Key Insights

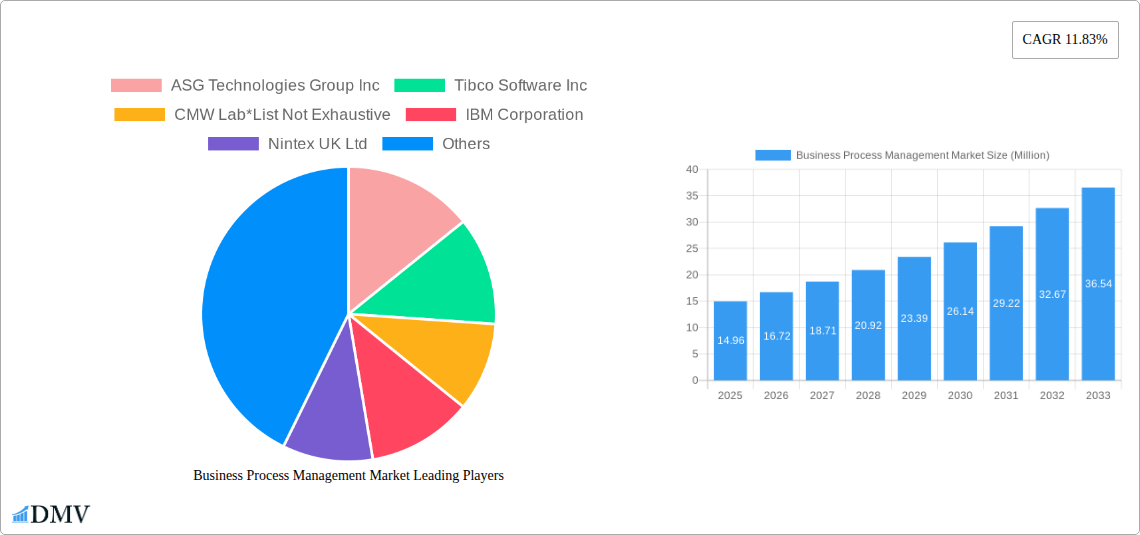

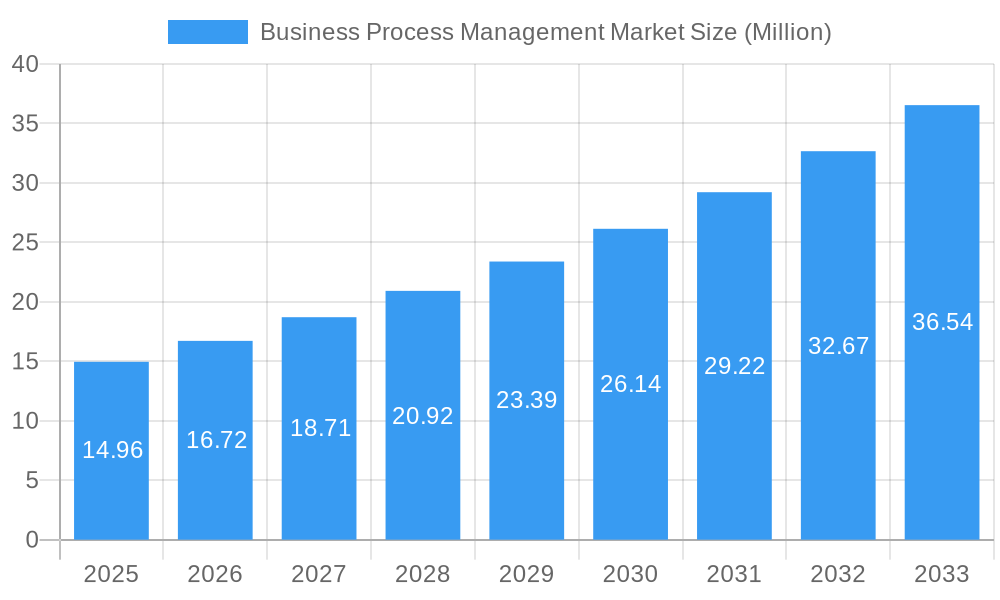

The Business Process Management (BPM) market is experiencing robust growth, projected to reach approximately $14.96 million in value. This expansion is fueled by a significant Compound Annual Growth Rate (CAGR) of 11.83%, indicating a strong demand for solutions that streamline operations and enhance efficiency across diverse industries. Key drivers of this market surge include the escalating need for digital transformation initiatives, the imperative to optimize operational costs, and the growing adoption of automation technologies to improve productivity and customer experiences. Businesses are increasingly recognizing BPM as a critical enabler for achieving agility, regulatory compliance, and competitive advantage in today's dynamic business landscape. The market's trajectory points towards a future where seamless process orchestration and intelligent automation are paramount for organizational success.

Business Process Management Market Market Size (In Million)

The BPM market is segmented by deployment models, with Cloud solutions gaining significant traction due to their scalability, cost-effectiveness, and ease of implementation. On-premise solutions continue to hold relevance for organizations with stringent data security and compliance requirements. In terms of solutions, Process Improvement, Process Automation, Content and Document Management, and Case Management are leading segments, addressing critical business needs. The Banking, Financial Services, and Insurance (BFSI) sector, along with Government and Defense, Healthcare, and IT and Telecommunication, represent major end-user industries driving adoption. Emerging economies in the Asia Pacific region are expected to witness substantial growth, driven by increasing digital penetration and government initiatives promoting business modernization. While the market is poised for expansion, potential restraints such as the complexity of integrating BPM with existing legacy systems and the need for skilled personnel could present challenges, although ongoing innovation is actively addressing these concerns.

Business Process Management Market Company Market Share

Unlock critical insights into the dynamic Business Process Management (BPM) market with our in-depth report. Covering the historical period of 2019-2024, base year 2025, and a comprehensive forecast period of 2025-2033, this report provides unparalleled strategic intelligence for stakeholders. We analyze market composition, key trends, product innovations, growth drivers, obstacles, and future opportunities, alongside a detailed examination of leading regions, countries, and segments. Discover how BPM solutions are revolutionizing Process Improvement, Process Automation, Content and Document Management, and Case Management across industries like BFSI, Government and Defense, Healthcare, IT and Telecommunication, Retail, and Manufacturing. This report is your definitive guide to navigating the evolving BPM landscape, identifying key players like IBM Corporation, Pegasystems Inc, and Appian, and understanding the latest industry developments.

Business Process Management Market Market Composition & Trends

The Business Process Management (BPM) market is characterized by a moderately concentrated landscape, with a few key players holding significant market share, projected to be around XX% by 2025. Innovation is primarily driven by the increasing demand for digital transformation and operational efficiency. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is a significant catalyst for market growth, enabling advanced process automation and predictive analytics. Regulatory landscapes are also shaping market dynamics, with data privacy and compliance requirements influencing solution development. Substitute products, such as siloed automation tools, exist but often lack the comprehensive orchestration capabilities of BPM suites. End-user profiles are increasingly diverse, with enterprises of all sizes seeking to streamline operations. Merger and Acquisition (M&A) activities are prevalent, with an estimated M&A deal value of over XXX Million in the past year, indicating consolidation and strategic expansion within the market.

- Market Concentration: Dominated by a few leading vendors, but with growing opportunities for niche players.

- Innovation Catalysts: Digital transformation initiatives, AI/ML integration, cloud adoption, and regulatory compliance.

- Regulatory Landscape: Increasing focus on data security, privacy (e.g., GDPR, CCPA), and industry-specific regulations.

- Substitute Products: Standalone RPA tools, workflow management software, and manual process execution.

- End-User Profiles: Enterprises of all sizes, across various industries seeking efficiency and agility.

- M&A Activities: Strategic acquisitions aimed at expanding product portfolios and market reach, with an estimated deal value of XXX Million.

Business Process Management Market Industry Evolution

The Business Process Management (BPM) market has witnessed a significant evolution driven by the imperative for enhanced operational efficiency, digital transformation, and customer-centricity. Over the historical period (2019-2024), the market experienced a Compound Annual Growth Rate (CAGR) of approximately XX%, fueled by the widespread adoption of digital technologies and the increasing complexity of business operations. The base year 2025 is anticipated to see the market reach a valuation of XXX Million, with a projected CAGR of XX% during the forecast period (2025-2033). This growth trajectory is underpinned by several factors, including the escalating need for process automation to reduce costs and minimize human error, and the growing emphasis on delivering superior customer experiences through streamlined service delivery. Technological advancements have played a pivotal role, with the integration of AI, ML, Robotic Process Automation (RPA), and low-code/no-code platforms democratizing BPM capabilities and accelerating deployment. Shifting consumer demands for faster, more personalized, and seamless interactions have pushed organizations to re-evaluate and optimize their internal processes. The rise of cloud-based BPM solutions has further democratized access, offering scalability, flexibility, and cost-effectiveness. On-premise deployments continue to hold relevance for organizations with stringent security and regulatory requirements, though the trend is increasingly shifting towards hybrid and cloud models. The market's evolution is marked by a move from simple workflow automation to more sophisticated, end-to-end process orchestration and intelligent automation, enabling businesses to achieve greater agility and competitive advantage.

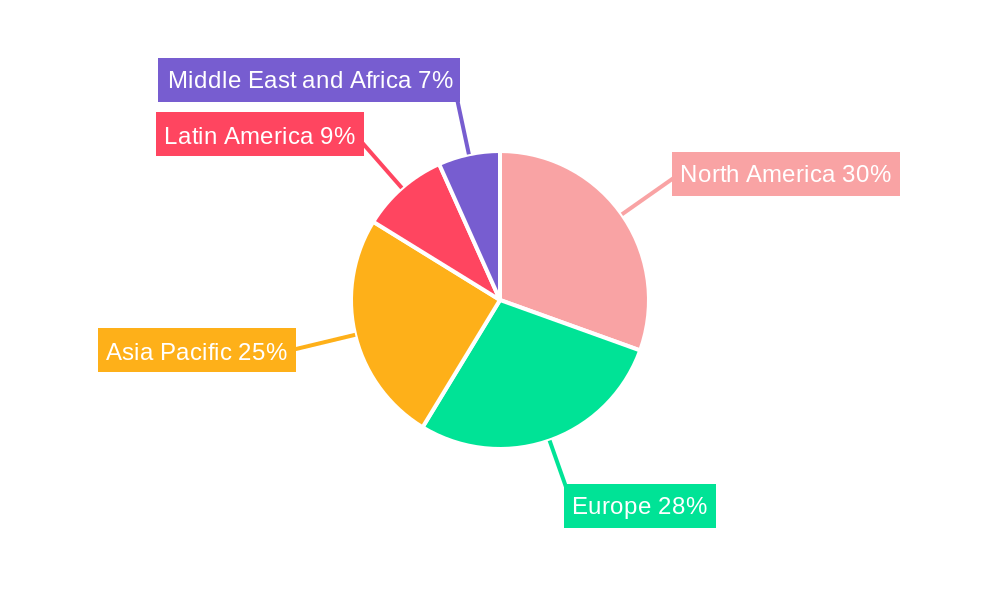

Leading Regions, Countries, or Segments in Business Process Management Market

The Cloud deployment segment is emerging as the dominant force within the Business Process Management market, projected to account for over XX% of the market share by 2025 and grow at an impressive CAGR of XX% during the forecast period (2025-2033). This ascendancy is driven by the inherent scalability, flexibility, and cost-effectiveness that cloud solutions offer, enabling organizations of all sizes to access sophisticated BPM capabilities without significant upfront infrastructure investments. Furthermore, the ease of integration with other cloud-based applications and services further bolsters its appeal.

Among the various solution segments, Process Automation is a key driver of market growth, expected to capture a significant market share of XX% by 2025, with a robust CAGR of XX%. This dominance stems from the increasing organizational focus on streamlining operations, reducing manual intervention, and enhancing productivity. The ability of process automation solutions to accelerate tasks, minimize errors, and free up human resources for more strategic activities is a compelling value proposition.

Geographically, North America is positioned as the leading region in the Business Process Management market, anticipated to hold a market share of approximately XX% in 2025, with a projected CAGR of XX% during the forecast period. This leadership is attributed to several factors:

- Technological Adoption: High penetration of advanced technologies and a strong culture of innovation within enterprises.

- Digital Transformation Initiatives: Significant investments by businesses in digital transformation strategies to enhance operational efficiency and customer experience.

- BFSI and Healthcare Dominance: Strong presence of the Banking, Financial Services, and Insurance (BFSI) and Healthcare sectors, which are major adopters of BPM solutions for regulatory compliance and service delivery optimization.

- Government Support: Favorable government initiatives and investments in modernizing public services, driving the adoption of BPM in the Government and Defense sector.

- Presence of Key Players: A concentrated presence of leading BPM vendors and technology providers, fostering a competitive and innovative ecosystem.

Business Process Management Market Product Innovations

Product innovations in the Business Process Management (BPM) market are increasingly focused on intelligent automation and enhanced user experience. Companies are integrating AI and ML capabilities to enable predictive analytics, automated decision-making, and proactive issue resolution. Low-code/no-code platforms are gaining traction, empowering citizen developers to rapidly build and deploy automated workflows, significantly reducing development cycles and IT dependency. Innovations in process mining are allowing organizations to gain deeper insights into existing processes, identify bottlenecks, and optimize performance metrics. Furthermore, the integration of BPM with other enterprise systems, such as CRM and ERP, is creating more cohesive and efficient operational ecosystems. These advancements are driving enhanced performance metrics like reduced cycle times, improved accuracy, and significant cost savings for end-users.

Propelling Factors for Business Process Management Market Growth

The Business Process Management market is propelled by several interconnected factors. The relentless pursuit of operational efficiency and cost reduction is a primary driver, as organizations seek to automate repetitive tasks and streamline workflows. The increasing adoption of digital transformation strategies across industries necessitates robust BPM solutions to manage and optimize evolving processes. Advancements in AI and machine learning are enabling more intelligent automation, predictive analytics, and data-driven decision-making, further enhancing the value proposition of BPM. Furthermore, the growing demand for improved customer experiences compels businesses to optimize their service delivery processes. Favorable regulatory environments in certain sectors also encourage BPM adoption for compliance and auditability. The rise of cloud-based BPM solutions has democratized access and scalability, attracting a wider range of businesses.

Obstacles in the Business Process Management Market Market

Despite its robust growth, the Business Process Management market faces several obstacles. High initial implementation costs and complexity can deter small and medium-sized enterprises (SMEs) from adopting comprehensive BPM suites. Resistance to change within organizations and a lack of skilled personnel to manage and implement BPM solutions can hinder adoption. Integration challenges with legacy systems and disparate IT infrastructures often pose significant technical hurdles. Data security and privacy concerns, particularly with cloud-based solutions, remain a critical consideration for highly regulated industries. Furthermore, vendor lock-in and the difficulty of switching between BPM platforms can create challenges for long-term strategy. Intense competitive pressure among vendors can also lead to price wars and affect profitability.

Future Opportunities in Business Process Management Market

Emerging opportunities in the Business Process Management market are diverse and promising. The expanding application of AI and intelligent automation in BPM is creating avenues for predictive process optimization and hyper-automation. The growing adoption of hyper-personalization in customer service will drive demand for BPM solutions that can orchestrate complex, individualized customer journeys. The increasing focus on sustainability and ESG (Environmental, Social, and Governance) goals will spur the development of BPM solutions that help organizations monitor and optimize their environmental impact and social responsibility. Furthermore, the continued growth of the Internet of Things (IoT) will generate vast amounts of data, creating opportunities for BPM to automate and manage processes driven by IoT data streams. Expansion into emerging economies with growing digitalization initiatives presents significant untapped market potential.

Major Players in the Business Process Management Market Ecosystem

- ASG Technologies Group Inc

- Tibco Software Inc

- IBM Corporation

- Nintex UK Ltd

- Software AG

- Signavio GmbH

- Kissflow Inc

- BP Logix Inc

- Ultimus Inc

- Pegasystems Inc

- Appian

- Open Text Corporation

- Fujitsu

- Oracle

Key Developments in Business Process Management Market Industry

- November 2022: IBM released new software to assist organizations in breaking down data and analytics silos, allowing them to make data-driven choices faster and navigate unanticipated challenges. This development enhances data integration capabilities within BPM.

- September 2022: AGS Health, a revenue cycle management (RCM) solutions provider and strategic growth partner in healthcare systems in the United States, launched the AGS AI platform. This connected solution combines artificial intelligence (AI) and automation with award-winning human-in-the-loop services and expert support to maximize revenue cycle performance, highlighting the impact of AI on industry-specific BPM.

- April 2022: Salesforce launched a no-code tool to help automate Government Program Delivery, allowing public servants to build, test quickly, and automate complex policy-based rules. It enables governments to set up quick automation that performs complex calculations, such as determining whether constituents are eligible for food assistance or whether a service member is suitable for a reenlistment bonus. This innovation showcases the growing trend of no-code solutions for public sector BPM.

Strategic Business Process Management Market Market Forecast

The strategic Business Process Management market forecast indicates sustained and robust growth driven by the increasing need for digital transformation and operational agility. Key growth catalysts include the pervasive adoption of cloud computing, the escalating integration of Artificial Intelligence (AI) and Machine Learning (ML) for intelligent automation, and the continuous demand for enhanced customer experiences. The market's potential is further amplified by its role in enabling regulatory compliance and data-driven decision-making across diverse industries. Emerging technologies like Robotic Process Automation (RPA) and the expansion of low-code/no-code platforms are democratizing BPM capabilities, opening up new avenues for market penetration and innovation. Strategic investments in process optimization, coupled with a growing awareness of BPM's strategic importance in achieving competitive advantage, will continue to propel market expansion throughout the forecast period, projecting a significant market size of XXX Million by 2033.

Business Process Management Market Segmentation

-

1. Deployment

- 1.1. Cloud

- 1.2. On-premise

-

2. Solution

- 2.1. Process Improvement

- 2.2. Process Automation

- 2.3. Content and Document Management

- 2.4. Case Management

- 2.5. Other So

-

3. End-User Industry

- 3.1. Banking, Financial Services, and Insurance (BFSI)

- 3.2. Government and Defense

- 3.3. Healthcare

- 3.4. IT and Telecommunication

- 3.5. Retail

- 3.6. Manufacturing

- 3.7. Other En

Business Process Management Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Business Process Management Market Regional Market Share

Geographic Coverage of Business Process Management Market

Business Process Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Low-code Systems; Increasing Efficiency of Predictable Tasks (Adaptive Case Management); Bots and AI Across Manufacturing Domain

- 3.3. Market Restrains

- 3.3.1. High upfront and licensing costs

- 3.4. Market Trends

- 3.4.1. BFSI Industry is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Business Process Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. Cloud

- 5.1.2. On-premise

- 5.2. Market Analysis, Insights and Forecast - by Solution

- 5.2.1. Process Improvement

- 5.2.2. Process Automation

- 5.2.3. Content and Document Management

- 5.2.4. Case Management

- 5.2.5. Other So

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Banking, Financial Services, and Insurance (BFSI)

- 5.3.2. Government and Defense

- 5.3.3. Healthcare

- 5.3.4. IT and Telecommunication

- 5.3.5. Retail

- 5.3.6. Manufacturing

- 5.3.7. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Business Process Management Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. Cloud

- 6.1.2. On-premise

- 6.2. Market Analysis, Insights and Forecast - by Solution

- 6.2.1. Process Improvement

- 6.2.2. Process Automation

- 6.2.3. Content and Document Management

- 6.2.4. Case Management

- 6.2.5. Other So

- 6.3. Market Analysis, Insights and Forecast - by End-User Industry

- 6.3.1. Banking, Financial Services, and Insurance (BFSI)

- 6.3.2. Government and Defense

- 6.3.3. Healthcare

- 6.3.4. IT and Telecommunication

- 6.3.5. Retail

- 6.3.6. Manufacturing

- 6.3.7. Other En

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Business Process Management Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. Cloud

- 7.1.2. On-premise

- 7.2. Market Analysis, Insights and Forecast - by Solution

- 7.2.1. Process Improvement

- 7.2.2. Process Automation

- 7.2.3. Content and Document Management

- 7.2.4. Case Management

- 7.2.5. Other So

- 7.3. Market Analysis, Insights and Forecast - by End-User Industry

- 7.3.1. Banking, Financial Services, and Insurance (BFSI)

- 7.3.2. Government and Defense

- 7.3.3. Healthcare

- 7.3.4. IT and Telecommunication

- 7.3.5. Retail

- 7.3.6. Manufacturing

- 7.3.7. Other En

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Pacific Business Process Management Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. Cloud

- 8.1.2. On-premise

- 8.2. Market Analysis, Insights and Forecast - by Solution

- 8.2.1. Process Improvement

- 8.2.2. Process Automation

- 8.2.3. Content and Document Management

- 8.2.4. Case Management

- 8.2.5. Other So

- 8.3. Market Analysis, Insights and Forecast - by End-User Industry

- 8.3.1. Banking, Financial Services, and Insurance (BFSI)

- 8.3.2. Government and Defense

- 8.3.3. Healthcare

- 8.3.4. IT and Telecommunication

- 8.3.5. Retail

- 8.3.6. Manufacturing

- 8.3.7. Other En

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Latin America Business Process Management Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. Cloud

- 9.1.2. On-premise

- 9.2. Market Analysis, Insights and Forecast - by Solution

- 9.2.1. Process Improvement

- 9.2.2. Process Automation

- 9.2.3. Content and Document Management

- 9.2.4. Case Management

- 9.2.5. Other So

- 9.3. Market Analysis, Insights and Forecast - by End-User Industry

- 9.3.1. Banking, Financial Services, and Insurance (BFSI)

- 9.3.2. Government and Defense

- 9.3.3. Healthcare

- 9.3.4. IT and Telecommunication

- 9.3.5. Retail

- 9.3.6. Manufacturing

- 9.3.7. Other En

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Middle East and Africa Business Process Management Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. Cloud

- 10.1.2. On-premise

- 10.2. Market Analysis, Insights and Forecast - by Solution

- 10.2.1. Process Improvement

- 10.2.2. Process Automation

- 10.2.3. Content and Document Management

- 10.2.4. Case Management

- 10.2.5. Other So

- 10.3. Market Analysis, Insights and Forecast - by End-User Industry

- 10.3.1. Banking, Financial Services, and Insurance (BFSI)

- 10.3.2. Government and Defense

- 10.3.3. Healthcare

- 10.3.4. IT and Telecommunication

- 10.3.5. Retail

- 10.3.6. Manufacturing

- 10.3.7. Other En

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ASG Technologies Group Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tibco Software Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CMW Lab*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IBM Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nintex UK Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Software AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Signavio GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kissflow Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BP Logix Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ultimus Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Pegasystems Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Appian

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Open Text Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Fujitsu

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Oracle

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 ASG Technologies Group Inc

List of Figures

- Figure 1: Global Business Process Management Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Business Process Management Market Revenue (Million), by Deployment 2025 & 2033

- Figure 3: North America Business Process Management Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: North America Business Process Management Market Revenue (Million), by Solution 2025 & 2033

- Figure 5: North America Business Process Management Market Revenue Share (%), by Solution 2025 & 2033

- Figure 6: North America Business Process Management Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 7: North America Business Process Management Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 8: North America Business Process Management Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Business Process Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Business Process Management Market Revenue (Million), by Deployment 2025 & 2033

- Figure 11: Europe Business Process Management Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 12: Europe Business Process Management Market Revenue (Million), by Solution 2025 & 2033

- Figure 13: Europe Business Process Management Market Revenue Share (%), by Solution 2025 & 2033

- Figure 14: Europe Business Process Management Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 15: Europe Business Process Management Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 16: Europe Business Process Management Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Business Process Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Business Process Management Market Revenue (Million), by Deployment 2025 & 2033

- Figure 19: Asia Pacific Business Process Management Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 20: Asia Pacific Business Process Management Market Revenue (Million), by Solution 2025 & 2033

- Figure 21: Asia Pacific Business Process Management Market Revenue Share (%), by Solution 2025 & 2033

- Figure 22: Asia Pacific Business Process Management Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 23: Asia Pacific Business Process Management Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Asia Pacific Business Process Management Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Business Process Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Business Process Management Market Revenue (Million), by Deployment 2025 & 2033

- Figure 27: Latin America Business Process Management Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 28: Latin America Business Process Management Market Revenue (Million), by Solution 2025 & 2033

- Figure 29: Latin America Business Process Management Market Revenue Share (%), by Solution 2025 & 2033

- Figure 30: Latin America Business Process Management Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 31: Latin America Business Process Management Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 32: Latin America Business Process Management Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Business Process Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Business Process Management Market Revenue (Million), by Deployment 2025 & 2033

- Figure 35: Middle East and Africa Business Process Management Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 36: Middle East and Africa Business Process Management Market Revenue (Million), by Solution 2025 & 2033

- Figure 37: Middle East and Africa Business Process Management Market Revenue Share (%), by Solution 2025 & 2033

- Figure 38: Middle East and Africa Business Process Management Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 39: Middle East and Africa Business Process Management Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 40: Middle East and Africa Business Process Management Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Business Process Management Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Business Process Management Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 2: Global Business Process Management Market Revenue Million Forecast, by Solution 2020 & 2033

- Table 3: Global Business Process Management Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: Global Business Process Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Business Process Management Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 6: Global Business Process Management Market Revenue Million Forecast, by Solution 2020 & 2033

- Table 7: Global Business Process Management Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 8: Global Business Process Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Business Process Management Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 10: Global Business Process Management Market Revenue Million Forecast, by Solution 2020 & 2033

- Table 11: Global Business Process Management Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 12: Global Business Process Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Business Process Management Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 14: Global Business Process Management Market Revenue Million Forecast, by Solution 2020 & 2033

- Table 15: Global Business Process Management Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 16: Global Business Process Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Business Process Management Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 18: Global Business Process Management Market Revenue Million Forecast, by Solution 2020 & 2033

- Table 19: Global Business Process Management Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 20: Global Business Process Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Business Process Management Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 22: Global Business Process Management Market Revenue Million Forecast, by Solution 2020 & 2033

- Table 23: Global Business Process Management Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 24: Global Business Process Management Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Business Process Management Market?

The projected CAGR is approximately 11.83%.

2. Which companies are prominent players in the Business Process Management Market?

Key companies in the market include ASG Technologies Group Inc, Tibco Software Inc, CMW Lab*List Not Exhaustive, IBM Corporation, Nintex UK Ltd, Software AG, Signavio GmbH, Kissflow Inc, BP Logix Inc, Ultimus Inc, Pegasystems Inc, Appian, Open Text Corporation, Fujitsu, Oracle.

3. What are the main segments of the Business Process Management Market?

The market segments include Deployment, Solution, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Low-code Systems; Increasing Efficiency of Predictable Tasks (Adaptive Case Management); Bots and AI Across Manufacturing Domain.

6. What are the notable trends driving market growth?

BFSI Industry is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

High upfront and licensing costs.

8. Can you provide examples of recent developments in the market?

November 2022: IBM released new software to assist organizations in breaking down data and analytics silos, allowing them to make data-driven choices faster and navigate unanticipated challenges.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Business Process Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Business Process Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Business Process Management Market?

To stay informed about further developments, trends, and reports in the Business Process Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence