Key Insights

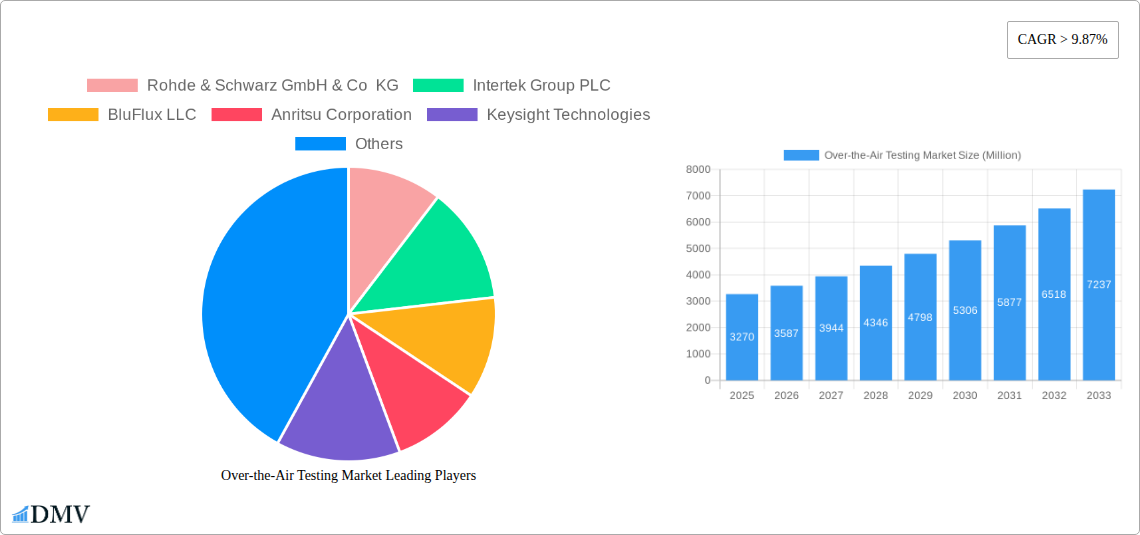

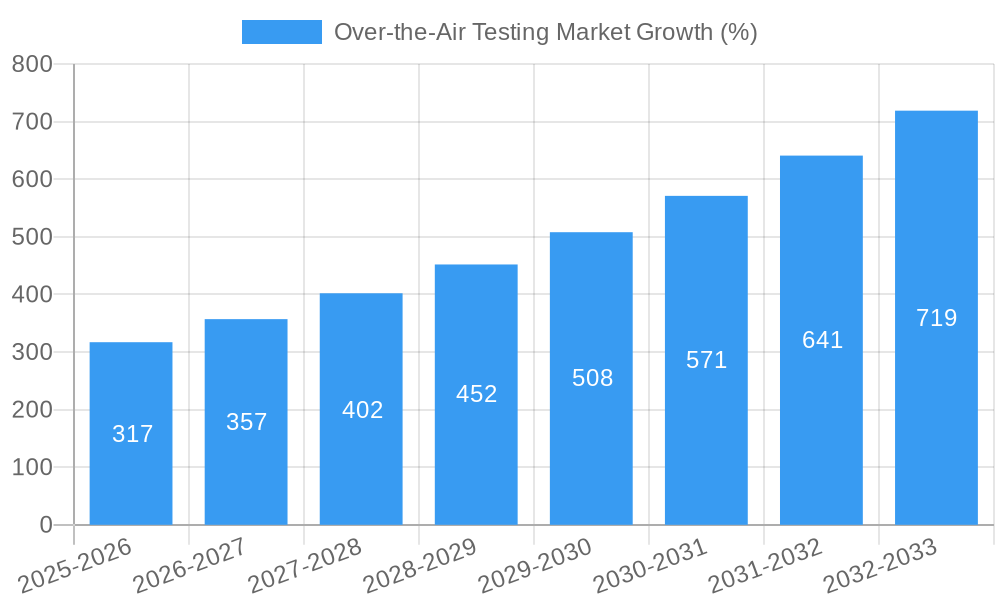

The Over-the-Air (OTA) testing market, valued at $3.27 billion in 2025, is projected to experience robust growth, driven by the increasing adoption of 5G technology and the expanding Internet of Things (IoT). The market's Compound Annual Growth Rate (CAGR) exceeding 9.87% from 2025 to 2033 indicates significant expansion potential. Key growth drivers include the proliferation of connected devices across automotive, industrial, and telecommunications sectors, demanding rigorous OTA testing to ensure seamless connectivity and performance. Furthermore, stringent regulatory compliance requirements for wireless devices are fueling demand for sophisticated OTA testing solutions. The market is segmented by technology (5G, LTE, UMTS, other technologies) and application (automotive, industrial, aerospace and defense, telecommunications, and consumer devices), with 5G and automotive applications expected to be the fastest-growing segments. Competition is intense, with established players like Rohde & Schwarz, Keysight Technologies, and Anritsu Corporation alongside emerging specialized firms like BluFlux LLC. Geographic expansion, particularly in the Asia-Pacific region fueled by increasing manufacturing and adoption of connected devices, will contribute significantly to market growth. While potential restraints could include high testing costs and complexities associated with new technologies, the overall market outlook remains extremely positive due to continuous innovation and the ever-growing demand for reliable wireless connectivity.

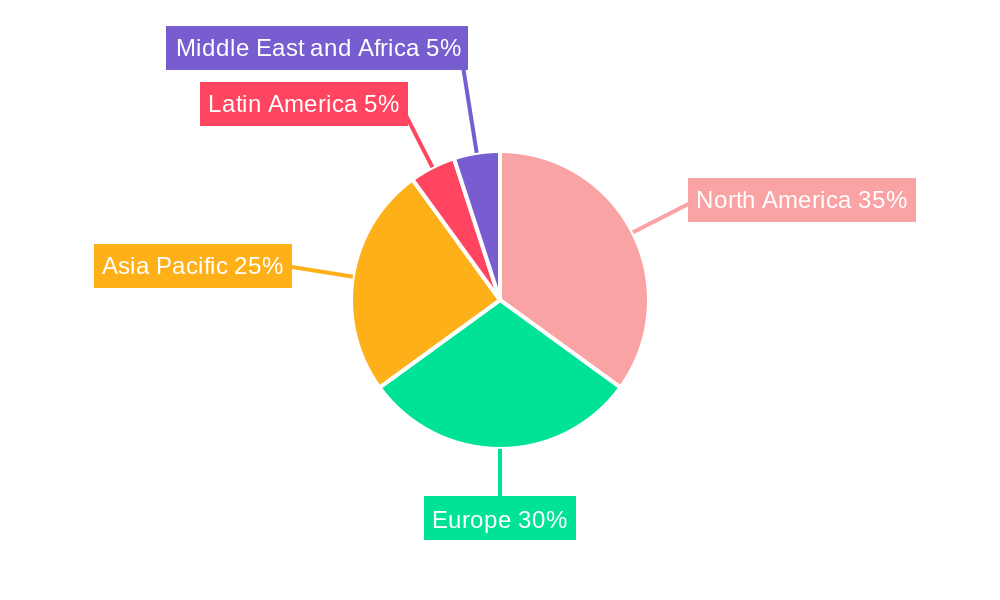

The forecast period (2025-2033) anticipates significant market expansion, predominantly fueled by the widespread rollout of 5G networks globally. This necessitates comprehensive OTA testing to ensure optimal performance and network compatibility. The increasing complexity of wireless devices and evolving communication protocols will further propel demand for advanced testing capabilities. Moreover, the rising demand for autonomous vehicles and smart infrastructure contributes substantially to the growth of the automotive and industrial segments. While North America and Europe currently hold significant market shares, the Asia-Pacific region is expected to witness exponential growth due to rapid technological advancements and the booming consumer electronics market. The competitive landscape is dynamic, with both established players and innovative startups vying for market dominance. Strategic partnerships, acquisitions, and technological innovations will play a vital role in shaping the competitive dynamics in the coming years.

Over-the-Air (OTA) Testing Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Over-the-Air (OTA) Testing market, offering invaluable insights for stakeholders seeking to navigate this dynamic landscape. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a robust understanding of past performance, current market dynamics, and future growth projections. The market is expected to reach xx Million by 2033.

Over-the-Air Testing Market Composition & Trends

This section delves into the competitive landscape of the OTA testing market, evaluating market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. The market is characterized by a moderately concentrated structure with key players such as Rohde & Schwarz, Keysight Technologies, and Anritsu Corporation holding significant market share. However, the emergence of smaller, specialized firms is increasing competition.

Market Concentration & Innovation:

- Market share distribution: Rohde & Schwarz (xx%), Keysight Technologies (xx%), Anritsu Corporation (xx%), Others (xx%).

- Innovation catalysts: The increasing demand for 5G and connected devices, coupled with advancements in mmWave technology, are driving innovation in OTA testing solutions.

- Regulatory landscape: Stringent regulatory requirements for device certification and performance are shaping market trends.

- Substitute products: While limited, alternative testing methods are emerging, posing a potential threat to traditional OTA testing.

- End-user profiles: Key end-users include automotive, telecommunications, aerospace & defense, and industrial sectors.

- M&A Activities: The last 5 years have witnessed xx M&A deals in the OTA testing market, with a total value of approximately xx Million.

Over-the-Air Testing Market Industry Evolution

This section analyzes the evolutionary trajectory of the OTA testing market, encompassing market growth trajectories, technological advancements, and shifting consumer demands. The market has witnessed significant growth driven by the proliferation of connected devices and the rollout of 5G networks. The historical period (2019-2024) showed a Compound Annual Growth Rate (CAGR) of xx%, while the forecast period (2025-2033) is projected to experience a CAGR of xx%. This growth is fueled by increasing demand for high-speed data transmission, improved network reliability, and the need for comprehensive device testing. Technological advancements, such as the introduction of 5G mmWave testing capabilities and automated testing solutions, further enhance efficiency and accuracy. Consumer demand for seamless connectivity and enhanced device performance is also a primary driver. The rising adoption of OTA testing solutions across various industries, including automotive and telecommunications, contributes to the overall market growth.

Leading Regions, Countries, or Segments in Over-the-Air Testing Market

This section identifies the leading regions, countries, and segments within the OTA testing market. The North American region currently holds the largest market share, driven by significant investments in 5G infrastructure and a strong presence of key players. However, the Asia-Pacific region is expected to witness the highest growth rate due to the burgeoning demand for connected devices and rapid adoption of 5G technology.

Dominant Segments:

- By Technology: 5G is the fastest-growing segment, followed by LTE.

- By Application: The automotive and transportation segment is experiencing robust growth due to the increasing adoption of connected car technologies.

Key Drivers:

- North America: Strong R&D investments, early 5G adoption, and presence of major players.

- Asia-Pacific: Rapid 5G deployment, increasing smartphone penetration, and expanding automotive industry.

- Europe: Stringent regulatory standards and growing demand for connected devices.

Over-the-Air Testing Market Product Innovations

Recent years have witnessed significant product innovations in the OTA testing market, including the development of automated testing systems, improved antenna measurement techniques, and the integration of AI and machine learning algorithms for enhanced data analysis and faster testing cycles. These advancements offer improved accuracy, efficiency, and reduced testing time, making OTA testing more accessible and cost-effective for various applications. The introduction of compact and portable testing solutions has further broadened the reach of OTA testing across diverse industries and geographic locations.

Propelling Factors for Over-the-Air Testing Market Growth

Several factors are driving the growth of the OTA testing market. The expansion of 5G networks is a significant contributor, increasing the demand for comprehensive testing solutions. The rise of connected devices across various sectors, including automotive, IoT, and industrial automation, fuels the market's expansion. Furthermore, stringent regulatory requirements for device certification and performance are creating a robust demand for OTA testing services.

Obstacles in the Over-the-Air Testing Market

Challenges in the OTA testing market include the high cost of advanced testing equipment, the complexity of testing procedures, and the need for skilled personnel. Supply chain disruptions and competitive pressures from emerging players also pose significant challenges. These factors can impact the overall market growth and necessitate continuous innovation and adaptation by existing players.

Future Opportunities in Over-the-Air Testing Market

Future opportunities lie in the expansion of 5G and beyond 5G technologies, the development of advanced testing solutions for mmWave and satellite communication, and the increasing demand for OTA testing in new sectors, such as healthcare and smart cities. Innovation in AI-driven testing and the development of cloud-based testing platforms offer further potential for growth and disruption in this rapidly evolving market.

Major Players in the Over-the-Air Testing Market Ecosystem

- Rohde & Schwarz GmbH & Co KG (Rohde & Schwarz)

- Intertek Group PLC (Intertek)

- BluFlux LLC

- Anritsu Corporation (Anritsu)

- Keysight Technologies (Keysight)

- Eurofins Scientific (Eurofins)

- SGS SA (SGS)

- MVG (Microwave Vision Group) (MVG)

- UL LLC (UL)

- Element Materials Technology

- Bureau Veritas SA (Bureau Veritas)

- CETECOM GmbH (RWTV GmbH)

Key Developments in Over-the-Air Testing Market Industry

- October 2023: Tessolve's collaboration with Airbiquity signifies a significant leap in connected vehicle technology, driving demand for OTA testing solutions for Telematics Gateways, OTA updates, and Data Logging.

- November 2022: Anokiwave and MilliBox's partnership advances mmWave OTA testing capabilities, potentially impacting the market with high-volume, accurate testing solutions for phased array antennas.

Strategic Over-the-Air Testing Market Forecast

The OTA testing market is poised for continued robust growth, driven by the proliferation of 5G and the expanding adoption of connected devices across various industries. Future opportunities lie in the development of innovative testing solutions for emerging technologies, such as satellite communication and IoT devices. The market is expected to reach significant heights by 2033, fueled by ongoing technological advancements and increasing regulatory mandates for device certification.

Over-the-Air Testing Market Segmentation

-

1. Technology

- 1.1. 5G

- 1.2. LTE

- 1.3. UMTS

- 1.4. Other Technologies (CDMA, GSM)

-

2. Application

- 2.1. Automotive and Transportation

- 2.2. Industrial

- 2.3. Aerospace and Defense

- 2.4. Telecommunication and Consumer Devices

- 2.5. Other Applications

Over-the-Air Testing Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Over-the-Air Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 9.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing IoT Market; Rapidly Evolving 5G Technology

- 3.3. Market Restrains

- 3.3.1. Lack of Standards in Applications and Initial Costs

- 3.4. Market Trends

- 3.4.1. Telecommunication and Consumer Devices Segment Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Over-the-Air Testing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. 5G

- 5.1.2. LTE

- 5.1.3. UMTS

- 5.1.4. Other Technologies (CDMA, GSM)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive and Transportation

- 5.2.2. Industrial

- 5.2.3. Aerospace and Defense

- 5.2.4. Telecommunication and Consumer Devices

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Over-the-Air Testing Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. 5G

- 6.1.2. LTE

- 6.1.3. UMTS

- 6.1.4. Other Technologies (CDMA, GSM)

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Automotive and Transportation

- 6.2.2. Industrial

- 6.2.3. Aerospace and Defense

- 6.2.4. Telecommunication and Consumer Devices

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Over-the-Air Testing Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. 5G

- 7.1.2. LTE

- 7.1.3. UMTS

- 7.1.4. Other Technologies (CDMA, GSM)

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Automotive and Transportation

- 7.2.2. Industrial

- 7.2.3. Aerospace and Defense

- 7.2.4. Telecommunication and Consumer Devices

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Over-the-Air Testing Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. 5G

- 8.1.2. LTE

- 8.1.3. UMTS

- 8.1.4. Other Technologies (CDMA, GSM)

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Automotive and Transportation

- 8.2.2. Industrial

- 8.2.3. Aerospace and Defense

- 8.2.4. Telecommunication and Consumer Devices

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Latin America Over-the-Air Testing Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. 5G

- 9.1.2. LTE

- 9.1.3. UMTS

- 9.1.4. Other Technologies (CDMA, GSM)

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Automotive and Transportation

- 9.2.2. Industrial

- 9.2.3. Aerospace and Defense

- 9.2.4. Telecommunication and Consumer Devices

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Over-the-Air Testing Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. 5G

- 10.1.2. LTE

- 10.1.3. UMTS

- 10.1.4. Other Technologies (CDMA, GSM)

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Automotive and Transportation

- 10.2.2. Industrial

- 10.2.3. Aerospace and Defense

- 10.2.4. Telecommunication and Consumer Devices

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. North America Over-the-Air Testing Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Over-the-Air Testing Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Over-the-Air Testing Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Over-the-Air Testing Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Over-the-Air Testing Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Rohde & Schwarz GmbH & Co KG

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Intertek Group PLC

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 BluFlux LLC

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Anritsu Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Keysight Technologies

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Eurofins Scientific

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 SGS SA

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 MVG (Microwave Vision Group)

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 UL LLC

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Element Materials Technology*List Not Exhaustive

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Bureau Veritas SA

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 CETECOM GmbH (RWTV GmbH)

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Rohde & Schwarz GmbH & Co KG

List of Figures

- Figure 1: Global Over-the-Air Testing Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Over-the-Air Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Over-the-Air Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Over-the-Air Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Over-the-Air Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Over-the-Air Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Over-the-Air Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Over-the-Air Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Over-the-Air Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Over-the-Air Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Over-the-Air Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Over-the-Air Testing Market Revenue (Million), by Technology 2024 & 2032

- Figure 13: North America Over-the-Air Testing Market Revenue Share (%), by Technology 2024 & 2032

- Figure 14: North America Over-the-Air Testing Market Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Over-the-Air Testing Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Over-the-Air Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Over-the-Air Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Over-the-Air Testing Market Revenue (Million), by Technology 2024 & 2032

- Figure 19: Europe Over-the-Air Testing Market Revenue Share (%), by Technology 2024 & 2032

- Figure 20: Europe Over-the-Air Testing Market Revenue (Million), by Application 2024 & 2032

- Figure 21: Europe Over-the-Air Testing Market Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe Over-the-Air Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Over-the-Air Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Over-the-Air Testing Market Revenue (Million), by Technology 2024 & 2032

- Figure 25: Asia Pacific Over-the-Air Testing Market Revenue Share (%), by Technology 2024 & 2032

- Figure 26: Asia Pacific Over-the-Air Testing Market Revenue (Million), by Application 2024 & 2032

- Figure 27: Asia Pacific Over-the-Air Testing Market Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Over-the-Air Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Over-the-Air Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Over-the-Air Testing Market Revenue (Million), by Technology 2024 & 2032

- Figure 31: Latin America Over-the-Air Testing Market Revenue Share (%), by Technology 2024 & 2032

- Figure 32: Latin America Over-the-Air Testing Market Revenue (Million), by Application 2024 & 2032

- Figure 33: Latin America Over-the-Air Testing Market Revenue Share (%), by Application 2024 & 2032

- Figure 34: Latin America Over-the-Air Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Over-the-Air Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Over-the-Air Testing Market Revenue (Million), by Technology 2024 & 2032

- Figure 37: Middle East and Africa Over-the-Air Testing Market Revenue Share (%), by Technology 2024 & 2032

- Figure 38: Middle East and Africa Over-the-Air Testing Market Revenue (Million), by Application 2024 & 2032

- Figure 39: Middle East and Africa Over-the-Air Testing Market Revenue Share (%), by Application 2024 & 2032

- Figure 40: Middle East and Africa Over-the-Air Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Over-the-Air Testing Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Over-the-Air Testing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Over-the-Air Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 3: Global Over-the-Air Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Over-the-Air Testing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Over-the-Air Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Over-the-Air Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Over-the-Air Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Over-the-Air Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Over-the-Air Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Over-the-Air Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Over-the-Air Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Over-the-Air Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Over-the-Air Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Over-the-Air Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Over-the-Air Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 16: Global Over-the-Air Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global Over-the-Air Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Over-the-Air Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 19: Global Over-the-Air Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Global Over-the-Air Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Over-the-Air Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 22: Global Over-the-Air Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 23: Global Over-the-Air Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Over-the-Air Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 25: Global Over-the-Air Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 26: Global Over-the-Air Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Over-the-Air Testing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 28: Global Over-the-Air Testing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Global Over-the-Air Testing Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Over-the-Air Testing Market?

The projected CAGR is approximately > 9.87%.

2. Which companies are prominent players in the Over-the-Air Testing Market?

Key companies in the market include Rohde & Schwarz GmbH & Co KG, Intertek Group PLC, BluFlux LLC, Anritsu Corporation, Keysight Technologies, Eurofins Scientific, SGS SA, MVG (Microwave Vision Group), UL LLC, Element Materials Technology*List Not Exhaustive, Bureau Veritas SA, CETECOM GmbH (RWTV GmbH).

3. What are the main segments of the Over-the-Air Testing Market?

The market segments include Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing IoT Market; Rapidly Evolving 5G Technology.

6. What are the notable trends driving market growth?

Telecommunication and Consumer Devices Segment Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Lack of Standards in Applications and Initial Costs.

8. Can you provide examples of recent developments in the market?

October 2023 - Tessolve has announced a collaboration with Airbiquity, one of the leading providers of connected vehicle services. This partnership heralds a new era of connected vehicles with Telematics Gateways, Over-The-Air (OTA) updates, and Data Logging solutions that promise enhanced connectivity, real-time updates, and predictive maintenance capabilities, ensuring safer, smarter, and more connected vehicles for the future.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Over-the-Air Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Over-the-Air Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Over-the-Air Testing Market?

To stay informed about further developments, trends, and reports in the Over-the-Air Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence