solutions.

- Focus on Sustainability and Green Automation: Opportunities exist for automation solutions that optimize energy consumption, reduce waste, and promote eco-friendly manufacturing processes.

- Rise of Smart Factories and Digital Twins: The development of fully integrated smart factories and the use of digital twins for simulation and optimization will create demand for advanced software and integrated hardware.

- Customized and Flexible Automation Solutions: Tailored automation systems that can adapt to rapidly changing production needs will be highly sought after.

Major Players in the India Industrial Automation Market Ecosystem

- Addverb Technologies Private Limited

- Bharat Heavy Electricals Limited (BHEL)

- Schaefer Systems International Pvt Ltd (SSI Schaefer AG)

- Honeywell International Inc

- ABB Ltd

- Kardex India Storage Solutions Private Limited (Kardex Holding AG)

- Godrej Koerber Supply Chain Limited

- Larsen & Toubro Ltd

- Crompton Greaves Ltd

- Space Magnum Equipment Pvt Ltd

- Fuji Electric Co Ltd

- Hinditron Group

- Armstrong Ltd

- Emerson Electric Co

- Mitsubishi Electric Corporation

- Siemens AG

- Bastian Solution Private Limited (Toyota Industries)

- ATS Conveyors India Pvt Ltd (ATS Group)

- Schneider Electric

- Falcon Autotech Private Limited

- Robert Bosch GmbH

- Bain & Company Inc

- The Hi-Tech Robotic Systemz Limited

- Rockwell Automation Inc

- Yokogawa Electric Corporation

- Danfoss A/S

- Daifuku India Private Limited (Daifuku Co Ltd)

- Grey Orange Pte Ltd

- Boston Consulting Grou

- Kuka India Private Limited (Kuka AG)

Key Developments in India Industrial Automation Market Industry

- June 2023: ABB India secured a significant contract to supply electrification and automation systems for ArcelorMittal Nippon Steel India's (AM/NS India) advanced steel cold rolling mill (CRM) in Hazira, Gujarat. This includes the ABB Ability System 800xA distributed control system (DCS) and related machinery, underscoring the growing demand for advanced automation in the heavy industry sector.

- March 2023: Bastian Solutions Private Limited showcased a range of its innovative products and solutions at the ProMattradeshow. Their booth featured a live demonstration integrating multiple technologies, including autonomous vehicles, Bastian Solutions SmartPicK AutoStore, Tompkins Robotics tSort, and Bastian Solutions conveyor systems, highlighting advancements in integrated material handling solutions.

Strategic India Industrial Automation Market Market Forecast

The strategic India Industrial Automation Market forecast indicates sustained high growth driven by the synergistic effects of government support, technological innovation, and increasing industry demand for efficiency and competitiveness. The market is expected to witness a significant expansion as more businesses embrace Industry 4.0 principles, leading to the development of fully integrated smart factories. The increasing adoption of robotics, AI-powered analytics, and sophisticated automated material handling solutions will be pivotal in optimizing supply chains and manufacturing processes. Opportunities in emerging sectors and a push towards sustainable automation practices will further fuel market potential. The forecast suggests a robust trajectory, positioning India as a key global hub for industrial automation advancements.

India Industrial Automation Market Segmentation

-

1. Type of Solution

-

1.1. Automated Material Handling Solutions

-

1.1.1. Hardware

- 1.1.1.1. Conveyor/Sortation Systems

- 1.1.1.2. Automated Storage and Retrieval System (AS/RS)

- 1.1.1.3. Mobile R

- 1.1.1.4. Automatic Identification and Data Capture (AIDC)

- 1.1.2. Software

-

1.1.1. Hardware

-

1.2. Factory Automation Solutions

-

1.2.1. Industrial Control Systems

- 1.2.1.1. DCS

- 1.2.1.2. SCADA

- 1.2.1.3. PLC

- 1.2.1.4. HMI

- 1.2.1.5. Other Control Systems

-

1.2.2. Field Devices

- 1.2.2.1. Sensors and Transmitters

- 1.2.2.2. Electric AC Drives

- 1.2.2.3. Servo Motors

- 1.2.2.4. Computer Numerical Control (CNC) Machines

- 1.2.2.5. Inverters

- 1.2.2.6. Industrial Robots

- 1.2.2.7. Other Factory Automation Solutions

- 1.2.3. Manufacturing Execution System (MES)

- 1.2.4. Product Lifecycle Management (PLM)

- 1.2.5. Other Types

-

1.2.1. Industrial Control Systems

-

1.1. Automated Material Handling Solutions

-

2. End-user

-

2.1. Automated Material Handling Market

- 2.1.1. Manufacturing

-

2.1.2. Non-manufacturing

- 2.1.2.1. General Merchandise

- 2.1.2.2. Healthcare

- 2.1.2.3. FMCG/Non-durable Goods

- 2.1.2.4. Other End-Users

-

2.2. Factory Automation Market

- 2.2.1. Food and Beverage

- 2.2.2. Pharmaceutical

- 2.2.3. Automotive

- 2.2.4. Textiles

- 2.2.5. Power

- 2.2.6. Oil and Gas

- 2.2.7. Petrochemicals and Fertilizers

-

2.1. Automated Material Handling Market

India Industrial Automation Market Segmentation By Geography

- 1. India

India Industrial Automation Market Regional Market Share

Geographic Coverage of India Industrial Automation Market

India Industrial Automation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Labels Manufactured with Digital Print Technologies; High Adoption from the Healthcare and Cosmetic Segment

- 3.3. Market Restrains

- 3.3.1. Lack of Products with the Ability to Withstand Harsh Climatic Conditions

- 3.4. Market Trends

- 3.4.1. HMI to Witness the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Industrial Automation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Solution

- 5.1.1. Automated Material Handling Solutions

- 5.1.1.1. Hardware

- 5.1.1.1.1. Conveyor/Sortation Systems

- 5.1.1.1.2. Automated Storage and Retrieval System (AS/RS)

- 5.1.1.1.3. Mobile R

- 5.1.1.1.4. Automatic Identification and Data Capture (AIDC)

- 5.1.1.2. Software

- 5.1.1.1. Hardware

- 5.1.2. Factory Automation Solutions

- 5.1.2.1. Industrial Control Systems

- 5.1.2.1.1. DCS

- 5.1.2.1.2. SCADA

- 5.1.2.1.3. PLC

- 5.1.2.1.4. HMI

- 5.1.2.1.5. Other Control Systems

- 5.1.2.2. Field Devices

- 5.1.2.2.1. Sensors and Transmitters

- 5.1.2.2.2. Electric AC Drives

- 5.1.2.2.3. Servo Motors

- 5.1.2.2.4. Computer Numerical Control (CNC) Machines

- 5.1.2.2.5. Inverters

- 5.1.2.2.6. Industrial Robots

- 5.1.2.2.7. Other Factory Automation Solutions

- 5.1.2.3. Manufacturing Execution System (MES)

- 5.1.2.4. Product Lifecycle Management (PLM)

- 5.1.2.5. Other Types

- 5.1.2.1. Industrial Control Systems

- 5.1.1. Automated Material Handling Solutions

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Automated Material Handling Market

- 5.2.1.1. Manufacturing

- 5.2.1.2. Non-manufacturing

- 5.2.1.2.1. General Merchandise

- 5.2.1.2.2. Healthcare

- 5.2.1.2.3. FMCG/Non-durable Goods

- 5.2.1.2.4. Other End-Users

- 5.2.2. Factory Automation Market

- 5.2.2.1. Food and Beverage

- 5.2.2.2. Pharmaceutical

- 5.2.2.3. Automotive

- 5.2.2.4. Textiles

- 5.2.2.5. Power

- 5.2.2.6. Oil and Gas

- 5.2.2.7. Petrochemicals and Fertilizers

- 5.2.1. Automated Material Handling Market

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type of Solution

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Addverb Technologies Private Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bharat Heavy Electricals Limited (BHEL)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Schaefer Systems International Pvt Ltd (SSI Schaefer AG)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Honeywell International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ABB Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kardex India Storage Solutions Private Limited (Kardex Holding AG)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Godrej Koerber Supply Chain Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Larsen & Toubro Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Crompton Greaves Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Space Magnum Equipment Pvt Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Fuji Electric Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Hinditron Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Armstrong Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Emerson Electric Co

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Mitsubishi Electric Corporation

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Siemens AG

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Bastian Solution Private Limited (Toyota Industries)

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 ATS Conveyors India Pvt Ltd (ATS Group)

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Schneider Electric

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Falcon Autotech Private Limited

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 Robert Bosch GmbH

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 Bain & Company Inc

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.23 The Hi-Tech Robotic Systemz Limited

- 6.2.23.1. Overview

- 6.2.23.2. Products

- 6.2.23.3. SWOT Analysis

- 6.2.23.4. Recent Developments

- 6.2.23.5. Financials (Based on Availability)

- 6.2.24 Rockwell Automation Inc

- 6.2.24.1. Overview

- 6.2.24.2. Products

- 6.2.24.3. SWOT Analysis

- 6.2.24.4. Recent Developments

- 6.2.24.5. Financials (Based on Availability)

- 6.2.25 Yokogawa Electric Corporation

- 6.2.25.1. Overview

- 6.2.25.2. Products

- 6.2.25.3. SWOT Analysis

- 6.2.25.4. Recent Developments

- 6.2.25.5. Financials (Based on Availability)

- 6.2.26 Danfoss A/S

- 6.2.26.1. Overview

- 6.2.26.2. Products

- 6.2.26.3. SWOT Analysis

- 6.2.26.4. Recent Developments

- 6.2.26.5. Financials (Based on Availability)

- 6.2.27 Daifuku India Private Limited (Daifuku Co Ltd)

- 6.2.27.1. Overview

- 6.2.27.2. Products

- 6.2.27.3. SWOT Analysis

- 6.2.27.4. Recent Developments

- 6.2.27.5. Financials (Based on Availability)

- 6.2.28 Grey Orange Pte Ltd

- 6.2.28.1. Overview

- 6.2.28.2. Products

- 6.2.28.3. SWOT Analysis

- 6.2.28.4. Recent Developments

- 6.2.28.5. Financials (Based on Availability)

- 6.2.29 Boston Consulting Grou

- 6.2.29.1. Overview

- 6.2.29.2. Products

- 6.2.29.3. SWOT Analysis

- 6.2.29.4. Recent Developments

- 6.2.29.5. Financials (Based on Availability)

- 6.2.30 Kuka India Private Limited (Kuka AG)

- 6.2.30.1. Overview

- 6.2.30.2. Products

- 6.2.30.3. SWOT Analysis

- 6.2.30.4. Recent Developments

- 6.2.30.5. Financials (Based on Availability)

- 6.2.1 Addverb Technologies Private Limited

List of Figures

- Figure 1: India Industrial Automation Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Industrial Automation Market Share (%) by Company 2025

List of Tables

- Table 1: India Industrial Automation Market Revenue Million Forecast, by Type of Solution 2020 & 2033

- Table 2: India Industrial Automation Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 3: India Industrial Automation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Industrial Automation Market Revenue Million Forecast, by Type of Solution 2020 & 2033

- Table 5: India Industrial Automation Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 6: India Industrial Automation Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Industrial Automation Market?

The projected CAGR is approximately 14.26%.

2. Which companies are prominent players in the India Industrial Automation Market?

Key companies in the market include Addverb Technologies Private Limited, Bharat Heavy Electricals Limited (BHEL), Schaefer Systems International Pvt Ltd (SSI Schaefer AG), Honeywell International Inc, ABB Ltd, Kardex India Storage Solutions Private Limited (Kardex Holding AG), Godrej Koerber Supply Chain Limited, Larsen & Toubro Ltd, Crompton Greaves Ltd, Space Magnum Equipment Pvt Ltd, Fuji Electric Co Ltd, Hinditron Group, Armstrong Ltd, Emerson Electric Co, Mitsubishi Electric Corporation, Siemens AG, Bastian Solution Private Limited (Toyota Industries), ATS Conveyors India Pvt Ltd (ATS Group), Schneider Electric, Falcon Autotech Private Limited, Robert Bosch GmbH, Bain & Company Inc, The Hi-Tech Robotic Systemz Limited, Rockwell Automation Inc, Yokogawa Electric Corporation, Danfoss A/S, Daifuku India Private Limited (Daifuku Co Ltd), Grey Orange Pte Ltd, Boston Consulting Grou, Kuka India Private Limited (Kuka AG).

3. What are the main segments of the India Industrial Automation Market?

The market segments include Type of Solution, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Labels Manufactured with Digital Print Technologies; High Adoption from the Healthcare and Cosmetic Segment.

6. What are the notable trends driving market growth?

HMI to Witness the Growth.

7. Are there any restraints impacting market growth?

Lack of Products with the Ability to Withstand Harsh Climatic Conditions.

8. Can you provide examples of recent developments in the market?

June 2023 - ABB India has been contracted to supply ArcelorMittal Nippon Steel India's (AM/NS India) advanced steel cold rolling mill (CRM) in Hazira, Gujarat, with electrification and automation systems, including the ABB Ability System 800xA distributed control system (DCS) and related machinery and supplies. The original equipment manufacturer (OEM) for the project, John Cockerill India Limited (JCIL), is responsible for the contract at the flagship manufacturing facility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Industrial Automation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Industrial Automation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Industrial Automation Market?

To stay informed about further developments, trends, and reports in the India Industrial Automation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence