Key Insights

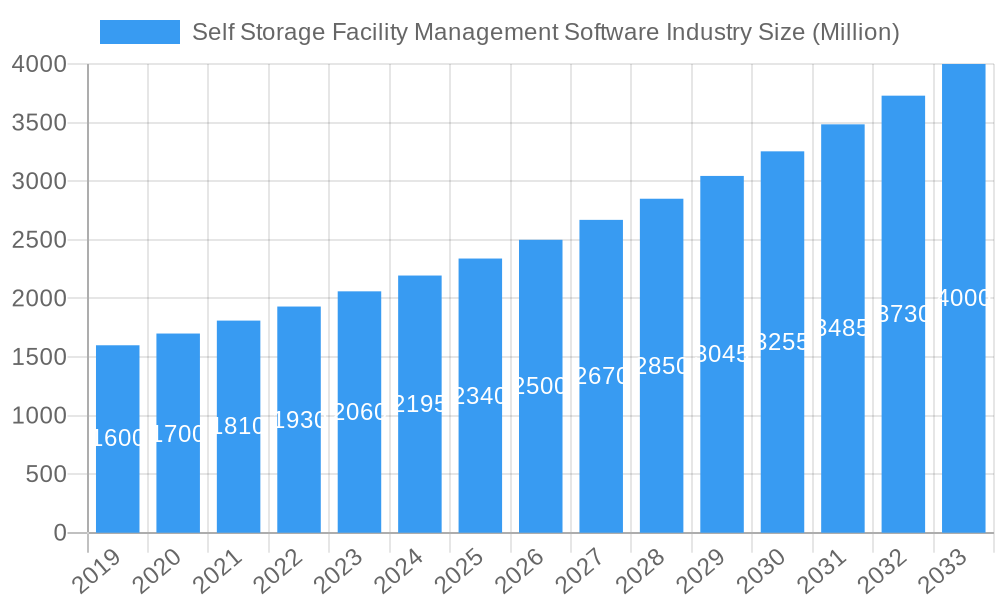

The global Self-Storage Facility Management Software market is poised for substantial growth, projected to reach an estimated USD 2,800 million by 2025, and is expected to expand at a Compound Annual Growth Rate (CAGR) of 7.57% through 2033. This robust expansion is primarily driven by the increasing adoption of cloud-based solutions that offer enhanced scalability, accessibility, and remote management capabilities, crucial for modern storage facilities. The market is witnessing a significant trend towards integrated platforms that combine booking, payment processing, customer relationship management (CRM), and marketing tools, streamlining operations and improving customer experience. Furthermore, the growing need for efficient inventory management and occupancy tracking, especially with the rising demand for self-storage units, acts as a key catalyst for software adoption. The proliferation of small and medium-sized enterprises (SMEs) within the self-storage sector, alongside the continued investment by large enterprises, further bolsters market penetration.

Self Storage Facility Management Software Industry Market Size (In Billion)

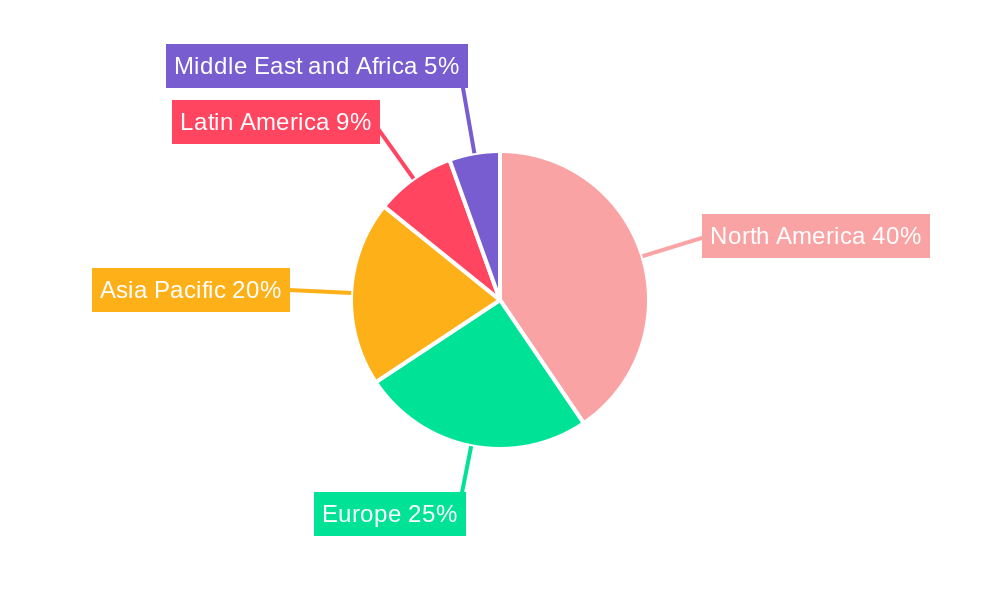

Despite the strong growth trajectory, the market faces certain restraints. The initial cost of implementing advanced software solutions and the potential resistance to adopting new technologies among some established operators can pose challenges. However, the benefits of increased operational efficiency, improved security features, and enhanced data analytics capabilities offered by these software solutions are increasingly outweighing these concerns. The market segmentation reveals a healthy balance between PC-based and cloud-based solutions, with cloud solutions gaining momentum due to their flexibility and cost-effectiveness. Geographically, North America is anticipated to maintain a dominant market share, owing to its mature self-storage industry and early adoption of technological advancements. However, the Asia Pacific region is expected to exhibit the fastest growth, fueled by rapid urbanization, increasing disposable incomes, and a growing awareness of self-storage as a viable solution for space constraints. Key players like Storable Group, DOMICO Software, and Corrigo Incorporated are at the forefront of innovation, continually developing sophisticated features to meet the evolving needs of the self-storage industry.

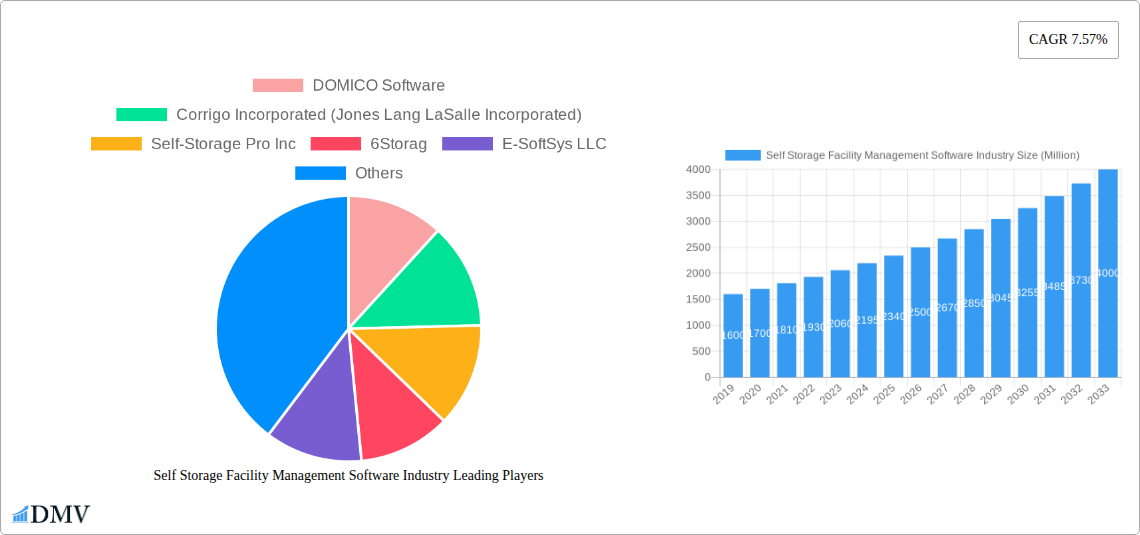

Self Storage Facility Management Software Industry Company Market Share

Self Storage Facility Management Software Industry Market Composition & Trends

The self-storage facility management software market is characterized by a moderate level of concentration, with key players vying for market share through continuous innovation and strategic alliances. The market is propelled by the increasing demand for efficient operational management and enhanced customer experiences in the self-storage sector. Regulatory landscapes are evolving, influencing data security protocols and compliance requirements. Substitute products, while present in simpler management tools, are largely outcompeted by the comprehensive features offered by specialized software. End-user profiles range from small, independent operators to large enterprise chains, each seeking tailored solutions. Mergers and acquisitions are anticipated to play a significant role in shaping market dynamics, with deal values estimated to reach several hundred million dollars as companies consolidate their offerings and expand their reach. Estimated market share distribution indicates a dynamic landscape where innovation and customer retention are paramount.

- Market Concentration: Moderate, with a few dominant players and numerous smaller, niche providers.

- Innovation Catalysts: Demand for automation, online rentals, enhanced security, and data analytics.

- Regulatory Landscapes: Evolving data privacy laws, security standards, and operational compliance.

- Substitute Products: Basic spreadsheets, manual tracking systems, and limited-functionality software.

- End-User Profiles: Small-to-medium enterprises (SMEs) and large enterprise chains, facility owners, and operators.

- M&A Activities: Driven by consolidation, market expansion, and technology acquisition, with estimated deal values in the range of $100 Million to $300 Million.

Self Storage Facility Management Software Industry Industry Evolution

The self-storage facility management software industry has undergone a significant evolutionary journey, transforming from rudimentary tracking systems to sophisticated, integrated cloud-based platforms. Historically, the market was dominated by PC-based solutions that offered core functionalities like tenant management and basic billing. However, the advent of the internet and the widespread adoption of cloud computing have catalyzed a paradigm shift. This evolution has been marked by a consistent growth trajectory, with the market expanding at a Compound Annual Growth Rate (CAGR) of approximately 12% from 2019 to 2024, reaching an estimated market size of $1.5 Billion in 2024. Technological advancements, including the integration of artificial intelligence for demand forecasting and dynamic pricing, alongside the proliferation of mobile accessibility, have been pivotal. Consumer demands have also shaped this evolution, with an increasing expectation for seamless online booking, digital payment options, and remote access capabilities. The adoption rate of cloud-based solutions has surged, now representing over 70% of the market share in 2024, a stark contrast to its nascent stages. This transition has enabled self-storage operators to achieve greater operational efficiency, reduce costs, and enhance the overall tenant experience. The industry's growth is further fueled by the continuous need for enhanced security features, streamlined marketing efforts, and robust customer relationship management tools, all of which are now standard offerings in modern self-storage management software. The forecast period (2025–2033) anticipates continued robust growth, projected to reach a market size exceeding $4 Billion by 2033, driven by further digital transformation and the expansion of self-storage services globally.

Leading Regions, Countries, or Segments in Self Storage Facility Management Software Industry

North America currently dominates the self-storage facility management software industry, driven by a mature and highly penetrated self-storage market, significant technological adoption, and a strong entrepreneurial spirit. The United States, in particular, stands as the primary growth engine within this region, benefiting from a well-established infrastructure for cloud-based services and a proactive approach to adopting innovative software solutions. This dominance is further solidified by a substantial number of both large enterprise chains and a thriving segment of small and medium-sized businesses (SMEs) actively seeking to optimize their operations.

The Cloud segment consistently outperforms its PC-based counterpart due to its inherent scalability, accessibility, and cost-effectiveness. Cloud solutions offer real-time data synchronization, remote management capabilities, and automatic updates, which are crucial for the dynamic nature of self-storage operations. This has led to an estimated 80% market share for cloud-based software in 2025, with a projected increase to over 90% by 2033.

Within the Size of Enterprise segmentation, both Small and Medium and Large enterprises are significant contributors, though their adoption patterns and needs differ. Small and medium-sized enterprises often prioritize affordability, ease of use, and comprehensive features that can automate core tasks and reduce administrative burden. Their adoption is a critical driver of market penetration. Large enterprises, on the other hand, demand highly scalable, customizable solutions with advanced analytics, robust integration capabilities with other enterprise systems, and sophisticated security features to manage vast portfolios of facilities. The increasing complexity of managing large self-storage portfolios necessitates advanced software solutions, making them a crucial segment for high-value contracts.

Key drivers for this regional and segment dominance include:

- Investment Trends: Significant venture capital and private equity investments in the self-storage sector, encouraging technology adoption.

- Regulatory Support: Favorable business environments and supportive government policies that encourage technological innovation and business growth.

- Consumer Demand: High consumer reliance on self-storage services in North America, leading to increased facility development and a corresponding need for efficient management.

- Technological Infrastructure: Widespread availability of high-speed internet and robust cloud infrastructure across North America.

- Market Penetration of Cloud Services: A mature market already accustomed to cloud-based solutions across various industries, making the transition for self-storage operators smoother.

Self Storage Facility Management Software Industry Product Innovations

Recent product innovations in self-storage facility management software are heavily focused on enhancing automation, tenant experience, and operational efficiency. Leading solutions now incorporate AI-driven dynamic pricing models that adjust rates based on demand and occupancy, maximizing revenue. Advanced online rental portals allow prospective tenants to seamlessly browse available units, reserve them, complete digital contracts, and even upload identification documents, all within a few minutes. Integrations with access control systems provide tenants with keyless entry via mobile apps, while real-time data analytics dashboards empower operators with actionable insights into performance metrics, occupancy trends, and financial health. These innovations are crucial for staying competitive and meeting the evolving demands of both operators and end-users.

Propelling Factors for Self Storage Facility Management Software Industry Growth

The self-storage facility management software industry is experiencing robust growth driven by several key factors. Technological advancements are paramount, with the widespread adoption of cloud computing, mobile accessibility, and AI enabling more efficient and data-driven operations. The increasing demand for self-storage services globally, fueled by urbanization, smaller living spaces, and flexible lifestyle choices, directly translates to a higher need for effective management solutions. Furthermore, economic influences, such as the need for cost optimization and revenue maximization by facility operators, push them towards software that can streamline processes and improve profitability. Regulatory changes that emphasize data security and compliance also encourage the adoption of sophisticated software.

Obstacles in the Self Storage Facility Management Software Industry Market

Despite its growth, the self-storage facility management software market faces several obstacles. High implementation costs can be a barrier for smaller operators, making initial investment in comprehensive software solutions challenging. Resistance to change among some long-standing operators who are accustomed to manual processes can hinder adoption. Cybersecurity concerns and the need for robust data protection remain a significant challenge, requiring continuous investment in security measures. Market saturation in certain developed regions also presents a competitive hurdle, forcing providers to differentiate through advanced features and superior customer support. Supply chain disruptions, while less direct, can impact hardware components if integrated with access control systems.

Future Opportunities in Self Storage Facility Management Software Industry

Emerging opportunities in the self-storage facility management software industry are diverse and promising. The expansion into emerging markets in Asia and Latin America presents significant untapped potential. The development of AI-powered predictive analytics for demand forecasting and personalized marketing campaigns offers new revenue streams. Integrating with the Internet of Things (IoT) for smart facility management, such as environmental monitoring and automated security, will further enhance operational efficiency. The growing trend of flexible and on-demand storage solutions also opens avenues for innovative software features that cater to these evolving consumer needs.

Major Players in the Self Storage Facility Management Software Industry Ecosystem

- DOMICO Software

- Corrigo Incorporated (Jones Lang LaSalle Incorporated)

- Self-Storage Pro Inc

- 6Storag

- E-SoftSys LLC

- U-Haul International Inc

- Storable Group (SiteLink storEDGE and SpareFoot)

- RADical Systems (UK) Ltd

- QuikStor Security & Software

- Syrasoft LLC

Key Developments in Self Storage Facility Management Software Industry Industry

- August 2022: The Storage Group (TSG) integrated its ClickandStor online-rental tool with Self Storage Manager Inc.'s (SSM) cloud-based Enterprise Management Software. This integration allows SSM users to embed ClickandStor into their websites, enabling online unit reservations, ID verification, and electronic lease signing.

- August 2022: PTI Security Systems announced an integration between its StorLogix Cloud access-control software and DoorSwap. This integration aims to simplify daily management tasks, providing anywhere access to data, real-time tenant information synchronization, and instant software enhancements.

Strategic Self Storage Facility Management Software Industry Market Forecast

The strategic forecast for the self-storage facility management software industry is highly positive, driven by ongoing digital transformation and increasing adoption of cloud-based, feature-rich solutions. The market is poised for sustained growth, projected to exceed $4 Billion by 2033. Key growth catalysts include the continued expansion of the self-storage sector globally, the demand for automation and operational efficiency, and the integration of advanced technologies like AI and IoT. Emerging markets and evolving consumer preferences for seamless online experiences will further fuel market penetration and innovation, ensuring significant opportunities for providers and substantial value for facility operators seeking to optimize their businesses.

Self Storage Facility Management Software Industry Segmentation

-

1. Size of Enterprise

- 1.1. Small and Medium

- 1.2. Large

-

2. Type

- 2.1. PC-based

- 2.2. Cloud

Self Storage Facility Management Software Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Self Storage Facility Management Software Industry Regional Market Share

Geographic Coverage of Self Storage Facility Management Software Industry

Self Storage Facility Management Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emergence of cloud-based self-storage software and mobile applications; Increasing Competition in Self-storage Market

- 3.3. Market Restrains

- 3.3.1. The growth in the unused storage prices and dependency on the season; Cyber Security Concerns about Payment Process through Software Apps

- 3.4. Market Trends

- 3.4.1. Cloud-based Self-storage is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Self Storage Facility Management Software Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Size of Enterprise

- 5.1.1. Small and Medium

- 5.1.2. Large

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. PC-based

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Size of Enterprise

- 6. North America Self Storage Facility Management Software Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Size of Enterprise

- 6.1.1. Small and Medium

- 6.1.2. Large

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. PC-based

- 6.2.2. Cloud

- 6.1. Market Analysis, Insights and Forecast - by Size of Enterprise

- 7. Europe Self Storage Facility Management Software Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Size of Enterprise

- 7.1.1. Small and Medium

- 7.1.2. Large

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. PC-based

- 7.2.2. Cloud

- 7.1. Market Analysis, Insights and Forecast - by Size of Enterprise

- 8. Asia Pacific Self Storage Facility Management Software Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Size of Enterprise

- 8.1.1. Small and Medium

- 8.1.2. Large

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. PC-based

- 8.2.2. Cloud

- 8.1. Market Analysis, Insights and Forecast - by Size of Enterprise

- 9. Latin America Self Storage Facility Management Software Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Size of Enterprise

- 9.1.1. Small and Medium

- 9.1.2. Large

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. PC-based

- 9.2.2. Cloud

- 9.1. Market Analysis, Insights and Forecast - by Size of Enterprise

- 10. Middle East and Africa Self Storage Facility Management Software Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Size of Enterprise

- 10.1.1. Small and Medium

- 10.1.2. Large

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. PC-based

- 10.2.2. Cloud

- 10.1. Market Analysis, Insights and Forecast - by Size of Enterprise

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DOMICO Software

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Corrigo Incorporated (Jones Lang LaSalle Incorporated)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Self-Storage Pro Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 6Storag

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 E-SoftSys LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 U-Haul International Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Storable Group (SiteLink storEDGE and SpareFoot)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 RADical Systems (UK) Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 QuikStor Security & Software

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Syrasoft LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 DOMICO Software

List of Figures

- Figure 1: Global Self Storage Facility Management Software Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Self Storage Facility Management Software Industry Revenue (Million), by Size of Enterprise 2025 & 2033

- Figure 3: North America Self Storage Facility Management Software Industry Revenue Share (%), by Size of Enterprise 2025 & 2033

- Figure 4: North America Self Storage Facility Management Software Industry Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Self Storage Facility Management Software Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Self Storage Facility Management Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Self Storage Facility Management Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Self Storage Facility Management Software Industry Revenue (Million), by Size of Enterprise 2025 & 2033

- Figure 9: Europe Self Storage Facility Management Software Industry Revenue Share (%), by Size of Enterprise 2025 & 2033

- Figure 10: Europe Self Storage Facility Management Software Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Self Storage Facility Management Software Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Self Storage Facility Management Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Self Storage Facility Management Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Self Storage Facility Management Software Industry Revenue (Million), by Size of Enterprise 2025 & 2033

- Figure 15: Asia Pacific Self Storage Facility Management Software Industry Revenue Share (%), by Size of Enterprise 2025 & 2033

- Figure 16: Asia Pacific Self Storage Facility Management Software Industry Revenue (Million), by Type 2025 & 2033

- Figure 17: Asia Pacific Self Storage Facility Management Software Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: Asia Pacific Self Storage Facility Management Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Self Storage Facility Management Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Self Storage Facility Management Software Industry Revenue (Million), by Size of Enterprise 2025 & 2033

- Figure 21: Latin America Self Storage Facility Management Software Industry Revenue Share (%), by Size of Enterprise 2025 & 2033

- Figure 22: Latin America Self Storage Facility Management Software Industry Revenue (Million), by Type 2025 & 2033

- Figure 23: Latin America Self Storage Facility Management Software Industry Revenue Share (%), by Type 2025 & 2033

- Figure 24: Latin America Self Storage Facility Management Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Self Storage Facility Management Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Self Storage Facility Management Software Industry Revenue (Million), by Size of Enterprise 2025 & 2033

- Figure 27: Middle East and Africa Self Storage Facility Management Software Industry Revenue Share (%), by Size of Enterprise 2025 & 2033

- Figure 28: Middle East and Africa Self Storage Facility Management Software Industry Revenue (Million), by Type 2025 & 2033

- Figure 29: Middle East and Africa Self Storage Facility Management Software Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Middle East and Africa Self Storage Facility Management Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Self Storage Facility Management Software Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Self Storage Facility Management Software Industry Revenue Million Forecast, by Size of Enterprise 2020 & 2033

- Table 2: Global Self Storage Facility Management Software Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Self Storage Facility Management Software Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Self Storage Facility Management Software Industry Revenue Million Forecast, by Size of Enterprise 2020 & 2033

- Table 5: Global Self Storage Facility Management Software Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Self Storage Facility Management Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Self Storage Facility Management Software Industry Revenue Million Forecast, by Size of Enterprise 2020 & 2033

- Table 8: Global Self Storage Facility Management Software Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 9: Global Self Storage Facility Management Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Self Storage Facility Management Software Industry Revenue Million Forecast, by Size of Enterprise 2020 & 2033

- Table 11: Global Self Storage Facility Management Software Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Self Storage Facility Management Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Self Storage Facility Management Software Industry Revenue Million Forecast, by Size of Enterprise 2020 & 2033

- Table 14: Global Self Storage Facility Management Software Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 15: Global Self Storage Facility Management Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Self Storage Facility Management Software Industry Revenue Million Forecast, by Size of Enterprise 2020 & 2033

- Table 17: Global Self Storage Facility Management Software Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Self Storage Facility Management Software Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Self Storage Facility Management Software Industry?

The projected CAGR is approximately 7.57%.

2. Which companies are prominent players in the Self Storage Facility Management Software Industry?

Key companies in the market include DOMICO Software, Corrigo Incorporated (Jones Lang LaSalle Incorporated), Self-Storage Pro Inc, 6Storag, E-SoftSys LLC, U-Haul International Inc, Storable Group (SiteLink storEDGE and SpareFoot), RADical Systems (UK) Ltd, QuikStor Security & Software, Syrasoft LLC.

3. What are the main segments of the Self Storage Facility Management Software Industry?

The market segments include Size of Enterprise, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Emergence of cloud-based self-storage software and mobile applications; Increasing Competition in Self-storage Market.

6. What are the notable trends driving market growth?

Cloud-based Self-storage is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

The growth in the unused storage prices and dependency on the season; Cyber Security Concerns about Payment Process through Software Apps.

8. Can you provide examples of recent developments in the market?

August 2022 - The Storage Group (TSG), a marketing and technology company serving the self-storage industry, has integrated TSG's ClickandStor online-rental tool with cloud-based Enterprise Management Software from Self Storage Manager Inc. (SSM). Owing to this integration, customers using the SSM product will be able to use ClickandStor as part of their website framework, allowing tenants to reserve units online, verify their IDs, and electronically sign a lease.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Self Storage Facility Management Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Self Storage Facility Management Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Self Storage Facility Management Software Industry?

To stay informed about further developments, trends, and reports in the Self Storage Facility Management Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence