Key Insights

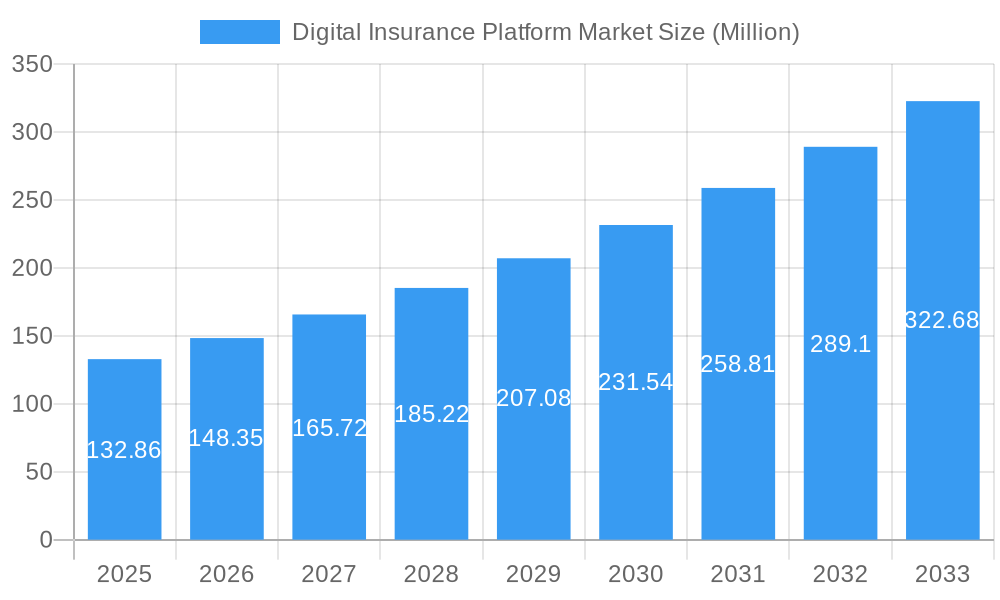

The Digital Insurance Platform Market is experiencing robust growth, projected to reach an impressive USD 132.86 million by 2025. This expansion is fueled by a significant Compound Annual Growth Rate (CAGR) of 11.51%, indicating a dynamic and evolving landscape. Key drivers of this growth include the escalating demand for personalized insurance products, the imperative for enhanced customer experience, and the transformative impact of emerging technologies such as Artificial Intelligence (AI), Machine Learning (ML), and blockchain. Insurers are increasingly adopting digital platforms to streamline operations, automate claims processing, improve underwriting accuracy, and offer seamless omnichannel experiences. This shift is critical for insurers seeking to remain competitive in an industry rapidly reshaped by digital innovation and evolving consumer expectations. The market's trajectory suggests a sustained period of high investment and strategic development as companies prioritize digital transformation to meet these demands.

Digital Insurance Platform Market Market Size (In Million)

The market segmentation reveals a strong leaning towards cloud-based deployments, offering scalability, flexibility, and cost-efficiency to organizations of all sizes. Large enterprises are spearheading adoption, leveraging these platforms to manage complex operations and gain a competitive edge, while Small and Medium Enterprises (SMEs) are increasingly recognizing the value proposition for modernizing their insurance services. The application landscape is diverse, with significant penetration expected in Automotive and Transportation, Life and Health, and Business and Enterprise segments, driven by the need for sophisticated risk management and customer engagement. Emerging applications in Consumer Electronics and Industrial Machines, alongside the Travel sector, highlight the pervasive influence of digital insurance solutions across a broad spectrum of industries. Leading companies like Appian Corporation, IBM Corporation, Microsoft Corporation, and Oracle Corporation are at the forefront of this transformation, offering innovative solutions that are shaping the future of insurance.

Digital Insurance Platform Market Company Market Share

This comprehensive market research report delves into the dynamic Digital Insurance Platform Market, providing an in-depth analysis of its current state, growth trajectories, and future potential. With a study period spanning 2019–2033, this report offers invaluable insights for stakeholders seeking to navigate the evolving insurance technology sector. The digital insurance platform market size is projected to witness significant expansion, driven by increasing adoption of insurtech solutions and a growing demand for enhanced customer experiences.

Digital Insurance Platform Market Market Composition & Trends

The Digital Insurance Platform Market is characterized by a moderate concentration of leading players alongside a robust influx of innovative startups. Innovation catalysts abound, fueled by the urgent need for insurers to embrace digital transformation and meet evolving consumer expectations. The regulatory landscape, while evolving, presents both opportunities and challenges for insurance software providers. Substitute products, such as traditional underwriting methods, are rapidly being replaced by more efficient digital insurance solutions. End-user profiles range from digitally savvy millennials seeking seamless policy management to large enterprises requiring sophisticated core insurance systems. Mergers and acquisitions (M&A) are significant, with recent deals valued in the hundreds of millions to billions of dollars, consolidating market share and fostering technological advancements. For instance, strategic acquisitions by major technology firms are reshaping the competitive landscape. The market share distribution indicates a growing dominance of cloud-based platforms.

- Market Share Distribution: Leading players hold approximately 60% of the market, with emerging companies rapidly gaining traction.

- M&A Deal Values: Average deal values have ranged from $50 Million to over $1,000 Million in strategic acquisitions.

- Innovation Catalysts: AI-powered underwriting, blockchain for claims processing, and API integrations for seamless data exchange.

- Regulatory Impact: GDPR, CCPA, and evolving insurtech regulations are shaping platform development and data privacy.

Digital Insurance Platform Market Industry Evolution

The Digital Insurance Platform Market has undergone a dramatic evolution over the historical period of 2019–2024, driven by a confluence of technological advancements and a paradigm shift in consumer behavior. Initially, the market was characterized by incremental digital enhancements to legacy systems. However, the COVID-19 pandemic acted as a significant accelerant, forcing insurers to rapidly adopt online insurance platforms and digital insurance solutions to maintain business continuity and serve customers remotely. This period witnessed a surge in the adoption of cloud-based infrastructure, enabling greater scalability, flexibility, and cost-efficiency. The growth trajectory has been impressive, with a Compound Annual Growth Rate (CAGR) projected to exceed 15% through the forecast period of 2025–2033.

Technological advancements have been pivotal. The integration of Artificial Intelligence (AI) and Machine Learning (ML) has revolutionized underwriting, claims processing, and personalized customer engagement. Insurers are leveraging AI for fraud detection, risk assessment, and automated claims adjudication, leading to faster resolution times and reduced operational costs. The rise of APIs has facilitated seamless integration between insurers, intermediaries, and third-party service providers, creating a more connected and efficient insurance ecosystem. Furthermore, the proliferation of mobile devices and the increasing comfort of consumers with digital interactions have spurred the demand for intuitive and user-friendly digital insurance portals. Customer demands have shifted from transactional interactions to personalized, proactive, and omnichannel experiences. Policyholders now expect instant access to policy information, self-service capabilities, and tailored product recommendations, all delivered through digital channels. This evolving customer expectation is a primary driver for the continuous innovation and investment in digital insurance platform development. The market is moving beyond basic policy administration to comprehensive customer lifecycle management, encompassing sales, service, claims, and renewal. The estimated market size for 2025 stands at approximately $25,000 Million.

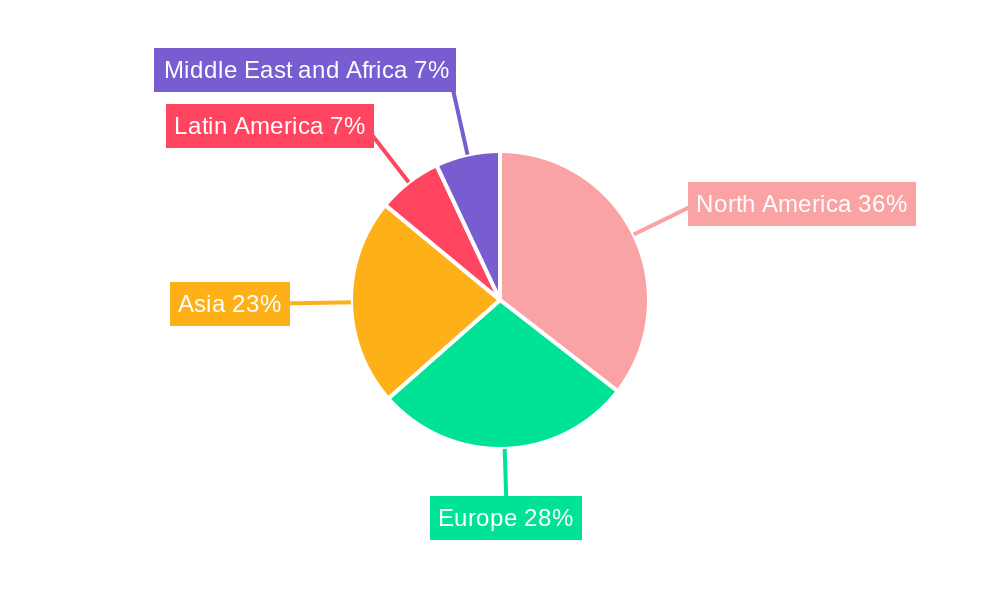

Leading Regions, Countries, or Segments in Digital Insurance Platform Market

The dominance within the Digital Insurance Platform Market is multifaceted, with several regions, countries, and segments showcasing significant growth and adoption.

Deployment:

- Cloud: The cloud insurance platform segment is experiencing explosive growth, driven by its scalability, cost-effectiveness, and agility.

- Key Drivers: Reduced IT infrastructure costs, faster deployment times, enhanced data security, and accessibility from anywhere.

- Dominance Factors: Major cloud providers like AWS, Azure, and Google Cloud are enabling insurers to migrate their operations, fostering innovation and competition. The ability to scale resources up or down based on demand makes cloud deployment an attractive option for both startups and established players.

- On-premise: While still present, the on-premise deployment segment is seeing a gradual decline as organizations prioritize the benefits of cloud solutions.

Organization Size:

- Large Enterprises: These organizations are the primary adopters of sophisticated digital insurance platforms due to their extensive customer bases and complex operational needs.

- Key Drivers: Need for robust core insurance systems, advanced analytics for risk management, compliance with stringent regulations, and integration capabilities with existing enterprise systems.

- Dominance Factors: Large enterprises have the financial resources and strategic vision to invest heavily in digital transformation, often leading multi-year implementation projects. They benefit significantly from improved efficiency, reduced operational costs, and enhanced customer retention.

- Small and Medium Enterprises (SMEs): SMEs are increasingly adopting scalable and cost-effective digital insurance solutions to compete with larger players.

Application:

- Life and Health: This segment is a major driver of digital insurance platform adoption, with a strong focus on personalized offerings, simplified application processes, and enhanced customer engagement.

- Key Drivers: Growing demand for health and life insurance, increasing awareness of financial planning, and the ability of digital platforms to streamline complex policy underwriting and claims.

- Dominance Factors: The inherent complexity of life and health insurance products, coupled with the need for efficient data management and regulatory compliance, makes digital platforms indispensable. Innovations in telemedicine and health data integration further bolster this segment.

- Automotive and Transportation: Rapid advancements in connected vehicles and autonomous driving are creating new opportunities and challenges for digital insurance platforms in this sector.

- Home and Commercial Buildings: Digital platforms are transforming the way property insurance is managed, offering streamlined quoting, policy management, and claims processing.

- Business and Enterprise: This broad category encompasses various commercial insurance lines where digital platforms are enhancing efficiency and risk management.

- Consumer Electronics and Industrial Machines: Emerging insurance models for these products are being facilitated by digital platforms.

- Travel: Digital platforms are enhancing the booking and management of travel insurance, offering convenience to consumers.

The United States, followed by Europe, currently leads the Digital Insurance Platform Market, driven by a mature insurance industry, strong technological infrastructure, and supportive regulatory frameworks.

Digital Insurance Platform Market Product Innovations

Product innovations in the Digital Insurance Platform Market are centered on enhancing user experience, automating processes, and leveraging advanced technologies. Key innovations include AI-powered underwriting engines that provide instant risk assessments, blockchain-based solutions for secure and transparent claims processing, and robust API marketplaces that enable seamless integration with third-party services. Furthermore, platforms are offering enhanced customer self-service portals with personalized dashboards, virtual assistants for policy inquiries, and simplified claim submission processes. Performance metrics are being redefined by faster policy issuance times (often within minutes), reduced claims processing cycles (cut by up to 50%), and significant improvements in customer satisfaction scores. Unique selling propositions now include end-to-end digital journeys from quote to claim, predictive analytics for proactive risk mitigation, and the ability to offer highly customized insurance products. The focus is on creating a truly frictionless and engaging experience for both policyholders and insurance providers.

Propelling Factors for Digital Insurance Platform Market Growth

Several key factors are propelling the growth of the Digital Insurance Platform Market. The relentless demand for enhanced customer experiences, driven by consumer expectations shaped by other digital industries, is a primary catalyst. Technological advancements, including the widespread adoption of Artificial Intelligence (AI), Machine Learning (ML), and Big Data analytics, are enabling insurers to offer more personalized products, streamline operations, and improve risk assessment. The increasing penetration of smartphones and the growing comfort of consumers with digital interactions are facilitating the adoption of online insurance platforms. Furthermore, regulatory reforms and government initiatives promoting digital adoption in the financial sector are creating a more favorable environment for insurtech solutions. Economic factors, such as the growing global middle class and rising disposable incomes, are increasing the demand for insurance products, further driving the need for efficient digital platforms to manage this growth.

Obstacles in the Digital Insurance Platform Market Market

Despite the robust growth, the Digital Insurance Platform Market faces several obstacles. Regulatory hurdles and compliance complexities remain a significant challenge, as insurers must navigate diverse and evolving data privacy laws and industry-specific regulations across different jurisdictions. Cybersecurity threats and data breaches pose a constant risk, necessitating substantial investments in security infrastructure and protocols, impacting the overall cost of digital solutions. The significant upfront investment required for implementing new digital platforms and the resistance to change within traditional insurance organizations can slow down adoption rates. Moreover, integrating new digital platforms with legacy IT systems, which are often complex and outdated, presents substantial technical challenges. Finally, the shortage of skilled talent in areas such as AI, data science, and cybersecurity within the insurance industry can hinder the effective development and deployment of digital solutions.

Future Opportunities in Digital Insurance Platform Market

The Digital Insurance Platform Market is ripe with future opportunities. The expanding Insurtech ecosystem offers immense potential for partnerships and collaborations, enabling a broader range of specialized services and innovative product offerings. The increasing adoption of IoT devices and telematics data provides insurers with unprecedented insights for dynamic pricing and personalized risk management, particularly in the automotive and property insurance sectors. Emerging markets in Asia, Africa, and Latin America, with their growing middle classes and increasing insurance penetration, represent significant untapped potential for digital insurance solutions. The development of embedded insurance models, where insurance is seamlessly integrated into other purchasing journeys (e.g., buying a car or booking a flight), is another lucrative opportunity. Furthermore, the growing demand for parametric insurance, which pays out automatically based on predefined triggers like weather events, will be greatly facilitated by advanced digital platforms.

Major Players in the Digital Insurance Platform Market Ecosystem

- Appian Corporation

- IBM Corporation

- EIS Software Limited

- Microsoft Corporation

- Majesco

- Pegasystems Inc

- DXC Technology Company

- Prima Solutions SA

- Oracle Corporation

- Mindtree Ltd

Key Developments in Digital Insurance Platform Market Industry

- August 2022: USAA Life announced a partnership with Human API, a health data platform, to further digitize the life insurance buying process. USAA will get access to its members' digital health data using Human API's Health Intelligence Platform, which consists of a patient portal network and HIPAA-authorized networks, to enhance the user experience and streamline and speed up the purchasing process.

- April 2022: To assist insurance businesses with their digital transformation, Mindtree, a provider of technology services, has teamed up with Sapiens International Corporation. This company develops software solutions for the banking and insurance sectors. Insurance firms will be able to boost scalability, speed-to-market, and customer happiness thanks to the partnership between Sapiens and Mindtree and their advanced, cloud-native core suite of banking and insurance apps.

Strategic Digital Insurance Platform Market Market Forecast

The strategic Digital Insurance Platform Market forecast indicates sustained and robust growth, driven by the continued imperative for insurers to enhance efficiency, improve customer engagement, and adapt to a rapidly changing technological landscape. The market's expansion will be fueled by ongoing investments in AI and machine learning for advanced analytics, underwriting, and claims automation, leading to significant operational cost reductions and faster service delivery. The shift towards cloud-native architectures will continue to enable greater scalability and agility, allowing insurers to respond quickly to market demands and introduce new products more effectively. The increasing adoption of IoT and telematics data will unlock new avenues for personalized pricing and risk mitigation strategies. Furthermore, the growing demand for embedded insurance and seamless digital customer journeys will necessitate deeper integrations and API-driven ecosystems. The market potential is estimated to reach over $60,000 Million by 2033, with a projected CAGR of approximately 15%.

Digital Insurance Platform Market Segmentation

-

1. Deployment

- 1.1. Cloud

- 1.2. On-premise

-

2. Organization Size

- 2.1. Large Enterprises

- 2.2. Small and Medium Enterprises

-

3. Application

- 3.1. Automotive and Transportation

- 3.2. Home and Commercial Buildings

- 3.3. Life and Health

- 3.4. Business and Enterprise

- 3.5. Consumer Electronics and Industrial Machines

- 3.6. Travel

Digital Insurance Platform Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia and New Zealand

- 4. Latin America

- 5. Middle East and Africa

Digital Insurance Platform Market Regional Market Share

Geographic Coverage of Digital Insurance Platform Market

Digital Insurance Platform Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.51% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Shift of Insurance Companies From Product Based to Customer-centric Strategies; Increased Awareness Among Insurers About Digital Channels; Growing Cloud Adoption

- 3.3. Market Restrains

- 3.3.1. Difficulty Regarding Integration of Insurance Platform with Legacy Systems

- 3.4. Market Trends

- 3.4.1. Growing Cloud Adoption is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Insurance Platform Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. Cloud

- 5.1.2. On-premise

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Large Enterprises

- 5.2.2. Small and Medium Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Automotive and Transportation

- 5.3.2. Home and Commercial Buildings

- 5.3.3. Life and Health

- 5.3.4. Business and Enterprise

- 5.3.5. Consumer Electronics and Industrial Machines

- 5.3.6. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Digital Insurance Platform Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. Cloud

- 6.1.2. On-premise

- 6.2. Market Analysis, Insights and Forecast - by Organization Size

- 6.2.1. Large Enterprises

- 6.2.2. Small and Medium Enterprises

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Automotive and Transportation

- 6.3.2. Home and Commercial Buildings

- 6.3.3. Life and Health

- 6.3.4. Business and Enterprise

- 6.3.5. Consumer Electronics and Industrial Machines

- 6.3.6. Travel

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Digital Insurance Platform Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. Cloud

- 7.1.2. On-premise

- 7.2. Market Analysis, Insights and Forecast - by Organization Size

- 7.2.1. Large Enterprises

- 7.2.2. Small and Medium Enterprises

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Automotive and Transportation

- 7.3.2. Home and Commercial Buildings

- 7.3.3. Life and Health

- 7.3.4. Business and Enterprise

- 7.3.5. Consumer Electronics and Industrial Machines

- 7.3.6. Travel

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Digital Insurance Platform Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. Cloud

- 8.1.2. On-premise

- 8.2. Market Analysis, Insights and Forecast - by Organization Size

- 8.2.1. Large Enterprises

- 8.2.2. Small and Medium Enterprises

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Automotive and Transportation

- 8.3.2. Home and Commercial Buildings

- 8.3.3. Life and Health

- 8.3.4. Business and Enterprise

- 8.3.5. Consumer Electronics and Industrial Machines

- 8.3.6. Travel

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Latin America Digital Insurance Platform Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. Cloud

- 9.1.2. On-premise

- 9.2. Market Analysis, Insights and Forecast - by Organization Size

- 9.2.1. Large Enterprises

- 9.2.2. Small and Medium Enterprises

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Automotive and Transportation

- 9.3.2. Home and Commercial Buildings

- 9.3.3. Life and Health

- 9.3.4. Business and Enterprise

- 9.3.5. Consumer Electronics and Industrial Machines

- 9.3.6. Travel

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Middle East and Africa Digital Insurance Platform Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. Cloud

- 10.1.2. On-premise

- 10.2. Market Analysis, Insights and Forecast - by Organization Size

- 10.2.1. Large Enterprises

- 10.2.2. Small and Medium Enterprises

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Automotive and Transportation

- 10.3.2. Home and Commercial Buildings

- 10.3.3. Life and Health

- 10.3.4. Business and Enterprise

- 10.3.5. Consumer Electronics and Industrial Machines

- 10.3.6. Travel

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Appian Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IBM Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 EIS Software Limited*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Microsoft Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Majesco

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Pegasystems Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DXC Technology Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Prima Solutions SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Oracle Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mindtree Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Appian Corporation

List of Figures

- Figure 1: Global Digital Insurance Platform Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Digital Insurance Platform Market Revenue (Million), by Deployment 2025 & 2033

- Figure 3: North America Digital Insurance Platform Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: North America Digital Insurance Platform Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 5: North America Digital Insurance Platform Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 6: North America Digital Insurance Platform Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Digital Insurance Platform Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Digital Insurance Platform Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Digital Insurance Platform Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Digital Insurance Platform Market Revenue (Million), by Deployment 2025 & 2033

- Figure 11: Europe Digital Insurance Platform Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 12: Europe Digital Insurance Platform Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 13: Europe Digital Insurance Platform Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 14: Europe Digital Insurance Platform Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Digital Insurance Platform Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Digital Insurance Platform Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Digital Insurance Platform Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Digital Insurance Platform Market Revenue (Million), by Deployment 2025 & 2033

- Figure 19: Asia Digital Insurance Platform Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 20: Asia Digital Insurance Platform Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 21: Asia Digital Insurance Platform Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 22: Asia Digital Insurance Platform Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Digital Insurance Platform Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Digital Insurance Platform Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Digital Insurance Platform Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Digital Insurance Platform Market Revenue (Million), by Deployment 2025 & 2033

- Figure 27: Latin America Digital Insurance Platform Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 28: Latin America Digital Insurance Platform Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 29: Latin America Digital Insurance Platform Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 30: Latin America Digital Insurance Platform Market Revenue (Million), by Application 2025 & 2033

- Figure 31: Latin America Digital Insurance Platform Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Latin America Digital Insurance Platform Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Digital Insurance Platform Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Digital Insurance Platform Market Revenue (Million), by Deployment 2025 & 2033

- Figure 35: Middle East and Africa Digital Insurance Platform Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 36: Middle East and Africa Digital Insurance Platform Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 37: Middle East and Africa Digital Insurance Platform Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 38: Middle East and Africa Digital Insurance Platform Market Revenue (Million), by Application 2025 & 2033

- Figure 39: Middle East and Africa Digital Insurance Platform Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Digital Insurance Platform Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Digital Insurance Platform Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Digital Insurance Platform Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 2: Global Digital Insurance Platform Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 3: Global Digital Insurance Platform Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Digital Insurance Platform Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Digital Insurance Platform Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 6: Global Digital Insurance Platform Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 7: Global Digital Insurance Platform Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Digital Insurance Platform Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Digital Insurance Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Digital Insurance Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Digital Insurance Platform Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 12: Global Digital Insurance Platform Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 13: Global Digital Insurance Platform Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Digital Insurance Platform Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Digital Insurance Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Digital Insurance Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Digital Insurance Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Digital Insurance Platform Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 19: Global Digital Insurance Platform Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 20: Global Digital Insurance Platform Market Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global Digital Insurance Platform Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Digital Insurance Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Digital Insurance Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Digital Insurance Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia and New Zealand Digital Insurance Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Digital Insurance Platform Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 27: Global Digital Insurance Platform Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 28: Global Digital Insurance Platform Market Revenue Million Forecast, by Application 2020 & 2033

- Table 29: Global Digital Insurance Platform Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Digital Insurance Platform Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 31: Global Digital Insurance Platform Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 32: Global Digital Insurance Platform Market Revenue Million Forecast, by Application 2020 & 2033

- Table 33: Global Digital Insurance Platform Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Insurance Platform Market?

The projected CAGR is approximately 11.51%.

2. Which companies are prominent players in the Digital Insurance Platform Market?

Key companies in the market include Appian Corporation, IBM Corporation, EIS Software Limited*List Not Exhaustive, Microsoft Corporation, Majesco, Pegasystems Inc, DXC Technology Company, Prima Solutions SA, Oracle Corporation, Mindtree Ltd.

3. What are the main segments of the Digital Insurance Platform Market?

The market segments include Deployment, Organization Size, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 132.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Shift of Insurance Companies From Product Based to Customer-centric Strategies; Increased Awareness Among Insurers About Digital Channels; Growing Cloud Adoption.

6. What are the notable trends driving market growth?

Growing Cloud Adoption is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Difficulty Regarding Integration of Insurance Platform with Legacy Systems.

8. Can you provide examples of recent developments in the market?

August 2022 - USAA Life announced a partnership with Human API, a health data platform, to further digitize the life insurance buying process. USAA will get access to its members' digital health data using Human API's Health Intelligence Platform, which consists of a patient portal network and HIPAA-authorized networks, to enhance the user experience and streamline and speed up the purchasing process.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Insurance Platform Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Insurance Platform Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Insurance Platform Market?

To stay informed about further developments, trends, and reports in the Digital Insurance Platform Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence