Key Insights

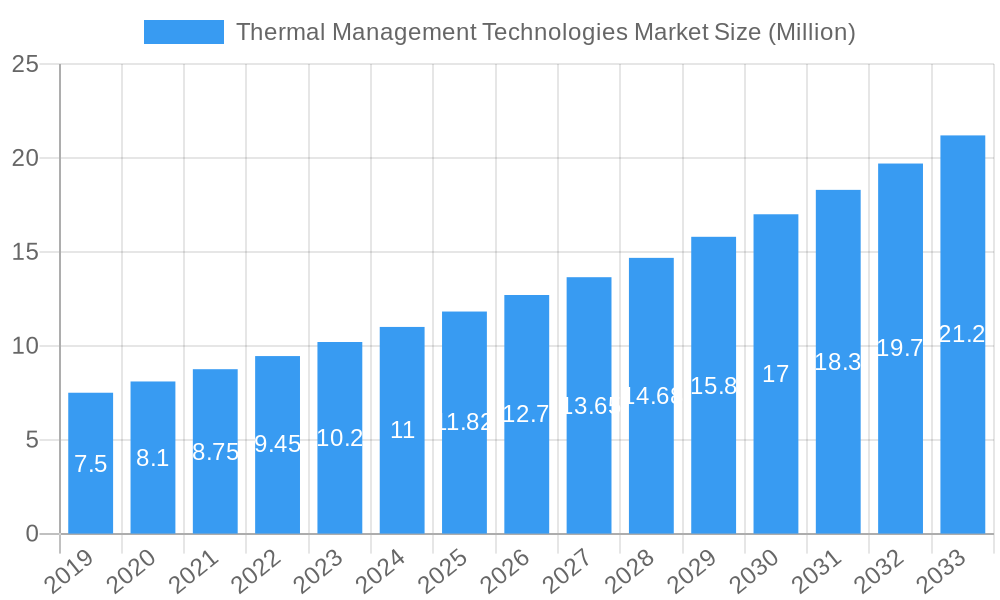

The global Thermal Management Technologies market is poised for significant expansion, projected to reach a substantial USD 12.62 billion in value. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 8.30% between 2019 and 2033. The escalating demand for efficient thermal solutions across a myriad of applications is a primary market driver. Industries such as automotive, particularly with the surge in electric vehicles (EVs) requiring sophisticated battery thermal management, are playing a pivotal role. Similarly, the burgeoning consumer electronics sector, with its ever-increasing power densities and miniaturization trends, necessitates advanced cooling solutions. The proliferation of data centers, driven by cloud computing and big data analytics, also contributes significantly, demanding reliable and efficient thermal management to maintain optimal operating temperatures. Furthermore, the growing adoption of renewable energy systems, such as solar and wind power, requires effective thermal control to ensure longevity and performance.

Thermal Management Technologies Market Market Size (In Million)

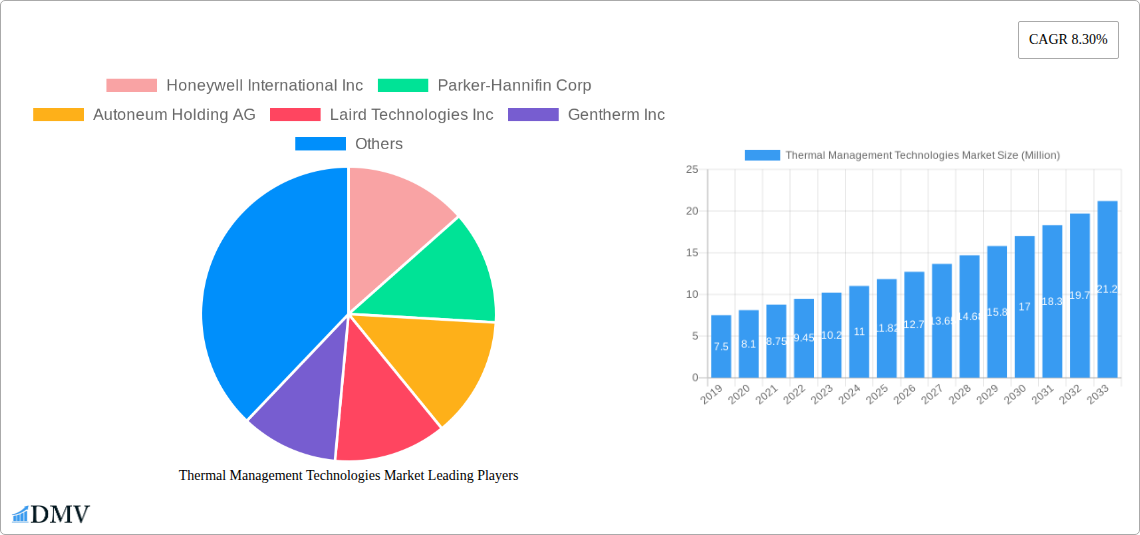

The market landscape is characterized by a dynamic interplay of segments and competitive forces. In terms of product type, software plays an increasingly crucial role, enabling sophisticated control and optimization of thermal systems. Hardware components, including heat sinks, fans, and liquid cooling solutions, remain foundational. Substrates and interfaces are critical for efficient heat transfer. Application-wise, computers and consumer electronics represent substantial markets, while automotive electronics and telecommunication are experiencing rapid growth. The "Other Applications" segment, encompassing areas like aerospace and industrial machinery, also presents considerable opportunities. Key players like Honeywell International Inc., Parker-Hannifin Corp., and Gentherm Inc. are actively innovating, driving technological advancements and shaping market trends. Restraints may include the initial cost of advanced thermal management systems and the complexity of integration in certain legacy systems. However, the long-term benefits of enhanced performance, reliability, and energy efficiency are expected to outweigh these challenges, propelling the market forward.

Thermal Management Technologies Market Company Market Share

This in-depth Thermal Management Technologies Market report provides a comprehensive analysis of a rapidly evolving sector critical to the performance and longevity of modern electronics and systems. Covering the Study Period 2019–2033, with a Base Year and Estimated Year of 2025, and a robust Forecast Period of 2025–2033, this report delves into historical trends, current dynamics, and future projections. The Historical Period 2019–2024 sets the stage for understanding the market's trajectory. This analysis is crucial for stakeholders seeking to navigate the complexities of thermal management solutions, heat dissipation technologies, and advanced cooling systems. The market is segmented by Product Type including Software, Hardware, Substrate, and Interface, and by Application encompassing Computers, Consumer Electronics, Automotive Electronics, Telecommunication, Renewable Energy, and Other Applications. With a projected market size expected to reach USD XXX Million by 2033, understanding these nuances is paramount.

Thermal Management Technologies Market Market Composition & Trends

The Thermal Management Technologies Market exhibits a dynamic composition shaped by intense innovation and strategic maneuvers. Market concentration is influenced by a blend of established leaders and emerging specialists, with key players like Honeywell International Inc., Parker-Hannifin Corp., and Gentherm Inc. vying for significant market share. Innovation catalysts are primarily driven by the escalating power density in electronic devices, the demand for energy efficiency, and the stringent thermal requirements of industries such as automotive electronics and renewable energy. The regulatory landscape, while still developing in some regions, increasingly favors solutions that enhance device reliability and reduce environmental impact. Substitute products, though present, often fall short in meeting the sophisticated demands for high-performance heat sinks, advanced thermal interface materials (TIMs), and integrated cooling solutions. End-user profiles span from individual consumers seeking better performance from their consumer electronics to large-scale industrial operators in the telecommunication and renewable energy sectors. Mergers and acquisitions (M&A) activity is a significant trend, with deal values in the tens to hundreds of Million USD indicating consolidation and strategic integration to expand product portfolios and market reach. For instance, the strategic importance of acquiring niche technologies in advanced cooling or specialized thermal management software is a constant pursuit. The market share distribution is gradually shifting as new entrants with disruptive technologies gain traction, particularly in areas like liquid cooling and phase change materials.

Thermal Management Technologies Market Industry Evolution

The Thermal Management Technologies Market has witnessed a profound industry evolution driven by relentless technological advancements and shifting consumer demands. Over the Study Period 2019–2033, this sector has transformed from addressing basic heat dissipation needs to developing sophisticated, integrated solutions for complex electronic systems. The Historical Period 2019–2024 saw steady growth, fueled by the increasing proliferation of powerful processors in computers and the burgeoning consumer electronics market. However, the true inflection point began with the rapid electrification of the automotive sector. The demand for advanced thermal management solutions in electric vehicles (EVs) and autonomous driving systems has become a dominant growth trajectory. This necessitates highly efficient battery thermal management systems (BTMS), advanced heat exchangers, and robust thermal interface materials to ensure safety, performance, and longevity. Similarly, the expansion of telecommunication infrastructure, particularly with the rollout of 5G, and the continuous growth of renewable energy installations like solar and wind farms, which generate significant heat, have amplified the need for reliable and scalable thermal solutions. Technological advancements have been pivotal, moving beyond passive cooling methods to active and hybrid systems. Innovations in liquid cooling, including immersion cooling and direct-to-chip solutions, are gaining significant traction for high-performance computing and data centers. The development of advanced thermal interface materials with higher thermal conductivity and improved durability, such as specialized pastes, pads, and adhesives, continues to be a focus. Furthermore, the integration of thermal management software for predictive analysis, real-time monitoring, and optimized control of cooling systems is emerging as a critical differentiator. Adoption metrics for these advanced technologies are steadily increasing, with segments like automotive electronics and telecommunication leading the charge, showcasing growth rates often exceeding 10% year-on-year. The overarching trend is towards smarter, more integrated, and highly efficient thermal management that is essential for the continued miniaturization and increased power of electronic devices across all applications.

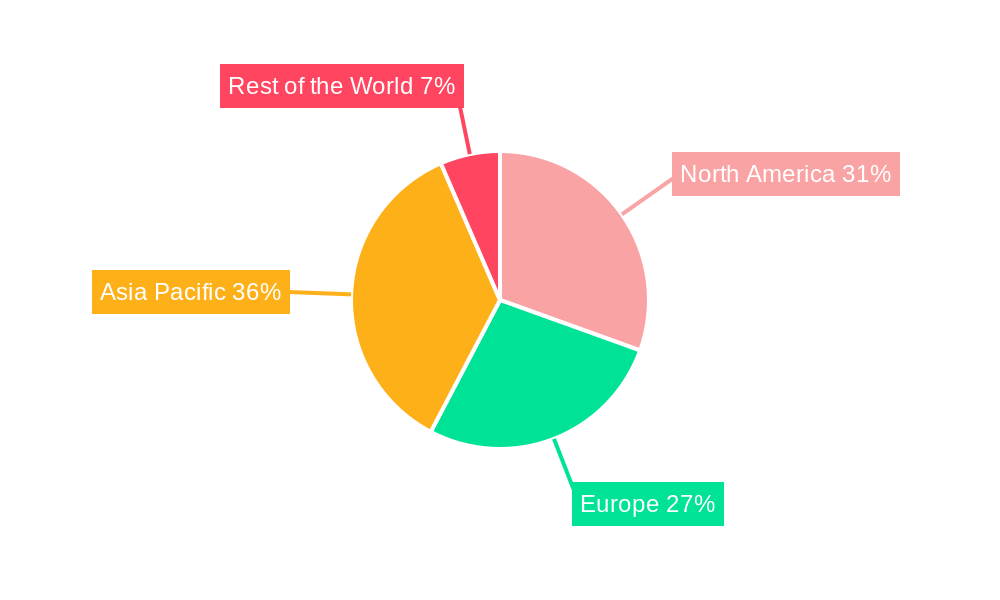

Leading Regions, Countries, or Segments in Thermal Management Technologies Market

The Thermal Management Technologies Market sees significant regional dominance and segment leadership, driven by a confluence of technological adoption, industrial growth, and investment trends. Among the product types, Hardware continues to hold a substantial market share due to the fundamental need for physical components like heat sinks, fans, heat pipes, and thermal interface materials across all applications. The Automotive Electronics segment is a particularly strong driver of growth within the application landscape. This dominance is fueled by the global push towards electric vehicles (EVs), which require sophisticated thermal management for batteries, power electronics, and charging systems. Government incentives for EV adoption, stringent safety regulations, and the increasing complexity of in-car electronics are key drivers.

- North America, particularly the United States, stands out as a leading region. This is attributed to its robust presence in the automotive industry, significant investments in data centers and high-performance computing, and a strong focus on renewable energy expansion. The presence of major technology companies and research institutions fosters continuous innovation in thermal management solutions.

- Europe is another pivotal region, largely driven by its stringent automotive emission standards and leading position in EV manufacturing. Countries like Germany, France, and the UK are at the forefront of adopting advanced thermal management technologies to meet regulatory requirements and consumer demand for sustainable mobility. The region's strong industrial base and commitment to renewable energy further bolster the market.

- Within product types, Hardware leads, with the market for advanced heat sinks and thermal interface materials (TIMs) being particularly robust. For applications, Automotive Electronics is experiencing the most rapid growth, followed closely by Consumer Electronics and Telecommunication.

- Investment trends in North America and Europe are heavily skewed towards R&D for next-generation thermal solutions, particularly those applicable to EVs and high-density computing. Regulatory support for energy efficiency and emissions reduction further solidifies these regions' leadership.

- The dominance of Hardware as a product type is underscored by the continuous demand for improved thermal conductivity and miniaturization in physical components. In applications, the sheer volume of electronic components in modern vehicles, coupled with the critical need for thermal stability in batteries, places Automotive Electronics at the apex of market influence and projected growth.

Thermal Management Technologies Market Product Innovations

Product innovations in the Thermal Management Technologies Market are consistently pushing the boundaries of heat dissipation efficiency and application versatility. Cutting-edge advancements include highly conductive thermal interface materials such as advanced ceramic-polymer composites and graphene-infused pastes that offer superior thermal performance with lower application pressure. Novel heat pipe designs, including loop heat pipes and thermosyphons, are enabling more efficient heat transport in compact form factors. Furthermore, the development of intelligent thermal management software that leverages AI for predictive cooling and real-time optimization is transforming how thermal systems are managed. These innovations translate to extended device lifespan, improved performance under extreme conditions, and reduced energy consumption, particularly crucial for high-power density applications like advanced computing and electric vehicle powertrains.

Propelling Factors for Thermal Management Technologies Market Growth

The Thermal Management Technologies Market is propelled by several key growth drivers. The escalating power density in electronic devices, from high-performance processors in computers to advanced systems in automotive electronics, necessitates more effective heat dissipation. The global shift towards electric vehicles (EVs) is a monumental catalyst, demanding robust battery thermal management systems (BTMS) and efficient cooling for power electronics. Furthermore, the expansion of telecommunication networks, particularly 5G infrastructure, and the increasing adoption of renewable energy sources like solar and wind farms, which generate significant heat, are driving demand for specialized thermal solutions. Technological advancements, including breakthroughs in materials science for advanced thermal interface materials (TIMs) and innovative cooling architectures, further fuel growth by offering enhanced performance and miniaturization capabilities.

Obstacles in the Thermal Management Technologies Market Market

Despite robust growth, the Thermal Management Technologies Market faces several obstacles. The high cost of advanced materials and manufacturing processes for cutting-edge thermal solutions can be a barrier to widespread adoption, especially for cost-sensitive applications. Supply chain disruptions, exacerbated by geopolitical factors and the availability of raw materials for specialized components, can impact production timelines and costs. Furthermore, the complex integration requirements of sophisticated thermal management systems, particularly in new applications like advanced automotive and aerospace, can pose engineering challenges and necessitate specialized expertise. Regulatory hurdles and the need for extensive testing and certification for critical applications like automotive and medical devices can also slow down market entry.

Future Opportunities in Thermal Management Technologies Market

The Thermal Management Technologies Market is poised for significant future opportunities. The continued exponential growth in data center expansion and the increasing demand for high-performance computing present a massive market for advanced liquid cooling and immersion cooling solutions. The sustained global push for electrification across transportation, including heavy-duty vehicles and aviation, will drive innovation in battery thermal management and power electronics cooling. The burgeoning Internet of Things (IoT) ecosystem, with its array of connected devices, will create a decentralized demand for compact and efficient thermal management solutions. Emerging markets in developing economies, as they adopt advanced electronics and EVs, also represent substantial untapped potential.

Major Players in the Thermal Management Technologies Market Ecosystem

- Honeywell International Inc.

- Parker-Hannifin Corp.

- Autoneum Holding AG

- Laird Technologies Inc.

- Gentherm Inc.

- Sapa Extrusions Inc.

- Outlast Technologies LLC

- AllCell Technologies

- Pentair Thermal Management

- Thermacore Inc.

- Advanced Cooling Technologies Inc.

Key Developments in Thermal Management Technologies Market Industry

- July 2022: Honeywell and British aerospace company Reaction Engines Limited signed a memorandum of understanding to collaborate on developing thermal management technologies as a key enabler to reduce aircraft emissions, regardless of the fuel type used in the aircraft. This development signifies a strategic push into the sustainable aviation sector, promising advanced thermal solutions for next-generation aircraft.

- December 2021: The Chomerics division of Parker Hannifin Corporation introduced THERM-A-GAPTM PAD 30 and 60, its next generation of thermal gap filler pads for all heat transfer applications between electronic components and heat sinks. This product launch addresses the growing need for high-performance, easy-to-apply thermal interface materials in demanding electronic applications, enhancing device reliability and thermal performance.

Strategic Thermal Management Technologies Market Market Forecast

The Thermal Management Technologies Market is forecast to experience robust growth, driven by the relentless demand for enhanced electronic performance and efficiency. Key growth catalysts include the accelerating adoption of electric vehicles, requiring sophisticated battery thermal management systems, and the continuous expansion of data centers and high-performance computing, necessitating advanced cooling solutions. The proliferation of 5G technology and the increasing integration of smart devices across various sectors will further amplify the need for reliable thermal management. Innovations in materials science and the development of intelligent, integrated cooling systems will unlock new market potential, allowing for higher power densities and extended device lifespans. The market is projected to witness significant expansion, with an estimated compound annual growth rate of over 8% during the forecast period, reaching a valuation of over USD 25,000 Million by 2033.

Thermal Management Technologies Market Segmentation

-

1. Product Type

- 1.1. Software

- 1.2. Hardware

- 1.3. Substrate

- 1.4. Interface

-

2. Application

- 2.1. Computers

- 2.2. Consumer Electronics

- 2.3. Automotive Electronics

- 2.4. Telecommunication

- 2.5. Renewable Energy

- 2.6. Other Applications

Thermal Management Technologies Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Thermal Management Technologies Market Regional Market Share

Geographic Coverage of Thermal Management Technologies Market

Thermal Management Technologies Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Vehicle Energy Efficiency and Performance; Thermal Management Technology Proliferation

- 3.3. Market Restrains

- 3.3.1. Variability of Verification Devices and Compatibility with Legacy Systems

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Consumer Electronics will Enhance the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Thermal Management Technologies Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Software

- 5.1.2. Hardware

- 5.1.3. Substrate

- 5.1.4. Interface

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Computers

- 5.2.2. Consumer Electronics

- 5.2.3. Automotive Electronics

- 5.2.4. Telecommunication

- 5.2.5. Renewable Energy

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Thermal Management Technologies Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Software

- 6.1.2. Hardware

- 6.1.3. Substrate

- 6.1.4. Interface

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Computers

- 6.2.2. Consumer Electronics

- 6.2.3. Automotive Electronics

- 6.2.4. Telecommunication

- 6.2.5. Renewable Energy

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Thermal Management Technologies Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Software

- 7.1.2. Hardware

- 7.1.3. Substrate

- 7.1.4. Interface

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Computers

- 7.2.2. Consumer Electronics

- 7.2.3. Automotive Electronics

- 7.2.4. Telecommunication

- 7.2.5. Renewable Energy

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Thermal Management Technologies Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Software

- 8.1.2. Hardware

- 8.1.3. Substrate

- 8.1.4. Interface

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Computers

- 8.2.2. Consumer Electronics

- 8.2.3. Automotive Electronics

- 8.2.4. Telecommunication

- 8.2.5. Renewable Energy

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of the World Thermal Management Technologies Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Software

- 9.1.2. Hardware

- 9.1.3. Substrate

- 9.1.4. Interface

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Computers

- 9.2.2. Consumer Electronics

- 9.2.3. Automotive Electronics

- 9.2.4. Telecommunication

- 9.2.5. Renewable Energy

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Honeywell International Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Parker-Hannifin Corp

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Autoneum Holding AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Laird Technologies Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Gentherm Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Sapa Extrusions Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Outlast Technologies LLC*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 AllCell Technologies

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Pentair Thermal Management

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Thermacore Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Advanced Cooling Technologies Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Thermal Management Technologies Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Thermal Management Technologies Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Thermal Management Technologies Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Thermal Management Technologies Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Thermal Management Technologies Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Thermal Management Technologies Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Thermal Management Technologies Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Thermal Management Technologies Market Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe Thermal Management Technologies Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Thermal Management Technologies Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Thermal Management Technologies Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Thermal Management Technologies Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Thermal Management Technologies Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Thermal Management Technologies Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Thermal Management Technologies Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Thermal Management Technologies Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Thermal Management Technologies Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Thermal Management Technologies Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Thermal Management Technologies Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Thermal Management Technologies Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Rest of the World Thermal Management Technologies Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Rest of the World Thermal Management Technologies Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Rest of the World Thermal Management Technologies Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of the World Thermal Management Technologies Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Thermal Management Technologies Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Thermal Management Technologies Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Thermal Management Technologies Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Thermal Management Technologies Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Thermal Management Technologies Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Thermal Management Technologies Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Thermal Management Technologies Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Thermal Management Technologies Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Global Thermal Management Technologies Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Global Thermal Management Technologies Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Thermal Management Technologies Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Global Thermal Management Technologies Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Thermal Management Technologies Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Thermal Management Technologies Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Thermal Management Technologies Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Thermal Management Technologies Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thermal Management Technologies Market?

The projected CAGR is approximately 8.30%.

2. Which companies are prominent players in the Thermal Management Technologies Market?

Key companies in the market include Honeywell International Inc, Parker-Hannifin Corp, Autoneum Holding AG, Laird Technologies Inc, Gentherm Inc, Sapa Extrusions Inc, Outlast Technologies LLC*List Not Exhaustive, AllCell Technologies, Pentair Thermal Management, Thermacore Inc, Advanced Cooling Technologies Inc.

3. What are the main segments of the Thermal Management Technologies Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Vehicle Energy Efficiency and Performance; Thermal Management Technology Proliferation.

6. What are the notable trends driving market growth?

Increasing Demand for Consumer Electronics will Enhance the Market Growth.

7. Are there any restraints impacting market growth?

Variability of Verification Devices and Compatibility with Legacy Systems.

8. Can you provide examples of recent developments in the market?

July 2022: Honeywell and British aerospace company Reaction Engines Limited signed a memorandum of understanding to collaborate on developing thermal management technologies as a key enabler to reduce aircraft emissions, regardless of the fuel type used in the aircraft.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thermal Management Technologies Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thermal Management Technologies Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thermal Management Technologies Market?

To stay informed about further developments, trends, and reports in the Thermal Management Technologies Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence