Key Insights

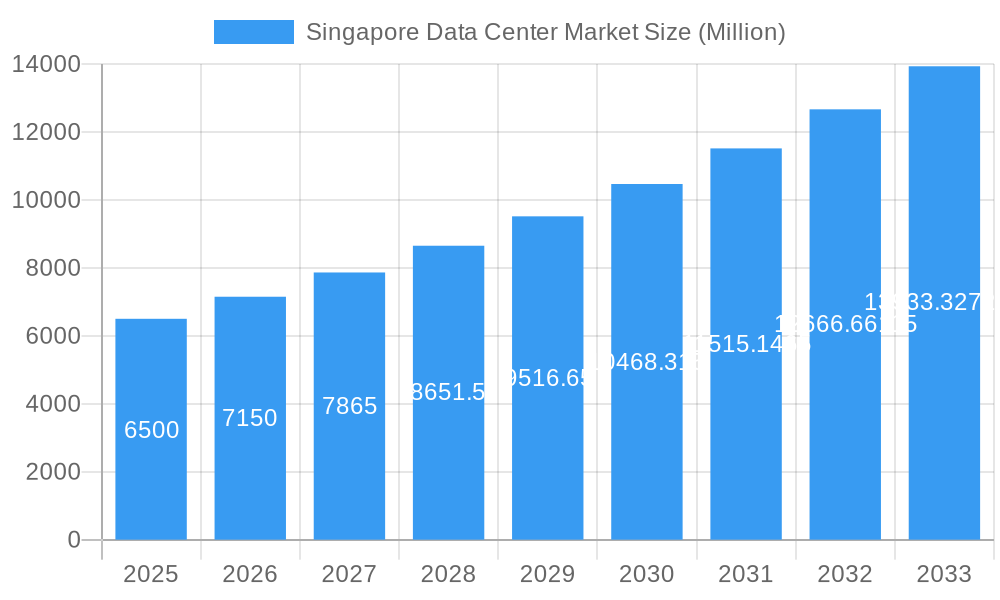

The Singapore data center market is poised for substantial expansion, projected to reach a market size of approximately $6,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 10.00% expected throughout the forecast period of 2025-2033. This significant growth is fueled by several key drivers, including the escalating demand for cloud computing services, the rapid digitalization of businesses across various sectors, and the strategic importance of Singapore as a digital hub in the Asia-Pacific region. The increasing adoption of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) further necessitates more advanced and scalable data center infrastructure. Furthermore, government initiatives promoting a digital economy and foreign direct investment in technology are creating a highly favorable environment for data center development and expansion. The market is witnessing a surge in demand for hyperscale and mega-sized data centers to support the burgeoning data processing and storage needs of cloud providers and large enterprises.

Singapore Data Center Market Market Size (In Billion)

Despite the immense growth potential, the market faces certain restraints. The primary challenge is the increasing scarcity and high cost of suitable land for new data center construction, coupled with stringent regulatory requirements and environmental sustainability concerns, particularly regarding energy consumption and cooling technologies. The availability of skilled labor for managing and operating sophisticated data center facilities also presents a potential bottleneck. However, these challenges are being addressed through innovative solutions such as advanced cooling systems, renewable energy integration, and strategic partnerships. The market is segmented by data center size, with large, massive, and mega-sized facilities experiencing the highest demand. Tier 3 and Tier 4 data centers are predominantly preferred due to their high reliability and uptime requirements. End-user segments like Cloud, BFSI, E-Commerce, and Government are major contributors to this demand, driving innovation and investment in the Singapore data center landscape. Prominent companies like Empyrion DC, Equinix Inc., Digital Realty Trust Inc., and Princeton Digital Group are actively investing and expanding their presence, underscoring the market's dynamism.

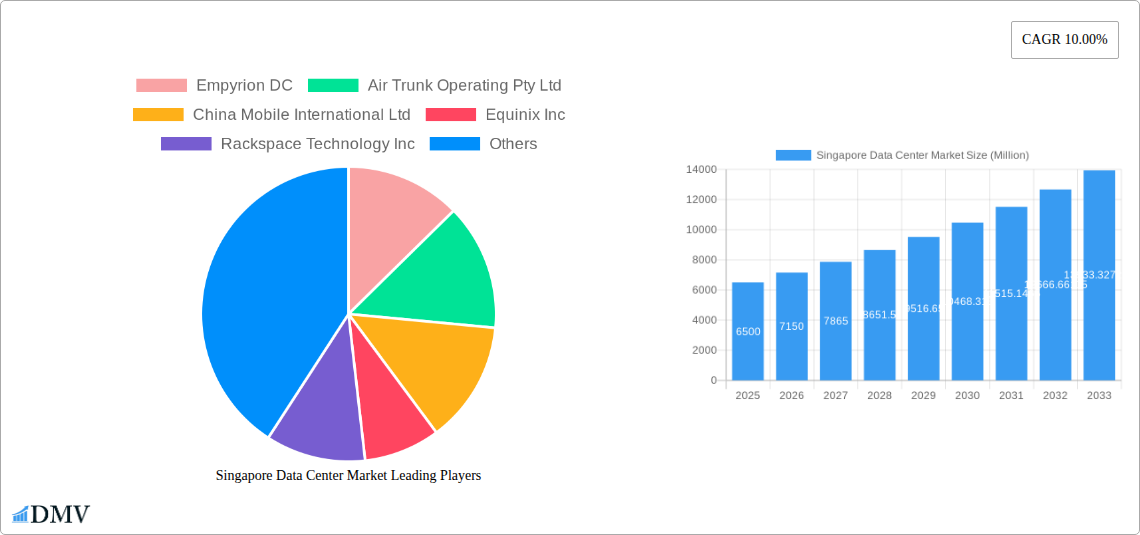

Singapore Data Center Market Company Market Share

Here's the SEO-optimized and insightful report description for the Singapore Data Center Market:

The Singapore Data Center Market is characterized by a dynamic and evolving landscape, driven by robust demand from cloud computing, BFSI, and e-commerce sectors. Market concentration is notably influenced by the presence of established global players alongside emerging local entities, all vying for dominance. Innovation catalysts are plentiful, fueled by government initiatives supporting digital transformation and substantial private sector investments in cutting-edge infrastructure. The regulatory framework, while stringent, fosters a secure and reliable operating environment. Substitute products are limited in the context of physical data center infrastructure, but efficiency gains and emerging technologies like edge computing present evolving alternatives. End-user profiles are increasingly sophisticated, demanding higher power densities, lower latency, and enhanced security. Merger and acquisition (M&A) activities are a significant trend, indicating consolidation and strategic expansion. For instance, deals in the range of hundreds of millions of dollars are reshaping the competitive map as companies aim to scale their operations and capture market share.

Singapore Data Center Market Industry Evolution

The Singapore Data Center Market has witnessed remarkable growth, underpinned by a sustained surge in digital services and enterprise cloud adoption. Over the historical period of 2019–2024, the market experienced a compound annual growth rate (CAGR) of approximately 15%, driven by exponential data generation and the increasing reliance on data center services by businesses across diverse sectors. The base year of 2025 signifies a pivotal point, with projected growth expected to maintain a strong CAGR of around 12% through to 2033. This sustained expansion is directly attributable to several key factors: the nation's strategic geographic location, its stable political and economic environment, and its status as a leading digital hub in Southeast Asia. Technological advancements have played a crucial role, with a significant shift towards hyperscale facilities, increased adoption of AI and machine learning workloads, and a growing emphasis on sustainable power solutions. Consumer demands have likewise evolved, with end-users now expecting higher levels of service availability, advanced security protocols, and greater energy efficiency. The increasing integration of hybrid and multi-cloud strategies by enterprises further propels the need for flexible and scalable data center solutions. This evolution is not merely about capacity expansion but also about enhancing operational intelligence, improving power utilization effectiveness (PUE), and embracing innovative cooling technologies to meet the demands of high-density computing.

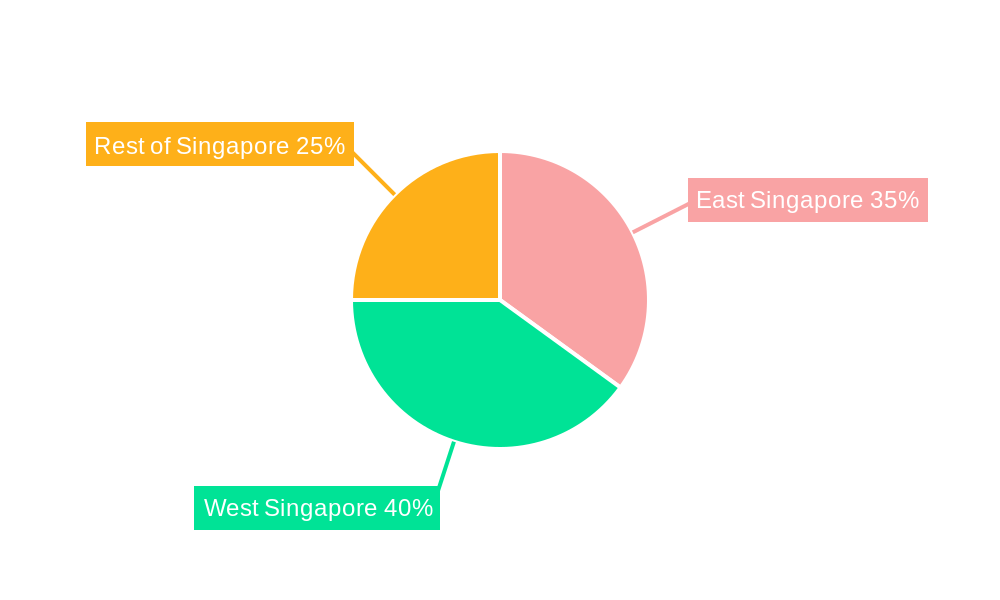

Leading Regions, Countries, or Segments in Singapore Data Center Market

Within the Singapore Data Center Market, East Singapore stands out as the preeminent region, consistently attracting significant investment and development due to its established infrastructure and proximity to key business districts. This dominance is further reinforced by the prevalence of Mega and Large data center sizes, catering to the stringent requirements of hyperscale operators and large enterprises. The Tier 4 and Tier 3 classifications are highly sought after, reflecting the critical need for uninterrupted operations and robust redundancy, particularly for the Cloud, BFSI, and Government end-user segments.

Dominant Region: East Singapore:

- Investment Trends: East Singapore has witnessed the lion's share of new data center construction and expansion projects, driven by its excellent connectivity and access to skilled labor.

- Regulatory Support: The government's proactive stance in facilitating the development of digital infrastructure, including land availability and streamlined approvals, significantly benefits this region.

- End-User Concentration: A high concentration of financial institutions, cloud providers, and government agencies in and around East Singapore creates a perpetual demand for high-quality data center services.

Dominant Data Center Size: Mega & Large:

- Hyperscale Demand: The increasing adoption of cloud computing and the growing data needs of global technology giants necessitate the deployment of massive data center facilities.

- Scalability & Flexibility: Mega and Large data centers offer the scalability and flexibility required to accommodate the dynamic growth of digital workloads.

- Power & Cooling Efficiency: These larger facilities often benefit from economies of scale, allowing for more advanced and efficient power and cooling systems.

Dominant Tier Type: Tier 3 & Tier 4:

- Mission-Critical Operations: Sectors like BFSI and Government require the highest levels of uptime and resilience, making Tier 3 and Tier 4 facilities indispensable.

- Redundancy & Fault Tolerance: The design of these tiers ensures that even in the event of equipment failure or maintenance, operations can continue without interruption.

- Data Security & Integrity: Enhanced physical and logical security measures inherent in higher-tier data centers are crucial for protecting sensitive data.

Dominant End Users: Cloud, BFSI, Government:

- Cloud Computing Growth: The rapid expansion of cloud services by hyperscalers is a primary driver, demanding vast amounts of compute, storage, and networking capacity.

- Financial Services Robustness: The BFSI sector's reliance on secure, low-latency, and highly available data processing for trading, transactions, and customer services fuels significant demand.

- Digital Government Initiatives: Government efforts to digitize public services and enhance national cybersecurity create a substantial and consistent demand for data center infrastructure.

Singapore Data Center Market Product Innovations

The Singapore Data Center Market is witnessing significant product innovations focused on enhancing efficiency, sustainability, and performance. Advanced cooling solutions, including liquid cooling technologies and innovative air management systems, are becoming more prevalent to support higher-density racks. Furthermore, the integration of AI-powered analytics for predictive maintenance and operational optimization is transforming data center management. The adoption of modular and prefabricated data center designs is also accelerating, enabling faster deployment and greater flexibility for end-users. These innovations are critical in meeting the evolving demands for compute-intensive workloads and achieving ambitious sustainability targets within the industry.

Propelling Factors for Singapore Data Center Market Growth

Several key factors are propelling the growth of the Singapore Data Center Market. Technologically, the relentless rise of cloud computing, AI, big data analytics, and the Internet of Things (IoT) is driving an insatiable demand for data storage and processing capabilities. Economically, Singapore's strategic position as a regional hub, coupled with strong government support for digitalization and foreign direct investment in the technology sector, creates a fertile ground for expansion. Regulatory frameworks that ensure stability, security, and ease of doing business further bolster confidence. The nation's robust digital infrastructure and connectivity further solidify its appeal for data center operators and users alike.

Obstacles in the Singapore Data Center Market Market

Despite its strong growth trajectory, the Singapore Data Center Market faces several obstacles. Land scarcity and high real estate costs present a significant challenge for building new facilities. Furthermore, the substantial power requirements of data centers, coupled with the nation's commitment to sustainability, create a complex challenge in securing renewable energy sources and managing energy consumption efficiently. Stringent environmental regulations, while necessary, can also add to development costs and timelines. The intense competition among existing and new market players can also lead to pricing pressures and a need for continuous innovation to maintain a competitive edge.

Future Opportunities in Singapore Data Center Market

The future opportunities in the Singapore Data Center Market are vast and multifaceted. The ongoing expansion of hyperscale cloud services and the increasing adoption of edge computing for real-time data processing present significant growth avenues. The burgeoning demand for specialized data center services, such as high-performance computing (HPC) for AI research and development, also offers considerable potential. Furthermore, the drive towards sustainability opens doors for innovation in green data center designs, renewable energy integration, and efficient resource management. Singapore's continued role as a gateway to Southeast Asia ensures sustained interest from international enterprises seeking a reliable and advanced digital infrastructure partner.

Major Players in the Singapore Data Center Market Ecosystem

- Empyrion DC

- Air Trunk Operating Pty Ltd

- China Mobile International Ltd

- Equinix Inc

- Rackspace Technology Inc

- 1-Net Singapore Pte Ltd (Mediacorp)

- PhoenixNAP

- Princeton Digital Group

- Cyxtera Technologies

- Digital Realty Trust Inc

- Global Switch Holdings Limited

Key Developments in Singapore Data Center Market Industry

- November 2022: AirTrunk completed the final phase of SGP1 data center, expanding its total capacity to over 78 MW, enabling hyperscale capacity deployment at unprecedented speed and scale.

- September 2022: Equinix, Inc. announced a partnership with the Centre for Energy Research & Technology (CERT) at the National University of Singapore (NUS) to explore hydrogen as a green fuel source for mission-critical data center infrastructure.

- June 2022: phoenixNAP announced a partnership with Pliops, a provider of data processors for cloud and enterprise data centers, to deliver on-demand cloud services for performance-sensitive users.

Strategic Singapore Data Center Market Market Forecast

The strategic forecast for the Singapore Data Center Market indicates continued robust growth driven by increasing demand for digital infrastructure. The market is expected to benefit from ongoing investments in hyperscale facilities and the expansion of cloud services, supported by Singapore's stable economic and political environment. Key growth catalysts include the proliferation of AI, machine learning, and IoT applications, as well as the nation's commitment to becoming a leading smart city. Future opportunities lie in sustainable data center development, advanced cooling technologies, and catering to niche markets like HPC. The forecast remains highly positive, solidifying Singapore's position as a premier data center hub in Asia.

Singapore Data Center Market Segmentation

-

1. Hotspot

- 1.1. East Singapore

- 1.2. West Singapore

- 1.3. Rest of Singapore

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1

- 3.2. Tier 2

- 3.3. Tier 3

- 3.4. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

5. End User

- 5.1. Cloud

- 5.2. BFSI

- 5.3. E-Commerce

- 5.4. Government

- 5.5. Manufacturing

- 5.6. Media & Entertainment

- 5.7. Telecom

- 5.8. Other End User

Singapore Data Center Market Segmentation By Geography

- 1. Singapore

Singapore Data Center Market Regional Market Share

Geographic Coverage of Singapore Data Center Market

Singapore Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness of Energy Consumption Control

- 3.3. Market Restrains

- 3.3.1. High Risk Associated with Data

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Data Center Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. East Singapore

- 5.1.2. West Singapore

- 5.1.3. Rest of Singapore

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1

- 5.3.2. Tier 2

- 5.3.3. Tier 3

- 5.3.4. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by End User

- 5.5.1. Cloud

- 5.5.2. BFSI

- 5.5.3. E-Commerce

- 5.5.4. Government

- 5.5.5. Manufacturing

- 5.5.6. Media & Entertainment

- 5.5.7. Telecom

- 5.5.8. Other End User

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Empyrion DC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Air Trunk Operating Pty Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China Mobile International Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Equinix Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rackspace Technology Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 1-Net Singapore Pte Ltd (Mediacorp)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PhoenixNAP

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Princeton Digital Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cyxtera Technologies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Digital Realty Trust Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Global Switch Holdings Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Empyrion DC

List of Figures

- Figure 1: Singapore Data Center Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Singapore Data Center Market Share (%) by Company 2025

List of Tables

- Table 1: Singapore Data Center Market Revenue undefined Forecast, by Hotspot 2020 & 2033

- Table 2: Singapore Data Center Market Volume K Unit Forecast, by Hotspot 2020 & 2033

- Table 3: Singapore Data Center Market Revenue undefined Forecast, by Data Center Size 2020 & 2033

- Table 4: Singapore Data Center Market Volume K Unit Forecast, by Data Center Size 2020 & 2033

- Table 5: Singapore Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 6: Singapore Data Center Market Volume K Unit Forecast, by Tier Type 2020 & 2033

- Table 7: Singapore Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 8: Singapore Data Center Market Volume K Unit Forecast, by Absorption 2020 & 2033

- Table 9: Singapore Data Center Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 10: Singapore Data Center Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 11: Singapore Data Center Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 12: Singapore Data Center Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 13: Singapore Data Center Market Revenue undefined Forecast, by Hotspot 2020 & 2033

- Table 14: Singapore Data Center Market Volume K Unit Forecast, by Hotspot 2020 & 2033

- Table 15: Singapore Data Center Market Revenue undefined Forecast, by Data Center Size 2020 & 2033

- Table 16: Singapore Data Center Market Volume K Unit Forecast, by Data Center Size 2020 & 2033

- Table 17: Singapore Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 18: Singapore Data Center Market Volume K Unit Forecast, by Tier Type 2020 & 2033

- Table 19: Singapore Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 20: Singapore Data Center Market Volume K Unit Forecast, by Absorption 2020 & 2033

- Table 21: Singapore Data Center Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 22: Singapore Data Center Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 23: Singapore Data Center Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Singapore Data Center Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Data Center Market?

The projected CAGR is approximately 7.84%.

2. Which companies are prominent players in the Singapore Data Center Market?

Key companies in the market include Empyrion DC, Air Trunk Operating Pty Ltd, China Mobile International Ltd, Equinix Inc, Rackspace Technology Inc, 1-Net Singapore Pte Ltd (Mediacorp), PhoenixNAP, Princeton Digital Group, Cyxtera Technologies, Digital Realty Trust Inc, Global Switch Holdings Limited.

3. What are the main segments of the Singapore Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness of Energy Consumption Control.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Risk Associated with Data.

8. Can you provide examples of recent developments in the market?

November 2022: AirTrunk completed the final phase of SGP1 data center expanding the total capacity of the data center to more than 78 MW to deploy hyperscale capacity at at unprecedented speed and scale.September 2022: Equinix, Inc. announced a partnership with the Centre for Energy Research & Technology (CERT) under the National University of Singapore's (NUS) College of Design and Engineering to explore technologies that enable the use of hydrogen as a green fuel source for mission-critical data center infrastructure.June 2022: phoenixNAP announced that it has entered into a partnership with Pliops, a leading provider of data processors for cloud and enterprise data centers. Through this collaboration, phoenixNAP will delivers on-demand cloud services that meet the needs of performance-sensitive users.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Data Center Market?

To stay informed about further developments, trends, and reports in the Singapore Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence