Key Insights

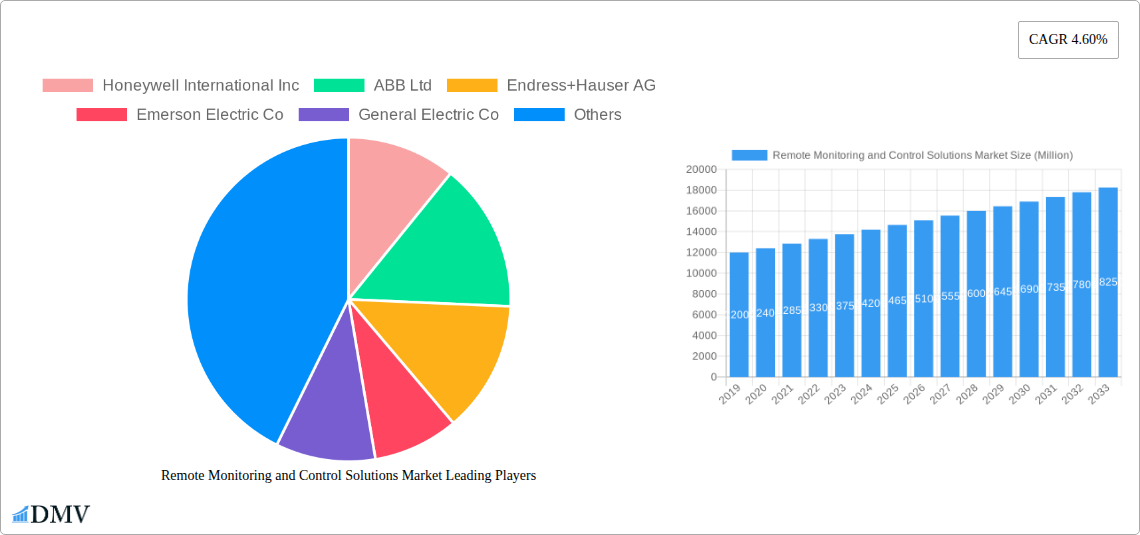

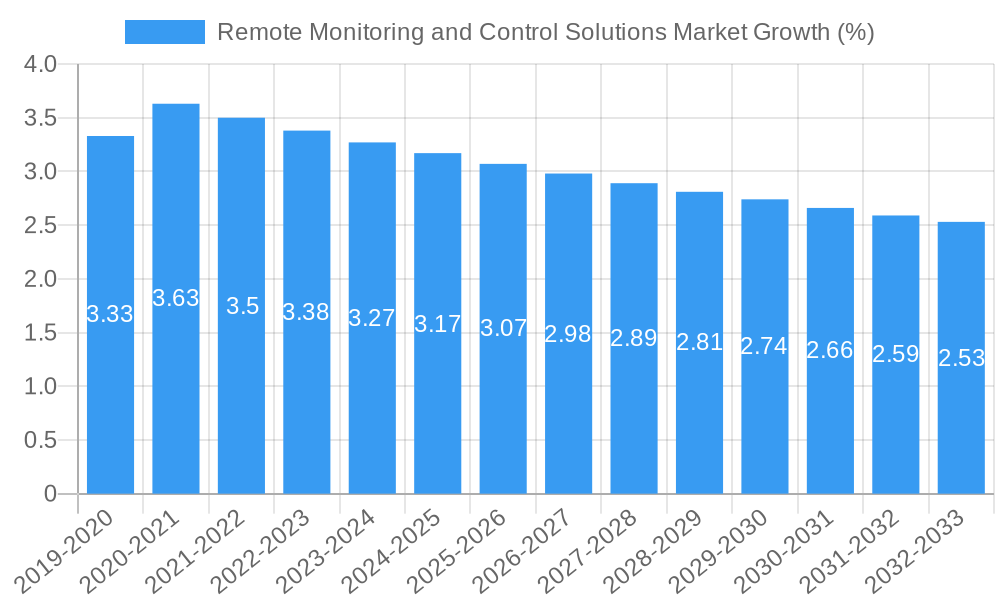

The global Remote Monitoring and Control Solutions Market is poised for robust expansion, projected to reach an estimated market size of approximately $15,870 million by 2025, growing at a Compound Annual Growth Rate (CAGR) of 4.60% through 2033. This dynamic market is fueled by a confluence of factors, most notably the escalating demand for operational efficiency and cost reduction across various industrial sectors. The increasing adoption of Industrial Internet of Things (IIoT) technologies, coupled with the growing need for real-time data acquisition and analysis, is a primary driver. Furthermore, stringent regulatory compliance requirements and the imperative to enhance safety and minimize environmental impact are compelling businesses to invest in advanced remote monitoring and control systems. The surge in digitalization initiatives and the development of sophisticated software platforms are enabling more effective and integrated management of remote assets.

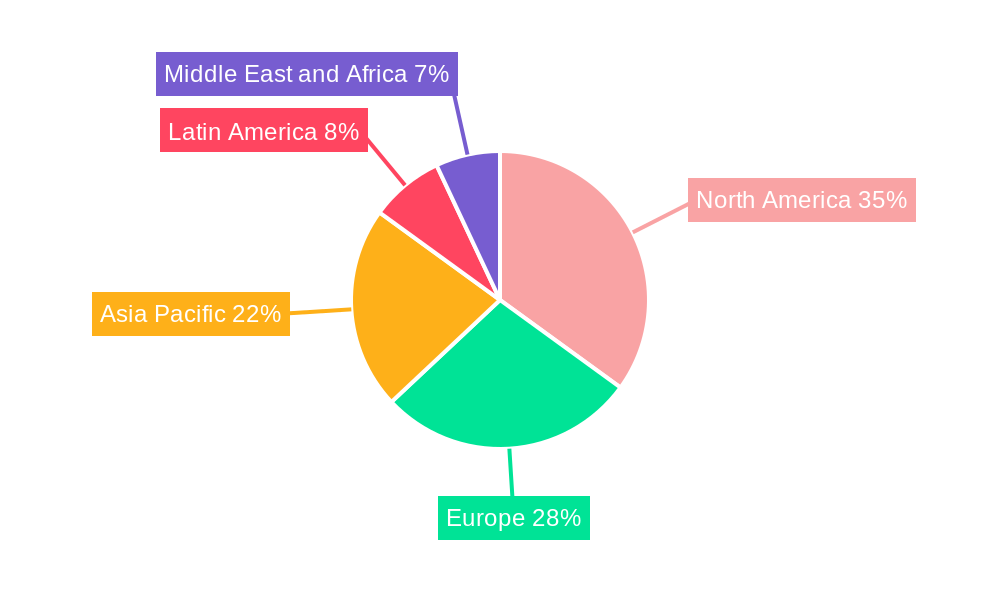

Key segments contributing to this growth include the "Solutions" segment, encompassing software platforms and analytics, which is experiencing significant adoption due to its ability to provide actionable insights. "Field Instruments" are also crucial, providing the foundational data for remote operations. The "Oil and Gas" and "Power Generation" industries represent the largest end-user segments, driven by the inherent need for monitoring and controlling geographically dispersed and often hazardous operations. However, emerging sectors like "Water and Wastewater" and "Food & Beverages" are also showing substantial growth potential as they increasingly embrace automation and remote management for improved quality control and resource optimization. Geographically, North America and Europe are currently leading the market, but the Asia Pacific region, with its rapid industrialization and increasing adoption of smart technologies, is expected to witness the fastest growth trajectory.

This comprehensive report provides an in-depth analysis of the global Remote Monitoring and Control Solutions Market. Delving into key market dynamics, technological advancements, and strategic opportunities, this research is essential for stakeholders seeking to understand and capitalize on the evolving landscape of industrial automation and data management. With a study period spanning from 2019 to 2033, the report offers robust insights derived from historical data (2019-2024), a detailed base year analysis (2025), and a forward-looking forecast period (2025-2033). Our estimated year analysis for 2025 provides critical current-state insights.

Remote Monitoring and Control Solutions Market Market Composition & Trends

The Remote Monitoring and Control Solutions Market exhibits a moderate to high concentration, driven by a landscape featuring prominent players like Honeywell International Inc, ABB Ltd, Endress+Hauser AG, Emerson Electric Co, General Electric Co, Schneider Electric SE, Rockwell Automation Inc, and Yokogawa Electric Corporation. Innovation catalysts are numerous, fueled by the growing demand for operational efficiency, predictive maintenance, and enhanced safety across diverse industrial sectors. The regulatory landscape, while varying by region, generally favors the adoption of these solutions due to their contributions to environmental compliance and industrial safety standards. Substitute products, such as manual oversight or localized control systems, are increasingly becoming less viable against the cost-effectiveness and advanced capabilities offered by remote monitoring and control.

End-user profiles highlight a significant demand from capital-intensive industries prioritizing continuous operations and asset management. Key sectors include:

- Oil and Gas: Essential for offshore operations, pipeline monitoring, and refinery management.

- Power Generation: Critical for grid stability, renewable energy farm management, and plant efficiency.

- Chemical: Vital for process control, safety monitoring, and hazardous material management.

- Metals & Mining: Used for equipment monitoring, production optimization, and remote site management.

- Water and Wastewater: Crucial for treatment plant operations, distribution network monitoring, and leak detection.

- Food & Beverages: Important for quality control, supply chain tracking, and process optimization.

- Pharmaceuticals: Essential for temperature-sensitive product monitoring, manufacturing compliance, and cold chain logistics.

- Pulp & Paper: Utilized for process control, energy management, and environmental monitoring.

Mergers and acquisitions (M&A) activities within the market are strategic, focusing on consolidating technological capabilities, expanding market reach, and acquiring specialized expertise. Deal values are projected to increase as companies seek to strengthen their portfolios in this rapidly growing sector. Approximately 15-20% of the market value is expected to be influenced by M&A activities within the forecast period.

Remote Monitoring and Control Solutions Market Industry Evolution

The Remote Monitoring and Control Solutions Market has undergone a significant evolution, transitioning from rudimentary data collection to sophisticated, AI-driven platforms. This transformation is a direct response to the increasing need for operational resilience, proactive maintenance, and data-driven decision-making across a multitude of industries. Historically, the market was characterized by standalone systems with limited connectivity. However, the advent of Industry 4.0 and the proliferation of the Internet of Things (IoT) have fundamentally reshaped its trajectory. The integration of advanced sensors, cloud computing, and artificial intelligence has enabled real-time data acquisition, analysis, and automated control, leading to substantial improvements in efficiency and productivity.

Growth trajectories for the Remote Monitoring and Control Solutions Market have been consistently upward. From 2019 to 2024, the market witnessed a Compound Annual Growth Rate (CAGR) of approximately 10-12%, driven by early adoption in sectors like oil and gas and power generation. For the forecast period of 2025-2033, the CAGR is projected to accelerate to 13-15%, fueled by expanding applications in emerging industries and greater adoption of advanced features like predictive analytics and digital twins. For instance, the adoption of remote monitoring solutions in the water and wastewater sector has surged by over 25% in the last two years alone, as municipalities and utilities seek to optimize resource management and reduce operational costs.

Technological advancements have been the primary engine of this evolution. The shift from proprietary hardware to more open, software-defined solutions has fostered interoperability and reduced integration complexities. Furthermore, the development of advanced analytics and machine learning algorithms has moved beyond simple monitoring to enable predictive maintenance, anomaly detection, and process optimization. This has allowed businesses to anticipate equipment failures, minimize downtime, and reduce maintenance expenditures, thereby enhancing their competitive edge. The adoption of cybersecurity measures has also become paramount, ensuring the integrity and security of the vast amounts of data being transmitted and processed. This continuous innovation cycle ensures the Remote Monitoring and Control Solutions Market remains dynamic and responsive to evolving industrial demands, with a global market size estimated to reach over $120 Billion by 2025 and projected to exceed $250 Billion by 2033.

Leading Regions, Countries, or Segments in Remote Monitoring and Control Solutions Market

The Remote Monitoring and Control Solutions Market is significantly driven by advancements and adoption patterns across various regions and industry segments. Dominance is observed in regions with robust industrial infrastructure and a strong impetus for technological integration, coupled with supportive regulatory frameworks. North America and Europe have historically led this market due to their mature industrial bases, significant investments in automation, and stringent environmental and safety regulations. Asia Pacific, however, is emerging as a critical growth engine, propelled by rapid industrialization, increasing foreign direct investment, and a burgeoning manufacturing sector. China, in particular, is a powerhouse, with substantial government initiatives promoting smart manufacturing and digitalization, significantly boosting the adoption of remote monitoring and control solutions.

The Oil and Gas and Power Generation sectors continue to be frontrunners in the adoption of remote monitoring and control solutions.

Oil and Gas:

- Key Drivers: The inherently hazardous nature of operations, the need for efficient resource extraction from remote or challenging environments, stringent safety protocols, and the demand for optimized production and pipeline integrity management.

- Dominance Factors: The substantial capital expenditure in exploration and production, coupled with the long lifecycle of assets requiring continuous monitoring and maintenance, makes this sector a primary consumer. The global market for remote monitoring solutions in oil and gas alone is expected to surpass $30 Billion by 2025.

Power Generation:

- Key Drivers: The increasing complexity of power grids with the integration of renewable energy sources, the need for real-time energy management, optimization of plant efficiency, predictive maintenance for critical infrastructure, and adherence to evolving energy policies.

- Dominance Factors: The sheer scale of power generation infrastructure, the critical nature of uninterrupted power supply, and the drive towards a more sustainable and digitized energy landscape contribute to its leading position. The market for these solutions in the power sector is projected to reach over $25 Billion by 2025.

The Type: Solutions segment generally holds a larger market share compared to Field Instruments, as it encompasses the integrated software, analytics, and services that leverage data from the instruments. However, the demand for advanced field instruments, such as smart sensors and controllers with enhanced connectivity, is also experiencing significant growth, often driven by their crucial role in data acquisition for the solutions.

The Chemical and Water and Wastewater industries are also demonstrating robust growth, driven by increasing regulatory pressures for environmental compliance and operational efficiency. The Pharmaceuticals sector is rapidly adopting these solutions, particularly for cold chain logistics and quality control, with the BluTag 360 solution by Honeywell highlighting this trend. The Metals & Mining and Food & Beverages sectors are also key contributors, focusing on process optimization and supply chain visibility.

Remote Monitoring and Control Solutions Market Product Innovations

Product innovation in the Remote Monitoring and Control Solutions Market is rapidly advancing, driven by the integration of cutting-edge technologies. Companies are focusing on developing intelligent, interconnected systems that offer enhanced data analytics, predictive capabilities, and seamless integration with existing infrastructure. A prime example of this is Rockwell Automation's recent introduction of their remote access solution, featuring FactoryTalk Remote Access cloud-based software and the Stratix 4300 remote access router. This innovation allows for secure, managed connections to customer equipment, enhancing OEM support and remote troubleshooting capabilities, a significant leap in asset management.

The development of AI-powered analytics for anomaly detection, fault prediction, and process optimization is a key trend. Furthermore, the push towards edge computing allows for real-time data processing closer to the source, reducing latency and improving responsiveness. Solutions are increasingly incorporating advanced cybersecurity features to protect sensitive industrial data, a critical concern for all end-user industries. The performance metrics being targeted include reduced downtime, improved energy efficiency, enhanced safety, and a higher return on investment for industrial operations.

Propelling Factors for Remote Monitoring and Control Solutions Market Growth

Several key factors are propelling the growth of the Remote Monitoring and Control Solutions Market. The relentless drive for operational efficiency and cost reduction across industries is a primary catalyst, with remote solutions enabling proactive maintenance, optimized resource allocation, and minimized downtime. The increasing adoption of Industry 4.0 principles and the Internet of Things (IoT) is creating a demand for interconnected systems that can collect, analyze, and act upon real-time data. Furthermore, stringent regulatory requirements for safety, environmental compliance, and quality control are pushing industries towards more sophisticated monitoring and control mechanisms. The growing complexity of industrial assets and operations, especially in sectors like oil and gas and power generation, necessitates advanced remote management capabilities. The decreasing cost of sensors and connectivity, coupled with the development of sophisticated software analytics and AI, also makes these solutions more accessible and attractive to a wider range of businesses.

Obstacles in the Remote Monitoring and Control Solutions Market Market

Despite its robust growth, the Remote Monitoring and Control Solutions Market faces certain obstacles. Cybersecurity concerns remain a significant barrier, as the increasing connectivity of industrial systems makes them vulnerable to sophisticated cyber threats. The initial investment cost for implementing comprehensive remote monitoring and control systems can be substantial, posing a challenge for small and medium-sized enterprises (SMEs). Integration complexities with legacy systems can also hinder adoption, requiring significant effort and expertise. Lack of skilled personnel to manage and interpret the data generated by these advanced systems is another concern. Furthermore, regulatory uncertainties and varying standards across different geographies can create compliance challenges. Lastly, resistance to change within established operational paradigms and a lack of clear return on investment justification for some organizations can slow down the adoption pace.

Future Opportunities in Remote Monitoring and Control Solutions Market

The Remote Monitoring and Control Solutions Market is brimming with future opportunities. The expansion of 5G technology promises to enhance connectivity, enabling real-time data transmission with ultra-low latency, crucial for time-sensitive industrial applications. The increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) for predictive maintenance and autonomous operations presents a significant growth avenue. The growing demand for sustainable and environmentally friendly industrial practices will drive the adoption of solutions for energy management and emissions monitoring. Emerging markets in developing economies, with their rapidly industrializing sectors, offer substantial untapped potential. The development of digital twins, which create virtual replicas of physical assets for simulation and analysis, is another promising area. Furthermore, the increasing focus on supply chain visibility and resilience post-pandemic will boost the adoption of remote monitoring solutions across various logistics and manufacturing verticals.

Major Players in the Remote Monitoring and Control Solutions Market Ecosystem

- Honeywell International Inc

- ABB Ltd

- Endress+Hauser AG

- Emerson Electric Co

- General Electric Co

- Schneider Electric SE

- Rockwell Automation Inc

- Yokogawa Electric Corporation

Key Developments in Remote Monitoring and Control Solutions Market Industry

- November 2021: Rockwell Automation introduced a new remote access solution, including 'The FactoryTalk Remote Access cloud-based software' for OEMs to manage, configure, and initiate secure connections to customer equipment, and 'The Stratix 4300 remote access router' for on-site installation to provide remote access to equipment.

- April 2021: Honeywell introduced BluTag 360, a data-monitoring solution leveraging machine learning and blockchain technology to capture critical shipping-condition data for temperature-sensitive goods, addressing issues like counterfeiting during transit.

Strategic Remote Monitoring and Control Solutions Market Market Forecast

The Remote Monitoring and Control Solutions Market is poised for sustained and accelerated growth, driven by the indispensable need for operational efficiency, enhanced safety, and data-driven decision-making across a global industrial spectrum. The ongoing digital transformation, epitomized by Industry 4.0 and the pervasive influence of IoT, will continue to be a primary growth catalyst, fostering greater interconnectedness and intelligent automation. Advancements in AI, machine learning, and edge computing are unlocking sophisticated capabilities such as predictive maintenance and autonomous operations, promising significant reductions in downtime and operational costs. Furthermore, the increasing emphasis on sustainability and regulatory compliance will spur the adoption of solutions for energy management and environmental monitoring. The strategic importance of resilient and visible supply chains will also fuel demand. As cybersecurity measures mature and the cost of advanced technologies becomes more accessible, the market is expected to witness a surge in adoption across both developed and emerging economies, solidifying its position as a critical enabler of modern industrial operations. The market size is projected to exceed $250 Billion by 2033.

Remote Monitoring and Control Solutions Market Segmentation

-

1. Type

- 1.1. Solutions

- 1.2. Field Instruments

-

2. End-user Industry

- 2.1. Oil and Gas

- 2.2. Power Generation

- 2.3. Chemical

- 2.4. Metals & Mining

- 2.5. Water and Wastewater

- 2.6. Food & Beverages

- 2.7. Pharmaceuticals

- 2.8. Pulp & Paper

- 2.9. Other End-user Industries

Remote Monitoring and Control Solutions Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Remote Monitoring and Control Solutions Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Industrial Automation; Increased Demand for Industrial Mobility for Remotely Managing the Process Industry

- 3.3. Market Restrains

- 3.3.1. Security Challenges of Wireless Communication

- 3.4. Market Trends

- 3.4.1. Water and Wastewater Industry to Grow Rapidly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Remote Monitoring and Control Solutions Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Solutions

- 5.1.2. Field Instruments

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas

- 5.2.2. Power Generation

- 5.2.3. Chemical

- 5.2.4. Metals & Mining

- 5.2.5. Water and Wastewater

- 5.2.6. Food & Beverages

- 5.2.7. Pharmaceuticals

- 5.2.8. Pulp & Paper

- 5.2.9. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Remote Monitoring and Control Solutions Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Solutions

- 6.1.2. Field Instruments

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Oil and Gas

- 6.2.2. Power Generation

- 6.2.3. Chemical

- 6.2.4. Metals & Mining

- 6.2.5. Water and Wastewater

- 6.2.6. Food & Beverages

- 6.2.7. Pharmaceuticals

- 6.2.8. Pulp & Paper

- 6.2.9. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Remote Monitoring and Control Solutions Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Solutions

- 7.1.2. Field Instruments

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Oil and Gas

- 7.2.2. Power Generation

- 7.2.3. Chemical

- 7.2.4. Metals & Mining

- 7.2.5. Water and Wastewater

- 7.2.6. Food & Beverages

- 7.2.7. Pharmaceuticals

- 7.2.8. Pulp & Paper

- 7.2.9. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Remote Monitoring and Control Solutions Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Solutions

- 8.1.2. Field Instruments

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Oil and Gas

- 8.2.2. Power Generation

- 8.2.3. Chemical

- 8.2.4. Metals & Mining

- 8.2.5. Water and Wastewater

- 8.2.6. Food & Beverages

- 8.2.7. Pharmaceuticals

- 8.2.8. Pulp & Paper

- 8.2.9. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Remote Monitoring and Control Solutions Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Solutions

- 9.1.2. Field Instruments

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Oil and Gas

- 9.2.2. Power Generation

- 9.2.3. Chemical

- 9.2.4. Metals & Mining

- 9.2.5. Water and Wastewater

- 9.2.6. Food & Beverages

- 9.2.7. Pharmaceuticals

- 9.2.8. Pulp & Paper

- 9.2.9. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Remote Monitoring and Control Solutions Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Solutions

- 10.1.2. Field Instruments

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Oil and Gas

- 10.2.2. Power Generation

- 10.2.3. Chemical

- 10.2.4. Metals & Mining

- 10.2.5. Water and Wastewater

- 10.2.6. Food & Beverages

- 10.2.7. Pharmaceuticals

- 10.2.8. Pulp & Paper

- 10.2.9. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Remote Monitoring and Control Solutions Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Remote Monitoring and Control Solutions Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Rest of Europe

- 13. Asia Pacific Remote Monitoring and Control Solutions Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 India

- 13.1.3 Japan

- 13.1.4 Rest of Asia Pacific

- 14. Latin America Remote Monitoring and Control Solutions Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Mexico

- 14.1.3 Rest of Latin America

- 15. Middle East and Africa Remote Monitoring and Control Solutions Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Honeywell International Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 ABB Ltd

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Endress+Hauser AG

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Emerson Electric Co

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 General Electric Co

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Schneider Electric SE

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Rockwell Automation Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Yokogawa Electric Corporation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Remote Monitoring and Control Solutions Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Remote Monitoring and Control Solutions Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Remote Monitoring and Control Solutions Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Remote Monitoring and Control Solutions Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Remote Monitoring and Control Solutions Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Remote Monitoring and Control Solutions Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Remote Monitoring and Control Solutions Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Remote Monitoring and Control Solutions Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Remote Monitoring and Control Solutions Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Remote Monitoring and Control Solutions Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Remote Monitoring and Control Solutions Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Remote Monitoring and Control Solutions Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Remote Monitoring and Control Solutions Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Remote Monitoring and Control Solutions Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 15: North America Remote Monitoring and Control Solutions Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: North America Remote Monitoring and Control Solutions Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Remote Monitoring and Control Solutions Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Remote Monitoring and Control Solutions Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Remote Monitoring and Control Solutions Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Remote Monitoring and Control Solutions Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 21: Europe Remote Monitoring and Control Solutions Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: Europe Remote Monitoring and Control Solutions Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Remote Monitoring and Control Solutions Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Remote Monitoring and Control Solutions Market Revenue (Million), by Type 2024 & 2032

- Figure 25: Asia Pacific Remote Monitoring and Control Solutions Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: Asia Pacific Remote Monitoring and Control Solutions Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 27: Asia Pacific Remote Monitoring and Control Solutions Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 28: Asia Pacific Remote Monitoring and Control Solutions Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Remote Monitoring and Control Solutions Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Remote Monitoring and Control Solutions Market Revenue (Million), by Type 2024 & 2032

- Figure 31: Latin America Remote Monitoring and Control Solutions Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: Latin America Remote Monitoring and Control Solutions Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Latin America Remote Monitoring and Control Solutions Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Latin America Remote Monitoring and Control Solutions Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Remote Monitoring and Control Solutions Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Remote Monitoring and Control Solutions Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Middle East and Africa Remote Monitoring and Control Solutions Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Middle East and Africa Remote Monitoring and Control Solutions Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 39: Middle East and Africa Remote Monitoring and Control Solutions Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 40: Middle East and Africa Remote Monitoring and Control Solutions Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Remote Monitoring and Control Solutions Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Remote Monitoring and Control Solutions Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Remote Monitoring and Control Solutions Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Remote Monitoring and Control Solutions Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Remote Monitoring and Control Solutions Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Remote Monitoring and Control Solutions Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Remote Monitoring and Control Solutions Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Remote Monitoring and Control Solutions Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: India Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Asia Pacific Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Remote Monitoring and Control Solutions Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Brazil Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Latin America Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Remote Monitoring and Control Solutions Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: United Arab Emirates Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Saudi Arabia Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Middle East and Africa Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Remote Monitoring and Control Solutions Market Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Global Remote Monitoring and Control Solutions Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 28: Global Remote Monitoring and Control Solutions Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United States Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Canada Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Remote Monitoring and Control Solutions Market Revenue Million Forecast, by Type 2019 & 2032

- Table 32: Global Remote Monitoring and Control Solutions Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 33: Global Remote Monitoring and Control Solutions Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Germany Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: United Kingdom Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: France Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Europe Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Remote Monitoring and Control Solutions Market Revenue Million Forecast, by Type 2019 & 2032

- Table 39: Global Remote Monitoring and Control Solutions Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 40: Global Remote Monitoring and Control Solutions Market Revenue Million Forecast, by Country 2019 & 2032

- Table 41: China Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Japan Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Asia Pacific Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Remote Monitoring and Control Solutions Market Revenue Million Forecast, by Type 2019 & 2032

- Table 46: Global Remote Monitoring and Control Solutions Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 47: Global Remote Monitoring and Control Solutions Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Brazil Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Mexico Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Latin America Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global Remote Monitoring and Control Solutions Market Revenue Million Forecast, by Type 2019 & 2032

- Table 52: Global Remote Monitoring and Control Solutions Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 53: Global Remote Monitoring and Control Solutions Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: United Arab Emirates Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Saudi Arabia Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Middle East and Africa Remote Monitoring and Control Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Remote Monitoring and Control Solutions Market?

The projected CAGR is approximately 4.60%.

2. Which companies are prominent players in the Remote Monitoring and Control Solutions Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Endress+Hauser AG, Emerson Electric Co, General Electric Co, Schneider Electric SE, Rockwell Automation Inc, Yokogawa Electric Corporation.

3. What are the main segments of the Remote Monitoring and Control Solutions Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Industrial Automation; Increased Demand for Industrial Mobility for Remotely Managing the Process Industry.

6. What are the notable trends driving market growth?

Water and Wastewater Industry to Grow Rapidly.

7. Are there any restraints impacting market growth?

Security Challenges of Wireless Communication.

8. Can you provide examples of recent developments in the market?

November 2021 - Rockwell Automation introduced new remote access solution that includes 'The FactoryTalk Remote Access cloud-based software' which allows OEMs to manage, configure and initiate secure connections to a customer's equipment and 'The Stratix 4300 remote access router' which is installed at the customer's site to provide remote access to the equipment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Remote Monitoring and Control Solutions Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Remote Monitoring and Control Solutions Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Remote Monitoring and Control Solutions Market?

To stay informed about further developments, trends, and reports in the Remote Monitoring and Control Solutions Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence