Key Insights

The Saudi Arabian telecom tower market is poised for significant expansion, propelled by the nation's Vision 2030 initiative. This strategic plan emphasizes digital transformation and infrastructure development, driving substantial investment in 5G network deployment. Consequently, demand for telecom towers is escalating to support enhanced network coverage and capacity. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.92% from 2025 to 2033. Key industry players, including Saudi Telecom, TAWAL, Zain Saudi Arabia, Mobily, and Virgin Mobile Saudi Arabia, are actively expanding their infrastructure, fostering a competitive and innovative landscape. Market segmentation is expected to encompass macro towers, small cells, and rooftop installations, addressing diverse network requirements. Further growth is attributed to rising smartphone penetration and data consumption across the Saudi population, necessitating more robust and extensive network infrastructure. Potential market restraints include regulatory complexities, land acquisition challenges, and significant upfront capital for tower construction. Despite these, the market outlook remains highly positive, supported by sustained government backing and the burgeoning digital economy.

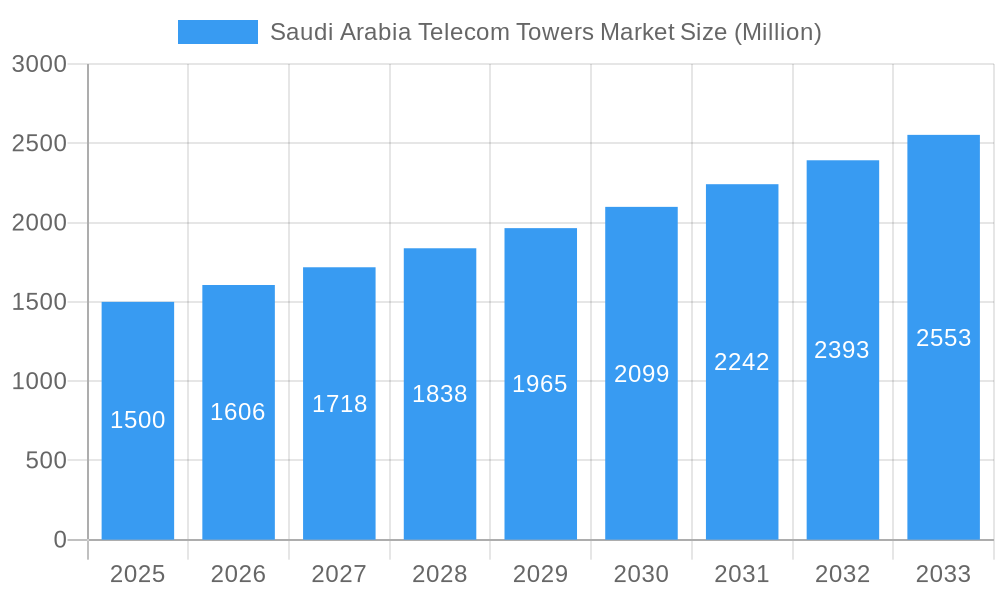

Saudi Arabia Telecom Towers Market Market Size (In Billion)

The forecast period, from 2025 to 2033, indicates sustained market growth, with potential acceleration as 5G adoption matures. The base year of 2025 provides a critical benchmark for assessing future market performance. Analysis of historical data from 2019 to 2024 offers valuable insights into market trends and refines future projections. Driven by strong growth factors and considerable investments, the market is anticipated to reach a substantial size by 2033, significantly exceeding its current valuation. The market size is estimated at 19.04 billion in the base year. Strategic collaborations between telecom operators and tower infrastructure providers are expected to further invigorate market dynamics. An increasing emphasis on sustainable and energy-efficient tower solutions will likely become a key differentiator as environmental considerations gain prominence.

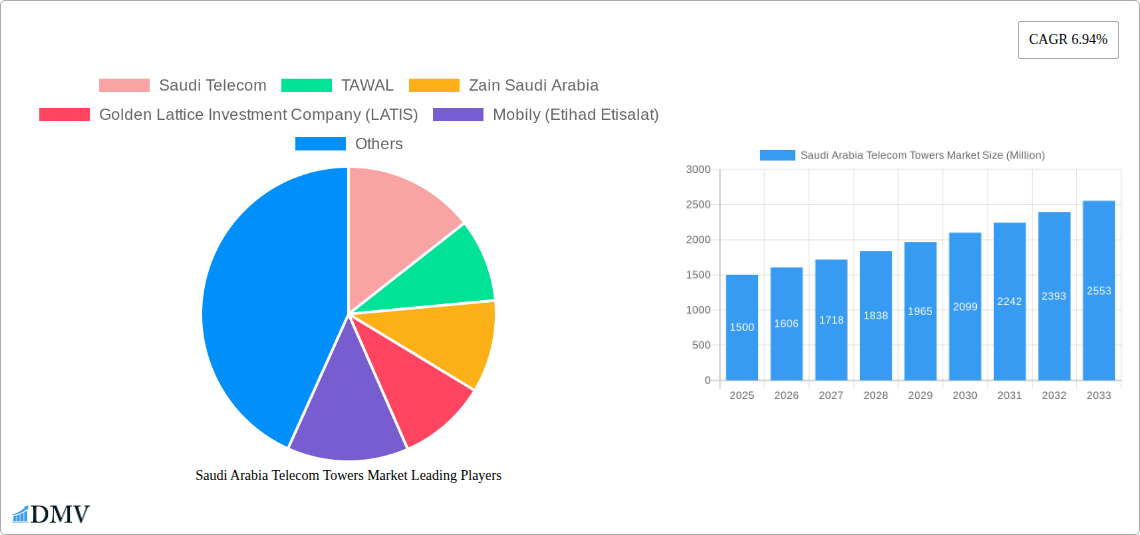

Saudi Arabia Telecom Towers Market Company Market Share

Saudi Arabia Telecom Towers Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Saudi Arabia Telecom Towers Market, offering a comprehensive overview of its current state, future trajectory, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report leverages extensive market research to provide stakeholders with actionable intelligence for informed decision-making. The market is poised for significant growth, driven by technological advancements, increasing mobile penetration, and government initiatives. This report is crucial for investors, telecom operators, tower companies, and industry analysts seeking to understand and capitalize on opportunities within this dynamic market. The total market value is projected to reach xx Million by 2033.

Saudi Arabia Telecom Towers Market Composition & Trends

This section delves into the intricate landscape of the Saudi Arabia Telecom Towers Market, examining market concentration, innovation drivers, regulatory frameworks, substitute technologies, end-user profiles, and mergers and acquisitions (M&A) activity. The market is characterized by a moderately concentrated structure, with key players such as Saudi Telecom, TAWAL, and Zain Saudi Arabia holding significant market share. However, the entry of new players and ongoing M&A activity are reshaping the competitive dynamics.

- Market Share Distribution (2024): Saudi Telecom (xx%), TAWAL (xx%), Zain Saudi Arabia (xx%), Mobily (xx%), Others (xx%). These figures represent estimates based on available data.

- Innovation Catalysts: The deployment of 5G technology, the rising demand for improved network coverage, and the adoption of smart city initiatives are fueling innovation.

- Regulatory Landscape: Government regulations regarding tower infrastructure, spectrum allocation, and environmental impact assessments play a significant role.

- Substitute Products: While traditional macrocell towers remain dominant, the emergence of small cells and distributed antenna systems (DAS) presents alternative solutions.

- End-User Profiles: The primary end-users include mobile network operators (MNOs), government agencies, and private sector businesses.

- M&A Activity: The recent merger of Saudi Telecom's TAWAL unit with Golden Lattice Investment Company (GLIC) highlights the significant M&A activity, with deal values estimated at xx Million in 2024 alone. This reflects strategic consolidation and expansion efforts within the sector.

Saudi Arabia Telecom Towers Market Industry Evolution

This section meticulously analyzes the evolution of the Saudi Arabia Telecom Towers Market from 2019 to 2024, projecting trends through 2033. The market has witnessed consistent growth fueled by increased mobile subscriptions and data consumption. Technological advancements, particularly the rollout of 5G networks, are driving demand for advanced tower infrastructure capable of supporting high-speed data transmission. Shifting consumer demands for seamless connectivity and improved network performance are further accelerating market growth.

The market exhibited a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). This growth is driven by factors such as increasing smartphone penetration, rising data consumption, and government initiatives promoting digital transformation. The adoption rate of 5G technology in the Kingdom is also expected to be a key driver of growth in the coming years. Moreover, the increasing demand for improved network coverage in remote and underserved areas will further fuel expansion.

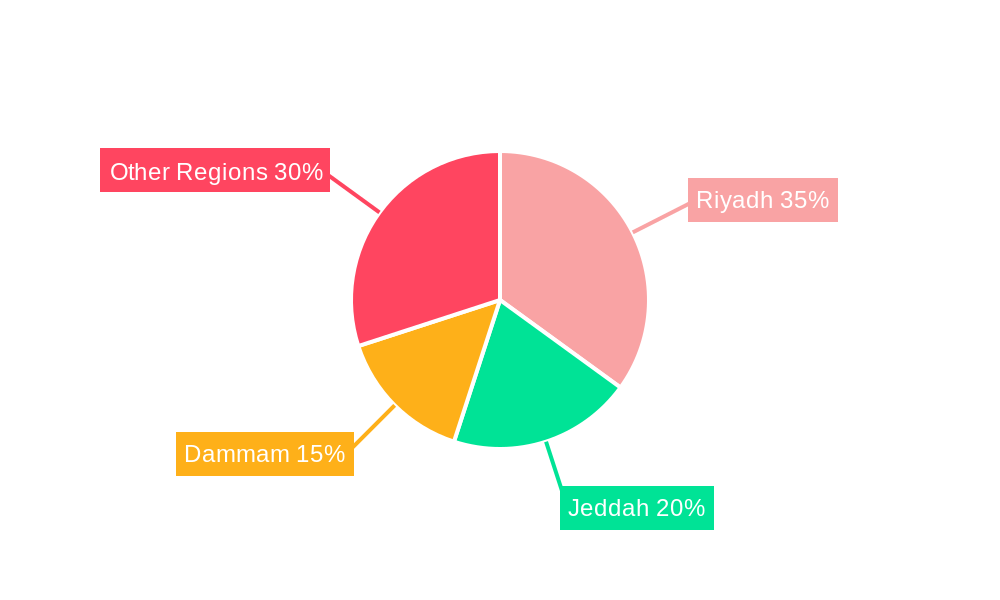

Leading Regions, Countries, or Segments in Saudi Arabia Telecom Towers Market

The Saudi Arabia Telecom Towers Market is predominantly concentrated in major urban centers such as Riyadh, Jeddah, and Dammam, driven by high population density and mobile usage. These regions benefit from significant investment in infrastructure development and robust regulatory support.

- Key Drivers in Dominant Regions:

- High Population Density: Concentrated populations in major cities translate to higher demand for telecom services and infrastructure.

- Government Initiatives: Government-led initiatives promoting digital transformation and infrastructure development are creating favorable conditions for market growth.

- Investment in 5G Networks: Significant investments in 5G network deployment are driving the need for modern, high-capacity tower infrastructure.

- Foreign Direct Investment (FDI): The inflow of FDI into the Saudi Arabian telecom sector further stimulates growth and development.

The dominance of these urban areas is largely attributed to their economic strength, higher mobile penetration rates, and proactive governmental support for infrastructure development. The focus on these regions is expected to continue throughout the forecast period, though expansion into less developed regions is likely to occur at a slower pace.

Saudi Arabia Telecom Towers Market Product Innovations

Recent product innovations in the Saudi Arabia Telecom Towers Market include the deployment of advanced antenna systems to enhance network capacity and improve signal quality. The integration of smart technologies and the use of environmentally friendly materials are gaining traction. Companies are focusing on unique selling propositions (USPs), such as improved energy efficiency and reduced environmental impact, to stay competitive. The development of multi-operator towers is also a key trend, aimed at optimizing resource utilization and reducing overall costs.

Propelling Factors for Saudi Arabia Telecom Towers Market Growth

Several factors are driving the growth of the Saudi Arabia Telecom Towers Market. Technological advancements, particularly the deployment of 5G, necessitate advanced infrastructure capable of handling increased bandwidth and data traffic. The economic growth of the country and the rising disposable incomes of consumers are leading to increased demand for mobile data services. Furthermore, supportive government policies and regulatory frameworks promote infrastructure development and attract investment in the sector.

Obstacles in the Saudi Arabia Telecom Towers Market

The Saudi Arabia Telecom Towers Market faces several challenges. Securing necessary permits and approvals for tower construction can be time-consuming and complex, creating regulatory hurdles. Supply chain disruptions and material cost fluctuations can impact profitability and project timelines. Intense competition among established players and the emergence of new entrants further intensify market pressures. These factors can potentially restrain market growth to some extent.

Future Opportunities in Saudi Arabia Telecom Towers Market

The Saudi Arabia Telecom Towers Market presents significant opportunities for growth. Expanding into underserved regions, leveraging the potential of small cells and DAS technologies, and investing in innovative tower designs will create new avenues for expansion. Meeting the rising demand for 5G infrastructure and providing advanced solutions for smart city applications are key opportunities. Furthermore, embracing sustainability initiatives and exploring partnerships to optimize resource utilization offer further prospects for growth and innovation.

Major Players in the Saudi Arabia Telecom Towers Market Ecosystem

- Saudi Telecom

- TAWAL

- Zain Saudi Arabia

- Golden Lattice Investment Company (LATIS)

- Mobily (Etihad Etisalat)

- Virgin Mobile Saudi Arabia

Key Developments in Saudi Arabia Telecom Towers Market Industry

- April 2024: Saudi Telecom Company finalized the merger of its TAWAL unit with Golden Lattice Investment Company (GLIC), creating a larger regional operation and bolstering international expansion plans.

- January 2024: RSG and Zain KSA collaborated on the design and installation of advanced telecom towers, improving communication experiences.

Strategic Saudi Arabia Telecom Towers Market Forecast

The Saudi Arabia Telecom Towers Market is poised for sustained growth over the forecast period, driven by the expansion of 5G networks, increasing mobile penetration, and supportive government policies. Opportunities exist in the deployment of advanced technologies, expansion into underserved areas, and strategic partnerships. The market's potential is significant, promising robust returns for investors and stakeholders willing to navigate the challenges and capitalize on emerging opportunities.

Saudi Arabia Telecom Towers Market Segmentation

-

1. Ownership

- 1.1. Operator-owned

- 1.2. Private-owned

- 1.3. MNO Captive sites

-

2. Installation

- 2.1. Rooftop

- 2.2. Ground-based

-

3. Fuel Type

- 3.1. Renewable

- 3.2. Non-renewable

Saudi Arabia Telecom Towers Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Telecom Towers Market Regional Market Share

Geographic Coverage of Saudi Arabia Telecom Towers Market

Saudi Arabia Telecom Towers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs

- 3.3. Market Restrains

- 3.3.1. Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs

- 3.4. Market Trends

- 3.4.1. 5G deployments are a major catalyst for growth in the cell-tower leasing environment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Telecom Towers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 5.1.1. Operator-owned

- 5.1.2. Private-owned

- 5.1.3. MNO Captive sites

- 5.2. Market Analysis, Insights and Forecast - by Installation

- 5.2.1. Rooftop

- 5.2.2. Ground-based

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Renewable

- 5.3.2. Non-renewable

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Saudi Telecom

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TAWAL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zain Saudi Arabia

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Golden Lattice Investment Company (LATIS)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mobily (Etihad Etisalat)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Virgin Mobile Saudi Arabi

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Saudi Telecom

List of Figures

- Figure 1: Saudi Arabia Telecom Towers Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Telecom Towers Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Telecom Towers Market Revenue billion Forecast, by Ownership 2020 & 2033

- Table 2: Saudi Arabia Telecom Towers Market Revenue billion Forecast, by Installation 2020 & 2033

- Table 3: Saudi Arabia Telecom Towers Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 4: Saudi Arabia Telecom Towers Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Telecom Towers Market Revenue billion Forecast, by Ownership 2020 & 2033

- Table 6: Saudi Arabia Telecom Towers Market Revenue billion Forecast, by Installation 2020 & 2033

- Table 7: Saudi Arabia Telecom Towers Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 8: Saudi Arabia Telecom Towers Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Telecom Towers Market?

The projected CAGR is approximately 3.92%.

2. Which companies are prominent players in the Saudi Arabia Telecom Towers Market?

Key companies in the market include Saudi Telecom, TAWAL, Zain Saudi Arabia, Golden Lattice Investment Company (LATIS), Mobily (Etihad Etisalat), Virgin Mobile Saudi Arabi.

3. What are the main segments of the Saudi Arabia Telecom Towers Market?

The market segments include Ownership, Installation, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.04 billion as of 2022.

5. What are some drivers contributing to market growth?

Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs.

6. What are the notable trends driving market growth?

5G deployments are a major catalyst for growth in the cell-tower leasing environment.

7. Are there any restraints impacting market growth?

Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs.

8. Can you provide examples of recent developments in the market?

April 2024: Saudi Telecom Company has finalized a merger of its towers business with its parent company, forming a more extensive regional operation poised to bolster its international expansion ambitions. The telecom operator revealed its decision to merge its TAWAL unit with Golden Lattice Investment Company (GLIC). GLIC, primarily owned by Saudi Arabia's Public Investment Fund (PIF), operates in the towers business and is also a major shareholder in STC.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Telecom Towers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Telecom Towers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Telecom Towers Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Telecom Towers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence