Key Insights

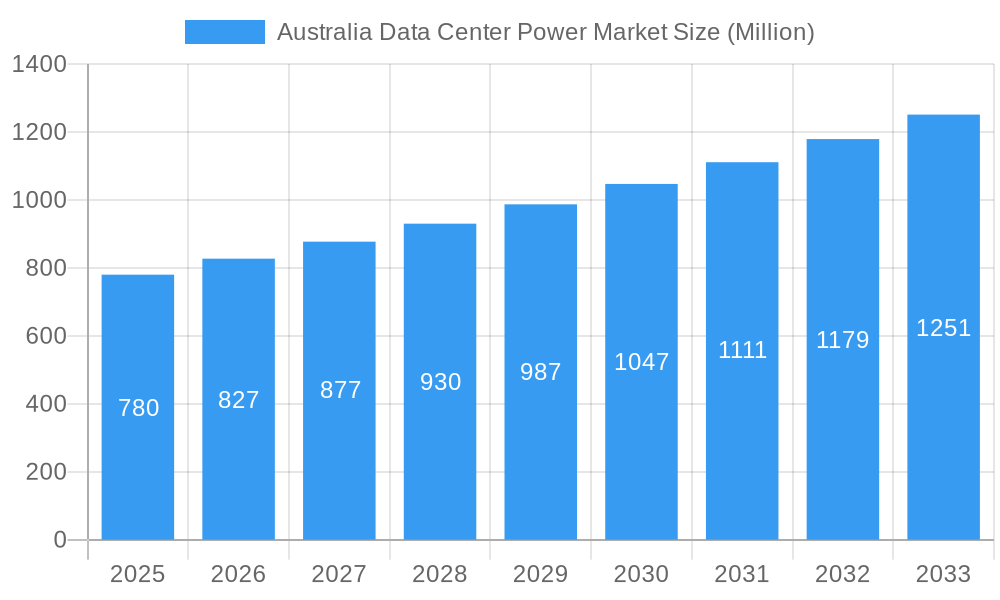

The Australian data center power market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.09% from a base of approximately $780 million in 2025. This upward trajectory is primarily fueled by the escalating demand for digital services, cloud computing adoption, and the increasing reliance on IT infrastructure across various sectors. Key growth drivers include the burgeoning need for hyperscale and colocation data centers to support big data analytics, artificial intelligence, and the Internet of Things (IoT). Furthermore, the ongoing digital transformation initiatives by government bodies and the expanding financial services sector are significantly contributing to the market’s expansion. Investments in upgrading existing power infrastructure and building new, more efficient facilities are critical to meeting this surging demand. The market will see substantial demand for UPS systems, generators, and advanced power distribution solutions to ensure uninterrupted operations and resilience.

Australia Data Center Power Market Market Size (In Million)

The Australian data center power market is characterized by several emerging trends, including a growing emphasis on sustainable power solutions and energy efficiency. This is driven by both regulatory pressures and the increasing corporate responsibility to reduce carbon footprints. Consequently, there's a rising interest in renewable energy integration, such as solar and wind power, for data centers. Moreover, advancements in cooling technologies that reduce power consumption are gaining traction. While the market is experiencing strong growth, certain restraints, such as the high initial capital investment required for data center construction and the availability of skilled labor for specialized power management, need to be addressed. However, the overwhelming demand for data processing and storage, coupled with the continuous innovation in power technologies, is expected to outweigh these challenges, leading to a dynamic and expanding market landscape. The IT & Telecommunication and BFSI sectors are anticipated to be the largest end-users, followed by government and media & entertainment.

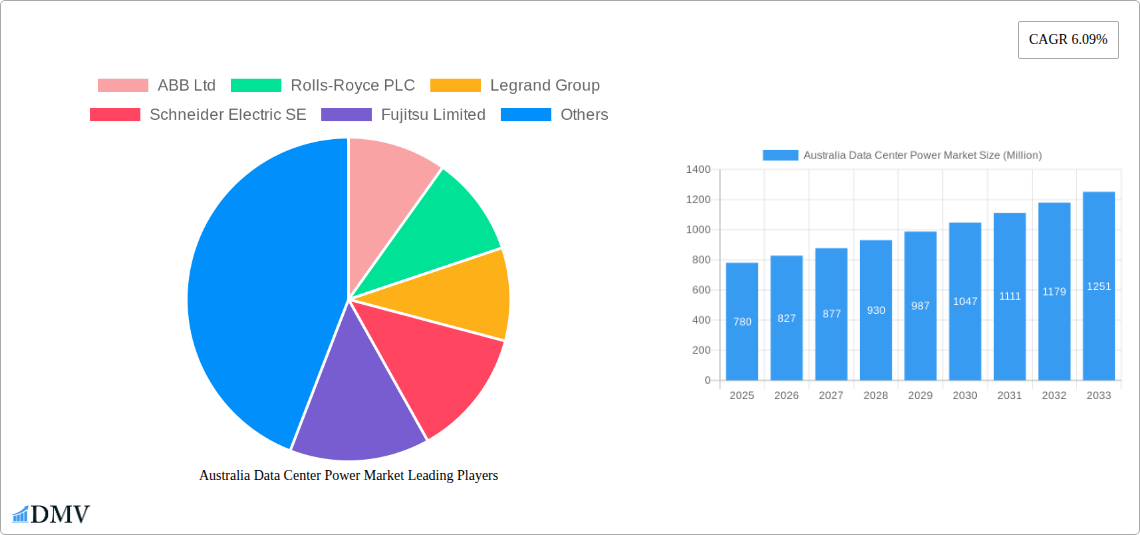

Australia Data Center Power Market Company Market Share

Here is an SEO-optimized and insightful report description for the Australia Data Center Power Market:

Gain unparalleled insights into the dynamic Australia Data Center Power Market with this definitive report. Spanning a comprehensive study period from 2019 to 2033, with a base year of 2025, this analysis delves deep into the market's composition, trends, evolution, and future potential. We equip stakeholders with actionable intelligence to navigate the rapidly expanding Australian data center landscape, driven by increasing digital transformation, cloud adoption, and AI infrastructure demands. This report forecasts market size, segmentation, and key growth drivers, providing a crucial roadmap for investors, technology providers, and industry strategists.

Australia Data Center Power Market Market Composition & Trends

The Australia Data Center Power Market exhibits a moderate concentration, characterized by a blend of established global players and emerging local service providers. Innovation is a primary catalyst, with significant investments in advanced power solutions to support the burgeoning demand for high-density computing. The regulatory landscape, while evolving, emphasizes energy efficiency and sustainability, influencing technology adoption and operational practices. Substitute products, primarily older or less efficient power management systems, are gradually being phased out in favor of cutting-edge, reliable solutions. End-user profiles reveal a strong reliance on IT & Telecommunication, BFSI, and Government sectors, all of which are expanding their data infrastructure footprints. Mergers & Acquisitions (M&A) activities are anticipated to play a pivotal role in market consolidation, with projected deal values in the high tens of millions of Australian dollars, as companies seek to expand their service offerings and geographic reach. The market share distribution is expected to see shifts as new players enter and existing ones innovate, with a growing emphasis on integrated power management solutions.

Australia Data Center Power Market Industry Evolution

The Australia Data Center Power Market is undergoing a transformative evolution, characterized by robust growth trajectories fueled by the relentless digital acceleration across all industries. Between the historical period of 2019-2024 and the projected forecast period of 2025-2033, the market is poised for significant expansion. This growth is intrinsically linked to the escalating demand for data storage, processing, and networking capabilities, driven by widespread cloud adoption, the proliferation of the Internet of Things (IoT), and the emerging wave of Artificial Intelligence (AI) and machine learning applications. Technological advancements are at the forefront of this evolution, with a continuous drive towards more efficient, reliable, and sustainable power solutions. The adoption of advanced Uninterruptible Power Supply (UPS) systems, high-efficiency generators, and sophisticated power distribution units (PDUs) is becoming standard practice to ensure uninterrupted operations for critical data center infrastructure. Shifting consumer demands are also shaping the market; end-users now expect higher levels of uptime, lower latency, and increasingly, a commitment to environmental responsibility. This has spurred innovation in areas such as renewable energy integration, intelligent power management, and modular data center designs that optimize energy consumption. The market is witnessing a heightened focus on modular and scalable power solutions that can adapt to fluctuating power requirements, thereby reducing capital expenditure and operational costs. The overall market growth rate is projected to be in the range of 7-9% annually during the forecast period, indicating a sustained period of expansion. The adoption metrics for advanced power solutions are showing a significant upward trend, with over 60% of new data center deployments incorporating state-of-the-art UPS and PDU technologies. This evolution signifies a mature market actively embracing innovation to meet the ever-increasing demands of the digital economy.

Leading Regions, Countries, or Segments in Australia Data Center Power Market

The Power Infrastructure: Electrical Solution segment, particularly Power Distribution Solutions (PDU, Switchgear, Critical Power Distribution, Transfer Switches, Remote Power Panels, Others), stands as the dominant force within the Australia Data Center Power Market. This dominance is underscored by significant investment trends and robust regulatory support for reliable and efficient power delivery systems crucial for data center operations.

- Dominance Drivers for Power Distribution Solutions:

- Critical Uptime Requirements: Data centers demand an exceptionally high level of uptime, making robust and redundant power distribution essential. Any lapse in power can lead to catastrophic data loss and financial repercussions, driving investment in sophisticated PDU and switchgear technologies.

- Technological Advancements in PDUs: The evolution of PDUs, from basic power strips to intelligent, remotely managed units with outlet-level monitoring and control, has been a key differentiator. These advanced PDUs offer granular insights into power consumption, enable predictive maintenance, and facilitate remote troubleshooting, significantly enhancing operational efficiency.

- Scalability and Modularity: The trend towards modular data center design necessitates power solutions that can scale alongside the infrastructure. Advanced power distribution systems offer the flexibility to add capacity incrementally, aligning with business growth and mitigating upfront investment risks.

- Energy Efficiency Mandates: Increasingly stringent energy efficiency regulations and corporate sustainability goals are pushing data center operators to adopt power distribution solutions that minimize energy loss and optimize power usage effectiveness (PUE).

- Rise of Hyperscale and Colocation Facilities: The growth of hyperscale data centers and colocation providers, which house significant computing power, directly translates to a substantial demand for high-capacity and highly reliable power distribution infrastructure.

The IT & Telecommunication end-user segment also plays a crucial role in driving demand within this segment, as telecommunication networks and IT service providers are expanding their infrastructure to support cloud services, 5G deployment, and increasing data traffic. The BFSI sector, with its stringent security and uptime requirements, is another major contributor, demanding the most resilient power solutions. Government initiatives promoting digital transformation further bolster the demand for reliable data center power infrastructure. The service segment, while growing, is intrinsically linked to the installation, maintenance, and upgrade of these power infrastructure components, reinforcing the primary dominance of electrical solutions in the market's current trajectory.

Australia Data Center Power Market Product Innovations

Recent product innovations in the Australia Data Center Power Market are significantly enhancing operational efficiency and reliability. A prime example is Enlogic's February 2024 introduction of new Horizontal & Vertical High AMP PDUs. These advanced PDUs offer enhanced versatility with combination and locking combination outlets, including configurations for C13/C15 and C13/C15/C19/C21, catering to a wider range of equipment and ensuring secure connections. This innovation addresses the need for flexible power delivery in high-density computing environments, allowing for more streamlined cable management and reduced risk of accidental disconnections. Such developments highlight a market trend towards intelligent, adaptable power management solutions that optimize space and performance within data center racks.

Propelling Factors for Australia Data Center Power Market Growth

The Australia Data Center Power Market is propelled by several key growth factors. Increasing demand for cloud computing services, driven by digital transformation initiatives across industries, necessitates expanded data center capacity and, consequently, advanced power solutions. The rapid adoption of Artificial Intelligence (AI) and Machine Learning (ML) is creating a substantial need for high-performance computing infrastructure, which in turn requires robust and scalable power systems. Government investments in digital infrastructure and cybersecurity further fuel market expansion. Moreover, the growing emphasis on sustainability and energy efficiency is driving the adoption of innovative power technologies that reduce operational costs and environmental impact.

Obstacles in the Australia Data Center Power Market Market

Despite robust growth, the Australia Data Center Power Market faces several obstacles. Regulatory challenges related to grid capacity and renewable energy integration can sometimes impede the rapid deployment of new data centers. Supply chain disruptions, as experienced globally, can lead to delays in the delivery of critical power components, impacting project timelines and costs. Intense competitive pressures among a growing number of vendors can also lead to price erosion, affecting profit margins. Furthermore, the upfront capital investment required for state-of-the-art power infrastructure can be a significant barrier for smaller operators, leading to a reliance on phased upgrades rather than immediate adoption of the latest technologies.

Future Opportunities in Australia Data Center Power Market

Future opportunities in the Australia Data Center Power Market are abundant, driven by emerging trends and evolving technological landscapes. The increasing demand for edge computing solutions presents a significant opportunity for decentralized and modular power infrastructure. The continued growth of AI and High-Performance Computing (HPC) will drive demand for highly specialized and powerful data center facilities, requiring cutting-edge power delivery and management systems. Furthermore, the global push towards sustainability and carbon neutrality opens avenues for advanced renewable energy integration and energy storage solutions within data center power architectures. The ongoing digital transformation in sectors like healthcare and advanced manufacturing will also create new demand centers for data center services and, consequently, their power infrastructure.

Major Players in the Australia Data Center Power Market Ecosystem

- ABB Ltd

- Rolls-Royce PLC

- Legrand Group

- Schneider Electric SE

- Fujitsu Limited

- Caterpillar Inc

- Rittal GmbH & Co KG

- Cisco Systems Inc

- Cummins Inc

- Vertiv Group Corp

- Eaton Corporation

Key Developments in Australia Data Center Power Market Industry

- February 2024: Enlogic, a significant provider of power products, announced two new PDUs to its extensive iPDU product line: Horizontal & Vertical high AMP PDUs. They included a High Amp Vertical PDU with combination and locking combination outlet and a Horizontal high Amp PDU (100/125A) with combination and locking combination outlets of C13/C15 and C13/C15/C19/C21, offering versatility and flexibility, directly impacting the market by providing more adaptable power distribution solutions for high-density racks.

- January 2024: Vertiv announced the plans to double its manufacturing capacity for busways, switchgear, and integrated modular solutions (IMS) by 2025. The expansion plans include increasing the utilization and footprint in the United Arab Emirates, Ireland, South Carolina (United States), Mexico, Slovakia, and Northern Ireland, signaling a significant global investment in bolstering the supply of critical power infrastructure components, which will indirectly benefit the Australian market through global production capacity increases and potential future expansions.

Strategic Australia Data Center Power Market Market Forecast

The strategic forecast for the Australia Data Center Power Market indicates sustained and robust growth, driven by the confluence of accelerating digital transformation, escalating AI adoption, and the persistent need for reliable, high-performance data infrastructure. Future opportunities lie in catering to the burgeoning demand for edge computing, hyperscale facilities, and colocation services, all of which will necessitate advanced, scalable, and energy-efficient power solutions. The market's trajectory is strongly influenced by a commitment to sustainability, encouraging the integration of renewable energy sources and intelligent power management systems, thereby reducing operational costs and environmental footprints. Strategic investments in innovative power distribution technologies, such as intelligent PDUs and efficient UPS systems, are anticipated to be key differentiators, ensuring continued market expansion and leadership.

Australia Data Center Power Market Segmentation

-

1. Power Infrastructure

-

1.1. Electrical Solution

- 1.1.1. UPS Systems

- 1.1.2. Generators

-

1.1.3. Power Distribution Solutions

- 1.1.3.1. PDU

- 1.1.3.2. Switchgear

- 1.1.3.3. Critical Power Distribution

- 1.1.3.4. Transfer Switches

- 1.1.3.5. Remote Power Panels

- 1.1.3.6. Others

- 1.2. Service

-

1.1. Electrical Solution

-

2. End User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End User

Australia Data Center Power Market Segmentation By Geography

- 1. Australia

Australia Data Center Power Market Regional Market Share

Geographic Coverage of Australia Data Center Power Market

Australia Data Center Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. The IT & Telecom Segment is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Data Center Power Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 5.1.1. Electrical Solution

- 5.1.1.1. UPS Systems

- 5.1.1.2. Generators

- 5.1.1.3. Power Distribution Solutions

- 5.1.1.3.1. PDU

- 5.1.1.3.2. Switchgear

- 5.1.1.3.3. Critical Power Distribution

- 5.1.1.3.4. Transfer Switches

- 5.1.1.3.5. Remote Power Panels

- 5.1.1.3.6. Others

- 5.1.2. Service

- 5.1.1. Electrical Solution

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End User

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rolls-Royce PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Legrand Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schneider Electric SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fujitsu Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Caterpillar Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rittal GmbH & Co KG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cisco Systems Inc *List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cummins Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vertiv Group Corp

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Eaton Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 ABB Ltd

List of Figures

- Figure 1: Australia Data Center Power Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Data Center Power Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Data Center Power Market Revenue Million Forecast, by Power Infrastructure 2020 & 2033

- Table 2: Australia Data Center Power Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Australia Data Center Power Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Australia Data Center Power Market Revenue Million Forecast, by Power Infrastructure 2020 & 2033

- Table 5: Australia Data Center Power Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Australia Data Center Power Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Data Center Power Market?

The projected CAGR is approximately 6.09%.

2. Which companies are prominent players in the Australia Data Center Power Market?

Key companies in the market include ABB Ltd, Rolls-Royce PLC, Legrand Group, Schneider Electric SE, Fujitsu Limited, Caterpillar Inc, Rittal GmbH & Co KG, Cisco Systems Inc *List Not Exhaustive, Cummins Inc, Vertiv Group Corp, Eaton Corporation.

3. What are the main segments of the Australia Data Center Power Market?

The market segments include Power Infrastructure, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs.

6. What are the notable trends driving market growth?

The IT & Telecom Segment is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

February 2024: Enlogic, a significant provider of power products, announced two new PDUs to its extensive iPDU product line: Horizontal & Vertical high AMP PDUs. They included a High Amp Vertical PDU with combination and locking combination outlet and a Horizontal high Amp PDU (100/125A) with combination and locking combination outlets of C13/C15 and C13/C15/C19/C21, offering versatility and flexibility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Data Center Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Data Center Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Data Center Power Market?

To stay informed about further developments, trends, and reports in the Australia Data Center Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence