Key Insights

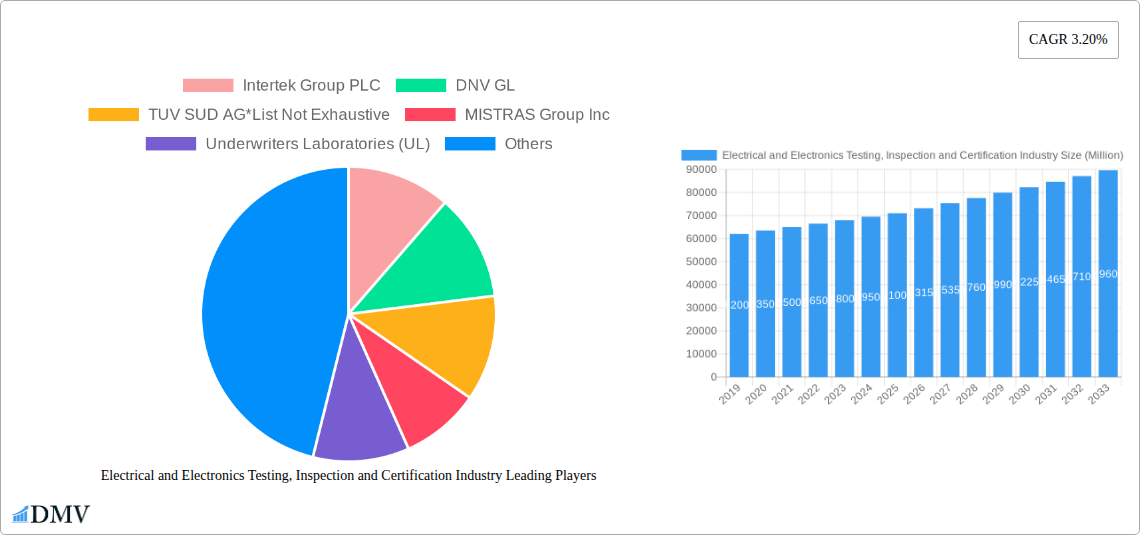

The global Electrical and Electronics Testing, Inspection, and Certification (TIC) market is projected for substantial growth, reaching an estimated market size of approximately USD 75,000 million by 2025, with a Compound Annual Growth Rate (CAGR) of 3.20% through 2033. This robust expansion is primarily fueled by escalating demand for consumer electronics, the increasing complexity and interconnectedness of electronic devices, and stringent regulatory mandates ensuring product safety, performance, and compliance. Key drivers include the proliferation of IoT devices, the rapid adoption of 5G technology, and the growing emphasis on cybersecurity for electronic products, all of which necessitate rigorous testing and certification processes. The market is also benefiting from a heightened awareness among manufacturers regarding the reputational and financial risks associated with non-compliant products.

Electrical and Electronics Testing, Inspection and Certification Industry Market Size (In Billion)

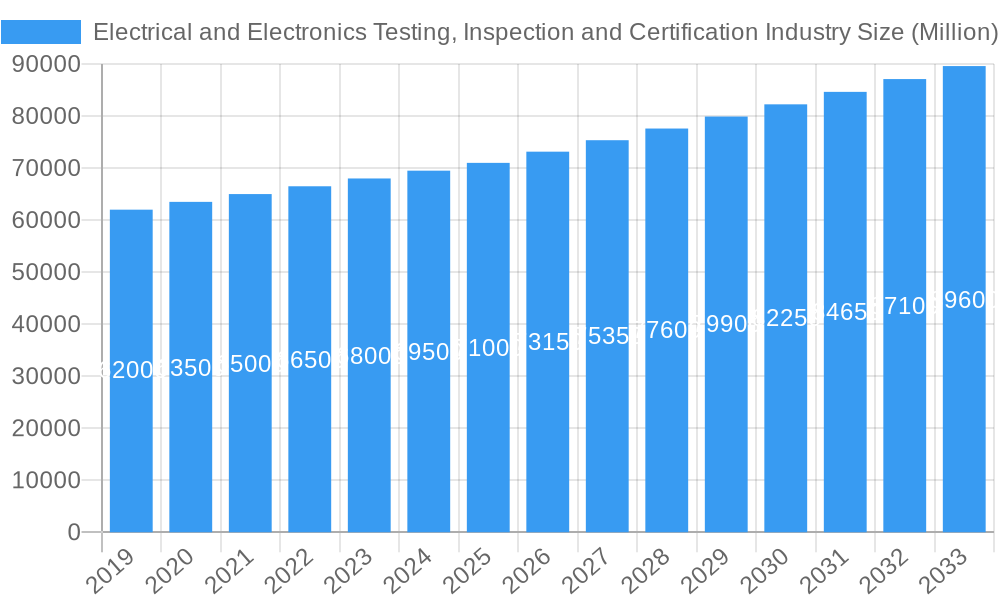

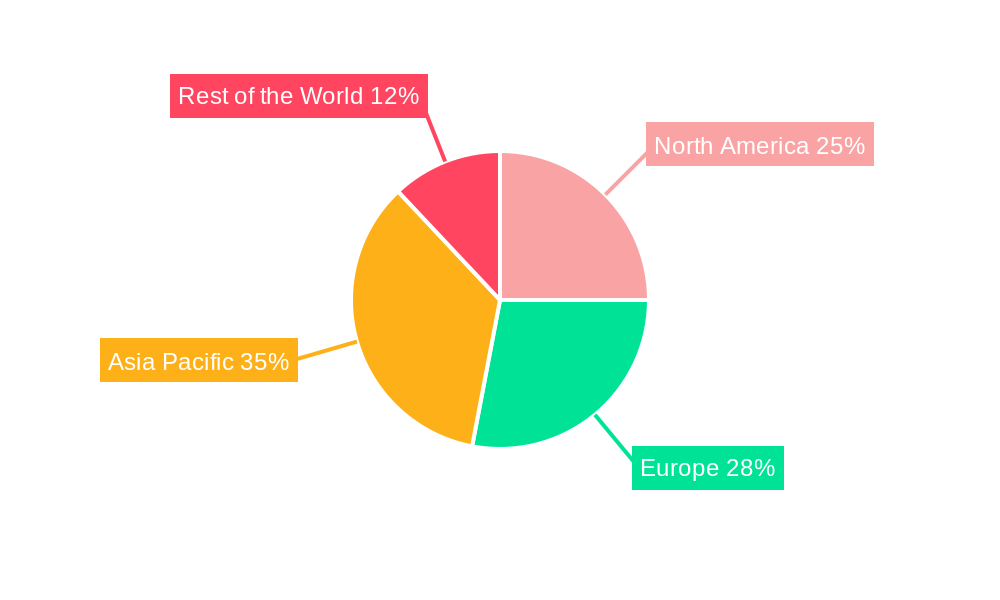

The competitive landscape features prominent global players such as Intertek Group PLC, DNV GL, TÜV SÜD AG, and SGS SA, alongside a growing number of specialized regional providers. The market segments into various sourcing types, with a significant and growing trend towards outsourcing TIC services to specialized third-party providers who offer expertise, cost-efficiency, and faster time-to-market. Geographically, North America and Europe are established mature markets, characterized by advanced regulatory frameworks and high adoption rates of sophisticated electronic products. However, the Asia Pacific region, driven by China, Japan, South Korea, and India, is emerging as a critical growth engine due to its massive manufacturing base and increasing domestic consumption of electronics. Restraints for the market include the high cost of advanced testing equipment and the evolving nature of international standards, requiring continuous investment and adaptation from TIC providers.

Electrical and Electronics Testing, Inspection and Certification Industry Company Market Share

Electrical and Electronics Testing, Inspection and Certification Industry Market Composition & Trends

The Electrical and Electronics Testing, Inspection and Certification (TIC) industry is characterized by a moderately concentrated market, driven by stringent quality, safety, and compliance demands across diverse sectors. Key innovation catalysts include the rapid evolution of smart devices, IoT integration, and increasing adoption of advanced manufacturing techniques such as AI and automation. Regulatory landscapes are continuously evolving, with a growing emphasis on cybersecurity, electromagnetic compatibility (EMC), and sustainable energy standards. Substitute products or services are limited, as independent third-party validation remains crucial for market access and consumer trust. End-user profiles are broad, encompassing manufacturers, importers, retailers, and government bodies. Mergers and acquisitions (M&A) are strategic, aimed at expanding service portfolios and geographical reach, with deal values often reaching hundreds of Million.

- Market Share Distribution: Leading players hold significant market shares, with the top 5 companies accounting for an estimated 60% of the global market in the base year 2025.

- M&A Deal Values: In the historical period 2019-2024, the total value of M&A deals in the Electrical and Electronics TIC sector reached approximately 2,000 Million.

- Innovation Focus: Emphasis is placed on certifications for 5G infrastructure, electric vehicles (EVs), renewable energy systems, and medical devices.

- Regulatory Impact: Compliance with standards like IEC, ISO, and regional specific regulations (e.g., CE marking, FCC) dictates service offerings.

Electrical and Electronics Testing, Inspection and Certification Industry Industry Evolution

The Electrical and Electronics Testing, Inspection and Certification industry has witnessed a remarkable growth trajectory, consistently outpacing global economic expansion. This ascent is fueled by a dynamic interplay of technological innovation, escalating consumer expectations for safety and performance, and an increasingly complex global regulatory framework. From its nascent stages, the industry has evolved from basic safety compliance to offering sophisticated solutions for emerging technologies. The study period, 2019–2033, encapsulates a transformative era, with the base year 2025 serving as a pivotal point for current market dynamics and the estimated year 2025 projecting immediate trends. The forecast period, 2025–2033, is anticipated to see sustained robust growth, building upon the foundational advancements of the historical period, 2019–2024.

Technological advancements have been a paramount driver. The proliferation of the Internet of Things (IoT) has created a surge in demand for testing and certification of interconnected devices, spanning smart home appliances, industrial automation systems, and wearable technology. This necessitates rigorous testing for interoperability, data security, and electromagnetic interference. Similarly, the burgeoning electric vehicle (EV) market has dramatically increased the need for certification of battery systems, charging infrastructure, and vehicle electronics, ensuring safety and performance standards are met. The expansion of 5G networks and the development of advanced semiconductor technologies also contribute significantly, requiring specialized testing for signal integrity, power efficiency, and compliance with international telecommunications standards.

Shifting consumer demands play an equally critical role. Modern consumers are more informed and prioritize products that are not only functional but also safe, reliable, and environmentally sustainable. This heightened awareness translates into a greater demand for independent third-party verification of product claims, particularly in sensitive sectors like food and healthcare, and for consumer electronics. Manufacturers are increasingly recognizing the value of TIC services as a competitive differentiator and a crucial component of brand reputation. Furthermore, the global supply chain's increasing complexity, with products manufactured and assembled across multiple continents, underscores the necessity of standardized testing and certification to ensure consistent quality and compliance before market entry. This intricate web of technological progress and evolving consumer preferences positions the Electrical and Electronics TIC market for continued expansion and innovation. The industry's growth rate has averaged approximately 8.5% annually over the historical period, with projections indicating a sustained growth of 9.0% through 2033. Adoption metrics for advanced testing protocols related to cybersecurity and AI in electronics have seen a year-on-year increase of over 15%.

Leading Regions, Countries, or Segments in Electrical and Electronics Testing, Inspection and Certification Industry

In the Electrical and Electronics Testing, Inspection and Certification Industry, the dominance is not confined to a single region but rather a confluence of factors influencing various segments. Globally, Asia-Pacific consistently emerges as the leading region, driven by its status as the manufacturing hub for a vast array of electrical and electronic products. Countries like China, South Korea, Japan, and Taiwan are at the forefront due to their extensive manufacturing capabilities, significant domestic demand, and strong export markets. The region's dominance is further bolstered by substantial investments in research and development, leading to a continuous stream of new products requiring rigorous testing and certification.

Within this dominant region, the Products and Retail end-user vertical represents a significant segment for Electrical and Electronics TIC services. This is directly linked to the massive production volumes of consumer electronics, home appliances, and personal computing devices. The need to ensure product safety, compliance with international standards such as CE, FCC, and RoHS, and the growing demand for smart and connected devices make this vertical a consistent powerhouse. Outsourced sourcing type also plays a pivotal role across all verticals, as manufacturers increasingly rely on specialized third-party TIC providers to navigate complex regulations and maintain impartiality.

Key Drivers in Asia-Pacific:

- Manufacturing Prowess: Unparalleled production capacity for electronics globally.

- Regulatory Adoption: Swift integration and enforcement of international and regional compliance standards.

- Investment Trends: Significant government and private sector investment in advanced manufacturing and R&D.

- Export-Oriented Economy: High volume of exports necessitates adherence to diverse international market requirements.

Dominance Factors in Products and Retail:

- Consumer Demand: Insatiable global appetite for new and evolving consumer electronics.

- Product Complexity: Increasing sophistication of smart devices and IoT integration.

- Safety Concerns: High public awareness and regulatory scrutiny regarding consumer product safety.

- Market Access: Essential for product entry into major global markets.

Sourcing Type Influence (Outsourced):

- Expertise: Access to specialized knowledge and equipment not available in-house.

- Cost-Effectiveness: Reduced overhead and capital investment for manufacturers.

- Speed to Market: Streamlined testing and certification processes.

- Impartiality: Enhanced credibility and trust from consumers and regulators.

The Industrial vertical also contributes significantly, particularly with the rise of Industry 4.0, automation, and the need for reliable industrial control systems and equipment. The Energy and Commodities sector, with its focus on renewable energy components (solar panels, wind turbines) and electrical infrastructure, is another growth area. However, the sheer volume and diversity of consumer-facing electronic products firmly establish the Products and Retail vertical as a primary driver of market activity within the leading Asia-Pacific region, especially through the Outsourced sourcing model.

Electrical and Electronics Testing, Inspection and Certification Industry Product Innovations

The Electrical and Electronics Testing, Inspection and Certification industry is continuously innovating its service offerings to keep pace with rapid technological advancements. Key product innovations include the development of advanced AI-powered automated testing platforms that significantly reduce testing times and improve accuracy for complex circuitry and software. The advent of IoT-specific security certification protocols addresses critical vulnerabilities in connected devices, ensuring data integrity and user privacy. Furthermore, specialized electromagnetic compatibility (EMC) testing solutions are being refined to accommodate miniaturized components and higher frequency operations. Performance metrics are being redefined by faster turnaround times, achieving an average reduction of 20% in certification cycles, and enhanced detection capabilities for subtle defects, leading to a 15% improvement in failure rate identification. Unique selling propositions now revolve around comprehensive cybersecurity testing, lifecycle assessment certifications, and tailored testing for emerging technologies like quantum computing components.

Propelling Factors for Electrical and Electronics Testing, Inspection and Certification Industry Growth

The Electrical and Electronics Testing, Inspection and Certification industry is propelled by several key growth drivers. Technologically, the rapid pace of innovation in areas like 5G, IoT, artificial intelligence, and electric vehicles mandates continuous testing and certification to ensure safety, performance, and interoperability. Economically, increasing global trade and the need for market access in diverse regulatory environments compel manufacturers to invest in TIC services. Regulatory influences are paramount, with governments worldwide strengthening safety, environmental, and cybersecurity standards, making compliance non-negotiable. For instance, stricter EMC regulations for medical devices and enhanced cybersecurity mandates for critical infrastructure are significant growth catalysts. The growing consumer demand for safe, reliable, and sustainable products further reinforces the industry's importance.

Obstacles in the Electrical and Electronics Testing, Inspection and Certification Industry Market

Despite robust growth, the Electrical and Electronics Testing, Inspection and Certification industry faces several obstacles. Regulatory fragmentation across different countries and regions creates complexity and increases the cost of compliance for global manufacturers. Supply chain disruptions, exacerbated by geopolitical events and component shortages, can lead to delays in product development and testing schedules, impacting revenue for TIC providers. Intense competitive pressures among established players and the emergence of new entrants can lead to price wars, squeezing profit margins. The high cost of acquiring and maintaining cutting-edge testing equipment and skilled personnel also presents a significant barrier to entry and operational efficiency, potentially impacting the availability of specialized testing services for emerging technologies.

Future Opportunities in Electrical and Electronics Testing, Inspection and Certification Industry

The Electrical and Electronics Testing, Inspection and Certification industry is ripe with future opportunities. The expanding adoption of Artificial Intelligence (AI) and Machine Learning (ML) in product development creates a demand for AI-specific certification and ethical AI testing. The continued growth of the Internet of Things (IoT) ecosystem, including smart cities and industrial IoT (IIoT), will require extensive testing for connectivity, security, and interoperability. The ongoing transition to renewable energy sources and the electrification of transportation will drive demand for certification of batteries, charging infrastructure, and associated electronic components. Furthermore, the increasing focus on sustainability and circular economy principles opens avenues for lifecycle assessment and eco-design certifications. Emerging markets in developing economies also present untapped potential for TIC services as their manufacturing sectors mature and regulatory frameworks evolve.

Major Players in the Electrical and Electronics Testing, Inspection and Certification Industry Ecosystem

- Intertek Group PLC

- DNV GL

- TUV SUD AG

- MISTRAS Group Inc

- Underwriters Laboratories (UL)

- BSI Group

- SAI Global Limited

- Dekra Certification GmbH

- SGS SA

- ALS Limited

- Bureau Veritas SA

- Eurofins Scientific SE

- Exova Group PLC

Key Developments in Electrical and Electronics Testing, Inspection and Certification Industry Industry

- 2023 (Q4): Dekra Certification GmbH announces acquisition of a cybersecurity testing firm, enhancing its capabilities in IoT security.

- 2024 (Q1): Underwriters Laboratories (UL) launches a new certification program for AI-powered medical devices, addressing safety and efficacy.

- 2024 (Q2): SGS SA expands its renewable energy testing services to support the growing offshore wind sector.

- 2024 (Q3): Intertek Group PLC invests heavily in advanced semiconductor testing facilities to meet rising demand.

- 2024 (Q4): Bureau Veritas SA partners with a leading EV battery manufacturer to provide comprehensive testing and certification solutions.

Strategic Electrical and Electronics Testing, Inspection and Certification Industry Market Forecast

The Electrical and Electronics Testing, Inspection and Certification industry is poised for sustained robust growth through 2033, driven by an escalating need for assured safety, quality, and compliance in an increasingly complex technological landscape. Key growth catalysts include the pervasive expansion of the Internet of Things (IoT), the accelerating adoption of electric vehicles (EVs) and renewable energy technologies, and the continuous evolution of stringent international and regional regulatory standards. The industry's ability to adapt and offer specialized testing for emerging fields like AI-driven electronics and advanced semiconductor technologies will be crucial. Strategic investments in digitalized testing platforms and the expansion of services focused on cybersecurity and sustainability will further solidify its market position, presenting significant future market potential valued in the billions of Million.

Electrical and Electronics Testing, Inspection and Certification Industry Segmentation

-

1. Sourcing Type

- 1.1. In-house

- 1.2. Outsourced

-

2. End-user Vertical

- 2.1. Construction and Engineering

- 2.2. Chemicals

- 2.3. Food and Healthcare

- 2.4. Energy and Commodities

- 2.5. Transportation

- 2.6. Products and Retail

- 2.7. Industrial

- 2.8. Other End-user Vertical

Electrical and Electronics Testing, Inspection and Certification Industry Segmentation By Geography

-

1. North America

- 1.1. US

- 1.2. Canada

-

2. Europe

- 2.1. UK

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. India

- 3.5. Rest of Asia Pacific

- 4. Rest of the World

Electrical and Electronics Testing, Inspection and Certification Industry Regional Market Share

Geographic Coverage of Electrical and Electronics Testing, Inspection and Certification Industry

Electrical and Electronics Testing, Inspection and Certification Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Globalization and Digitization; Growing Export Regulations and High Emphasis on Energy Efficient and Environmentally Safety Products

- 3.3. Market Restrains

- 3.3.1. ; Trade Wars and Growth Fluctuations of End-user Industries

- 3.4. Market Trends

- 3.4.1. Products and Retail is Expected to Hold the Largest Market Share during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electrical and Electronics Testing, Inspection and Certification Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 5.1.1. In-house

- 5.1.2. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Construction and Engineering

- 5.2.2. Chemicals

- 5.2.3. Food and Healthcare

- 5.2.4. Energy and Commodities

- 5.2.5. Transportation

- 5.2.6. Products and Retail

- 5.2.7. Industrial

- 5.2.8. Other End-user Vertical

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 6. North America Electrical and Electronics Testing, Inspection and Certification Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 6.1.1. In-house

- 6.1.2. Outsourced

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Construction and Engineering

- 6.2.2. Chemicals

- 6.2.3. Food and Healthcare

- 6.2.4. Energy and Commodities

- 6.2.5. Transportation

- 6.2.6. Products and Retail

- 6.2.7. Industrial

- 6.2.8. Other End-user Vertical

- 6.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 7. Europe Electrical and Electronics Testing, Inspection and Certification Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 7.1.1. In-house

- 7.1.2. Outsourced

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Construction and Engineering

- 7.2.2. Chemicals

- 7.2.3. Food and Healthcare

- 7.2.4. Energy and Commodities

- 7.2.5. Transportation

- 7.2.6. Products and Retail

- 7.2.7. Industrial

- 7.2.8. Other End-user Vertical

- 7.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 8. Asia Pacific Electrical and Electronics Testing, Inspection and Certification Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 8.1.1. In-house

- 8.1.2. Outsourced

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Construction and Engineering

- 8.2.2. Chemicals

- 8.2.3. Food and Healthcare

- 8.2.4. Energy and Commodities

- 8.2.5. Transportation

- 8.2.6. Products and Retail

- 8.2.7. Industrial

- 8.2.8. Other End-user Vertical

- 8.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 9. Rest of the World Electrical and Electronics Testing, Inspection and Certification Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 9.1.1. In-house

- 9.1.2. Outsourced

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Construction and Engineering

- 9.2.2. Chemicals

- 9.2.3. Food and Healthcare

- 9.2.4. Energy and Commodities

- 9.2.5. Transportation

- 9.2.6. Products and Retail

- 9.2.7. Industrial

- 9.2.8. Other End-user Vertical

- 9.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Intertek Group PLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 DNV GL

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 TUV SUD AG*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 MISTRAS Group Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Underwriters Laboratories (UL)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 BSI Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 SAI Global Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Dekra Certification GmbH

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 SGS SA

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ALS Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Bureau Veritas SA

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Eurofins Scientific SE

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Exova Group PLC

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Intertek Group PLC

List of Figures

- Figure 1: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by Sourcing Type 2025 & 2033

- Figure 3: North America Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 4: North America Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 5: North America Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 6: North America Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by Sourcing Type 2025 & 2033

- Figure 9: Europe Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 10: Europe Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 11: Europe Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 12: Europe Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by Sourcing Type 2025 & 2033

- Figure 15: Asia Pacific Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 16: Asia Pacific Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 17: Asia Pacific Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 18: Asia Pacific Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by Sourcing Type 2025 & 2033

- Figure 21: Rest of the World Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by Sourcing Type 2025 & 2033

- Figure 22: Rest of the World Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 23: Rest of the World Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Rest of the World Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Electrical and Electronics Testing, Inspection and Certification Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 2: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 3: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 5: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: US Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 10: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 11: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: UK Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 17: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 18: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: South Korea Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: India Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Electrical and Electronics Testing, Inspection and Certification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 25: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 26: Global Electrical and Electronics Testing, Inspection and Certification Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electrical and Electronics Testing, Inspection and Certification Industry?

The projected CAGR is approximately 3.20%.

2. Which companies are prominent players in the Electrical and Electronics Testing, Inspection and Certification Industry?

Key companies in the market include Intertek Group PLC, DNV GL, TUV SUD AG*List Not Exhaustive, MISTRAS Group Inc, Underwriters Laboratories (UL), BSI Group, SAI Global Limited, Dekra Certification GmbH, SGS SA, ALS Limited, Bureau Veritas SA, Eurofins Scientific SE, Exova Group PLC.

3. What are the main segments of the Electrical and Electronics Testing, Inspection and Certification Industry?

The market segments include Sourcing Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Globalization and Digitization; Growing Export Regulations and High Emphasis on Energy Efficient and Environmentally Safety Products.

6. What are the notable trends driving market growth?

Products and Retail is Expected to Hold the Largest Market Share during the Forecast Period.

7. Are there any restraints impacting market growth?

; Trade Wars and Growth Fluctuations of End-user Industries.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electrical and Electronics Testing, Inspection and Certification Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electrical and Electronics Testing, Inspection and Certification Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electrical and Electronics Testing, Inspection and Certification Industry?

To stay informed about further developments, trends, and reports in the Electrical and Electronics Testing, Inspection and Certification Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence