Key Insights

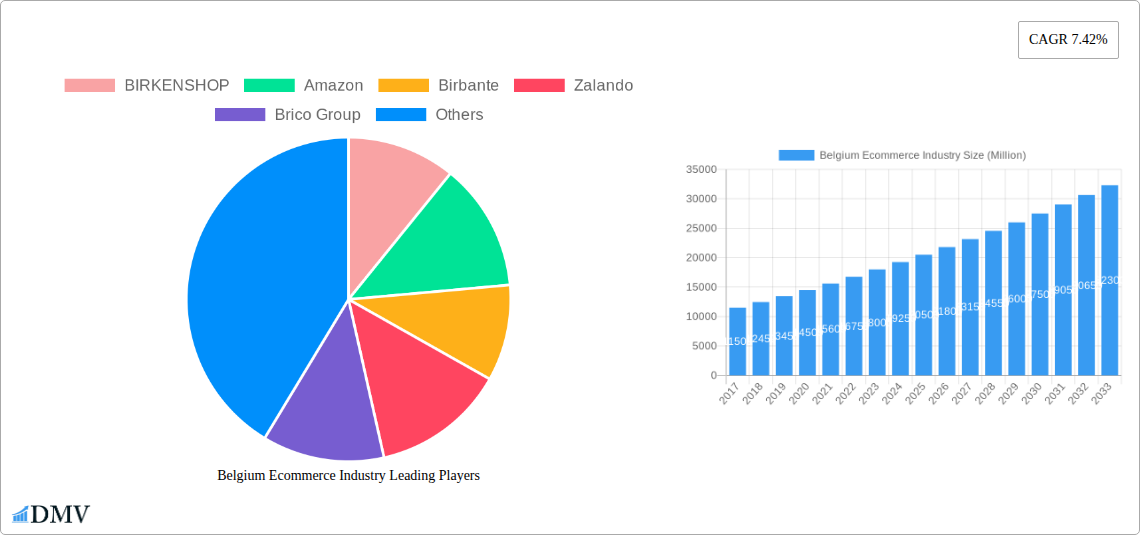

Belgium's e-commerce market is projected to reach $22.71 billion by 2025, expanding at a CAGR of 6.95% from a base year of 2025. This robust growth is propelled by strong B2C and B2B sector adoption. In B2C, General Merchandise, particularly Fashion & Apparel, Consumer Electronics, and Beauty & Personal Care, will lead expansion. Key drivers include high smartphone penetration, widespread internet access, and growing consumer trust in online transactions, complemented by convenient delivery services and Belgium's advancing digital infrastructure. Major international players like Amazon and Zalando, alongside prominent local e-tailers such as Coolblue and bol.com, foster a competitive and customer-focused market.

Belgium Ecommerce Industry Market Size (In Billion)

The Belgian e-commerce landscape is further shaped by evolving consumer demands and technological advancements. The "Others" segment, including Toys, DIY, and Media, is expected to see significant growth as consumers explore diverse online product selections. The B2B e-commerce sector is also a critical growth area, driven by businesses embracing digital procurement for improved efficiency and market reach. While strong growth drivers are evident, potential challenges related to regulatory shifts and the necessity for advanced logistics and cybersecurity infrastructure will require strategic management. Nevertheless, Belgium's e-commerce industry forecasts a sustained period of innovation, market expansion, and increased digital commerce across all significant segments.

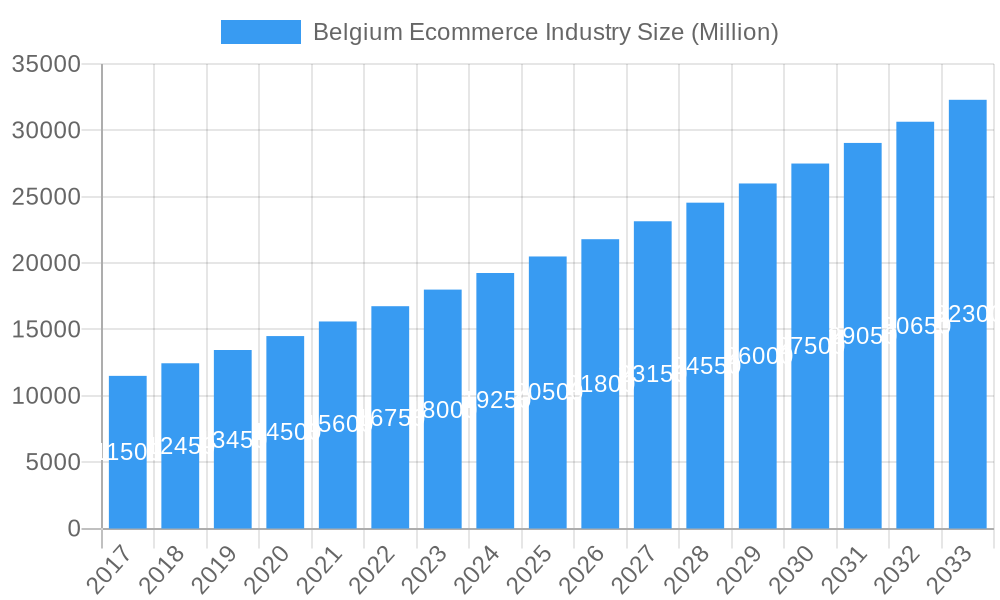

Belgium Ecommerce Industry Company Market Share

Belgium Ecommerce Industry Market Composition & Trends

The Belgian e-commerce landscape is characterized by a dynamic and evolving market concentration, influenced by a blend of established international players and agile local businesses. Innovation is a primary catalyst, with companies continuously investing in seamless customer experiences, advanced logistics, and personalized offerings. The regulatory framework, while supportive of digital growth, also presents opportunities for adaptation and compliance. Substitute products are becoming increasingly sophisticated, pushing e-commerce retailers to differentiate through superior service and unique value propositions. End-user profiles are diverse, ranging from tech-savvy millennials to convenience-seeking baby boomers, each with distinct purchasing behaviors and preferences. Mergers and acquisitions (M&A) activities are on the rise as larger entities seek to consolidate market share and smaller innovative firms aim for scalability. The market share distribution sees significant influence from major online retailers, but a burgeoning number of specialized e-commerce sites are carving out niches. M&A deal values are projected to escalate as strategic partnerships and acquisitions become crucial for sustained growth in this competitive environment.

Belgium Ecommerce Industry Industry Evolution

The Belgian e-commerce industry has undergone a remarkable transformation over the historical period of 2019–2024, exhibiting robust market growth trajectories driven by increasing internet penetration, smartphone adoption, and a growing consumer trust in online transactions. Technological advancements have been pivotal in shaping this evolution. The widespread adoption of mobile commerce (m-commerce) has enabled consumers to shop anytime, anywhere, leading to an increase in impulse purchases and a demand for intuitive mobile interfaces. Payment gateway innovations have also played a crucial role, offering secure and diverse payment options, from traditional credit cards to digital wallets and buy-now-pay-later solutions, thereby reducing transaction friction.

Shifting consumer demands have further accelerated this evolution. Belgian consumers now expect not only competitive pricing but also fast and reliable delivery, flexible return policies, and highly personalized shopping experiences. This has spurred significant investment in last-mile logistics and supply chain optimization. The COVID-19 pandemic acted as a significant accelerant, pushing even hesitant consumers towards online channels for a wide array of products, from groceries to home essentials and electronics. This surge in online activity has permanently altered consumer habits, solidifying e-commerce as a primary shopping channel.

Growth rates in the Belgian e-commerce market have consistently outpaced those of traditional retail, driven by these converging factors. Adoption metrics for online shopping across various demographics have seen substantial increases. For instance, the adoption of online grocery shopping, once a niche segment, has witnessed exponential growth, reflecting a fundamental shift in how Belgians procure daily necessities. Similarly, the fashion and electronics sectors have continued to thrive, benefiting from the convenience of browsing extensive catalogs and comparing prices with ease. The industry's evolution is a testament to its adaptability and its ability to respond to both technological innovation and evolving consumer expectations, setting the stage for continued expansion in the forecast period.

Leading Regions, Countries, or Segments in Belgium Ecommerce Industry

The Belgian e-commerce industry is a complex ecosystem with distinct drivers of dominance across its various segments. The B2C E-commerce sector, in particular, demonstrates significant growth and segmentation, with a projected Market size (GMV) that has seen consistent expansion from 2017 through to the estimated year of 2025 and is forecasted to reach substantial figures by 2027. This dominance is underpinned by several key drivers.

Market Segmentation by Application reveals that Fashion & Apparel consistently emerges as a leading segment. This is attributable to several factors:

- High Purchase Frequency: Consumers tend to purchase apparel more frequently than other categories, leading to higher transaction volumes.

- Visual Appeal & Trend Responsiveness: Fashion is inherently visual and trend-driven, making it well-suited for online discovery and purchase, with platforms like Zalando and Veepee playing a crucial role.

- Wide Product Variety & Customization: Online channels allow for an extensive range of styles, sizes, and brands that would be impossible to replicate in physical stores.

Furthermore, Consumer Electronics also holds a significant share, driven by:

- Technological Advancements: The rapid pace of innovation in electronics necessitates frequent upgrades, fueling consistent demand.

- Price Sensitivity & Comparison: Consumers actively compare prices and specifications online, benefiting from competitive offerings from players like Amazon and Coolblue.

- Convenience of Delivery: For bulky or heavy electronics, home delivery is a significant advantage.

The Furniture & Home segment is experiencing robust growth, propelled by:

- "Do It Yourself" (DIY) Culture: The popularity of home improvement and decoration fuels demand for furniture and home goods. Retailers like Brico Group are leveraging online platforms.

- Visual Inspiration & Augmented Reality (AR): Online retailers are increasingly using high-quality imagery and AR tools to help consumers visualize products in their homes.

- Increased Home Focus: Post-pandemic trends have led consumers to invest more in their living spaces.

B2B E-commerce in Belgium is also a substantial and growing market, with a significant Market size projected for the period of 2017-2027. Its dominance is driven by:

- Operational Efficiency: Businesses are increasingly adopting e-commerce solutions to streamline procurement processes, reduce administrative overhead, and improve inventory management.

- Access to Wider Supplier Networks: B2B platforms enable businesses to source goods and services from a broader range of suppliers, often at more competitive prices.

- Specialized Solutions: Many B2B e-commerce platforms offer tailored solutions for specific industries, catering to unique business needs.

Investment trends in both B2C and B2B e-commerce are strong, with significant capital flowing into logistics, platform development, and digital marketing. Regulatory support for digital transformation further bolsters confidence and encourages investment. The dominance of these segments is a direct result of their inherent suitability for online sales, coupled with strategic investments and evolving consumer and business behaviors.

Belgium Ecommerce Industry Product Innovations

Product innovations in the Belgian e-commerce sector are increasingly focused on enhancing the customer journey and operational efficiency. This includes the development of sophisticated AI-powered recommendation engines that personalize product suggestions, leading to higher conversion rates. Augmented reality (AR) applications are transforming how consumers interact with products, particularly in the fashion and furniture sectors, allowing them to virtually try on clothes or visualize furniture in their homes before purchasing. Smart packaging solutions and eco-friendly delivery options are also gaining traction, appealing to environmentally conscious consumers. Furthermore, the integration of voice commerce capabilities and the expansion of faster, more flexible delivery options like same-day delivery are pushing the boundaries of convenience and service.

Propelling Factors for Belgium Ecommerce Industry Growth

Several key factors are propelling the growth of the Belgium e-commerce industry. Technologically, the increasing penetration of high-speed internet and smartphones, coupled with advancements in mobile payment systems and secure online transaction platforms, forms a robust digital infrastructure. Economically, rising disposable incomes and a growing consumer confidence in online shopping contribute significantly. The convenience of online shopping, offering 24/7 accessibility and a vast product selection, caters to modern lifestyle demands. Regulatory support for digital businesses and e-commerce initiatives also plays a vital role, creating a favorable business environment. Finally, the continuous innovation in logistics and last-mile delivery solutions ensures faster and more reliable fulfillment, a critical factor for customer satisfaction.

Obstacles in the Belgium Ecommerce Industry Market

Despite its strong growth, the Belgium e-commerce market faces several obstacles. Regulatory challenges, including evolving data privacy laws (GDPR) and cross-border taxation complexities, can impact operational costs and compliance efforts. Supply chain disruptions, exacerbated by global events, can lead to stockouts, delayed deliveries, and increased shipping costs, impacting customer satisfaction. Intense competitive pressures from both global giants and niche players necessitate continuous investment in marketing and customer acquisition, often leading to higher operational expenses. Furthermore, the need for significant investment in cybersecurity to protect sensitive customer data and prevent fraud remains a constant concern.

Future Opportunities in Belgium Ecommerce Industry

The future of the Belgium e-commerce industry is ripe with opportunities. The expansion of cross-border e-commerce, particularly within the European Union, presents a significant avenue for growth. Emerging technologies like Artificial Intelligence (AI) and the Metaverse offer potential for innovative customer engagement, personalized experiences, and immersive shopping environments. The growing demand for sustainable and ethically sourced products creates opportunities for brands focusing on eco-friendly practices and transparent supply chains. Furthermore, the increasing adoption of m-commerce and the development of seamless mobile payment solutions will continue to drive impulse purchases and enhance convenience. Niche market segments, such as personalized health and wellness products and specialized hobby items, also represent untapped potential.

Major Players in the Belgium Ecommerce Industry Ecosystem

- BIRKENSHOP

- Amazon

- Birbante

- Zalando

- Brico Group

- Coolblue

- Veepee

- Qpon

- Vanden Borre NV

- bol com

Key Developments in Belgium Ecommerce Industry Industry

- April 2022: ViaEurope, an e-commerce logistics company, launched a fully automatic sorting belt in its Liege E-Hub. This system handles over 3,500 parcels per hour, scanning barcodes on five sides, weighing, measuring, and capturing pictures, demonstrating a commitment to operational safety and efficiency.

- February 2022: Amazon announced plans to build its first fulfillment center at Antwerp's new Blue Gate area by the end of 2020. This center aims to facilitate parcel supply to small and medium-sized local delivery companies.

Strategic Belgium Ecommerce Industry Market Forecast

The strategic forecast for the Belgium e-commerce market indicates continued robust growth, fueled by an increasing adoption of digital technologies and evolving consumer purchasing habits. Key growth catalysts include further advancements in logistics and fulfillment, enabling faster and more personalized delivery services. The integration of emerging technologies like AI and AR will create more engaging and immersive shopping experiences, driving customer loyalty. The growing emphasis on sustainability and ethical consumption will also present opportunities for brands that align with these values. The ongoing expansion of B2B e-commerce, driven by the pursuit of operational efficiency, will further solidify the industry's upward trajectory. Overall, the market potential remains substantial, with a strong outlook for innovation and increased market penetration across diverse product categories.

Belgium Ecommerce Industry Segmentation

-

1. B2C E-commerce

- 1.1. Market size (GMV) for the period of 2017-2027

-

1.2. Market Segmentation - by Application

- 1.2.1. Beauty & Personal Care

- 1.2.2. Consumer Electronics

- 1.2.3. Fashion & Apparel

- 1.2.4. Food & Beverage

- 1.2.5. Furniture & Home

- 1.2.6. Others (Toys, DIY, Media, etc.)

- 2. Market size (GMV) for the period of 2017-2027

-

3. Application

- 3.1. Beauty & Personal Care

- 3.2. Consumer Electronics

- 3.3. Fashion & Apparel

- 3.4. Food & Beverage

- 3.5. Furniture & Home

- 3.6. Others (Toys, DIY, Media, etc.)

- 4. Beauty & Personal Care

- 5. Consumer Electronics

- 6. Fashion & Apparel

- 7. Food & Beverage

- 8. Furniture & Home

- 9. Others (Toys, DIY, Media, etc.)

-

10. B2B E-commerce

- 10.1. Market size for the period of 2017-2027

Belgium Ecommerce Industry Segmentation By Geography

- 1. Belgium

Belgium Ecommerce Industry Regional Market Share

Geographic Coverage of Belgium Ecommerce Industry

Belgium Ecommerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Internet Penetration Across the Country; Increased Adoption of Smartphones

- 3.3. Market Restrains

- 3.3.1. Low Light Sensing Capabilities Act as a Restraining Factor; Low-cost Sensors are Increasing the Threat to Scale Down the Quality

- 3.4. Market Trends

- 3.4.1. Increase in Internet Penetration Across the Country is Fueling the Growth of the Market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Belgium Ecommerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 5.1.1. Market size (GMV) for the period of 2017-2027

- 5.1.2. Market Segmentation - by Application

- 5.1.2.1. Beauty & Personal Care

- 5.1.2.2. Consumer Electronics

- 5.1.2.3. Fashion & Apparel

- 5.1.2.4. Food & Beverage

- 5.1.2.5. Furniture & Home

- 5.1.2.6. Others (Toys, DIY, Media, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Market size (GMV) for the period of 2017-2027

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Beauty & Personal Care

- 5.3.2. Consumer Electronics

- 5.3.3. Fashion & Apparel

- 5.3.4. Food & Beverage

- 5.3.5. Furniture & Home

- 5.3.6. Others (Toys, DIY, Media, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Beauty & Personal Care

- 5.5. Market Analysis, Insights and Forecast - by Consumer Electronics

- 5.6. Market Analysis, Insights and Forecast - by Fashion & Apparel

- 5.7. Market Analysis, Insights and Forecast - by Food & Beverage

- 5.8. Market Analysis, Insights and Forecast - by Furniture & Home

- 5.9. Market Analysis, Insights and Forecast - by Others (Toys, DIY, Media, etc.)

- 5.10. Market Analysis, Insights and Forecast - by B2B E-commerce

- 5.10.1. Market size for the period of 2017-2027

- 5.11. Market Analysis, Insights and Forecast - by Region

- 5.11.1. Belgium

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BIRKENSHOP

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amazon

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Birbante

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zalando

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Brico Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Coolblue

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Veepee*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Qpon

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Vanden Borre NV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 bol com

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BIRKENSHOP

List of Figures

- Figure 1: Belgium Ecommerce Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Belgium Ecommerce Industry Share (%) by Company 2025

List of Tables

- Table 1: Belgium Ecommerce Industry Revenue billion Forecast, by B2C E-commerce 2020 & 2033

- Table 2: Belgium Ecommerce Industry Revenue billion Forecast, by Market size (GMV) for the period of 2017-2027 2020 & 2033

- Table 3: Belgium Ecommerce Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Belgium Ecommerce Industry Revenue billion Forecast, by Beauty & Personal Care 2020 & 2033

- Table 5: Belgium Ecommerce Industry Revenue billion Forecast, by Consumer Electronics 2020 & 2033

- Table 6: Belgium Ecommerce Industry Revenue billion Forecast, by Fashion & Apparel 2020 & 2033

- Table 7: Belgium Ecommerce Industry Revenue billion Forecast, by Food & Beverage 2020 & 2033

- Table 8: Belgium Ecommerce Industry Revenue billion Forecast, by Furniture & Home 2020 & 2033

- Table 9: Belgium Ecommerce Industry Revenue billion Forecast, by Others (Toys, DIY, Media, etc.) 2020 & 2033

- Table 10: Belgium Ecommerce Industry Revenue billion Forecast, by B2B E-commerce 2020 & 2033

- Table 11: Belgium Ecommerce Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 12: Belgium Ecommerce Industry Revenue billion Forecast, by B2C E-commerce 2020 & 2033

- Table 13: Belgium Ecommerce Industry Revenue billion Forecast, by Market size (GMV) for the period of 2017-2027 2020 & 2033

- Table 14: Belgium Ecommerce Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Belgium Ecommerce Industry Revenue billion Forecast, by Beauty & Personal Care 2020 & 2033

- Table 16: Belgium Ecommerce Industry Revenue billion Forecast, by Consumer Electronics 2020 & 2033

- Table 17: Belgium Ecommerce Industry Revenue billion Forecast, by Fashion & Apparel 2020 & 2033

- Table 18: Belgium Ecommerce Industry Revenue billion Forecast, by Food & Beverage 2020 & 2033

- Table 19: Belgium Ecommerce Industry Revenue billion Forecast, by Furniture & Home 2020 & 2033

- Table 20: Belgium Ecommerce Industry Revenue billion Forecast, by Others (Toys, DIY, Media, etc.) 2020 & 2033

- Table 21: Belgium Ecommerce Industry Revenue billion Forecast, by B2B E-commerce 2020 & 2033

- Table 22: Belgium Ecommerce Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Belgium Ecommerce Industry?

The projected CAGR is approximately 6.95%.

2. Which companies are prominent players in the Belgium Ecommerce Industry?

Key companies in the market include BIRKENSHOP, Amazon, Birbante, Zalando, Brico Group, Coolblue, Veepee*List Not Exhaustive, Qpon, Vanden Borre NV, bol com.

3. What are the main segments of the Belgium Ecommerce Industry?

The market segments include B2C E-commerce, Market size (GMV) for the period of 2017-2027, Application, Beauty & Personal Care, Consumer Electronics, Fashion & Apparel, Food & Beverage, Furniture & Home, Others (Toys, DIY, Media, etc.), B2B E-commerce.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.71 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Internet Penetration Across the Country; Increased Adoption of Smartphones.

6. What are the notable trends driving market growth?

Increase in Internet Penetration Across the Country is Fueling the Growth of the Market..

7. Are there any restraints impacting market growth?

Low Light Sensing Capabilities Act as a Restraining Factor; Low-cost Sensors are Increasing the Threat to Scale Down the Quality.

8. Can you provide examples of recent developments in the market?

April 2022 - ViaEurope, an e-commerce logistics company, has launched a fully automatic sorting belt in its Liege E-Hub. This new system can handle over 3.500 parcels per hour, scan barcodes on five sides of the package, weigh it, measure it, and capture pictures. This system launch was according to the company's commitment to operational safety and efficiency.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Belgium Ecommerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Belgium Ecommerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Belgium Ecommerce Industry?

To stay informed about further developments, trends, and reports in the Belgium Ecommerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence