Key Insights

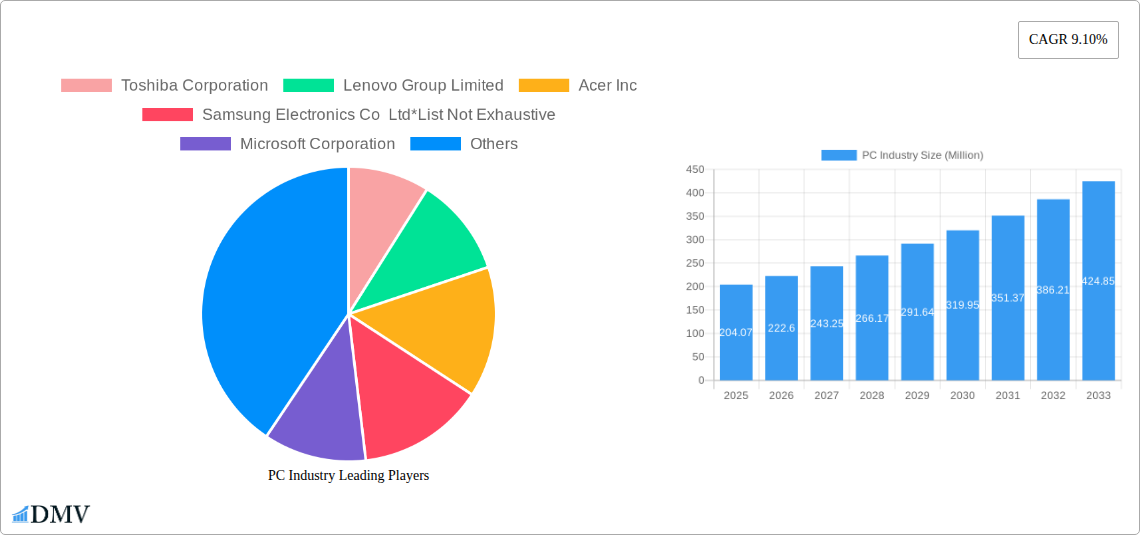

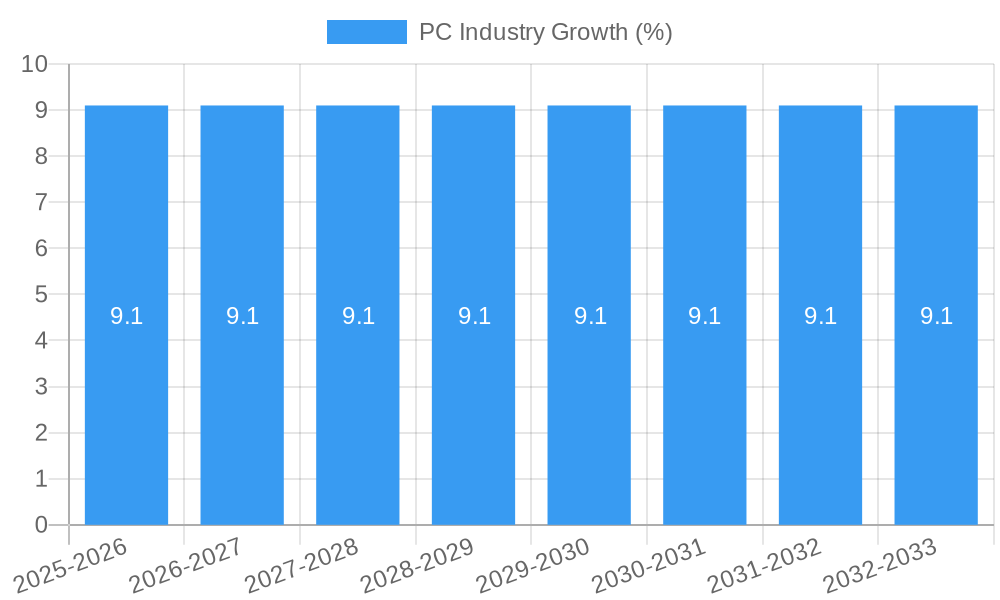

The global PC Industry is poised for substantial growth, currently valued at approximately $204.07 million, and is projected to expand at a Compound Annual Growth Rate (CAGR) of 9.10% through 2033. This robust expansion is fueled by several key drivers, including the increasing demand for advanced computing power in professional environments, the sustained popularity of gaming PCs, and the ongoing digital transformation across various sectors. The widespread adoption of remote and hybrid work models continues to necessitate upgraded personal computing devices, while the burgeoning creator economy further stimulates demand for high-performance laptops and desktops. Furthermore, advancements in artificial intelligence and machine learning are pushing the boundaries of what PCs can achieve, creating new use cases and driving upgrades. The market segments, encompassing Laptops, Desktop PCs, All-In-One Stations, and Tablets, are all expected to witness healthy growth, with laptops likely to dominate due to their portability and versatility.

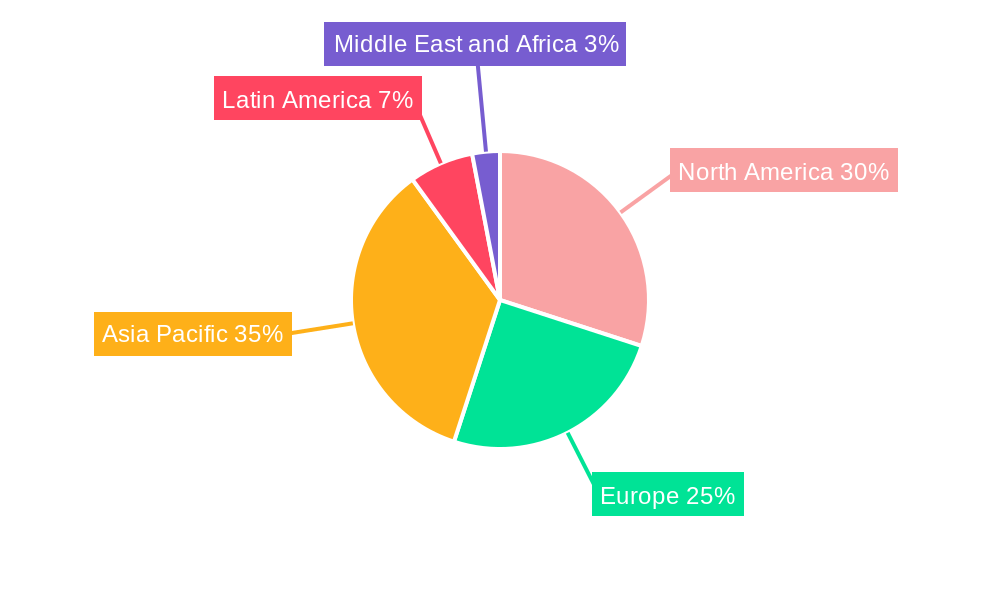

However, the industry also faces certain restraints that could temper its growth trajectory. Intense price competition among major players, including industry giants like Lenovo, Dell, HP, and Apple, can impact profit margins. Additionally, the increasing lifespan of PCs, driven by improved durability and upgradeability, might slow down the replacement cycle for some consumers. Supply chain disruptions, though potentially easing, can still present challenges in meeting demand fluctuations. The market is characterized by a dynamic competitive landscape, with established players like Toshiba Corporation, Acer Inc., Samsung Electronics Co., Ltd., Microsoft Corporation, Micro-Star International Co., ASUSTeK Computer Inc., and Razer Inc. vying for market share. Regional analysis indicates that North America and Europe currently represent significant market shares, with the Asia Pacific region anticipated to exhibit the fastest growth due to its large population, increasing disposable incomes, and rapid technological adoption.

PC Industry Market Composition & Trends

This comprehensive PC industry market report delves into the intricate dynamics shaping the global personal computer landscape from 2019 to 2033, with a robust focus on the 2025 base and forecast periods. We meticulously analyze market concentration, identifying key players and their strategic maneuvers. Innovation catalysts, including advancements in processor technology and display resolutions, are thoroughly examined for their impact. The evolving regulatory landscapes across major economies are assessed, alongside an evaluation of substitute products and their competitive pressures. End-user profiles are delineated, segmenting demand across consumer, enterprise, and educational sectors. M&A activities are dissected, with a projected XX Million in deal values anticipated within the forecast period, illustrating consolidation and strategic acquisitions. Market share distribution is projected to see significant shifts, with established giants like Lenovo Group Limited and HP vying for dominance against agile innovators like Acer Inc and ASUSTek Computer Inc. The report provides an in-depth look at the PC market size and future projections.

- Market Concentration: Analysis of market share distribution among leading players, including Dell Inc, Microsoft Corporation, and Apple Inc.

- Innovation Catalysts: Examination of emerging technologies like AI integration, enhanced graphics capabilities, and sustainable manufacturing processes.

- Regulatory Landscapes: Impact of trade policies, data privacy regulations, and environmental compliance on PC market growth.

- Substitute Products: Competitive analysis of smartphones, tablets, and cloud computing services.

- End-User Profiles: Segmentation of demand from gamers, remote workers, creative professionals, and students.

- M&A Activities: Overview of recent and anticipated mergers, acquisitions, and partnerships within the PC ecosystem.

PC Industry Industry Evolution

The PC industry has undergone a profound transformation, evolving from bulky desktop machines to sleek, portable, and powerful devices that are integral to modern life. Our extensive analysis traces this evolution from 2019 through 2024, projecting its trajectory to 2033. During the historical period (2019–2024), the industry witnessed a significant surge driven by the widespread adoption of remote work and online learning, leading to an approximate compound annual growth rate (CAGR) of 3.5%. Technological advancements have been the relentless engine of this evolution. The introduction of more energy-efficient processors, such as those developed by Intel Corporation and AMD, coupled with the proliferation of solid-state drives (SSDs), dramatically improved performance and user experience. The rise of specialized computing needs, from gaming to content creation, has fueled innovation in areas like high-performance GPUs and advanced cooling systems.

Shifting consumer demands have been equally pivotal. The desire for portability and versatility has propelled the laptop segment, making it the dominant form factor. This is evident in the increasing market penetration of ultra-thin and lightweight laptops. Furthermore, the growing emphasis on immersive experiences has spurred demand for premium gaming PCs and All-In-One stations designed for productivity and entertainment. The PC industry growth trajectory has also been influenced by cyclical refresh rates and the increasing integration of cloud services, blurring the lines between local computing power and online resources. For instance, the adoption of operating systems and productivity software has seen a continuous upward trend, with Microsoft Corporation remaining a dominant force. The estimated market size for PC components is projected to reach XX Million by 2025, reflecting sustained demand. The ongoing development of hybrid work models and the increasing reliance on digital infrastructure for all aspects of life suggest a continued, albeit potentially more moderated, growth phase in the coming years. The PC market value is expected to see steady expansion.

Leading Regions, Countries, or Segments in PC Industry

The PC industry's global dominance is intricately linked to specific regions and product segments, with laptops emerging as the undisputed leader. This segment is projected to account for over XX Million in market value by 2025. The proliferation of hybrid work models, coupled with the increasing demand for mobile computing solutions in both enterprise and consumer sectors, has cemented laptops' position. Key drivers fueling this dominance include significant investment trends in portable device manufacturing, exemplified by companies like Lenovo Group Limited and Dell Inc, which have consistently focused on innovating their laptop lines. Furthermore, regulatory support in various countries, aimed at promoting digital literacy and technological adoption, indirectly benefits the laptop market by increasing overall PC penetration.

North America and Asia-Pacific currently represent the largest regional markets for personal computers. North America, driven by a mature enterprise market and a strong consumer appetite for premium devices, contributes significantly to the overall PC market size. Companies like Apple Inc, with its highly sought-after MacBook series, and Microsoft Corporation, through its Surface line, have a substantial presence here. The Asia-Pacific region, on the other hand, is characterized by its rapidly expanding middle class and a growing demand for affordable yet capable computing solutions, making it a crucial growth engine for brands such as Acer Inc and ASUSTek Computer Inc. Investment trends in these regions are heavily skewed towards research and development for more powerful, energy-efficient, and aesthetically pleasing laptops.

The dominance of the laptop segment is further amplified by its adaptability across diverse user needs, from business professionals requiring robust performance and security to students needing portability and affordability. While Desktop PCs and All-In-One Stations maintain a steady presence, particularly in professional and home office environments, their growth is comparatively slower than that of laptops. Tablets, while popular for specific use cases like media consumption and light productivity, have not achieved the same level of comprehensive computing utility as laptops, thus limiting their market share in the broader PC industry context. The ongoing innovation in laptop form factors, such as 2-in-1 convertibles and foldable displays, ensures their continued relevance and market leadership throughout the forecast period.

PC Industry Product Innovations

Product innovation in the PC industry is relentlessly pushing boundaries. Recent advancements include the integration of AI-powered features for enhanced productivity and user experience, exemplified by Microsoft Corporation's Copilot. Performance metrics are consistently improving, with processors achieving higher clock speeds and greater energy efficiency. Unique selling propositions now focus on sustainable materials, advanced cooling systems for gaming PCs by brands like Micro-Star International Co, and ultra-high-resolution displays for creative professionals. The development of advanced connectivity, such as Wi-Fi 7 and Thunderbolt 4, further enhances the performance and versatility of modern PCs, appealing to a broad spectrum of users.

Propelling Factors for PC Industry Growth

The PC industry's growth is propelled by several key factors. Technological advancements, including the relentless innovation in CPU and GPU technology from companies like Intel and NVIDIA, are constantly enabling more powerful and versatile devices. The expanding digital economy, with its increasing reliance on cloud computing and data processing, creates a continuous demand for personal computing hardware. Furthermore, the sustained trend of remote and hybrid work models necessitates robust computing solutions for a distributed workforce, driving the need for laptops and desktops. Government initiatives promoting digital transformation and technology adoption in education and businesses also play a crucial role. The PC market size is poised for continued expansion due to these synergistic forces.

Obstacles in the PC Industry Market

Despite robust growth, the PC industry faces significant obstacles. Global supply chain disruptions, exacerbated by geopolitical tensions and component shortages, continue to impact production volumes and lead times, potentially increasing PC market value for consumers. Stringent regulatory hurdles in certain regions, particularly concerning trade tariffs and data privacy, can impede market access and increase operational costs. Fierce competitive pressures among major players like Lenovo Group Limited, HP, and Dell Inc can lead to price wars, squeezing profit margins. The increasing maturity of the PC market in developed economies also presents a challenge, as replacement cycles become longer.

Future Opportunities in PC Industry

The PC industry is ripe with future opportunities. The growing demand for specialized computing devices, such as high-performance gaming PCs and powerful workstations for AI development and content creation, presents a significant avenue for growth. Emerging markets in developing economies offer vast untapped potential for PC adoption as digital infrastructure expands. The integration of advanced AI capabilities directly into PC hardware presents a paradigm shift, promising more intelligent and personalized computing experiences. Furthermore, the increasing focus on sustainability and eco-friendly manufacturing provides opportunities for companies that prioritize green technologies and circular economy principles. The PC market forecast indicates strong potential in these areas.

Major Players in the PC Industry Ecosystem

- Toshiba Corporation

- Lenovo Group Limited

- Acer Inc

- Samsung Electronics Co Ltd

- Microsoft Corporation

- Dell Inc

- Micro-Star International Co

- ASUSTek Computer Inc

- Razer Inc

- The Hewlett-Packard Company (HP)

- Apple Inc

Key Developments in PC Industry Industry

- June 2022: Apple, the leading telephone brand in the world, launched the MacBook Air 2022 with the latest design and M2 chip. Apple's new M2 processor helps the 2022 Air function 40% better than its predecessor.

- June 2022: Dell Technologies disclosed the availability of its newest line-up of business laptops from the Latitude and Precision series. The new laptops are intended to enhance hybrid work experiences for enterprises. Pricing for Dell's 2022 array of business laptops and mobile workstations begins at Rs 79,990 (USD 967).

Strategic PC Industry Market Forecast

The strategic PC industry market forecast indicates a sustained growth trajectory driven by ongoing technological innovation and evolving consumer and enterprise needs. The increasing demand for premium laptops, coupled with the rise of specialized computing segments like gaming and professional workstations, will fuel market expansion. Emerging markets in developing nations represent significant untapped potential, offering substantial growth opportunities for PC manufacturers. The continued integration of AI and advanced connectivity features will further enhance the value proposition of personal computers. Strategic investments in research and development, coupled with adaptive business models, will be crucial for key players to capitalize on future market potential and maintain a strong PC market share.

PC Industry Segmentation

-

1. Type

- 1.1. Laptops

- 1.2. Desktop PCs

- 1.3. All-In-One Stations

- 1.4. Tablets

PC Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

PC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Demand of Laptop; Impacts of Digitalization Across the Globe

- 3.3. Market Restrains

- 3.3.1. Inflation Hurts The Overall Market

- 3.4. Market Trends

- 3.4.1. Laptop Demand Boosting the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. PC Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Laptops

- 5.1.2. Desktop PCs

- 5.1.3. All-In-One Stations

- 5.1.4. Tablets

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America PC Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Laptops

- 6.1.2. Desktop PCs

- 6.1.3. All-In-One Stations

- 6.1.4. Tablets

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe PC Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Laptops

- 7.1.2. Desktop PCs

- 7.1.3. All-In-One Stations

- 7.1.4. Tablets

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific PC Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Laptops

- 8.1.2. Desktop PCs

- 8.1.3. All-In-One Stations

- 8.1.4. Tablets

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America PC Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Laptops

- 9.1.2. Desktop PCs

- 9.1.3. All-In-One Stations

- 9.1.4. Tablets

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa PC Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Laptops

- 10.1.2. Desktop PCs

- 10.1.3. All-In-One Stations

- 10.1.4. Tablets

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America PC Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe PC Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific PC Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America PC Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa PC Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Toshiba Corporation

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Lenovo Group Limited

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Acer Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Samsung Electronics Co Ltd*List Not Exhaustive

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Microsoft Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Dell Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Micro-Star International Co

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 ASUSTek Computer Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Razer Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 The Hewlett-Packard Company(HP)

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Apple Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Toshiba Corporation

List of Figures

- Figure 1: PC Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: PC Industry Share (%) by Company 2024

List of Tables

- Table 1: PC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: PC Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: PC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: PC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: PC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: PC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: PC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: PC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: PC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: PC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: PC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: PC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: PC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: PC Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 15: PC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: PC Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 17: PC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: PC Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: PC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: PC Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 21: PC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: PC Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 23: PC Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the PC Industry?

The projected CAGR is approximately 9.10%.

2. Which companies are prominent players in the PC Industry?

Key companies in the market include Toshiba Corporation, Lenovo Group Limited, Acer Inc, Samsung Electronics Co Ltd*List Not Exhaustive, Microsoft Corporation, Dell Inc, Micro-Star International Co, ASUSTek Computer Inc, Razer Inc, The Hewlett-Packard Company(HP), Apple Inc.

3. What are the main segments of the PC Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 204.07 Million as of 2022.

5. What are some drivers contributing to market growth?

Robust Demand of Laptop; Impacts of Digitalization Across the Globe.

6. What are the notable trends driving market growth?

Laptop Demand Boosting the Market.

7. Are there any restraints impacting market growth?

Inflation Hurts The Overall Market.

8. Can you provide examples of recent developments in the market?

June 2022: Apple, the leading telephone brand in the world, launched the MacBook Air 2022 with the latest design and M2 chip. Apple's new M2 processor helps the 2022 Air function 40% better than its predecessor.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "PC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the PC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the PC Industry?

To stay informed about further developments, trends, and reports in the PC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence