Key Insights

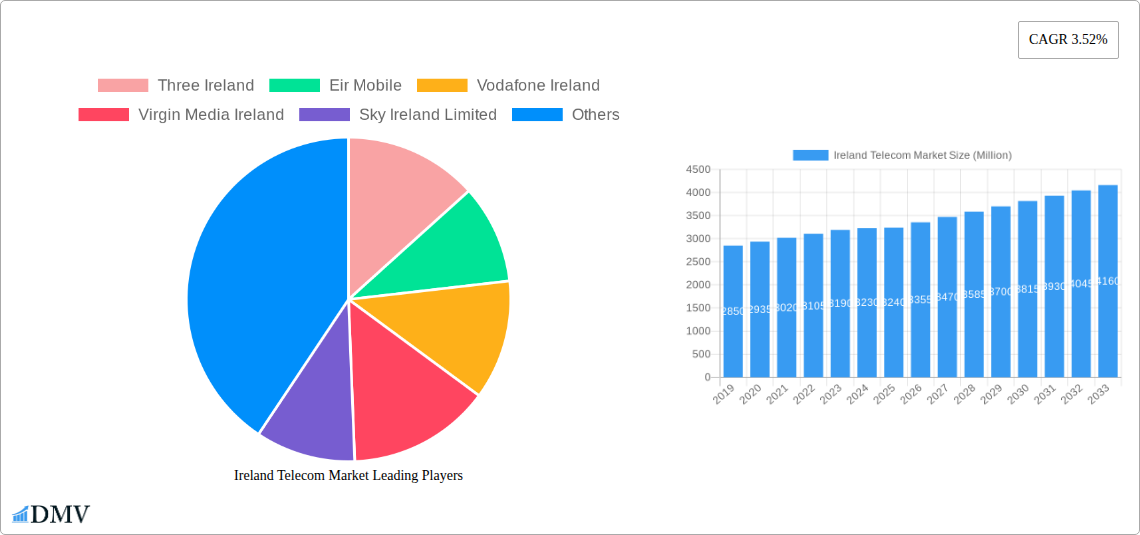

The Irish telecommunications market is poised for steady expansion, projected to reach a significant valuation by 2033. With an estimated market size of €3.24 million in 2025, the sector is expected to grow at a Compound Annual Growth Rate (CAGR) of 3.52% throughout the forecast period. This sustained growth is underpinned by several key drivers, including the escalating demand for high-speed broadband services, the continuous innovation in mobile technologies such as 5G, and the increasing adoption of digital services across both consumer and enterprise segments. The expansion of fiber optic networks is a crucial development, enabling faster and more reliable data transmission, which in turn fuels the consumption of data-intensive applications and services like cloud computing and IoT. Furthermore, the burgeoning over-the-top (OTT) and pay-TV services are reshaping how content is consumed, driving revenue streams for telecom providers.

Ireland Telecom Market Market Size (In Billion)

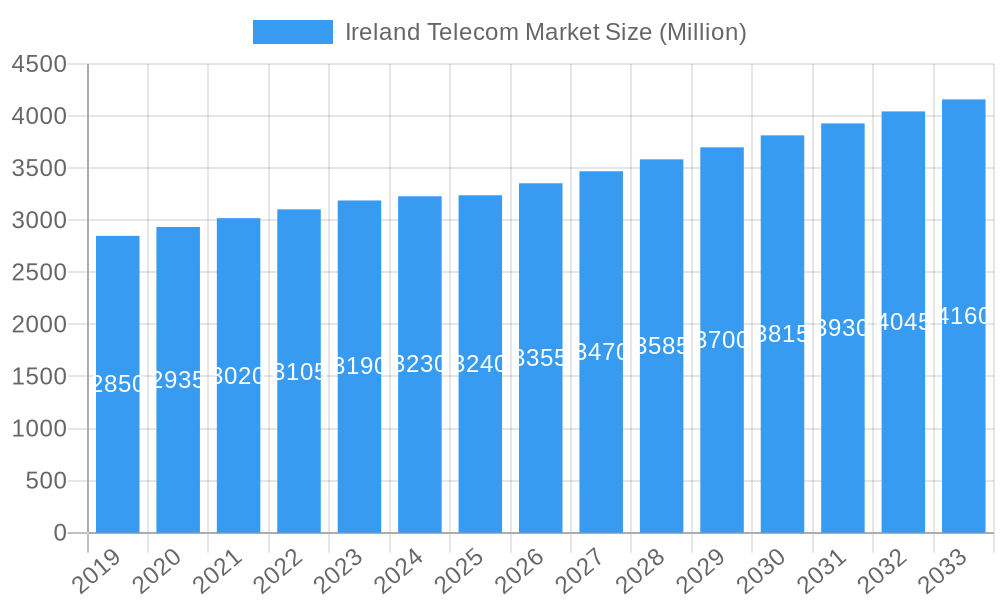

Despite the positive growth trajectory, the market also faces certain restraints. Intense competition among established players and emerging virtual network operators can lead to price wars, impacting profit margins. The significant capital expenditure required for network upgrades, particularly for 5G deployment and fiber expansion, presents a substantial financial challenge for companies. Moreover, regulatory hurdles and the need for ongoing spectrum allocation can also influence the pace of development. Nonetheless, the market segments of Data and Messaging Services, and OTT and PayTV Services are expected to exhibit robust growth, driven by evolving consumer preferences and the increasing reliance on digital communication and entertainment. Key companies such as Three Ireland, Eir Mobile, Vodafone Ireland, and Virgin Media Ireland are actively investing in infrastructure and service diversification to capture market share in this dynamic landscape.

Ireland Telecom Market Company Market Share

Ireland Telecom Market Market Composition & Trends

The Ireland telecom market is characterized by a dynamic interplay of established players and emerging innovators, with a notable trend towards consolidation and strategic alliances. Market concentration is moderate, with key operators like Eir Mobile, Vodafone Ireland, and Three Ireland holding significant, though evolving, market shares. Innovation catalysts include the relentless pursuit of 5G deployment, fiber optic network expansion, and the integration of artificial intelligence for enhanced customer service and network management. The regulatory landscape, overseen by ComReg, actively promotes competition and infrastructure investment, influencing market entry and operational strategies. Substitute products, primarily driven by Over-The-Top (OTT) services for communication and entertainment, continue to challenge traditional revenue streams, compelling operators to diversify their offerings. End-user profiles are increasingly sophisticated, demanding higher bandwidth, lower latency, and seamless connectivity across multiple devices and platforms. Mergers and Acquisitions (M&A) activities are pivotal, with deal values projected to impact market dynamics significantly. For instance, the recent acquisition of Cellnex Ireland by Phoenix Tower International for an estimated USD 1057.3 Million signifies a strategic move to bolster tower infrastructure, crucial for 5G rollout. While precise market share distribution percentages are proprietary, informed estimates suggest a competitive environment where subscriber acquisition and retention are paramount. The strategic landscape is further shaped by investments in next-generation networks and the continuous adaptation to evolving consumer preferences, ensuring a robust and competitive telecom ecosystem.

Ireland Telecom Market Industry Evolution

The Irish telecommunications industry has undergone a profound transformation, driven by relentless technological advancements and evolving consumer demands, charting a remarkable growth trajectory from 2019 to 2033. Historically, the period of 2019-2024 witnessed significant investments in mobile network upgrades, with operators progressively rolling out 4G and laying the groundwork for 5G. This era was defined by increasing data consumption, fueled by the proliferation of smartphones and the growing adoption of digital services for entertainment, communication, and productivity. The base year of 2025 marks a critical juncture, with the market poised for accelerated growth. Technological advancements are at the forefront of this evolution. The ongoing nationwide deployment of high-speed fiber optic networks by players like Open Eir is fundamentally reshaping broadband accessibility, enabling higher download and upload speeds and supporting an array of data-intensive applications. Concurrently, the expansion of 5G infrastructure is unlocking new possibilities for low-latency services, Internet of Things (IoT) applications, and enhanced mobile broadband experiences. Shifting consumer demands are a significant catalyst. There's a palpable move away from basic connectivity towards integrated digital experiences, encompassing seamless streaming, cloud gaming, and immersive augmented and virtual reality applications. This necessitates a constant re-evaluation of service portfolios and infrastructure capabilities by telecom providers. For example, the increasing demand for reliable home broadband, especially post-pandemic, has spurred significant investment in fixed-line infrastructure, with average broadband speeds in Ireland steadily climbing. The forecasted period of 2025–2033 is anticipated to witness exponential growth, driven by the widespread adoption of 5G, the maturation of IoT ecosystems, and the increasing convergence of telecommunications with other digital sectors. This sustained growth is further supported by regulatory frameworks designed to foster innovation and competition, ensuring that Ireland remains at the forefront of digital transformation in the European Union. The industry's evolution is a testament to its adaptability, consistently responding to and anticipating the needs of a digitally empowered society, with projected Compound Annual Growth Rates (CAGRs) indicating robust expansion in the coming years.

Leading Regions, Countries, or Segments in Ireland Telecom Market

In the dynamic Ireland telecom market, Data and Messaging Services stand out as the dominant segment, propelled by robust investment trends and supportive regulatory initiatives. This dominance is deeply intertwined with the country's increasing reliance on digital communication and entertainment. The widespread adoption of smartphones and the growing prevalence of remote work and hybrid learning models have significantly amplified the demand for high-speed, reliable data connectivity and versatile messaging solutions.

Key Drivers of Dominance in Data and Messaging Services:

- Ubiquitous Smartphone Penetration: Ireland boasts a high rate of smartphone ownership, with a significant portion of the population actively utilizing mobile data for browsing, social media, video streaming, and communication apps. This fundamental driver underpins the entire segment.

- Fiber Optic Network Expansion: Investments by companies like Open Eir in expanding their fiber optic networks across urban and rural areas are crucial. This infrastructure upgrade provides the backbone for high-speed internet access, which is essential for delivering robust data services and supporting data-intensive applications. The ongoing commitment to nationwide fiber deployment directly fuels growth in this segment.

- Growth of OTT Services: The proliferation of Over-The-Top (OTT) services, such as WhatsApp, Zoom, Netflix, and other streaming platforms, relies heavily on strong data connectivity. Telecom operators benefit indirectly from this ecosystem as users require robust data plans to access these services, thereby increasing data consumption.

- Enterprise Demand for Data Solutions: Businesses in Ireland are increasingly digitizing their operations, leading to a substantial demand for secure, high-capacity data solutions, cloud services, and advanced connectivity for remote workforces. This enterprise segment contributes significantly to the overall data services revenue.

- Regulatory Support for Infrastructure: Regulatory bodies like ComReg actively encourage investment in telecommunications infrastructure, including broadband and mobile networks. Policies aimed at promoting competition and ensuring universal access to high-speed internet create a favorable environment for the growth of data and messaging services.

- Innovation in Mobile Technologies (5G): The ongoing rollout of 5G technology promises to unlock even greater potential for data services, enabling lower latency, higher speeds, and the development of new applications like enhanced mobile broadband, massive IoT, and mission-critical communications. This forward-looking investment directly supports the future growth of the data and messaging segment.

In-depth analysis reveals that the dominance of data and messaging services is not merely a matter of volume but also of value. As consumers and businesses demand richer, more immersive online experiences, the pressure on telecom providers to deliver superior data speeds, lower latency, and greater reliability intensifies. This has led to a competitive landscape where operators are differentiating themselves through network quality, pricing strategies, and bundled service offerings that often include generous data allowances. The shift from traditional voice services to data-centric communication platforms has been a defining trend, making data the primary revenue driver for most Irish telecom companies. While Voice Services (Wired and Wireless) still hold a foundational role, their revenue contribution is gradually being overshadowed by data consumption. Similarly, while OTT and PayTV services are significant components of the digital media consumption landscape, their success is intrinsically linked to the underlying data infrastructure provided by telecom operators. Therefore, the strength of the data and messaging segment directly influences the performance and growth potential of these related services. The consistent investment in network upgrades and the evolving digital habits of the Irish population firmly establish data and messaging services as the leading force within the Ireland telecom market.

Ireland Telecom Market Product Innovations

Ireland's telecom sector is witnessing a surge in product innovations centered around enhanced connectivity and user experience. The deployment of 5G networks is a key driver, enabling ultra-low latency for applications like cloud gaming and augmented reality, and massive IoT capabilities for smart cities and industrial automation. Operators are actively developing and bundling innovative data packages that cater to specific user needs, from unlimited streaming options to dedicated gaming data. Furthermore, advancements in AI-powered customer service chatbots are improving query resolution times and personalizing user interactions. The integration of eSIM technology is simplifying device management and enabling more flexible subscription models. Performance metrics are being redefined by faster download/upload speeds and improved network stability, directly impacting the performance of real-time applications and the overall customer satisfaction.

Propelling Factors for Ireland Telecom Market Growth

The Ireland telecom market's growth is being propelled by several key factors. Technologically, the widespread rollout of 5G networks and the ongoing expansion of fiber optic infrastructure are foundational, promising higher speeds, lower latency, and greater capacity for a range of services. Economically, a strong and growing digital economy, coupled with increasing digitalization across businesses and households, fuels demand for advanced connectivity solutions. Regulatory influences, such as government initiatives promoting digital inclusion and infrastructure investment, create a favorable environment. Specific examples include the National Broadband Plan, aiming to deliver high-speed broadband to rural areas, and the continued investment by operators like Eir and Vodafone in network upgrades. The increasing adoption of cloud computing, IoT devices, and the growing demand for high-definition streaming and online gaming are further contributing to this upward trajectory.

Obstacles in the Ireland Telecom Market Market

Despite robust growth, the Ireland telecom market faces several obstacles. High infrastructure deployment costs, particularly for expanding fiber and 5G networks to rural or geographically challenging areas, present a significant financial hurdle. Regulatory complexities and lengthy approval processes for site acquisition and network deployment can also lead to delays. Supply chain disruptions, as witnessed globally, can impact the availability of critical network equipment. Furthermore, intense competitive pressures among major players like Three Ireland, Eir Mobile, and Vodafone Ireland can lead to price wars, potentially impacting profit margins. The challenge of bridging the digital divide and ensuring equitable access to high-speed broadband across all regions remains a persistent issue, requiring substantial and ongoing investment.

Future Opportunities in Ireland Telecom Market

The future of the Ireland telecom market is rich with opportunities. The continued expansion and monetization of 5G capabilities will unlock new revenue streams through enterprise solutions, enhanced mobile broadband, and IoT applications in sectors like healthcare, manufacturing, and transportation. The growth of the Internet of Things (IoT) ecosystem presents a significant avenue for service providers to offer managed connectivity solutions for smart homes, smart cities, and industrial IoT. The increasing demand for cloud-based services and edge computing necessitates robust network infrastructure, creating opportunities for telecom operators to partner with cloud providers. Furthermore, the ongoing development of digital entertainment platforms, including immersive VR/AR experiences and advanced gaming, will drive further demand for high-bandwidth, low-latency connectivity.

Major Players in the Ireland Telecom Market Ecosystem

- Three Ireland

- Eir Mobile

- Vodafone Ireland

- Virgin Media Ireland

- Sky Ireland Limited

- Digiweb Ltd

- Pure Telecom

- Telcom Group Est 1999 DAC

- Tesco Mobile

- Imagine Networks Services Lt

Key Developments in Ireland Telecom Market Industry

- May 2024: Comarch secured a major contract with Open Eir to transform field services, aiming to improve customer experience with the implementation of a unified technician platform. Open Eir is embarking on a journey to transform customer experiences and establish itself as the preferred network for users.

- March 2024: Phoenix Tower International (PTI) announced that they are adding around 1,900 mobile telecommunication sites in Ireland to its portfolio through the acquisition of Cellnex Telecom’s EUR 971 million (USD 1057.3 million) Irish business. Blackstone-backed PTI agreed to acquire Cellnex Ireland and Cignal Infrastructure, a deal that will boost PTI’s Irish business with an additional 1,700 mobile telecom sites and roughly 200 land locations suitable for hosting third-party wireless sites.

Strategic Ireland Telecom Market Market Forecast

The strategic forecast for the Ireland telecom market points towards sustained and robust growth, driven by the accelerated adoption of 5G technology and the continued expansion of high-speed fiber optic networks. Future opportunities lie in the burgeoning Internet of Things (IoT) ecosystem, where telecom providers can offer integrated connectivity solutions for smart homes, cities, and industries. The increasing demand for cloud services and edge computing will further necessitate sophisticated network infrastructure, creating avenues for partnerships. The evolution of digital entertainment, including immersive VR/AR experiences, will continue to fuel the need for high-bandwidth, low-latency connectivity. This optimistic outlook is supported by ongoing investments in next-generation infrastructure and a supportive regulatory environment, positioning Ireland as a leader in digital transformation.

Ireland Telecom Market Segmentation

-

1. Services

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and Messaging Services

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Ireland Telecom Market Segmentation By Geography

- 1. Ireland

Ireland Telecom Market Regional Market Share

Geographic Coverage of Ireland Telecom Market

Ireland Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for 5G; Growth of IoT Usage in Telecom

- 3.3. Market Restrains

- 3.3.1. Rising Demand for 5G; Growth of IoT Usage in Telecom

- 3.4. Market Trends

- 3.4.1. Wireless Services are Expected to Grow

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Ireland Telecom Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and Messaging Services

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Ireland

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Three Ireland

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Eir Mobile

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vodafone Ireland

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Virgin Media Ireland

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sky Ireland Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Digiweb Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pure Telecom

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Telcom Group Est 1999 DAC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tesco Mobile

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Imagine Networks Services Lt

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Three Ireland

List of Figures

- Figure 1: Ireland Telecom Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Ireland Telecom Market Share (%) by Company 2025

List of Tables

- Table 1: Ireland Telecom Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Ireland Telecom Market Volume Billion Forecast, by Services 2020 & 2033

- Table 3: Ireland Telecom Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Ireland Telecom Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Ireland Telecom Market Revenue Million Forecast, by Services 2020 & 2033

- Table 6: Ireland Telecom Market Volume Billion Forecast, by Services 2020 & 2033

- Table 7: Ireland Telecom Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Ireland Telecom Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ireland Telecom Market?

The projected CAGR is approximately 3.52%.

2. Which companies are prominent players in the Ireland Telecom Market?

Key companies in the market include Three Ireland, Eir Mobile, Vodafone Ireland, Virgin Media Ireland, Sky Ireland Limited, Digiweb Ltd, Pure Telecom, Telcom Group Est 1999 DAC, Tesco Mobile, Imagine Networks Services Lt.

3. What are the main segments of the Ireland Telecom Market?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.24 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for 5G; Growth of IoT Usage in Telecom.

6. What are the notable trends driving market growth?

Wireless Services are Expected to Grow.

7. Are there any restraints impacting market growth?

Rising Demand for 5G; Growth of IoT Usage in Telecom.

8. Can you provide examples of recent developments in the market?

May 2024: Comarch secured a major contract with Open Eir to transform field services, aiming to improve customer experience with the implementation of a unified technician platform. Open Eir is embarking on a journey to transform customer experiences and establish itself as the preferred network for users.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ireland Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ireland Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ireland Telecom Market?

To stay informed about further developments, trends, and reports in the Ireland Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence