Key Insights

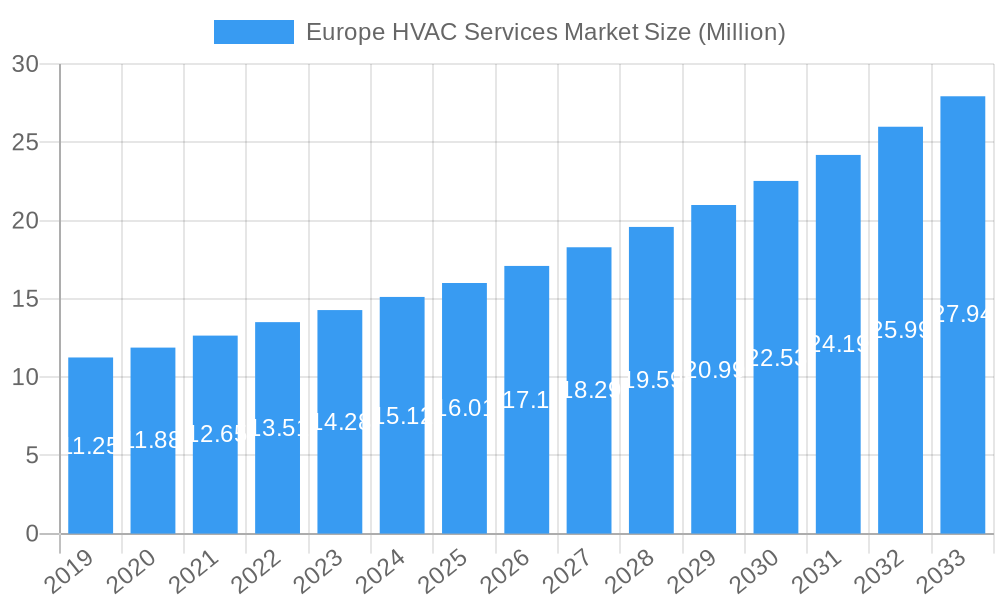

The Europe HVAC Services Market is poised for significant expansion, projected to reach a valuation of $14.68 million by 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 7.10% through 2033. This upward trajectory is fueled by a confluence of factors, including increasing demand for energy-efficient and sustainable building solutions, stringent government regulations promoting reduced carbon emissions, and the growing need for sophisticated climate control systems in both new construction and existing retrofitted buildings. The market's dynamism is further underscored by a strong emphasis on maintenance and repair services, essential for optimizing the lifespan and performance of HVAC equipment. Installation services also play a pivotal role, driven by the ongoing wave of commercial and industrial development across the region. The non-residential sector, encompassing offices, retail spaces, and industrial facilities, stands as a primary end-user, reflecting the critical importance of reliable HVAC systems for business operations and employee comfort.

Europe HVAC Services Market Market Size (In Million)

Key drivers propelling this market forward include the continuous innovation in HVAC technologies, leading to more intelligent and adaptive systems. The push towards smart buildings and the Internet of Things (IoT) integration in HVAC management further enhances efficiency and predictive maintenance capabilities. While the market is generally robust, certain restraints, such as the high initial investment costs associated with advanced HVAC systems and the availability of skilled labor for complex installations and repairs, present challenges. However, these are being steadily addressed through technological advancements and training initiatives. The competitive landscape is characterized by the presence of both global giants and specialized regional players, all vying to capture market share through product innovation, service excellence, and strategic partnerships. Companies are focusing on offering comprehensive solutions that address the evolving needs of the European market for efficient, reliable, and environmentally conscious HVAC services.

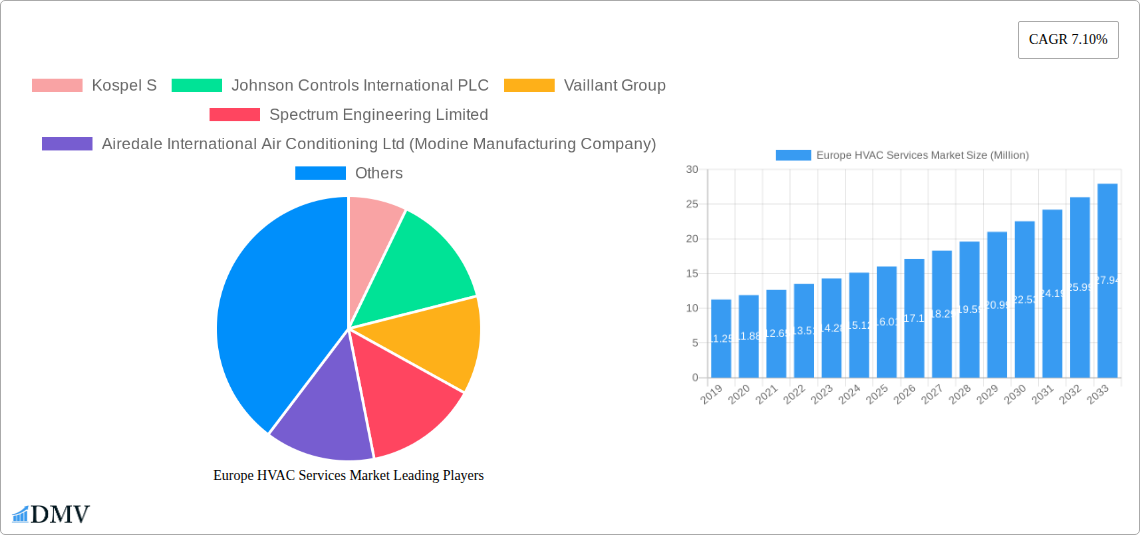

Europe HVAC Services Market Company Market Share

Europe HVAC Services Market: Comprehensive Analysis, Trends, and Future Outlook (2019–2033)

This in-depth report provides a definitive analysis of the dynamic Europe HVAC Services Market. Covering the historical period (2019–2024), base year (2025), and an extensive forecast period (2025–2033), this study offers unparalleled insights into market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, emerging opportunities, key players, and recent developments. With a focus on energy-efficient HVAC solutions, sustainable building technologies, and smart HVAC systems, this report is an essential resource for stakeholders seeking to navigate the complexities and capitalize on the vast potential of the European HVAC services sector. The market is valued in Millions.

Europe HVAC Services Market Market Composition & Trends

The Europe HVAC Services Market is characterized by a moderate to high level of concentration, with a few dominant players alongside a fragmented landscape of regional and specialized service providers. Innovation is a significant catalyst, driven by increasing demand for energy-efficient HVAC systems, smart building integration, and compliance with stringent environmental regulations. The regulatory landscape, particularly the European Union's directives on energy performance and emissions, plays a crucial role in shaping market trends and incentivizing the adoption of advanced HVAC technologies. Substitute products, such as portable cooling units or simpler heating systems, are present but often fall short of the comprehensive comfort and efficiency offered by integrated HVAC services. End-user profiles vary significantly, ranging from large commercial enterprises and industrial facilities to residential property owners, each with unique service needs. Mergers and acquisitions (M&A) activities are prevalent as companies seek to expand their service portfolios, geographic reach, and technological capabilities. Notable M&A deal values contribute to market consolidation and strategic growth. The market share distribution is influenced by the provision of installation, maintenance, and repair services across various building types and end-user industries. The European HVAC services market size is projected to witness substantial growth, driven by retrofitting initiatives and new construction projects demanding sophisticated heating, ventilation, and air conditioning (HVAC) solutions.

Europe HVAC Services Market Industry Evolution

The Europe HVAC Services Market has undergone a significant transformation over the historical period and is poised for substantial expansion in the forecast period. The industry's evolution is marked by a consistent growth trajectory fueled by escalating environmental consciousness and a growing imperative for energy-efficient HVAC systems. This shift is directly attributable to a confluence of factors, including stricter government regulations aimed at reducing carbon footprints, increasing energy prices, and a heightened awareness among consumers and businesses regarding the long-term economic and environmental benefits of sustainable HVAC solutions. Technological advancements have been paramount in this evolution. The integration of IoT (Internet of Things) capabilities has given rise to smart HVAC systems that offer remote monitoring, predictive maintenance, and optimized energy consumption. This has not only improved operational efficiency but also enhanced user comfort and convenience. The adoption of advanced control systems, variable speed drives, and energy recovery technologies has become increasingly commonplace, leading to improved performance metrics and reduced operational costs. Furthermore, the demand for indoor air quality (IAQ) has surged, particularly post-pandemic, driving innovation in ventilation and air purification technologies within HVAC systems. Shifting consumer demands are increasingly prioritizing comfort, health, and sustainability. Building owners are actively seeking HVAC solutions that contribute to healthier indoor environments, reduce energy bills, and minimize their environmental impact. This has led to a greater demand for services such as commissioning, retro-commissioning, and advanced maintenance tailored to optimize system performance and lifespan. The European HVAC services market growth rate is expected to remain robust, driven by a continuous cycle of innovation, regulatory compliance, and evolving end-user preferences. The market's expansion is also being shaped by a growing emphasis on lifecycle management of HVAC systems, encompassing installation, ongoing maintenance, and eventual upgrades or replacements. The increasing complexity of modern HVAC systems necessitates specialized expertise, thereby bolstering the demand for professional HVAC services.

Leading Regions, Countries, or Segments in Europe HVAC Services Market

The Europe HVAC Services Market exhibits distinct regional leadership and segment dominance, primarily driven by a combination of investment trends, regulatory support, and specific industry demands. Maintenance and Repair services represent a cornerstone of the market's current strength and future growth, owing to the extensive existing building stock across Europe and the increasing lifespan of HVAC equipment.

Key Drivers for Maintenance and Repair Dominance:

- Aging Infrastructure: A significant portion of Europe's building infrastructure requires ongoing maintenance to ensure optimal performance and energy efficiency. This creates a constant demand for skilled technicians and specialized services.

- Regulatory Compliance: Strict energy efficiency standards and emissions regulations necessitate regular checks and servicing of HVAC systems to ensure compliance and avoid penalties.

- Cost Savings: Proactive maintenance and repair are more cost-effective in the long run, preventing major breakdowns and extending the operational life of expensive HVAC equipment.

- Focus on Indoor Air Quality (IAQ): Increased awareness of IAQ benefits, particularly in non-residential sectors, drives demand for regular filter replacements, system cleaning, and performance checks.

In terms of Type of Service, Maintenance and Repair consistently outpaces Installation and Implementation, although both are critical for market growth. Installation services are primarily driven by New Construction projects, particularly in rapidly developing urban centers and regions with significant infrastructure investment. However, the Retrofit Buildings segment is experiencing substantial growth as governments and private entities invest in upgrading older buildings to meet modern energy efficiency standards.

Leading End-user Industry:

The Non-residential sector stands as a dominant end-user industry within the Europe HVAC Services Market. This encompasses a wide array of sub-segments, including:

- Commercial Offices: High demand for comfortable and energy-efficient workspaces.

- Retail Spaces: Ensuring optimal customer experience through controlled climate.

- Healthcare Facilities: Critical need for precise temperature and air quality control for patient well-being and equipment functionality.

- Educational Institutions: Maintaining conducive learning environments.

- Hospitality Sector: Essential for guest comfort and satisfaction.

The dominance of the non-residential sector is attributed to several factors:

- Larger Scale of Operations: Non-residential buildings typically house more complex and extensive HVAC systems, requiring more comprehensive service contracts.

- Higher Energy Consumption: These facilities often have higher energy demands, making the economic benefits of efficient HVAC services more pronounced.

- Stringent Operational Requirements: Industries like healthcare and data centers have critical operational requirements for consistent climate control, making HVAC service reliability paramount.

- Investment in Building Modernization: Many businesses are investing in upgrading their facilities to improve energy efficiency and occupant comfort, driving demand for advanced HVAC retrofitting and maintenance.

While Industry also represents a significant segment, the sheer volume and diversity of the non-residential sector, coupled with ongoing trends towards energy efficiency and smart building integration, solidify its position as the leading end-user industry in the Europe HVAC Services Market. The combination of a robust demand for ongoing maintenance, coupled with significant investments in retrofitting and new construction within the non-residential space, underpins the segment's market leadership.

Europe HVAC Services Market Product Innovations

The Europe HVAC Services Market is witnessing a surge in innovative solutions aimed at enhancing energy efficiency, sustainability, and user comfort. Key product innovations include the development of high-efficiency heat pumps, advanced variable refrigerant flow (VRF) systems with enhanced zone control, and intelligent building management systems (BMS) that integrate HVAC operations with other building functions. Furthermore, the integration of IoT sensors and AI-driven analytics is enabling predictive maintenance, real-time performance optimization, and personalized climate control. Environmentally friendly refrigerants and materials are also a significant focus, aligning with stringent EU regulations and growing consumer demand for sustainable solutions. These advancements are not only improving performance metrics such as SEER (Seasonal Energy Efficiency Ratio) and HSPF (Heating Seasonal Performance Factor) but also reducing operational costs and carbon footprints, offering unique selling propositions for service providers and manufacturers alike.

Propelling Factors for Europe HVAC Services Market Growth

Several pivotal factors are propelling the growth of the Europe HVAC Services Market. Firstly, stringent EU regulations mandating energy efficiency and emission reductions are a primary driver, encouraging the adoption of modern, sustainable HVAC technologies and demanding expert installation and maintenance services. Secondly, the increasing focus on indoor air quality (IAQ), heightened by recent global health events, is spurring demand for advanced ventilation and filtration systems. Thirdly, the widespread retrofit of existing buildings to improve energy performance presents a substantial opportunity, requiring specialized services to upgrade older HVAC infrastructure. Lastly, the continuous rise of smart building technologies and IoT integration is creating a demand for sophisticated HVAC solutions that offer remote monitoring, automated controls, and energy optimization, further bolstering the market.

Obstacles in the Europe HVAC Services Market Market

Despite robust growth, the Europe HVAC Services Market faces several obstacles. High initial investment costs for advanced HVAC systems can deter some smaller businesses and homeowners. Supply chain disruptions, exacerbated by geopolitical events and raw material shortages, can lead to project delays and increased costs for equipment and components. Furthermore, a shortage of skilled labor with expertise in new, complex HVAC technologies poses a significant challenge for service providers aiming to meet growing demand. The complexity of regulatory frameworks across different EU member states can also create compliance hurdles for businesses operating across borders. Intense competitive pressure from established players and new entrants also necessitates continuous innovation and cost management.

Future Opportunities in Europe HVAC Services Market

The Europe HVAC Services Market is ripe with future opportunities. The ongoing transition to renewable energy sources creates a significant demand for HVAC systems that can seamlessly integrate with solar thermal and geothermal technologies. The burgeoning smart city initiatives across Europe will necessitate interconnected and intelligent HVAC systems for urban infrastructure. Furthermore, the increasing adoption of electrification of heating offers a substantial avenue for growth in heat pump installation and maintenance services. The demand for circular economy principles in HVAC, including recycling and refurbishment of components, presents an opportunity for service providers to offer sustainable solutions and build brand loyalty.

Major Players in the Europe HVAC Services Market Ecosystem

- Kospel S

- Johnson Controls International PLC

- Vaillant Group

- Spectrum Engineering Limited

- Airedale International Air Conditioning Ltd (Modine Manufacturing Company)

- Carrier Corporation (United Technologies)

- Crystal Air Holdings Limited

- Pentair Inc

- Air Conditioning Solutions Inc

- Ingersoll Rand PLC

- BDR Thermea Group

- IAC Vestcold AS

- Klima Venta

- Aggreko PLC

- Envirotec Limited

- AAF International (Daikin Industries Ltd)

- Aermec SpA (Giordano Riello International Group SpA)

- Daikin Applied Americas Inc

Key Developments in Europe HVAC Services Market Industry

- April 2024: Panasonic Corporation announced the launch of new environmentally friendly HVAC solutions in Europe, leveraging innovative technologies and partnerships to meet the growing need for energy-efficient heating, ventilation, and air conditioning HVAC solutions. The European HVAC division ensures a healthy, sustainable environment, well-being, and comfort.

- January 2024: Apleona announced the acquisition of Air for All, the ventilation and air conditioning company, to expand its range of technical systems and presence in the southwest region of Germany. Air for All has specialized experience in facilities such as cleanrooms and laboratories for customers in the automotive and healthcare industries.

Strategic Europe HVAC Services Market Market Forecast

The strategic Europe HVAC Services Market forecast indicates sustained and robust growth, driven by a confluence of favorable factors. The accelerating demand for energy-efficient HVAC solutions will continue to be a primary growth catalyst, propelled by increasingly stringent EU environmental regulations and a growing awareness of the economic and ecological benefits of sustainable technologies. The significant ongoing investment in the retrofit of existing buildings across Europe presents a substantial market opportunity, requiring specialized expertise for upgrades and modernization. Furthermore, the widespread adoption of smart building technologies and the integration of IoT are creating a need for sophisticated, interconnected HVAC systems that offer enhanced control, monitoring, and optimization capabilities. The transition towards electrification of heating and the increasing prominence of renewable energy integration in HVAC systems will also play a crucial role in shaping the market's future trajectory, presenting opportunities for innovation and service expansion. The overall outlook suggests a dynamic and expanding market poised for significant development in the coming years.

Europe HVAC Services Market Segmentation

-

1. Type of Service

- 1.1. Maintenance and Repair

- 1.2. Installation

-

2. Implementation Type

- 2.1. New Construction

- 2.2. Retrofit Buildings

-

3. End-user Industry

- 3.1. Non-residential

Europe HVAC Services Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

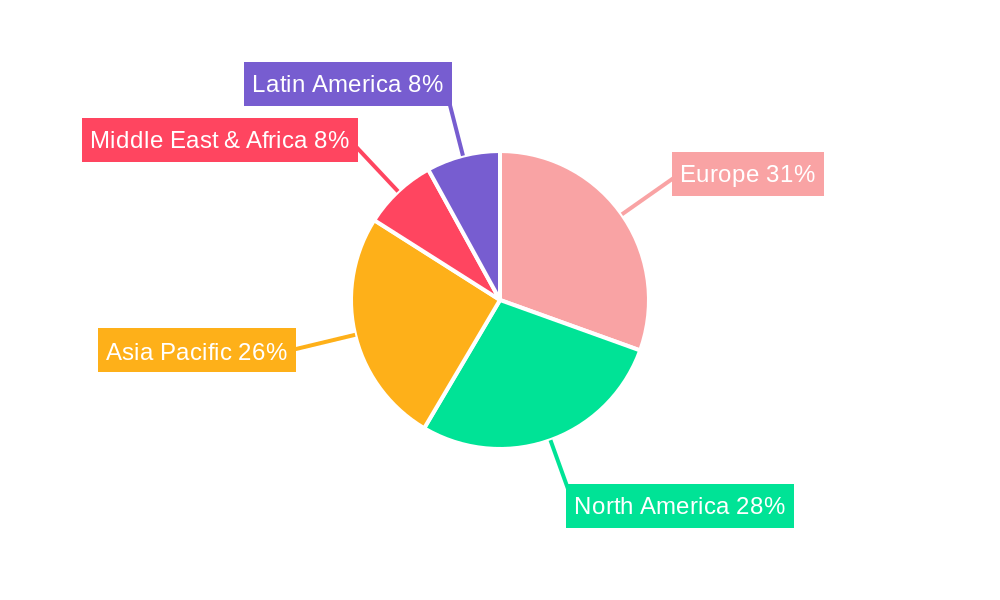

Europe HVAC Services Market Regional Market Share

Geographic Coverage of Europe HVAC Services Market

Europe HVAC Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Construction Activity; Growing Demand for Replacement and Retrofit Services

- 3.3. Market Restrains

- 3.3.1. Data privacy and security concerns; High installation and maintenance costs

- 3.4. Market Trends

- 3.4.1. The Residential Segment Holds Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe HVAC Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Service

- 5.1.1. Maintenance and Repair

- 5.1.2. Installation

- 5.2. Market Analysis, Insights and Forecast - by Implementation Type

- 5.2.1. New Construction

- 5.2.2. Retrofit Buildings

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Non-residential

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type of Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kospel S

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Johnson Controls International PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vaillant Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Spectrum Engineering Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Airedale International Air Conditioning Ltd (Modine Manufacturing Company)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Carrier Corporation (United Technologies)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Crystal Air Holdings Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pentair Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Air Conditioning Solutions Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ingersoll Rand PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 BDR Thermea Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 IAC Vestcold AS

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Klima Venta

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Aggreko PLC

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Envirotec Limited

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 AAF International (Daikin Industries Ltd)

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Aermec SpA (Giordano Riello International Group SpA)

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Daikin Applied Americas Inc

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.1 Kospel S

List of Figures

- Figure 1: Europe HVAC Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe HVAC Services Market Share (%) by Company 2025

List of Tables

- Table 1: Europe HVAC Services Market Revenue Million Forecast, by Type of Service 2020 & 2033

- Table 2: Europe HVAC Services Market Revenue Million Forecast, by Implementation Type 2020 & 2033

- Table 3: Europe HVAC Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Europe HVAC Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe HVAC Services Market Revenue Million Forecast, by Type of Service 2020 & 2033

- Table 6: Europe HVAC Services Market Revenue Million Forecast, by Implementation Type 2020 & 2033

- Table 7: Europe HVAC Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Europe HVAC Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe HVAC Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe HVAC Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe HVAC Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe HVAC Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe HVAC Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe HVAC Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe HVAC Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe HVAC Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe HVAC Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe HVAC Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe HVAC Services Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe HVAC Services Market?

The projected CAGR is approximately 7.10%.

2. Which companies are prominent players in the Europe HVAC Services Market?

Key companies in the market include Kospel S, Johnson Controls International PLC, Vaillant Group, Spectrum Engineering Limited, Airedale International Air Conditioning Ltd (Modine Manufacturing Company), Carrier Corporation (United Technologies), Crystal Air Holdings Limited, Pentair Inc, Air Conditioning Solutions Inc, Ingersoll Rand PLC, BDR Thermea Group, IAC Vestcold AS, Klima Venta, Aggreko PLC, Envirotec Limited, AAF International (Daikin Industries Ltd), Aermec SpA (Giordano Riello International Group SpA), Daikin Applied Americas Inc.

3. What are the main segments of the Europe HVAC Services Market?

The market segments include Type of Service, Implementation Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.68 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Construction Activity; Growing Demand for Replacement and Retrofit Services.

6. What are the notable trends driving market growth?

The Residential Segment Holds Significant Market Share.

7. Are there any restraints impacting market growth?

Data privacy and security concerns; High installation and maintenance costs.

8. Can you provide examples of recent developments in the market?

April 2024: Panasonic Corporation announced the launch of new environmentally friendly HVAC solutions in Europe. In addition, the company leverages innovative technologies and partnerships to meet the growing need for energy-efficient heating, ventilation, and air conditioning HVAC solutions in Europe. The European HVAC division ensures a healthy, sustainable environment, well-being, and comfort.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe HVAC Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe HVAC Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe HVAC Services Market?

To stay informed about further developments, trends, and reports in the Europe HVAC Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence