Key Insights

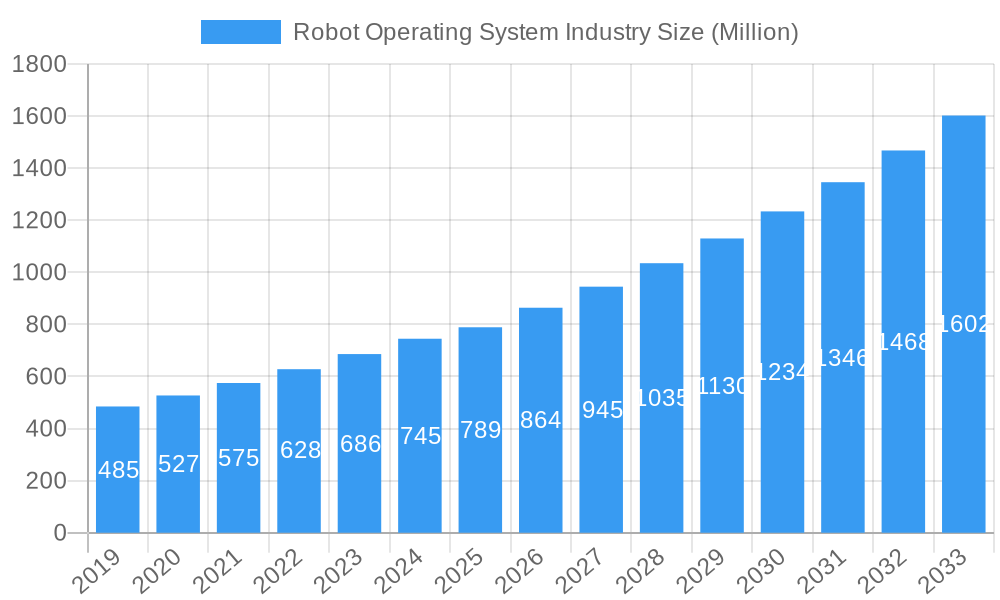

The global Robot Operating System (ROS) market is projected to reach $742.37 million by 2025, driven by a significant Compound Annual Growth Rate (CAGR) of 13.92% through 2033. This robust growth is propelled by escalating automation adoption across manufacturing, logistics, healthcare, and agriculture. Key growth factors include the increasing demand for sophisticated robots for complex tasks, advancements in AI and machine learning integration, and the open-source nature of ROS fostering community development and interoperability. The democratization of advanced robotics capabilities stimulates innovation, supported by the rise of industrial robots, autonomous vehicles, and smart home and service applications.

Robot Operating System Industry Market Size (In Million)

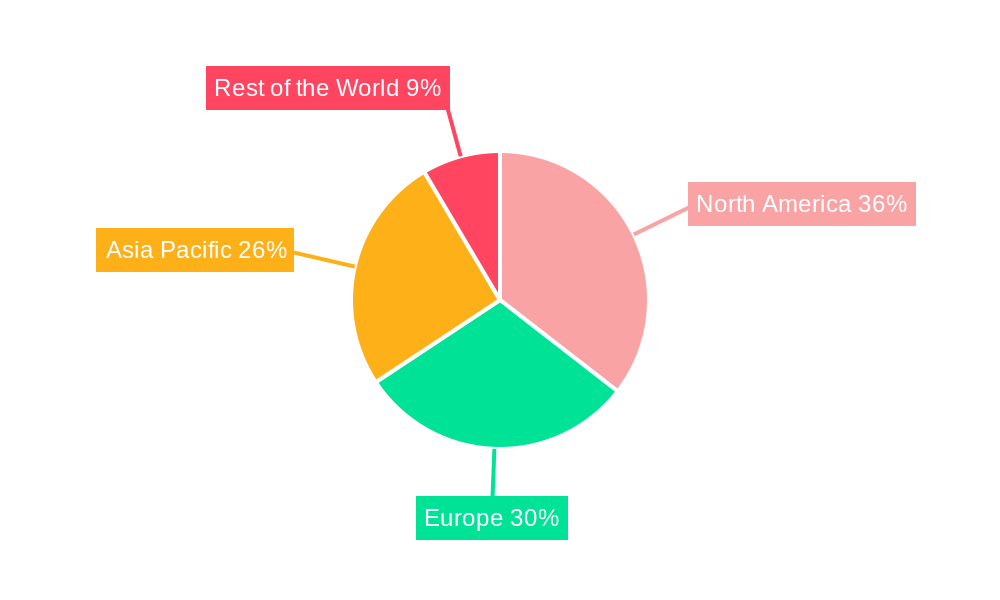

Emerging trends shaping the ROS market include the widespread adoption of ROS 2.0 for enhanced security and real-time capabilities, its integration with collaborative robots (cobots), and its use in edge computing for real-time decision-making. While implementation complexity and the need for skilled personnel present challenges, intense competition and innovation among key players such as Brain Corporation, KUKA AG, and Microsoft Corporation are driving market expansion. Geographically, North America and Europe are leading market regions, with the Asia Pacific anticipated to experience the fastest growth due to its expanding manufacturing sector and increased robotics investments.

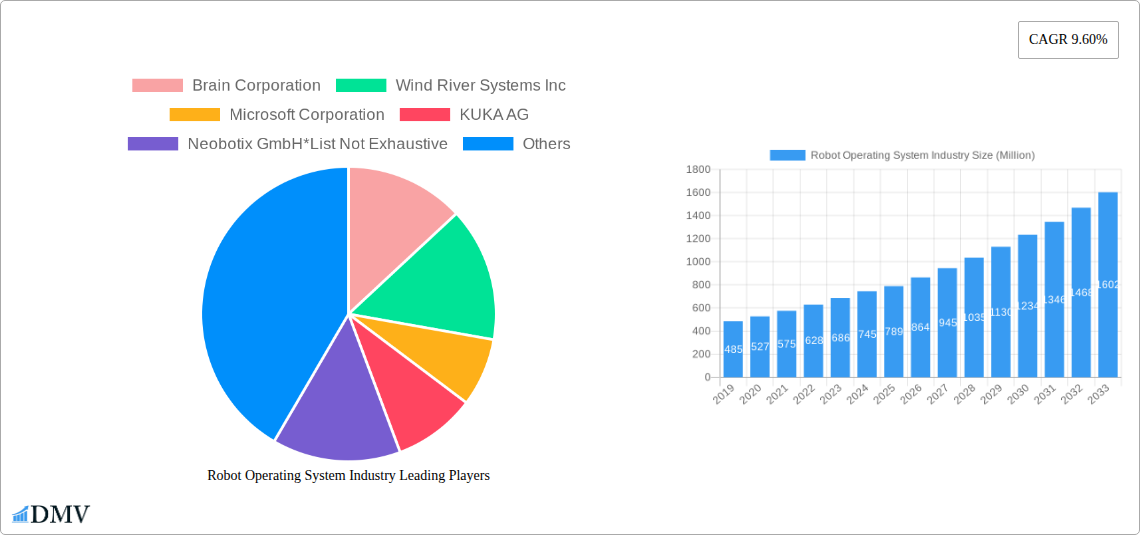

Robot Operating System Industry Company Market Share

Robot Operating System Industry Market Composition & Trends

The global Robot Operating System (ROS) industry is characterized by a dynamic and evolving market composition, driven by a confluence of technological innovation and increasing adoption across diverse sectors. Market concentration is moderately fragmented, with key players like Brain Corporation, Wind River Systems Inc., and Microsoft Corporation holding significant influence through their foundational ROS contributions and integrated solutions. Innovation catalysts are primarily centered on enhancing ROS capabilities in areas such as AI integration, real-time processing, and multi-robot coordination, crucial for advanced robotics applications. The regulatory landscape, while still developing, is increasingly focusing on safety standards and interoperability protocols, influencing development pathways. Substitute products, such as proprietary robot control systems, exist but often lack the open-source flexibility and extensive community support that defines ROS. End-user profiles span manufacturing, logistics, healthcare, and research, each demanding tailored ROS functionalities. Mergers and acquisitions (M&A) activity is anticipated to grow as larger tech firms seek to bolster their robotics portfolios and gain access to specialized ROS expertise. Estimated M&A deal values are projected to reach XX Million during the forecast period. The market share distribution is influenced by the prevalence of ROS in research and development, with increasing penetration in industrial automation and autonomous systems.

- Market Concentration: Moderately fragmented with significant influence from key technology providers and open-source communities.

- Innovation Catalysts: AI integration, real-time processing, multi-robot systems, enhanced simulation tools.

- Regulatory Landscape: Evolving standards for safety, security, and interoperability.

- Substitute Products: Proprietary control systems, specialized middleware.

- End-User Profiles: Manufacturing, logistics, healthcare, agriculture, research & development, defense.

- M&A Activity: Anticipated growth, driven by strategic acquisitions for talent and technology integration.

Robot Operating System Industry Industry Evolution

The evolution of the Robot Operating System (ROS) industry is a testament to the rapid advancements in artificial intelligence, automation, and the increasing demand for intelligent robotic solutions. Over the Historical Period (2019–2024), ROS has transitioned from a niche research tool to a foundational middleware for a wide array of robotic applications, witnessing a compound annual growth rate (CAGR) of approximately 15%. This growth trajectory has been fueled by significant technological breakthroughs. The introduction of ROS 2, with its enhanced real-time capabilities, improved security features, and broader platform support (including real-time operating systems and embedded systems), has been a pivotal moment, expanding its applicability beyond academic research into industrial settings. Key adoption metrics indicate a substantial increase in the number of deployed ROS-based robots, with over XX Million units estimated to be in operation by the end of the historical period. Shifting consumer demands are also playing a crucial role; businesses are increasingly seeking automation solutions that offer flexibility, scalability, and ease of integration. ROS, with its open-source nature and extensive library of packages, perfectly aligns with these demands, enabling faster development cycles and reduced costs for robotic system deployment. The ongoing development of sophisticated algorithms for perception, navigation, manipulation, and human-robot interaction, all readily available within the ROS ecosystem, further propels this evolution. The increasing focus on swarm robotics and collaborative robots has also driven the need for robust, distributed operating systems like ROS. The estimated market size for ROS-compatible hardware and software reached XX Million in 2024, showcasing a robust expansion.

- Market Growth Trajectories: Witnessed a CAGR of approximately 15% during the historical period, driven by increasing automation demands.

- Technological Advancements: Development and adoption of ROS 2, enhanced real-time capabilities, improved security, and wider platform support.

- Shifting Consumer Demands: Growing need for flexible, scalable, and cost-effective automation solutions.

- Adoption Metrics: Over XX Million ROS-based robots estimated in operation by 2024.

- Impact of ROS 2: Facilitated broader industrial adoption and enhanced system capabilities.

- Market Size (2024): Approximately XX Million for ROS-compatible hardware and software.

Leading Regions, Countries, or Segments in Robot Operating System Industry

The global Robot Operating System (ROS) industry exhibits distinct leadership across various regions and segments, driven by concentrated investment, strong technological ecosystems, and supportive industrial policies.

Production Analysis: North America, particularly the United States, leads in ROS production, fueled by a robust concentration of leading technology companies like Microsoft Corporation and research institutions pioneering ROS development. Germany, home to KUKA AG, and Japan, with strong players in industrial automation, also hold significant production capabilities, especially in hardware integration for ROS.

Consumption Analysis: Asia-Pacific, spearheaded by China, is the largest consumer of ROS-enabled robotics. This surge is driven by the massive manufacturing sector demanding advanced automation, rapid e-commerce growth necessitating efficient logistics robots, and substantial government initiatives promoting industrial digitalization. North America and Europe follow, with increasing adoption in advanced manufacturing, healthcare, and service robotics.

Import Market Analysis (Value & Volume): The import market is dominated by countries with high manufacturing output and a need to supplement domestic production of specialized robotic components and software. China is a major importer of ROS-compatible hardware and advanced robotic modules. European nations also exhibit substantial import volumes to support their sophisticated industrial automation needs. The estimated import market value for ROS-related technologies reached XX Million in 2024. The import volume is projected to grow at a CAGR of XX% during the forecast period.

Export Market Analysis (Value & Volume): The United States and Germany are key exporters, capitalizing on their advanced ROS development capabilities and established global robotics supply chains. These exports often include sophisticated software solutions, integrated robotic systems, and specialized hardware components. The estimated export market value for ROS-related technologies was XX Million in 2024, with an anticipated CAGR of XX% for the forecast period.

Price Trend Analysis: The price of ROS itself, being open-source, is negligible. However, the price of ROS-compatible hardware, software licenses for proprietary extensions, and integration services varies significantly. Prices are influenced by the complexity of the robot, the advanced functionalities required (e.g., sophisticated AI, advanced manipulation), and the level of vendor support. Prices are generally expected to decline gradually due to economies of scale and increased competition, particularly for common robotic platforms.

Industry Developments: Key developments include the increasing integration of ROS with cloud robotics platforms, enabling remote monitoring, data analytics, and distributed AI processing. The rise of edge computing for ROS applications is also crucial for real-time decision-making in autonomous systems.

- Dominant Region (Production): North America (USA)

- Dominant Region (Consumption): Asia-Pacific (China)

- Key Import Drivers: High manufacturing output, demand for advanced automation, e-commerce growth.

- Key Export Drivers: Advanced ROS development capabilities, established supply chains, sophisticated software solutions.

- Estimated Import Market Value (2024): XX Million

- Estimated Export Market Value (2024): XX Million

- Price Trend Influences: Complexity, AI, manipulation capabilities, vendor support, economies of scale.

Robot Operating System Industry Product Innovations

Recent product innovations in the Robot Operating System (ROS) industry are pushing the boundaries of robotic autonomy and collaboration. Developers are focusing on enhancing ROS with advanced AI capabilities, enabling robots to perform more complex tasks with greater intelligence and adaptability. Innovations include the development of more robust perception modules that leverage deep learning for object recognition and scene understanding, improving navigation in dynamic environments. Furthermore, advancements in motion planning algorithms are allowing robots to execute intricate manipulation tasks with enhanced precision and dexterity. Cloud-connected ROS platforms are emerging, facilitating remote operation, data analytics, and over-the-air updates, significantly improving fleet management and system maintenance. The integration of ROS with simulation environments is also a key innovation, allowing for extensive testing and validation of robot behaviors in virtual settings before real-world deployment, thus accelerating development cycles and reducing costs. These innovations are making ROS-powered robots more versatile and capable across diverse applications, from industrial automation to personal assistance.

Propelling Factors for Robot Operating System Industry Growth

The growth of the Robot Operating System (ROS) industry is propelled by several interconnected factors. Technological Advancements in artificial intelligence, machine learning, and sensor technology are creating more capable robots, which in turn demand sophisticated operating systems like ROS. The increasing demand for automation across sectors such as manufacturing, logistics, healthcare, and agriculture is a significant economic driver. Government initiatives and investments in robotics research and development, particularly in emerging economies, are further stimulating adoption. The open-source nature of ROS, fostered by a vast and active global community, significantly lowers the barrier to entry for developers and researchers, accelerating innovation and the creation of new applications. Furthermore, the growing need for flexible and scalable robotic solutions that can be easily customized and integrated into existing systems makes ROS an attractive choice.

Obstacles in the Robot Operating System Industry Market

Despite its promising growth, the Robot Operating System (ROS) industry faces several obstacles. Regulatory Challenges related to safety standards, data privacy, and ethical considerations for autonomous systems can slow down adoption and development. Supply Chain Disruptions, particularly concerning specialized hardware components for robotics, can impact production timelines and costs. Cybersecurity Vulnerabilities in connected robotic systems pose a significant risk, requiring robust security measures within the ROS framework. Furthermore, the steep learning curve associated with advanced ROS functionalities can be a barrier for smaller companies or those with limited technical expertise. Intense Competitive Pressures from proprietary robotics platforms also present a challenge, though ROS's open-source nature offers a significant advantage in terms of flexibility and cost.

Future Opportunities in Robot Operating System Industry

The future of the Robot Operating System (ROS) industry is ripe with opportunities. The expansion of ROS into new application areas, such as autonomous drones, underwater robotics, and advanced human-robot collaboration, presents significant growth potential. Emerging technologies like 5G connectivity will enable more sophisticated cloud robotics applications, enhancing the capabilities of ROS-powered fleets. The increasing demand for personalized and assistive robots in healthcare and domestic environments opens up new markets for ROS. Furthermore, the growing trend of the "Internet of Robotic Things" (IoRT) will create opportunities for ROS to act as a unifying middleware for diverse robotic devices. Continued advancements in AI and machine learning, seamlessly integrated with ROS, will lead to more intelligent and adaptable robots.

Major Players in the Robot Operating System Industry Ecosystem

- Brain Corporation

- Wind River Systems Inc.

- Microsoft Corporation

- KUKA AG

- Neobotix GmbH

- Clearpath Robotics

- Husarion Inc.

Key Developments in Robot Operating System Industry Industry

- August 2022: Xiaomi Launched its first humanoid robot CyberOne, at the company's new product launch event in Beijing. CyberOne is fitted with advanced arms and legs, supports bipedal-motion posture balancing, and reaches peak torque of up to 300Nm. CyberOne's AI and mechanical capabilities are all self-developed by Xiaomi Robotics Lab.

- August 2022: Yaskawa launched the MOTOMAN-HC30PL, a human collaboration robot for palletizing applications such as cardboard, for the human collaboration robot series that has been developed with 10 kg and 20 kg payload capacity. Primary Application of Packaging, boxed products, and transportation of cardboard packages.

Strategic Robot Operating System Industry Market Forecast

The strategic forecast for the Robot Operating System (ROS) industry indicates robust and sustained growth driven by increasing automation demands across diverse sectors. The continuous evolution of ROS 2, with its enhanced security, real-time capabilities, and platform flexibility, will further solidify its position as the de facto standard for robotic software development. Key growth catalysts include the escalating need for intelligent automation in manufacturing and logistics, the burgeoning healthcare robotics market, and the expansion of autonomous systems in sectors like agriculture and defense. The open-source nature of ROS, coupled with a vibrant global community, will continue to foster rapid innovation and reduce development costs, making sophisticated robotics more accessible. The integration of advanced AI, edge computing, and 5G technologies will unlock new levels of robot autonomy and connectivity, paving the way for widespread adoption of complex robotic solutions. The market is projected to witness significant advancements in human-robot collaboration, assistive robotics, and swarm intelligence, all underpinned by the adaptable and powerful ROS framework.

Robot Operating System Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Robot Operating System Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Robot Operating System Industry Regional Market Share

Geographic Coverage of Robot Operating System Industry

Robot Operating System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Industrial Automation among SMEs and Large Enterprises; Increased Funding in Research and Development Activities; Increased Adoption of ROS by End-user Industries

- 3.3. Market Restrains

- 3.3.1. High Cost of Maintenance; High Cost of Installation

- 3.4. Market Trends

- 3.4.1. Increased Adoption of ROS by End-user Industries is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Robot Operating System Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Robot Operating System Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Europe Robot Operating System Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Asia Pacific Robot Operating System Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Rest of the World Robot Operating System Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Brain Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Wind River Systems Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Microsoft Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 KUKA AG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Neobotix GmbH*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Clearpath Robotics

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Husarion Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Brain Corporation

List of Figures

- Figure 1: Global Robot Operating System Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Robot Operating System Industry Revenue (million), by Production Analysis 2025 & 2033

- Figure 3: North America Robot Operating System Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Robot Operating System Industry Revenue (million), by Consumption Analysis 2025 & 2033

- Figure 5: North America Robot Operating System Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Robot Operating System Industry Revenue (million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Robot Operating System Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Robot Operating System Industry Revenue (million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Robot Operating System Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Robot Operating System Industry Revenue (million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Robot Operating System Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Robot Operating System Industry Revenue (million), by Country 2025 & 2033

- Figure 13: North America Robot Operating System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Robot Operating System Industry Revenue (million), by Production Analysis 2025 & 2033

- Figure 15: Europe Robot Operating System Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: Europe Robot Operating System Industry Revenue (million), by Consumption Analysis 2025 & 2033

- Figure 17: Europe Robot Operating System Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: Europe Robot Operating System Industry Revenue (million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: Europe Robot Operating System Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: Europe Robot Operating System Industry Revenue (million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: Europe Robot Operating System Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: Europe Robot Operating System Industry Revenue (million), by Price Trend Analysis 2025 & 2033

- Figure 23: Europe Robot Operating System Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: Europe Robot Operating System Industry Revenue (million), by Country 2025 & 2033

- Figure 25: Europe Robot Operating System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Robot Operating System Industry Revenue (million), by Production Analysis 2025 & 2033

- Figure 27: Asia Pacific Robot Operating System Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Asia Pacific Robot Operating System Industry Revenue (million), by Consumption Analysis 2025 & 2033

- Figure 29: Asia Pacific Robot Operating System Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Asia Pacific Robot Operating System Industry Revenue (million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Asia Pacific Robot Operating System Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Asia Pacific Robot Operating System Industry Revenue (million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Asia Pacific Robot Operating System Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Asia Pacific Robot Operating System Industry Revenue (million), by Price Trend Analysis 2025 & 2033

- Figure 35: Asia Pacific Robot Operating System Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Asia Pacific Robot Operating System Industry Revenue (million), by Country 2025 & 2033

- Figure 37: Asia Pacific Robot Operating System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Rest of the World Robot Operating System Industry Revenue (million), by Production Analysis 2025 & 2033

- Figure 39: Rest of the World Robot Operating System Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Rest of the World Robot Operating System Industry Revenue (million), by Consumption Analysis 2025 & 2033

- Figure 41: Rest of the World Robot Operating System Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Rest of the World Robot Operating System Industry Revenue (million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Rest of the World Robot Operating System Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Rest of the World Robot Operating System Industry Revenue (million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Rest of the World Robot Operating System Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Rest of the World Robot Operating System Industry Revenue (million), by Price Trend Analysis 2025 & 2033

- Figure 47: Rest of the World Robot Operating System Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Rest of the World Robot Operating System Industry Revenue (million), by Country 2025 & 2033

- Figure 49: Rest of the World Robot Operating System Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Robot Operating System Industry Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Robot Operating System Industry Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Robot Operating System Industry Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Robot Operating System Industry Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Robot Operating System Industry Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Robot Operating System Industry Revenue million Forecast, by Region 2020 & 2033

- Table 7: Global Robot Operating System Industry Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Robot Operating System Industry Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Robot Operating System Industry Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Robot Operating System Industry Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Robot Operating System Industry Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Robot Operating System Industry Revenue million Forecast, by Country 2020 & 2033

- Table 13: Global Robot Operating System Industry Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 14: Global Robot Operating System Industry Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 15: Global Robot Operating System Industry Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 16: Global Robot Operating System Industry Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 17: Global Robot Operating System Industry Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 18: Global Robot Operating System Industry Revenue million Forecast, by Country 2020 & 2033

- Table 19: Global Robot Operating System Industry Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 20: Global Robot Operating System Industry Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 21: Global Robot Operating System Industry Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 22: Global Robot Operating System Industry Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 23: Global Robot Operating System Industry Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 24: Global Robot Operating System Industry Revenue million Forecast, by Country 2020 & 2033

- Table 25: Global Robot Operating System Industry Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Robot Operating System Industry Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Robot Operating System Industry Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Robot Operating System Industry Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Robot Operating System Industry Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Robot Operating System Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Robot Operating System Industry?

The projected CAGR is approximately 13.92%.

2. Which companies are prominent players in the Robot Operating System Industry?

Key companies in the market include Brain Corporation, Wind River Systems Inc, Microsoft Corporation, KUKA AG, Neobotix GmbH*List Not Exhaustive, Clearpath Robotics, Husarion Inc.

3. What are the main segments of the Robot Operating System Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 742.37 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Industrial Automation among SMEs and Large Enterprises; Increased Funding in Research and Development Activities; Increased Adoption of ROS by End-user Industries.

6. What are the notable trends driving market growth?

Increased Adoption of ROS by End-user Industries is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

High Cost of Maintenance; High Cost of Installation.

8. Can you provide examples of recent developments in the market?

August 2022 - Xiaomi Launched its first humanoid robot CyberOne, at the company's new product launch event in Beijing. CyberOne is fitted with advanced arms and legs, supports bipedal-motion posture balancing, and reaches peak torque of up to 300Nm. CyberOne's AI and mechanical capabilities are all self-developed by Xiaomi Robotics Lab.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Robot Operating System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Robot Operating System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Robot Operating System Industry?

To stay informed about further developments, trends, and reports in the Robot Operating System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence