Key Insights

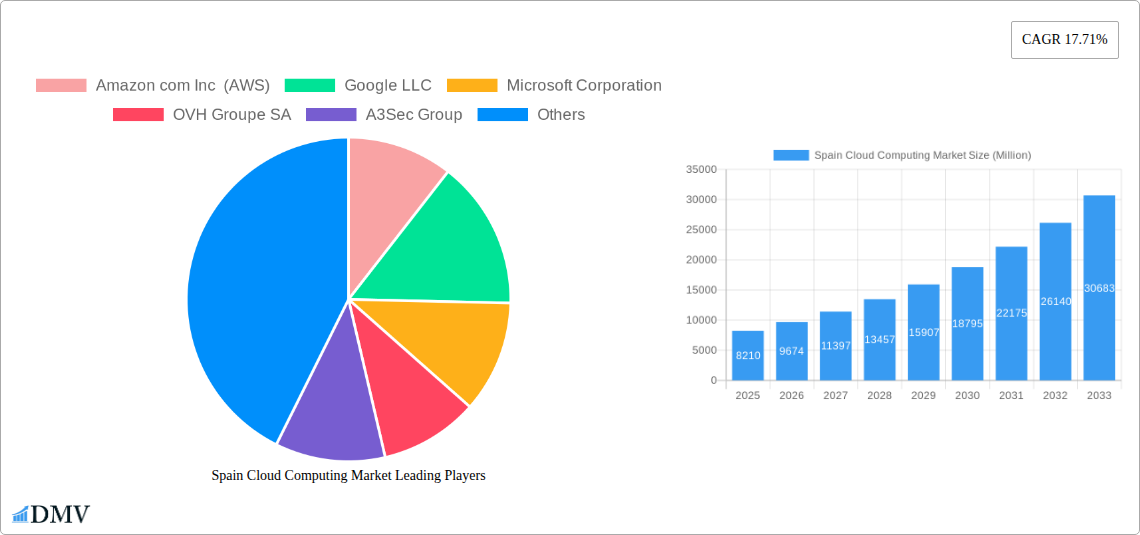

The Spanish cloud computing market is poised for robust expansion, projecting a market size of approximately €8.21 billion and a remarkable Compound Annual Growth Rate (CAGR) of 17.71% during the forecast period of 2025-2033. This impressive growth is underpinned by several key drivers, including the escalating demand for digital transformation initiatives across various sectors, the increasing adoption of advanced technologies like AI and IoT, and the inherent benefits of cloud services such as scalability, cost-efficiency, and enhanced operational agility. The Spanish government's commitment to digital infrastructure development and fostering a cloud-first environment further fuels this expansion. Furthermore, the increasing penetration of SMEs and large enterprises leveraging cloud solutions for competitive advantage and innovation is a significant contributor to market vitality.

Spain Cloud Computing Market Market Size (In Billion)

The market's segmentation reveals a dynamic landscape driven by diverse needs. Public cloud services, encompassing IaaS, PaaS, and SaaS, are expected to witness substantial adoption due to their flexibility and accessibility. However, private and hybrid cloud models are also gaining traction as organizations seek greater control and tailored solutions, particularly in sensitive sectors like healthcare and finance. End-user industries like Manufacturing, Retail, Healthcare, and BFSI are at the forefront of cloud adoption, driven by the need for data analytics, improved customer experiences, and streamlined operations. The ongoing digital transformation in the Transportation & Logistics and Telecom & IT sectors, alongside the government's push for e-governance, will continue to shape market dynamics. Key players like Amazon Web Services (AWS), Google Cloud, and Microsoft Azure are intensely competing, alongside established technology giants and specialized providers like Oracle and IBM, to capture market share in this high-growth region.

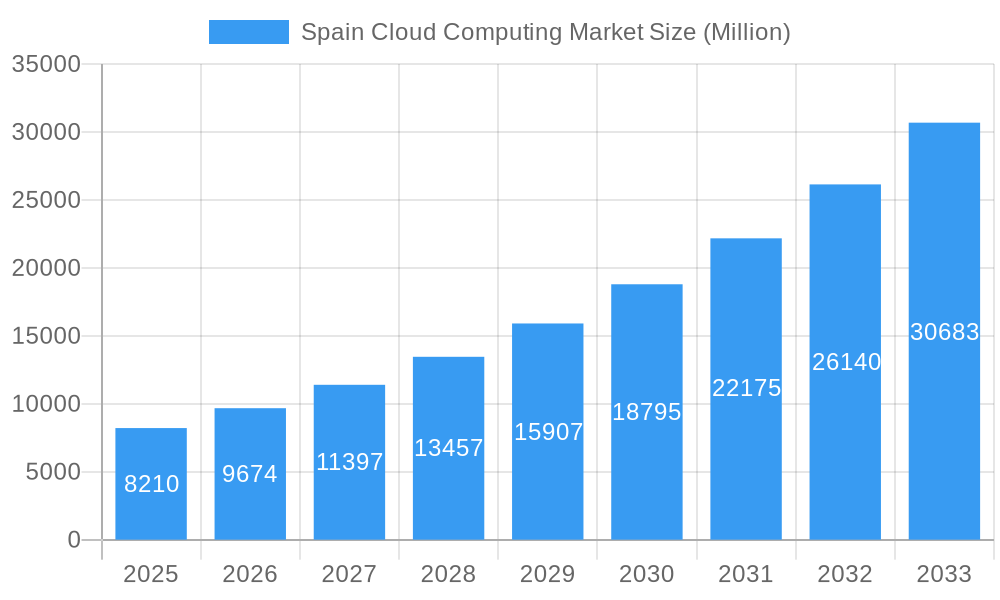

Spain Cloud Computing Market Company Market Share

Spain Cloud Computing Market Size, Share, and Trends Analysis Report (2019-2033)

Report Description:

Dive into the dynamic and rapidly expanding Spain Cloud Computing Market with this comprehensive industry analysis. This report offers an in-depth examination of market drivers, segmentation, competitive landscapes, and future projections, providing actionable insights for stakeholders navigating the evolving digital infrastructure of Spain. From Infrastructure as a Service (IaaS) to Software as a Service (SaaS), and covering Public, Private, and Hybrid cloud models, this report details the intricate workings of the Spanish cloud ecosystem. We meticulously analyze the adoption patterns across Small and Medium-sized Enterprises (SMEs) and Large Enterprises, and their impact on critical end-user industries such as Manufacturing, Healthcare, BFSI, Telecom and IT, and Government and Public Sector.

The study period spans from 2019 to 2033, with a detailed analysis of the base year 2025, estimated year 2025, and a robust forecast period of 2025–2033, built upon the historical period of 2019–2024. Discover key industry developments, including significant investments in cloud and AI infrastructure by giants like Amazon Web Services (AWS) and strategic expansions by European players like OVHcloud. This report is an indispensable resource for cloud providers, technology investors, enterprise decision-makers, and policymakers seeking to understand and capitalize on the substantial growth opportunities within the Spanish cloud market. Leverage our expert analysis to refine your strategies and secure a competitive edge in this high-growth sector.

Spain Cloud Computing Market Market Composition & Trends

The Spain Cloud Computing Market exhibits a dynamic composition shaped by increasing digital transformation initiatives and a growing demand for scalable and flexible IT solutions. Market concentration is moderately high, with major global players like Amazon com Inc (AWS), Google LLC, and Microsoft Corporation holding significant shares across Public, Private, and Hybrid cloud segments. Innovation is primarily driven by advancements in Artificial Intelligence (AI), Machine Learning (ML), and edge computing, which are increasingly integrated into cloud offerings to provide enhanced data processing and analytics capabilities. The regulatory landscape, while evolving, generally favors cloud adoption through initiatives promoting data localization and digital security. Substitute products, such as on-premise data centers, are steadily losing ground to the cost-efficiency and agility of cloud services. End-user profiles are diverse, with SMEs increasingly leveraging cloud solutions for cost savings and scalability, while large enterprises are adopting hybrid and multi-cloud strategies for enhanced flexibility and disaster recovery. Mergers and Acquisitions (M&A) activity is anticipated to increase as larger players seek to consolidate market presence and acquire specialized cloud capabilities, further shaping market concentration. The estimated M&A deal value is expected to reach XX Million USD in the forecast period, reflecting strategic consolidation and expansion.

- Market Concentration: Dominated by hyperscale cloud providers with growing participation from specialized European providers.

- Innovation Catalysts: AI/ML integration, edge computing, serverless architectures, and enhanced cybersecurity solutions.

- Regulatory Landscapes: GDPR compliance, national cybersecurity strategies, and initiatives promoting digital sovereignty.

- Substitute Products: Traditional on-premise IT infrastructure, managed hosting services.

- End-User Profiles: Growing adoption by SMEs for agility and cost-efficiency; large enterprises focusing on hybrid and multi-cloud for optimization.

- M&A Activities: Expected consolidation, acquisition of niche cloud service providers, and strategic partnerships.

Spain Cloud Computing Market Industry Evolution

The Spain Cloud Computing Market has witnessed an impressive growth trajectory, evolving from a nascent stage to a critical component of the nation's digital infrastructure. This evolution has been fueled by a confluence of technological advancements, increasing digitalization across industries, and a supportive governmental focus on fostering a robust digital economy. Initially, the market was characterized by a gradual adoption of basic cloud services, primarily focused on storage and computing. However, over the historical period of 2019-2024, we observed a significant acceleration in the adoption of more sophisticated cloud solutions, including Platform as a Service (PaaS) and Software as a Service (SaaS). This shift was driven by the growing realization among businesses of all sizes about the cost-effectiveness, scalability, and agility that cloud computing offers, enabling them to respond faster to market changes and innovate more effectively.

Technological advancements have played a pivotal role in shaping this evolution. The widespread availability of high-speed internet, coupled with the maturation of virtualization technologies, laid the groundwork for efficient cloud service delivery. More recently, the rapid development and adoption of Artificial Intelligence (AI) and Machine Learning (ML) capabilities hosted on cloud platforms have opened up new frontiers for data analytics, automation, and personalized customer experiences across various sectors. Furthermore, the increasing emphasis on data security and compliance, spurred by regulations like GDPR, has pushed cloud providers to enhance their security offerings, making cloud solutions a more trusted and viable option for sensitive data.

Shifting consumer demands have also contributed significantly. Businesses are no longer looking for just basic IT resources; they are seeking integrated solutions that drive business outcomes. This includes demand for advanced analytics, IoT enablement, and seamless integration of various cloud services. The COVID-19 pandemic further accelerated this trend, highlighting the critical importance of remote work capabilities and resilient IT infrastructure, which cloud computing readily provides. The Spanish government's commitment to digital transformation, through initiatives aimed at fostering innovation and digital skills, has also created a fertile ground for cloud adoption. Consequently, the Spain Cloud Computing Market has moved from being a mere IT cost center to a strategic enabler of business growth and innovation, projected to continue its upward trajectory in the coming years. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of approximately XX% from 2025 to 2033, reaching a market size of XX Billion USD by 2033. Adoption metrics indicate that over XX% of Spanish businesses are currently utilizing at least one cloud service, with this figure projected to rise to over XX% by 2030.

Leading Regions, Countries, or Segments in Spain Cloud Computing Market

The Spain Cloud Computing Market showcases distinct leadership across various segments, driven by a combination of investment trends, regulatory support, and industry-specific demands. In terms of cloud type, Public Cloud is currently the dominant segment, encompassing Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). This dominance is fueled by its inherent scalability, cost-effectiveness, and rapid deployment capabilities, making it attractive to a wide range of organizations. The increasing availability of robust, secure, and compliant Public Cloud offerings from major global players like Amazon com Inc (AWS), Google LLC, and Microsoft Corporation has further cemented its leading position.

Geographically, within Spain, regions with established technological hubs and a strong presence of large enterprises, such as Madrid and Catalonia, lead in cloud adoption and investment. These regions benefit from a concentration of talent, research institutions, and a supportive ecosystem for digital innovation. The Telecom and IT and BFSI (Banking, Financial Services, and Insurance) sectors are at the forefront of cloud adoption, driven by the need for advanced data analytics, robust security, and the agility to launch new digital services quickly. The Government and Public Sector is also emerging as a significant growth area, with increasing investments in cloud solutions for digitalizing public services and enhancing national cybersecurity.

Regarding organization size, Large Enterprises currently represent the largest share of cloud spending due to their extensive IT infrastructure and the complexity of their digital transformation initiatives. However, SMEs are rapidly catching up, leveraging cloud services to compete with larger players by accessing advanced technologies and scaling their operations without significant upfront capital expenditure. The ongoing digital transformation mandates across all sectors, coupled with the Spanish government's commitment to digitalizing the economy, are key drivers for this widespread adoption.

- Dominant Cloud Type: Public Cloud (IaaS, PaaS, SaaS)

- Key Drivers: Scalability, cost-efficiency, rapid deployment, advanced service offerings, and global provider presence.

- IaaS: Foundation for scalable computing, storage, and networking.

- PaaS: Accelerates application development and deployment.

- SaaS: Delivers ready-to-use software applications, driving operational efficiency.

- Leading Geographical Segments: Madrid and Catalonia

- Key Drivers: Concentration of technology companies, financial institutions, skilled workforce, and supportive regional government policies.

- Madrid: Financial capital and business hub, driving demand for enterprise-grade cloud solutions.

- Catalonia: Strong presence of IT innovation and startups, fostering adoption of agile cloud services.

- Leading End-User Industries: Telecom and IT, BFSI, Manufacturing, Healthcare, and Government and Public Sector.

- Telecom and IT: High demand for scalable infrastructure, data analytics, and agile service delivery.

- BFSI: Critical need for robust security, regulatory compliance, data analytics, and digital banking solutions.

- Manufacturing: Adoption for Industry 4.0 initiatives, IoT, supply chain optimization, and predictive maintenance.

- Healthcare: Growing use for EMR/EHR management, telemedicine, AI-driven diagnostics, and secure data storage.

- Government and Public Sector: Digitalization of services, smart city initiatives, and enhanced citizen engagement.

- Leading Organization Size: Large Enterprises, with rapidly growing adoption by SMEs.

- Large Enterprises: Focus on hybrid and multi-cloud strategies for optimization and risk management.

- SMEs: Leveraging cloud for cost savings, agility, and access to advanced technologies to foster growth and competitiveness.

Spain Cloud Computing Market Product Innovations

Product innovation in the Spain Cloud Computing Market is primarily focused on enhancing security, optimizing performance, and enabling advanced analytics and AI capabilities. Cloud providers are continuously developing new services that offer enhanced data protection, compliance with stringent regulations, and robust disaster recovery solutions. Innovations in serverless computing and edge computing are enabling developers to build and deploy applications with greater efficiency and reduced latency, catering to the growing demand for real-time data processing. Furthermore, the integration of AI and Machine Learning services directly into cloud platforms is empowering businesses to derive deeper insights from their data, automate complex tasks, and personalize customer experiences. Performance metrics are being pushed with the introduction of new hardware and software optimizations, leading to faster processing speeds and increased storage capacities. Unique selling propositions often revolve around specialized industry solutions, enhanced sustainability features in data centers, and comprehensive managed services that simplify cloud adoption for businesses.

Propelling Factors for Spain Cloud Computing Market Growth

Several key factors are propelling the growth of the Spain Cloud Computing Market. Firstly, the overarching digital transformation initiatives by both the Spanish government and private enterprises are driving the adoption of cloud-based solutions as the foundational technology for modernization. Secondly, the increasing demand for data analytics and AI/ML capabilities across industries necessitates the scalable and powerful infrastructure that cloud providers offer. Thirdly, cost optimization and operational efficiency remain significant drivers, as businesses seek to reduce capital expenditure on IT infrastructure and gain agility. The growing awareness of cloud security and compliance benefits, coupled with increasing investment in cybersecurity measures by cloud providers, is also building trust and encouraging broader adoption. Finally, the expansion of high-speed broadband internet infrastructure across Spain ensures reliable access to cloud services, further facilitating market growth.

Obstacles in the Spain Cloud Computing Market Market

Despite the robust growth, the Spain Cloud Computing Market faces certain obstacles. Data privacy and security concerns, although diminishing with enhanced provider offerings, still linger for some organizations, particularly those handling highly sensitive data. Regulatory complexities and compliance requirements across different sectors can also pose challenges for cloud adoption. Furthermore, a shortage of skilled cloud professionals within Spain can hinder the effective implementation and management of cloud solutions. Vendor lock-in concerns and the perceived difficulty of migrating complex legacy systems to the cloud can also act as restraints. Finally, initial migration costs and the need for significant organizational change management can present a hurdle for some businesses, especially SMEs with limited resources.

Future Opportunities in Spain Cloud Computing Market

The Spain Cloud Computing Market presents numerous future opportunities. The continued expansion of AI and Machine Learning services on cloud platforms opens doors for advanced data analytics, automation, and intelligent applications. The growing adoption of IoT devices across various sectors will drive demand for cloud infrastructure capable of handling massive data streams and real-time processing. The ongoing digitalization of public services and the development of smart cities present significant opportunities for cloud providers. Emerging trends like hybrid and multi-cloud strategies will continue to evolve, offering greater flexibility and resilience. Furthermore, specialized cloud solutions tailored for specific industries, such as FinTech and AgriTech, are likely to see substantial growth. The increasing focus on sustainability in cloud operations also presents an opportunity for providers offering energy-efficient solutions.

Major Players in the Spain Cloud Computing Market Ecosystem

- Amazon com Inc (AWS)

- Google LLC

- Microsoft Corporation

- OVH Groupe SA

- A3Sec Group

- Arsys Internet SLU

- Oracle Corporation

- IBM Corporation

- Akamai Technologies

- Salesforce Inc

- SAP S

Key Developments in Spain Cloud Computing Market Industry

- May 2024: AWS invested USD 17 billion to expand its cloud and AI infrastructure services in Spain, with a focus on the Aragón region. This expansion aims to create 6,800 jobs and contribute USD 24 billion to Spain’s gross domestic product, with a significant portion benefiting local businesses and supporting over 17,500 jobs.

- February 2024: OVHcloud launched its first two public cloud 'Local Zones' in Madrid, Spain. This rapid deployment, facilitated by a recent acquisition, enhances OVHcloud's ability to offer low-latency Public Cloud services and ensures compliance with local data residency mandates for its Spanish customers.

Strategic Spain Cloud Computing Market Market Forecast

The strategic forecast for the Spain Cloud Computing Market anticipates continued robust growth driven by increasing digital transformation imperatives and technological advancements. The significant investments in cloud infrastructure by major players, exemplified by AWS's substantial expansion in Spain, signal strong confidence in the market's potential. The growing adoption of AI and ML, coupled with the proliferation of IoT devices, will further fuel demand for scalable and powerful cloud solutions. Government initiatives to digitalize public services and enhance cybersecurity will create substantial opportunities. The trend towards hybrid and multi-cloud architectures will offer greater flexibility and resilience, catering to the diverse needs of both SMEs and large enterprises. Emerging niche markets and specialized industry solutions are poised for significant expansion, solidifying Spain's position as a key player in the European cloud landscape. The market is expected to reach an estimated value of XX Billion USD by 2033, reflecting its strategic importance and sustained growth.

Spain Cloud Computing Market Segmentation

-

1. Type

-

1.1. Public Cloud

- 1.1.1. IaaS

- 1.1.2. PaaS

- 1.1.3. SaaS

- 1.2. Private Cloud

- 1.3. Hybrid Cloud

-

1.1. Public Cloud

-

2. Organization Size

- 2.1. SMEs

- 2.2. Large Enterprises

-

3. End-user Industries

- 3.1. Manufacturing

- 3.2. Education

- 3.3. Retail

- 3.4. Transportation and Logistics

- 3.5. Healthcare

- 3.6. BFSI

- 3.7. Telecom and IT

- 3.8. Government and Public Sector

- 3.9. Other En

Spain Cloud Computing Market Segmentation By Geography

- 1. Spain

Spain Cloud Computing Market Regional Market Share

Geographic Coverage of Spain Cloud Computing Market

Spain Cloud Computing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.71% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Shift toward Digital Transformation across the Country; Data Privacy Concerns are Driving Increased Adoption of Public Cloud Services

- 3.3. Market Restrains

- 3.3.1. Robust Shift toward Digital Transformation across the Country; Data Privacy Concerns are Driving Increased Adoption of Public Cloud Services

- 3.4. Market Trends

- 3.4.1. Significant Progress in Digital Transformation Nationwide

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Cloud Computing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Public Cloud

- 5.1.1.1. IaaS

- 5.1.1.2. PaaS

- 5.1.1.3. SaaS

- 5.1.2. Private Cloud

- 5.1.3. Hybrid Cloud

- 5.1.1. Public Cloud

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. SMEs

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End-user Industries

- 5.3.1. Manufacturing

- 5.3.2. Education

- 5.3.3. Retail

- 5.3.4. Transportation and Logistics

- 5.3.5. Healthcare

- 5.3.6. BFSI

- 5.3.7. Telecom and IT

- 5.3.8. Government and Public Sector

- 5.3.9. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amazon com Inc (AWS)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Google LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Microsoft Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 OVH Groupe SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 A3Sec Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Arsys Internet SLU

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Oracle Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IBM Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Akamai Technologies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Salesforce Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SAP S

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Amazon com Inc (AWS)

List of Figures

- Figure 1: Spain Cloud Computing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Spain Cloud Computing Market Share (%) by Company 2025

List of Tables

- Table 1: Spain Cloud Computing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Spain Cloud Computing Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Spain Cloud Computing Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 4: Spain Cloud Computing Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 5: Spain Cloud Computing Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 6: Spain Cloud Computing Market Volume Billion Forecast, by End-user Industries 2020 & 2033

- Table 7: Spain Cloud Computing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Spain Cloud Computing Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Spain Cloud Computing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Spain Cloud Computing Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Spain Cloud Computing Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 12: Spain Cloud Computing Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 13: Spain Cloud Computing Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 14: Spain Cloud Computing Market Volume Billion Forecast, by End-user Industries 2020 & 2033

- Table 15: Spain Cloud Computing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Spain Cloud Computing Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Cloud Computing Market?

The projected CAGR is approximately 17.71%.

2. Which companies are prominent players in the Spain Cloud Computing Market?

Key companies in the market include Amazon com Inc (AWS), Google LLC, Microsoft Corporation, OVH Groupe SA, A3Sec Group, Arsys Internet SLU, Oracle Corporation, IBM Corporation, Akamai Technologies, Salesforce Inc, SAP S.

3. What are the main segments of the Spain Cloud Computing Market?

The market segments include Type, Organization Size, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Robust Shift toward Digital Transformation across the Country; Data Privacy Concerns are Driving Increased Adoption of Public Cloud Services.

6. What are the notable trends driving market growth?

Significant Progress in Digital Transformation Nationwide.

7. Are there any restraints impacting market growth?

Robust Shift toward Digital Transformation across the Country; Data Privacy Concerns are Driving Increased Adoption of Public Cloud Services.

8. Can you provide examples of recent developments in the market?

May 2024: AWS invested USD 17 billion to expand its cloud and AI infrastructure services in Spain. Amazon’s cloud business expanded its cloud infrastructure in the Aragón region of northeastern Spain, creating 6,800 jobs across roles, including construction, engineering, and facilities maintenance. AWS stated that its infrastructure expansion would contribute USD 24 billion to Spain’s gross domestic product. More than half of the contribution came from the Aragón region while also supporting 17,500 jobs in local businesses.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Cloud Computing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Cloud Computing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Cloud Computing Market?

To stay informed about further developments, trends, and reports in the Spain Cloud Computing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence