Key Insights

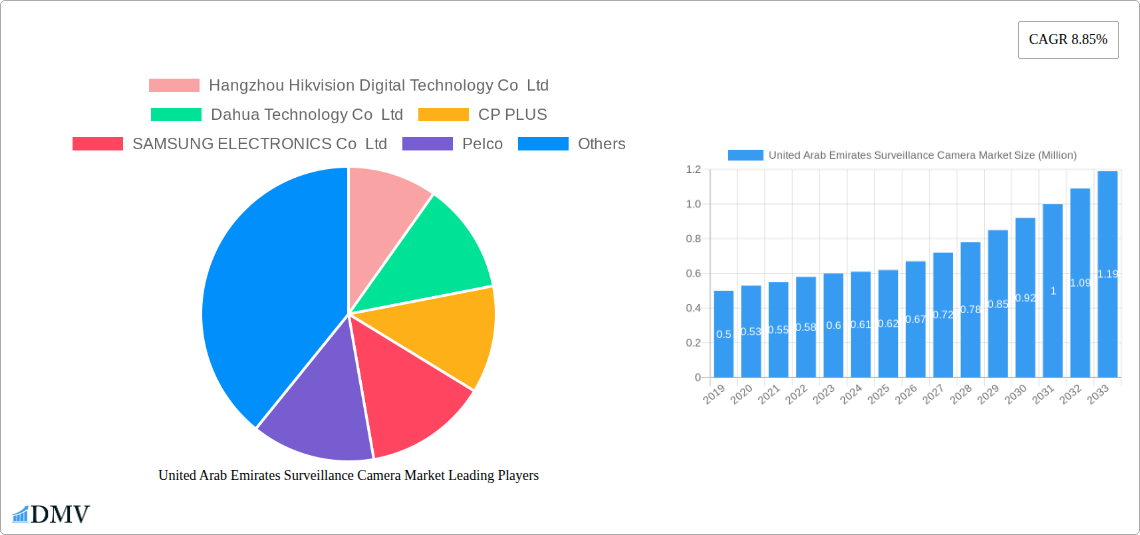

The United Arab Emirates surveillance camera market is poised for significant expansion, driven by a confluence of escalating security concerns, robust infrastructure development, and the government's proactive stance on public safety. With a current market size of USD 0.62 million (estimated for 2025), the sector is projected to witness a Compound Annual Growth Rate (CAGR) of 8.85% from 2025 to 2033. This impressive growth trajectory is fueled by increasing investments in smart city initiatives, the need for enhanced security in commercial and industrial sectors, and the ongoing expansion of public infrastructure projects across the UAE. The demand for advanced surveillance solutions, particularly IP-based cameras offering higher resolution, intelligent analytics, and remote accessibility, is expected to surge. Government mandates for stringent security protocols in critical infrastructure and public spaces, coupled with the proliferation of retail, hospitality, and residential developments, are key catalysts for this market's ascent.

United Arab Emirates Surveillance Camera Market Market Size (In Million)

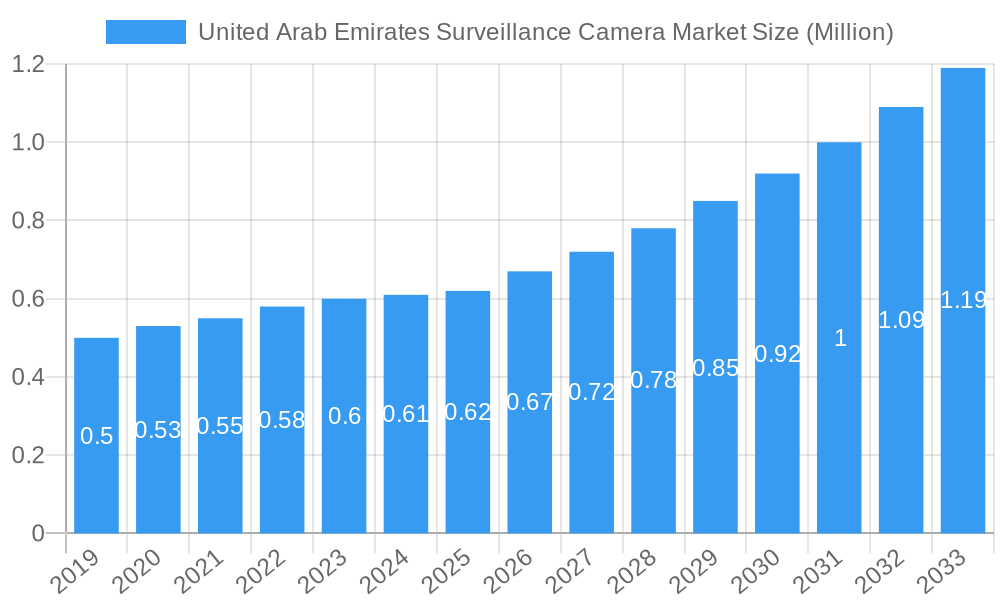

The market is characterized by a dynamic competitive landscape, featuring both global giants and emerging regional players. Major companies such as Hangzhou Hikvision Digital Technology Co. Ltd, Dahua Technology Co. Ltd, and SAMSUNG ELECTRONICS Co. Ltd are vying for market share, alongside established entities like Honeywell International Inc. and Axis Communications AB. The market segmentation reveals a strong preference for IP-based surveillance solutions over analog, reflecting the technological advancements and the need for more sophisticated monitoring capabilities. Key end-user industries like Government, Banking, Healthcare, Transportation and Logistics, and Industrial sectors are primary adopters, each with unique security requirements that are driving innovation and market demand. Emerging trends include the integration of artificial intelligence (AI) for advanced video analytics, facial recognition, and anomaly detection, further solidifying the UAE's position as a leader in adopting cutting-edge security technologies.

United Arab Emirates Surveillance Camera Market Company Market Share

United Arab Emirates Surveillance Camera Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a strategic analysis of the United Arab Emirates surveillance camera market, a rapidly evolving sector driven by robust security initiatives and technological advancements. Covering the historical period from 2019 to 2024 and projecting through 2033, with a base year of 2025, this report offers invaluable insights into market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, and future opportunities. The UAE CCTV market is witnessing substantial investment, making it a critical focus for stakeholders in physical security solutions.

United Arab Emirates Surveillance Camera Market Market Composition & Trends

The UAE surveillance camera market exhibits a moderate to high concentration, with key players like Hangzhou Hikvision Digital Technology Co Ltd, Dahua Technology Co Ltd, and CP PLUS holding significant market share. Innovation is primarily driven by the adoption of IP-based surveillance cameras, advancements in Artificial Intelligence (AI) integration for intelligent video analytics, and the increasing demand for high-resolution imaging. Regulatory frameworks, particularly concerning data privacy and surveillance protocols, play a crucial role in shaping market dynamics. The demand for sophisticated security cameras UAE is amplified by government mandates and private sector investments in smart city initiatives and enhanced public safety. Substitute products, such as access control systems and advanced alarm systems, coexist and complement the surveillance camera ecosystem. End-user profiles range from the government sector, implementing large-scale public safety projects, to banking and finance, requiring stringent security for data and assets, and the transportation and logistics industry, optimizing operations and ensuring cargo security. Merger and acquisition activities, while not yet dominant, are expected to increase as larger players seek to consolidate market position and acquire innovative technologies. Projected M&A deal values are estimated to be in the range of hundreds of millions of dollars as consolidation pressures rise.

United Arab Emirates Surveillance Camera Market Industry Evolution

The United Arab Emirates surveillance camera market has experienced a remarkable trajectory of growth and transformation over the historical period (2019-2024) and is poised for continued expansion in the forecast period (2025-2033). The initial phase was characterized by the widespread adoption of traditional analog surveillance cameras, driven by cost-effectiveness and basic security needs. However, technological advancements have led to a significant shift towards more sophisticated IP-based surveillance systems. This evolution is fueled by the superior image quality, scalability, and remote accessibility offered by IP cameras, making them the preferred choice for modern security infrastructure. The market has witnessed a substantial CAGR of approximately 12-15% in recent years, with projections indicating sustained double-digit growth. This expansion is intrinsically linked to the UAE's ambitious smart city vision, a commitment to enhancing public safety, and the burgeoning tourism and business sectors, all of which necessitate advanced security solutions. The increasing integration of AI and machine learning into surveillance systems, enabling features like facial recognition, object detection, and behavioral analysis, is a key trend revolutionizing the industry. These intelligent features not only enhance security effectiveness but also provide valuable data for operational efficiency and predictive analytics. Consumer demand is increasingly influenced by the need for integrated security solutions, cloud-based storage, and cybersecurity resilience, pushing manufacturers to develop more comprehensive and user-friendly products. The Dubai surveillance market and Abu Dhabi security camera market are leading this transformation, setting benchmarks for the rest of the region.

Leading Regions, Countries, or Segments in United Arab Emirates Surveillance Camera Market

The IP-based surveillance cameras segment is undeniably dominant in the United Arab Emirates surveillance camera market. This dominance is driven by a confluence of factors including superior technological capabilities, a growing demand for high-definition video, enhanced network integration, and the burgeoning adoption of smart city initiatives. The Government end-user industry also holds a leading position, primarily due to significant investments in public safety, smart city projects, and national security infrastructure. The Sharjah Police's recent deployment of nearly 90,000 high-tech surveillance cameras, resulting in a significant increase in residents' feelings of safety and confidence in law enforcement, exemplifies the government's commitment and the tangible impact of these technologies. This massive deployment, alongside similar initiatives in Dubai and Abu Dhabi, underscores the substantial procurement power and strategic importance of the government sector in driving market growth.

IP-based Surveillance Cameras:

- Technological Superiority: Offers higher resolutions, advanced analytics, remote accessibility, and easier integration with other network systems.

- Smart City Integration: Essential for smart city infrastructure, IoT applications, and intelligent traffic management.

- Cost-Effectiveness (Long-Term): Despite higher initial investment, IP cameras offer better scalability, reduced cabling, and lower maintenance costs over their lifecycle.

- AI and Analytics Enablement: Crucial for advanced features like facial recognition, anomaly detection, and behavioral analysis, which are increasingly sought after.

Government End-User Industry:

- National Security Mandates: Driven by the need to maintain law and order, counter terrorism, and ensure public safety across the nation.

- Smart City Development: Significant investments in smart city projects necessitate comprehensive surveillance networks for traffic management, public space monitoring, and emergency response.

- Infrastructure Protection: High-priority projects for securing critical infrastructure, including airports, ports, and energy facilities.

- Positive Public Perception: Demonstrated impact of surveillance on crime reduction and public safety, as evidenced by the Sharjah Police initiative, reinforces government commitment to further investment. The reported decline in serious crime rates to 40 incidents per 100,000 people last year is a testament to the effectiveness of enhanced surveillance.

While other segments such as Banking, Healthcare, and Industrial also contribute significantly, the sheer scale of government projects and the technological advantage of IP-based systems cement their leading positions in the UAE security camera market.

United Arab Emirates Surveillance Camera Market Product Innovations

The United Arab Emirates surveillance camera market is at the forefront of technological innovation. Recent advancements, such as Hanwha Vision's introduction of AI PTZ Plus cameras (XNP-C9310R and XNP-C7310R) in April 2024, exemplify this trend. These cameras leverage sophisticated AI for rapid zoom and focus, drastically improving situational awareness and response times. Their ability to perform optimally in harsh weather conditions, with built-in spin dry and heater functions to combat water and ice, ensures consistent, clear visuals. This focus on ruggedized, intelligent cameras with advanced analytical capabilities is a key differentiator, enhancing performance in diverse environmental and operational contexts across the UAE.

Propelling Factors for United Arab Emirates Surveillance Camera Market Growth

Several key factors are propelling the growth of the United Arab Emirates surveillance camera market. Firstly, the government's unwavering commitment to enhancing public safety and security through ambitious smart city initiatives and robust law enforcement strategies is a primary driver. Secondly, the continuous technological evolution, particularly the integration of Artificial Intelligence (AI) for advanced video analytics like facial recognition and anomaly detection, significantly boosts the market. Thirdly, the expanding tourism and hospitality sectors, coupled with major events like Expo and the upcoming FIFA World Cup preparations, necessitate heightened security measures, driving demand for advanced surveillance solutions. Finally, the increasing adoption of IP-based cameras over analog systems due to their superior capabilities and scalability further fuels market expansion.

Obstacles in the United Arab Emirates Surveillance Camera Market Market

Despite robust growth, the United Arab Emirates surveillance camera market faces certain obstacles. Data privacy regulations and concerns regarding the ethical use of surveillance technology can pose challenges, requiring careful compliance and transparent operational policies. The initial high cost of advanced IP-based systems and AI-integrated cameras can be a barrier for smaller businesses and organizations with limited budgets, although total cost of ownership often proves more economical. Furthermore, intermittent supply chain disruptions for advanced components can affect product availability and pricing. Intense competition among numerous global and local manufacturers also exerts downward pressure on prices, necessitating continuous innovation and value-added services to maintain profitability.

Future Opportunities in United Arab Emirates Surveillance Camera Market

Emerging opportunities in the United Arab Emirates surveillance camera market are substantial. The ongoing expansion of smart city projects across all emirates will continue to drive demand for integrated surveillance networks. The growing adoption of cloud-based surveillance solutions, offering enhanced flexibility and scalability, presents a significant growth avenue. Furthermore, the increasing integration of AI for predictive policing, crowd management, and operational efficiency in industries like retail and transportation offers immense potential. The development of specialized cameras for niche applications, such as thermal imaging for perimeter security or high-frame-rate cameras for sports analytics, will also cater to evolving market needs and create new revenue streams.

Major Players in the United Arab Emirates Surveillance Camera Market Ecosystem

- Hangzhou Hikvision Digital Technology Co Ltd

- Dahua Technology Co Ltd

- CP PLUS

- SAMSUNG ELECTRONICS Co Ltd

- Pelco

- Axis Communications AB

- Honeywell International Inc

- Vantage Security

- Uniview-UAE (Zhejiang Uniview Technologies Co Ltd)

- ZKTECO CO LTD List Not Exhaustive

Key Developments in United Arab Emirates Surveillance Camera Market Industry

- April 2024: Hanwha Vision introduced two cutting-edge AI PTZ Plus cameras: the XNP-C9310R and XNP-C7310R. These cameras leverage AI for rapid zooming and focusing, bolstering situational awareness and slashing response times. Notably, they are designed to perform exceptionally even in harsh weather conditions like storms and snow. Due to their innovative spin dry and heater functions, they efficiently eliminate water and ice, guaranteeing clear visuals consistently.

- March 2024: Sharjah Police's installation of 89,772 high-tech surveillance cameras in the emirate has left a resounding impact, with an overwhelming 99.7% of Sharjah residents reporting heightened feelings of safety. The police highlighted that 99.3% of residents express confidence in the force's security maintenance capabilities, and an impressive 99.1% voiced their trust in local police stations. During a recent briefing, authorities disclosed a significant decline in serious crimes, with the rate plummeting to 40 incidents per 100,000 people last year.

Strategic United Arab Emirates Surveillance Camera Market Market Forecast

The United Arab Emirates surveillance camera market is projected for robust and sustained growth, driven by an intensifying focus on national security, smart city development, and technological innovation. The continuous integration of AI-powered video analytics, cloud-based solutions, and increasingly sophisticated hardware will be key growth catalysts. Investments in securing critical infrastructure, managing large public gatherings, and enhancing urban mobility will fuel demand across various end-user industries, particularly government, transportation, and industrial sectors. The market's future is characterized by a strong emphasis on intelligent, integrated, and adaptable surveillance systems that offer not only security but also valuable data insights, ensuring the UAE remains a global leader in safety and technological advancement.

United Arab Emirates Surveillance Camera Market Segmentation

-

1. Type

- 1.1. Analog

- 1.2. IP-based

-

2. End-user Industry

- 2.1. Government

- 2.2. Banking

- 2.3. Healthcare

- 2.4. Transportation and Logistics

- 2.5. Industrial

- 2.6. Other En

United Arab Emirates Surveillance Camera Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Surveillance Camera Market Regional Market Share

Geographic Coverage of United Arab Emirates Surveillance Camera Market

United Arab Emirates Surveillance Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Urbanization and Population Growth; Stringent Government Regulations to Prevent Increasing Criminal Activities

- 3.3. Market Restrains

- 3.3.1. Rapid Urbanization and Population Growth; Stringent Government Regulations to Prevent Increasing Criminal Activities

- 3.4. Market Trends

- 3.4.1. IP-Based Camera Type is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Surveillance Camera Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analog

- 5.1.2. IP-based

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Government

- 5.2.2. Banking

- 5.2.3. Healthcare

- 5.2.4. Transportation and Logistics

- 5.2.5. Industrial

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dahua Technology Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CP PLUS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SAMSUNG ELECTRONICS Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pelco

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Axis Communications AB

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Honeywell International Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vantage Security

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Uniview-UAE (Zhejiang Uniview Technologies Co Ltd)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ZKTECO CO LTD*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Hangzhou Hikvision Digital Technology Co Ltd

List of Figures

- Figure 1: United Arab Emirates Surveillance Camera Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United Arab Emirates Surveillance Camera Market Share (%) by Company 2025

List of Tables

- Table 1: United Arab Emirates Surveillance Camera Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: United Arab Emirates Surveillance Camera Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: United Arab Emirates Surveillance Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: United Arab Emirates Surveillance Camera Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 5: United Arab Emirates Surveillance Camera Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United Arab Emirates Surveillance Camera Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: United Arab Emirates Surveillance Camera Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: United Arab Emirates Surveillance Camera Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: United Arab Emirates Surveillance Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: United Arab Emirates Surveillance Camera Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 11: United Arab Emirates Surveillance Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Arab Emirates Surveillance Camera Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Surveillance Camera Market?

The projected CAGR is approximately 8.85%.

2. Which companies are prominent players in the United Arab Emirates Surveillance Camera Market?

Key companies in the market include Hangzhou Hikvision Digital Technology Co Ltd, Dahua Technology Co Ltd, CP PLUS, SAMSUNG ELECTRONICS Co Ltd, Pelco, Axis Communications AB, Honeywell International Inc, Vantage Security, Uniview-UAE (Zhejiang Uniview Technologies Co Ltd), ZKTECO CO LTD*List Not Exhaustive.

3. What are the main segments of the United Arab Emirates Surveillance Camera Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Urbanization and Population Growth; Stringent Government Regulations to Prevent Increasing Criminal Activities.

6. What are the notable trends driving market growth?

IP-Based Camera Type is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Rapid Urbanization and Population Growth; Stringent Government Regulations to Prevent Increasing Criminal Activities.

8. Can you provide examples of recent developments in the market?

April 2024: Hanwha Vision introduced two cutting-edge AI PTZ Plus cameras: the XNP-C9310R and XNP-C7310R. These cameras leverage AI for rapid zooming and focusing, bolstering situational awareness and slashing response times. Notably, they are designed to perform exceptionally even in harsh weather conditions like storms and snow. Due to their innovative spin dry and heater functions, they efficiently eliminate water and ice, guaranteeing clear visuals consistently.March 2024: Sharjah Police's installation of 89,772 high-tech surveillance cameras in the emirate has left a resounding impact, with an overwhelming 99.7% of Sharjah residents reporting heightened feelings of safety. The police highlighted that 99.3% of residents express confidence in the force's security maintenance capabilities, and an impressive 99.1% voiced their trust in local police stations. During a recent briefing, authorities disclosed a significant decline in serious crimes, with the rate plummeting to 40 incidents per 100,000 people last year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Surveillance Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Surveillance Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Surveillance Camera Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Surveillance Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence