Key Insights

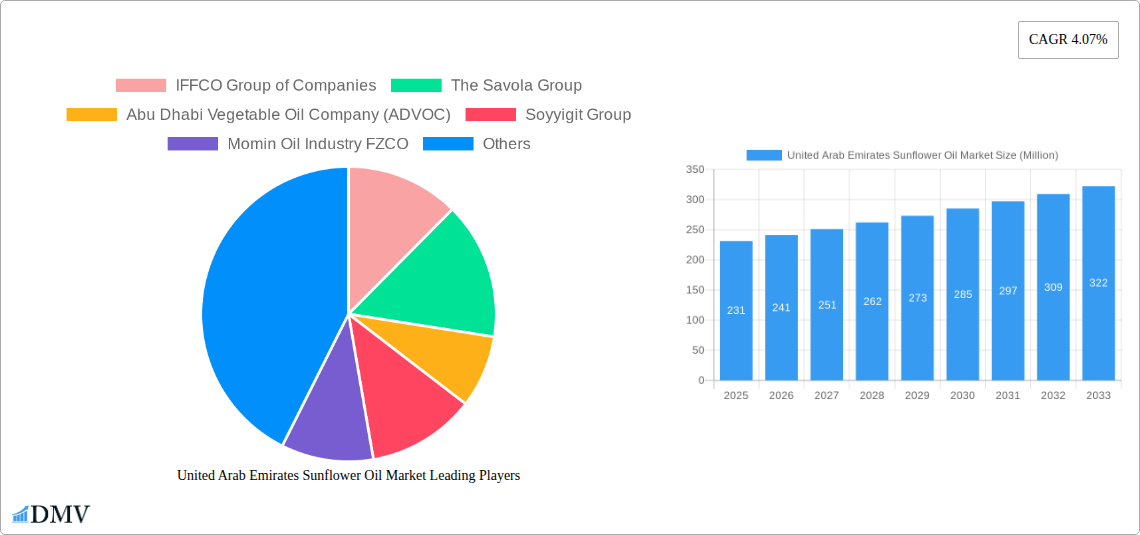

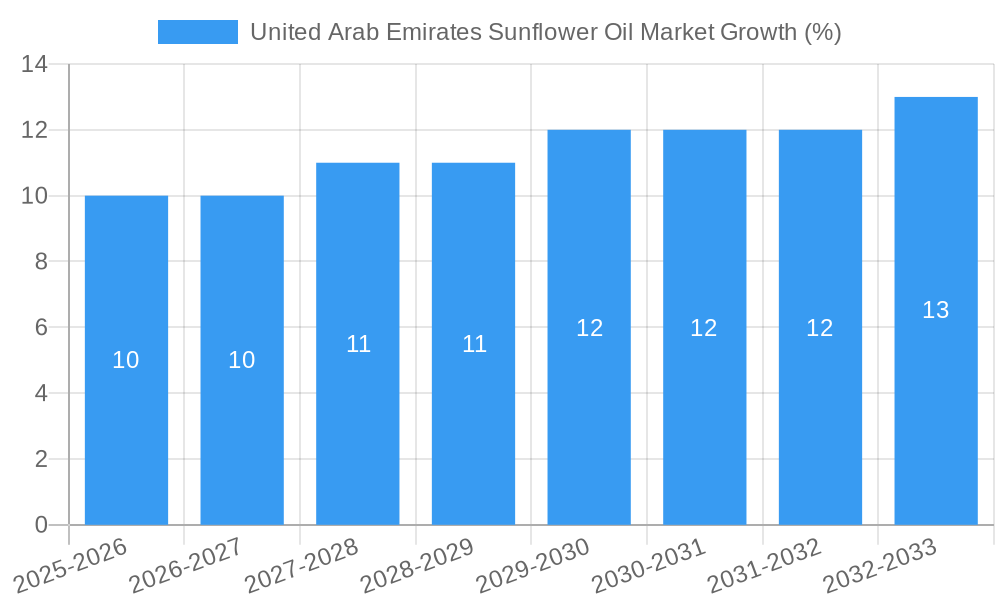

The United Arab Emirates (UAE) sunflower oil market, valued at $231 million in 2025, is projected to experience steady growth, driven by a robust CAGR of 4.07% from 2025 to 2033. This growth is fueled by several key factors. Increasing health consciousness among consumers is leading to a higher demand for vegetable oils perceived as healthier alternatives, with sunflower oil being a prominent choice due to its relatively lower saturated fat content compared to other cooking oils. The UAE's thriving food processing and culinary industries, along with a substantial population of expatriates with diverse culinary preferences, further contribute to the market's expansion. Furthermore, the consistent rise in disposable incomes and a growing preference for convenient, pre-packaged food products containing sunflower oil are bolstering market growth. However, price fluctuations in global sunflower seed production and potential competition from other vegetable oils pose challenges to sustained market expansion. Major players like IFFCO Group of Companies, The Savola Group, and Abu Dhabi Vegetable Oil Company (ADVOC) are actively involved in shaping the market landscape through product diversification and strategic partnerships.

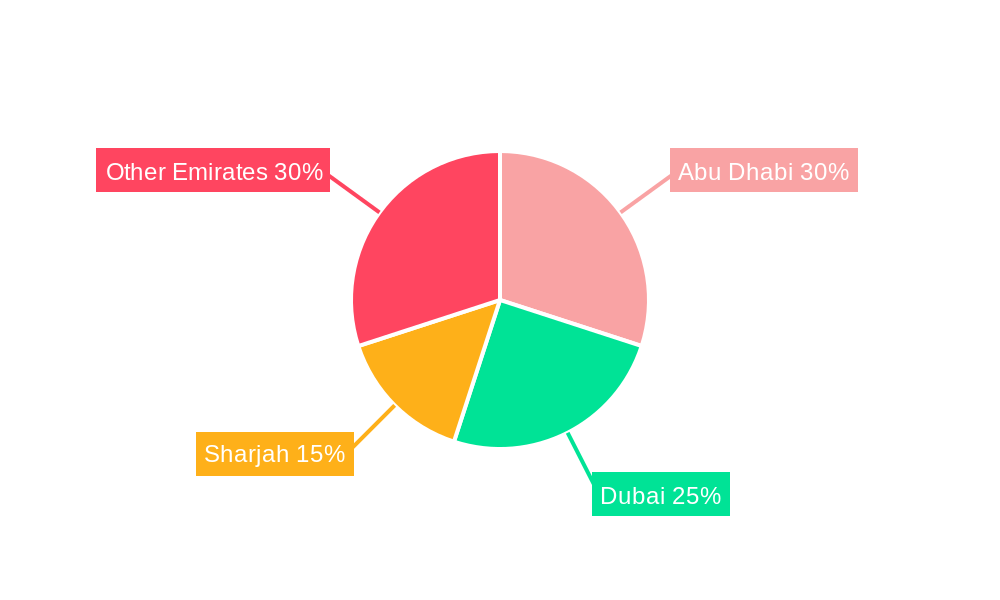

The market segmentation within the UAE reveals a diverse consumer base with varying preferences for different types of sunflower oil, including refined, unrefined, and organic variants. Regional variations in consumption patterns may also exist across the emirates, influenced by factors like local culinary traditions and distribution networks. The forecast period (2025-2033) anticipates a continued expansion, with potential acceleration based on successful marketing campaigns highlighting the health benefits of sunflower oil and increased penetration into niche markets such as the burgeoning organic and health food segments. Future market developments will likely hinge on government policies regarding food imports, the global supply chain stability for sunflower seeds, and the adoption of innovative packaging and distribution strategies.

United Arab Emirates Sunflower Oil Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the United Arab Emirates (UAE) sunflower oil market, offering a comprehensive overview of its current state, future trends, and key players. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. This report is invaluable for stakeholders seeking to understand market dynamics, identify opportunities, and make informed business decisions within this thriving sector.

United Arab Emirates Sunflower Oil Market Composition & Trends

This section delves into the intricate structure of the UAE sunflower oil market, examining its concentration, innovation drivers, regulatory framework, substitute products, consumer profiles, and mergers & acquisitions (M&A) activities. We analyze market share distribution among key players, revealing the competitive landscape. M&A deal values are also explored, providing a financial perspective on market consolidation.

- Market Concentration: The UAE sunflower oil market exhibits a [xx]% concentration ratio, with the top [xx] players holding a significant share. This suggests a [describe market structure: e.g., moderately competitive or oligopolistic] market.

- Innovation Catalysts: Growing consumer preference for healthy cooking oils and increasing awareness of the health benefits of sunflower oil are driving innovation in product formulations (e.g., organic, refined, fortified).

- Regulatory Landscape: UAE food safety regulations and labeling requirements significantly influence market dynamics, impacting product standards and trade practices. Import duties and tariffs also play a crucial role.

- Substitute Products: Other cooking oils like olive oil, canola oil, and vegetable oil compete with sunflower oil, impacting market share and pricing strategies. This competitive pressure is further shaped by consumer preferences and price sensitivity.

- End-User Profiles: The UAE’s diverse population—expatriates and locals—have varying preferences and consumption patterns. This report analyzes these differences and their implications for market segmentation.

- M&A Activities: Recent mergers and acquisitions, such as IHC Food Holding's acquisition of a 75% stake in ADVOC for USD 24.7 Million in January 2022, indicate market consolidation and strategic investments. Total M&A deal value in the period 2019-2024 is estimated at [xx] Million USD.

United Arab Emirates Sunflower Oil Market Industry Evolution

This section provides a detailed analysis of the UAE sunflower oil market’s evolutionary trajectory, encompassing growth rates, technological advancements, and evolving consumer preferences. The report examines factors influencing the market's expansion, including economic growth, population trends, and lifestyle changes.

The UAE sunflower oil market has witnessed a [xx]% Compound Annual Growth Rate (CAGR) during the historical period (2019-2024). This growth is projected to continue at a [xx]% CAGR during the forecast period (2025-2033), reaching a market value of [xx] Million USD by 2033. Technological advancements in oil extraction and refining processes, as well as innovations in packaging and distribution, have improved efficiency and product quality. Consumer demand is shifting towards healthier and more convenient options, leading to increased demand for refined and specialty sunflower oils. The increasing adoption of online grocery platforms is also reshaping distribution channels.

Leading Regions, Countries, or Segments in United Arab Emirates Sunflower Oil Market

This section pinpoints the dominant regions, countries, or segments within the UAE sunflower oil market. A detailed analysis reveals the underlying factors contributing to their market leadership.

- Key Drivers:

- High Population Density: Urban areas with higher population densities, such as Dubai and Abu Dhabi, exhibit higher consumption rates of sunflower oil due to increased demand from households and the food service industry.

- Government Initiatives: Government support for the food processing industry, including investment incentives and infrastructure development, fuels market expansion.

- Retail Sector Growth: The expansion of supermarkets and hypermarkets, particularly the recent opening of Lulu Group’s 24th store in Dubai Mall in October 2023, further boosts sunflower oil sales.

- Tourism: The UAE’s robust tourism industry also contributes to sunflower oil consumption, as it fuels demand within hotels, restaurants, and catering services.

The UAE's major urban centers, particularly Dubai and Abu Dhabi, dominate the market due to their high population densities, robust retail infrastructure, and significant tourism sector contributions. Further research can delve into regional variances in consumer preferences and price sensitivity.

United Arab Emirates Sunflower Oil Market Product Innovations

Recent innovations in the UAE sunflower oil market have focused on enhancing product quality and expanding product offerings. This includes the introduction of organic sunflower oil, fortified sunflower oil with added vitamins and minerals, and high-oleic sunflower oil with improved health benefits. These innovations cater to the increasing health-consciousness among consumers. Advancements in packaging, such as convenient sizes and sustainable options, enhance product appeal.

Propelling Factors for United Arab Emirates Sunflower Oil Market Growth

Several factors are driving the growth of the UAE sunflower oil market. Firstly, rising disposable incomes and a growing population are boosting demand. Secondly, a preference for healthier cooking options, along with health awareness campaigns, increases the consumption of sunflower oil. Thirdly, the expanding food service industry, particularly the rise of quick-service restaurants and cafes, contributes to higher sunflower oil usage. Finally, favorable government policies promoting the food processing sector also boost market growth.

Obstacles in the United Arab Emirates Sunflower Oil Market

Despite favorable trends, the UAE sunflower oil market faces some challenges. Fluctuations in global sunflower seed prices can impact production costs and market stability. Competition from other vegetable oils and increasing import costs also put pressure on profit margins. Moreover, maintaining stringent quality control and adhering to food safety regulations pose ongoing operational challenges for market players.

Future Opportunities in United Arab Emirates Sunflower Oil Market

Future opportunities lie in expanding into niche segments such as organic and high-oleic sunflower oil. Furthermore, exploring sustainable and eco-friendly packaging solutions can attract environmentally conscious consumers. Collaborating with food manufacturers to develop value-added products using sunflower oil, such as functional foods, offers further market potential. Finally, exploiting online retail channels to reach a wider consumer base is a key strategy for future growth.

Major Players in the United Arab Emirates Sunflower Oil Market Ecosystem

- IFFCO Group of Companies

- The Savola Group

- Abu Dhabi Vegetable Oil Company (ADVOC)

- Soyyigit Group

- Momin Oil Industry FZCO

- Eatco General Trading LLC (Family Harvest)

- ACG Alokozay Group of Companies

- AVES (Avesafya Oil)

- Avril Group

- LuLu Group International

- List Not Exhaustive

Key Developments in United Arab Emirates Sunflower Oil Market Industry

- October 2023: LuLu Group opened its 24th hypermarket in Dubai Mall (72,000 sq. ft.), significantly increasing the distribution and penetration of Lulu-branded sunflower oil. This development underscores the strong retail presence driving market expansion.

- May 2023: The collaboration between DMT, Lulu Group International, and ADIO to develop a new community center in Al Rahbah will include food and beverage outlets, indirectly benefiting the sunflower oil market through increased demand.

- January 2022: IHC Food Holding's acquisition of a 75% stake in ADVOC for USD 24.7 million signals a significant market consolidation event with implications for market competition and supply chain dynamics. This M&A activity reflects strategic investments aimed at increasing market share and expansion.

Strategic United Arab Emirates Sunflower Oil Market Market Forecast

The UAE sunflower oil market is poised for sustained growth driven by a combination of factors. Rising disposable incomes, population growth, and increasing health awareness all contribute to positive market trends. Strategic investments in the food processing sector and innovations in product offerings further fuel market expansion. The forecast period anticipates significant market value growth, solidifying the UAE's position as a key consumer market for sunflower oil.

United Arab Emirates Sunflower Oil Market Segmentation

-

1. Type

- 1.1. Refined Deodorized

- 1.2. Unrefined

-

2. End User

- 2.1. Industrial

- 2.2. Foodservice

-

2.3. Retail/Household

-

2.3.1. Packaging Type

- 2.3.1.1. Cans

- 2.3.1.2. Bottles

-

2.3.1. Packaging Type

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Convenience Stores

- 3.3. Online Retail Stores

United Arab Emirates Sunflower Oil Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Sunflower Oil Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.07% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Augmented Tourism Supporting Foodservice Demand; Increasing Industrial Demand for Sunflower Oil Supporting Market Growth

- 3.3. Market Restrains

- 3.3.1. Augmented Tourism Supporting Foodservice Demand; Increasing Industrial Demand for Sunflower Oil Supporting Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Consumption of Refined Deodorized Sunflower Oil Supporting Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Sunflower Oil Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Refined Deodorized

- 5.1.2. Unrefined

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Industrial

- 5.2.2. Foodservice

- 5.2.3. Retail/Household

- 5.2.3.1. Packaging Type

- 5.2.3.1.1. Cans

- 5.2.3.1.2. Bottles

- 5.2.3.1. Packaging Type

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Convenience Stores

- 5.3.3. Online Retail Stores

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 IFFCO Group of Companies

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Savola Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Abu Dhabi Vegetable Oil Company (ADVOC)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Soyyigit Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Momin Oil Industry FZCO

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Eatco General Trading LLC (Family Harvest)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ACG Alokozay Group of Companies

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AVES (Avesafya Oil)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Avril Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LuLu Group International*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 IFFCO Group of Companies

List of Figures

- Figure 1: United Arab Emirates Sunflower Oil Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Arab Emirates Sunflower Oil Market Share (%) by Company 2024

List of Tables

- Table 1: United Arab Emirates Sunflower Oil Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Arab Emirates Sunflower Oil Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: United Arab Emirates Sunflower Oil Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: United Arab Emirates Sunflower Oil Market Volume Million Forecast, by Type 2019 & 2032

- Table 5: United Arab Emirates Sunflower Oil Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: United Arab Emirates Sunflower Oil Market Volume Million Forecast, by End User 2019 & 2032

- Table 7: United Arab Emirates Sunflower Oil Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: United Arab Emirates Sunflower Oil Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 9: United Arab Emirates Sunflower Oil Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: United Arab Emirates Sunflower Oil Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: United Arab Emirates Sunflower Oil Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: United Arab Emirates Sunflower Oil Market Volume Million Forecast, by Type 2019 & 2032

- Table 13: United Arab Emirates Sunflower Oil Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: United Arab Emirates Sunflower Oil Market Volume Million Forecast, by End User 2019 & 2032

- Table 15: United Arab Emirates Sunflower Oil Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: United Arab Emirates Sunflower Oil Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: United Arab Emirates Sunflower Oil Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Arab Emirates Sunflower Oil Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Sunflower Oil Market?

The projected CAGR is approximately 4.07%.

2. Which companies are prominent players in the United Arab Emirates Sunflower Oil Market?

Key companies in the market include IFFCO Group of Companies, The Savola Group, Abu Dhabi Vegetable Oil Company (ADVOC), Soyyigit Group, Momin Oil Industry FZCO, Eatco General Trading LLC (Family Harvest), ACG Alokozay Group of Companies, AVES (Avesafya Oil), Avril Group, LuLu Group International*List Not Exhaustive.

3. What are the main segments of the United Arab Emirates Sunflower Oil Market?

The market segments include Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 231 Million as of 2022.

5. What are some drivers contributing to market growth?

Augmented Tourism Supporting Foodservice Demand; Increasing Industrial Demand for Sunflower Oil Supporting Market Growth.

6. What are the notable trends driving market growth?

Rising Consumption of Refined Deodorized Sunflower Oil Supporting Market Growth.

7. Are there any restraints impacting market growth?

Augmented Tourism Supporting Foodservice Demand; Increasing Industrial Demand for Sunflower Oil Supporting Market Growth.

8. Can you provide examples of recent developments in the market?

October 2023: LuLu Group opened its hypermarket spread in a 72,000 sq. ft area in Dubai Mall, marking the company's 24th store in Dubai. The store offers primarily groceries, fresh food, fruits and vegetables, bakery, health and beauty, stationery, household, IT products, and fresh flowers, among others, resulting in an increasing penetration of Lulu-branded sunflower oil.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Sunflower Oil Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Sunflower Oil Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Sunflower Oil Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Sunflower Oil Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence