Key Insights

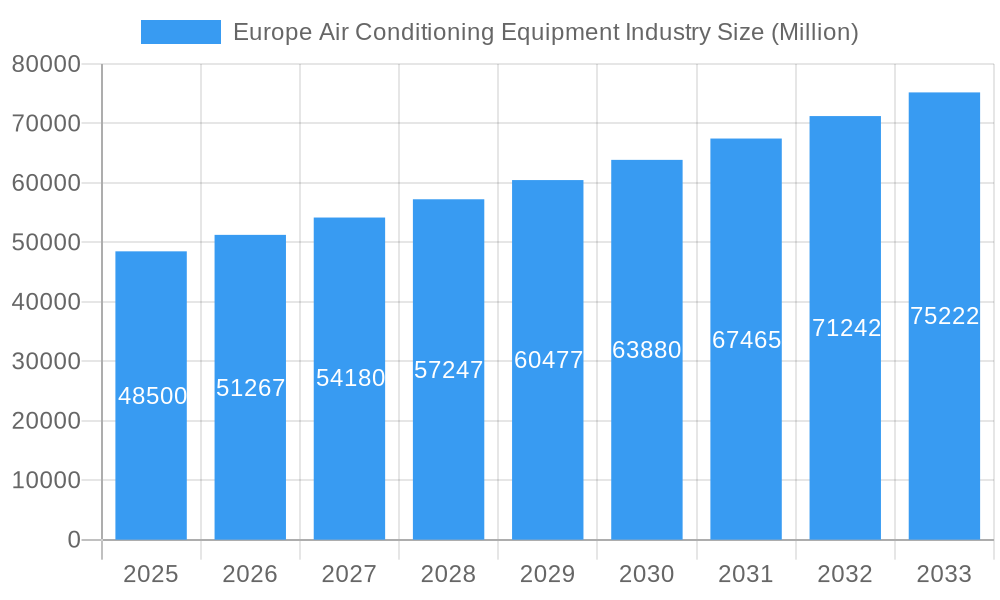

The European Air Conditioning Equipment market is projected for significant growth, reaching a market size of $1.53 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6% anticipated through 2033. This expansion is driven by increasing disposable incomes and a growing demand for energy-efficient cooling. Stringent environmental regulations, particularly concerning high global warming potential refrigerants, are accelerating the adoption of advanced technologies like Variable Refrigerant Flow (VRF) systems and high-efficiency chillers. Enhanced indoor air quality demands, exacerbated by recent global health concerns, are also boosting the market for air handling units and ventilation systems across residential and commercial sectors. Urbanization and the proliferation of smart homes and buildings further contribute to this growth, with a rising preference for integrated and automated climate control solutions.

Europe Air Conditioning Equipment Industry Market Size (In Billion)

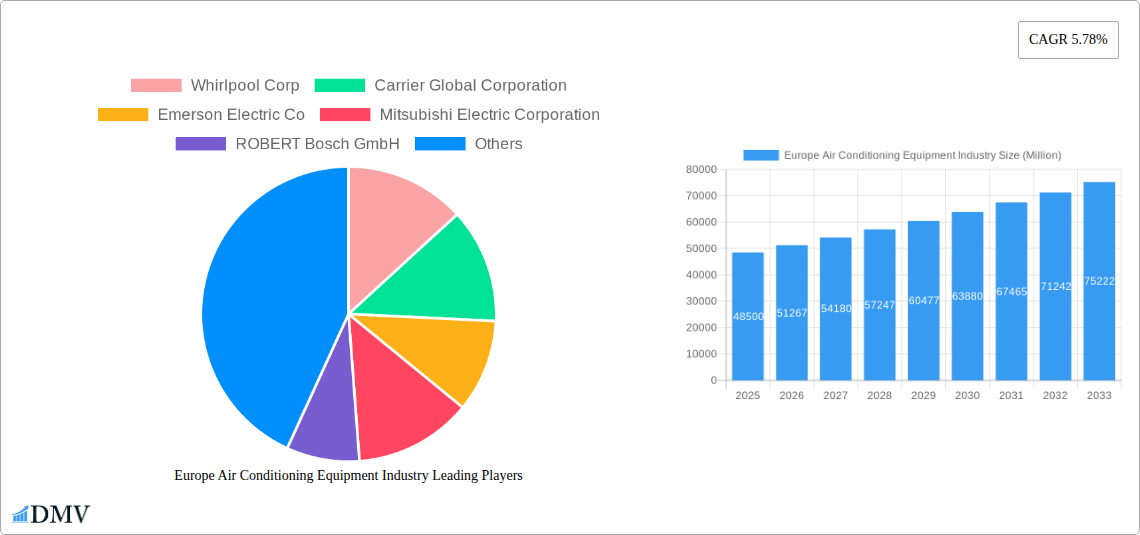

Despite a positive outlook, certain factors may moderate growth. The initial high investment cost of advanced air conditioning systems, including VRF and sophisticated chillers, can be a barrier, especially in price-sensitive markets or for smaller businesses. The availability and cost of skilled labor for installation and maintenance of these complex systems also present challenges. However, technological advancements leading to cost reductions, increased consumer awareness of long-term operational savings, and government initiatives promoting energy efficiency are expected to mitigate these restraints. The market features a competitive landscape with major players such as Daikin Industries Limited, Carrier Global Corporation, and Mitsubishi Electric Corporation, alongside component manufacturers like Emerson Electric Co. and Danfoss A/S, all focusing on innovation and strategic partnerships. Sustainability and energy efficiency will continue to guide product development and market strategies.

Europe Air Conditioning Equipment Industry Company Market Share

Europe Air Conditioning Equipment Industry Market Composition & Trends

This comprehensive report delves into the dynamic Europe Air Conditioning Equipment Industry, offering an in-depth analysis of its market composition and evolving trends. Spanning the historical period of 2019-2024 and projecting to 2033, with a base and estimated year of 2025, this study meticulously examines market concentration, identifying key players and their strategic positioning. We explore innovation catalysts, including advancements in energy efficiency and smart technology integration, alongside the intricate regulatory landscapes that are shaping product development and adoption, particularly concerning refrigerants with lower Global Warming Potential (GWP). The report also scrutinizes the threat of substitute products and the increasingly sophisticated profiles of end-users across Residential, Commercial, and Industrial sectors. Furthermore, a detailed overview of Mergers & Acquisitions (M&A) activities and their impact on market share distribution, with reported deal values in the Millions, provides critical insights into industry consolidation. Expect to uncover the driving forces behind strategic partnerships and market expansion within this vital sector.

- Market Concentration & Key Players: Analysis of dominant manufacturers and their estimated market share distribution.

- Innovation Catalysts: Focus on R&D investments in energy-efficient technologies and smart HVAC solutions.

- Regulatory Landscape: Examination of EU directives, F-gas regulations, and their influence on product compliance.

- Substitute Products & End-User Demands: Evaluation of alternative cooling solutions and evolving preferences of residential, commercial, and industrial consumers.

- M&A Activities: Tracking significant mergers, acquisitions, and joint ventures with reported deal values in the Millions.

Europe Air Conditioning Equipment Industry Industry Evolution

The Europe Air Conditioning Equipment Industry is undergoing a significant transformation, driven by a confluence of technological innovation, stringent environmental regulations, and evolving consumer demands. Our extensive analysis, covering the period from 2019 to 2033, with a base year of 2025, reveals a market characterized by robust growth trajectories and a paradigm shift towards sustainable and intelligent cooling solutions. The historical period (2019-2024) has witnessed an increasing emphasis on energy efficiency, with a growing adoption of inverter technology and heat pumps, leading to an average annual growth rate of approximately 5.5%. The forecast period (2025-2033) is poised for accelerated expansion, projected at an impressive CAGR of around 6.2%, fueled by the widespread implementation of smart home technologies and the burgeoning demand for improved indoor air quality (IAQ). Technological advancements are at the forefront, with the integration of IoT capabilities enabling remote monitoring, predictive maintenance, and optimized energy consumption. The shift towards refrigerants with lower GWP, such as R-454B, is a critical development, driven by regulatory mandates and a growing environmental consciousness among consumers. This transition is spurring significant R&D investments and product redesigns, presenting both challenges and opportunities for manufacturers. The commercial and industrial sectors, in particular, are witnessing a surge in demand for advanced solutions like Variable Refrigerant Flow (VRF) systems and sophisticated Air Handling Units (AHUs) designed for precise temperature and humidity control, contributing to overall market growth. Residential demand is also on an upward trajectory, driven by increasing disposable incomes, rising comfort expectations, and a greater awareness of the health benefits associated with well-managed indoor environments. The industry's evolution is a testament to its adaptability, moving towards a future where efficiency, sustainability, and user-centric design are paramount.

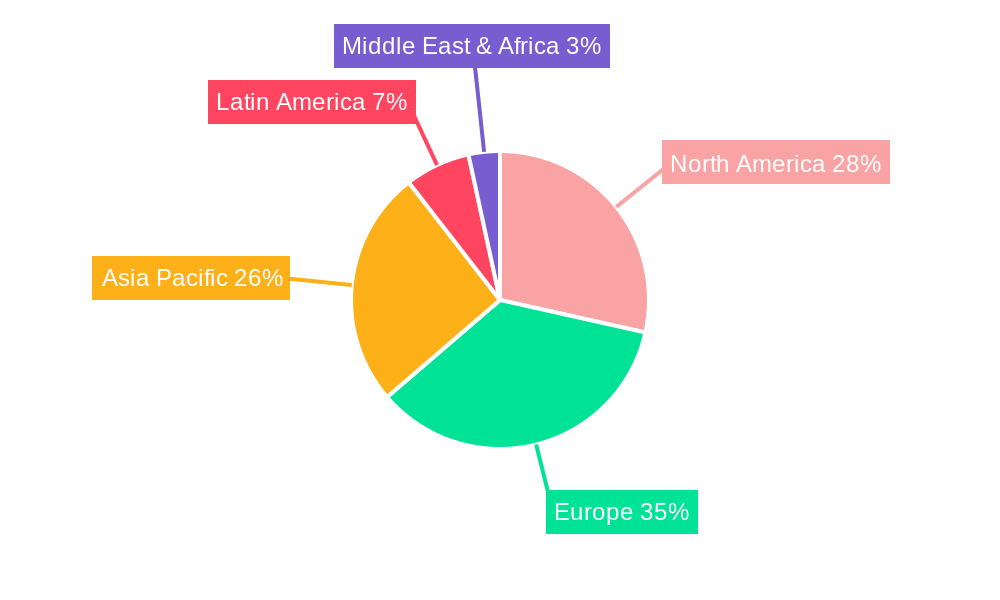

Leading Regions, Countries, or Segments in Europe Air Conditioning Equipment Industry

Within the expansive Europe Air Conditioning Equipment Industry, a clear hierarchy of dominance emerges across various regions, countries, and product segments. Germany, France, and the United Kingdom consistently represent the most significant markets, driven by substantial investments in new construction, stringent energy efficiency standards, and a high propensity for adopting advanced HVAC technologies. The Commercial end-user segment is particularly dominant across Europe, accounting for an estimated 45% of the market value. This is propelled by increasing office building renovations, the expansion of retail spaces, and the growing demand for sophisticated climate control in hotels and healthcare facilities.

Within the Type segmentation, Single Splits/Multi-Splits continue to hold the largest market share, estimated at around 35%, due to their widespread application in both residential and smaller commercial spaces, offering a cost-effective and versatile cooling solution. However, VRF (Variable Refrigerant Flow) systems are exhibiting the fastest growth rate, projected at a CAGR of over 7% during the forecast period. This surge is attributed to their superior energy efficiency, flexibility in installation, and suitability for larger commercial and mixed-use buildings.

Dominant Regions & Countries:

- Germany: Strong economic performance, stringent building codes (e.g., EnEV), and high consumer awareness for energy-efficient products drive demand. Investments in renewable energy integration with HVAC systems are also notable.

- France: Government incentives for energy-efficient upgrades and a large existing building stock undergoing retrofitting contribute significantly to market growth.

- United Kingdom: A growing focus on IAQ and sustainable building practices, coupled with robust new construction projects, underpins demand.

Key Drivers for Segment Dominance:

- Commercial End-User:

- Investment Trends: Increased capital expenditure in modernizing office spaces and constructing sustainable commercial buildings.

- Regulatory Support: Mandates for improved IAQ and energy performance in non-residential buildings.

- Technological Advancements: Demand for integrated building management systems and smart controls.

- Single Splits/Multi-Splits Type:

- Cost-Effectiveness: Lower initial investment compared to larger, more complex systems.

- Ease of Installation: Suitable for retrofitting and smaller spaces where ductwork is challenging.

- Growing Residential Sector: Rising disposable incomes and comfort expectations in individual households.

- VRF Systems Type:

- Energy Efficiency: Significant operational cost savings compared to traditional systems.

- Design Flexibility: Ability to provide simultaneous heating and cooling with zone control.

- Smart Technology Integration: Seamless integration with building automation systems.

- Commercial End-User:

Europe Air Conditioning Equipment Industry Product Innovations

Product innovation within the Europe Air Conditioning Equipment Industry is primarily focused on enhancing energy efficiency, reducing environmental impact, and improving user experience. The introduction of refrigerants with significantly lower GWPs, such as R-454B, is a pivotal development, exemplified by CIAT's VectiosPower rooftop units, which offer an over 80% reduction in carbon footprint compared to traditional HFC R-410A. Furthermore, the integration of advanced technologies for superior indoor air quality (IAQ) is gaining traction. The collaboration between Barrisol and Carrier showcases integrated ceiling solutions that not only provide exceptional comfort and aesthetic appeal but also ensure a stable indoor environment with very low air velocities and precise temperature regulation. These innovations are driving enhanced performance metrics, including higher Seasonal Energy Efficiency Ratios (SEER), reduced noise levels, and intelligent control features for optimized operation.

Propelling Factors for Europe Air Conditioning Equipment Industry Growth

The Europe Air Conditioning Equipment Industry is propelled by a confluence of powerful factors. Increasingly stringent energy efficiency regulations, such as those mandating lower GWP refrigerants and higher SEER ratings, are compelling manufacturers to innovate and adopt more sustainable technologies. Growing consumer awareness regarding the importance of indoor air quality (IAQ) and its impact on health is driving demand for advanced filtration and ventilation systems. Furthermore, rising disposable incomes and a greater focus on comfort in residential and commercial spaces are contributing to market expansion. The ongoing trend of smart home integration and the development of connected HVAC systems, enabling remote control and energy optimization, are also significant growth catalysts. Economic recovery and increased construction activities across Europe further bolster the demand for air conditioning equipment.

Obstacles in the Europe Air Conditioning Equipment Industry Market

Despite robust growth, the Europe Air Conditioning Equipment Industry faces several obstacles. Stringent and evolving regulatory landscapes, particularly concerning refrigerant phase-downs and energy performance standards, can lead to compliance challenges and increased R&D costs for manufacturers. Supply chain disruptions, exacerbated by geopolitical events and raw material price volatility, can impact production timelines and product availability, leading to price fluctuations. The high initial cost of advanced energy-efficient systems can also be a barrier to adoption for some segments of the market, particularly in price-sensitive residential applications. Intense competition among established players and the emergence of new market entrants also exert pressure on profit margins.

Future Opportunities in Europe Air Conditioning Equipment Industry

The future of the Europe Air Conditioning Equipment Industry is ripe with opportunities. The increasing demand for decarbonization presents a significant chance for companies offering heat pump technology and solutions integrated with renewable energy sources. The growing emphasis on IAQ in post-pandemic scenarios opens avenues for advanced air purification and ventilation systems, particularly in commercial and public spaces. The retrofitting of existing buildings to meet modern energy efficiency standards represents a substantial market segment. Furthermore, the expansion of smart city initiatives and the development of integrated building management systems will drive demand for connected and intelligent HVAC solutions. Emerging markets within Europe, coupled with evolving consumer preferences for sustainable and user-friendly products, will continue to shape market dynamics.

Major Players in the Europe Air Conditioning Equipment Industry Ecosystem

- Whirlpool Corp

- Carrier Global Corporation

- Emerson Electric Co

- Mitsubishi Electric Corporation

- ROBERT Bosch GmbH

- Luvata Oy

- Danfoss A/S

- Lennox International Inc

- Johnson Controls-Hitachi Air Conditioning

- Daikin Industries Limited

Key Developments in Europe Air Conditioning Equipment Industry Industry

- March 2022: CIAT has released a new line of VectiosPower rooftop air conditioning units that use R-454B refrigerant, providing clients with the finest possible application option. R-454B's overall carbon footprint is more than 80% lower than that of HFC R-410A, the refrigerant it replaces, with a GWP of 466.

- December 2021: Barrisol, the prominent player in HVAC ceiling solutions, and Carrier have collaborated to offer a variety of integrated air conditioning solutions that provide exceptional comfort, improved indoor air quality (IAQ), and reduced running costs. The new advanced ceiling solutions offer the better standards of aesthetic design, a high-quality, stable indoor environment, and are suitable for any application requiring very low air velocities and precise temperature regulation.

Strategic Europe Air Conditioning Equipment Industry Market Forecast

The strategic outlook for the Europe Air Conditioning Equipment Industry is exceptionally promising, driven by a proactive shift towards sustainability and intelligent climate control. The relentless pursuit of energy efficiency, coupled with tightening environmental regulations, will continue to favor the adoption of heat pumps and low-GWP refrigerants, representing substantial growth catalysts. The increasing prioritization of indoor air quality (IAQ) by consumers and businesses alike is creating fertile ground for innovative solutions in air purification and ventilation. Furthermore, the pervasive integration of IoT and smart technologies into HVAC systems will lead to more optimized energy consumption, predictive maintenance, and enhanced user convenience, driving demand for connected solutions. The ongoing modernization of existing building stock across Europe presents a significant opportunity for retrofitting and upgrading to more efficient and environmentally friendly air conditioning equipment, ensuring a robust and expanding market trajectory throughout the forecast period.

Europe Air Conditioning Equipment Industry Segmentation

-

1. Type

- 1.1. Single Splits/Multi-Splits

- 1.2. VRF

- 1.3. Air Handling Units

- 1.4. Chillers

- 1.5. Fans

- 1.6. Other Types

-

2. End User

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

Europe Air Conditioning Equipment Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Air Conditioning Equipment Industry Regional Market Share

Geographic Coverage of Europe Air Conditioning Equipment Industry

Europe Air Conditioning Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Smart Cities in the Region; Replacement of Existing Equipment with Better Performing Ones

- 3.3. Market Restrains

- 3.3.1. High Costs of Equipment

- 3.4. Market Trends

- 3.4.1. Industrial is Expected to Grow at a Signficant Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Air Conditioning Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Splits/Multi-Splits

- 5.1.2. VRF

- 5.1.3. Air Handling Units

- 5.1.4. Chillers

- 5.1.5. Fans

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Whirlpool Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Carrier Global Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Emerson Electric Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mitsubishi Electric Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ROBERT Bosch GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Luvata Oy

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Danfoss A/S

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lennox International Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Johnson Controls-Hitachi Air Conditioning

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Daikin Industries Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Whirlpool Corp

List of Figures

- Figure 1: Europe Air Conditioning Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Air Conditioning Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Air Conditioning Equipment Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Air Conditioning Equipment Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Europe Air Conditioning Equipment Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Europe Air Conditioning Equipment Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 5: Europe Air Conditioning Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Air Conditioning Equipment Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Europe Air Conditioning Equipment Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Europe Air Conditioning Equipment Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: Europe Air Conditioning Equipment Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 10: Europe Air Conditioning Equipment Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 11: Europe Air Conditioning Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Europe Air Conditioning Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Air Conditioning Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Air Conditioning Equipment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Air Conditioning Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Air Conditioning Equipment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: France Europe Air Conditioning Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Europe Air Conditioning Equipment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Air Conditioning Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Air Conditioning Equipment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Air Conditioning Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Air Conditioning Equipment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Air Conditioning Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Air Conditioning Equipment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Air Conditioning Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Air Conditioning Equipment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Air Conditioning Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Air Conditioning Equipment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Air Conditioning Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Air Conditioning Equipment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Air Conditioning Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Air Conditioning Equipment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Air Conditioning Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Air Conditioning Equipment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Air Conditioning Equipment Industry?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Europe Air Conditioning Equipment Industry?

Key companies in the market include Whirlpool Corp, Carrier Global Corporation, Emerson Electric Co, Mitsubishi Electric Corporation, ROBERT Bosch GmbH, Luvata Oy, Danfoss A/S, Lennox International Inc, Johnson Controls-Hitachi Air Conditioning, Daikin Industries Limited.

3. What are the main segments of the Europe Air Conditioning Equipment Industry?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.53 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Smart Cities in the Region; Replacement of Existing Equipment with Better Performing Ones.

6. What are the notable trends driving market growth?

Industrial is Expected to Grow at a Signficant Rate.

7. Are there any restraints impacting market growth?

High Costs of Equipment.

8. Can you provide examples of recent developments in the market?

March 2022- CIAT has released a new line of VectiosPower rooftop air conditioning units that use R-454B refrigerant, providing clients with the finest possible application option. R-454B's overall carbon footprint is more than 80% lower than that of HFC R-410A, the refrigerant it replaces, with a GWP of 466.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Air Conditioning Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Air Conditioning Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Air Conditioning Equipment Industry?

To stay informed about further developments, trends, and reports in the Europe Air Conditioning Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence