Key Insights

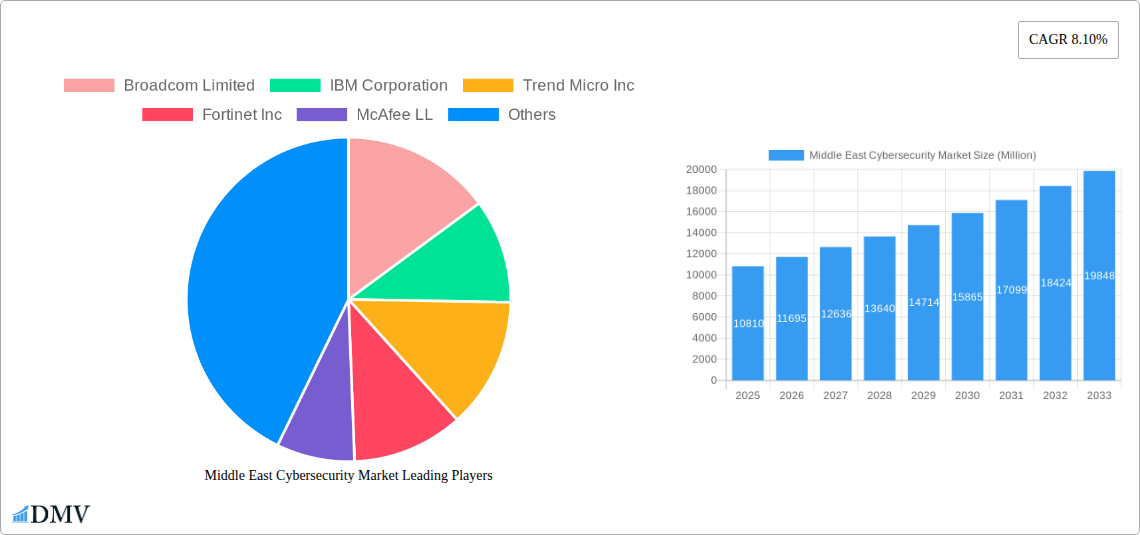

The Middle East cybersecurity market is poised for significant expansion, projected to reach USD 10.81 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.10% anticipated throughout the forecast period of 2025-2033. This substantial growth is fueled by escalating digital transformation initiatives across various sectors, the increasing sophistication of cyber threats, and a growing awareness among organizations regarding the critical need for robust security measures. The region's commitment to developing its digital infrastructure, including smart city projects and the expansion of cloud computing services, directly translates into a heightened demand for comprehensive cybersecurity solutions. Government mandates and regulatory frameworks are also playing a pivotal role, compelling businesses to invest in advanced security technologies to protect sensitive data and critical infrastructure. The adoption of cloud security, data security, and identity and access management (IAM) solutions are expected to be key drivers, as organizations increasingly rely on these to secure their evolving digital landscapes.

Middle East Cybersecurity Market Market Size (In Billion)

The market segmentation reveals a diverse demand landscape. In terms of offerings, while integrated risk management and network security equipment are seeing strong adoption, the rapid growth of cloud security and data security solutions underscores the immediate concerns of businesses. Services such as managed security services are gaining traction, allowing organizations to outsource their complex security operations to specialized providers, thus optimizing costs and enhancing their security posture. Small and Medium-sized Enterprises (SMEs) are increasingly recognizing the importance of cybersecurity and are becoming a significant growth segment, alongside large enterprises. The IT & Telecom, BFSI, and Government sectors are leading the charge in cybersecurity investments, reflecting the high-stakes nature of the data and services they handle. The Middle East, with countries like Saudi Arabia and the United Arab Emirates at the forefront, is actively investing in advanced cybersecurity capabilities to safeguard its burgeoning digital economy and maintain national security.

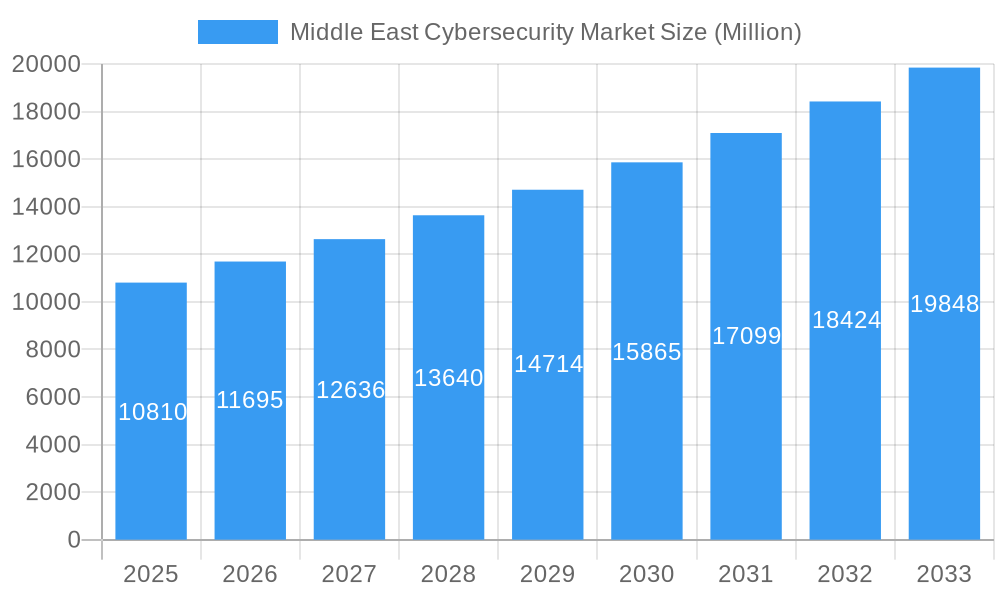

Middle East Cybersecurity Market Company Market Share

This in-depth report delivers an unparalleled analysis of the Middle East cybersecurity market, providing critical insights for stakeholders seeking to navigate this rapidly evolving landscape. Covering a comprehensive study period of 2019–2033, with a base year of 2025 and an extensive forecast period from 2025–2033, this report equips you with the data-driven intelligence necessary for strategic decision-making. Explore market dynamics, identify growth opportunities, and understand the competitive forces shaping the GCC cybersecurity market, MENA cybersecurity solutions, and GCC cyber defense technologies.

Middle East Cybersecurity Market Market Composition & Trends

The Middle East cybersecurity market is characterized by a dynamic interplay of innovation, regulatory evolution, and a growing awareness of sophisticated cyber threats. Market concentration remains moderately fragmented, with key players vying for dominance across diverse security offerings. Innovation catalysts include the increasing adoption of digital transformation initiatives, the proliferation of IoT devices, and the escalating sophistication of cyberattacks, driving demand for advanced cloud security, data security, and identity access management (IAM) solutions. The regulatory landscape is also maturing, with governments across the region implementing stricter data protection laws and cybersecurity mandates, thereby fostering a more robust and secure digital ecosystem. Substitute products are continuously emerging, ranging from open-source security tools to in-house developed security frameworks, though the demand for specialized, enterprise-grade solutions from leading vendors remains strong. End-user profiles are diverse, spanning across critical sectors like BFSI, Government, and IT & Telecom, each with unique security needs and risk appetites. Merger and acquisition (M&A) activities are a significant trend, with major corporations acquiring innovative startups to enhance their service portfolios and expand their market reach. For instance, recent M&A deals in the cybersecurity sector are reshaping the competitive landscape, with an estimated total M&A deal value of over $500 Million in the historical period.

- Market Share Distribution: Leading companies like IBM Corporation, Broadcom Limited, and Cisco Systems Inc. hold significant market shares, with specific segments like network security equipment experiencing considerable revenue generation.

- M&A Deal Values: While specific deal values fluctuate, the overall trend indicates substantial investment in consolidating market positions and acquiring cutting-edge technologies. The historical period (2019-2024) saw an estimated $700 Million in cybersecurity-related M&A activities.

- Regulatory Impact: The enforcement of data privacy regulations is a key driver for compliance cybersecurity solutions.

- Innovation Hubs: The UAE and Saudi Arabia are emerging as key innovation hubs for cybersecurity technologies in the region.

Middle East Cybersecurity Market Industry Evolution

The Middle East cybersecurity market has witnessed remarkable growth trajectories and technological advancements over the historical period of 2019–2024, driven by a confluence of factors including escalating cyber threats, robust digital transformation agendas, and increasing government investments in national security. The region's commitment to diversifying its economies away from oil has fueled rapid digitalization across all sectors, from BFSI to retail & e-commerce, subsequently expanding the attack surface for malicious actors. This surge in digital adoption, coupled with the increasing complexity of threat landscapes encompassing ransomware, phishing, and advanced persistent threats (APTs), has created an urgent demand for comprehensive and sophisticated cybersecurity solutions.

Technological advancements have played a pivotal role in shaping the industry's evolution. The adoption of cloud security solutions, including infrastructure protection and application security, has surged as organizations migrate their operations to cloud environments. Data security has become paramount, with a growing emphasis on data encryption, data loss prevention (DLP), and data access governance. The market has also seen significant innovation in identity access management (IAM), with the implementation of multi-factor authentication (MFA) and privileged access management (PAM) solutions becoming standard practice. Furthermore, the deployment of advanced network security equipment, such as next-generation firewalls (NGFWs), intrusion detection and prevention systems (IDPS), and secure web gateways, has become essential for safeguarding critical infrastructure and sensitive data.

Consumer demand has shifted considerably, with both individuals and businesses exhibiting a heightened awareness of cybersecurity risks and a greater willingness to invest in protective measures. The rise of remote work and the increasing reliance on digital services have amplified the need for robust endpoint security and secure remote access solutions. The consumer security software segment, while smaller, is also experiencing growth as individuals become more aware of personal data protection. The market has moved beyond traditional perimeter security to embrace a more holistic, zero-trust security model, emphasizing continuous monitoring, threat intelligence, and incident response capabilities. This evolution is further supported by the increasing demand for managed services that offer specialized expertise and proactive threat management, allowing organizations to focus on their core business objectives while entrusting their cybersecurity posture to experts. The Middle East cybersecurity market size is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 15% during the forecast period, reaching an estimated value of over $30 Billion by 2030. This growth is propelled by ongoing digital transformation initiatives and a persistent need to combat evolving cyber threats.

Leading Regions, Countries, or Segments in Middle East Cybersecurity Market

The Middle East cybersecurity market is experiencing robust growth across various segments, with specific regions and countries emerging as dominant forces. Among the end-user industries, IT & Telecom and BFSI consistently lead in terms of cybersecurity spending, driven by their extensive digital footprints, the critical nature of their data, and the high volume of sensitive transactions they handle. The Government sector is also a significant and rapidly growing segment, fueled by national cybersecurity strategies, defense initiatives, and the imperative to protect critical national infrastructure.

Within the offering segments, Cloud Security has witnessed an exponential rise, mirroring the region's accelerated adoption of cloud computing. This includes solutions for securing public, private, and hybrid cloud environments. Data Security is another critical area, encompassing data encryption, DLP, and data masking, as organizations grapple with increasingly stringent data privacy regulations and the threat of data breaches. Network Security Equipment remains a foundational element, with substantial investments in firewalls, intrusion detection/prevention systems, and VPNs.

The deployment mode landscape shows a clear trend towards Cloud-based deployments, offering scalability and flexibility, although On-premises solutions continue to be relevant for highly regulated industries and sensitive data. For organization sizes, Large Enterprises are major spenders due to their complex IT infrastructures and higher risk exposure. However, the SMEs segment is rapidly growing, driven by increasing awareness and the availability of more affordable, cloud-based security solutions.

Key Drivers for Dominance:

- Government Initiatives: Countries like the UAE and Saudi Arabia are at the forefront, with substantial government investment in cybersecurity infrastructure and national security frameworks. Their proactive regulatory environment encourages adoption.

- Digital Transformation: The accelerated pace of digital transformation across sectors like finance, telecommunications, and government services directly correlates with increased demand for cybersecurity solutions.

- Geopolitical Landscape: The region's geopolitical complexities necessitate a strong focus on national security and cyber resilience.

- Growing Threat Landscape: The increasing sophistication and frequency of cyberattacks compel organizations to invest in advanced security measures.

Dominant Segments Analysis:

- Cloud Security: Expected to capture over 30% of the market share by 2030, driven by cloud migration trends.

- BFSI Sector: Accounts for an estimated 25% of the total cybersecurity spending in the region, due to the high value of financial data and critical infrastructure.

- UAE & Saudi Arabia: These nations are projected to contribute over 60% of the regional cybersecurity market revenue by 2030, owing to significant government and private sector investments.

- Managed Services: This segment is projected to grow at a CAGR of over 18%, as organizations increasingly seek specialized expertise.

Middle East Cybersecurity Market Product Innovations

The Middle East cybersecurity market is buzzing with innovative product developments aimed at addressing the region's unique threat landscape. Companies are heavily investing in AI and machine learning to enhance threat detection and response capabilities, leading to the development of intelligent security platforms. Solutions like Trend Micro's Email Security, launched in January 2024, exemplify this trend, utilizing advanced techniques like machine learning and sandbox analysis to combat email-borne threats. The focus is shifting towards proactive threat hunting, predictive analytics, and automated incident response. Innovations in cloud security are enabling more secure migration and management of cloud workloads, while advancements in data security are offering enhanced encryption and privacy-preserving technologies. The integration of security across the entire IT ecosystem, from endpoint to cloud, is a key theme, with vendors offering comprehensive, unified security platforms.

Propelling Factors for Middle East Cybersecurity Market Growth

Several potent factors are propelling the growth of the Middle East cybersecurity market. The escalating sophistication and frequency of cyberattacks, including state-sponsored threats and organized cybercrime, are compelling organizations across all sectors to bolster their defenses. Concurrently, the aggressive digital transformation initiatives spearheaded by governments and private enterprises, aiming to create smart cities, diversify economies, and enhance digital services, are expanding the attack surface, thereby increasing the demand for robust cybersecurity solutions. Furthermore, the increasing adoption of cloud computing, IoT, and remote work models necessitates advanced cloud security, network security, and endpoint protection. Regulatory mandates and the growing emphasis on data privacy are also significant drivers, forcing organizations to invest in compliance-driven security measures. The estimated market value is projected to reach over $25 Billion by 2028.

Obstacles in the Middle East Cybersecurity Market Market

Despite its robust growth, the Middle East cybersecurity market faces certain obstacles. A significant challenge is the ongoing shortage of skilled cybersecurity professionals, which limits the effective implementation and management of advanced security solutions across the region. The high cost of some advanced cybersecurity solutions can also be a barrier, particularly for Small and Medium-sized Enterprises (SMEs). Furthermore, the complex and evolving regulatory landscape across different countries within the Middle East can create compliance challenges for businesses operating regionally. Supply chain disruptions, though less prevalent than in other industries, can still impact the availability of specialized hardware and software. The evolving nature of cyber threats also necessitates continuous investment in security upgrades, posing an ongoing financial burden.

Future Opportunities in Middle East Cybersecurity Market

The Middle East cybersecurity market presents a wealth of future opportunities. The burgeoning adoption of Artificial Intelligence (AI) and Machine Learning (ML) in cybersecurity offers immense potential for developing more intelligent, predictive, and automated threat detection and response systems. The expansion of IoT devices across smart cities, industrial automation, and consumer electronics creates a substantial demand for specialized IoT security solutions. The increasing focus on cloud adoption, particularly hybrid and multi-cloud environments, will drive the need for sophisticated cloud security management and security orchestration solutions. Furthermore, the growing emphasis on sovereign cloud initiatives and data localization policies in certain Middle Eastern countries will create opportunities for localized cybersecurity services and solutions. The projected market growth is estimated to be around 15% annually.

Major Players in the Middle East Cybersecurity Market Ecosystem

- Broadcom Limited

- IBM Corporation

- Trend Micro Inc

- Fortinet Inc

- McAfee LLC

- Cisco Systems Inc

- Microsoft Corporation

- Atos SE

- Dell Technologies Inc

- Intel Corporation

Key Developments in Middle East Cybersecurity Market Industry

- January 2024: Trend Micro launched its Email Security, an innovative cybersecurity solution that leverages cross-generational threat techniques, including machine learning, sandbox analysis, data loss prevention (DLP), and various other methods to stop all email-based threats. This solution is expected to be hosted in the UAE for the entire Middle East and Africa region.

- October 2023: Du, from Emirates Integrated Telecommunications Company (EITC), has signed a Memorandum of Understanding (MoU) with Microsoft to transform the digital landscape in UAE by combining Microsoft’s Azure cloud computing capabilities with Du’s network capabilities. The collaboration further fuels digital transformation for businesses while offering improved solutions in AI and cybersecurity.

Strategic Middle East Cybersecurity Market Market Forecast

The Middle East cybersecurity market is poised for significant growth, driven by a confluence of escalating cyber threats, ambitious digital transformation agendas, and increasing regulatory stringency. The forecast period (2025–2033) anticipates a robust expansion, fueled by substantial investments in advanced security solutions like cloud security, data security, and identity access management. Key growth catalysts include the ongoing adoption of AI and ML in threat intelligence, the secure integration of IoT devices, and the continuous development of resilient network infrastructure. The strategic focus on national cybersecurity resilience and data protection will further propel market expansion, positioning the Middle East as a critical and dynamic hub for cybersecurity innovation and adoption, with an estimated market valuation exceeding $30 Billion by 2033.

Middle East Cybersecurity Market Segmentation

-

1. Offering

-

1.1. Solution

- 1.1.1. Cloud Security

- 1.1.2. Data Security

- 1.1.3. Identity Access Management (IAM)

- 1.1.4. Network Security Equipment

- 1.1.5. Infrastructure Protection

- 1.1.6. Integrated Risk Management

- 1.1.7. Consumer Security Software

- 1.1.8. Application Security

- 1.1.9. Other Solutions

-

1.2. Services

- 1.2.1. Professional Services

- 1.2.2. Managed Services

-

1.1. Solution

-

2. Deployment Mode

- 2.1. Cloud

- 2.2. On-premises

-

3. Organization Size

- 3.1. SMEs

- 3.2. Large Enterprises

-

4. End-user Industry

- 4.1. IT & Telecom

- 4.2. BFSI

- 4.3. Retail & E-commerce

- 4.4. Government

- 4.5. Manufacturing

- 4.6. Healthcare

- 4.7. Other End-user Industries

Middle East Cybersecurity Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Cybersecurity Market Regional Market Share

Geographic Coverage of Middle East Cybersecurity Market

Middle East Cybersecurity Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digital Transformation Technologies and Rise of Security Intelligence; High Potential Damages From Attacks on Critical Infrastructure and Increasing Sophistication of Attacks; Demand For Managed Security Service Providers (MSSPs) and Cloud-first Strategy

- 3.3. Market Restrains

- 3.3.1. Lack of Cybersecurity Professionals; High Reliance on Traditional Authentication Methods and Low Preparedness

- 3.4. Market Trends

- 3.4.1. Cloud to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Cybersecurity Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Solution

- 5.1.1.1. Cloud Security

- 5.1.1.2. Data Security

- 5.1.1.3. Identity Access Management (IAM)

- 5.1.1.4. Network Security Equipment

- 5.1.1.5. Infrastructure Protection

- 5.1.1.6. Integrated Risk Management

- 5.1.1.7. Consumer Security Software

- 5.1.1.8. Application Security

- 5.1.1.9. Other Solutions

- 5.1.2. Services

- 5.1.2.1. Professional Services

- 5.1.2.2. Managed Services

- 5.1.1. Solution

- 5.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.2.1. Cloud

- 5.2.2. On-premises

- 5.3. Market Analysis, Insights and Forecast - by Organization Size

- 5.3.1. SMEs

- 5.3.2. Large Enterprises

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. IT & Telecom

- 5.4.2. BFSI

- 5.4.3. Retail & E-commerce

- 5.4.4. Government

- 5.4.5. Manufacturing

- 5.4.6. Healthcare

- 5.4.7. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Broadcom Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IBM Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Trend Micro Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fortinet Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 McAfee LL

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cisco Systems Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Microsoft Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Atos SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dell Technologies Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Intel Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Broadcom Limited

List of Figures

- Figure 1: Middle East Cybersecurity Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East Cybersecurity Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Cybersecurity Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 2: Middle East Cybersecurity Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 3: Middle East Cybersecurity Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 4: Middle East Cybersecurity Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 5: Middle East Cybersecurity Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Middle East Cybersecurity Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 7: Middle East Cybersecurity Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 8: Middle East Cybersecurity Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 9: Middle East Cybersecurity Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Middle East Cybersecurity Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Saudi Arabia Middle East Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: United Arab Emirates Middle East Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Israel Middle East Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Qatar Middle East Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Kuwait Middle East Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Oman Middle East Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Bahrain Middle East Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Jordan Middle East Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Lebanon Middle East Cybersecurity Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Cybersecurity Market?

The projected CAGR is approximately 8.10%.

2. Which companies are prominent players in the Middle East Cybersecurity Market?

Key companies in the market include Broadcom Limited, IBM Corporation, Trend Micro Inc, Fortinet Inc, McAfee LL, Cisco Systems Inc, Microsoft Corporation, Atos SE, Dell Technologies Inc, Intel Corporation.

3. What are the main segments of the Middle East Cybersecurity Market?

The market segments include Offering, Deployment Mode, Organization Size, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Digital Transformation Technologies and Rise of Security Intelligence; High Potential Damages From Attacks on Critical Infrastructure and Increasing Sophistication of Attacks; Demand For Managed Security Service Providers (MSSPs) and Cloud-first Strategy.

6. What are the notable trends driving market growth?

Cloud to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Lack of Cybersecurity Professionals; High Reliance on Traditional Authentication Methods and Low Preparedness.

8. Can you provide examples of recent developments in the market?

January 2024 - Trend Micro launched its Email Security, an innovative cybersecurity solution that leverages cross-generational threat techniques, including machine learning, sandbox analysis, data loss prevention (DLP), and various other methods to stop all email-based threats. This solution is expected to be hosted in the UAE for the entire Middle East and Africa region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Cybersecurity Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Cybersecurity Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Cybersecurity Market?

To stay informed about further developments, trends, and reports in the Middle East Cybersecurity Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence