Key Insights

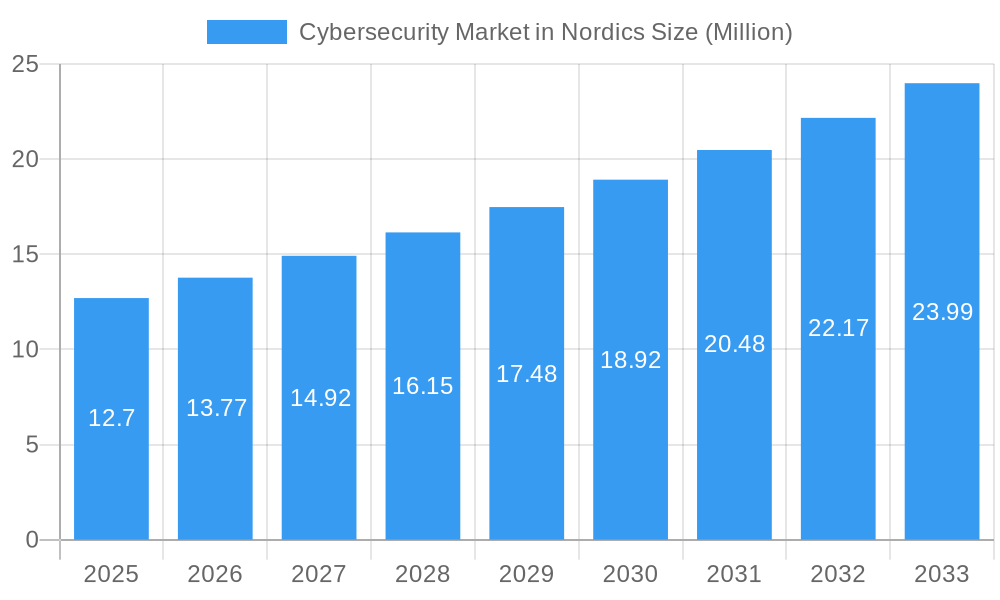

The Nordic cybersecurity market is poised for robust expansion, projected to reach approximately USD 12.70 million with a Compound Annual Growth Rate (CAGR) of 8.46% over the forecast period of 2025-2033. This significant growth is fueled by a heightened awareness of sophisticated cyber threats across all sectors, particularly within the BFSI, Healthcare, and IT & Telecommunication industries, which are increasingly adopting advanced digital solutions. The escalating complexity of cyber-attacks, coupled with stringent data privacy regulations such as GDPR, is driving substantial investments in comprehensive security solutions. Key drivers include the growing adoption of cloud security measures to protect sensitive data hosted remotely, the increasing demand for identity and access management (IAM) to secure digital identities, and the imperative for robust application security to safeguard critical business operations from vulnerabilities. Furthermore, the proliferation of connected devices in the Internet of Things (IoT) ecosystem necessitates enhanced infrastructure protection, contributing to market growth.

Cybersecurity Market in Nordics Market Size (In Million)

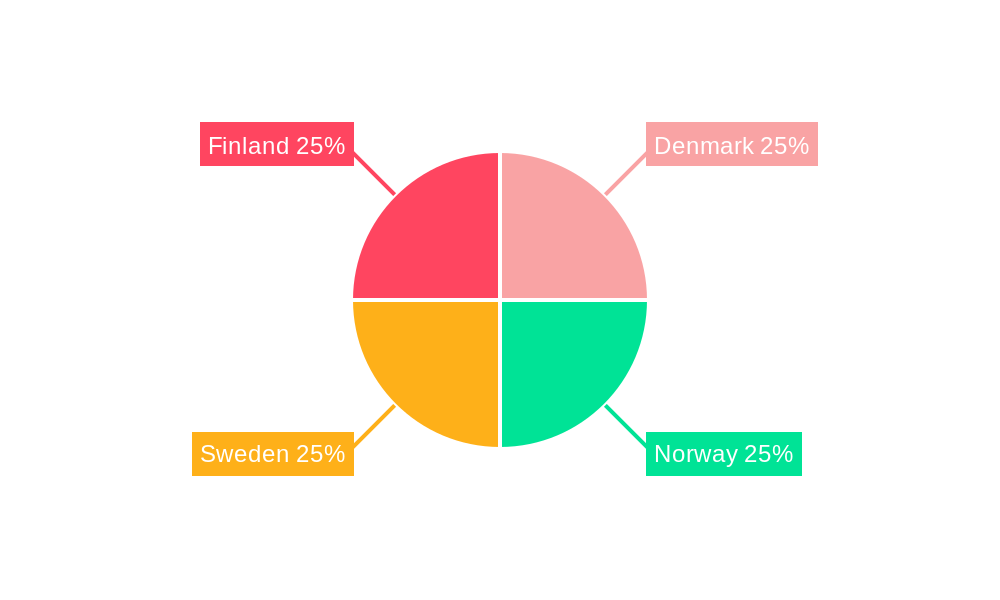

The market is characterized by a dynamic interplay of evolving threats and innovative solutions. While the demand for advanced security technologies like advanced threat intelligence and zero-trust architecture is on the rise, certain restraints such as the shortage of skilled cybersecurity professionals and the significant upfront investment required for implementing comprehensive security frameworks can pose challenges. However, the increasing availability of managed security services and the deployment of cloud-based security solutions are mitigating these challenges by offering scalable and cost-effective alternatives. The competitive landscape is shaped by established players offering a broad spectrum of solutions, alongside agile startups focusing on niche areas like consumer security software and specialized data security. The geographical focus on Denmark, Norway, Sweden, and Finland highlights a region prioritizing digital transformation while simultaneously investing heavily in securing its digital infrastructure against an ever-evolving threat landscape.

Cybersecurity Market in Nordics Company Market Share

Unlock critical insights into the burgeoning Nordic cybersecurity landscape. This in-depth report delivers a definitive analysis of the Cybersecurity Market in Nordics, spanning the historical period from 2019 to 2024 and projecting robust growth through 2033. With a base year of 2025, this report is your essential guide to understanding market dynamics, key players, evolving trends, and future opportunities across Denmark, Norway, Sweden, and Finland. Invest with confidence as you navigate the complexities of cloud security, data protection, identity access management, and more within this strategically vital region. Discover how organizations are fortifying their digital defenses against an ever-evolving threat landscape.

Cybersecurity Market in Nordics Market Composition & Trends

The Cybersecurity Market in Nordics is characterized by a moderate market concentration, with a significant presence of both global cybersecurity giants and agile regional players. Innovation is a constant catalyst, driven by an increasingly sophisticated threat landscape and proactive regulatory environments. The Nordics boast a robust framework of data privacy laws, including GDPR, which significantly influences cybersecurity investment and strategy. Substitute products, while present in niche areas, are largely outpaced by the comprehensive solutions offered by established cybersecurity vendors. End-user profiles are diverse, with BFSI, IT and Telecommunication, and Government sectors leading adoption due to high-value data and critical infrastructure. Mergers and Acquisitions (M&A) activities are observed, albeit at a more measured pace compared to larger global markets, often focusing on strategic tuck-ins to enhance specific capabilities. For instance, M&A deal values in the Nordics are estimated to range from $XX million to $XXX million, reflecting targeted acquisitions rather than broad consolidations. Market share distribution indicates a strong foothold for network security equipment and cloud security solutions, driven by the region's digital transformation initiatives.

- Market Concentration: Moderate, with a mix of multinational corporations and specialized Nordic firms.

- Innovation Catalysts: Evolving cyber threats, stringent data privacy regulations, and digital transformation mandates.

- Regulatory Landscapes: GDPR compliance remains paramount, influencing product development and service offerings.

- Substitute Products: Limited impact due to the demand for comprehensive and integrated cybersecurity solutions.

- End-User Profiles: BFSI, IT and Telecommunication, Government, and Healthcare are key adopters.

- M&A Activities: Targeted acquisitions to bolster specific cybersecurity domains.

Cybersecurity Market in Nordics Industry Evolution

The Cybersecurity Market in Nordics has undergone a significant evolution throughout the historical period of 2019-2024 and is poised for accelerated growth during the forecast period of 2025-2033. The market's trajectory has been shaped by a confluence of factors, including the increasing sophistication and frequency of cyber-attacks, the rapid adoption of cloud technologies, and a heightened awareness among businesses and individuals regarding the importance of robust digital security. Early adoption of advanced technologies has been a hallmark of the Nordic region, leading to a strong demand for cutting-edge solutions. The shift from traditional on-premise security models to flexible cloud-based deployments has been a defining trend, enabling businesses to scale their security infrastructure more effectively and respond rapidly to emerging threats. This transition has been supported by significant investments in cloud security solutions, which are projected to see a compound annual growth rate (CAGR) of approximately 18% over the forecast period.

Technological advancements have been rapid, with a notable surge in the adoption of Artificial Intelligence (AI) and Machine Learning (ML) for threat detection and response. The market has witnessed a growing demand for integrated risk management platforms that offer a holistic view of an organization's security posture. Furthermore, the rise of remote work and the increasing interconnectedness of devices (IoT) have created new attack vectors, driving the need for advanced network security equipment and endpoint protection. Consumer security software has also seen steady growth as individuals become more aware of phishing scams, ransomware, and data breaches. Government initiatives and regulations aimed at enhancing national cybersecurity infrastructure have further fueled market expansion. For example, public sector investments in cybersecurity in the Nordics are estimated to have grown by over 15% annually during the historical period. The industry's evolution is marked by a constant pursuit of more intelligent, proactive, and integrated security solutions to counter the ever-evolving cyber threat landscape.

Leading Regions, Countries, or Segments in Cybersecurity Market in Nordics

Within the dynamic Cybersecurity Market in Nordics, Sweden consistently emerges as a leading force, closely followed by Denmark. This dominance is underpinned by several converging factors, including substantial government investment in cybersecurity initiatives, a highly digitized economy, and a proactive stance on data privacy and security regulations. The IT and Telecommunication sector, along with the BFSI (Banking, Financial Services, and Insurance) industry, are particularly influential segments driving demand in these leading countries. These sectors handle vast amounts of sensitive data and are critical to national infrastructure, making robust cybersecurity an imperative rather than an option.

Dominant Countries:

- Sweden: Characterized by strong government support for cybersecurity research and development, a thriving tech ecosystem, and a high adoption rate of advanced security solutions across all industries. Swedish companies are at the forefront of adopting integrated risk management and cloud security solutions.

- Denmark: Exhibits a mature cybersecurity market with a strong emphasis on compliance and risk mitigation. The BFSI sector in Denmark has been a significant early adopter of sophisticated data security and identity access management solutions, driven by stringent regulatory requirements and a focus on customer trust.

Key Segments Driving Dominance:

- Cloud Security: The rapid digital transformation across Nordic enterprises, particularly in Sweden and Denmark, has led to a massive migration to cloud environments. This necessitates comprehensive cloud security solutions, including cloud access security brokers (CASB), cloud workload protection platforms (CWPP), and cloud security posture management (CSPM). The market for cloud security is projected to grow at a CAGR of 19% in these leading countries.

- Identity Access Management (IAM): With the increasing prevalence of remote work and sophisticated phishing attacks, ensuring secure access to corporate resources is paramount. The BFSI and Government sectors in Sweden and Denmark are investing heavily in advanced IAM solutions, including multi-factor authentication (MFA) and privileged access management (PAM).

- Data Security: Protecting sensitive customer and corporate data is a top priority. This drives demand for data loss prevention (DLP) solutions, encryption technologies, and data masking tools. The regulatory push for data privacy further amplifies the importance of this segment.

- Network Security Equipment: Despite the rise of cloud, robust network security remains crucial. This includes next-generation firewalls (NGFW), intrusion detection/prevention systems (IDPS), and secure web gateways, which are essential for protecting both on-premise and hybrid IT environments.

Investment Trends: Significant venture capital and private equity investments are being directed towards cybersecurity startups and established players in Sweden and Denmark, fostering innovation and market expansion.

Regulatory Support: Government incentives, grants for cybersecurity research, and clear regulatory frameworks encourage businesses to prioritize and invest in security solutions.

End-User Industry Focus: The high concentration of digital businesses in the BFSI and IT/Telecommunication sectors in these countries fuels a constant demand for advanced cybersecurity offerings.

Cybersecurity Market in Nordics Product Innovations

Product innovation in the Cybersecurity Market in Nordics is largely driven by the need for intelligent automation and proactive threat prevention. Solutions are increasingly incorporating AI and ML to detect zero-day vulnerabilities and respond to emerging threats in real-time. Advances in cloud security platforms offer enhanced visibility and control over hybrid and multi-cloud environments. Identity Access Management solutions are evolving with biometric authentication and zero-trust architectures, ensuring granular access control. Furthermore, integrated risk management platforms are providing a unified view of an organization's security posture, consolidating various security tools into a single interface. The focus is on delivering solutions that are not only effective but also user-friendly and scalable.

Propelling Factors for Cybersecurity Market in Nordics Growth

The Cybersecurity Market in Nordics is experiencing significant growth driven by several key factors. The escalating sophistication and frequency of cyber-attacks, including ransomware and phishing campaigns, compel organizations to invest in advanced security measures. The pervasive digital transformation across industries, characterized by increased cloud adoption and the proliferation of IoT devices, expands the attack surface, necessitating robust cybersecurity solutions. Stringent data privacy regulations, such as GDPR, impose strict compliance requirements, driving demand for comprehensive data security and identity management solutions. Furthermore, a proactive approach by Nordic governments to bolster national cybersecurity infrastructure and foster innovation through research and development grants provides a supportive ecosystem for market expansion. The growing awareness of cyber risks among businesses and individuals also contributes to increased market penetration.

- Increasing Cyber Threats: Rise in ransomware, phishing, and advanced persistent threats (APTs).

- Digital Transformation: Widespread adoption of cloud computing, IoT, and remote work.

- Regulatory Compliance: Strict data protection laws like GDPR mandating robust security measures.

- Government Initiatives: Investments in national cybersecurity infrastructure and R&D.

- Heightened Awareness: Growing understanding of cyber risks among organizations and end-users.

Obstacles in the Cybersecurity Market in Nordics Market

Despite robust growth, the Cybersecurity Market in Nordics faces several obstacles. A significant challenge is the persistent shortage of skilled cybersecurity professionals, which hinders the effective implementation and management of advanced security solutions. The high cost of sophisticated cybersecurity technologies can also be a barrier for small and medium-sized enterprises (SMEs), limiting their ability to adopt comprehensive protection. Furthermore, the fragmented nature of the threat landscape, with ever-evolving attack vectors, requires continuous adaptation and investment, posing a challenge for budget-constrained organizations. Supply chain disruptions, though less prominent than in other regions, can occasionally impact the availability of specialized hardware components.

- Talent Shortage: Lack of skilled cybersecurity professionals for implementation and management.

- High Technology Costs: Premium pricing of advanced solutions can be prohibitive for SMEs.

- Evolving Threat Landscape: Constant need for adaptation and upgrades against new attack methods.

- Integration Complexity: Difficulty in seamlessly integrating disparate security solutions.

Future Opportunities in Cybersecurity Market in Nordics

The Cybersecurity Market in Nordics is ripe with future opportunities, driven by emerging technologies and evolving threat landscapes. The increasing adoption of AI and Machine Learning in cybersecurity presents a significant opportunity for advanced threat detection and automated incident response solutions. The growing demand for Zero Trust security models, which assume no implicit trust and verify all access, will fuel the market for identity and access management, micro-segmentation, and endpoint security solutions. The expansion of IoT devices across industries, from smart manufacturing to connected healthcare, creates a burgeoning market for specialized IoT security solutions. Furthermore, the increasing focus on cloud-native security and container security will drive innovation in these areas, catering to businesses that are increasingly relying on cloud infrastructure. The growing awareness of ransomware threats also presents an opportunity for enhanced data backup and recovery solutions.

- AI/ML-Powered Security: Demand for intelligent threat detection and response.

- Zero Trust Architecture: Growth in IAM, micro-segmentation, and endpoint security.

- IoT Security: Expansion of dedicated security solutions for connected devices.

- Cloud-Native Security: Focus on securing cloud-based applications and infrastructure.

- Ransomware Prevention & Recovery: Increased need for robust data backup and resilience solutions.

Major Players in the Cybersecurity Market in Nordics Ecosystem

- IBM Corporation

- Trend Micro Inc

- Fortinet Inc

- F5 Networks Inc

- Nortonlifelock Inc

- Cisco Systems Inc

- Proofpoint Inc

- Clavister

- Acronis International GmbH

- AVG Technologies

- Dell Technologies Inc

- CyberArk Software Ltd

Key Developments in Cybersecurity Market in Nordics Industry

- May 2022: Cisco announced the public release of the Cisco Cloud Controls Framework (CCF). This comprehensive framework aggregates national and international security compliance and certification requirements, aiming to simplify the process of ensuring security and compliance in cloud environments for organizations.

- August 2022: Irdeto, a provider of digital platform cybersecurity solutions, and Clavister, a developer of high-performance cybersecurity solutions, announced a new alliance. This collaboration will see Irdeto's Connected Transport division work with Clavister to integrate Clavister's Next-Generation Firewall (NGFW) solution and AI engine for zero-day vulnerability detection with Irdeto's asset protection capabilities, enabling secure remote monitoring and control of connected fleets.

Strategic Cybersecurity Market in Nordics Market Forecast

The strategic outlook for the Cybersecurity Market in Nordics is exceptionally positive, projected to witness substantial expansion driven by a combination of proactive market forces and continuous technological advancement. The forecast period of 2025–2033 indicates a sustained high growth trajectory, fueled by the persistent threat of sophisticated cyber-attacks and the ongoing digital transformation across all sectors. Investments in cloud security, identity and access management, and data protection solutions are expected to remain paramount as organizations prioritize robust defenses. Emerging technologies like AI and Machine Learning will play an increasingly vital role in predictive threat intelligence and automated response mechanisms. Furthermore, government initiatives supporting cybersecurity resilience and the growing demand for integrated risk management platforms will solidify the market's strong upward momentum, positioning the Nordics as a leading region in cybersecurity innovation and adoption.

Cybersecurity Market in Nordics Segmentation

-

1. Product Type

- 1.1. Application Security

- 1.2. Cloud Security

- 1.3. Consumer Security Software

- 1.4. Data Security

- 1.5. Identity Access Management

- 1.6. Infrastructure Protection

- 1.7. Integrated Risk Management

- 1.8. Network Security Equipment

- 1.9. Other Solution Types

-

2. Service

- 2.1. Professional

- 2.2. Managed

-

3. Deployment

- 3.1. On-Premise

- 3.2. Cloud

-

4. End-User Industry

- 4.1. BFSI

- 4.2. Healthcare

- 4.3. Aerospace and Defense

- 4.4. IT and Telecommunication

- 4.5. Government

- 4.6. Retail

- 4.7. Manufacturing

- 4.8. Other End-user Industries

-

5. Geography

- 5.1. Denmark

- 5.2. Norway

- 5.3. Sweden

- 5.4. Finland

Cybersecurity Market in Nordics Segmentation By Geography

- 1. Denmark

- 2. Norway

- 3. Sweden

- 4. Finland

Cybersecurity Market in Nordics Regional Market Share

Geographic Coverage of Cybersecurity Market in Nordics

Cybersecurity Market in Nordics REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Digitalization and Scalable IT Infrastructure; Rapidly Increasing Cybersecurity Incidents and Regulations Requiring Their Reporting

- 3.3. Market Restrains

- 3.3.1. Lack of Cybersecurity Professionals; High Reliance on Traditional Authentication Methods and Low Preparednes

- 3.4. Market Trends

- 3.4.1. Initiatives Taken by Government on Cyber Security drives the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cybersecurity Market in Nordics Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Application Security

- 5.1.2. Cloud Security

- 5.1.3. Consumer Security Software

- 5.1.4. Data Security

- 5.1.5. Identity Access Management

- 5.1.6. Infrastructure Protection

- 5.1.7. Integrated Risk Management

- 5.1.8. Network Security Equipment

- 5.1.9. Other Solution Types

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Professional

- 5.2.2. Managed

- 5.3. Market Analysis, Insights and Forecast - by Deployment

- 5.3.1. On-Premise

- 5.3.2. Cloud

- 5.4. Market Analysis, Insights and Forecast - by End-User Industry

- 5.4.1. BFSI

- 5.4.2. Healthcare

- 5.4.3. Aerospace and Defense

- 5.4.4. IT and Telecommunication

- 5.4.5. Government

- 5.4.6. Retail

- 5.4.7. Manufacturing

- 5.4.8. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. Denmark

- 5.5.2. Norway

- 5.5.3. Sweden

- 5.5.4. Finland

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Denmark

- 5.6.2. Norway

- 5.6.3. Sweden

- 5.6.4. Finland

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Denmark Cybersecurity Market in Nordics Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Application Security

- 6.1.2. Cloud Security

- 6.1.3. Consumer Security Software

- 6.1.4. Data Security

- 6.1.5. Identity Access Management

- 6.1.6. Infrastructure Protection

- 6.1.7. Integrated Risk Management

- 6.1.8. Network Security Equipment

- 6.1.9. Other Solution Types

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Professional

- 6.2.2. Managed

- 6.3. Market Analysis, Insights and Forecast - by Deployment

- 6.3.1. On-Premise

- 6.3.2. Cloud

- 6.4. Market Analysis, Insights and Forecast - by End-User Industry

- 6.4.1. BFSI

- 6.4.2. Healthcare

- 6.4.3. Aerospace and Defense

- 6.4.4. IT and Telecommunication

- 6.4.5. Government

- 6.4.6. Retail

- 6.4.7. Manufacturing

- 6.4.8. Other End-user Industries

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. Denmark

- 6.5.2. Norway

- 6.5.3. Sweden

- 6.5.4. Finland

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Norway Cybersecurity Market in Nordics Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Application Security

- 7.1.2. Cloud Security

- 7.1.3. Consumer Security Software

- 7.1.4. Data Security

- 7.1.5. Identity Access Management

- 7.1.6. Infrastructure Protection

- 7.1.7. Integrated Risk Management

- 7.1.8. Network Security Equipment

- 7.1.9. Other Solution Types

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Professional

- 7.2.2. Managed

- 7.3. Market Analysis, Insights and Forecast - by Deployment

- 7.3.1. On-Premise

- 7.3.2. Cloud

- 7.4. Market Analysis, Insights and Forecast - by End-User Industry

- 7.4.1. BFSI

- 7.4.2. Healthcare

- 7.4.3. Aerospace and Defense

- 7.4.4. IT and Telecommunication

- 7.4.5. Government

- 7.4.6. Retail

- 7.4.7. Manufacturing

- 7.4.8. Other End-user Industries

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. Denmark

- 7.5.2. Norway

- 7.5.3. Sweden

- 7.5.4. Finland

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Sweden Cybersecurity Market in Nordics Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Application Security

- 8.1.2. Cloud Security

- 8.1.3. Consumer Security Software

- 8.1.4. Data Security

- 8.1.5. Identity Access Management

- 8.1.6. Infrastructure Protection

- 8.1.7. Integrated Risk Management

- 8.1.8. Network Security Equipment

- 8.1.9. Other Solution Types

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Professional

- 8.2.2. Managed

- 8.3. Market Analysis, Insights and Forecast - by Deployment

- 8.3.1. On-Premise

- 8.3.2. Cloud

- 8.4. Market Analysis, Insights and Forecast - by End-User Industry

- 8.4.1. BFSI

- 8.4.2. Healthcare

- 8.4.3. Aerospace and Defense

- 8.4.4. IT and Telecommunication

- 8.4.5. Government

- 8.4.6. Retail

- 8.4.7. Manufacturing

- 8.4.8. Other End-user Industries

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. Denmark

- 8.5.2. Norway

- 8.5.3. Sweden

- 8.5.4. Finland

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Finland Cybersecurity Market in Nordics Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Application Security

- 9.1.2. Cloud Security

- 9.1.3. Consumer Security Software

- 9.1.4. Data Security

- 9.1.5. Identity Access Management

- 9.1.6. Infrastructure Protection

- 9.1.7. Integrated Risk Management

- 9.1.8. Network Security Equipment

- 9.1.9. Other Solution Types

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. Professional

- 9.2.2. Managed

- 9.3. Market Analysis, Insights and Forecast - by Deployment

- 9.3.1. On-Premise

- 9.3.2. Cloud

- 9.4. Market Analysis, Insights and Forecast - by End-User Industry

- 9.4.1. BFSI

- 9.4.2. Healthcare

- 9.4.3. Aerospace and Defense

- 9.4.4. IT and Telecommunication

- 9.4.5. Government

- 9.4.6. Retail

- 9.4.7. Manufacturing

- 9.4.8. Other End-user Industries

- 9.5. Market Analysis, Insights and Forecast - by Geography

- 9.5.1. Denmark

- 9.5.2. Norway

- 9.5.3. Sweden

- 9.5.4. Finland

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 IBM Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Trend Micro Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Fortinet Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 F5 Networks Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Nortonlifelock Inc *List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Cisco Systems Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Proofpoint Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Clavister

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Acronis International GmbH

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 AVG Technologies

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Dell Technologies Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 CyberArk Software Ltd

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 IBM Corporation

List of Figures

- Figure 1: Global Cybersecurity Market in Nordics Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Denmark Cybersecurity Market in Nordics Revenue (Million), by Product Type 2025 & 2033

- Figure 3: Denmark Cybersecurity Market in Nordics Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Denmark Cybersecurity Market in Nordics Revenue (Million), by Service 2025 & 2033

- Figure 5: Denmark Cybersecurity Market in Nordics Revenue Share (%), by Service 2025 & 2033

- Figure 6: Denmark Cybersecurity Market in Nordics Revenue (Million), by Deployment 2025 & 2033

- Figure 7: Denmark Cybersecurity Market in Nordics Revenue Share (%), by Deployment 2025 & 2033

- Figure 8: Denmark Cybersecurity Market in Nordics Revenue (Million), by End-User Industry 2025 & 2033

- Figure 9: Denmark Cybersecurity Market in Nordics Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 10: Denmark Cybersecurity Market in Nordics Revenue (Million), by Geography 2025 & 2033

- Figure 11: Denmark Cybersecurity Market in Nordics Revenue Share (%), by Geography 2025 & 2033

- Figure 12: Denmark Cybersecurity Market in Nordics Revenue (Million), by Country 2025 & 2033

- Figure 13: Denmark Cybersecurity Market in Nordics Revenue Share (%), by Country 2025 & 2033

- Figure 14: Norway Cybersecurity Market in Nordics Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Norway Cybersecurity Market in Nordics Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Norway Cybersecurity Market in Nordics Revenue (Million), by Service 2025 & 2033

- Figure 17: Norway Cybersecurity Market in Nordics Revenue Share (%), by Service 2025 & 2033

- Figure 18: Norway Cybersecurity Market in Nordics Revenue (Million), by Deployment 2025 & 2033

- Figure 19: Norway Cybersecurity Market in Nordics Revenue Share (%), by Deployment 2025 & 2033

- Figure 20: Norway Cybersecurity Market in Nordics Revenue (Million), by End-User Industry 2025 & 2033

- Figure 21: Norway Cybersecurity Market in Nordics Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 22: Norway Cybersecurity Market in Nordics Revenue (Million), by Geography 2025 & 2033

- Figure 23: Norway Cybersecurity Market in Nordics Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Norway Cybersecurity Market in Nordics Revenue (Million), by Country 2025 & 2033

- Figure 25: Norway Cybersecurity Market in Nordics Revenue Share (%), by Country 2025 & 2033

- Figure 26: Sweden Cybersecurity Market in Nordics Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Sweden Cybersecurity Market in Nordics Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Sweden Cybersecurity Market in Nordics Revenue (Million), by Service 2025 & 2033

- Figure 29: Sweden Cybersecurity Market in Nordics Revenue Share (%), by Service 2025 & 2033

- Figure 30: Sweden Cybersecurity Market in Nordics Revenue (Million), by Deployment 2025 & 2033

- Figure 31: Sweden Cybersecurity Market in Nordics Revenue Share (%), by Deployment 2025 & 2033

- Figure 32: Sweden Cybersecurity Market in Nordics Revenue (Million), by End-User Industry 2025 & 2033

- Figure 33: Sweden Cybersecurity Market in Nordics Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 34: Sweden Cybersecurity Market in Nordics Revenue (Million), by Geography 2025 & 2033

- Figure 35: Sweden Cybersecurity Market in Nordics Revenue Share (%), by Geography 2025 & 2033

- Figure 36: Sweden Cybersecurity Market in Nordics Revenue (Million), by Country 2025 & 2033

- Figure 37: Sweden Cybersecurity Market in Nordics Revenue Share (%), by Country 2025 & 2033

- Figure 38: Finland Cybersecurity Market in Nordics Revenue (Million), by Product Type 2025 & 2033

- Figure 39: Finland Cybersecurity Market in Nordics Revenue Share (%), by Product Type 2025 & 2033

- Figure 40: Finland Cybersecurity Market in Nordics Revenue (Million), by Service 2025 & 2033

- Figure 41: Finland Cybersecurity Market in Nordics Revenue Share (%), by Service 2025 & 2033

- Figure 42: Finland Cybersecurity Market in Nordics Revenue (Million), by Deployment 2025 & 2033

- Figure 43: Finland Cybersecurity Market in Nordics Revenue Share (%), by Deployment 2025 & 2033

- Figure 44: Finland Cybersecurity Market in Nordics Revenue (Million), by End-User Industry 2025 & 2033

- Figure 45: Finland Cybersecurity Market in Nordics Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 46: Finland Cybersecurity Market in Nordics Revenue (Million), by Geography 2025 & 2033

- Figure 47: Finland Cybersecurity Market in Nordics Revenue Share (%), by Geography 2025 & 2033

- Figure 48: Finland Cybersecurity Market in Nordics Revenue (Million), by Country 2025 & 2033

- Figure 49: Finland Cybersecurity Market in Nordics Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cybersecurity Market in Nordics Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Cybersecurity Market in Nordics Revenue Million Forecast, by Service 2020 & 2033

- Table 3: Global Cybersecurity Market in Nordics Revenue Million Forecast, by Deployment 2020 & 2033

- Table 4: Global Cybersecurity Market in Nordics Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 5: Global Cybersecurity Market in Nordics Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global Cybersecurity Market in Nordics Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Cybersecurity Market in Nordics Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Global Cybersecurity Market in Nordics Revenue Million Forecast, by Service 2020 & 2033

- Table 9: Global Cybersecurity Market in Nordics Revenue Million Forecast, by Deployment 2020 & 2033

- Table 10: Global Cybersecurity Market in Nordics Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 11: Global Cybersecurity Market in Nordics Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Global Cybersecurity Market in Nordics Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Cybersecurity Market in Nordics Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Cybersecurity Market in Nordics Revenue Million Forecast, by Service 2020 & 2033

- Table 15: Global Cybersecurity Market in Nordics Revenue Million Forecast, by Deployment 2020 & 2033

- Table 16: Global Cybersecurity Market in Nordics Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 17: Global Cybersecurity Market in Nordics Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Global Cybersecurity Market in Nordics Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Cybersecurity Market in Nordics Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Global Cybersecurity Market in Nordics Revenue Million Forecast, by Service 2020 & 2033

- Table 21: Global Cybersecurity Market in Nordics Revenue Million Forecast, by Deployment 2020 & 2033

- Table 22: Global Cybersecurity Market in Nordics Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 23: Global Cybersecurity Market in Nordics Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Global Cybersecurity Market in Nordics Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global Cybersecurity Market in Nordics Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: Global Cybersecurity Market in Nordics Revenue Million Forecast, by Service 2020 & 2033

- Table 27: Global Cybersecurity Market in Nordics Revenue Million Forecast, by Deployment 2020 & 2033

- Table 28: Global Cybersecurity Market in Nordics Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 29: Global Cybersecurity Market in Nordics Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Global Cybersecurity Market in Nordics Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cybersecurity Market in Nordics?

The projected CAGR is approximately 8.46%.

2. Which companies are prominent players in the Cybersecurity Market in Nordics?

Key companies in the market include IBM Corporation, Trend Micro Inc, Fortinet Inc, F5 Networks Inc, Nortonlifelock Inc *List Not Exhaustive, Cisco Systems Inc, Proofpoint Inc, Clavister, Acronis International GmbH, AVG Technologies, Dell Technologies Inc, CyberArk Software Ltd.

3. What are the main segments of the Cybersecurity Market in Nordics?

The market segments include Product Type, Service, Deployment, End-User Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Digitalization and Scalable IT Infrastructure; Rapidly Increasing Cybersecurity Incidents and Regulations Requiring Their Reporting.

6. What are the notable trends driving market growth?

Initiatives Taken by Government on Cyber Security drives the Market Growth.

7. Are there any restraints impacting market growth?

Lack of Cybersecurity Professionals; High Reliance on Traditional Authentication Methods and Low Preparednes.

8. Can you provide examples of recent developments in the market?

May 2022: Cisco announced that it had released the Cisco Cloud Controls Framework (CCF) to the public. Cisco CCF is a comprehensive set of national and international security compliance and certification requirements aggregated into one framework.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cybersecurity Market in Nordics," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cybersecurity Market in Nordics report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cybersecurity Market in Nordics?

To stay informed about further developments, trends, and reports in the Cybersecurity Market in Nordics, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence