Key Insights

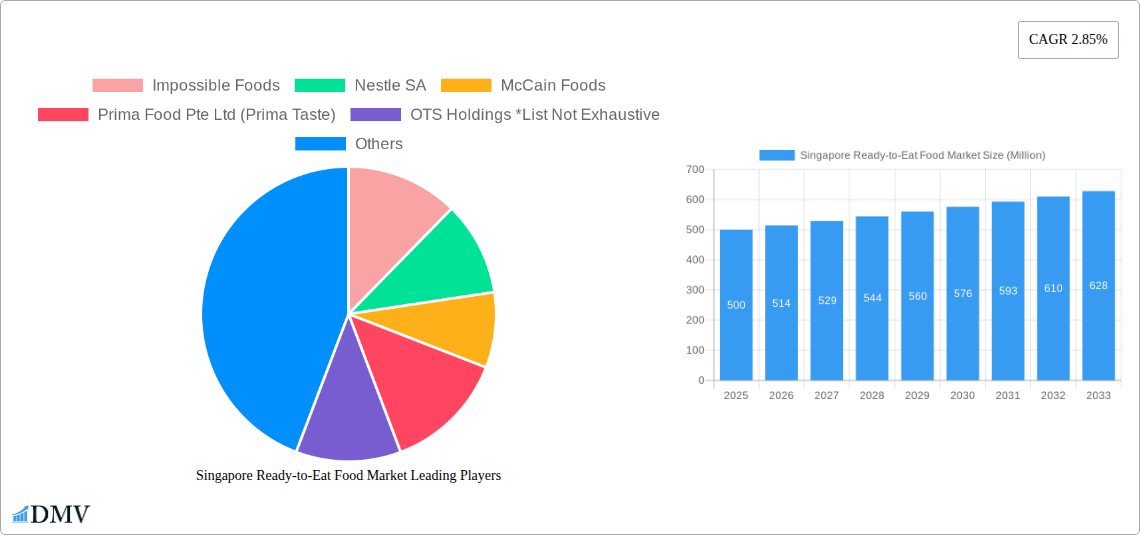

The Singapore ready-to-eat (RTE) food market is projected to reach $124.76 million by 2025, with a compound annual growth rate (CAGR) of 3.35% from 2025 to 2033. This growth is propelled by Singapore's rapid urbanization, the rise of dual-income households, and a consumer preference for convenient meal solutions. The market is segmented by product type, including instant breakfasts, soups, snacks, ready meals, baked goods, and meat products. Key distribution channels encompass hypermarkets, supermarkets, convenience stores, specialty shops, and online retail. The competitive landscape features global and local players like Nestle SA, McCain Foods, and Prima Taste, presenting opportunities for innovation and market expansion. Growing demand for healthier, diverse, and diet-specific RTE options offers significant growth potential.

Singapore Ready-to-Eat Food Market Market Size (In Million)

The expansion of the Singapore RTE food market is further accelerated by the increasing adoption of e-commerce and online food delivery services, enhancing accessibility to a broad range of products and supporting niche brands. Key market challenges include raw material price volatility, stringent food safety regulations, and competition from traditional food preparation. Balancing convenience with nutritional value is paramount for sustained growth. Continuous innovation in product development and distribution strategies will define the market's trajectory.

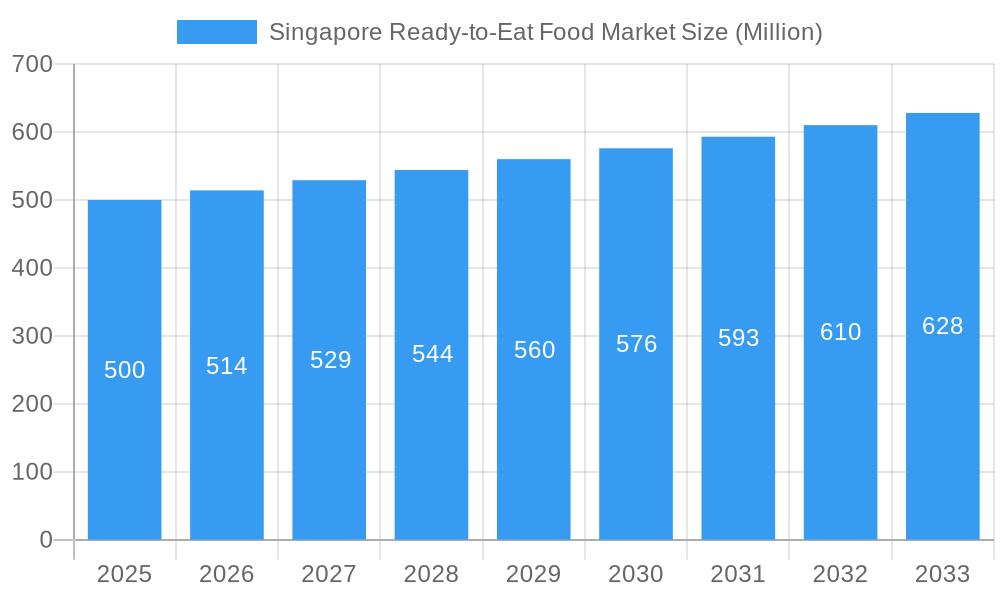

Singapore Ready-to-Eat Food Market Company Market Share

Singapore Ready-to-Eat Food Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Singapore ready-to-eat food market, offering crucial data and forecasts for stakeholders from 2019 to 2033. The study covers market size, segmentation, key players, and future trends, empowering businesses to make informed strategic decisions. With a focus on key market drivers and challenges, this report is essential for navigating the dynamic landscape of Singapore's thriving ready-to-eat food sector. The base year for this report is 2025, with estimations and forecasts spanning from 2025 to 2033, and incorporating historical data from 2019 to 2024.

Singapore Ready-to-Eat Food Market Composition & Trends

This section delves into the current state of the Singapore ready-to-eat food market, examining market concentration, innovation, regulations, and competitive dynamics. The market is characterized by a mix of multinational giants and local players, leading to a moderately fragmented landscape. The estimated market value in 2025 is $XX Million, projected to reach $XX Million by 2033.

- Market Concentration: The top 5 players command an estimated XX% market share in 2025, indicating moderate concentration. Smaller players focus on niche segments like organic or specialized dietary needs.

- Innovation Catalysts: Growing demand for convenience, health-conscious options, and diverse flavors fuels innovation. Plant-based alternatives and technological advancements in food preservation are key drivers.

- Regulatory Landscape: Singapore's stringent food safety regulations influence product development and distribution. Clear labeling and ingredient transparency are paramount.

- Substitute Products: Home-cooked meals and restaurant dining pose competition. However, the convenience factor of ready-to-eat options sustains market growth.

- End-User Profiles: The market caters to busy professionals, students, and families seeking quick and convenient meal solutions. Demand varies across demographics, with specific preferences for product types and price points.

- M&A Activities: The historical period (2019-2024) saw XX M&A deals with a total estimated value of $XX Million, primarily driven by larger players seeking to expand their product portfolio and market reach.

Singapore Ready-to-Eat Food Market Industry Evolution

This section analyzes the market's evolution, focusing on growth trajectories, technological advancements, and changing consumer preferences. The Singapore ready-to-eat food market has witnessed robust growth over the past few years, driven by factors such as increasing disposable incomes, changing lifestyles, and urbanization.

The market exhibited a Compound Annual Growth Rate (CAGR) of XX% during the historical period (2019-2024). This growth is projected to continue, with a forecasted CAGR of XX% during the forecast period (2025-2033). Key technological advancements include improved packaging technologies extending shelf life and the use of advanced preservation techniques to maintain food quality. Consumer demands are shifting towards healthier, more convenient, and diverse food options. This is leading to an increase in demand for plant-based alternatives, organic products, and personalized dietary solutions. The adoption rate of online retail channels for ready-to-eat food is steadily increasing, reaching an estimated XX% in 2025.

Leading Regions, Countries, or Segments in Singapore Ready-to-Eat Food Market

This section identifies the dominant segments within the Singapore ready-to-eat food market.

Product Type:

- Ready Meals: This segment dominates due to high consumer preference for complete meal solutions. Key drivers include convenience, affordability, and diverse culinary offerings.

- Instant Noodles: Strong demand driven by affordability and ease of preparation.

- Other Product Types: This category is rapidly expanding due to innovation and consumer demand for specific dietary needs.

Distribution Channel:

- Hypermarkets/Supermarkets: Maintain a dominant share due to wide reach and established distribution networks.

- Convenience/Grocery Stores: Experience strong growth due to their widespread presence and convenience.

- Online Retail Stores: Rapidly expanding, facilitated by increasing internet penetration and e-commerce adoption. Increased investment in logistics and delivery services are key drivers.

Singapore Ready-to-Eat Food Market Product Innovations

Recent innovations include plant-based alternatives mirroring traditional meat products (Impossible Foods’ Impossible Burger), unique flavor combinations in instant noodles (Nissin X IRVINS Salted Egg Instant Noodle Bowl), and the launch of new convenient ready-to-eat meal kits catering to specific dietary preferences (ANEW by OTS Holdings). These innovations enhance convenience, expand choice, and cater to evolving consumer preferences.

Propelling Factors for Singapore Ready-to-Eat Food Market Growth

The market's growth is propelled by several factors: rising disposable incomes, increasing urbanization and fast-paced lifestyles, the growing popularity of convenient food options, and increased demand for healthier and more diverse food choices. Government support for food innovation and the development of food technology further boosts the sector.

Obstacles in the Singapore Ready-to-Eat Food Market

Challenges include stringent food safety regulations demanding high compliance costs, potential supply chain disruptions impacting product availability, and intense competition among existing players, particularly in the most popular ready-to-eat product categories.

Future Opportunities in Singapore Ready-to-Eat Food Market

Opportunities lie in expanding into niche segments (e.g., organic, vegan, gluten-free), leveraging technological advancements in food preservation and packaging to enhance shelf life and convenience, and capitalizing on growing demand for personalized nutrition solutions and meal kits.

Major Players in the Singapore Ready-to-Eat Food Market Ecosystem

- Impossible Foods

- Nestle SA

- McCain Foods

- Prima Food Pte Ltd (Prima Taste)

- OTS Holdings

- General Mills Inc

- Slect Group Pte Ltd

- PepsiCo Inc

- Kellogg Co

- Pondok Abang

- Nissin Foods Holdings Co Ltd

- Food Box

- Health Food Matters

Key Developments in Singapore Ready-to-Eat Food Market Industry

- May 2021: Impossible Foods launched its first ready-to-eat Impossible Burger in Singapore.

- September 2021: Nissin Foods Singapore launched the Nissin X IRVINS Salted Egg Instant Noodle Bowl.

- June 2022: OTS Holdings launched the plant-based ready-to-eat food brand ANEW.

Strategic Singapore Ready-to-Eat Food Market Forecast

The Singapore ready-to-eat food market is poised for sustained growth, driven by evolving consumer preferences and technological advancements. The market’s expansion into new product categories, coupled with the increasing adoption of online retail channels, presents significant opportunities for both established and emerging players. This positive outlook indicates a highly promising future for the Singapore ready-to-eat food market.

Singapore Ready-to-Eat Food Market Segmentation

-

1. Product Type

- 1.1. Instant Breakfast/Cereals

- 1.2. Instant Soups and Snacks

- 1.3. Ready Meals

- 1.4. Baked Goods

- 1.5. Meat Products

- 1.6. Other Product Types

-

2. Distribution Channel

- 2.1. Hypermarkets/Supermarkets

- 2.2. Convenience/Grocery Stores

- 2.3. Specialty Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

Singapore Ready-to-Eat Food Market Segmentation By Geography

- 1. Singapore

Singapore Ready-to-Eat Food Market Regional Market Share

Geographic Coverage of Singapore Ready-to-Eat Food Market

Singapore Ready-to-Eat Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand For Ready Meals Food Products to Influence Growth; Increasing Demand for Organic and Vegan Ready-to-Eat food products.

- 3.3. Market Restrains

- 3.3.1. Rising Concern Over Health Issues Associated with Processed Foods

- 3.4. Market Trends

- 3.4.1. Demand Surge for Convenient and Healthy Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Ready-to-Eat Food Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Instant Breakfast/Cereals

- 5.1.2. Instant Soups and Snacks

- 5.1.3. Ready Meals

- 5.1.4. Baked Goods

- 5.1.5. Meat Products

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/Supermarkets

- 5.2.2. Convenience/Grocery Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Impossible Foods

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestle SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 McCain Foods

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Prima Food Pte Ltd (Prima Taste)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 OTS Holdings *List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 General Mills Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Slect Group Pte Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PepsiCo Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kellogg Co

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Pondok Abang

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Nissin Foods Holdings Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Food Box

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Health Food Matters

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Impossible Foods

List of Figures

- Figure 1: Singapore Ready-to-Eat Food Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Singapore Ready-to-Eat Food Market Share (%) by Company 2025

List of Tables

- Table 1: Singapore Ready-to-Eat Food Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Singapore Ready-to-Eat Food Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Singapore Ready-to-Eat Food Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Singapore Ready-to-Eat Food Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 5: Singapore Ready-to-Eat Food Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Singapore Ready-to-Eat Food Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Ready-to-Eat Food Market?

The projected CAGR is approximately 3.35%.

2. Which companies are prominent players in the Singapore Ready-to-Eat Food Market?

Key companies in the market include Impossible Foods, Nestle SA, McCain Foods, Prima Food Pte Ltd (Prima Taste), OTS Holdings *List Not Exhaustive, General Mills Inc, Slect Group Pte Ltd, PepsiCo Inc, Kellogg Co, Pondok Abang, Nissin Foods Holdings Co Ltd, Food Box, Health Food Matters.

3. What are the main segments of the Singapore Ready-to-Eat Food Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 124.76 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand For Ready Meals Food Products to Influence Growth; Increasing Demand for Organic and Vegan Ready-to-Eat food products..

6. What are the notable trends driving market growth?

Demand Surge for Convenient and Healthy Food.

7. Are there any restraints impacting market growth?

Rising Concern Over Health Issues Associated with Processed Foods.

8. Can you provide examples of recent developments in the market?

June 2022: OTS Holdings Limited, a brand builder and food manufacturing group, launched a plant-based, ready-to-eat food brand ANEW that aims to deliver quality, nutrition, and convenience to consumers with a taste of heritage.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Ready-to-Eat Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Ready-to-Eat Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Ready-to-Eat Food Market?

To stay informed about further developments, trends, and reports in the Singapore Ready-to-Eat Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence