Key Insights

The global accelerometer market, projected to reach $7.92 billion by 2025, is forecasted to expand at a Compound Annual Growth Rate (CAGR) of 9.8%. This robust growth is primarily driven by escalating demand across key sectors including Aerospace & Defense, Automotive, and Consumer Electronics. The widespread integration of accelerometers in Advanced Driver-Assistance Systems (ADAS), autonomous vehicles, and critical navigation and control systems for aerospace and defense applications are significant growth catalysts. Concurrently, the burgeoning consumer electronics market, with its demand for smart wearables, gaming consoles, and advanced home appliances, further solidifies market vitality. The increasing adoption of MEMS accelerometers, valued for their compact design, low power consumption, and cost-efficiency, is accelerating market penetration and fostering innovation.

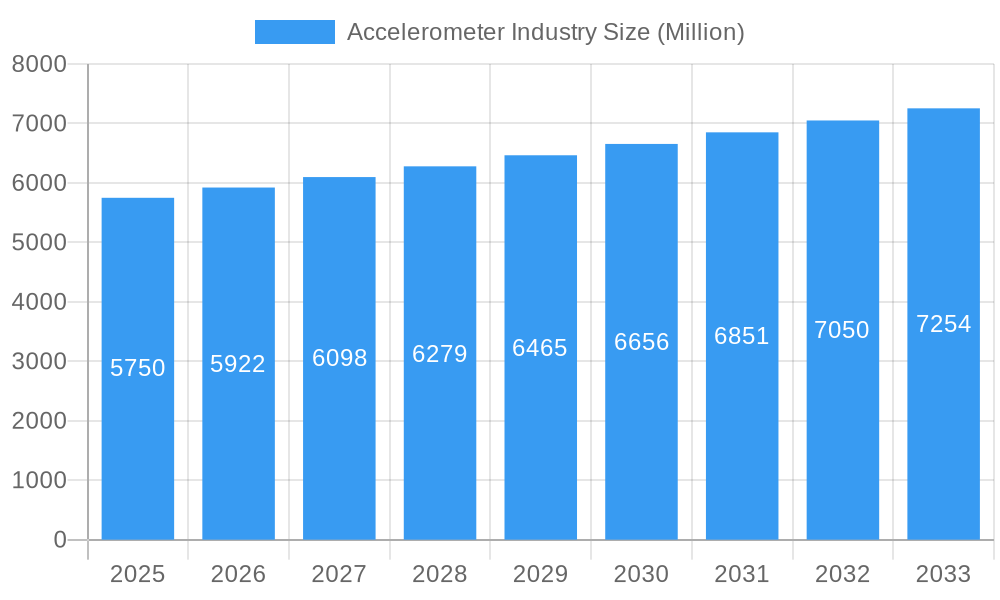

Accelerometer Industry Market Size (In Billion)

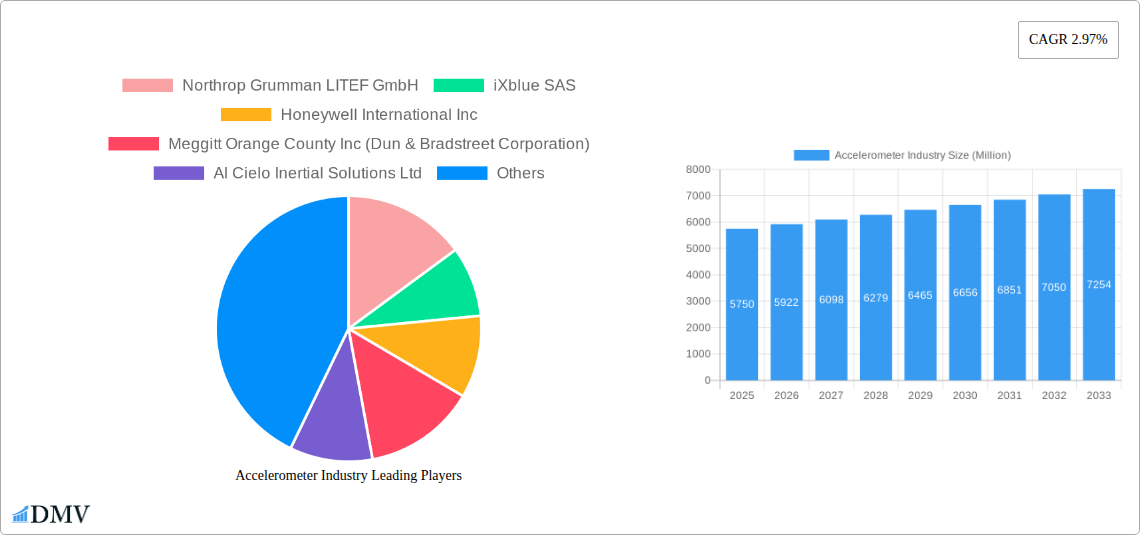

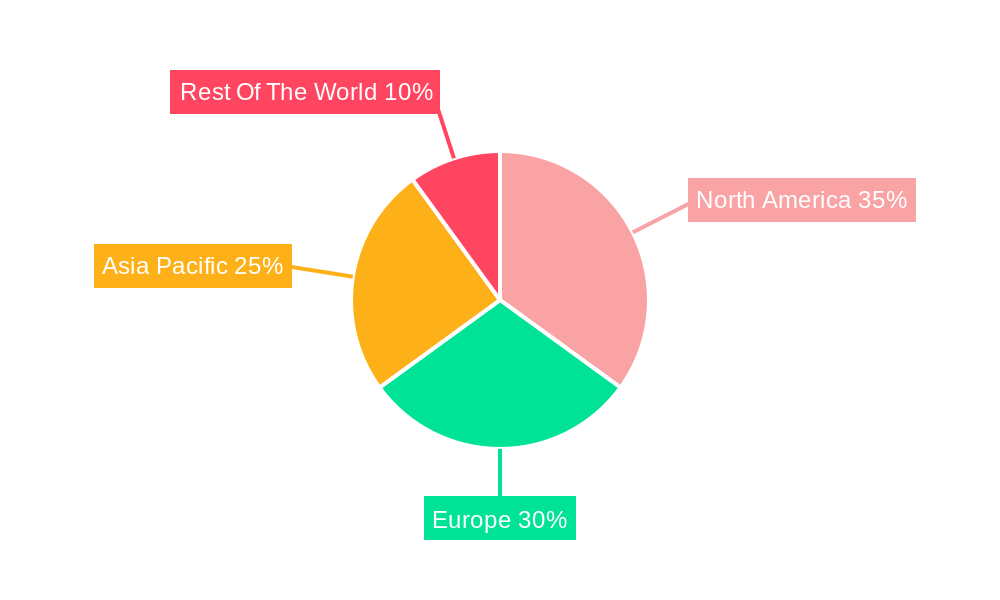

The competitive environment features both established industry leaders and agile innovators such as Honeywell International Inc., Robert Bosch GmbH, and STMicroelectronics, alongside specialized entities like iXblue SAS and Silicon Sensing Systems Limited. These key players are actively investing in research and development to improve accelerometer performance, accuracy, and miniaturization, thereby addressing sophisticated application requirements. Geographically, North America and Europe are expected to retain substantial market shares, supported by advanced technology adoption and a strong presence of major manufacturers. The Asia Pacific region, however, is poised for the most rapid expansion, fueled by expanding manufacturing capabilities, increasing automotive production, and the swift growth of the consumer electronics sector in nations like China and India. Potential market growth may be tempered by factors such as the significant investment required for advanced sensor development and rigorous quality assurance mandates for critical applications.

Accelerometer Industry Company Market Share

Accelerometer Industry Market Composition & Trends

The global Accelerometer Industry is characterized by a moderate market concentration, driven by intense innovation and a sophisticated regulatory landscape. Key players like Honeywell International Inc, STMicroelectronics, and Analog Devices Inc command significant market share, estimated at over 50% collectively. The industry's evolution is spurred by continuous technological advancements in MEMS (Micro-Electro-Mechanical Systems) and advanced sensor integration, creating new application frontiers. Substitute products, while present, often fall short of the precision and reliability offered by dedicated accelerometers, particularly in high-stakes applications. End-user profiles are diverse, with Aerospace and Defense and Industrial sectors exhibiting the highest demand due to stringent performance requirements. Consumer Electronics, while a large volume market, often seeks more cost-effective solutions. Mergers and Acquisitions (M&A) are a vital component of market dynamics, with strategic acquisitions aimed at consolidating market presence and acquiring cutting-edge technologies. For instance, recent M&A activities have seen deal values in the range of hundreds of millions, significantly impacting competitive positioning. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 8.5% from the base year of 2025 to 2033, with a projected market size of over $7 Billion by the end of the forecast period.

Accelerometer Industry Industry Evolution

The Accelerometer Industry has witnessed a remarkable evolution, driven by relentless technological innovation and an ever-expanding array of applications. From its early days, the industry has transitioned from bulky, less precise mechanical devices to highly integrated, miniaturized MEMS accelerometers that offer unparalleled performance and cost-effectiveness. The study period, spanning from 2019 to 2033, with a base year of 2025, encapsulates this dynamic growth trajectory. Over the historical period (2019-2024), the market experienced a steady upward trend, fueled by the increasing adoption of accelerometers in consumer electronics, such as smartphones and wearable devices. This demand surge alone accounted for an estimated 30% of the overall market growth. The forecast period (2025-2033) is expected to see an accelerated growth rate, projected at a CAGR of 8.5%, pushing the market value to an estimated $7.2 Billion by 2033. This expansion is largely attributed to breakthroughs in sensor fusion, AI integration, and the development of ultra-low-power accelerometers, making them viable for an even wider range of applications. The increasing sophistication of industrial automation, the growing demand for advanced driver-assistance systems (ADAS) in the automotive sector, and the stringent requirements of the aerospace and defense industries are all significant contributors to this sustained growth. Furthermore, the development of specialized accelerometers for medical devices and the Internet of Things (IoT) continues to open new avenues for market penetration and revenue generation. Adoption metrics for high-performance accelerometers in specialized industrial applications have seen an increase of approximately 15% annually over the last two years.

Leading Regions, Countries, or Segments in Accelerometer Industry

The Aerospace and Defense end-user segment stands out as a dominant force within the global Accelerometer Industry, consistently driving demand for high-precision, reliable, and robust sensing solutions. This dominance is underpinned by several critical factors:

- Stringent Performance Requirements: The inherent nature of aerospace and defense operations necessitates accelerometers capable of withstanding extreme conditions, including high G-forces, vibration, and temperature fluctuations. This translates into a continuous demand for advanced inertial measurement units (IMUs) and navigation systems, where accelerometers are a foundational component. Investments in next-generation aircraft, satellites, and defense systems directly correlate with the demand for these specialized sensors.

- Navigational Accuracy and Stability: In applications ranging from missile guidance systems and aircraft navigation to satellite attitude control, the accuracy and long-term stability of accelerometers are paramount. The need for precise positioning and orientation in these critical missions fuels continuous research and development, leading to higher average selling prices for accelerometers in this segment.

- Regulatory Support and National Security: Government initiatives and defense spending globally create a stable and growing market for aerospace and defense technologies. Countries with robust defense industries, such as the United States, are major consumers of advanced inertial sensors. The emphasis on indigenous manufacturing and technological sovereignty further bolsters the demand for domestically developed or secured accelerometer solutions.

- Long Product Lifecycles and Upgrades: While the initial purchase volume might be lower than consumer electronics, the long operational lifecycles of aerospace and defense platforms necessitate ongoing maintenance, upgrades, and replacements of critical components. This ensures a sustained revenue stream for accelerometer manufacturers catering to this sector.

Following closely, the Industrial segment also exhibits significant growth, propelled by the rise of Industry 4.0 and the pervasive adoption of automation, robotics, and predictive maintenance. The integration of accelerometers in industrial machinery for vibration monitoring, condition-based maintenance, and process control is a key driver. The Automotive sector is also a rapidly expanding market, particularly with the proliferation of ADAS, autonomous driving technologies, and electric vehicles, all of which rely on precise motion sensing. Consumer Electronics, while a massive volume market, often has lower average selling prices, impacting its overall dominance in terms of revenue compared to the specialized, high-value aerospace and defense applications. The Other End Users category, encompassing medical devices, scientific instrumentation, and energy exploration, also contributes steadily to market diversification and growth.

Accelerometer Industry Product Innovations

Recent product innovations in the Accelerometer Industry are revolutionizing capabilities. High-sensitivity, low-noise MEMS accelerometers with integrated signal processing are enabling unprecedented accuracy in inertial navigation and motion tracking. Advancements in temperature compensation and bias stability are critical for demanding applications like autonomous vehicles and drone navigation. The development of ruggedized and radiation-hardened accelerometers ensures reliability in extreme environments, from deep-sea exploration to space missions. Furthermore, the integration of artificial intelligence (AI) algorithms within accelerometer modules is enabling intelligent data interpretation for predictive maintenance and gesture recognition, offering unique selling propositions for manufacturers.

Propelling Factors for Accelerometer Industry Growth

Several key factors are propelling the growth of the Accelerometer Industry. The escalating demand for sophisticated navigation and guidance systems in Aerospace and Defense applications, driven by advancements in aircraft, drones, and satellite technology, is a primary driver. The rapid expansion of the Automotive sector, particularly with the proliferation of Advanced Driver-Assistance Systems (ADAS) and the push towards autonomous driving, necessitates high-performance accelerometers for precise motion sensing. Furthermore, the ongoing digitalization of industries and the rise of Industry 4.0 are fueling the adoption of accelerometers for condition monitoring, predictive maintenance, and robotics in the Industrial sector. The miniaturization and cost reduction of MEMS accelerometers have also made them integral to a wide range of Consumer Electronics, including smartphones, wearables, and gaming devices, further broadening market penetration.

Obstacles in the Accelerometer Industry Market

Despite robust growth, the Accelerometer Industry faces several obstacles. Intense price competition, particularly in the high-volume consumer electronics segment, can squeeze profit margins for manufacturers. Supply chain disruptions, exacerbated by geopolitical factors and the reliance on specific raw materials and advanced manufacturing capabilities, pose a persistent challenge. Furthermore, stringent regulatory requirements and the need for extensive certification processes in sectors like aerospace and automotive can lengthen product development cycles and increase costs. The rapid pace of technological change also requires continuous investment in R&D to stay competitive, which can be a barrier for smaller players.

Future Opportunities in Accelerometer Industry

Emerging opportunities in the Accelerometer Industry are abundant and diverse. The burgeoning market for wearable health monitoring devices presents a significant avenue for low-power, highly accurate accelerometers. The continued development of autonomous systems across various sectors, including logistics, agriculture, and security, will drive demand for advanced inertial sensing. The increasing adoption of smart city infrastructure and the expansion of the Internet of Things (IoT) will create new applications for accelerometers in environmental monitoring, structural health assessment, and asset tracking. Furthermore, advancements in quantum sensing and novel materials hold the potential to unlock entirely new performance benchmarks and applications in the long term.

Major Players in the Accelerometer Industry Ecosystem

- Northrop Grumman

- LITEF GmbH

- iXblue SAS

- Honeywell International Inc

- Meggitt Orange County Inc

- Al Cielo Inertial Solutions Ltd

- Atlantic inertial systems Ltd

- STMicroelectronics

- Silicon Sensing Systems Limited

- Robert Bosch GmbH

- Rockwell Automation Inc

- InvenSense

- Analog Devices Inc

- Kearfott Corporation

Key Developments in Accelerometer Industry Industry

- 2023/06: STMicroelectronics launched a new generation of ultra-low-power accelerometers for IoT applications, significantly extending battery life.

- 2023/04: Analog Devices acquired a leading MEMS accelerometer developer, bolstering its inertial sensing portfolio for automotive and industrial markets.

- 2022/11: Honeywell International Inc announced a new inertial navigation system for commercial aircraft featuring enhanced accelerometer accuracy and reliability.

- 2022/07: Silicon Sensing Systems Limited introduced a compact, high-performance accelerometer for drone stabilization and navigation.

- 2021/12: iXblue SAS secured a major contract for inertial navigation systems for a new class of naval vessels, highlighting defense sector demand.

- 2021/09: Robert Bosch GmbH expanded its automotive accelerometer offerings with enhanced vibration sensing capabilities for EV battery management.

- 2020/05: InvenSense (TDK Group company) released an advanced motion tracking module with integrated accelerometers for consumer electronics and AR/VR applications.

- 2020/01: Northrop Grumman demonstrated a new inertial measurement unit with significantly improved drift characteristics for aerospace applications.

Strategic Accelerometer Industry Market Forecast

The strategic Accelerometer Industry market forecast indicates a robust and sustained growth trajectory. The integration of accelerometers into the expanding ecosystems of Aerospace and Defense, Industrial Automation, and Automotive ADAS will continue to be primary growth catalysts. The increasing adoption of IoT devices and the demand for advanced motion sensing in Consumer Electronics will further fuel market expansion. Future opportunities lie in developing specialized accelerometers for emerging applications like personalized health monitoring and advanced robotics. Continued innovation in MEMS technology, coupled with AI integration, will unlock new levels of performance and market penetration, ensuring a promising outlook for the industry with a projected market size exceeding $7 Billion by 2033.

Accelerometer Industry Segmentation

-

1. End User

- 1.1. Aerospace and Defense

- 1.2. Industrial

- 1.3. Consumer Electronics

- 1.4. Automotive

- 1.5. Other End users

Accelerometer Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Rest Of The World

Accelerometer Industry Regional Market Share

Geographic Coverage of Accelerometer Industry

Accelerometer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Emergence of the MEMS Technology; Increasing Demand from Consumer Electronics; Developing Aerospace and Defense Sector (High-end Accelerometers)

- 3.3. Market Restrains

- 3.3.1. ; Costs and Complexity Concerns

- 3.4. Market Trends

- 3.4.1. Aerospace and Defense Industry to Account for a Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Accelerometer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Aerospace and Defense

- 5.1.2. Industrial

- 5.1.3. Consumer Electronics

- 5.1.4. Automotive

- 5.1.5. Other End users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest Of The World

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Accelerometer Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Aerospace and Defense

- 6.1.2. Industrial

- 6.1.3. Consumer Electronics

- 6.1.4. Automotive

- 6.1.5. Other End users

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe Accelerometer Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Aerospace and Defense

- 7.1.2. Industrial

- 7.1.3. Consumer Electronics

- 7.1.4. Automotive

- 7.1.5. Other End users

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific Accelerometer Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Aerospace and Defense

- 8.1.2. Industrial

- 8.1.3. Consumer Electronics

- 8.1.4. Automotive

- 8.1.5. Other End users

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Rest Of The World Accelerometer Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Aerospace and Defense

- 9.1.2. Industrial

- 9.1.3. Consumer Electronics

- 9.1.4. Automotive

- 9.1.5. Other End users

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Northrop Grumman LITEF GmbH

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 iXblue SAS

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Honeywell International Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Meggitt Orange County Inc (Dun & Bradstreet Corporation)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Al Cielo Inertial Solutions Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Atlantic inertial systems Ltd(AIS Global Holdings LLC)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 STMicroelectronics

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Silicon Sensing Systems Limited(Collins Aerospace and Sumitomo Precision Products)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Robert Bosch GmbH

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Rockwell Automation Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 InvenSense (TDK Group company)

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Analog Devices Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Kearfott Corporation(Astronautics Corporation of America)

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Northrop Grumman LITEF GmbH

List of Figures

- Figure 1: Global Accelerometer Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Accelerometer Industry Volume Breakdown (metres per second, %) by Region 2025 & 2033

- Figure 3: North America Accelerometer Industry Revenue (billion), by End User 2025 & 2033

- Figure 4: North America Accelerometer Industry Volume (metres per second), by End User 2025 & 2033

- Figure 5: North America Accelerometer Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Accelerometer Industry Volume Share (%), by End User 2025 & 2033

- Figure 7: North America Accelerometer Industry Revenue (billion), by Country 2025 & 2033

- Figure 8: North America Accelerometer Industry Volume (metres per second), by Country 2025 & 2033

- Figure 9: North America Accelerometer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Accelerometer Industry Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Accelerometer Industry Revenue (billion), by End User 2025 & 2033

- Figure 12: Europe Accelerometer Industry Volume (metres per second), by End User 2025 & 2033

- Figure 13: Europe Accelerometer Industry Revenue Share (%), by End User 2025 & 2033

- Figure 14: Europe Accelerometer Industry Volume Share (%), by End User 2025 & 2033

- Figure 15: Europe Accelerometer Industry Revenue (billion), by Country 2025 & 2033

- Figure 16: Europe Accelerometer Industry Volume (metres per second), by Country 2025 & 2033

- Figure 17: Europe Accelerometer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Accelerometer Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Accelerometer Industry Revenue (billion), by End User 2025 & 2033

- Figure 20: Asia Pacific Accelerometer Industry Volume (metres per second), by End User 2025 & 2033

- Figure 21: Asia Pacific Accelerometer Industry Revenue Share (%), by End User 2025 & 2033

- Figure 22: Asia Pacific Accelerometer Industry Volume Share (%), by End User 2025 & 2033

- Figure 23: Asia Pacific Accelerometer Industry Revenue (billion), by Country 2025 & 2033

- Figure 24: Asia Pacific Accelerometer Industry Volume (metres per second), by Country 2025 & 2033

- Figure 25: Asia Pacific Accelerometer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Accelerometer Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Rest Of The World Accelerometer Industry Revenue (billion), by End User 2025 & 2033

- Figure 28: Rest Of The World Accelerometer Industry Volume (metres per second), by End User 2025 & 2033

- Figure 29: Rest Of The World Accelerometer Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Rest Of The World Accelerometer Industry Volume Share (%), by End User 2025 & 2033

- Figure 31: Rest Of The World Accelerometer Industry Revenue (billion), by Country 2025 & 2033

- Figure 32: Rest Of The World Accelerometer Industry Volume (metres per second), by Country 2025 & 2033

- Figure 33: Rest Of The World Accelerometer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest Of The World Accelerometer Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Accelerometer Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 2: Global Accelerometer Industry Volume metres per second Forecast, by End User 2020 & 2033

- Table 3: Global Accelerometer Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Accelerometer Industry Volume metres per second Forecast, by Region 2020 & 2033

- Table 5: Global Accelerometer Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global Accelerometer Industry Volume metres per second Forecast, by End User 2020 & 2033

- Table 7: Global Accelerometer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Global Accelerometer Industry Volume metres per second Forecast, by Country 2020 & 2033

- Table 9: United States Accelerometer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United States Accelerometer Industry Volume (metres per second) Forecast, by Application 2020 & 2033

- Table 11: Canada Accelerometer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada Accelerometer Industry Volume (metres per second) Forecast, by Application 2020 & 2033

- Table 13: Global Accelerometer Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 14: Global Accelerometer Industry Volume metres per second Forecast, by End User 2020 & 2033

- Table 15: Global Accelerometer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Accelerometer Industry Volume metres per second Forecast, by Country 2020 & 2033

- Table 17: Germany Accelerometer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Germany Accelerometer Industry Volume (metres per second) Forecast, by Application 2020 & 2033

- Table 19: United Kingdom Accelerometer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom Accelerometer Industry Volume (metres per second) Forecast, by Application 2020 & 2033

- Table 21: France Accelerometer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: France Accelerometer Industry Volume (metres per second) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Accelerometer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Europe Accelerometer Industry Volume (metres per second) Forecast, by Application 2020 & 2033

- Table 25: Global Accelerometer Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 26: Global Accelerometer Industry Volume metres per second Forecast, by End User 2020 & 2033

- Table 27: Global Accelerometer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Global Accelerometer Industry Volume metres per second Forecast, by Country 2020 & 2033

- Table 29: China Accelerometer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: China Accelerometer Industry Volume (metres per second) Forecast, by Application 2020 & 2033

- Table 31: Japan Accelerometer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Japan Accelerometer Industry Volume (metres per second) Forecast, by Application 2020 & 2033

- Table 33: India Accelerometer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: India Accelerometer Industry Volume (metres per second) Forecast, by Application 2020 & 2033

- Table 35: South Korea Accelerometer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: South Korea Accelerometer Industry Volume (metres per second) Forecast, by Application 2020 & 2033

- Table 37: Rest of Asia Pacific Accelerometer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of Asia Pacific Accelerometer Industry Volume (metres per second) Forecast, by Application 2020 & 2033

- Table 39: Global Accelerometer Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 40: Global Accelerometer Industry Volume metres per second Forecast, by End User 2020 & 2033

- Table 41: Global Accelerometer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Global Accelerometer Industry Volume metres per second Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Accelerometer Industry?

The projected CAGR is approximately 9.8%.

2. Which companies are prominent players in the Accelerometer Industry?

Key companies in the market include Northrop Grumman LITEF GmbH, iXblue SAS, Honeywell International Inc, Meggitt Orange County Inc (Dun & Bradstreet Corporation), Al Cielo Inertial Solutions Ltd, Atlantic inertial systems Ltd(AIS Global Holdings LLC), STMicroelectronics, Silicon Sensing Systems Limited(Collins Aerospace and Sumitomo Precision Products), Robert Bosch GmbH, Rockwell Automation Inc, InvenSense (TDK Group company), Analog Devices Inc, Kearfott Corporation(Astronautics Corporation of America).

3. What are the main segments of the Accelerometer Industry?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.92 billion as of 2022.

5. What are some drivers contributing to market growth?

; Emergence of the MEMS Technology; Increasing Demand from Consumer Electronics; Developing Aerospace and Defense Sector (High-end Accelerometers).

6. What are the notable trends driving market growth?

Aerospace and Defense Industry to Account for a Significant Share in the Market.

7. Are there any restraints impacting market growth?

; Costs and Complexity Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in metres per second.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Accelerometer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Accelerometer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Accelerometer Industry?

To stay informed about further developments, trends, and reports in the Accelerometer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence