Key Insights

The U.S. Wearable Sensors market is projected to achieve a market size of $26.53 billion by 2025, exhibiting a strong Compound Annual Growth Rate (CAGR) of 19.72% from the base year 2025. This significant growth is primarily fueled by escalating consumer demand for proactive health and wellness monitoring, amplified by a heightened awareness of preventative healthcare and the pursuit of personalized fitness solutions. The widespread adoption of smart devices, encompassing advanced wearables and discreet sensor technology integrated into everyday apparel, is a key growth driver. Furthermore, the expanding landscape of remote patient monitoring and home-based rehabilitation, driven by the imperative for accessible healthcare, presents substantial opportunities for wearable sensor manufacturers. Continuous technological advancements are enhancing sensor sophistication and accuracy, particularly within the Health Sensors and MEMS Sensors segments, thereby broadening application scope.

US Wearable Sensors Industry Market Size (In Billion)

The U.S. Wearable Sensors market is defined by a synergistic combination of technological innovation and evolving consumer needs. Health Sensors, propelled by breakthroughs in biometric monitoring and disease detection, are anticipated to lead the market. Concurrently, Environmental Sensors, providing crucial insights into personal exposure to environmental factors, are also experiencing robust growth. MEMS Sensors are foundational to this evolution, enabling the miniaturization and enhanced functionality of wearable devices. Wristwear is expected to remain the dominant device segment due to its established market presence and versatility, with Bodywear following closely, offering more comprehensive physiological data. Health and Wellness applications will continue to be the primary market driver, while Safety Monitoring and Home Rehabilitation are emerging as significant growth areas, particularly relevant for an aging demographic and the increasing emphasis on independent living. Leading industry players are making substantial R&D investments to secure market leadership. However, the high cost associated with advanced sensor technology and concerns regarding data privacy may present market restraints, requiring a strategic balance between innovation and consumer confidence.

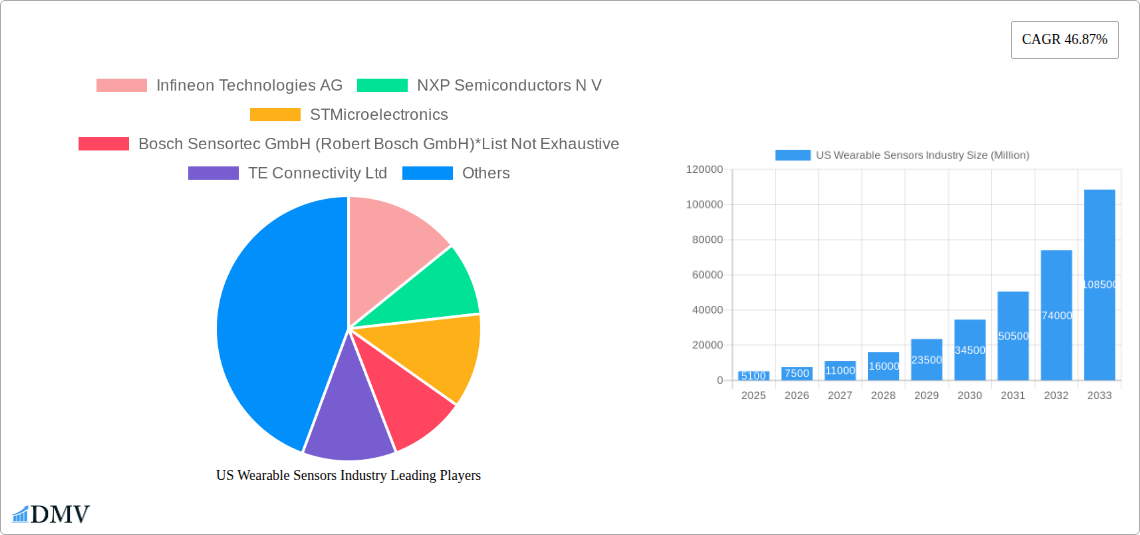

US Wearable Sensors Industry Company Market Share

US Wearable Sensors Industry Market Composition & Trends

The US wearable sensors industry is characterized by a dynamic market concentration, driven by relentless innovation and an evolving regulatory landscape. While key players like Infineon Technologies AG, NXP Semiconductors N V, STMicroelectronics, and Bosch Sensortec GmbH (Robert Bosch GmbH) hold significant market share, the ecosystem is increasingly fragmented by emerging technologies and specialized sensor applications. Innovation catalysts are primarily fueled by advancements in miniaturization, power efficiency, and data analytics capabilities, enabling sophisticated health monitoring and environmental sensing. The regulatory environment, particularly within the health and wellness segment, is a critical factor influencing product development and market access. Substitute products, such as standalone health tracking devices and smartphone-based sensors, present ongoing competitive pressures, although dedicated wearable solutions offer superior integration and continuous monitoring. End-user profiles span from health-conscious individuals and athletes to individuals requiring chronic disease management and elderly care. Mergers and acquisition (M&A) activities are expected to remain a strategic tool for companies seeking to expand their sensor portfolios, acquire intellectual property, and gain market access. While specific M&A deal values are subject to market fluctuations, these transactions are projected to represent several hundred Million dollars annually as the industry consolidates.

US Wearable Sensors Industry Industry Evolution

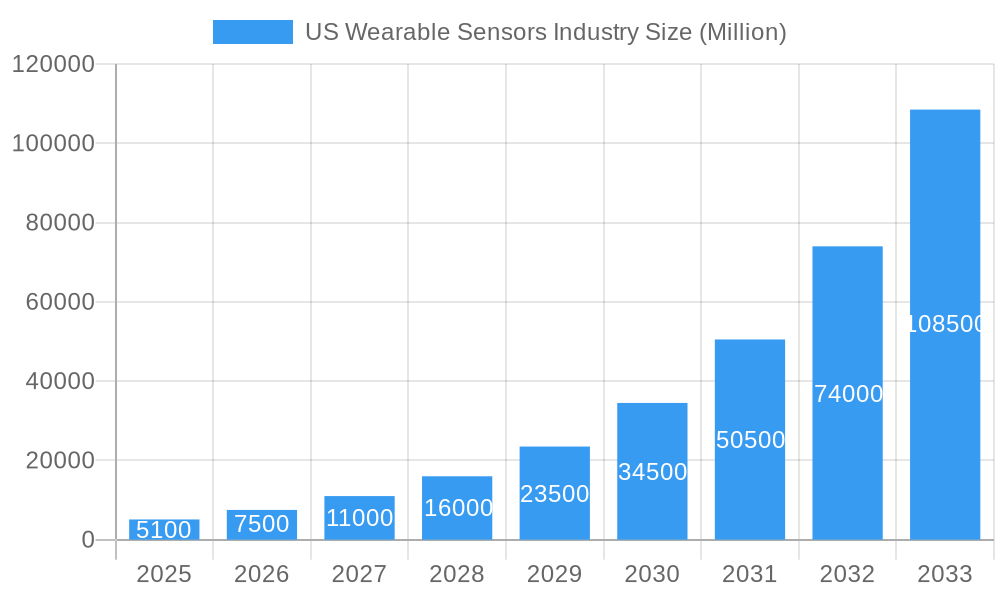

The US wearable sensors industry has undergone a significant evolution, marked by impressive growth trajectories and transformative technological advancements. From its nascent stages, the market has witnessed a compound annual growth rate (CAGR) of approximately 15-20% over the historical period of 2019–2024, driven by increasing consumer adoption of smart devices and a growing awareness of health and wellness. The base year of 2025 is projected to see the market value reach over $10,000 Million, with a robust forecast period of 2025–2033 indicating continued expansion. Shifting consumer demands have been a primary catalyst, with a pronounced shift towards proactive health management and personalized wellness solutions. This demand has spurred the development of more sophisticated and accurate sensors capable of monitoring a wider array of physiological parameters. Technologically, the industry has progressed from basic motion tracking to advanced biosensors, environmental sensors, and MEMS (Micro-Electro-Mechanical Systems) that offer unparalleled precision and real-time data. The integration of artificial intelligence (AI) and machine learning (ML) into wearable devices has further enhanced their capabilities, enabling predictive analytics and personalized insights, thereby driving higher adoption metrics. The average adoption rate of wearable health monitoring devices has seen a year-over-year increase of nearly 25% in the past three years, underscoring the market's strong momentum. As the industry matures, research and development efforts are increasingly focused on miniaturizing components, improving battery life, and ensuring robust data security and privacy, further solidifying the industry's growth potential.

Leading Regions, Countries, or Segments in US Wearable Sensors Industry

Within the expansive US wearable sensors industry, the Health Sensors segment, particularly within the Wristwear device category, emerges as the undisputed leader. This dominance is fueled by a confluence of factors, including escalating consumer interest in health and fitness, a rising prevalence of chronic diseases, and robust government initiatives promoting preventative healthcare. The application of Health Sensors in Health and Wellness and Safety Monitoring applications is particularly pronounced, with devices continuously tracking vital signs like heart rate, blood oxygen levels, and sleep patterns.

Key Drivers of Dominance:

- Investment Trends: Significant venture capital and corporate investments are channeling into companies developing advanced health-monitoring sensors, with billions of dollars invested in the last five years alone. These investments focus on improving sensor accuracy, expanding the range of detectable biomarkers, and enhancing data interpretability.

- Regulatory Support: The US Food and Drug Administration (FDA) has shown an increasing willingness to regulate and approve wearable health devices, providing a clearer path to market for innovative technologies. This regulatory clarity encourages further development and commercialization.

- Consumer Demand: A growing population of health-conscious consumers, coupled with an aging demographic actively seeking ways to manage their well-being and monitor chronic conditions, creates a massive addressable market for wristwear health sensors.

- Technological Advancements: Continuous innovation in MEMS technology, miniaturization of components, and advancements in AI for data analysis have enabled the creation of sophisticated, unobtrusive, and highly accurate health sensors integrated into everyday wristwear.

The market share for Health Sensors is estimated to be over 50% of the total US wearable sensors market, with wristwear devices accounting for over 70% of this segment. The Application of Health and Wellness applications alone is projected to contribute over $5,000 Million to the market by 2025, with Safety Monitoring and Home Rehabilitation applications also showing substantial growth. While other segments like Environmental Sensors and Motion Sensors are vital, their current market penetration and growth rates do not yet rival the overwhelming impact of Health Sensors in the US wearable ecosystem. The synergy between technological innovation, evolving consumer needs, and supportive regulatory frameworks positions Health Sensors in wristwear as the defining segment of the US wearable sensors industry for the foreseeable future.

US Wearable Sensors Industry Product Innovations

Product innovations in the US wearable sensors industry are rapidly pushing the boundaries of what's possible. Recent advancements include the development of highly sensitive biosensors capable of detecting early signs of diseases through sweat and interstitial fluid analysis, offering non-invasive diagnostic capabilities. MEMS pressure sensors are now integrated into footwear to monitor gait and detect falls, crucial for elderly safety. Furthermore, the miniaturization and power efficiency of motion sensors have enabled their seamless integration into discreet bodywear for advanced athletic performance analysis and rehabilitation. These innovations are characterized by their increased accuracy, reduced form factor, and enhanced data processing capabilities, often leveraging AI for real-time feedback and predictive insights. The unique selling proposition lies in their ability to provide continuous, personalized, and actionable health and performance data, fundamentally transforming how individuals manage their well-being.

Propelling Factors for US Wearable Sensors Industry Growth

Several key factors are propelling the US wearable sensors industry forward. The surging demand for personalized health and wellness solutions, driven by increased consumer health consciousness and the proliferation of chronic diseases, is a primary growth catalyst. Technological advancements, particularly in miniaturization, power efficiency, and the integration of AI and machine learning, are enabling more sophisticated and accurate sensor functionalities. Government initiatives and regulatory support, especially in healthcare applications, are fostering innovation and market adoption. Economic factors, including rising disposable incomes and increased healthcare spending, also contribute to market expansion. Finally, the growing trend towards remote patient monitoring and telehealth services creates a significant market for wearable sensor-based solutions, accelerating growth across various segments.

Obstacles in the US Wearable Sensors Industry Market

Despite its robust growth, the US wearable sensors industry faces several obstacles. Regulatory hurdles, particularly concerning data privacy and the approval of medical-grade devices, can slow down innovation and market entry. Supply chain disruptions, as evidenced by recent global events, can impact the availability of essential components and manufacturing capabilities, leading to production delays and increased costs. Intense competitive pressures from both established technology giants and agile startups necessitate continuous innovation and cost optimization. Furthermore, consumer concerns regarding data security and the accuracy of sensor readings can hinder widespread adoption. The high cost of some advanced sensors and devices also presents a barrier for certain consumer segments, limiting market penetration.

Future Opportunities in US Wearable Sensors Industry

The future opportunities in the US wearable sensors industry are vast and multifaceted. The growing demand for remote patient monitoring and proactive disease management presents a significant avenue for expansion, especially in collaboration with healthcare providers. Advancements in materials science and nanotechnology are paving the way for even more sensitive and unobtrusive sensors, opening doors for new diagnostic applications. The integration of wearables with the Internet of Things (IoT) ecosystem will create seamless smart home and smart city environments, enhancing safety and convenience. Emerging markets, such as personalized nutrition and stress management, also offer substantial growth potential. Furthermore, the development of specialized sensors for niche applications, like environmental pollutant detection and advanced sports analytics, will contribute to market diversification and sustained growth.

Major Players in the US Wearable Sensors Industry Ecosystem

- Infineon Technologies AG

- NXP Semiconductors N V

- STMicroelectronics

- Bosch Sensortec GmbH (Robert Bosch GmbH)

- TE Connectivity Ltd

- Texas Instruments Incorporated

- Analog Devices Inc

- Freescale Semiconductor Inc

- InvenSense Inc

- Panasonic Corporation

Key Developments in US Wearable Sensors Industry Industry

- September 2020: Apple launched the Apple Watch Series 6, a significant advancement in smartwatch technology, enabling blood oxygen monitoring and measuring oxygen saturation in the blood for enhanced fitness and wellness insights. This development underscored the increasing sophistication of health-tracking capabilities in consumer wearables.

- January 2021: NeuTigers, an Artificial Intelligence company spun out of Princeton University, announced the launch of CovidDeep. This clinically validated solution leverages physiological sensor data derived from wearable devices to triage individuals requiring further testing for SARS-CoV-2/COVID-19, showcasing the potential of wearables in public health initiatives.

Strategic US Wearable Sensors Industry Market Forecast

The strategic forecast for the US wearable sensors industry indicates continued robust growth, driven by an increasing emphasis on personalized health and wellness. The market's trajectory will be significantly shaped by ongoing technological innovations, including the refinement of biosensors, advancements in AI-powered analytics, and the miniaturization of components. As consumer awareness of preventative healthcare escalates, the demand for sophisticated health and safety monitoring devices will remain a primary growth catalyst. Furthermore, the expanding integration of wearable sensors into broader IoT ecosystems and the increasing adoption by healthcare providers for remote patient monitoring will unlock substantial new market opportunities. The industry is poised for a future where wearable sensors are indispensable tools for proactive health management, performance optimization, and enhanced safety, with projected market expansion into the tens of thousands of Million dollars by the end of the forecast period.

US Wearable Sensors Industry Segmentation

-

1. Type

- 1.1. Health Sensors

- 1.2. Environmental Sensors

- 1.3. MEMS Sensors

- 1.4. Motion Sensors

- 1.5. Others

-

2. Device

- 2.1. Wristwear

- 2.2. Bodywear and Footwear

- 2.3. Others

-

3. Application

- 3.1. Health and Wellness

- 3.2. Safety Monitoring

- 3.3. Home Rehabilitation

- 3.4. Others

US Wearable Sensors Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

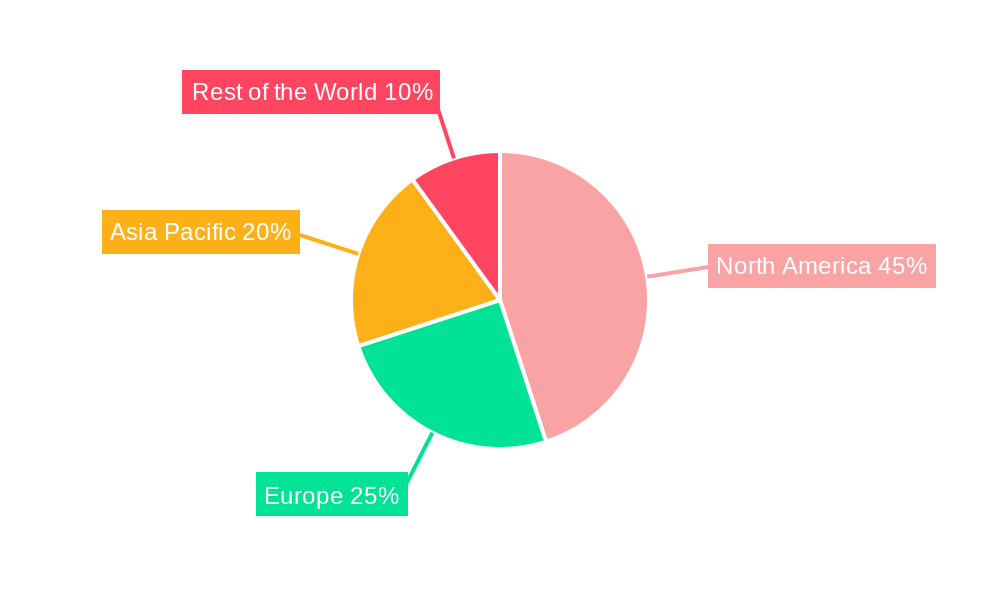

US Wearable Sensors Industry Regional Market Share

Geographic Coverage of US Wearable Sensors Industry

US Wearable Sensors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid technological developments and miniaturization of sensors; Increasing applications in the industrial sector

- 3.3. Market Restrains

- 3.3.1. High initial costs for large scale implementation in industries

- 3.4. Market Trends

- 3.4.1. Increase in demand of wearable fitness devices is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Wearable Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Health Sensors

- 5.1.2. Environmental Sensors

- 5.1.3. MEMS Sensors

- 5.1.4. Motion Sensors

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Device

- 5.2.1. Wristwear

- 5.2.2. Bodywear and Footwear

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Health and Wellness

- 5.3.2. Safety Monitoring

- 5.3.3. Home Rehabilitation

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America US Wearable Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Health Sensors

- 6.1.2. Environmental Sensors

- 6.1.3. MEMS Sensors

- 6.1.4. Motion Sensors

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Device

- 6.2.1. Wristwear

- 6.2.2. Bodywear and Footwear

- 6.2.3. Others

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Health and Wellness

- 6.3.2. Safety Monitoring

- 6.3.3. Home Rehabilitation

- 6.3.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America US Wearable Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Health Sensors

- 7.1.2. Environmental Sensors

- 7.1.3. MEMS Sensors

- 7.1.4. Motion Sensors

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Device

- 7.2.1. Wristwear

- 7.2.2. Bodywear and Footwear

- 7.2.3. Others

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Health and Wellness

- 7.3.2. Safety Monitoring

- 7.3.3. Home Rehabilitation

- 7.3.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe US Wearable Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Health Sensors

- 8.1.2. Environmental Sensors

- 8.1.3. MEMS Sensors

- 8.1.4. Motion Sensors

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Device

- 8.2.1. Wristwear

- 8.2.2. Bodywear and Footwear

- 8.2.3. Others

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Health and Wellness

- 8.3.2. Safety Monitoring

- 8.3.3. Home Rehabilitation

- 8.3.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa US Wearable Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Health Sensors

- 9.1.2. Environmental Sensors

- 9.1.3. MEMS Sensors

- 9.1.4. Motion Sensors

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Device

- 9.2.1. Wristwear

- 9.2.2. Bodywear and Footwear

- 9.2.3. Others

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Health and Wellness

- 9.3.2. Safety Monitoring

- 9.3.3. Home Rehabilitation

- 9.3.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific US Wearable Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Health Sensors

- 10.1.2. Environmental Sensors

- 10.1.3. MEMS Sensors

- 10.1.4. Motion Sensors

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Device

- 10.2.1. Wristwear

- 10.2.2. Bodywear and Footwear

- 10.2.3. Others

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Health and Wellness

- 10.3.2. Safety Monitoring

- 10.3.3. Home Rehabilitation

- 10.3.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Infineon Technologies AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NXP Semiconductors N V

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 STMicroelectronics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bosch Sensortec GmbH (Robert Bosch GmbH)*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 TE Connectivity Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Texas Instruments Incorporated

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Analog Devices Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Freescale Semiconductor Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 InvenSense Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Panasonic Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Global US Wearable Sensors Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America US Wearable Sensors Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America US Wearable Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America US Wearable Sensors Industry Revenue (billion), by Device 2025 & 2033

- Figure 5: North America US Wearable Sensors Industry Revenue Share (%), by Device 2025 & 2033

- Figure 6: North America US Wearable Sensors Industry Revenue (billion), by Application 2025 & 2033

- Figure 7: North America US Wearable Sensors Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America US Wearable Sensors Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America US Wearable Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America US Wearable Sensors Industry Revenue (billion), by Type 2025 & 2033

- Figure 11: South America US Wearable Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America US Wearable Sensors Industry Revenue (billion), by Device 2025 & 2033

- Figure 13: South America US Wearable Sensors Industry Revenue Share (%), by Device 2025 & 2033

- Figure 14: South America US Wearable Sensors Industry Revenue (billion), by Application 2025 & 2033

- Figure 15: South America US Wearable Sensors Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America US Wearable Sensors Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: South America US Wearable Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe US Wearable Sensors Industry Revenue (billion), by Type 2025 & 2033

- Figure 19: Europe US Wearable Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe US Wearable Sensors Industry Revenue (billion), by Device 2025 & 2033

- Figure 21: Europe US Wearable Sensors Industry Revenue Share (%), by Device 2025 & 2033

- Figure 22: Europe US Wearable Sensors Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: Europe US Wearable Sensors Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe US Wearable Sensors Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe US Wearable Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa US Wearable Sensors Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East & Africa US Wearable Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East & Africa US Wearable Sensors Industry Revenue (billion), by Device 2025 & 2033

- Figure 29: Middle East & Africa US Wearable Sensors Industry Revenue Share (%), by Device 2025 & 2033

- Figure 30: Middle East & Africa US Wearable Sensors Industry Revenue (billion), by Application 2025 & 2033

- Figure 31: Middle East & Africa US Wearable Sensors Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: Middle East & Africa US Wearable Sensors Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa US Wearable Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific US Wearable Sensors Industry Revenue (billion), by Type 2025 & 2033

- Figure 35: Asia Pacific US Wearable Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Asia Pacific US Wearable Sensors Industry Revenue (billion), by Device 2025 & 2033

- Figure 37: Asia Pacific US Wearable Sensors Industry Revenue Share (%), by Device 2025 & 2033

- Figure 38: Asia Pacific US Wearable Sensors Industry Revenue (billion), by Application 2025 & 2033

- Figure 39: Asia Pacific US Wearable Sensors Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Asia Pacific US Wearable Sensors Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific US Wearable Sensors Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Wearable Sensors Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global US Wearable Sensors Industry Revenue billion Forecast, by Device 2020 & 2033

- Table 3: Global US Wearable Sensors Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global US Wearable Sensors Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global US Wearable Sensors Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global US Wearable Sensors Industry Revenue billion Forecast, by Device 2020 & 2033

- Table 7: Global US Wearable Sensors Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global US Wearable Sensors Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global US Wearable Sensors Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Global US Wearable Sensors Industry Revenue billion Forecast, by Device 2020 & 2033

- Table 14: Global US Wearable Sensors Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global US Wearable Sensors Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global US Wearable Sensors Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Global US Wearable Sensors Industry Revenue billion Forecast, by Device 2020 & 2033

- Table 21: Global US Wearable Sensors Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Global US Wearable Sensors Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global US Wearable Sensors Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 33: Global US Wearable Sensors Industry Revenue billion Forecast, by Device 2020 & 2033

- Table 34: Global US Wearable Sensors Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 35: Global US Wearable Sensors Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global US Wearable Sensors Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 43: Global US Wearable Sensors Industry Revenue billion Forecast, by Device 2020 & 2033

- Table 44: Global US Wearable Sensors Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 45: Global US Wearable Sensors Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific US Wearable Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Wearable Sensors Industry?

The projected CAGR is approximately 19.72%.

2. Which companies are prominent players in the US Wearable Sensors Industry?

Key companies in the market include Infineon Technologies AG, NXP Semiconductors N V, STMicroelectronics, Bosch Sensortec GmbH (Robert Bosch GmbH)*List Not Exhaustive, TE Connectivity Ltd, Texas Instruments Incorporated, Analog Devices Inc, Freescale Semiconductor Inc, InvenSense Inc, Panasonic Corporation.

3. What are the main segments of the US Wearable Sensors Industry?

The market segments include Type, Device, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.53 billion as of 2022.

5. What are some drivers contributing to market growth?

Rapid technological developments and miniaturization of sensors; Increasing applications in the industrial sector.

6. What are the notable trends driving market growth?

Increase in demand of wearable fitness devices is driving the market.

7. Are there any restraints impacting market growth?

High initial costs for large scale implementation in industries.

8. Can you provide examples of recent developments in the market?

September 2020: Apple launched the Apple watch series 6, which is the latest smartwatch that enables blood oxygen monitoring and measures oxygen saturation in the blood for a better understanding of fitness and wellness.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Wearable Sensors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Wearable Sensors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Wearable Sensors Industry?

To stay informed about further developments, trends, and reports in the US Wearable Sensors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence