Key Insights

The French mobile payment market is projected for significant expansion, reaching an estimated size of €234.91 billion by 2025, driven by a compound annual growth rate (CAGR) of 11.98% through 2033. Key growth drivers include increasing smartphone penetration, widespread mobile internet adoption, and evolving consumer demand for convenient and secure digital transactions, particularly among younger demographics. Government initiatives supporting digital economy growth and the integration of mobile payments across retail, e-commerce, transportation, and hospitality sectors are further accelerating market penetration.

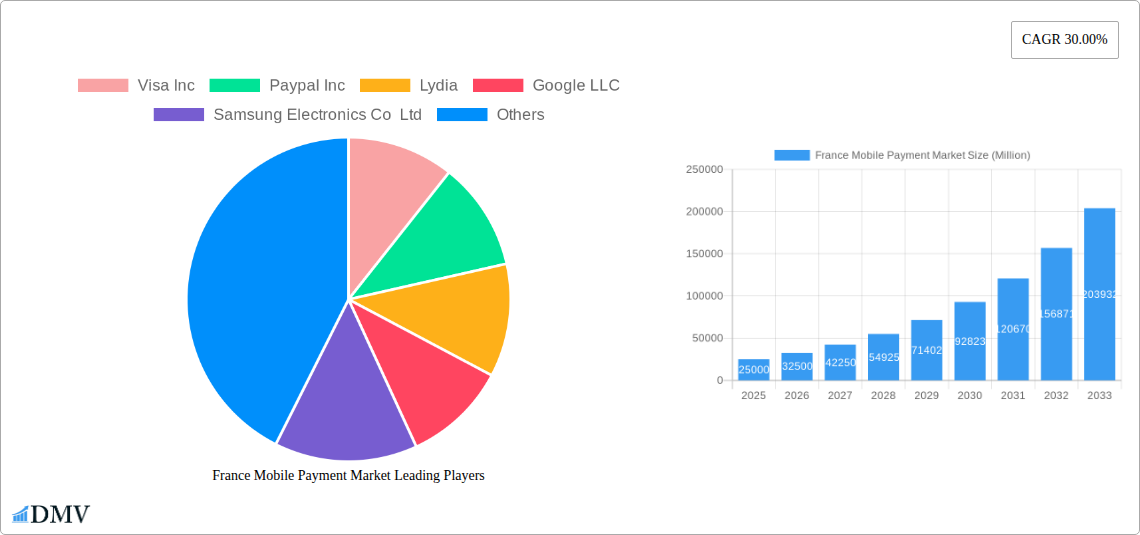

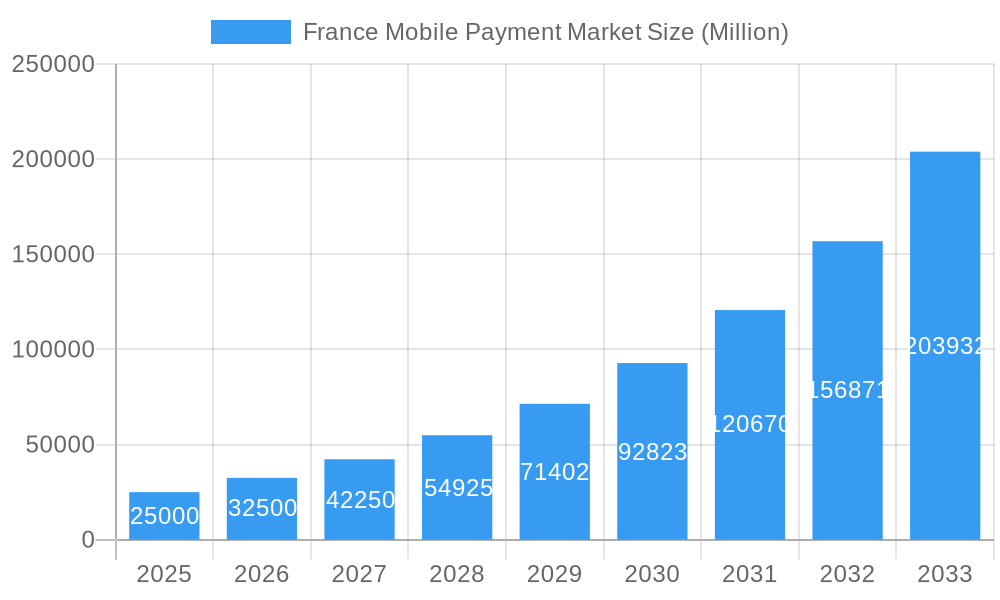

France Mobile Payment Market Market Size (In Billion)

While data security and privacy concerns, network infrastructure, and interoperability challenges may pose some restraints, the competitive landscape is robust. Leading global players such as Visa Inc., PayPal Inc., Google LLC, Samsung Electronics Co. Ltd., Amazon.com Inc., Mastercard Inc., and Apple Inc., alongside innovative local providers like Lydia and Paylib Services, are fostering continuous innovation. The market is segmented into Proximity and Remote payment types, with substantial growth anticipated across Retail, E-commerce, Transportation, and Hospitality industries.

France Mobile Payment Market Company Market Share

This report offers a strategic analysis of the France mobile payment market, detailing its current state, historical performance, and projected trajectory through 2033. Spanning the study period of 2019–2033, with the base year of 2025, this research provides essential insights into market trends, technological advancements, regulatory influences, and competitive strategies shaping the future of mobile payments in France.

France Mobile Payment Market Market Composition & Trends

The France mobile payment market is characterized by a dynamic interplay of established financial institutions and agile fintech players, fostering a competitive yet collaborative ecosystem. Market concentration is moderate, with key players like Visa Inc, Mastercard Inc, Paypal Inc, and Apple Inc holding significant shares, while emerging innovators such as Lydia, Swile, and Paylib Services carve out substantial niches. The innovation landscape is driven by a burgeoning demand for seamless, secure, and convenient payment solutions, fueled by increasing smartphone penetration and a growing digital economy. Regulatory frameworks, while evolving to ensure consumer protection and data security, are generally supportive of digital payment adoption. Substitute products, primarily traditional card payments and cash, are steadily being supplanted by the convenience and speed of mobile transactions. End-user profiles are diverse, encompassing tech-savvy millennials and Gen Z, busy professionals, and a growing segment of the unbanked and underbanked seeking accessible financial services. Mergers and acquisitions (M&A) activities are anticipated to play a pivotal role in market consolidation and the expansion of service offerings. For instance, the March 2022 acquisition of Tink by Visa signifies a strategic move to bolster open banking capabilities, directly impacting how financial products and services are developed and transferred within the ecosystem. The value of such strategic M&A deals is projected to reach several hundred million Euros over the forecast period, influencing market share distribution and driving technological integration.

France Mobile Payment Market Industry Evolution

The France mobile payment market has witnessed a remarkable transformation over the historical period (2019-2024) and is poised for accelerated growth in the coming years. This evolution is fundamentally driven by a confluence of technological advancements, shifting consumer behaviors, and supportive governmental initiatives aimed at fostering a digital economy. Early adoption was primarily characterized by the gradual integration of Near Field Communication (NFC) technology for in-store purchases, marking the nascent stages of proximity mobile payment. As e-commerce surged and consumer expectations for convenience intensified, remote mobile payment solutions gained significant traction, enabling seamless transactions for online shopping, digital services, and peer-to-peer transfers.

Technological breakthroughs have been instrumental in this progress. The widespread availability of high-speed mobile internet, coupled with the proliferation of smartphones boasting advanced processing power and secure element chips, has laid the groundwork for sophisticated payment applications. Mobile wallets, once a niche offering, have become ubiquitous, integrating loyalty programs, transit passes, and identity verification alongside payment functionalities. Furthermore, the adoption of QR code technology has democratized mobile payments, allowing even basic smartphone users to participate in the digital transaction ecosystem, especially in the retail and hospitality sectors.

Consumer demand has pivoted dramatically towards frictionless experiences. Consumers now expect to complete transactions with a few taps or even a glance, prioritizing speed, security, and ease of use. This has spurred significant investment from companies like Google LLC and Samsung Electronics Co Ltd in developing intuitive and secure mobile payment platforms. The convenience of mobile payments has also extended beyond personal transactions to business operations, with a growing interest in mobile point-of-sale (mPOS) solutions for small businesses and enhanced expense management systems, as exemplified by the November 2021 partnership between American Express and Fujitsu.

The transportation industry has also embraced mobile payments, with ticketing and fare payment systems increasingly transitioning to smartphone-based solutions, further solidifying the market's growth trajectory. The market's compound annual growth rate (CAGR) is projected to remain robust, driven by continuous innovation and increasing consumer trust in mobile payment security. Adoption metrics for mobile payment solutions have seen consistent upward trends, with a significant percentage of the French population now regularly utilizing these services. The ongoing digitalization of various industries, coupled with the inherent advantages of mobile payments in terms of efficiency and data insights, ensures a sustained growth path for the France mobile payment market throughout the forecast period.

Leading Regions, Countries, or Segments in France Mobile Payment Market

Within the France mobile payment market, the dominance is not dictated by a single geographical region but rather by the robust performance across key segments, with Retail and E-commerce emerging as the primary drivers of growth and adoption. These sectors consistently demonstrate high transaction volumes and a strong consumer appetite for convenient and secure payment methods.

Retail Segment Dominance:

- High Transaction Volume: The sheer volume of daily transactions in the retail sector, encompassing everything from groceries to fashion, makes it a cornerstone for mobile payment integration. Proximity payments, facilitated by NFC technology in smartphones and smartwatches, have become increasingly commonplace at checkout counters across France.

- Enhanced Customer Experience: Retailers are leveraging mobile payments to streamline the checkout process, reduce queues, and offer personalized promotions, thereby enhancing the overall customer experience. This is crucial in a competitive retail landscape where efficiency and customer satisfaction are paramount.

- Technological Integration: The widespread adoption of in-store payment terminals capable of accepting contactless and mobile payments has accelerated the shift away from traditional methods. Companies are investing in mPOS solutions and integrating loyalty programs directly into mobile payment apps, creating a sticky ecosystem for consumers.

- Investment Trends: Significant investments are being channeled into developing secure and user-friendly mobile payment solutions tailored for the retail environment, including loyalty integrations and personalized offers accessible via mobile wallets.

E-commerce Segment Growth:

- Seamless Online Transactions: The rapid expansion of online shopping has propelled the demand for secure and frictionless remote payment solutions. Mobile payment gateways and digital wallets offer a faster and more convenient alternative to manual card entry, significantly reducing cart abandonment rates.

- Growing Consumer Trust: As consumers become more comfortable with online transactions, their trust in mobile payment security has increased, further boosting adoption in the e-commerce space. The use of biometric authentication and tokenization adds an extra layer of security, reassuring users.

- Cross-Border E-commerce: Mobile payment platforms facilitate easier cross-border e-commerce transactions, opening up new markets for French businesses and providing consumers with access to a wider range of products and services.

- Regulatory Support for Digital Transactions: Supportive regulatory environments that encourage digital innovation and consumer protection further bolster the growth of e-commerce mobile payments. The ability to access aggregated financial data through open banking initiatives also aids in fraud detection and risk management for online merchants.

While Transportation and Hospitality also represent significant growth areas, their current transaction volumes and adoption rates, while increasing, are outpaced by the pervasive influence of the Retail and E-commerce sectors in driving the overall France mobile payment market. The continuous innovation in proximity and remote payment technologies, coupled with evolving consumer preferences for digital convenience, solidifies the leading position of these two segments.

France Mobile Payment Market Product Innovations

The France mobile payment market is a hotbed of innovation, with a constant stream of new products and applications designed to enhance user experience and security. Leading companies are focusing on developing sophisticated mobile wallets that integrate multiple functionalities beyond just payments, such as loyalty programs, digital identity management, and access to financial services like budgeting tools and micro-investments. The performance metrics for these innovations are measured by transaction speed, security protocols (e.g., tokenization, biometric authentication), user interface intuitiveness, and the breadth of services offered. Unique selling propositions often lie in the seamless integration of various financial and non-financial services into a single, user-friendly mobile platform, catering to the evolving demands for a consolidated digital life.

Propelling Factors for France Mobile Payment Market Growth

Several key factors are propelling the France mobile payment market forward. Technologically, the widespread adoption of smartphones with advanced NFC capabilities and robust security features is fundamental. Economically, increasing disposable incomes and a growing preference for digital convenience drive consumer adoption. Regulatory initiatives, such as the PSD2 directive promoting open banking, foster innovation and competition, creating a more dynamic market. Furthermore, the continuous development of user-friendly mobile applications by major players like Apple Inc and Google LLC simplifies the payment process for consumers, making it more accessible and appealing. The robust growth of the e-commerce sector and the increasing need for contactless payment solutions post-pandemic have also been significant catalysts.

Obstacles in the France Mobile Payment Market Market

Despite the strong growth trajectory, the France mobile payment market faces certain obstacles. Regulatory challenges, while generally supportive, can sometimes lead to compliance complexities for new entrants. Ensuring robust data security and privacy remains a paramount concern, and any breaches can significantly erode consumer trust. Supply chain disruptions, particularly for hardware components used in payment devices, could temporarily impact the availability of certain solutions. Moreover, intense competitive pressures from established players and emerging fintechs can lead to price wars and challenges in achieving profitability for smaller entities. The digital divide, though shrinking, still presents a barrier for segments of the population less familiar with digital technologies.

Future Opportunities in France Mobile Mobile Payment Market

The future of the France mobile payment market is ripe with opportunities. The expansion of contactless payment acceptance in smaller businesses and public transport networks presents a significant growth avenue. The increasing integration of mobile payments with the Internet of Things (IoT) devices, enabling payments from smart appliances and wearable technology, offers a vast untapped market. Furthermore, the development of advanced analytics and AI-powered personalized financial services accessible via mobile platforms can create new revenue streams and enhance customer loyalty. The burgeoning demand for buy now, pay later (BNPL) solutions integrated into mobile payment apps also represents a substantial opportunity for market expansion.

Major Players in the France Mobile Payment Market Ecosystem

- Visa Inc

- Paypal Inc

- Lydia

- Google LLC

- Samsung Electronics Co Ltd

- Amazon com Inc

- Mastercard Inc

- Apple Inc

- American Express Co

- Paylib Services

- Swile

Key Developments in France Mobile Payment Market Industry

- March 2022: Visa announced the completion of its acquisition of Tink, an open banking platform that allows financial institutions, fintechs, and merchants to develop and transfer financial products and services. Tink's clients may move money, view aggregated financial data, and use smart financial services like risk insights and account verification using a single API. This development significantly enhances Visa's capabilities in open banking and data aggregation within the French market.

- November 2021: American Express International, Inc. and Fujitsu Limited, a leading provider of information and communication technology (ICT) company, have made a partnership to centralize and drive the digital transformation of expense management for all Fujitsu offices and group companies through the provision of a single expense account and management system. This partnership signifies a move towards streamlined corporate mobile payment solutions and digital transformation in expense management.

Strategic France Mobile Payment Market Market Forecast

The strategic France mobile payment market forecast indicates sustained and robust growth driven by ongoing technological advancements and evolving consumer preferences. The market is expected to benefit from the increasing penetration of contactless payment infrastructure across various sectors, including retail, e-commerce, transportation, and hospitality. The continued innovation in mobile wallet functionalities, such as enhanced security features, loyalty program integrations, and the development of advanced financial management tools, will further incentivize consumer adoption. The supportive regulatory environment, particularly concerning open banking and data security, will foster a competitive landscape conducive to innovation and strategic collaborations, leading to a significant expansion in transaction volumes and market value over the forecast period.

France Mobile Payment Market Segmentation

-

1. Type

- 1.1. Proximity

- 1.2. Remote

-

2. Industry

- 2.1. Retail

- 2.2. E-commerce

- 2.3. Transportation

- 2.4. Hospitality

France Mobile Payment Market Segmentation By Geography

- 1. France

France Mobile Payment Market Regional Market Share

Geographic Coverage of France Mobile Payment Market

France Mobile Payment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Internet Penetration and Growing E-commerce Market; Increasing Number of Loyalty Benefits in Mobile Environment

- 3.3. Market Restrains

- 3.3.1. ; Complex Analytical Process

- 3.4. Market Trends

- 3.4.1. Proximity Segment is Expected to Drive Growth of Mobile Payment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Mobile Payment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Proximity

- 5.1.2. Remote

- 5.2. Market Analysis, Insights and Forecast - by Industry

- 5.2.1. Retail

- 5.2.2. E-commerce

- 5.2.3. Transportation

- 5.2.4. Hospitality

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Visa Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Paypal Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lydia

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Google LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Samsung Electronics Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amazon com Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mastercard Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Apple Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 American Express Co

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Paylib Services

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Swile

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Visa Inc

List of Figures

- Figure 1: France Mobile Payment Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France Mobile Payment Market Share (%) by Company 2025

List of Tables

- Table 1: France Mobile Payment Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: France Mobile Payment Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: France Mobile Payment Market Revenue billion Forecast, by Industry 2020 & 2033

- Table 4: France Mobile Payment Market Volume K Unit Forecast, by Industry 2020 & 2033

- Table 5: France Mobile Payment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: France Mobile Payment Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: France Mobile Payment Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: France Mobile Payment Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: France Mobile Payment Market Revenue billion Forecast, by Industry 2020 & 2033

- Table 10: France Mobile Payment Market Volume K Unit Forecast, by Industry 2020 & 2033

- Table 11: France Mobile Payment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: France Mobile Payment Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Mobile Payment Market?

The projected CAGR is approximately 11.98%.

2. Which companies are prominent players in the France Mobile Payment Market?

Key companies in the market include Visa Inc, Paypal Inc, Lydia, Google LLC, Samsung Electronics Co Ltd, Amazon com Inc, Mastercard Inc, Apple Inc, American Express Co, Paylib Services, Swile.

3. What are the main segments of the France Mobile Payment Market?

The market segments include Type , Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 234.91 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Internet Penetration and Growing E-commerce Market; Increasing Number of Loyalty Benefits in Mobile Environment.

6. What are the notable trends driving market growth?

Proximity Segment is Expected to Drive Growth of Mobile Payment.

7. Are there any restraints impacting market growth?

; Complex Analytical Process.

8. Can you provide examples of recent developments in the market?

March 2022 - Visa announced the completion of its acquisition of Tink, an open banking platform that allows financial institutions, fintechs, and merchants to develop and transfer financial products and services. Tink's clients may move money, view aggregated financial data, and use smart financial services like risk insights and account verification using a single API.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Mobile Payment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Mobile Payment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Mobile Payment Market?

To stay informed about further developments, trends, and reports in the France Mobile Payment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence