Key Insights

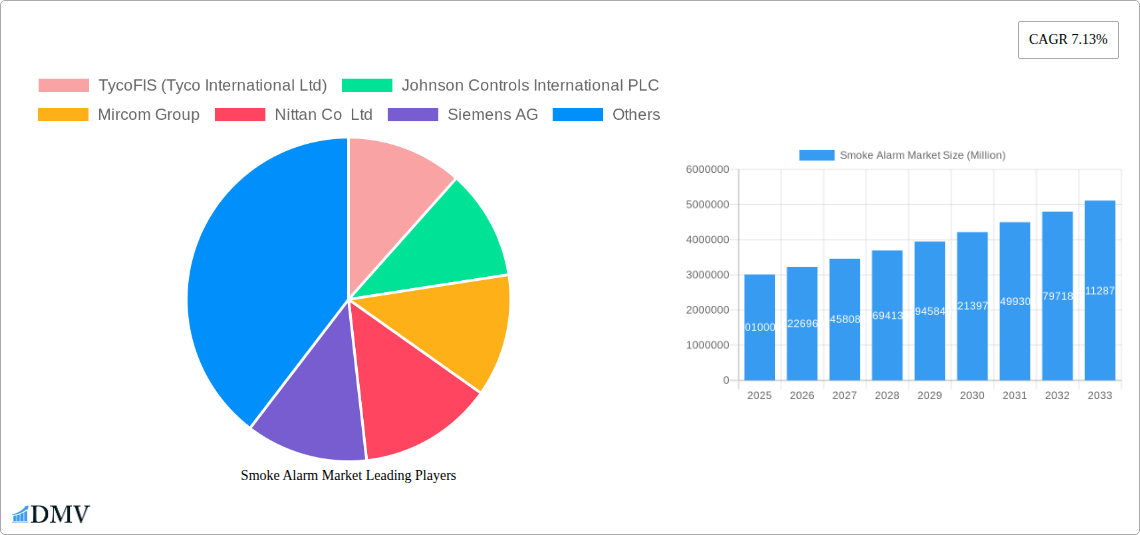

The global smoke alarm market is poised for significant expansion, projected to reach \$3.01 million with a robust Compound Annual Growth Rate (CAGR) of 7.13% from 2019 to 2033. This impressive growth trajectory is primarily fueled by increasing global awareness of fire safety regulations, a rise in residential and commercial construction, and advancements in smart home technology integrating smoke detection capabilities. Key drivers include stringent government mandates for smoke alarm installation in new and existing buildings, coupled with a growing consumer demand for enhanced safety solutions. The market is segmented into various technology types, with ionization and photoelectric smoke detection devices holding dominant positions due to their reliability and cost-effectiveness. Beam smoke detection devices are also gaining traction in larger commercial and industrial settings. End-user industries such as commercial and residential sectors are the largest contributors, driven by safety compliance and personal security concerns.

Smoke Alarm Market Market Size (In Million)

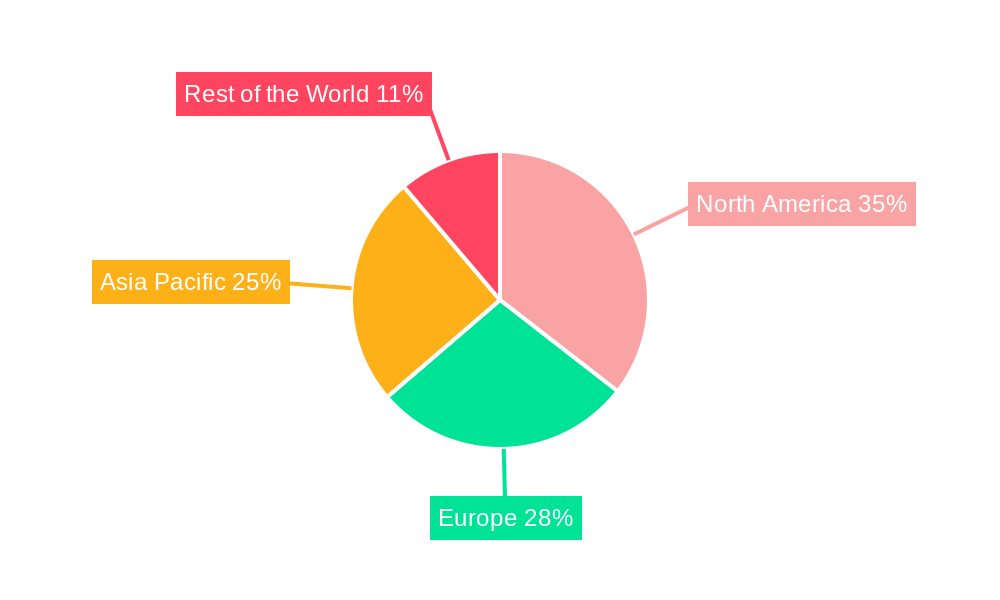

The market's dynamism is further shaped by emerging trends like the integration of IoT and AI in smoke alarms, enabling features such as remote monitoring, mobile alerts, and self-testing functionalities. These "smart" smoke alarms are particularly appealing to tech-savvy consumers and the burgeoning smart home ecosystem. Despite the positive outlook, the market faces certain restraints, including the initial cost of advanced smoke alarm systems and potential consumer apathy towards regular maintenance and battery replacement, which can impact their long-term effectiveness. However, the increasing affordability of these devices and ongoing promotional efforts by manufacturers are expected to mitigate these challenges. Geographically, North America and Europe currently lead the market, driven by established safety regulations and high disposable incomes. The Asia Pacific region, however, is anticipated to exhibit the fastest growth, propelled by rapid urbanization, increasing construction activities, and a growing emphasis on fire safety awareness in developing economies like China and India. Leading companies like Johnson Controls, Siemens, and Honeywell are at the forefront of innovation, continually introducing advanced and interconnected smoke detection solutions.

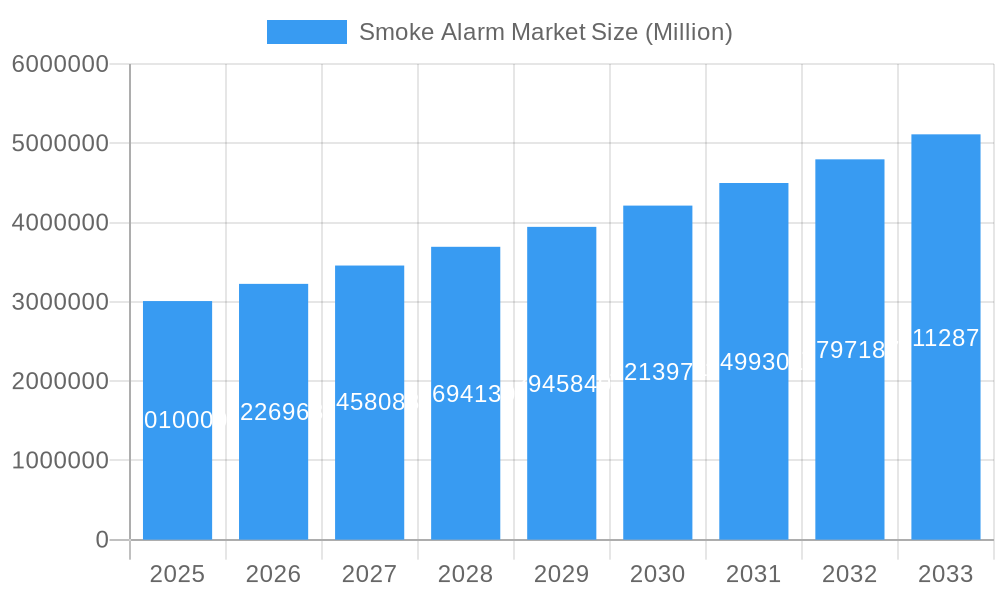

Smoke Alarm Market Company Market Share

This in-depth Smoke Alarm Market report provides a comprehensive analysis of the global fire safety market, focusing on the evolving landscape of smoke detection devices. Spanning a study period of 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, this report offers unparalleled insights into market dynamics, technological advancements, and future growth trajectories. We delve into the market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, and future opportunities, equipping stakeholders with actionable intelligence. The report analyzes the intricate interplay of ionization smoke detection devices, photoelectric smoke detection devices, and emerging beam smoke detection devices, alongside their adoption across commercial, residential, transportation & logistics, oil & gas, and other end-user industries. With a focus on key players and critical industry developments, this report is an indispensable resource for manufacturers, suppliers, investors, and industry experts navigating the competitive smart smoke detector and connected fire safety solutions arena.

Smoke Alarm Market Market Composition & Trends

The smoke alarm market exhibits a moderate to high degree of concentration, driven by a blend of established players and emerging innovators. Market dynamics are significantly influenced by stringent building codes and fire safety regulations across developed and developing economies, acting as a primary catalyst for sustained demand for reliable smoke detectors. Innovation is heavily geared towards the development of smart smoke alarms and interconnected systems, responding to growing consumer demand for enhanced safety and convenience. The proliferation of IoT and smart home technology is further accelerating this trend, with Wi-Fi enabled and app-controlled smoke alarms gaining significant traction. Substitute products, such as advanced fire sprinkler systems, exist but are often complementary rather than direct replacements in most applications. End-user profiles range from individual homeowners seeking basic protection to large-scale commercial enterprises and industrial facilities requiring sophisticated, integrated fire detection systems. Mergers and acquisitions (M&A) activity remains a key strategy for market consolidation and the acquisition of innovative technologies, with recent deal values in the high hundreds of millions of dollars. The market share distribution is dynamic, with leading companies like Johnson Controls, TycoFIS, and Siemens AG holding significant portions, while niche players focus on specialized or advanced wireless smoke alarms. Understanding these intricate market components is crucial for forecasting future smoke alarm market size and opportunities.

Smoke Alarm Market Industry Evolution

The smoke alarm market has undergone a significant transformation over the historical period of 2019–2024, and is poised for accelerated growth through 2033. This evolution is characterized by a consistent upward trajectory in market value, driven by escalating awareness of fire safety and increasing regulatory mandates for the installation of compliant fire detection solutions. Early market dominance was largely held by traditional ionization smoke detection devices, favored for their cost-effectiveness. However, advancements in sensing technology have propelled the widespread adoption of photoelectric smoke detection devices, renowned for their superior performance in detecting smoldering fires, a significant cause of residential fire fatalities. The advent of the smart home ecosystem has been a pivotal factor, shifting consumer preference towards connected smoke alarms and IoT-enabled fire safety devices. These devices offer enhanced functionalities such as remote monitoring, instant alerts to mobile devices, and seamless integration with other smart home appliances. This shift has also spurred the development of multi-sensor smoke alarms that combine both ionization and photoelectric technologies for broader detection capabilities.

The forecast period of 2025–2033 is expected to witness further market expansion, fueled by government initiatives promoting fire safety and the increasing need for advanced protection in commercial and industrial settings. The transportation & logistics and oil & gas sectors, with their inherent risks, are becoming significant growth avenues for specialized industrial smoke detectors and robust fire suppression systems. The market’s growth rate is projected to be in the high single digits, a testament to the continuous innovation and increasing demand for enhanced safety features. Adoption metrics for smart smoke alarms have surged, with a considerable percentage of new residential constructions and major renovations now incorporating these advanced systems. The ongoing research and development in areas like AI-powered anomaly detection and predictive maintenance for fire safety equipment will further shape the smoke alarm industry. The demand for interoperable wireless fire alarm systems that can communicate effectively with emergency services is also a key trend shaping the industry's future.

Leading Regions, Countries, or Segments in Smoke Alarm Market

The dominance within the smoke alarm market is multifaceted, with significant influence stemming from both regional factors and specific technology types and end-user industries. North America, particularly the United States, consistently leads the market due to its robust fire safety regulations, high disposable incomes, and a mature smart home adoption rate. The strong emphasis on residential safety, coupled with stringent building codes that mandate the installation of interconnected smoke alarms, drives substantial demand for both ionization smoke detection devices and photoelectric smoke detection devices.

Within the Technology Type segment, photoelectric smoke detection devices are increasingly capturing market share. This is primarily due to their enhanced ability to detect smoldering fires, which are responsible for a larger proportion of fire fatalities compared to flaming fires. Regulatory bodies and safety organizations worldwide are emphasizing the benefits of photoelectric technology, further boosting its adoption. While ionization smoke detection devices remain popular due to their lower cost and effectiveness against fast-flaming fires, the trend is leaning towards dual-sensor alarms or standalone photoelectric units for comprehensive protection. Beam smoke detection devices, while currently holding a smaller market share, are witnessing significant growth in specialized applications, particularly in large industrial spaces, warehouses, and open-plan commercial areas where traditional spot detectors are less effective.

In terms of End-user Industry, the residential segment remains the largest and most consistent driver of smoke alarm sales. This is underpinned by mandatory installations in new homes and renovations, as well as the growing consumer preference for smart and interconnected home fire safety systems. The commercial segment follows closely, encompassing office buildings, retail spaces, hotels, and educational institutions. These sectors require not only individual smoke detectors but also integrated fire alarm panels and sophisticated detection systems to ensure the safety of occupants and assets. The transportation & logistics sector, including aviation, maritime, and road transport, presents a growing opportunity as stringent safety regulations necessitate advanced fire detection capabilities. Similarly, the oil & gas industry, with its high-risk environments, demands specialized, robust, and often explosion-proof industrial smoke detection solutions. The overarching trend across all segments is the increasing integration of smart features and connectivity, driving the demand for smart smoke alarms and comprehensive fire protection solutions.

Smoke Alarm Market Product Innovations

Product innovation in the smoke alarm market is primarily focused on enhancing detection accuracy, improving user experience through smart connectivity, and ensuring interoperability within smart home ecosystems. Recent advancements include the development of dual-sensor smoke alarms that combine ionization and photoelectric technologies for comprehensive fire detection, addressing the limitations of single-sensor units. The integration of Wi-Fi connectivity and Bluetooth technology has enabled the creation of smart smoke alarms that send real-time alerts to user smartphones, allowing for remote monitoring and immediate response. These smart devices often feature advanced functionalities such as voice alerts, self-testing capabilities, and integration with virtual assistants. Furthermore, the development of connected smoke alarm systems allows for seamless communication between multiple alarms, ensuring that an alert in one area triggers a response throughout the entire property. Performance metrics are continually being refined, with a focus on reducing false alarms while maintaining rapid and reliable detection of various fire types.

Propelling Factors for Smoke Alarm Market Growth

The smoke alarm market is propelled by several key factors driving its sustained growth. Firstly, stringent government regulations and building codes mandating the installation of smoke detectors in residential and commercial properties worldwide is a fundamental driver. Secondly, the increasing consumer awareness regarding fire safety, amplified by media coverage of fire incidents and their devastating consequences, is a significant catalyst for adoption. The escalating trend of smart home adoption and the burgeoning IoT ecosystem are fostering demand for smart smoke alarms with advanced connectivity features like Wi-Fi and app control, enabling remote monitoring and alerts. Technological advancements leading to the development of more accurate and reliable photoelectric smoke detection devices and dual-sensor smoke alarms further enhance safety and consumer confidence. Finally, the growing urbanization and construction of new residential and commercial buildings necessitate the installation of compliant fire safety systems.

Obstacles in the Smoke Alarm Market Market

Despite robust growth, the smoke alarm market faces certain obstacles. A significant challenge includes the high cost associated with advanced smart smoke alarms and interconnected systems, which can be a barrier for budget-conscious consumers, particularly in developing economies. The complexity of installation and maintenance for some integrated fire detection systems can also deter adoption. Ensuring interoperability between different brands and platforms of connected smoke alarms remains an ongoing challenge, potentially limiting the seamless integration desired by consumers. Furthermore, the presence of counterfeit or sub-standard products in the market can erode consumer trust and pose safety risks, necessitating stricter market surveillance and regulatory enforcement. Supply chain disruptions, as seen in recent global events, can impact the availability and cost of components, affecting production timelines and pricing strategies for manufacturers of fire safety equipment.

Future Opportunities in Smoke Alarm Market

The future of the smoke alarm market is brimming with opportunities, driven by innovation and evolving consumer needs. The increasing penetration of the Internet of Things (IoT) and smart home technology presents a significant opportunity for the proliferation of connected smoke alarms and integrated smart fire safety solutions. The development of AI-powered smoke detection algorithms that can differentiate between various types of smoke and potentially predict fire risks offers a path towards more intelligent and proactive safety systems. Emerging markets in Asia-Pacific and Latin America, with their rapidly growing populations and increasing focus on fire safety, represent untapped potential for smoke detector sales. The demand for specialized industrial smoke detectors for high-risk environments like the oil and gas, mining, and manufacturing sectors is also expected to grow. Furthermore, the development of long-lasting, maintenance-free wireless smoke alarms and the integration of advanced features such as air quality monitoring within smoke alarm units could open new avenues for product differentiation and market expansion.

Major Players in the Smoke Alarm Market Ecosystem

- TycoFIS (Tyco International Ltd)

- Johnson Controls International PLC

- Mircom Group

- Nittan Co Ltd

- Siemens AG

- Kidde Fire Safety (United Technologies Corporation)

- Nest Labs (Google LLC)

- Honeywell International

- ABB Group

- Hochiki Corporation

- Robert Bosch GmbH

Key Developments in Smoke Alarm Market Industry

- January 2022: Kidde launched its Smoke + Carbon Monoxide Alarm, which boasts various smart features, Wi-Fi connectivity, and can be managed via a new mobile app. This product represents one of the first smart systems capable of transforming existing Kidde hardwired interconnected alarms into smart ones, offering a comprehensive and easily integrated solution for whole-home protection.

- April 2021: Siemens AG's Smart Infrastructure business enhanced its portfolio for the small to medium-sized property sector with the release of Cerberus FIT, a new edition of its fire prevention system.

Strategic Smoke Alarm Market Market Forecast

The smoke alarm market is strategically positioned for robust growth, driven by a convergence of technological innovation, evolving regulatory landscapes, and heightened consumer safety consciousness. The forecast period, 2025–2033, is anticipated to witness significant expansion, fueled by the increasing adoption of smart smoke alarms and IoT-enabled fire safety solutions. The continuous integration of advanced sensing technologies, coupled with the proliferation of smart home ecosystems, will drive demand for more sophisticated and interconnected fire detection systems. Opportunities in emerging markets, coupled with the ongoing need for enhanced safety in commercial and industrial sectors, will further bolster market potential. Companies focusing on user-friendly interfaces, seamless integration, and reliable performance will be well-positioned to capitalize on the evolving global smoke alarm market. The emphasis on preventative fire safety and proactive threat detection will remain a cornerstone of strategic development, ensuring a sustained upward trajectory for the smoke alarm industry.

Smoke Alarm Market Segmentation

-

1. Technology Type

- 1.1. Ionization Smoke Detection Device

- 1.2. Photoelectric Smoke Detection Device

- 1.3. Beam Smoke Detection Device

-

2. End-user Industry

- 2.1. Commercial

- 2.2. Residential

- 2.3. Transportation & Logistics

- 2.4. Oil & Gas

- 2.5. Other End-user Industries

Smoke Alarm Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United Kingdom

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Latin America

- 4.2. Middle East

Smoke Alarm Market Regional Market Share

Geographic Coverage of Smoke Alarm Market

Smoke Alarm Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Concerns for Fire Safety; Implementation of Residential Safety Standards; Innovation in Sensor Technology

- 3.3. Market Restrains

- 3.3.1. Complications Regarding Installation of Smoke Detectors; Higher Costs of Replacements of Traditional Smoke Detectors with Smart Smoke Detectors

- 3.4. Market Trends

- 3.4.1. Residential Applications to Drive the Demand for Smoke Detectors

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smoke Alarm Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology Type

- 5.1.1. Ionization Smoke Detection Device

- 5.1.2. Photoelectric Smoke Detection Device

- 5.1.3. Beam Smoke Detection Device

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Commercial

- 5.2.2. Residential

- 5.2.3. Transportation & Logistics

- 5.2.4. Oil & Gas

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Technology Type

- 6. North America Smoke Alarm Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology Type

- 6.1.1. Ionization Smoke Detection Device

- 6.1.2. Photoelectric Smoke Detection Device

- 6.1.3. Beam Smoke Detection Device

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Commercial

- 6.2.2. Residential

- 6.2.3. Transportation & Logistics

- 6.2.4. Oil & Gas

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Technology Type

- 7. Europe Smoke Alarm Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology Type

- 7.1.1. Ionization Smoke Detection Device

- 7.1.2. Photoelectric Smoke Detection Device

- 7.1.3. Beam Smoke Detection Device

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Commercial

- 7.2.2. Residential

- 7.2.3. Transportation & Logistics

- 7.2.4. Oil & Gas

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Technology Type

- 8. Asia Pacific Smoke Alarm Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology Type

- 8.1.1. Ionization Smoke Detection Device

- 8.1.2. Photoelectric Smoke Detection Device

- 8.1.3. Beam Smoke Detection Device

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Commercial

- 8.2.2. Residential

- 8.2.3. Transportation & Logistics

- 8.2.4. Oil & Gas

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Technology Type

- 9. Rest of the World Smoke Alarm Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology Type

- 9.1.1. Ionization Smoke Detection Device

- 9.1.2. Photoelectric Smoke Detection Device

- 9.1.3. Beam Smoke Detection Device

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Commercial

- 9.2.2. Residential

- 9.2.3. Transportation & Logistics

- 9.2.4. Oil & Gas

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Technology Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 TycoFIS (Tyco International Ltd)

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Johnson Controls International PLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Mircom Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Nittan Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Siemens AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Kidde Fire Safety (United Technologies Corporation)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Nest Labs (Google LLC)*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Honeywell International

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 ABB Group

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Hochiki Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Robert Bosch GmbH

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 TycoFIS (Tyco International Ltd)

List of Figures

- Figure 1: Global Smoke Alarm Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Smoke Alarm Market Revenue (Million), by Technology Type 2025 & 2033

- Figure 3: North America Smoke Alarm Market Revenue Share (%), by Technology Type 2025 & 2033

- Figure 4: North America Smoke Alarm Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Smoke Alarm Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Smoke Alarm Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Smoke Alarm Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Smoke Alarm Market Revenue (Million), by Technology Type 2025 & 2033

- Figure 9: Europe Smoke Alarm Market Revenue Share (%), by Technology Type 2025 & 2033

- Figure 10: Europe Smoke Alarm Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Smoke Alarm Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Smoke Alarm Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Smoke Alarm Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Smoke Alarm Market Revenue (Million), by Technology Type 2025 & 2033

- Figure 15: Asia Pacific Smoke Alarm Market Revenue Share (%), by Technology Type 2025 & 2033

- Figure 16: Asia Pacific Smoke Alarm Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Smoke Alarm Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Smoke Alarm Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Smoke Alarm Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Smoke Alarm Market Revenue (Million), by Technology Type 2025 & 2033

- Figure 21: Rest of the World Smoke Alarm Market Revenue Share (%), by Technology Type 2025 & 2033

- Figure 22: Rest of the World Smoke Alarm Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Rest of the World Smoke Alarm Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Rest of the World Smoke Alarm Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Smoke Alarm Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Smoke Alarm Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 2: Global Smoke Alarm Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Smoke Alarm Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Smoke Alarm Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 5: Global Smoke Alarm Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Smoke Alarm Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Smoke Alarm Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Smoke Alarm Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Smoke Alarm Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 10: Global Smoke Alarm Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Smoke Alarm Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Germany Smoke Alarm Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Smoke Alarm Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Smoke Alarm Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Smoke Alarm Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Smoke Alarm Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 17: Global Smoke Alarm Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Smoke Alarm Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Smoke Alarm Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Smoke Alarm Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: South Korea Smoke Alarm Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Smoke Alarm Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Smoke Alarm Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 24: Global Smoke Alarm Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 25: Global Smoke Alarm Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Latin America Smoke Alarm Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Middle East Smoke Alarm Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smoke Alarm Market?

The projected CAGR is approximately 7.13%.

2. Which companies are prominent players in the Smoke Alarm Market?

Key companies in the market include TycoFIS (Tyco International Ltd), Johnson Controls International PLC, Mircom Group, Nittan Co Ltd, Siemens AG, Kidde Fire Safety (United Technologies Corporation), Nest Labs (Google LLC)*List Not Exhaustive, Honeywell International, ABB Group, Hochiki Corporation, Robert Bosch GmbH.

3. What are the main segments of the Smoke Alarm Market?

The market segments include Technology Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.01 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Concerns for Fire Safety; Implementation of Residential Safety Standards; Innovation in Sensor Technology.

6. What are the notable trends driving market growth?

Residential Applications to Drive the Demand for Smoke Detectors.

7. Are there any restraints impacting market growth?

Complications Regarding Installation of Smoke Detectors; Higher Costs of Replacements of Traditional Smoke Detectors with Smart Smoke Detectors.

8. Can you provide examples of recent developments in the market?

January 2022 - Kidde launched its Smoke + Carbon Monoxide Alarm, which has various smart features, and Wi-Fi connectivity and could be managed via a new mobile app. The company's new smoke alarm would be one of the first smart systems which could be used for transforming existing Kidde hardwired interconnected alarms into smart ones with a full and easily integrated solution that offers whole-home protection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smoke Alarm Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smoke Alarm Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smoke Alarm Market?

To stay informed about further developments, trends, and reports in the Smoke Alarm Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence