Key Insights

The South-East Asia Consulting Services Market is projected for significant expansion, expected to reach $277.2 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.3%. Key growth drivers include increasing demand for specialized HR consulting to address evolving workforce dynamics, financial consulting for navigating complex regulatory landscapes, and IT & digital consulting fueled by accelerating digital transformation. Strategy and operations consulting remains crucial for business adaptation and sustainable growth.

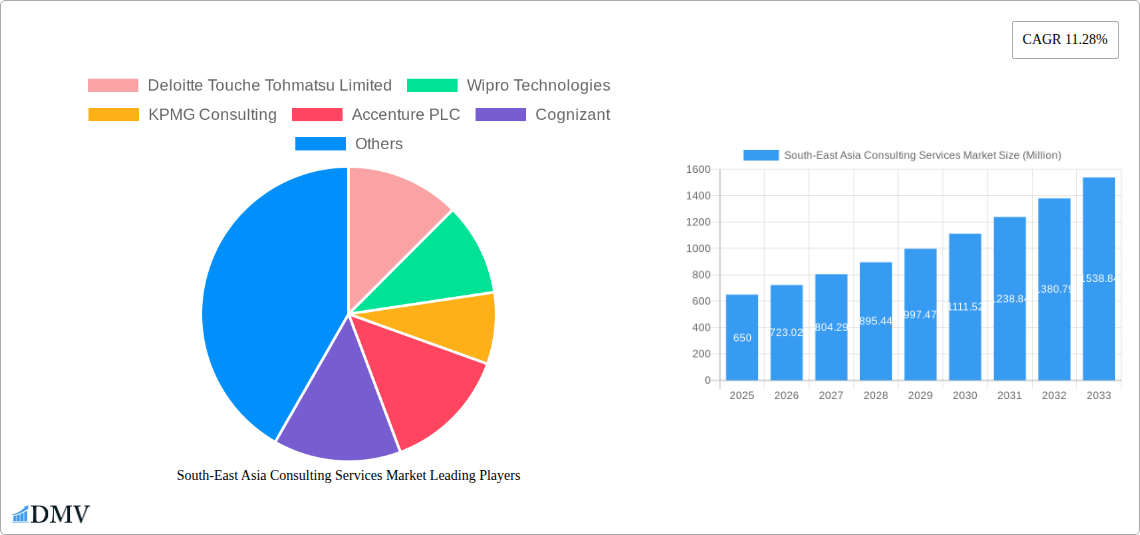

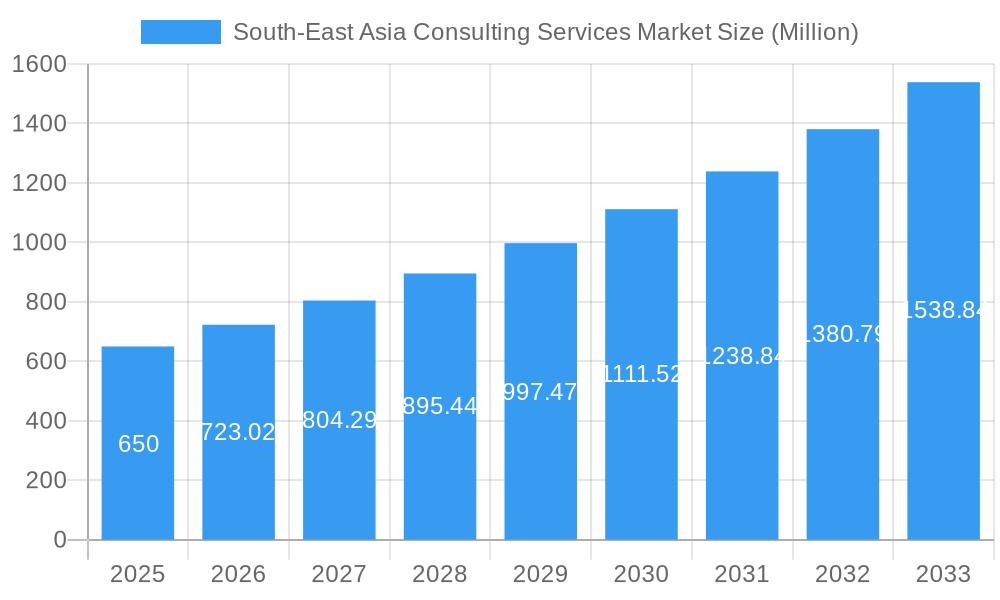

South-East Asia Consulting Services Market Market Size (In Billion)

Market expansion is further influenced by the adoption of cloud computing, big data analytics, and artificial intelligence, alongside a growing emphasis on sustainability and ESG integration. While talent shortages and economic uncertainties present potential challenges, the diverse end-user industries and the presence of major global and regional players indicate substantial market potential.

South-East Asia Consulting Services Market Company Market Share

South-East Asia Consulting Services Market: In-depth Analysis & Future Outlook (2019–2033)

This comprehensive report provides an in-depth analysis of the burgeoning South-East Asia consulting services market, offering strategic insights for stakeholders navigating this dynamic landscape. With a study period spanning from 2019 to 2033, and a base year of 2025, this report leverages historical data (2019–2024) and a detailed forecast period (2025–2033) to deliver actionable intelligence. Explore the market's composition, evolutionary trends, key growth drivers, inherent challenges, and emerging opportunities, all while keeping a close eye on leading players and pivotal industry developments. Discover how IT and Digital Consulting, Financial Services, and Digital Transformation are reshaping business strategies across the region.

South-East Asia Consulting Services Market Market Composition & Trends

The South-East Asia consulting services market exhibits a moderate concentration, with a few dominant players holding significant market share. Innovation is a key catalyst, driven by the region's rapid digital adoption and the increasing need for specialized expertise in areas such as IT and Digital Consulting, Financial Consulting, and Strategy and Operations. Regulatory landscapes are evolving, generally favoring business growth, though varying by country. Substitute products, such as in-house consulting teams or technology-driven solutions, exist but often fall short of the comprehensive strategic guidance offered by external consultants. End-user profiles are diverse, with the Financial Services, Life Sciences and Healthcare, and IT and Telecommunication sectors showing robust demand for consulting services. Mergers and acquisitions (M&A) activities are on the rise, indicating a consolidation trend and strategic expansion by key players. For instance, recent M&A deal values are estimated to be in the range of hundreds of millions of dollars.

- Market Share Distribution: Leading firms such as Accenture PLC, Deloitte Touche Tohmatsu Limited, and PricewaterhouseCoopers LLP collectively hold a substantial portion of the market.

- Innovation Catalysts: The proliferation of digital transformation, the adoption of artificial intelligence (AI), and the growing emphasis on hybrid cloud solutions are significant drivers of consulting demand.

- Regulatory Landscape: Generally supportive of foreign investment and business development, with some variations in compliance requirements across different Southeast Asian nations.

- M&A Activities: Strategic acquisitions are shaping the competitive landscape, with companies looking to expand their service offerings and geographical reach. Estimated M&A deal values are in the hundreds of millions of dollars.

South-East Asia Consulting Services Market Industry Evolution

The South-East Asia consulting services market is on an upward trajectory, fueled by consistent economic growth, increasing foreign direct investment, and a heightened awareness among businesses regarding the importance of strategic guidance. The historical period from 2019 to 2024 has witnessed a steady expansion, with the market size projected to reach an estimated $XX Billion by the end of 2024. This growth is intricately linked to the region's embrace of technological advancements. The digital revolution has been a paramount factor, with businesses across all sectors increasingly seeking expert advice on digital transformation, cloud computing, data analytics, and cybersecurity. The demand for IT and Digital Consulting services has surged, becoming a dominant segment. Furthermore, the burgeoning e-commerce sector and the rise of FinTech have propelled the need for specialized Financial Consulting.

Shifting consumer demands have also played a crucial role. As consumer expectations evolve towards personalized experiences and seamless digital interactions, companies are compelled to adapt their business models. This necessitates strategic consulting to re-evaluate customer engagement, optimize operational efficiencies, and implement new technologies. For instance, the adoption of AI-powered customer service solutions is becoming commonplace, requiring consulting expertise to integrate and manage these systems effectively. The Life Sciences and Healthcare sector, driven by the need for digital health solutions and improved patient outcomes, represents another significant area of growth for consulting services. The market is characterized by a compound annual growth rate (CAGR) of approximately XX% during the historical period, underscoring its robust expansion. Looking ahead to the forecast period (2025–2033), this growth is anticipated to continue, driven by ongoing digitalization initiatives, sustainability concerns, and the increasing complexity of global business operations. The market is projected to reach an estimated $XX Billion by 2033, reflecting sustained demand for strategic and operational expertise. The integration of business process management and supply chain optimization services remains critical for businesses aiming to enhance their competitive edge in this evolving regional market.

Leading Regions, Countries, or Segments in South-East Asia Consulting Services Market

The South-East Asia consulting services market is characterized by the dominance of specific segments and countries, driven by varying economic strengths, technological adoption rates, and regulatory environments. Among the service types, IT and Digital Consulting stands out as the leading segment. This dominance is fueled by the region's rapid digital transformation initiatives, the widespread adoption of cloud technologies, and the growing demand for data analytics and artificial intelligence (AI) solutions. Countries like Singapore and Malaysia are at the forefront of this digital wave, with significant investments in smart city projects and e-governance, which directly translate into a high demand for IT and digital consulting expertise.

In terms of end-user industries, the Financial Services sector consistently drives a substantial portion of consulting demand. The region's expanding economies, coupled with the rise of FinTech, have created a complex landscape where financial institutions require expert guidance on regulatory compliance, digital banking solutions, risk management, and cybersecurity. Singapore, as a major financial hub, leads in this regard, with a strong presence of global financial institutions seeking specialized consulting services. The IT and Telecommunication industry also presents a significant market for consulting services, as companies in this sector continuously innovate and adapt to evolving technological paradigms, including the rollout of 5G networks and the integration of IoT solutions.

- Dominant Service Segment: IT and Digital Consulting

- Key Drivers: Rapid digitalization across all industries, increasing adoption of cloud computing, demand for AI and data analytics, government initiatives for digital economies.

- Investment Trends: Significant investments in cloud infrastructure, cybersecurity solutions, and digital transformation projects across Southeast Asia.

- Regulatory Support: Favorable policies promoting digital innovation and e-commerce.

- Dominant End-User Industry: Financial Services

- Key Drivers: Growth of FinTech, need for regulatory compliance (e.g., AML, KYC), digital banking transformation, risk management, and cybersecurity enhancements.

- Investment Trends: Increased spending on digital transformation of banking platforms and customer experience.

- Market Dominance Factors: Singapore's status as a global financial center, robust economic growth in countries like Indonesia and Vietnam, and the expansion of banking services to underserved populations.

- Leading Countries: Singapore, Malaysia, and Indonesia are identified as key markets due to their advanced economies, significant foreign investment, and proactive adoption of digital technologies.

South-East Asia Consulting Services Market Product Innovations

Product innovations within the South-East Asia consulting services market are increasingly centered around advanced digital solutions and specialized expertise. Companies are developing proprietary platforms and methodologies to deliver more efficient and data-driven consulting outcomes. These innovations include AI-powered diagnostic tools for business process optimization, cloud-based collaboration suites for remote project management, and advanced analytics platforms that offer predictive insights into market trends and consumer behavior. The focus is on delivering tangible business value through agile and adaptable consulting frameworks. For instance, advancements in AI and machine learning are enabling consultants to offer more sophisticated strategic advice in areas like supply chain resilience and personalized customer engagement, significantly enhancing performance metrics for clients.

Propelling Factors for South-East Asia Consulting Services Market Growth

The South-East Asia consulting services market is propelled by several interconnected factors. A primary driver is the region's robust economic growth and increasing foreign direct investment, which necessitate strategic guidance for businesses to navigate complex markets. The rapid pace of digital transformation across all industries, from IT and Telecommunication to Financial Services, fuels demand for expertise in cloud computing, AI, and data analytics. Governments in the region are actively promoting digital economies and innovation, creating a favorable environment for consulting firms. Furthermore, the growing complexity of global supply chains and the increasing emphasis on sustainability and ESG (Environmental, Social, and Governance) practices are creating new avenues for specialized consulting services. The demand for HR Consulting to manage evolving workforces and attract top talent also contributes significantly to market expansion.

- Economic Growth & FDI: Leading to increased business complexity and demand for strategic advice.

- Digital Transformation: Driving need for expertise in IT, AI, cloud, and data analytics.

- Government Initiatives: Policies supporting digital economies and innovation.

- Supply Chain & ESG Focus: Creating opportunities for specialized consulting in resilience and sustainability.

Obstacles in the South-East Asia Consulting Services Market Market

Despite its robust growth, the South-East Asia consulting services market faces several obstacles. Intense competition from both established global players and emerging local firms can lead to price wars and pressure on profit margins. Talent acquisition and retention remain a significant challenge, with a scarcity of highly skilled consultants in specialized areas like AI, cybersecurity, and advanced data analytics. Regulatory variations across different Southeast Asian countries can create complexities for firms operating regionally, requiring diverse compliance strategies. Economic downturns or geopolitical instability in key markets can also impact client spending on consulting services. Furthermore, the increasing reliance on technology-driven solutions by some clients may lead them to bypass traditional consulting engagement for specific, narrowly defined problems.

- Intense Competition: Leading to price sensitivity and margin erosion.

- Talent Scarcity: Difficulty in finding and retaining specialized consultants.

- Regulatory Heterogeneity: Navigating varying legal and compliance frameworks.

- Economic Volatility: Potential impact on client budgets and project pipelines.

Future Opportunities in South-East Asia Consulting Services Market

The future of the South-East Asia consulting services market is rife with opportunities. The ongoing digital acceleration presents a continuous demand for IT and Digital Consulting, particularly in areas like cloud migration, AI implementation, and cybersecurity enhancement. The growing focus on sustainability and ESG compliance is creating a significant market for consulting services that help businesses develop and implement sustainable strategies. Emerging economies within the region, such as Vietnam and the Philippines, are poised for substantial growth, offering new markets for consulting firms to expand into. The increasing complexity of global trade and supply chains will also drive demand for consulting services focused on supply chain optimization and resilience. Furthermore, the rise of remote work and hybrid work models presents opportunities for HR Consulting and organizational design services.

- Digitalization & AI Integration: Continued demand for expertise in emerging technologies.

- Sustainability & ESG: Growing need for strategic guidance on environmental and social impact.

- Emerging Markets: Untapped potential in developing economies within Southeast Asia.

- Supply Chain Resilience: Demand for optimization and risk mitigation strategies.

Major Players in the South-East Asia Consulting Services Market Ecosystem

- Deloitte Touche Tohmatsu Limited

- Wipro Technologies

- KPMG Consulting

- Accenture PLC

- Cognizant

- Boston Consulting Group

- Ernst & Young Global Limited

- Mercer Consulting

- A T Kearney Inc

- PricewaterhouseCoopers LLP

- Tata Consultancy Services

- McKinsey & Company

Key Developments in South-East Asia Consulting Services Market Industry

- March 2023: IBM Consulting doubled down on its dedication to South East Asia with the introduction of a new Innovation Hub in the Philippines. The primary aim of the Innovation Hub in Cebu City was to cater to the growing demand for IBM Consulting's clients in Japan on topics involving business processes, digital transformation, application management, hybrid cloud, supply chain, artificial intelligence, finance, and procurement.

- June 2022: Accenture declared the acquisition of Entropia, its first acquisition in Southeast Asia. Entropia, one of the fastest-growing global agencies, would expand and complement Accenture Interactive's unique position within the market for various experience-led transformation services.

Strategic South-East Asia Consulting Services Market Market Forecast

The strategic forecast for the South-East Asia consulting services market indicates sustained and robust growth. The ongoing digital imperative across industries, coupled with a heightened focus on sustainability and ESG compliance, will be primary growth catalysts. Emerging economies within the region present significant untapped potential, driving demand for market entry and expansion strategies. The increasing complexity of global supply chains will necessitate consulting services focused on resilience and optimization. Furthermore, the evolving nature of work and the demand for specialized talent will continue to fuel growth in HR Consulting. The market's trajectory points towards an estimated market size of $XX Billion by 2033, driven by the region's dynamic economic landscape and its proactive adoption of technological advancements.

South-East Asia Consulting Services Market Segmentation

-

1. Service Type

- 1.1. HR Consulting

- 1.2. Financial Consulting

- 1.3. IT and Digital Consulting

- 1.4. Strategy and Operations

-

2. End-user Industry

- 2.1. Financial Services

- 2.2. Life Sciences and Healthcare

- 2.3. IT and Telecommunication

- 2.4. Government

- 2.5. Energy and Utilities

- 2.6. Other End-user Industries

South-East Asia Consulting Services Market Segmentation By Geography

-

1. South East Asia

- 1.1. Indonesia

- 1.2. Malaysia

- 1.3. Singapore

- 1.4. Thailand

- 1.5. Vietnam

- 1.6. Philippines

- 1.7. Myanmar

- 1.8. Cambodia

- 1.9. Laos

South-East Asia Consulting Services Market Regional Market Share

Geographic Coverage of South-East Asia Consulting Services Market

South-East Asia Consulting Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Investment in Emerging Technologies is Surging Companies Growth Strategy; Adoption of BI and Advanced Data Management Strategies across Multiple End-User Domain

- 3.3. Market Restrains

- 3.3.1. Shift in the Consulting Marketplace

- 3.4. Market Trends

- 3.4.1. Financial Advisory to Witness the Highest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South-East Asia Consulting Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. HR Consulting

- 5.1.2. Financial Consulting

- 5.1.3. IT and Digital Consulting

- 5.1.4. Strategy and Operations

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Financial Services

- 5.2.2. Life Sciences and Healthcare

- 5.2.3. IT and Telecommunication

- 5.2.4. Government

- 5.2.5. Energy and Utilities

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South East Asia

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Deloitte Touche Tohmatsu Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wipro Technologies

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KPMG Consulting

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Accenture PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cognizant

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Boston Consulting Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ernst & Young Global Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mercer Consulting

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 A T Kearney Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PricewaterhouseCoopers LLP

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Tata Consultancy Services

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 McKinsey & Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Deloitte Touche Tohmatsu Limited

List of Figures

- Figure 1: South-East Asia Consulting Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South-East Asia Consulting Services Market Share (%) by Company 2025

List of Tables

- Table 1: South-East Asia Consulting Services Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 2: South-East Asia Consulting Services Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: South-East Asia Consulting Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: South-East Asia Consulting Services Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 5: South-East Asia Consulting Services Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: South-East Asia Consulting Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Indonesia South-East Asia Consulting Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Malaysia South-East Asia Consulting Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Singapore South-East Asia Consulting Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Thailand South-East Asia Consulting Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Vietnam South-East Asia Consulting Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Philippines South-East Asia Consulting Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Myanmar South-East Asia Consulting Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Cambodia South-East Asia Consulting Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Laos South-East Asia Consulting Services Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South-East Asia Consulting Services Market?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the South-East Asia Consulting Services Market?

Key companies in the market include Deloitte Touche Tohmatsu Limited, Wipro Technologies, KPMG Consulting, Accenture PLC, Cognizant, Boston Consulting Group, Ernst & Young Global Limited, Mercer Consulting, A T Kearney Inc, PricewaterhouseCoopers LLP, Tata Consultancy Services, McKinsey & Company.

3. What are the main segments of the South-East Asia Consulting Services Market?

The market segments include Service Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 277.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Investment in Emerging Technologies is Surging Companies Growth Strategy; Adoption of BI and Advanced Data Management Strategies across Multiple End-User Domain.

6. What are the notable trends driving market growth?

Financial Advisory to Witness the Highest Growth Rate.

7. Are there any restraints impacting market growth?

Shift in the Consulting Marketplace.

8. Can you provide examples of recent developments in the market?

March 2023: IBM Consulting doubled down on its dedication to South East Asia with the introduction of a new Innovation Hub in the Philippines. The primary aim of the Innovation Hub in Cebu City was to cater to the growing demand for IBM Consulting's clients in Japan on topics involving business processes, digital transformation, application management, hybrid cloud, supply chain, artificial intelligence, finance, and procurement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South-East Asia Consulting Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South-East Asia Consulting Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South-East Asia Consulting Services Market?

To stay informed about further developments, trends, and reports in the South-East Asia Consulting Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence