Key Insights

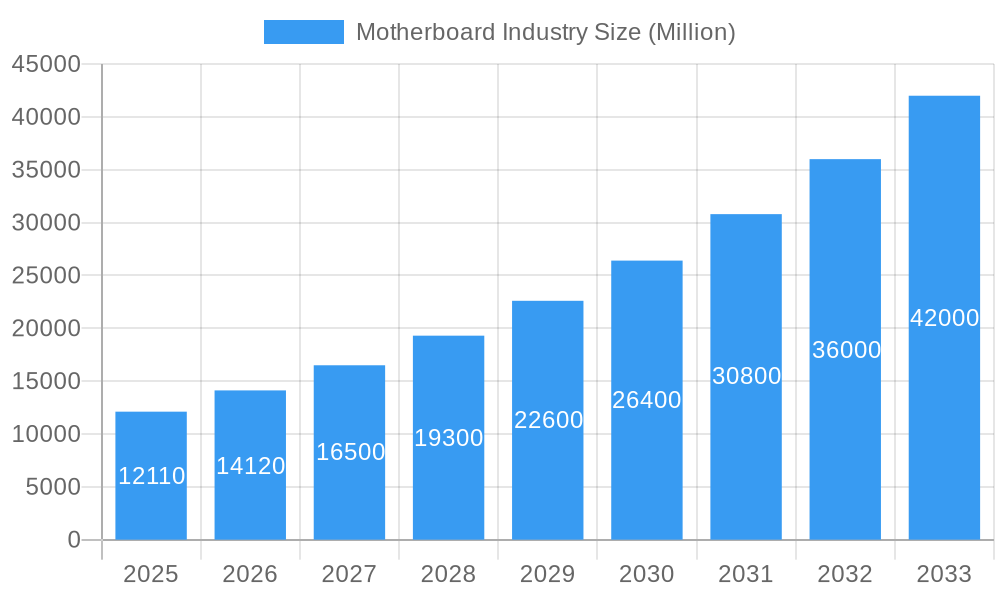

The global Motherboard Industry is poised for substantial growth, projected to reach a market size of USD 12.11 billion in 2025, with an impressive Compound Annual Growth Rate (CAGR) of 16.70% anticipated over the forecast period of 2025-2033. This robust expansion is primarily fueled by the relentless demand for increasingly powerful and feature-rich computing devices across both industrial and commercial sectors. Key drivers include the burgeoning PC gaming market, the continuous evolution of AI and machine learning applications requiring high-performance motherboards, and the growing adoption of advanced workstations for creative professionals and data scientists. Furthermore, the proliferation of IoT devices and the need for robust industrial control systems are creating significant opportunities for specialized motherboard solutions. The market is also witnessing a trend towards miniaturization and enhanced connectivity, with form factors like Mini-ITX gaining traction for their suitability in compact yet powerful systems. Innovations in power delivery, improved heat dissipation, and the integration of next-generation connectivity standards such as PCIe 5.0 and Wi-Fi 7 are also critical in driving market expansion.

Motherboard Industry Market Size (In Billion)

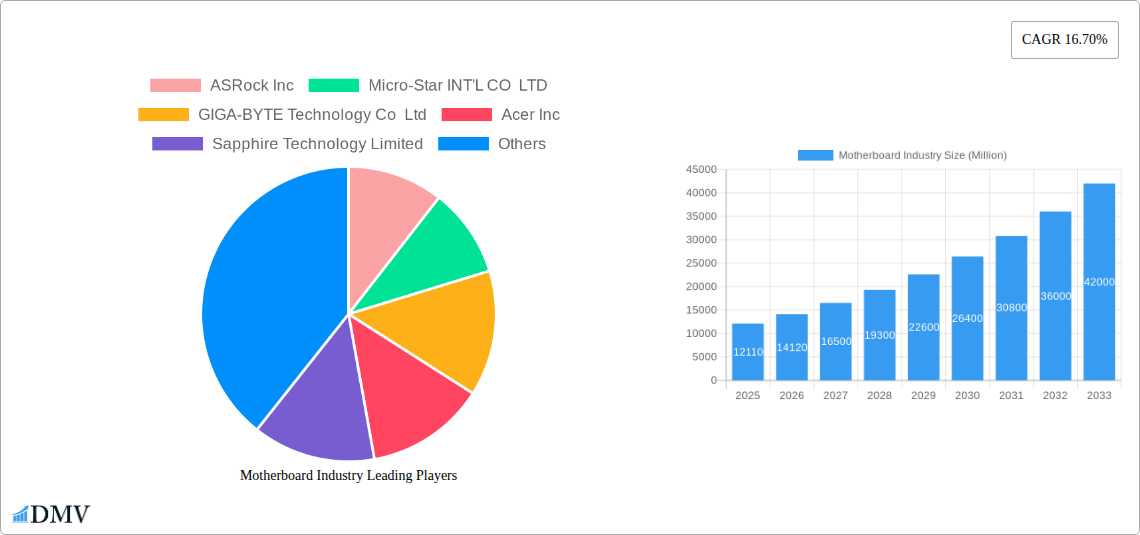

Despite the overwhelmingly positive growth trajectory, certain factors could present challenges. The intense competition among established players like ASUSTeK, GIGA-BYTE Technology, and MSI necessitates continuous innovation and competitive pricing strategies. Supply chain disruptions, though less prevalent than in recent years, can still impact production timelines and costs for critical components. Furthermore, the rapid pace of technological advancement means that motherboard manufacturers must constantly invest in research and development to keep pace with evolving processor architectures and chipset capabilities. The increasing demand for energy efficiency in computing also presents a design constraint and an opportunity for innovation. The market is segmented by form factor, with ATX, Micro-ATX, and Mini-ITX catering to diverse user needs, and by end-user industry, highlighting the significant contributions from industrial and commercial applications. Leading companies are actively engaged in developing motherboards that offer superior performance, enhanced reliability, and specialized features to capture market share.

Motherboard Industry Company Market Share

Here is an SEO-optimized, insightful report description for the Motherboard Industry, incorporating high-ranking keywords and adhering to all specified requirements.

Report Title: Motherboard Industry: Market Dynamics, Technological Advancements, and Future Outlook (2019–2033)

This comprehensive Motherboard Industry Report provides an in-depth analysis of the global motherboard market, covering historical trends from 2019–2024 and forecasting future growth trajectories through 2033. With a base year of 2025 and an estimated year also in 2025, this report leverages critical insights into PC hardware manufacturing, motherboard market share, and emerging motherboard technologies. It examines key players, ATX motherboard market, Mini-ITX motherboard trends, and the impact of industrial PC motherboards and commercial motherboard solutions. Dive into the latest motherboard innovations, PCIe 5.0 adoption, and the competitive landscape shaped by leading manufacturers. This report is essential for stakeholders seeking to understand the future of PC building, motherboard market opportunities, and the technological evolution driving the global motherboard ecosystem.

Motherboard Industry Market Composition & Trends

The motherboard industry, a critical component of the PC hardware ecosystem, exhibits a dynamic market composition influenced by technological innovation and evolving consumer demands. Market concentration remains robust, with key players continuously vying for motherboard market share. Innovation catalysts are primarily driven by the relentless pursuit of enhanced performance, improved power efficiency, and expanded connectivity, particularly with the advent of PCIe 5.0 and next-generation CPU sockets. The regulatory landscape, while generally stable for hardware components, can be impacted by trade policies and manufacturing standards. Substitute products, such as system-on-a-chip (SoC) solutions in highly integrated devices, pose a limited threat to the traditional motherboard market, which caters to the modularity and upgradeability demands of PC enthusiasts, gamers, and professionals. End-user profiles span across gaming motherboards, workstation motherboards, industrial motherboards, and embedded motherboards, each with distinct requirements. Merger and acquisition (M&A) activities, while not as frequent as in other tech sectors, play a role in consolidating market power and driving strategic advantages, with past deals potentially valued in the hundreds of millions of dollars.

- Market Share Distribution: Dominated by a few key players, with a significant portion attributed to specialized segments.

- M&A Deal Values: Historically ranging from tens of millions to hundreds of millions of dollars, impacting market consolidation.

- Innovation Focus: Enhanced power delivery, advanced cooling solutions, and seamless integration of new technologies like DDR5 RAM and NVMe SSDs.

- End-User Segments: Gaming, professional workstations, industrial automation, and commercial computing.

Motherboard Industry Industry Evolution

The motherboard industry has undergone a remarkable evolution, driven by relentless technological advancements and shifting consumer demands. Over the historical period of 2019–2024, the market witnessed a steady growth trajectory, fueled by the increasing demand for personal computers, gaming rigs, and high-performance workstations. The adoption of new CPU architectures from Intel and AMD has consistently pushed the boundaries of motherboard design, leading to the development of platforms supporting higher core counts, faster memory speeds, and advanced connectivity options. The transition to PCIe 4.0 and the anticipation of PCIe 5.0 have been pivotal, enabling significant improvements in graphics card and storage performance.

The base year of 2025 marks a period where next-generation processors are becoming mainstream, driving a renewed interest in motherboard upgrades. Consumer demand has diversified, with a growing segment prioritizing mini-ITX motherboards for compact gaming PCs and small form factor builds, alongside the enduring popularity of ATX motherboards and Micro-ATX motherboards for their balance of expandability and size. The industrial sector continues to demand robust and reliable motherboards, with industrial PC motherboards featuring extended temperature ranges and longer product lifecycles.

Technological advancements have been multifaceted. The integration of advanced power delivery systems (VRMs) ensures stable power to high-TDP CPUs. Improved audio codecs and networking solutions (e.g., 2.5GbE, Wi-Fi 6E) are now standard features, enhancing the user experience. The proliferation of RGB lighting and aesthetic customization has also become a significant factor, particularly in the gaming segment. Furthermore, the increasing focus on sustainability in manufacturing processes and material sourcing is beginning to influence product development.

The forecast period from 2025–2033 predicts continued innovation, with a strong emphasis on AI acceleration capabilities, enhanced I/O ports, and further miniaturization of components without compromising performance. The rise of edge computing and the Internet of Things (IoT) will likely create new opportunities for specialized motherboards. Adoption metrics for new technologies, such as Wi-Fi 7 and advancements in onboard storage solutions, will be key indicators of market momentum. The average growth rate for the motherboard market during the forecast period is projected to be around 6-8% annually, reflecting a healthy and expanding industry. The increasing average selling price (ASP) of motherboards, driven by feature-rich and high-performance models, will also contribute to market value growth, potentially reaching trillions of dollars in global revenue.

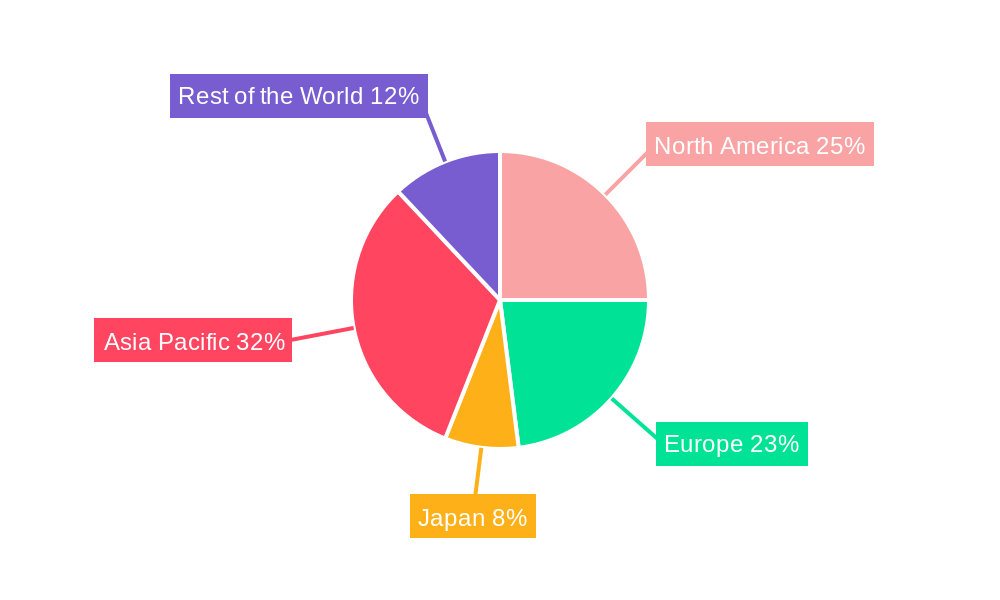

Leading Regions, Countries, or Segments in Motherboard Industry

The global motherboard industry is characterized by a distinct regional dominance and segment leadership, driven by a confluence of factors including manufacturing capabilities, consumer demand, and technological adoption rates.

Dominant Segment: ATX Form Factor

The ATX form factor consistently leads the motherboard market due to its inherent versatility and broad appeal across various end-user industries. Its larger size allows for greater component density, superior cooling solutions, and a wider array of expansion slots, making it the preferred choice for high-performance gaming PCs, professional workstations, and robust server builds. The ATX motherboard market benefits from a mature ecosystem of compatible components and a well-established enthusiast community that favors its upgradeability.

- Key Drivers for ATX Dominance:

- Performance and Expandability: Ample space for multiple PCIe slots, numerous SATA and M.2 ports, and robust VRM designs to support high-end CPUs and GPUs.

- Cooling Capabilities: Facilitates the installation of larger, more effective CPU coolers and chassis fans, crucial for thermal management in performance-oriented systems.

- Broad Compatibility: Ensures seamless integration with a vast range of components from various manufacturers, simplifying the PC building process.

- Market Maturity: Decades of development have solidified ATX as the de facto standard for desktop computing, with a strong brand presence and consumer familiarity.

Leading Region: Asia-Pacific

The Asia-Pacific region stands as the undisputed leader in the motherboard industry, primarily due to its unparalleled manufacturing prowess and significant consumption of PC hardware. Countries like Taiwan and China are global epicenters for PC component manufacturing, hosting the majority of the world's motherboard production facilities. This concentration of manufacturing allows for economies of scale, efficient supply chains, and rapid iteration of new designs.

- Key Drivers for Asia-Pacific Dominance:

- Manufacturing Hubs: Extensive presence of leading motherboard manufacturers and their supply chain partners, enabling high-volume production.

- Skilled Workforce: Availability of a technically skilled labor force experienced in electronics manufacturing.

- Cost-Effectiveness: Optimized production processes and competitive labor costs contribute to more affordable product pricing.

- Growing Consumer Market: Increasing disposable incomes in countries like China and Southeast Asian nations drive demand for consumer electronics, including high-performance PCs.

- Technological Innovation Centers: Significant investment in R&D by local and international companies headquartered in the region, fostering cutting-edge motherboard development.

While Micro-ATX and Mini-ITX form factors are gaining traction, especially in the compact PC segment, and Industrial and Commercial end-user industries represent substantial markets, the sheer volume and foundational importance of the ATX form factor, coupled with the manufacturing might of the Asia-Pacific region, solidify their leading positions in the global motherboard landscape.

Motherboard Industry Product Innovations

The motherboard industry is a hotbed of continuous product innovation, driven by the relentless pursuit of performance, efficiency, and enhanced user experience. Key advancements include the widespread adoption of PCIe 5.0 for graphics cards and NVMe SSDs, enabling unprecedented data transfer speeds. Manufacturers are also integrating next-generation networking solutions like Wi-Fi 7 and 2.5GbE Ethernet as standard. Enhanced power delivery systems (VRMs) are becoming more robust, supporting higher TDP CPUs and offering finer voltage control for overclocking enthusiasts. Furthermore, advancements in onboard audio codecs, AI acceleration features, and improved thermal management solutions are setting new benchmarks. Unique selling propositions often lie in specialized features for gamers, such as advanced RGB control and diagnostic LEDs, or for professionals, such as extensive I/O and robust build quality for workstations.

Propelling Factors for Motherboard Industry Growth

Several key factors are propelling the growth of the motherboard industry. Technologically, the continuous release of new CPU generations by Intel and AMD, demanding more advanced motherboards with enhanced power delivery and connectivity, is a primary driver. The burgeoning PC gaming market and the increasing demand for high-performance workstations for content creation and professional applications further fuel this growth. Economically, rising disposable incomes in emerging markets translate into greater consumer spending on personal computing devices. Regulatory support for the electronics manufacturing sector in key production regions also plays a role. The increasing prevalence of remote work and hybrid learning models continues to necessitate robust and reliable personal computing solutions, directly impacting motherboard demand.

- Technological Advancements: New CPU launches, PCIe 5.0 adoption, faster RAM standards (DDR5).

- Market Demand: Growth in PC gaming, content creation, professional workstations, and general consumer upgrades.

- Economic Factors: Increasing disposable incomes in emerging markets, driving consumer electronics sales.

- Emerging Trends: AI acceleration integration, edge computing solutions.

Obstacles in the Motherboard Industry Market

Despite robust growth, the motherboard industry faces several obstacles. Supply chain disruptions, particularly those related to semiconductor shortages and geopolitical tensions, can significantly impact production volumes and lead times. The increasing complexity of motherboard design and the need for advanced manufacturing processes require substantial capital investment, creating barriers to entry for smaller players. Intense competition among established manufacturers also leads to price pressures, squeezing profit margins. Furthermore, the rapid pace of technological evolution means that product lifecycles can be short, necessitating constant R&D and inventory management. Regulatory hurdles related to environmental compliance and component sourcing can also add to operational challenges.

- Supply Chain Vulnerabilities: Semiconductor shortages, logistics disruptions.

- High R&D Costs: Demands for continuous innovation in PC motherboard technology.

- Intense Competition: Price wars and market saturation in certain segments.

- Rapid Obsolescence: Short product lifecycles requiring frequent updates.

Future Opportunities in Motherboard Industry

The motherboard industry is poised for significant future opportunities driven by emerging technologies and evolving market needs. The expansion of the AI computing market will create demand for specialized motherboards with integrated AI accelerators and enhanced computational capabilities. The growing trend of edge computing will also foster the development of compact, ruggedized, and highly integrated motherboards for distributed processing. Furthermore, the increasing popularity of DIY PC building and the demand for customizable solutions will continue to drive innovation in aesthetic design and user-friendly features. The development of more energy-efficient motherboards aligned with global sustainability initiatives presents another promising avenue for growth.

- AI Integration: Motherboards designed for AI workloads and machine learning.

- Edge Computing Solutions: Compact, robust motherboards for decentralized processing.

- Customization & DIY Market: Enhanced features for PC builders and enthusiasts.

- Sustainability Focus: Development of eco-friendly and power-efficient motherboards.

Major Players in the Motherboard Industry Ecosystem

- ASRock Inc

- Micro-Star INT'L CO LTD

- GIGA-BYTE Technology Co Ltd

- Acer Inc

- Sapphire Technology Limited

- EVGA Corporation

- Super Micro Computer Inc

- ASUSTeK Computer Inc

- Biostar Group

- Advantech Co Ltd

- Shenzhen Seavo Technology Co Ltd

- MiTAC Computing Technology Corporation (MiTAC Group)

Key Developments in Motherboard Industry Industry

- September 2022: GIGABYTE TECHNOLOGY Co. Ltd introduced its Z790 AORUS gaming motherboards, specifically designed for the 13th Gen Intel Core processors. These next-gen ready motherboards feature PCIe 5.0 support for graphics cards and SSDs, offering advanced performance, power management, thermals, and audio capabilities to enhance computing power.

- June 2022: ASUS's upcoming PRO WS W790E-SAGE motherboard was sighted, anticipated to support Intel's next-gen Sapphire Rapids Fishhawk Falls HEDT CPUs. This development signals ASUS's continued focus on high-end desktop (HEDT) platforms, following their successful SAGE series for AMD's Ryzen Threadripper and Intel's Core-X lineups. Enhanced sensor monitoring support is expected in future diagnostic utility versions.

Strategic Motherboard Industry Market Forecast

The strategic motherboard industry market forecast predicts sustained growth fueled by continuous technological innovation and expanding application areas. The anticipated widespread adoption of PCIe 5.0 and the emergence of new CPU architectures will drive a significant upgrade cycle. The growing demand for high-performance computing in gaming, professional content creation, and the burgeoning field of AI will create lucrative opportunities for motherboard manufacturers. Furthermore, the increasing adoption of edge computing solutions and the continued expansion of the DIY PC market will contribute to market expansion. Manufacturers focusing on feature-rich, performance-oriented, and aesthetically appealing motherboards, alongside those developing specialized industrial and commercial solutions, are well-positioned for success. The global market value is projected to reach trillions of dollars by 2033.

Motherboard Industry Segmentation

-

1. Form Factor

- 1.1. ATX

- 1.2. Micro-ATX

- 1.3. Mini-ITX

-

2. End-user Industry

- 2.1. Industrial

- 2.2. Commercial

Motherboard Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Japan

- 4. Asia Pacific

- 5. Rest of the World

Motherboard Industry Regional Market Share

Geographic Coverage of Motherboard Industry

Motherboard Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Continous Innovations of Motherboards; Increase in demand for ATX

- 3.3. Market Restrains

- 3.3.1. Increasing Complexity of Design

- 3.4. Market Trends

- 3.4.1. Industrial Segment to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Motherboard Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form Factor

- 5.1.1. ATX

- 5.1.2. Micro-ATX

- 5.1.3. Mini-ITX

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Industrial

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Japan

- 5.3.4. Asia Pacific

- 5.3.5. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Form Factor

- 6. North America Motherboard Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Form Factor

- 6.1.1. ATX

- 6.1.2. Micro-ATX

- 6.1.3. Mini-ITX

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Industrial

- 6.2.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Form Factor

- 7. Europe Motherboard Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Form Factor

- 7.1.1. ATX

- 7.1.2. Micro-ATX

- 7.1.3. Mini-ITX

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Industrial

- 7.2.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Form Factor

- 8. Japan Motherboard Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Form Factor

- 8.1.1. ATX

- 8.1.2. Micro-ATX

- 8.1.3. Mini-ITX

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Industrial

- 8.2.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Form Factor

- 9. Asia Pacific Motherboard Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Form Factor

- 9.1.1. ATX

- 9.1.2. Micro-ATX

- 9.1.3. Mini-ITX

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Industrial

- 9.2.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Form Factor

- 10. Rest of the World Motherboard Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Form Factor

- 10.1.1. ATX

- 10.1.2. Micro-ATX

- 10.1.3. Mini-ITX

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Industrial

- 10.2.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Form Factor

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ASRock Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Micro-Star INT'L CO LTD

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GIGA-BYTE Technology Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Acer Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sapphire Technology Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 EVGA Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Super Micro Computer Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ASUSTeK Computer Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Biostar Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Advantech Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Shenzhen Seavo Technology Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 MiTAC Computing Technology Corporation (MiTAC Group)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 ASRock Inc

List of Figures

- Figure 1: Global Motherboard Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Motherboard Industry Revenue (Million), by Form Factor 2025 & 2033

- Figure 3: North America Motherboard Industry Revenue Share (%), by Form Factor 2025 & 2033

- Figure 4: North America Motherboard Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Motherboard Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Motherboard Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Motherboard Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Motherboard Industry Revenue (Million), by Form Factor 2025 & 2033

- Figure 9: Europe Motherboard Industry Revenue Share (%), by Form Factor 2025 & 2033

- Figure 10: Europe Motherboard Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Motherboard Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Motherboard Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Motherboard Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Japan Motherboard Industry Revenue (Million), by Form Factor 2025 & 2033

- Figure 15: Japan Motherboard Industry Revenue Share (%), by Form Factor 2025 & 2033

- Figure 16: Japan Motherboard Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Japan Motherboard Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Japan Motherboard Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Japan Motherboard Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Asia Pacific Motherboard Industry Revenue (Million), by Form Factor 2025 & 2033

- Figure 21: Asia Pacific Motherboard Industry Revenue Share (%), by Form Factor 2025 & 2033

- Figure 22: Asia Pacific Motherboard Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific Motherboard Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific Motherboard Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Motherboard Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Motherboard Industry Revenue (Million), by Form Factor 2025 & 2033

- Figure 27: Rest of the World Motherboard Industry Revenue Share (%), by Form Factor 2025 & 2033

- Figure 28: Rest of the World Motherboard Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Rest of the World Motherboard Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Rest of the World Motherboard Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Rest of the World Motherboard Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Motherboard Industry Revenue Million Forecast, by Form Factor 2020 & 2033

- Table 2: Global Motherboard Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Motherboard Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Motherboard Industry Revenue Million Forecast, by Form Factor 2020 & 2033

- Table 5: Global Motherboard Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Motherboard Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Motherboard Industry Revenue Million Forecast, by Form Factor 2020 & 2033

- Table 8: Global Motherboard Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Motherboard Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Motherboard Industry Revenue Million Forecast, by Form Factor 2020 & 2033

- Table 11: Global Motherboard Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Motherboard Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Motherboard Industry Revenue Million Forecast, by Form Factor 2020 & 2033

- Table 14: Global Motherboard Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Motherboard Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Motherboard Industry Revenue Million Forecast, by Form Factor 2020 & 2033

- Table 17: Global Motherboard Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Motherboard Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Motherboard Industry?

The projected CAGR is approximately 16.70%.

2. Which companies are prominent players in the Motherboard Industry?

Key companies in the market include ASRock Inc, Micro-Star INT'L CO LTD, GIGA-BYTE Technology Co Ltd, Acer Inc, Sapphire Technology Limited, EVGA Corporation, Super Micro Computer Inc, ASUSTeK Computer Inc, Biostar Group, Advantech Co Ltd, Shenzhen Seavo Technology Co Ltd, MiTAC Computing Technology Corporation (MiTAC Group).

3. What are the main segments of the Motherboard Industry?

The market segments include Form Factor, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Continous Innovations of Motherboards; Increase in demand for ATX.

6. What are the notable trends driving market growth?

Industrial Segment to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Increasing Complexity of Design.

8. Can you provide examples of recent developments in the market?

September 2022 - GIGABYTE TECHNOLOGY Co. Ltd, a manufacturer of motherboards, graphics cards, and hardware solutions, announced the introduction of the Z790 AORUS gaming motherboards, which are exclusively designed for the 13th Gen Intel Core processors. GIGABYTE Z790 AORUS motherboards are completely next-gen ready and are engineered for PCIe 5.0 graphics cards and SSDs. Equipped with an all-around performance, power management, thermals, and audio features, GIGABYTE Z790 AORUS motherboards definitively push computing firepower to the next level.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Motherboard Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Motherboard Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Motherboard Industry?

To stay informed about further developments, trends, and reports in the Motherboard Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence