Key Insights

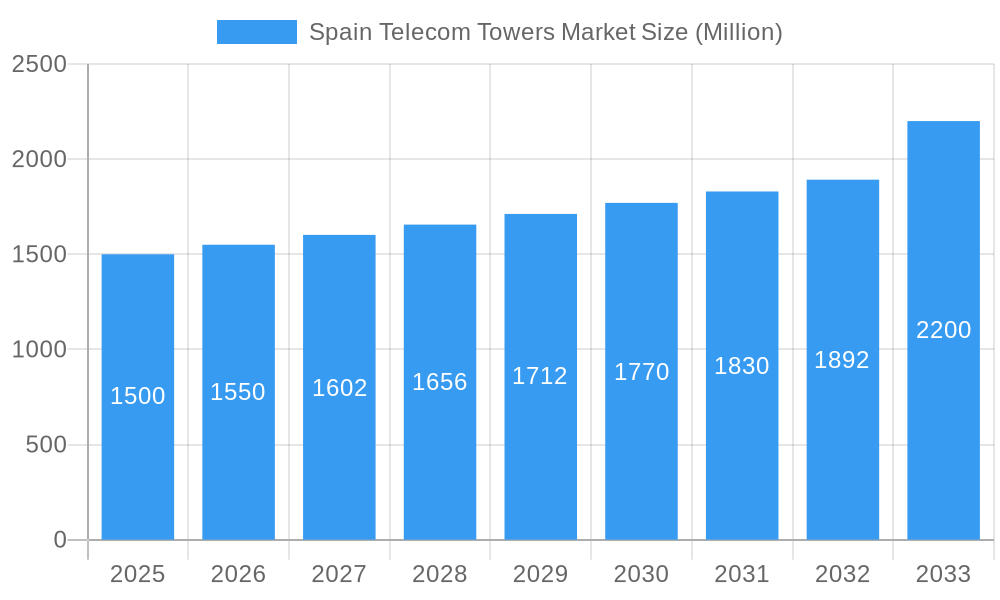

The Spain Telecom Towers market, valued at €32.85 billion in the base year 2024, is poised for significant expansion. This growth is underpinned by escalating mobile data consumption, the widespread deployment of 5G networks, and strategic consolidation within the telecom infrastructure sector. Leading entities, including Phoenix Tower International, American Tower Spain, and Cellnex Telecom SA, are making substantial investments in tower infrastructure to address the burgeoning demand. The market's Compound Annual Growth Rate (CAGR) of 2.9% forecasts consistent expansion through 2033, projecting a market size of approximately €38.7 billion by the end of the forecast period. This upward trajectory is further propelled by the increasing adoption of smartphones and the proliferation of IoT devices, creating a critical need for robust and reliable network coverage.

Spain Telecom Towers Market Market Size (In Billion)

Potential challenges to market growth include navigating regulatory complexities associated with permitting and site acquisition, alongside the risk of economic downturns. Market segmentation is expected to encompass macro towers, rooftop towers, and in-building solutions, each designed to meet distinct network deployment requirements. Regional market dynamics may vary, with higher demand anticipated in densely populated urban centers compared to rural areas. The competitive landscape features established tower operators alongside emerging specialized providers, fostering opportunities for strategic alliances and mergers to enhance market presence and broaden geographical reach.

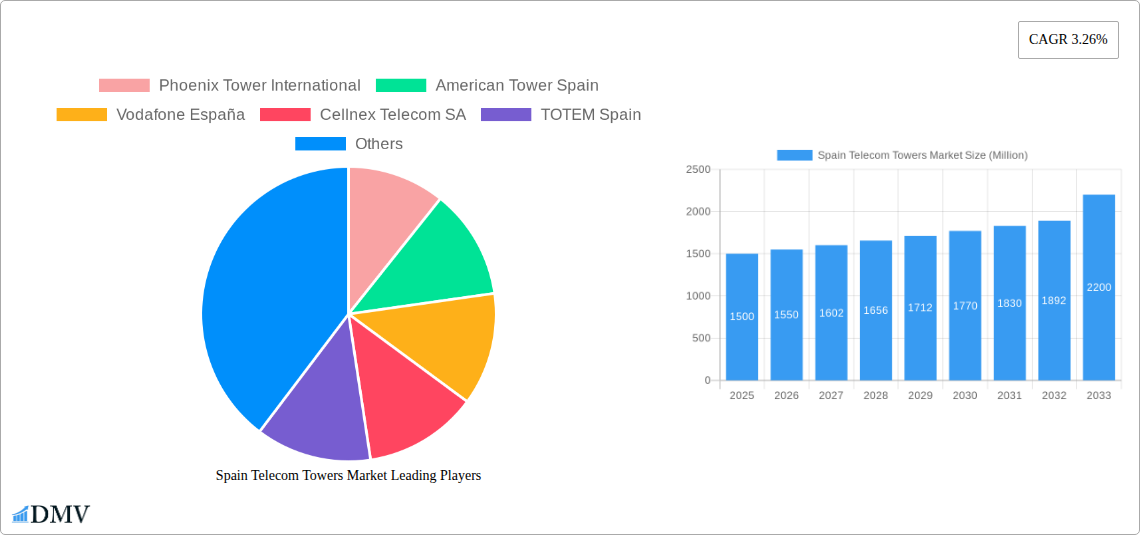

Spain Telecom Towers Market Company Market Share

The historical period (2019-2024) reflects a phase of steady market expansion, influenced by the maturation of 4G technology and increasing mobile subscriber penetration. The base year, 2024, marks a crucial inflection point, characterized by accelerated growth driven by 5G infrastructure demands. The forecast period (2024-2033) anticipates sustained growth, propelled by ongoing technological advancements and the increasing requirement for seamless connectivity across diverse industries. Detailed regional analysis will provide a more granular understanding of market dynamics within Spain. While dominant players currently shape the market, innovative technologies and new entrants possess the potential to reshape the competitive structure over the long term.

Spain Telecom Towers Market Analysis: Trends, Opportunities, and Forecast (2019-2033)

This comprehensive report offers an in-depth analysis of the Spanish Telecom Towers market, detailing key trends, major stakeholders, and future growth projections. Spanning from 2019 to 2033, with a specific focus on 2024 as the base year, this report is an indispensable resource for stakeholders aiming to identify and leverage opportunities within this dynamic sector. The market is projected to reach approximately $38.7 billion by 2033, underscoring substantial growth potential.

Spain Telecom Towers Market Market Composition & Trends

The Spain Telecom Towers market exhibits a moderately consolidated structure, with key players like Cellnex Telecom SA, American Tower Spain, and Telefónica holding significant market share. However, the entry of new players and M&A activities are reshaping the competitive landscape. Innovation in tower infrastructure, driven by the increasing demand for 5G and other advanced technologies, is a significant catalyst for market growth. The regulatory environment, while generally supportive of infrastructure development, presents certain challenges related to permitting and spectrum allocation. Substitute products, such as distributed antenna systems (DAS), present niche competition but haven't significantly impacted the dominance of traditional towers. End-user profiles consist primarily of mobile network operators (MNOs) and, increasingly, independent tower companies (ITCs). Recent M&A activity has involved significant investments, with deal values ranging from xx Million to xx Million, indicating substantial consolidation efforts within the sector.

- Market Concentration: Moderately consolidated, with top 3 players holding approximately xx% market share in 2024.

- Innovation Catalysts: 5G deployment, increasing data consumption, and demand for improved network coverage.

- Regulatory Landscape: Supportive but with challenges in permitting and spectrum allocation.

- Substitute Products: DAS and other distributed antenna systems present limited competition.

- End-User Profiles: Primarily MNOs and increasingly ITCs.

- M&A Activity: Significant M&A activity with deal values ranging from xx Million to xx Million in the last five years.

Spain Telecom Towers Market Industry Evolution

The Spain Telecom Towers market has witnessed robust growth throughout the historical period (2019-2024), fueled by rising mobile penetration, the expansion of 4G networks, and the early stages of 5G rollout. Technological advancements, including the deployment of small cells and the integration of IoT devices, have further stimulated demand. Consumer demand for higher data speeds and improved network reliability continues to drive investment in modern tower infrastructure. The market experienced a Compound Annual Growth Rate (CAGR) of xx% between 2019 and 2024. The forecast period (2025-2033) projects continued expansion, with a projected CAGR of xx%, driven primarily by the widespread adoption of 5G technology and the increasing need for enhanced network capacity to support emerging applications like the Internet of Things (IoT). The market size is anticipated to reach xx Million by 2033. This growth is also being fueled by government initiatives promoting digital infrastructure development. The continued investment in network upgrades by major MNOs will solidify this expansion further.

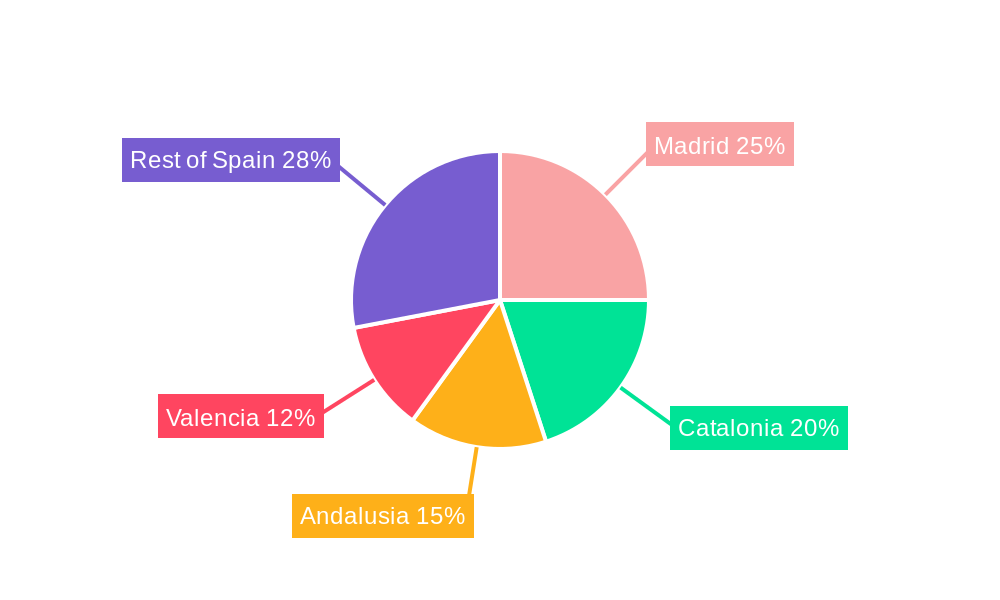

Leading Regions, Countries, or Segments in Spain Telecom Towers Market

The Madrid and Barcelona metropolitan areas, along with other major urban centers, represent the dominant regions within the Spain Telecom Towers market. These areas benefit from high population density, significant mobile penetration rates, and intense competition among MNOs, all driving demand for advanced tower infrastructure.

- Key Drivers:

- High population density and mobile penetration in major urban areas.

- Intense competition among MNOs for market share and superior network coverage.

- Significant investments in 5G network deployments.

- Supportive regulatory environment promoting digital infrastructure development. The dominance of these regions is further bolstered by the strategic location of these cities, enabling efficient coverage and accessibility for a large number of users. The concentration of MNO headquarters and significant technological advancements contribute to increased investment and consequently growth in these areas.

Spain Telecom Towers Market Product Innovations

Recent product innovations focus on enhancing tower capacity, improving energy efficiency, and optimizing site acquisition. This includes the deployment of innovative antenna technologies, the integration of smart solutions for remote monitoring and maintenance, and the adoption of environmentally friendly materials. These advancements aim to reduce operational costs, improve network performance, and minimize environmental impact. Key performance metrics tracked include power consumption, network capacity, and maintenance costs. The unique selling propositions of new products often focus on improved energy efficiency, reduced maintenance requirements, and enhanced capacity to meet the demands of 5G and beyond.

Propelling Factors for Spain Telecom Towers Market Growth

Several factors drive the growth of the Spain Telecom Towers market. The increasing adoption of 5G technology necessitates enhanced infrastructure, leading to increased demand for towers. Furthermore, the growth of the IoT sector requires significantly increased network capacity, further boosting the demand for advanced tower infrastructure. Government initiatives supporting digital infrastructure development and favorable regulatory frameworks further contribute to market expansion.

Obstacles in the Spain Telecom Towers Market Market

The Spain Telecom Towers market faces certain obstacles, including obtaining necessary permits and approvals for new tower installations, which can be time-consuming and complex. Supply chain disruptions can lead to delays and increased costs for tower construction and maintenance. The competitive landscape, with a mix of established players and new entrants, also creates pressure on pricing and profitability. These factors can collectively impact the market's growth trajectory.

Future Opportunities in Spain Telecom Towers Market

Future opportunities lie in the expansion of 5G networks into underserved rural areas and the growing demand for private 5G networks for industrial applications. The integration of AI and IoT technologies into tower management systems presents a significant opportunity for optimization and improved efficiency. The increasing demand for edge computing will also drive investment in tower infrastructure.

Major Players in the Spain Telecom Towers Market Ecosystem

- Phoenix Tower International

- American Tower Spain

- Vodafone España

- Cellnex Telecom SA

- TOTEM Spain

- Orange SA

- Vantage Towers

- Telefónic

Key Developments in Spain Telecom Towers Market Industry

- June 2024: Telefónica (Movistar) deployed high-performance 5G in the 3.5 GHz band across over 1,000 municipalities, significantly expanding 5G coverage nationwide. This development is a key driver of increased demand for tower infrastructure to support the expanded network.

- May 2024: O2 (Movistar) launched 5G Standalone (5G SA) services in multiple cities, further stimulating demand for advanced tower infrastructure capable of supporting 5G SA capabilities.

Strategic Spain Telecom Towers Market Market Forecast

The Spain Telecom Towers market is poised for sustained growth, driven by the continued rollout of 5G networks, the expansion of IoT applications, and ongoing investments in digital infrastructure. The market's potential is significant, with continued expansion expected across urban and rural areas, fueled by increasing mobile penetration and data consumption. The predicted growth aligns well with government incentives fostering technological advancements in the telecommunication sector.

Spain Telecom Towers Market Segmentation

-

1. Ownership

- 1.1. Operator-owned

- 1.2. Private-owned

- 1.3. MNO Captive sites

-

2. Installation

- 2.1. Rooftop

- 2.2. Ground-based

-

3. Fuel Type

- 3.1. Renewable

- 3.2. Non-renewable

Spain Telecom Towers Market Segmentation By Geography

- 1. Spain

Spain Telecom Towers Market Regional Market Share

Geographic Coverage of Spain Telecom Towers Market

Spain Telecom Towers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs

- 3.3. Market Restrains

- 3.3.1. Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs

- 3.4. Market Trends

- 3.4.1. 5G Deployments Are a Major Catalyst for Growth in the Cell-tower Leasing Environment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Telecom Towers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 5.1.1. Operator-owned

- 5.1.2. Private-owned

- 5.1.3. MNO Captive sites

- 5.2. Market Analysis, Insights and Forecast - by Installation

- 5.2.1. Rooftop

- 5.2.2. Ground-based

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Renewable

- 5.3.2. Non-renewable

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Phoenix Tower International

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 American Tower Spain

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vodafone España

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cellnex Telecom SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TOTEM Spain

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Orange SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vantage Towers

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Telefónic

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Phoenix Tower International

List of Figures

- Figure 1: Spain Telecom Towers Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Spain Telecom Towers Market Share (%) by Company 2025

List of Tables

- Table 1: Spain Telecom Towers Market Revenue billion Forecast, by Ownership 2020 & 2033

- Table 2: Spain Telecom Towers Market Revenue billion Forecast, by Installation 2020 & 2033

- Table 3: Spain Telecom Towers Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 4: Spain Telecom Towers Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Spain Telecom Towers Market Revenue billion Forecast, by Ownership 2020 & 2033

- Table 6: Spain Telecom Towers Market Revenue billion Forecast, by Installation 2020 & 2033

- Table 7: Spain Telecom Towers Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 8: Spain Telecom Towers Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Telecom Towers Market?

The projected CAGR is approximately 2.9%.

2. Which companies are prominent players in the Spain Telecom Towers Market?

Key companies in the market include Phoenix Tower International, American Tower Spain, Vodafone España, Cellnex Telecom SA, TOTEM Spain, Orange SA, Vantage Towers, Telefónic.

3. What are the main segments of the Spain Telecom Towers Market?

The market segments include Ownership, Installation, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.85 billion as of 2022.

5. What are some drivers contributing to market growth?

Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs.

6. What are the notable trends driving market growth?

5G Deployments Are a Major Catalyst for Growth in the Cell-tower Leasing Environment.

7. Are there any restraints impacting market growth?

Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs.

8. Can you provide examples of recent developments in the market?

June 2024: Spanish telecommunications operator Telefónica, operating under the Movistar brand, successfully deployed high-performance 5G in the 3.5 GHz band across more than 1,000 municipalities in Spain. The carrier announced that this spectrum allowed it to deploy 5G technology across nearly all of Spain, encompassing both rural and urban regions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Telecom Towers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Telecom Towers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Telecom Towers Market?

To stay informed about further developments, trends, and reports in the Spain Telecom Towers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence