Key Insights

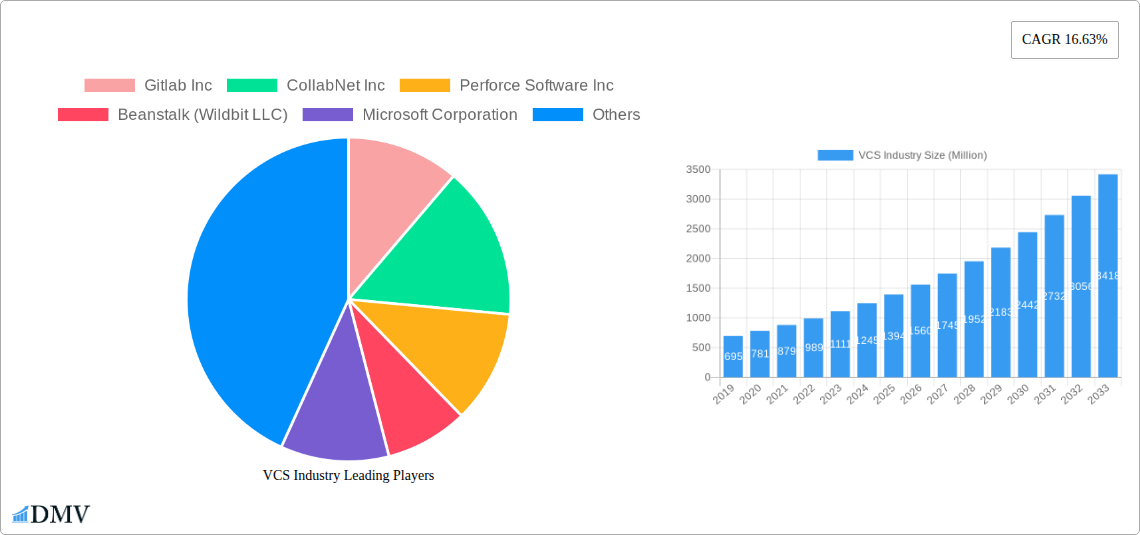

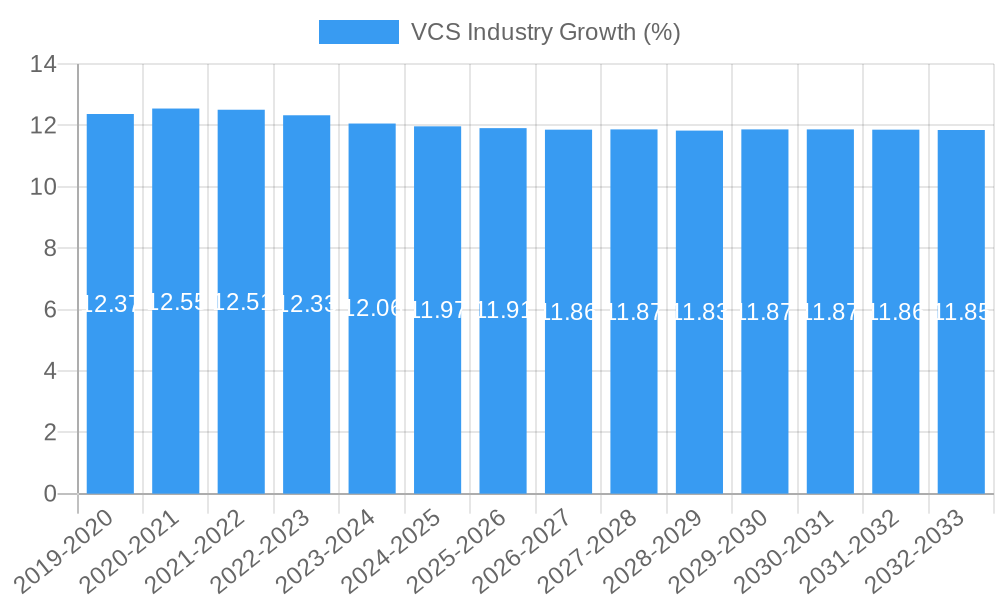

The Version Control System (VCS) industry is poised for remarkable expansion, projecting a current market size of USD 1.11 billion and an impressive Compound Annual Growth Rate (CAGR) of 16.63%. This robust growth is primarily fueled by an increasing demand for efficient software development workflows, heightened emphasis on collaboration among development teams, and the growing adoption of agile and DevOps methodologies across diverse industries. The critical role of VCS in managing code complexity, enabling seamless team integration, and ensuring code integrity in intricate software projects underpins its upward trajectory. Furthermore, the escalating need for robust data security and version management for intellectual property within enterprises also acts as a significant driver for VCS adoption. The market's expansion is also being propelled by the continuous evolution of VCS solutions, with features like advanced branching and merging capabilities, integration with CI/CD pipelines, and enhanced security protocols becoming standard offerings.

Key growth drivers for the VCS market include the accelerating digital transformation initiatives across sectors like IT and Telecom, Retail & E-commerce, Healthcare and Life Sciences, and BFSI. These industries are increasingly relying on sophisticated software for their operations, necessitating sophisticated tools for code management. The prevailing trend towards cloud-based solutions, with the "On-Cloud" deployment mode expected to dominate due to its scalability, flexibility, and cost-effectiveness, is shaping the market landscape. Conversely, while "On-Premise" solutions will continue to cater to organizations with stringent data security requirements or legacy infrastructure, their market share is projected to gradually decline. Emerging trends like the integration of AI and machine learning into VCS for automated code reviews and predictive analytics, alongside the growing popularity of distributed VCS architectures for enhanced resilience and performance, are further shaping the future of this dynamic market.

VCS Industry Market Composition & Trends

This comprehensive report delves into the intricate market composition and evolving trends within the Version Control System (VCS) industry. We analyze the market concentration, identifying key players and their estimated market share distribution, projected to reach XXX Million by 2025. The report highlights innovation catalysts, including advancements in distributed VCS and the increasing adoption of cloud-based solutions, which are shaping the competitive landscape. Regulatory landscapes are examined for their impact on development and deployment strategies. Substitute products, such as traditional file sharing and manual tracking methods, are evaluated against the efficiency and collaboration benefits offered by VCS. End-user profiles reveal a diverse adoption base, with IT and Telecom, Retail & E-commerce, Healthcare and Life Sciences, and BFSI sectors leading the charge. Mergers and acquisitions (M&A) activities are meticulously tracked, with deal values estimated to contribute significantly to market consolidation, reaching approximately XXX Million in recent transactions.

- Market Concentration: Dominated by a few large players, with a growing number of specialized VCS providers.

- Innovation Catalysts: Rise of GitOps, AI-powered code review, and enhanced security features.

- Regulatory Landscapes: GDPR and data privacy regulations influencing cloud VCS adoption.

- Substitute Products: Limited impact due to the inherent benefits of robust VCS.

- End-User Profiles: Growing adoption in DevOps, CI/CD pipelines, and collaborative software development.

- M&A Activities: Strategic acquisitions to expand feature sets and market reach.

VCS Industry Industry Evolution

The Version Control System (VCS) industry is undergoing a dynamic transformation, driven by rapid technological advancements and an ever-increasing demand for efficient, collaborative software development workflows. Over the study period of 2019–2033, the market has witnessed significant growth trajectories, moving from primarily on-premise solutions to a dominant cloud-based model. The historical period of 2019–2024 saw a steady rise in adoption rates, fueled by the widespread embrace of Agile and DevOps methodologies. Projections indicate a continued upward trend, with an estimated compound annual growth rate (CAGR) of XX% from the base year of 2025 through the forecast period of 2025–2033. This growth is intrinsically linked to the increasing complexity of software projects and the global distribution of development teams.

Technological advancements have been a cornerstone of this evolution. The shift from centralized VCS, like Subversion, to distributed VCS, with Git leading the charge, has revolutionized how developers manage code. Git's unparalleled flexibility, speed, and robust branching and merging capabilities have made it the de facto standard. Furthermore, the integration of VCS with Continuous Integration/Continuous Deployment (CI/CD) pipelines has become indispensable for modern software development, enabling faster release cycles and improved code quality. Cloud-based VCS platforms, such as GitHub, GitLab, and Bitbucket, have further democratized access to powerful version control tools, offering scalability, accessibility, and simplified collaboration for organizations of all sizes. The increasing prevalence of open-source software development also plays a crucial role, with platforms like GitHub hosting millions of open-source projects and fostering a collaborative ecosystem. Consumer demand has shifted towards solutions that offer seamless integration with other development tools, enhanced security features, and intuitive user interfaces. The industry is also seeing a growing demand for specialized VCS solutions catering to niche markets, such as embedded systems or game development, further diversifying the market. The projected market size by 2025 is estimated at XXX Million, with substantial growth anticipated as more industries recognize the strategic importance of effective version control. Adoption metrics showcase a significant increase in the percentage of development teams utilizing distributed VCS, with on-cloud deployment models now accounting for over XX% of the market.

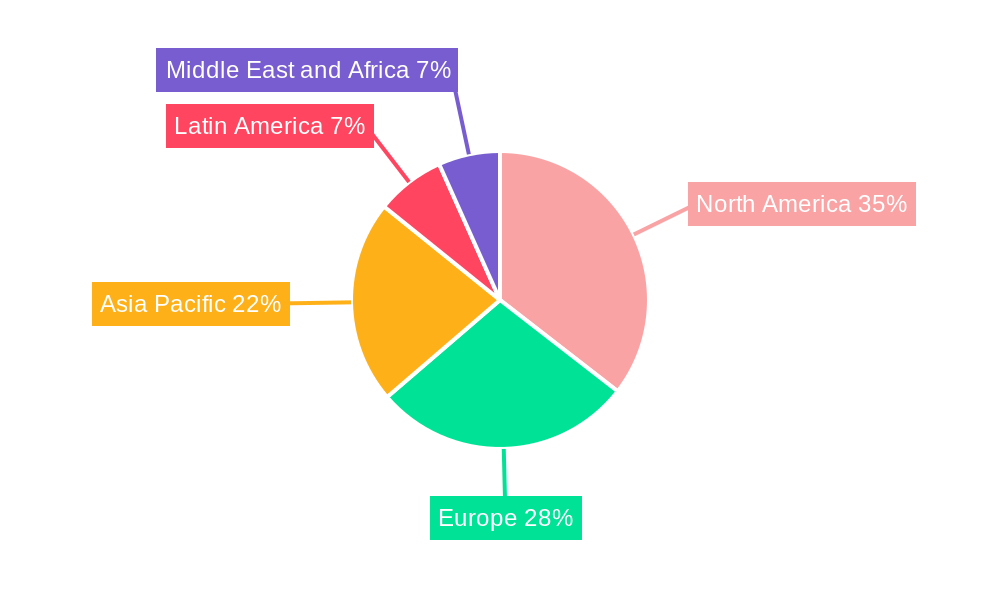

Leading Regions, Countries, or Segments in VCS Industry

The Version Control System (VCS) industry exhibits distinct leadership across various segments, driven by technological adoption, industry concentration, and economic factors. The On-Cloud deployment mode is emerging as the dominant segment, projected to capture over XX% of the market share by 2025. This dominance is fueled by its inherent scalability, cost-effectiveness, and accessibility, enabling remote and distributed development teams to collaborate seamlessly. The IT and Telecom end-user industry stands out as the primary driver of VCS adoption, accounting for an estimated XX% of the market. This sector's rapid innovation cycles, continuous software development, and the pervasive use of cloud infrastructure make robust version control systems indispensable.

Within the Type segment, Distributed VCS, spearheaded by Git, holds a commanding lead, with an estimated XX% market share. Its flexibility, decentralized nature, and efficient handling of large codebases have made it the preferred choice for modern software development. The North America region is anticipated to be the leading geographical market, driven by a high concentration of technology companies, significant R&D investments, and a mature DevOps ecosystem.

- Deployment Mode Dominance:

- On-Cloud: Expected to reach XXX Million by 2025, driven by global adoption of cloud computing and SaaS models.

- On-Premise: Continues to hold a significant share, especially in highly regulated industries requiring stringent data control.

- End-User Industry Leadership:

- IT and Telecom: Accounts for the largest market share due to continuous software development and the adoption of Agile/DevOps.

- BFSI: Growing adoption driven by the need for secure and auditable code management in financial services.

- Retail & E-commerce: Increasing demand for rapid feature deployment and personalized customer experiences.

- Healthcare and Life Sciences: Rising adoption due to the need for regulatory compliance and robust data management in medical software.

- Type Supremacy:

- Distributed VCS (Git): Dominates the market due to its speed, flexibility, and widespread community support.

- Centralized VCS: Still relevant in specific enterprise scenarios but facing declining market share against distributed alternatives.

- Regional Supremacy:

- North America: Leads due to its strong technology sector, innovation hubs, and early adoption of DevOps practices.

- Europe: Significant growth, driven by digital transformation initiatives and increasing adoption of cloud-based solutions.

- Asia Pacific: Fastest-growing region, fueled by expanding IT infrastructure, a burgeoning startup ecosystem, and increasing outsourcing activities.

VCS Industry Product Innovations

VCS product innovations are rapidly enhancing developer productivity and collaboration. Key advancements include the integration of AI-powered code analysis for automated bug detection and code quality improvements, alongside sophisticated branching and merging strategies that minimize conflicts and streamline workflows. Security remains a paramount focus, with enhanced access controls, end-to-end encryption, and robust audit trails becoming standard features. Furthermore, the seamless integration of VCS with CI/CD pipelines, issue tracking, and project management tools is creating unified development environments. Performance metrics showcase significant improvements in commit times, repository synchronization, and handling of large binary files, with some solutions offering near-instantaneous updates and an average reduction in merge conflict resolution time by XX%. The unique selling proposition lies in creating intelligent, secure, and highly collaborative development platforms.

Propelling Factors for VCS Industry Growth

Several key factors are propelling the growth of the VCS industry. The widespread adoption of DevOps and Agile methodologies across all industries necessitates efficient code management and collaboration, which VCS provides. The increasing complexity of software projects and the rise of microservices architectures demand robust version control for managing numerous code modules. Furthermore, the growing trend of remote and distributed development teams makes cloud-based VCS solutions essential for maintaining seamless collaboration and project continuity. Technological advancements, such as the evolution of Git and the development of specialized VCS tools for emerging technologies like AI and blockchain, are also significant growth drivers. The continuous push for faster time-to-market and improved software quality further reinforces the indispensable role of VCS in modern software development lifecycles.

Obstacles in the VCS Industry Market

Despite robust growth, the VCS industry faces several obstacles. Scalability challenges with extremely large repositories or massive concurrent user loads can sometimes strain system performance. Integration complexities with legacy systems or highly customized workflows can also pose challenges for seamless adoption. Security concerns, particularly regarding data breaches or unauthorized access to sensitive codebases, remain a constant threat, requiring robust security measures and user vigilance. The learning curve for new users transitioning from simpler systems or less sophisticated tools can be a barrier, although modern VCS interfaces are becoming increasingly intuitive. Additionally, vendor lock-in concerns and the cost associated with migrating large repositories can deter some organizations from switching providers. The ongoing evolution of cloud infrastructure and its associated costs also presents a factor to monitor.

Future Opportunities in VCS Industry

The future of the VCS industry is brimming with opportunities. The increasing adoption of DevOps and GitOps practices will continue to drive demand for advanced VCS solutions that support automated infrastructure management and continuous deployment. The burgeoning field of AI and Machine Learning presents a significant opportunity for VCS tools to integrate intelligent features for code generation, anomaly detection, and predictive maintenance of software. The expansion of edge computing and IoT devices will create new use cases for distributed and lightweight VCS solutions. Furthermore, the growing emphasis on code security and compliance will fuel the demand for enhanced security features, detailed audit trails, and specialized VCS for regulated industries like healthcare and finance. Emerging markets with rapidly growing software development sectors also represent substantial untapped potential.

Major Players in the VCS Industry Ecosystem

- Gitlab Inc

- CollabNet Inc

- Perforce Software Inc

- Beanstalk (Wildbit LLC)

- Microsoft Corporation

- Bitbucket org (Atlassian Corporation Plc)

- Amazon Web Services Inc

- APAChe Software Foundation

- Github Inc

- Dynamsoft Corporation

Key Developments in VCS Industry Industry

- September 2023: Accenture and Workday expanded their partnership to assist organizations in reinventing finance functions, developing data-led, composable finance solutions. This development impacts industries like software and technology, retail, and media, by enhancing their responsiveness to changing business requirements through better data management and integration, indirectly influencing the need for robust version control in their respective software development efforts.

- December 2022: Microsoft introduced a new Git version control feature for Power Apps canvas apps, resolving the challenge of single-author editing. This innovation allows multiple users to edit concurrently without conflicts, significantly improving collaborative development efficiency and preventing workflow disruptions by instantly syncing modifications.

- September 2022: The WebKit open-source web browser engine transitioned its development to GitHub, migrating from Subversion to Git. This move was motivated by GitHub's large developer community and potent automation features, enhancing the project's collaboration capabilities and source code management efficiency.

Strategic VCS Industry Market Forecast

The strategic VCS industry market forecast indicates sustained robust growth, driven by the indispensable role of effective version control in modern software development. The projected expansion is fueled by the accelerating adoption of DevOps and Agile methodologies, coupled with the increasing complexity of software projects and the rise of distributed development teams. Cloud-based VCS solutions will continue to dominate, offering scalability, accessibility, and cost-effectiveness. Emerging opportunities lie in the integration of AI for intelligent code assistance, enhanced security features to combat growing cyber threats, and the development of specialized VCS for burgeoning fields like IoT and blockchain. The market is poised for significant value creation as organizations worldwide prioritize efficient, secure, and collaborative software development lifecycles. The estimated market size by 2033 is projected to reach XXX Million.

VCS Industry Segmentation

-

1. Deployment Mode

- 1.1. On-Premise

- 1.2. On-Cloud

-

2. End-user Industry

- 2.1. IT and Telecom

- 2.2. Retail & E-commerce

- 2.3. Healthcare and Life Sciences

- 2.4. BFSI

- 2.5. Other

-

3. Type

- 3.1. Distributed VCS

- 3.2. Centralized VCS

VCS Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

VCS Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.63% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digitization of Business Processes Leading to Adoption of Software; Increasing Demand for Reduced Complexities in Software Development and Cost Optimization

- 3.3. Market Restrains

- 3.3.1. Use of Diversified Software Applications in Organizations; Growing Complexity Due to Massive Data Generation

- 3.4. Market Trends

- 3.4.1. BFSI Industry Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global VCS Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.1.1. On-Premise

- 5.1.2. On-Cloud

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. IT and Telecom

- 5.2.2. Retail & E-commerce

- 5.2.3. Healthcare and Life Sciences

- 5.2.4. BFSI

- 5.2.5. Other

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Distributed VCS

- 5.3.2. Centralized VCS

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 6. North America VCS Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 6.1.1. On-Premise

- 6.1.2. On-Cloud

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. IT and Telecom

- 6.2.2. Retail & E-commerce

- 6.2.3. Healthcare and Life Sciences

- 6.2.4. BFSI

- 6.2.5. Other

- 6.3. Market Analysis, Insights and Forecast - by Type

- 6.3.1. Distributed VCS

- 6.3.2. Centralized VCS

- 6.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 7. Europe VCS Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 7.1.1. On-Premise

- 7.1.2. On-Cloud

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. IT and Telecom

- 7.2.2. Retail & E-commerce

- 7.2.3. Healthcare and Life Sciences

- 7.2.4. BFSI

- 7.2.5. Other

- 7.3. Market Analysis, Insights and Forecast - by Type

- 7.3.1. Distributed VCS

- 7.3.2. Centralized VCS

- 7.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 8. Asia Pacific VCS Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 8.1.1. On-Premise

- 8.1.2. On-Cloud

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. IT and Telecom

- 8.2.2. Retail & E-commerce

- 8.2.3. Healthcare and Life Sciences

- 8.2.4. BFSI

- 8.2.5. Other

- 8.3. Market Analysis, Insights and Forecast - by Type

- 8.3.1. Distributed VCS

- 8.3.2. Centralized VCS

- 8.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 9. Latin America VCS Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 9.1.1. On-Premise

- 9.1.2. On-Cloud

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. IT and Telecom

- 9.2.2. Retail & E-commerce

- 9.2.3. Healthcare and Life Sciences

- 9.2.4. BFSI

- 9.2.5. Other

- 9.3. Market Analysis, Insights and Forecast - by Type

- 9.3.1. Distributed VCS

- 9.3.2. Centralized VCS

- 9.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 10. Middle East and Africa VCS Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 10.1.1. On-Premise

- 10.1.2. On-Cloud

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. IT and Telecom

- 10.2.2. Retail & E-commerce

- 10.2.3. Healthcare and Life Sciences

- 10.2.4. BFSI

- 10.2.5. Other

- 10.3. Market Analysis, Insights and Forecast - by Type

- 10.3.1. Distributed VCS

- 10.3.2. Centralized VCS

- 10.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 11. North America VCS Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe VCS Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific VCS Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America VCS Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America VCS Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA VCS Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Gitlab Inc

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 CollabNet Inc

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Perforce Software Inc

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Beanstalk (Wildbit LLC)

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Microsoft Corporation

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Bitbucket org (Atlassian Corporation Plc)

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Amazon Web Services Inc

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 APAChe Software Foundation

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Github Inc

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Dynamsoft Corporatio

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 Gitlab Inc

List of Figures

- Figure 1: Global VCS Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America VCS Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America VCS Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe VCS Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe VCS Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific VCS Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific VCS Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America VCS Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America VCS Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America VCS Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America VCS Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA VCS Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA VCS Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America VCS Industry Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 15: North America VCS Industry Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 16: North America VCS Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 17: North America VCS Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 18: North America VCS Industry Revenue (Million), by Type 2024 & 2032

- Figure 19: North America VCS Industry Revenue Share (%), by Type 2024 & 2032

- Figure 20: North America VCS Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: North America VCS Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe VCS Industry Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 23: Europe VCS Industry Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 24: Europe VCS Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 25: Europe VCS Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 26: Europe VCS Industry Revenue (Million), by Type 2024 & 2032

- Figure 27: Europe VCS Industry Revenue Share (%), by Type 2024 & 2032

- Figure 28: Europe VCS Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Europe VCS Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Asia Pacific VCS Industry Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 31: Asia Pacific VCS Industry Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 32: Asia Pacific VCS Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Asia Pacific VCS Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Asia Pacific VCS Industry Revenue (Million), by Type 2024 & 2032

- Figure 35: Asia Pacific VCS Industry Revenue Share (%), by Type 2024 & 2032

- Figure 36: Asia Pacific VCS Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: Asia Pacific VCS Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: Latin America VCS Industry Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 39: Latin America VCS Industry Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 40: Latin America VCS Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 41: Latin America VCS Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 42: Latin America VCS Industry Revenue (Million), by Type 2024 & 2032

- Figure 43: Latin America VCS Industry Revenue Share (%), by Type 2024 & 2032

- Figure 44: Latin America VCS Industry Revenue (Million), by Country 2024 & 2032

- Figure 45: Latin America VCS Industry Revenue Share (%), by Country 2024 & 2032

- Figure 46: Middle East and Africa VCS Industry Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 47: Middle East and Africa VCS Industry Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 48: Middle East and Africa VCS Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 49: Middle East and Africa VCS Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 50: Middle East and Africa VCS Industry Revenue (Million), by Type 2024 & 2032

- Figure 51: Middle East and Africa VCS Industry Revenue Share (%), by Type 2024 & 2032

- Figure 52: Middle East and Africa VCS Industry Revenue (Million), by Country 2024 & 2032

- Figure 53: Middle East and Africa VCS Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global VCS Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global VCS Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 3: Global VCS Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global VCS Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 5: Global VCS Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global VCS Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global VCS Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Belgium VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Netherland VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Nordics VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global VCS Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: China VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Japan VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: India VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Korea VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Southeast Asia VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Australia VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Indonesia VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Phillipes VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Singapore VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Thailandc VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Asia Pacific VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global VCS Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Brazil VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Argentina VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Peru VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Chile VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Colombia VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Ecuador VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Venezuela VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of South America VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global VCS Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: United States VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Canada VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Mexico VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global VCS Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 47: United Arab Emirates VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Saudi Arabia VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Africa VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Middle East and Africa VCS Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global VCS Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 52: Global VCS Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 53: Global VCS Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 54: Global VCS Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 55: Global VCS Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 56: Global VCS Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 57: Global VCS Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 58: Global VCS Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Global VCS Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 60: Global VCS Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 61: Global VCS Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 62: Global VCS Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 63: Global VCS Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 64: Global VCS Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 65: Global VCS Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 66: Global VCS Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 67: Global VCS Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 68: Global VCS Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 69: Global VCS Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 70: Global VCS Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the VCS Industry?

The projected CAGR is approximately 16.63%.

2. Which companies are prominent players in the VCS Industry?

Key companies in the market include Gitlab Inc, CollabNet Inc, Perforce Software Inc, Beanstalk (Wildbit LLC), Microsoft Corporation, Bitbucket org (Atlassian Corporation Plc), Amazon Web Services Inc, APAChe Software Foundation, Github Inc, Dynamsoft Corporatio.

3. What are the main segments of the VCS Industry?

The market segments include Deployment Mode, End-user Industry, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Digitization of Business Processes Leading to Adoption of Software; Increasing Demand for Reduced Complexities in Software Development and Cost Optimization.

6. What are the notable trends driving market growth?

BFSI Industry Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Use of Diversified Software Applications in Organizations; Growing Complexity Due to Massive Data Generation.

8. Can you provide examples of recent developments in the market?

September 2023 - Accenture and Workday have expanded their partnership to assist organizations in reinventing their finance functions to be more agile, data-driven, and customer-centric. The companies are collaborating to develop a suite of data-led, composable finance solutions that can be configured and reconfigured to help clients in the software and technology, retail, and media industries be more responsive to changing business requirements.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "VCS Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the VCS Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the VCS Industry?

To stay informed about further developments, trends, and reports in the VCS Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence