Key Insights

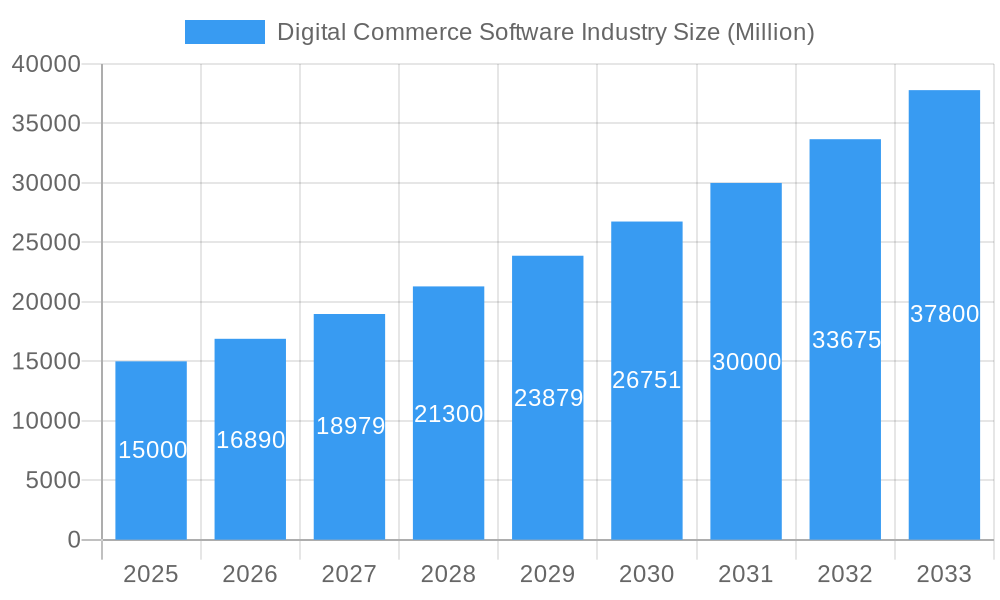

The global Digital Commerce Software market is poised for substantial expansion, projected to reach a significant market size by 2033, driven by an impressive Compound Annual Growth Rate (CAGR) of 12.64%. This robust growth is fueled by the increasing adoption of e-commerce solutions across diverse industries and the escalating demand for seamless, personalized customer experiences online. Key drivers include the rapid proliferation of mobile commerce, the growing importance of omnichannel retail strategies, and the continuous innovation in digital commerce platforms offering advanced features like AI-powered personalization, sophisticated analytics, and integrated payment gateways. The convenience and accessibility offered by digital commerce are reshaping consumer behavior, compelling businesses of all sizes to invest in scalable and efficient e-commerce solutions to remain competitive.

Digital Commerce Software Industry Market Size (In Billion)

The market segmentation by deployment model highlights a strong preference for cloud-based solutions, driven by their scalability, flexibility, and cost-effectiveness, though hybrid models are also gaining traction as businesses seek to integrate existing on-premise infrastructure with cloud capabilities. End-user industries such as Retail, BFSI (Banking, Financial Services, and Insurance), and IT & Communications are leading the charge in digital commerce adoption. The Travel & Tourism and Entertainment & Media sectors are also experiencing significant digital transformation. Geographically, North America and Europe currently dominate the market, owing to established digital infrastructures and high consumer spending power. However, the Asia Pacific region is emerging as a high-growth area, propelled by a burgeoning middle class, increasing internet penetration, and a surge in online retail activity. Restraints such as data security concerns and the need for skilled personnel to manage complex digital commerce ecosystems are being addressed through evolving security protocols and the increasing availability of managed services.

Digital Commerce Software Industry Company Market Share

Here is an SEO-optimized, insightful report description for the Digital Commerce Software Industry, crafted without placeholders and ready for immediate use:

Digital Commerce Software Industry Market Composition & Trends

The Digital Commerce Software industry is a dynamic and rapidly evolving sector, projected for significant expansion. Our comprehensive report delves into the intricate market composition, revealing a moderate concentration with key players like Oracle Corporation, SAP SE, and Shopify Inc. holding substantial market share. Innovation is a constant catalyst, driven by the increasing adoption of cloud-based solutions and the persistent demand for personalized customer experiences. Regulatory landscapes, though varying by region, are generally supportive of e-commerce growth, with initiatives aimed at consumer protection and data security. Substitute products, such as bespoke ERP solutions and basic website builders, exist but often lack the comprehensive features and scalability offered by dedicated digital commerce platforms. End-user profiles are diverse, with Retail dominating adoption, followed by BFSI and Travel & Tourism. IT & Communications and Entertainment & Media are also significant growth segments. Mergers and acquisitions (M&A) activities are prevalent, with deal values in the hundreds of millions of dollars, indicating a consolidation trend as larger players acquire innovative startups to enhance their offerings.

- Market Concentration: Moderate, with dominant players in enterprise and SMB segments.

- Innovation Catalysts: AI/ML integration, headless commerce, personalization engines.

- Regulatory Landscape: Evolving data privacy laws (e.g., GDPR, CCPA) influencing platform development.

- Substitute Products: ERP modules, basic website builders, custom-built solutions.

- End-User Industry Dominance: Retail accounting for an estimated 40% of market share.

- M&A Deal Value Range: XX Million – XXX Million.

Digital Commerce Software Industry Industry Evolution

The Digital Commerce Software industry has witnessed a dramatic evolution, transforming from rudimentary online storefronts to sophisticated, AI-driven platforms that orchestrate complex omnichannel customer journeys. Over the study period of 2019–2033, the market has experienced exponential growth, propelled by shifting consumer behaviors and the undeniable need for businesses to establish a robust online presence. In the historical period of 2019–2024, we observed a steady upward trajectory, with the pandemic acting as a significant accelerant for digital transformation initiatives across all sectors. The base year of 2025 marks a pivotal point where cloud-based solutions have largely surpassed on-premise deployments in terms of market share and adoption rates, largely due to their scalability, cost-effectiveness, and ease of integration. Technological advancements have been relentless. Initially, the focus was on basic transaction processing and product catalog management. However, this has rapidly evolved to encompass advanced features such as personalized recommendations powered by machine learning, real-time inventory synchronization across channels, sophisticated marketing automation tools, and seamless integration with social commerce and livestream shopping. Consumer demands have also become more sophisticated. Customers now expect personalized experiences, swift delivery, flexible payment options, and a consistent brand experience across all touchpoints. This has necessitated that digital commerce software evolve to support these demands, moving beyond mere transactional capabilities to become comprehensive customer engagement platforms. The growth rate, estimated at 15% year-over-year in recent years, is projected to continue this upward trend throughout the forecast period of 2025–2033, driven by emerging markets and the continuous innovation in platform functionalities. The adoption of cloud-based digital commerce software has reached an estimated 70% in 2025, a stark contrast to the 30% in 2019, highlighting the industry's transformative shift.

Leading Regions, Countries, or Segments in Digital Commerce Software Industry

The Retail end-user industry stands as the undisputed leader within the Digital Commerce Software market, demonstrating unparalleled adoption and driving significant innovation. This dominance is a direct consequence of the inherent nature of retail operations, which have been fundamentally reshaped by the shift to online channels. Retailers are acutely aware of the necessity to provide seamless, personalized, and convenient shopping experiences to stay competitive, making advanced digital commerce software indispensable. The global retail e-commerce market is projected to reach trillions of dollars by 2025, directly fueling the demand for the underlying software infrastructure.

Key Drivers of Retail Dominance:

- Consumer Behavior Shift: An overwhelming majority of consumers now research and purchase products online, creating a constant demand for robust e-commerce platforms.

- Omnichannel Imperative: Retailers must offer a unified experience across physical stores, mobile apps, and websites, requiring sophisticated software to manage inventory, customer data, and sales channels.

- Personalization Expectations: Consumers expect tailored product recommendations, promotions, and content, which advanced digital commerce software can deliver through AI and data analytics.

- Competitive Pressure: The rise of direct-to-consumer (DTC) brands and online marketplaces intensifies competition, forcing traditional retailers to invest heavily in their digital capabilities.

While Retail leads, the BFSI sector is emerging as a significant growth segment, driven by the digitization of financial services and the increasing demand for online banking, investment, and insurance platforms. The Travel & Tourism industry also leverages digital commerce for bookings, itinerary management, and customer service, showcasing strong growth. The IT & Communications sector, by its nature, is a heavy user of digital commerce for service subscriptions and product sales. The Entertainment & Media industry is rapidly expanding its digital commerce footprint through streaming subscriptions, digital content sales, and online ticketing.

From a deployment model perspective, Cloud-Based solutions are overwhelmingly leading the market. Their inherent scalability, cost-efficiency, and rapid deployment capabilities align perfectly with the dynamic needs of businesses in today's digital landscape. The ability to access sophisticated features without the burden of significant upfront infrastructure investment and ongoing maintenance makes cloud solutions the preferred choice for the vast majority of digital commerce software users. This trend is projected to continue its upward trajectory throughout the forecast period.

Digital Commerce Software Industry Product Innovations

Product innovations in the Digital Commerce Software industry are rapidly advancing, focusing on enhancing customer experience and operational efficiency. Key advancements include the widespread integration of Artificial Intelligence (AI) and Machine Learning (ML) for personalized product recommendations, intelligent search functionalities, and dynamic pricing strategies, estimating a 15% improvement in conversion rates. Headless commerce architectures are gaining traction, offering greater flexibility and enabling businesses to deliver content and commerce across an ever-expanding range of touchpoints, from IoT devices to augmented reality experiences. Furthermore, the focus on data analytics and customer journey mapping is intensifying, providing businesses with deeper insights to optimize their sales funnels and improve customer retention. Performance metrics like average order value (AOV) are seeing an uplift of approximately 10% with the implementation of these advanced features.

Propelling Factors for Digital Commerce Software Industry Growth

Several key factors are propelling the growth of the Digital Commerce Software industry. The escalating adoption of smartphones and high-speed internet globally has made online shopping accessible to a vast consumer base. Businesses are increasingly recognizing the imperative to establish and enhance their online presence to remain competitive in a globalized market. Technological advancements, particularly in areas like AI for personalization, cloud computing for scalability, and the increasing use of mobile commerce, are continuously creating new opportunities and improving the functionality of digital commerce platforms. Furthermore, favorable government initiatives and a growing acceptance of online transactions by consumers worldwide are creating a fertile ground for market expansion.

Obstacles in the Digital Commerce Software Industry Market

Despite robust growth, the Digital Commerce Software industry faces several obstacles. Increasing data privacy regulations, such as GDPR and CCPA, necessitate significant investment in compliance and can sometimes create friction for data-driven personalization efforts, impacting marketing effectiveness by an estimated 5-10%. Cybersecurity threats continue to be a major concern, with businesses and consumers alike wary of data breaches and fraud, leading to increased security spending. The complexity of integrating disparate systems, especially for legacy enterprises, can also pose a significant challenge. Moreover, the intense competition among software providers, coupled with the commoditization of basic e-commerce features, can lead to price pressures, impacting profit margins for some vendors.

Future Opportunities in Digital Commerce Software Industry

The future of the Digital Commerce Software industry is brimming with opportunities. The continued expansion of emerging markets, particularly in Asia and Africa, presents a vast untapped customer base. The growing trend of social commerce, where sales are integrated directly into social media platforms, is poised for significant growth, requiring specialized software capabilities. The advancement of Extended Reality (XR) technologies, including Augmented Reality (AR) and Virtual Reality (VR), offers new avenues for immersive shopping experiences, creating demand for innovative digital commerce solutions. Furthermore, the increasing focus on sustainability and ethical consumption may drive demand for software that supports transparent supply chains and eco-friendly business practices.

Major Players in the Digital Commerce Software Industry Ecosystem

- Volusion Inc

- TCS Ltd

- Digital River Inc

- Cleverbridge Inc

- Demandware Inc (Salesforce)

- Shopify Inc

- MarketLive Inc ( Kibo Software)

- eBay Enterprise

- Sappi Limited

- Oracle Corporation

- Intershop Communications AG

- SAP SE

Key Developments in Digital Commerce Software Industry Industry

- August 2022: papmall announced the launch of an e-commerce marketplace platform to support online sellers and buyers communities worldwide to connect and exchange values. The platform is expected to be the most technologically advanced assistant for online business and freelancing work.

- January 2022: Zitec, a European IT company, announced a partnership with the Kingfisher group to develop and launch Brico Dépôt, an online shop on the Magento 2 Commerce Cloud platform, as an external stimulant of their digital transformation. Zitec migrated the online store from Laravel to the Magento 2 Commerce Cloud and added several UX/UI improvements, such as improving the search function and identifying products on the site with the help of the integrated Magento 2 components.

Strategic Digital Commerce Software Industry Market Forecast

The strategic outlook for the Digital Commerce Software industry remains exceptionally positive. The forecast period of 2025–2033 is expected to witness sustained high growth, driven by the ongoing digital transformation across all business sectors and the evolving expectations of consumers for seamless online shopping experiences. Key growth catalysts include the increasing adoption of AI and machine learning for hyper-personalization, the expansion of headless commerce architectures, and the burgeoning potential of social commerce and immersive XR shopping experiences. Emerging markets will offer significant untapped potential, while advancements in data analytics will empower businesses to optimize their digital strategies. The industry's ability to adapt to evolving consumer trends and technological innovations will be paramount in capturing the substantial market opportunities ahead.

Digital Commerce Software Industry Segmentation

-

1. Deployment Model

- 1.1. On-Premise

- 1.2. Cloud-Based

- 1.3. Hybrid

-

2. End-User Industries

- 2.1. Retail

- 2.2. BFSI

- 2.3. Travel & Tourism

- 2.4. IT & Communications

- 2.5. Entertainment & Media

Digital Commerce Software Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Rest of the World

Digital Commerce Software Industry Regional Market Share

Geographic Coverage of Digital Commerce Software Industry

Digital Commerce Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 6.1 Growth in Adoption of Cloud-Based Services6.2 Growing Development in Wired and Wireless Communications Networks

- 3.3. Market Restrains

- 3.3.1. 7.1 Increasing Security and Privacy Concerns

- 3.4. Market Trends

- 3.4.1. Growth in the Adoption of Cloud-Based Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Commerce Software Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment Model

- 5.1.1. On-Premise

- 5.1.2. Cloud-Based

- 5.1.3. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by End-User Industries

- 5.2.1. Retail

- 5.2.2. BFSI

- 5.2.3. Travel & Tourism

- 5.2.4. IT & Communications

- 5.2.5. Entertainment & Media

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Deployment Model

- 6. North America Digital Commerce Software Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment Model

- 6.1.1. On-Premise

- 6.1.2. Cloud-Based

- 6.1.3. Hybrid

- 6.2. Market Analysis, Insights and Forecast - by End-User Industries

- 6.2.1. Retail

- 6.2.2. BFSI

- 6.2.3. Travel & Tourism

- 6.2.4. IT & Communications

- 6.2.5. Entertainment & Media

- 6.1. Market Analysis, Insights and Forecast - by Deployment Model

- 7. Europe Digital Commerce Software Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment Model

- 7.1.1. On-Premise

- 7.1.2. Cloud-Based

- 7.1.3. Hybrid

- 7.2. Market Analysis, Insights and Forecast - by End-User Industries

- 7.2.1. Retail

- 7.2.2. BFSI

- 7.2.3. Travel & Tourism

- 7.2.4. IT & Communications

- 7.2.5. Entertainment & Media

- 7.1. Market Analysis, Insights and Forecast - by Deployment Model

- 8. Asia Pacific Digital Commerce Software Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment Model

- 8.1.1. On-Premise

- 8.1.2. Cloud-Based

- 8.1.3. Hybrid

- 8.2. Market Analysis, Insights and Forecast - by End-User Industries

- 8.2.1. Retail

- 8.2.2. BFSI

- 8.2.3. Travel & Tourism

- 8.2.4. IT & Communications

- 8.2.5. Entertainment & Media

- 8.1. Market Analysis, Insights and Forecast - by Deployment Model

- 9. Rest of the World Digital Commerce Software Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment Model

- 9.1.1. On-Premise

- 9.1.2. Cloud-Based

- 9.1.3. Hybrid

- 9.2. Market Analysis, Insights and Forecast - by End-User Industries

- 9.2.1. Retail

- 9.2.2. BFSI

- 9.2.3. Travel & Tourism

- 9.2.4. IT & Communications

- 9.2.5. Entertainment & Media

- 9.1. Market Analysis, Insights and Forecast - by Deployment Model

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Volusion Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 TCS Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Digital River Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Cleverbridge Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Demandware Inc (Salesforce)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Shopify Inc*List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 MarketLive Inc ( Kibo Software)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 eBay Enterprise

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Sappi Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Oracle Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Intershop Communications AG

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 SAP SE

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Volusion Inc

List of Figures

- Figure 1: Global Digital Commerce Software Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Digital Commerce Software Industry Revenue (Million), by Deployment Model 2025 & 2033

- Figure 3: North America Digital Commerce Software Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 4: North America Digital Commerce Software Industry Revenue (Million), by End-User Industries 2025 & 2033

- Figure 5: North America Digital Commerce Software Industry Revenue Share (%), by End-User Industries 2025 & 2033

- Figure 6: North America Digital Commerce Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Digital Commerce Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Digital Commerce Software Industry Revenue (Million), by Deployment Model 2025 & 2033

- Figure 9: Europe Digital Commerce Software Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 10: Europe Digital Commerce Software Industry Revenue (Million), by End-User Industries 2025 & 2033

- Figure 11: Europe Digital Commerce Software Industry Revenue Share (%), by End-User Industries 2025 & 2033

- Figure 12: Europe Digital Commerce Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Digital Commerce Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Digital Commerce Software Industry Revenue (Million), by Deployment Model 2025 & 2033

- Figure 15: Asia Pacific Digital Commerce Software Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 16: Asia Pacific Digital Commerce Software Industry Revenue (Million), by End-User Industries 2025 & 2033

- Figure 17: Asia Pacific Digital Commerce Software Industry Revenue Share (%), by End-User Industries 2025 & 2033

- Figure 18: Asia Pacific Digital Commerce Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Digital Commerce Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Digital Commerce Software Industry Revenue (Million), by Deployment Model 2025 & 2033

- Figure 21: Rest of the World Digital Commerce Software Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 22: Rest of the World Digital Commerce Software Industry Revenue (Million), by End-User Industries 2025 & 2033

- Figure 23: Rest of the World Digital Commerce Software Industry Revenue Share (%), by End-User Industries 2025 & 2033

- Figure 24: Rest of the World Digital Commerce Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Digital Commerce Software Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Digital Commerce Software Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 2: Global Digital Commerce Software Industry Revenue Million Forecast, by End-User Industries 2020 & 2033

- Table 3: Global Digital Commerce Software Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Digital Commerce Software Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 5: Global Digital Commerce Software Industry Revenue Million Forecast, by End-User Industries 2020 & 2033

- Table 6: Global Digital Commerce Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Digital Commerce Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Digital Commerce Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Digital Commerce Software Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 10: Global Digital Commerce Software Industry Revenue Million Forecast, by End-User Industries 2020 & 2033

- Table 11: Global Digital Commerce Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Digital Commerce Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Digital Commerce Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Digital Commerce Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Digital Commerce Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Digital Commerce Software Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 17: Global Digital Commerce Software Industry Revenue Million Forecast, by End-User Industries 2020 & 2033

- Table 18: Global Digital Commerce Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Digital Commerce Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Digital Commerce Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Digital Commerce Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Digital Commerce Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Digital Commerce Software Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 24: Global Digital Commerce Software Industry Revenue Million Forecast, by End-User Industries 2020 & 2033

- Table 25: Global Digital Commerce Software Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Commerce Software Industry?

The projected CAGR is approximately 12.64%.

2. Which companies are prominent players in the Digital Commerce Software Industry?

Key companies in the market include Volusion Inc, TCS Ltd, Digital River Inc, Cleverbridge Inc, Demandware Inc (Salesforce), Shopify Inc*List Not Exhaustive, MarketLive Inc ( Kibo Software), eBay Enterprise, Sappi Limited, Oracle Corporation, Intershop Communications AG, SAP SE.

3. What are the main segments of the Digital Commerce Software Industry?

The market segments include Deployment Model, End-User Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

6.1 Growth in Adoption of Cloud-Based Services6.2 Growing Development in Wired and Wireless Communications Networks.

6. What are the notable trends driving market growth?

Growth in the Adoption of Cloud-Based Services.

7. Are there any restraints impacting market growth?

7.1 Increasing Security and Privacy Concerns.

8. Can you provide examples of recent developments in the market?

August 2022: papmall announced the launch of an e-commerce marketplace platform to support online sellers and buyers communities worldwide to connect and exchange values. The platform is expected to be the most technologically advanced assistant for online business and freelancing work.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Commerce Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Commerce Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Commerce Software Industry?

To stay informed about further developments, trends, and reports in the Digital Commerce Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence