Key Insights

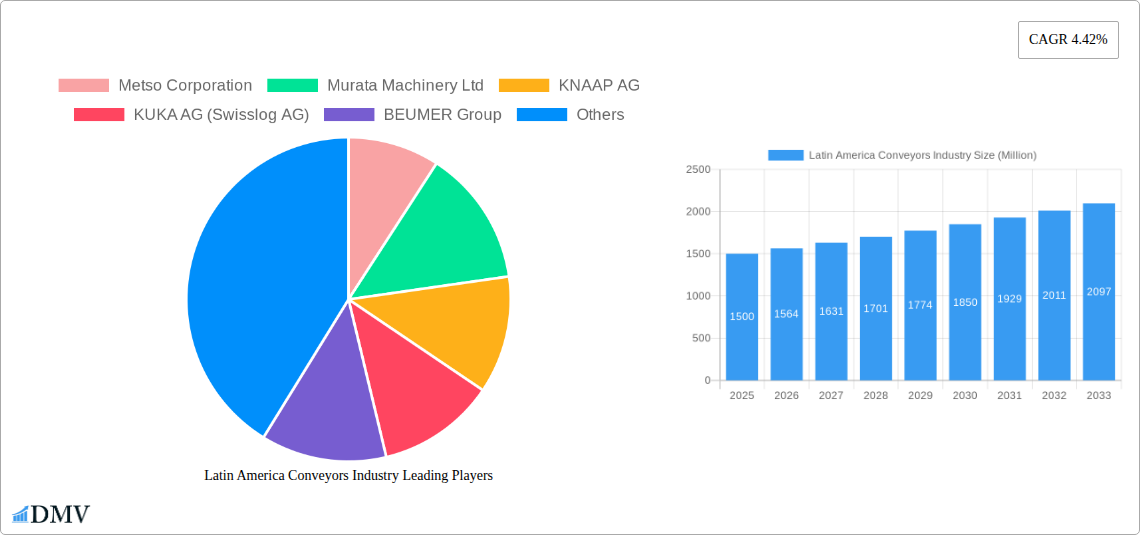

The Latin America Conveyors Industry is poised for robust growth, projected to reach a substantial market size driven by a CAGR of 4.42%. This expansion is fueled by the increasing demand for automation and efficient material handling solutions across diverse end-user industries. Key sectors such as airports, retail, automotive, manufacturing, food and beverage, pharmaceuticals, and mining are investing heavily in conveyor systems to streamline operations, reduce labor costs, and enhance productivity. The retail sector, in particular, is experiencing a surge in e-commerce, necessitating advanced logistics and warehousing solutions that rely heavily on sophisticated conveyor networks. Similarly, the burgeoning automotive and manufacturing sectors in countries like Brazil and Mexico are adopting automated production lines, further boosting the adoption of conveyor technologies. The food and beverage and pharmaceutical industries are also significant contributors, driven by stringent regulatory requirements for hygiene and product integrity, which automated conveyor systems help to maintain.

Latin America Conveyors Industry Market Size (In Billion)

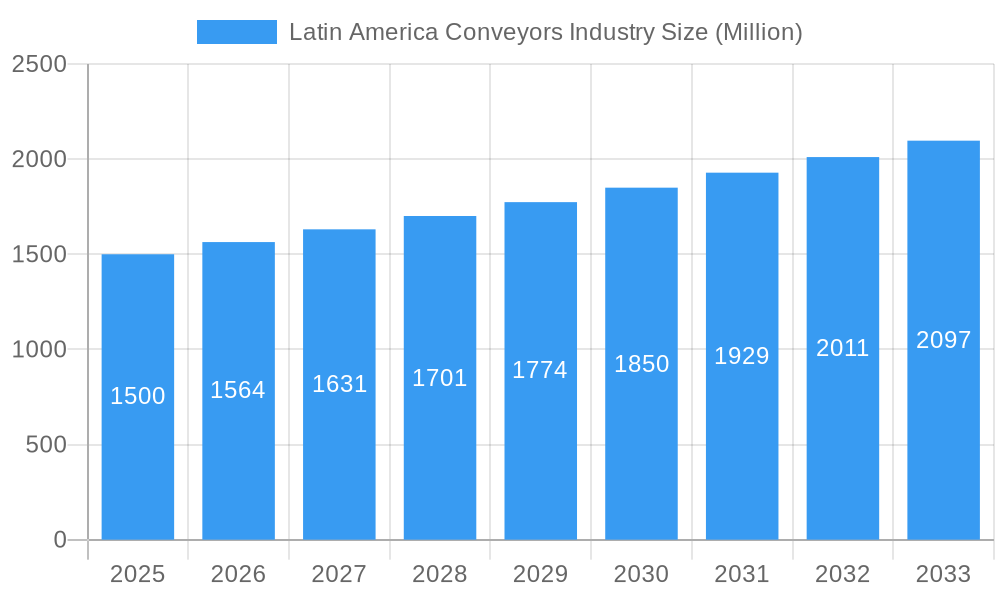

The competitive landscape features major global players like Metso Corporation, Murata Machinery Ltd, KUKA AG (Swisslog AG), BEUMER Group, and Daifuku Co Ltd, alongside regional specialists. These companies are focusing on innovation, offering advanced solutions such as belt, roller, pallet, and overhead conveyors tailored to specific industry needs. Trends such as the integration of IoT and AI for predictive maintenance and real-time monitoring, along with the development of energy-efficient and flexible conveyor designs, are shaping market dynamics. Restraints include the high initial investment costs and the need for skilled labor to operate and maintain complex systems, which may slow adoption in some smaller enterprises or less developed economies within the region. However, the long-term benefits of improved efficiency and reduced operational expenses are expected to outweigh these challenges, ensuring sustained market expansion throughout the forecast period.

Latin America Conveyors Industry Company Market Share

Latin America Conveyors Industry Market Composition & Trends

The Latin America conveyors market is characterized by a moderate to high level of concentration, with key players like Metso Corporation, Murata Machinery Ltd, KNAAP AG, KUKA AG (Swisslog AG), BEUMER Group, Bastian Solutions Inc, SSI Schaefer AG, Kardex Group, Dorner Mfg Corp, Honeywell Intelligrated Inc, Daifuku Co Ltd, Mecalux SA, and Interroll Holding AG capturing significant market share. This dynamic is driven by continuous innovation in belt conveyors, roller conveyors, pallet conveyors, and overhead conveyors, crucial for optimizing operations across diverse end-user industries. The regulatory landscape, while evolving, generally supports infrastructure development and industrial automation. Substitute products exist, but the inherent efficiency and scalability of conveyor systems often give them a competitive edge. End-user profiles are increasingly sophisticated, demanding tailored solutions for airports, retail, automotive, manufacturing, food and beverage, pharmaceuticals, and mining sectors. Merger and acquisition (M&A) activities are a notable trend, with estimated deal values reaching hundreds of millions, signaling strategic consolidation and expansion. The market share distribution indicates a strong presence of established global manufacturers alongside growing regional players. For instance, the automotive and manufacturing segments represent a substantial portion of the market share, estimated at over 25% each, due to significant investment in automated production lines. M&A deals in the past year alone are projected to have a cumulative value exceeding $500 Million, demonstrating robust consolidation strategies.

Latin America Conveyors Industry Industry Evolution

The evolution of the Latin America conveyors industry is a compelling narrative of technological advancement, economic expansion, and shifting operational demands. Over the study period from 2019 to 2033, with a base and estimated year of 2025, the market has witnessed significant growth trajectories. The historical period (2019-2024) laid the groundwork for this expansion, marked by increasing adoption of automated material handling solutions across various sectors. The forecast period (2025-2033) is projected to be a phase of accelerated growth, driven by a compound annual growth rate (CAGR) estimated at 7.5%. Technological advancements have been a primary catalyst, with the integration of IoT, AI, and advanced robotics revolutionizing conveyor system capabilities. Smart conveyors, capable of real-time data analytics and predictive maintenance, are becoming increasingly prevalent, enhancing operational efficiency and reducing downtime. Adoption metrics for these advanced systems are showing a steady upward trend, with an estimated 30% increase in smart conveyor installations between 2023 and 2025.

Consumer demand patterns have also played a pivotal role in shaping the industry's evolution. The burgeoning e-commerce sector, for example, has spurred significant demand for high-speed, automated sorting and conveying systems in retail and logistics operations. Similarly, the growing global demand for raw materials has fueled investment in robust and efficient conveyor systems within the mining industry. The automotive sector, a traditional stronghold, continues to innovate with flexible manufacturing lines requiring adaptable conveyor solutions. Furthermore, increasing consumer awareness regarding product safety and traceability has led to greater demand for hygienic and specialized conveyors in the food and beverage and pharmaceuticals industries. This evolving demand landscape necessitates a more agile and responsive approach from conveyor manufacturers, pushing them towards modular designs and customizable solutions. The shift towards Industry 4.0 principles across manufacturing sectors is a defining characteristic of this evolution, underscoring the importance of interconnected and intelligent material handling systems.

Leading Regions, Countries, or Segments in Latin America Conveyors Industry

The Latin America conveyors industry exhibits clear leadership across specific regions, countries, and product/end-user segments, driven by distinct economic, regulatory, and investment trends.

Dominant End-User Industries:

Manufacturing: This sector consistently leads in conveyor adoption due to its inherent need for efficient material flow within production lines. Key drivers include:

- Investment Trends: Significant capital expenditure in upgrading and expanding manufacturing facilities to meet global demand. Estimated investment in automation for manufacturing by 2025 is projected to be upwards of $800 Million across the region.

- Regulatory Support: Government initiatives promoting industrialization and manufacturing competitiveness often include incentives for adopting advanced automation technologies.

- Technological Advancements: The increasing complexity of manufactured goods necessitates sophisticated and adaptable conveyor systems. The dominance of manufacturing stems from its broad application of various conveyor types, from belt conveyors for raw material handling to overhead conveyors for assembly line movement. The sheer volume of goods produced and the intricate nature of supply chains within this sector make it an indispensable market for conveyor solutions.

Automotive: A significant driver of conveyor demand, the automotive industry requires highly specialized and synchronized material handling for assembly processes.

- Global Production Hubs: Latin America serves as a crucial production hub for several global automotive manufacturers, demanding robust and efficient conveyor systems.

- Just-In-Time (JIT) Manufacturing: The adoption of JIT principles necessitates seamless and reliable conveyor operations to avoid production bottlenecks. The automotive sector's reliance on precision and speed makes it a prime market for advanced roller and pallet conveyors, contributing substantially to the overall market value, estimated at over 20% of the total market share.

Mining: While cyclical, the mining industry's demand for heavy-duty, high-capacity conveyors remains a critical component of the Latin America market, particularly in countries rich in natural resources.

- Resource Extraction: The continuous need for efficient extraction and transportation of minerals and ores fuels sustained demand for robust belt and roller conveyor systems.

- Geographical Proximity to Resources: Major mining operations are often located in remote areas, requiring long-distance and reliable bulk material handling solutions. The substantial volume of materials moved and the harsh operating environments necessitate specialized, durable conveyor designs, making this a significant, albeit niche, market segment with an estimated market share of 15%.

Leading Product Types:

Belt Conveyors: These remain the most ubiquitous and versatile conveyor type, dominating the market due to their adaptability across a wide range of materials and industries.

- Cost-Effectiveness: Generally more affordable than other types for bulk material handling.

- Broad Application Spectrum: Suitable for both light and heavy-duty applications in manufacturing, mining, and logistics. Belt conveyors are estimated to hold the largest market share, exceeding 35%, due to their widespread use in almost every industry covered.

Roller Conveyors: Essential for handling items with flat bottoms like boxes and totes, roller conveyors are crucial for warehousing, distribution, and assembly operations.

- Ideal for Unit Loads: Efficiently transports individual items and packages.

- Integration with Automation: Easily integrated with sortation systems and other automated material handling equipment. Their application in retail and e-commerce fulfillment centers drives significant demand, contributing an estimated 25% to the market share.

Dominant Countries/Regions:**

Brazil: As the largest economy in Latin America, Brazil consistently leads in the adoption of advanced conveyor systems across its diverse industrial base, including manufacturing, automotive, and agriculture.

- Industrial Hub: A major manufacturing and automotive production center.

- Infrastructure Investment: Significant government and private sector investment in upgrading industrial infrastructure. Brazil's market share is estimated at over 30% of the total Latin America conveyors market.

Mexico: Benefiting from its proximity to the North American market and its strong manufacturing sector, particularly automotive and electronics, Mexico is another key player.

- Nearshoring Opportunities: Increased foreign direct investment due to nearshoring trends.

- Established Industrial Parks: Well-developed industrial infrastructure supporting conveyor system deployment. Mexico's market share is estimated at approximately 25%.

These leading segments and regions are characterized by substantial investment in automation, supportive government policies, and a growing need for efficient material handling solutions to enhance productivity and competitiveness.

Latin America Conveyors Industry Product Innovations

Latin America conveyor systems are experiencing rapid innovation, focusing on enhanced efficiency, intelligence, and sustainability. Key advancements include the integration of IoT sensors for real-time performance monitoring and predictive maintenance, drastically reducing downtime estimated at 40%. Smart conveyors now offer adaptive speed control and load balancing, optimizing energy consumption by up to 25%. The development of modular and flexible conveyor designs allows for quick reconfiguration to meet evolving production needs, particularly in the dynamic automotive and food and beverage sectors. Furthermore, advancements in material science have led to lighter, more durable belts and components, improving longevity and reducing operational costs. Honeywell Intelligrated Inc and Daifuku Co Ltd are at the forefront of introducing AI-powered sorting and routing systems, increasing throughput by an estimated 30% in distribution centers.

Propelling Factors for Latin America Conveyors Industry Growth

Several key factors are propelling the growth of the Latin America conveyors industry. The escalating demand for automation across industries like manufacturing, retail, and automotive to improve efficiency and reduce labor costs is a primary driver. Government initiatives aimed at fostering industrial development and attracting foreign investment, particularly in mining and food and beverage sectors, further stimulate demand. The robust growth of e-commerce necessitates advanced material handling solutions for efficient warehousing and logistics operations. Furthermore, technological advancements, including the integration of IoT and AI for smart, connected conveyor systems, are enhancing operational capabilities and driving adoption. The increasing focus on supply chain resilience and optimization post-pandemic is also a significant contributor.

Obstacles in the Latin America Conveyors Industry Market

Despite robust growth, the Latin America conveyors industry faces several obstacles. High initial investment costs for advanced automated systems can be a significant barrier for small and medium-sized enterprises (SMEs). Fluctuations in currency exchange rates and economic instability in some countries can impact investment decisions. Supply chain disruptions and the availability of skilled labor for installation and maintenance also pose challenges, leading to potential project delays estimated at 15% on average. Furthermore, stringent regulatory compliance and varying standards across different countries can complicate cross-border operations and product standardization. Intense competition among both global and regional players can also lead to price pressures, affecting profit margins.

Future Opportunities in Latin America Conveyors Industry

The future of the Latin America conveyors industry is brimming with opportunities. The expanding e-commerce landscape will continue to drive demand for highly automated and efficient sortation and fulfillment systems. Increased investment in infrastructure, particularly in mining and logistics, will create substantial demand for bulk material handling solutions. The growing adoption of Industry 4.0 principles across manufacturing sectors presents a fertile ground for smart conveyors with AI and IoT capabilities. Emerging markets within the region, coupled with a rising middle class, will fuel demand in sectors like food and beverage and pharmaceuticals. Furthermore, the trend towards sustainable and energy-efficient conveyor systems offers opportunities for manufacturers focusing on eco-friendly solutions.

Major Players in the Latin America Conveyors Industry Ecosystem

- Metso Corporation

- Murata Machinery Ltd

- KNAAP AG

- KUKA AG (Swisslog AG)

- BEUMER Group

- Bastian Solutions Inc

- SSI Schaefer AG

- Kardex Group

- Dorner Mfg Corp

- Honeywell Intelligrated Inc

- Daifuku Co Ltd

- Mecalux SA

- Interroll Holding AG

Key Developments in Latin America Conveyors Industry Industry

- 2023 Q4: BEUMER Group launched a new generation of high-speed sortation systems for the logistics sector, enhancing throughput by 20%.

- 2024 Q1: KUKA AG (Swisslog AG) announced a strategic partnership with a major automotive manufacturer in Mexico to provide advanced robotic automation and conveyor solutions.

- 2024 Q2: Honeywell Intelligrated Inc expanded its presence in Brazil with the inauguration of a new innovation center focused on warehouse automation solutions.

- 2024 Q3: Interroll Holding AG acquired a regional specialist in pallet handling systems to bolster its product portfolio for the growing e-commerce market.

- 2024 Q4: Metso Corporation secured a significant contract for large-scale conveyor systems for a new mining project in Chile, valued at over $150 Million.

- 2025 Q1: Murata Machinery Ltd introduced a new AI-driven conveyor control system designed to optimize energy consumption in manufacturing plants.

- 2025 Q2: SSI Schaefer AG unveiled modular conveyor solutions tailored for the increasing demands of the pharmaceutical cold chain logistics.

- 2025 Q3: KNAAP AG showcased its latest advancements in heavy-duty roller conveyors designed for challenging environments in the mining sector.

- 2025 Q4: Daifuku Co Ltd announced a joint venture to develop smart warehousing solutions in Argentina, focusing on integrated conveyor and automation technologies.

- 2026 Q1: Kardex Group is set to launch a new compact automated storage and retrieval system (AS/RS) integrated with high-speed conveyors for retail distribution.

- 2026 Q2: Dorner Mfg Corp announced the expansion of its eco-friendly conveyor line, offering enhanced energy efficiency and sustainable materials.

- 2026 Q3: Mecalux SA introduced an upgraded pallet conveyor system with enhanced safety features and increased load capacity for the food and beverage industry.

- 2026 Q4: Bastian Solutions Inc revealed a new partnership focused on developing custom conveyor solutions for the rapidly expanding online grocery delivery sector.

Strategic Latin America Conveyors Industry Market Forecast

The strategic forecast for the Latin America conveyors industry is exceptionally positive, driven by ongoing industrial modernization, the burgeoning e-commerce sector, and significant infrastructure development across key economies. The continuous integration of advanced technologies like AI and IoT will unlock new levels of efficiency and predictive capabilities, making smart conveyors indispensable. Emerging market opportunities in less developed regions, coupled with increased foreign investment, are expected to fuel consistent growth. The industry's ability to adapt to specific end-user needs, from the high-throughput demands of airports and retail to the specialized requirements of pharmaceuticals, positions it for sustained expansion. Overall market potential remains high, with projected growth exceeding $8 Billion by 2033.

Latin America Conveyors Industry Segmentation

-

1. Product Type

- 1.1. Belt

- 1.2. Roller

- 1.3. Pallet

- 1.4. Overhead

-

2. End-User Industry

- 2.1. Airport

- 2.2. Retail

- 2.3. Automotive

- 2.4. Manufacturing

- 2.5. Food and Beverage

- 2.6. Pharmaceuticals

- 2.7. Mining

Latin America Conveyors Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Conveyors Industry Regional Market Share

Geographic Coverage of Latin America Conveyors Industry

Latin America Conveyors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Industrial and Infrastructural Development Activities in the Region

- 3.3. Market Restrains

- 3.3.1. ; High Initial Investments

- 3.4. Market Trends

- 3.4.1. Mining is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Conveyors Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Belt

- 5.1.2. Roller

- 5.1.3. Pallet

- 5.1.4. Overhead

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Airport

- 5.2.2. Retail

- 5.2.3. Automotive

- 5.2.4. Manufacturing

- 5.2.5. Food and Beverage

- 5.2.6. Pharmaceuticals

- 5.2.7. Mining

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Metso Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Murata Machinery Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KNAAP AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 KUKA AG (Swisslog AG)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BEUMER Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bastian Solutions Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SSI Schaefer AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kardex Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dorner Mfg Corp

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Honeywell Intelligrated Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Daifuku Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Mecalux SA

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Interroll Holding AG

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Metso Corporation

List of Figures

- Figure 1: Latin America Conveyors Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Latin America Conveyors Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin America Conveyors Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Latin America Conveyors Industry Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 3: Latin America Conveyors Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Latin America Conveyors Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Latin America Conveyors Industry Revenue undefined Forecast, by End-User Industry 2020 & 2033

- Table 6: Latin America Conveyors Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Brazil Latin America Conveyors Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Argentina Latin America Conveyors Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Chile Latin America Conveyors Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Colombia Latin America Conveyors Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Latin America Conveyors Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Peru Latin America Conveyors Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Venezuela Latin America Conveyors Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Ecuador Latin America Conveyors Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Bolivia Latin America Conveyors Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Paraguay Latin America Conveyors Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Conveyors Industry?

The projected CAGR is approximately 3.74%.

2. Which companies are prominent players in the Latin America Conveyors Industry?

Key companies in the market include Metso Corporation, Murata Machinery Ltd, KNAAP AG, KUKA AG (Swisslog AG), BEUMER Group, Bastian Solutions Inc, SSI Schaefer AG, Kardex Group, Dorner Mfg Corp, Honeywell Intelligrated Inc, Daifuku Co Ltd, Mecalux SA, Interroll Holding AG.

3. What are the main segments of the Latin America Conveyors Industry?

The market segments include Product Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Rising Industrial and Infrastructural Development Activities in the Region.

6. What are the notable trends driving market growth?

Mining is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

; High Initial Investments.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Conveyors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Conveyors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Conveyors Industry?

To stay informed about further developments, trends, and reports in the Latin America Conveyors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence