Key Insights

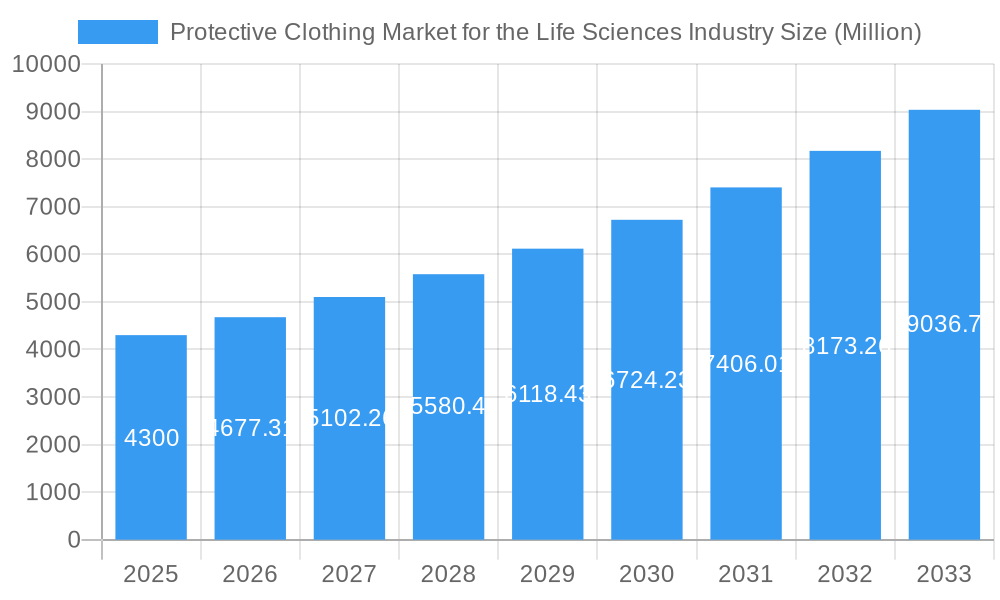

The global protective clothing market for the life sciences industry is experiencing robust growth, projected to reach \$4.30 billion in 2025 and maintain a compound annual growth rate (CAGR) of 8.89% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing prevalence of infectious diseases and biohazards necessitates stringent safety protocols in research, manufacturing, and healthcare settings, fueling demand for protective apparel across diverse applications. Secondly, stringent regulatory requirements and heightened awareness of workplace safety among life sciences companies are driving adoption of advanced protective clothing technologies. Furthermore, continuous advancements in materials science are leading to the development of lighter, more comfortable, and more effective protective garments, enhancing worker comfort and compliance. The market is segmented by product type (suits/coveralls, gloves, aprons, face masks, eyewear, footwear, wipes), material type (disposable, reusable), and application (cleanrooms, laboratories). Disposable protective clothing currently dominates the market due to its ease of use and hygiene benefits, though reusable options are gaining traction due to growing environmental concerns.

Protective Clothing Market for the Life Sciences Industry Market Size (In Billion)

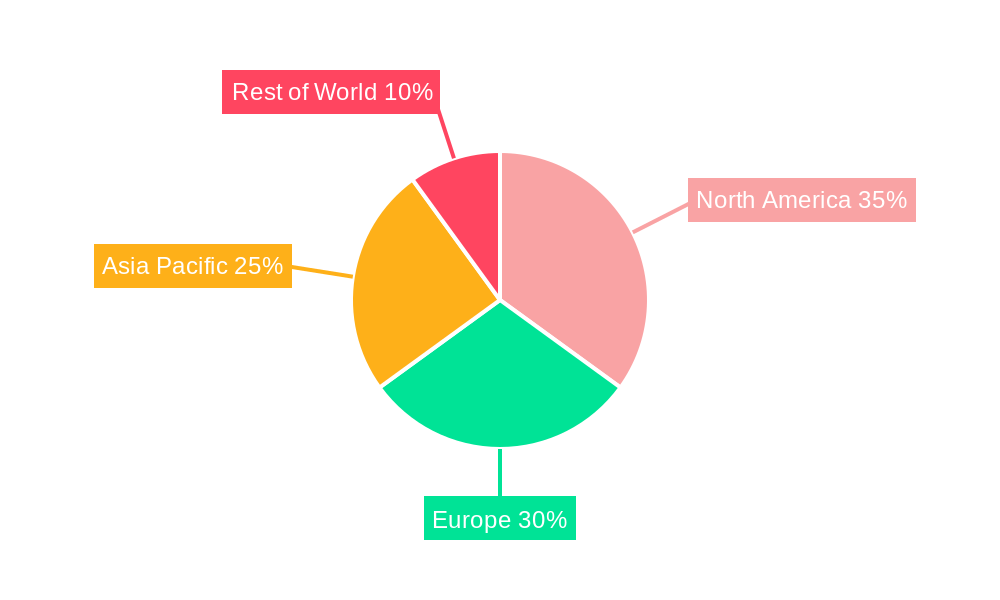

Geographical analysis reveals a strong presence across North America and Europe, fueled by well-established life sciences sectors and robust regulatory frameworks. However, the Asia-Pacific region is anticipated to experience significant growth due to rapid economic expansion, increasing healthcare investments, and a rising middle class. Growth restraints include the relatively high cost of advanced protective clothing, especially reusable options, and potential supply chain disruptions related to raw material sourcing. Nevertheless, the overall outlook remains positive, driven by the critical role of protective clothing in maintaining worker safety and operational efficiency within the life sciences industry. Key players like 3M, DuPont, and Ansell are actively shaping the market through innovation and expansion.

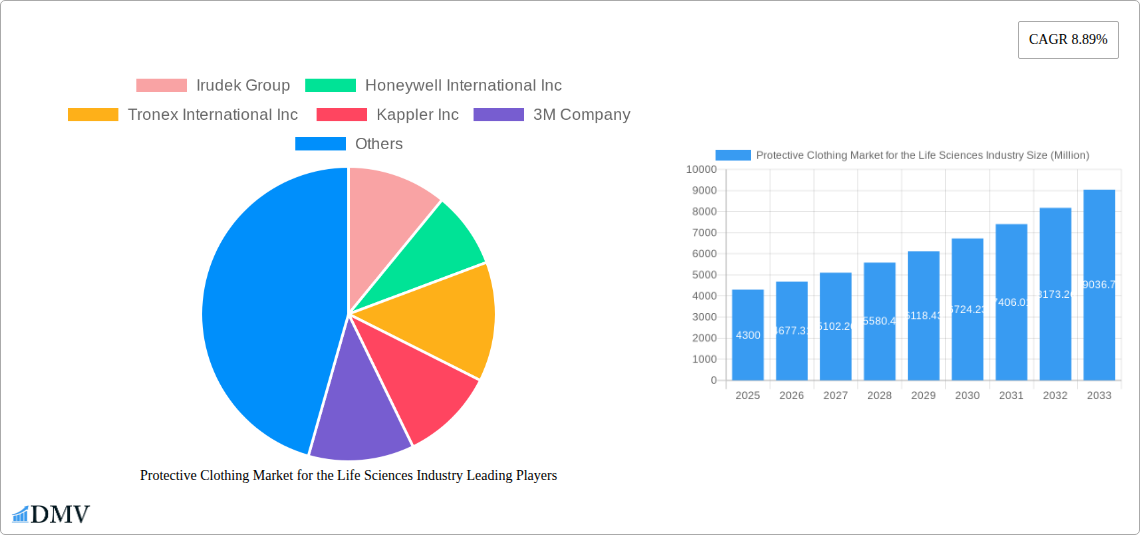

Protective Clothing Market for the Life Sciences Industry Company Market Share

Protective Clothing Market for the Life Sciences Industry: A Comprehensive Report (2019-2033)

This insightful report delivers a comprehensive analysis of the Protective Clothing Market for the Life Sciences Industry, providing crucial data and trends for informed decision-making. Valued at xx Million in 2025, the market is poised for significant growth, reaching xx Million by 2033. This in-depth study covers the historical period (2019-2024), the base year (2025), and forecasts until 2033, offering a complete understanding of market dynamics.

Protective Clothing Market for the Life Sciences Industry Market Composition & Trends

This section meticulously examines the market's competitive landscape, highlighting key trends and influencing factors. We delve into market concentration, analyzing the market share distribution among leading players like Irudek Group, Honeywell International Inc, Tronex International Inc, Kappler Inc, 3M Company, Lakeland Industries Inc, Berkshire Corporation, E I DuPont De Nemours and Company, Kimberly Clark Corporation, and Ansell Limited. We also quantify the influence of mergers and acquisitions (M&A) activities, estimating the total value of M&A deals within the study period at xx Million. Innovation within the protective clothing sector is also analyzed, focusing on advancements in materials science, ergonomics, and enhanced protection features. The impact of regulatory landscapes, particularly concerning safety standards and compliance requirements, is assessed. Further, the report explores substitute products, analyzing their market penetration and potential impact on the industry's growth. Detailed end-user profiles illuminate the specific needs and purchasing behaviors within the life sciences industry, while an overview of current and projected M&A activity rounds out the section.

- Market Concentration: Highly fragmented with top 5 players holding approximately xx% of market share.

- Innovation Catalysts: Advancements in nanotechnology, antimicrobial materials, and smart textiles are driving innovation.

- Regulatory Landscape: Stringent safety and compliance standards, especially for medical applications, shape industry practices.

- Substitute Products: Limited viable substitutes, but increasing focus on reusable and sustainable alternatives.

- M&A Activity: Significant M&A activity observed during the study period, with total deal value estimated at xx Million.

Protective Clothing Market for the Life Sciences Industry Industry Evolution

This section provides a detailed analysis of the protective clothing market's evolution over the study period (2019-2033). We track market growth trajectories, exploring the factors driving expansion and fluctuations in demand. Technological advancements, such as the development of new materials with superior protection properties, are examined for their impact on market dynamics. Shifting consumer demands, influenced by factors like enhanced comfort, improved ergonomics, and sustainability concerns, are also scrutinized. The report incorporates specific data points, including compound annual growth rates (CAGR) for key segments, and adoption metrics for new technologies. For instance, the adoption rate of disposable protective clothing is projected to increase by xx% during the forecast period due to increased awareness of infection control. The growing demand for specialized protective clothing in sectors such as biotechnology and pharmaceuticals is also analyzed, highlighting changing industry needs and trends.

Leading Regions, Countries, or Segments in Protective Clothing Market for the Life Sciences Industry

This section identifies the dominant regions, countries, and segments within the protective clothing market for the life sciences industry. We analyze the market's performance across different segments – Medical (Radiation Protection, Bacterial/Viral Protection, Chemical Protection, Other Applications), Products (Suits/Coveralls, Gloves, Aprons, Facemasks & Hats, Protective Eyewear & Cleanroom Goggles, Footwear & Overshoes, Wipes, Other Products), Type (Disposable, Reusable), and Application (Cleanroom Clothing).

Key Drivers for Dominant Segments:

- North America leads the market due to stringent regulatory environments, high healthcare expenditure, and significant R&D investments.

- Disposable Protective Clothing: High demand driven by infection control concerns and ease of use.

- Gloves: Largest product segment due to widespread application across various life science settings.

- Bacterial/Viral Protection: Rapid growth fueled by pandemics and outbreaks.

Dominance Factors: The dominance of specific segments or regions is analyzed through an examination of factors like regulatory frameworks, investment trends, technological advancements, and the presence of major market players. For example, the strong regulatory environment in North America drives demand for high-quality, certified protective clothing, fostering market growth.

Protective Clothing Market for the Life Sciences Industry Product Innovations

Recent innovations focus on enhancing comfort, breathability, and protection levels. Advancements include the integration of nanotechnology for improved barrier properties, the development of self-sterilizing materials, and improved ergonomic designs for enhanced user experience. Companies are emphasizing unique selling propositions such as superior durability, lightweight materials, and increased resistance to various chemicals and biological agents. For example, Toray Industries' LIVMOATM 4500AS disposable personal protective clothing offers superior water resistance, breathability, and dust protection, exceeding industry standards.

Propelling Factors for Protective Clothing Market for the Life Sciences Industry Growth

Several factors are driving market growth, including the increasing prevalence of infectious diseases, rising awareness of occupational health and safety, stringent regulatory compliance requirements, and technological advancements. The rising demand for specialized protective clothing in emerging economies is also contributing to the expansion of the market. For example, the increased investments in healthcare infrastructure in developing countries will create further demand.

Obstacles in the Protective Clothing Market for the Life Sciences Industry Market

Despite growth prospects, challenges exist. These include fluctuations in raw material costs, complexities in regulatory approvals, supply chain disruptions that hinder production and distribution, and intense competition among market participants. These factors can lead to price volatility and limit market expansion. For example, supply chain issues during the pandemic led to shortages of critical protective clothing items.

Future Opportunities in Protective Clothing Market for the Life Sciences Industry

The market presents several emerging opportunities, including increasing demand for sustainable and eco-friendly protective clothing, the development of smart protective apparel incorporating sensors and monitoring capabilities, and expansion into new applications such as personalized protective equipment.

Major Players in the Protective Clothing Market for the Life Sciences Industry Ecosystem

Key Developments in Protective Clothing Market for the Life Sciences Industry Industry

- June 2022: Health Supply US announces plans to establish new manufacturing operations, increasing domestic nitrile glove production by 4.3 billion annually. This significantly bolsters the domestic supply chain and reduces reliance on imports.

- April 20, 2022: Toray Industries, Inc. launches LIVMOATM 4500AS disposable protective clothing, meeting JIS T 8115 Type 4 standards for chemical protection. This product launch introduces a superior, high-performance option to the market.

Strategic Protective Clothing Market for the Life Sciences Industry Market Forecast

The protective clothing market for the life sciences industry is projected to experience robust growth, driven by continuing demand in healthcare, biotechnology, and pharmaceutical sectors. Emerging trends in personalized protective equipment and sustainable materials will further stimulate market expansion. The increasing focus on infection control and workplace safety will ensure sustained demand for a wide range of protective clothing products. The market’s future trajectory appears bright, indicating significant growth potential in the coming years.

Protective Clothing Market for the Life Sciences Industry Segmentation

-

1. Products

- 1.1. Suits/Coveralls

- 1.2. Gloves

- 1.3. Aprons

- 1.4. Facemasks and Hats

- 1.5. Protective Eyewear and Cleanroom Goggles

- 1.6. Footwear and Overshoes

- 1.7. Wipes

- 1.8. Other Products

-

2. Type

- 2.1. Disposable

- 2.2. Reusable

-

3. Application

-

3.1. Cleanroom Clothing

- 3.1.1. Pharmaceutical

- 3.1.2. Biotechnology

- 3.1.3. Medical

- 3.2. Radiation Protection

- 3.3. Bacterial/ Viral Protection

- 3.4. Chemical Protection

- 3.5. Other Applications

-

3.1. Cleanroom Clothing

Protective Clothing Market for the Life Sciences Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Protective Clothing Market for the Life Sciences Industry Regional Market Share

Geographic Coverage of Protective Clothing Market for the Life Sciences Industry

Protective Clothing Market for the Life Sciences Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strict Regulatory Standards Pertaining to Patient Safety; Growth in Biotechnology and Healthcare Spending; Increasing Use of Protective Gloves

- 3.3. Market Restrains

- 3.3.1. Increased Demand for Outsourcing and Automation in Pharmaceutical Manufacturing

- 3.4. Market Trends

- 3.4.1. Increasing Use of Protective Gloves is Boosting the Demand of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Protective Clothing Market for the Life Sciences Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Products

- 5.1.1. Suits/Coveralls

- 5.1.2. Gloves

- 5.1.3. Aprons

- 5.1.4. Facemasks and Hats

- 5.1.5. Protective Eyewear and Cleanroom Goggles

- 5.1.6. Footwear and Overshoes

- 5.1.7. Wipes

- 5.1.8. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Disposable

- 5.2.2. Reusable

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Cleanroom Clothing

- 5.3.1.1. Pharmaceutical

- 5.3.1.2. Biotechnology

- 5.3.1.3. Medical

- 5.3.2. Radiation Protection

- 5.3.3. Bacterial/ Viral Protection

- 5.3.4. Chemical Protection

- 5.3.5. Other Applications

- 5.3.1. Cleanroom Clothing

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Products

- 6. North America Protective Clothing Market for the Life Sciences Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Products

- 6.1.1. Suits/Coveralls

- 6.1.2. Gloves

- 6.1.3. Aprons

- 6.1.4. Facemasks and Hats

- 6.1.5. Protective Eyewear and Cleanroom Goggles

- 6.1.6. Footwear and Overshoes

- 6.1.7. Wipes

- 6.1.8. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Disposable

- 6.2.2. Reusable

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Cleanroom Clothing

- 6.3.1.1. Pharmaceutical

- 6.3.1.2. Biotechnology

- 6.3.1.3. Medical

- 6.3.2. Radiation Protection

- 6.3.3. Bacterial/ Viral Protection

- 6.3.4. Chemical Protection

- 6.3.5. Other Applications

- 6.3.1. Cleanroom Clothing

- 6.1. Market Analysis, Insights and Forecast - by Products

- 7. Europe Protective Clothing Market for the Life Sciences Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Products

- 7.1.1. Suits/Coveralls

- 7.1.2. Gloves

- 7.1.3. Aprons

- 7.1.4. Facemasks and Hats

- 7.1.5. Protective Eyewear and Cleanroom Goggles

- 7.1.6. Footwear and Overshoes

- 7.1.7. Wipes

- 7.1.8. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Disposable

- 7.2.2. Reusable

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Cleanroom Clothing

- 7.3.1.1. Pharmaceutical

- 7.3.1.2. Biotechnology

- 7.3.1.3. Medical

- 7.3.2. Radiation Protection

- 7.3.3. Bacterial/ Viral Protection

- 7.3.4. Chemical Protection

- 7.3.5. Other Applications

- 7.3.1. Cleanroom Clothing

- 7.1. Market Analysis, Insights and Forecast - by Products

- 8. Asia Pacific Protective Clothing Market for the Life Sciences Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Products

- 8.1.1. Suits/Coveralls

- 8.1.2. Gloves

- 8.1.3. Aprons

- 8.1.4. Facemasks and Hats

- 8.1.5. Protective Eyewear and Cleanroom Goggles

- 8.1.6. Footwear and Overshoes

- 8.1.7. Wipes

- 8.1.8. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Disposable

- 8.2.2. Reusable

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Cleanroom Clothing

- 8.3.1.1. Pharmaceutical

- 8.3.1.2. Biotechnology

- 8.3.1.3. Medical

- 8.3.2. Radiation Protection

- 8.3.3. Bacterial/ Viral Protection

- 8.3.4. Chemical Protection

- 8.3.5. Other Applications

- 8.3.1. Cleanroom Clothing

- 8.1. Market Analysis, Insights and Forecast - by Products

- 9. Rest of the World Protective Clothing Market for the Life Sciences Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Products

- 9.1.1. Suits/Coveralls

- 9.1.2. Gloves

- 9.1.3. Aprons

- 9.1.4. Facemasks and Hats

- 9.1.5. Protective Eyewear and Cleanroom Goggles

- 9.1.6. Footwear and Overshoes

- 9.1.7. Wipes

- 9.1.8. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Disposable

- 9.2.2. Reusable

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Cleanroom Clothing

- 9.3.1.1. Pharmaceutical

- 9.3.1.2. Biotechnology

- 9.3.1.3. Medical

- 9.3.2. Radiation Protection

- 9.3.3. Bacterial/ Viral Protection

- 9.3.4. Chemical Protection

- 9.3.5. Other Applications

- 9.3.1. Cleanroom Clothing

- 9.1. Market Analysis, Insights and Forecast - by Products

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Irudek Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Honeywell International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Tronex International Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Kappler Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 3M Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Lakeland Industries Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Berkshire Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 E I DuPont De Nemours and Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Kimberly Clark Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Ansell Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Irudek Group

List of Figures

- Figure 1: Global Protective Clothing Market for the Life Sciences Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Protective Clothing Market for the Life Sciences Industry Revenue (Million), by Products 2025 & 2033

- Figure 3: North America Protective Clothing Market for the Life Sciences Industry Revenue Share (%), by Products 2025 & 2033

- Figure 4: North America Protective Clothing Market for the Life Sciences Industry Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Protective Clothing Market for the Life Sciences Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Protective Clothing Market for the Life Sciences Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Protective Clothing Market for the Life Sciences Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Protective Clothing Market for the Life Sciences Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Protective Clothing Market for the Life Sciences Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Protective Clothing Market for the Life Sciences Industry Revenue (Million), by Products 2025 & 2033

- Figure 11: Europe Protective Clothing Market for the Life Sciences Industry Revenue Share (%), by Products 2025 & 2033

- Figure 12: Europe Protective Clothing Market for the Life Sciences Industry Revenue (Million), by Type 2025 & 2033

- Figure 13: Europe Protective Clothing Market for the Life Sciences Industry Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Protective Clothing Market for the Life Sciences Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Protective Clothing Market for the Life Sciences Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Protective Clothing Market for the Life Sciences Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Protective Clothing Market for the Life Sciences Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Protective Clothing Market for the Life Sciences Industry Revenue (Million), by Products 2025 & 2033

- Figure 19: Asia Pacific Protective Clothing Market for the Life Sciences Industry Revenue Share (%), by Products 2025 & 2033

- Figure 20: Asia Pacific Protective Clothing Market for the Life Sciences Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Asia Pacific Protective Clothing Market for the Life Sciences Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Pacific Protective Clothing Market for the Life Sciences Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Pacific Protective Clothing Market for the Life Sciences Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Protective Clothing Market for the Life Sciences Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Protective Clothing Market for the Life Sciences Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Protective Clothing Market for the Life Sciences Industry Revenue (Million), by Products 2025 & 2033

- Figure 27: Rest of the World Protective Clothing Market for the Life Sciences Industry Revenue Share (%), by Products 2025 & 2033

- Figure 28: Rest of the World Protective Clothing Market for the Life Sciences Industry Revenue (Million), by Type 2025 & 2033

- Figure 29: Rest of the World Protective Clothing Market for the Life Sciences Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Rest of the World Protective Clothing Market for the Life Sciences Industry Revenue (Million), by Application 2025 & 2033

- Figure 31: Rest of the World Protective Clothing Market for the Life Sciences Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: Rest of the World Protective Clothing Market for the Life Sciences Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Protective Clothing Market for the Life Sciences Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Protective Clothing Market for the Life Sciences Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 2: Global Protective Clothing Market for the Life Sciences Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Protective Clothing Market for the Life Sciences Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Protective Clothing Market for the Life Sciences Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Protective Clothing Market for the Life Sciences Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 6: Global Protective Clothing Market for the Life Sciences Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Protective Clothing Market for the Life Sciences Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Protective Clothing Market for the Life Sciences Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Protective Clothing Market for the Life Sciences Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 10: Global Protective Clothing Market for the Life Sciences Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Protective Clothing Market for the Life Sciences Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Protective Clothing Market for the Life Sciences Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Protective Clothing Market for the Life Sciences Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 14: Global Protective Clothing Market for the Life Sciences Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 15: Global Protective Clothing Market for the Life Sciences Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global Protective Clothing Market for the Life Sciences Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Protective Clothing Market for the Life Sciences Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 18: Global Protective Clothing Market for the Life Sciences Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Protective Clothing Market for the Life Sciences Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Protective Clothing Market for the Life Sciences Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Protective Clothing Market for the Life Sciences Industry?

The projected CAGR is approximately 8.89%.

2. Which companies are prominent players in the Protective Clothing Market for the Life Sciences Industry?

Key companies in the market include Irudek Group, Honeywell International Inc, Tronex International Inc , Kappler Inc, 3M Company, Lakeland Industries Inc, Berkshire Corporation, E I DuPont De Nemours and Company, Kimberly Clark Corporation, Ansell Limited.

3. What are the main segments of the Protective Clothing Market for the Life Sciences Industry?

The market segments include Products, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Strict Regulatory Standards Pertaining to Patient Safety; Growth in Biotechnology and Healthcare Spending; Increasing Use of Protective Gloves.

6. What are the notable trends driving market growth?

Increasing Use of Protective Gloves is Boosting the Demand of the Market.

7. Are there any restraints impacting market growth?

Increased Demand for Outsourcing and Automation in Pharmaceutical Manufacturing.

8. Can you provide examples of recent developments in the market?

June 2022: Health Supply US, a government contracting and medical supply company, announced its plan to establish new manufacturing operations in Greenville County. The company's FDA-compliant products include Class I medical devices and products such as medical isolation gowns and nitrile gloves. The new facility will produce an expected 4.3 billion nitrile gloves annually and greatly increase the domestic supply of this critical medical supply product.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Protective Clothing Market for the Life Sciences Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Protective Clothing Market for the Life Sciences Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Protective Clothing Market for the Life Sciences Industry?

To stay informed about further developments, trends, and reports in the Protective Clothing Market for the Life Sciences Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence