Key Insights

The Oil & Gas Digital Transformation Market is set for robust expansion, projected to reach $90.44 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 17% through 2033. This growth is driven by the critical need for enhanced operational efficiency, improved safety standards, and cost optimization within the oil and gas sector. Key technologies like Big Data/Analytics and Cloud Computing are fundamental, offering advanced data processing and accessibility. Artificial Intelligence (AI) and the Internet of Things (IoT) are transforming the industry through predictive maintenance, real-time asset monitoring, and optimized resource allocation, reducing downtime and maximizing output. Extended Reality (AR, VR, MR) further enhances training, remote assistance, and visualization of complex data and infrastructure.

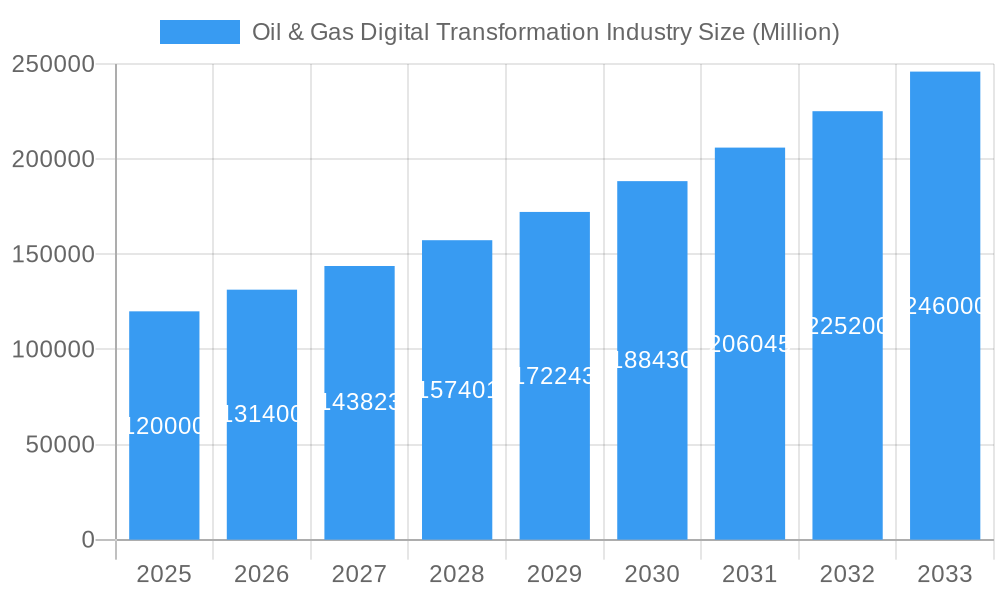

Oil & Gas Digital Transformation Industry Market Size (In Billion)

Advancements in Field Devices, including sensors and Variable Frequency Drives (VFDs), provide granular data crucial for performance monitoring and control across upstream, midstream, and downstream operations. While significant initial investment and cybersecurity challenges exist, the demand for sustainability, reduced environmental impact, and regulatory compliance will drive digital transformation in the oil and gas sector. Leading companies such as Honeywell International Inc, ABB Ltd, Siemens AG, and Emerson Electric Co are pioneering this evolution.

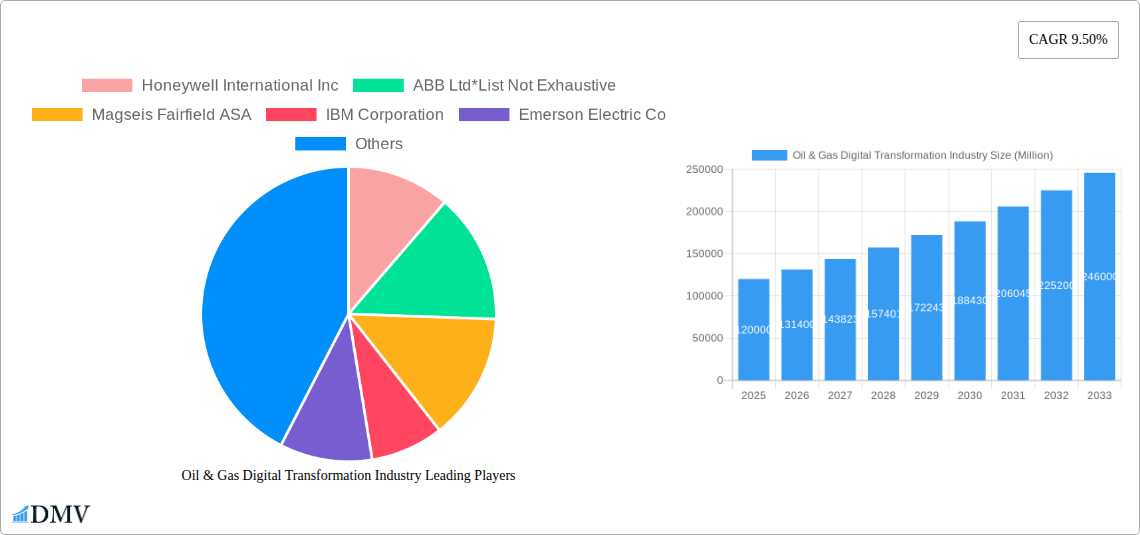

Oil & Gas Digital Transformation Industry Company Market Share

Oil & Gas Digital Transformation Industry Market Composition & Trends

The Oil & Gas Digital Transformation Industry is experiencing a dynamic market composition driven by substantial investments in advanced technologies to optimize operations across the value chain. Key trends indicate a significant shift towards data-driven decision-making, enhanced automation, and predictive maintenance to improve efficiency, safety, and sustainability. Market concentration is moderate, with a mix of large multinational corporations and specialized technology providers vying for market share. Innovation catalysts include the imperative to reduce operational costs, address environmental concerns, and navigate complex regulatory landscapes. M&A activities are on the rise as companies seek to acquire critical digital capabilities and expand their service offerings. Recent M&A deals have seen values reaching several hundred million dollars, signifying strategic consolidation. The regulatory landscape is evolving to encourage digital adoption, particularly concerning data security and emissions reduction. Substitute products are limited in the core digital transformation space, but incremental improvements in legacy systems pose a form of competition. End-user profiles encompass upstream exploration and production companies, midstream transportation and storage operators, and downstream refining and petrochemical giants.

- Market Share Distribution: Highly competitive, with key players holding significant but not monopolistic shares.

- M&A Deal Values: Expected to increase, with individual deals potentially exceeding 100 Million USD.

- Innovation Catalysts: Cost reduction, sustainability mandates, enhanced safety protocols, and data-driven insights.

- Regulatory Landscape: Increasingly supportive of digital integration, with a focus on cybersecurity and environmental compliance.

Oil & Gas Digital Transformation Industry Industry Evolution

The Oil & Gas Digital Transformation Industry is undergoing a profound evolution, marked by a robust growth trajectory fueled by the relentless pursuit of operational excellence and cost optimization. This evolution is intrinsically linked to the rapid advancements in enabling technologies that are fundamentally reshaping how the industry operates. From the exploration phase in the upstream sector, where Big Data analytics and Artificial Intelligence are revolutionizing seismic interpretation and reservoir modeling, to the downstream segment, where IoT-enabled sensors and cloud computing are optimizing refinery processes and supply chain logistics, digital transformation is pervasive. The historical period from 2019 to 2024 witnessed significant early adoption and pilot programs, demonstrating tangible ROI and building confidence in digital solutions. The base year of 2025 serves as a crucial inflection point, with widespread implementation and integration becoming the norm. The forecast period from 2025 to 2033 is projected to see exponential growth, with an estimated Compound Annual Growth Rate (CAGR) of 12-15%. This surge is driven by the increasing maturity of technologies like AI, machine learning, and Extended Reality (AR, VR, MR), which are moving from niche applications to mainstream deployment. For instance, AI-powered predictive maintenance systems are now projected to reduce unplanned downtime by up to 20%, a significant improvement over traditional methods. Furthermore, the adoption of Industrial IoT (IIoT) across thousands of field devices, including sensors, motors, and Variable Frequency Drives (VFDs), is generating vast amounts of real-time data that are crucial for intelligent decision-making. Consumer demands for more sustainable and ethically sourced energy products are also indirectly pushing the industry towards digital solutions that can enhance transparency and efficiency. The integration of Big Data and Cloud Computing is no longer a novelty but a foundational requirement, enabling the processing and analysis of petabytes of data generated daily. This comprehensive digital overhaul is not just about incremental improvements; it represents a paradigm shift towards a more agile, resilient, and future-proof oil and gas sector.

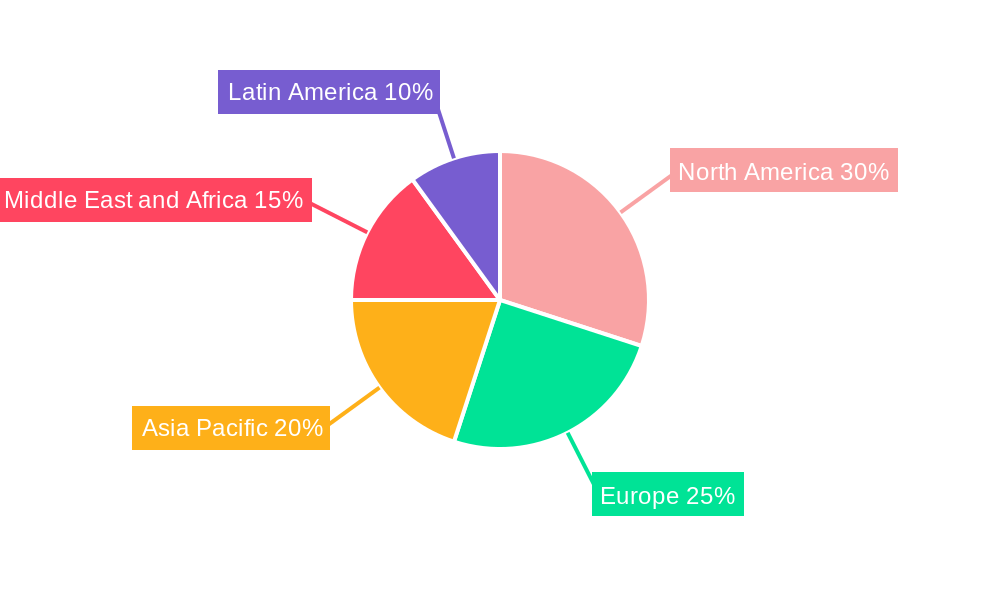

Leading Regions, Countries, or Segments in Oil & Gas Digital Transformation Industry

The dominance in the Oil & Gas Digital Transformation Industry is multifaceted, with North America and Europe emerging as leading regions, driven by significant investment in advanced technologies and a mature oil and gas infrastructure. Within enabling technologies, Big Data/Analytics and Cloud Computing are currently the most influential segments, forming the bedrock for many other digital initiatives. The ability to process and analyze vast datasets is paramount for optimizing exploration, production, and distribution.

Dominant Enabling Technologies:

- Big Data/Analytics and Cloud Computing: Essential for data-driven insights, predictive modeling, and operational efficiency. Investment trends show a continuous increase in cloud adoption for data storage and processing, reaching an estimated 250 Million USD annually in the sector.

- Internet of Things (IoT): Crucial for real-time monitoring of assets, predictive maintenance, and enhancing safety across Upstream, Mid Stream, and Downstream operations. Adoption rates for IoT sensors are projected to grow by 18% annually in the forecast period.

- Artificial Intelligence (AI): Transforming decision-making in exploration, reservoir management, and process optimization. AI algorithms are estimated to improve exploration success rates by 10-15%.

Dominant Oil and Gas Industry Activity Segments:

- Upstream: This segment sees substantial adoption of digital solutions for seismic data analysis, drilling optimization, and remote monitoring of well sites. Investment in AI for reservoir characterization is a key driver, with market penetration expected to reach 40% by 2028.

- Mid Stream: Focuses on pipeline integrity monitoring, logistics optimization, and smart asset management. IoT and Big Data analytics are critical for ensuring the safe and efficient transportation of oil and gas.

- Downstream: Refining and petrochemical operations benefit greatly from AI-driven process control, predictive maintenance in complex machinery, and supply chain visibility. The implementation of digital twins is also gaining traction, with an estimated 100 Million USD in associated investment projected by 2027.

Key Drivers of Dominance:

- Technological Maturity: Availability and refinement of AI, IoT, and cloud platforms.

- Investment Trends: Significant capital expenditure by major oil and gas companies on digital initiatives.

- Regulatory Support: Government initiatives and environmental mandates encouraging digital adoption for efficiency and sustainability.

- Skilled Workforce: Growing availability of talent capable of implementing and managing digital solutions.

Oil & Gas Digital Transformation Industry Product Innovations

Product innovations in the Oil & Gas Digital Transformation Industry are centered on enhancing operational efficiency, safety, and sustainability. Key advancements include the development of sophisticated AI-powered analytics platforms that offer predictive maintenance capabilities, reducing unplanned downtime by an estimated 20%. Integrated Industrial IoT (IIoT) solutions are enabling real-time monitoring of thousands of field devices, from advanced sensors detecting minute anomalies to intelligent motors and VFDs optimizing energy consumption. Extended Reality (AR, VR, and MR) applications are revolutionizing training, remote assistance, and maintenance procedures, projecting a 30% increase in field technician efficiency. These innovations are crucial for the efficient functioning of Upstream, Mid Stream, and Downstream operations.

Propelling Factors for Oil & Gas Digital Transformation Industry Growth

Several key factors are propelling the growth of the Oil & Gas Digital Transformation Industry. Technological advancements, particularly in Artificial Intelligence, IoT, Big Data analytics, and cloud computing, are providing the tools for unprecedented operational optimization. The economic imperative to reduce costs and improve efficiency in a volatile market environment is a significant driver. Furthermore, increasing regulatory pressures related to environmental sustainability and safety are compelling companies to adopt digital solutions for better compliance and performance monitoring. The successful implementation of initiatives like the Kyndryl and Motiva Enterprises agreement, worth 160 Million USD, showcases the tangible benefits of digital transformation in enhancing IT services and accelerating cloud journeys.

Obstacles in the Oil & Gas Digital Transformation Industry Market

Despite robust growth, the Oil & Gas Digital Transformation Industry faces several significant obstacles. Regulatory challenges, particularly around data privacy and cybersecurity, can slow down adoption and implementation. The existing legacy infrastructure in many oil and gas facilities requires substantial investment for integration with new digital technologies, representing a considerable financial barrier. Supply chain disruptions for specialized hardware and software components can also lead to project delays and increased costs, with an estimated impact of 50 Million USD on critical project timelines. Furthermore, a persistent skills gap in digital technologies within the traditional oil and gas workforce necessitates extensive training and upskilling initiatives. Competitive pressures from companies focusing on niche digital solutions also create a fragmented market landscape.

Future Opportunities in Oil & Gas Digital Transformation Industry

The future of the Oil & Gas Digital Transformation Industry presents substantial opportunities. The expansion of IoT networks across the entire value chain, coupled with advanced AI for predictive analytics, offers immense potential for further optimizing exploration, production, and refining processes. Emerging markets are showing increasing interest in adopting digital solutions, creating new avenues for growth. The development of digital twins for entire facilities, going beyond individual assets, represents a significant opportunity for enhanced simulation and operational planning. Furthermore, the increasing demand for sustainable energy solutions will drive innovation in digital technologies that can improve emissions monitoring, carbon capture, and the integration of renewable energy sources into traditional oil and gas operations. The BayoTech and Emerson agreement highlights the growing synergy between digital solutions and emerging energy sectors like hydrogen.

Major Players in the Oil & Gas Digital Transformation Industry Ecosystem

- Honeywell International Inc

- ABB Ltd

- Magseis Fairfield ASA

- IBM Corporation

- Emerson Electric Co

- Mitsubishi Electric Corporation

- Siemens AG

- Schneider Electric SE

- WFS Technologies Ltd

- Fanuc Corporation

- Omron Corporation

- Rockwell Automation Inc

- Rohrback Cosasco Systems Inc

- Yokogawa Electric Corporation

Key Developments in Oil & Gas Digital Transformation Industry Industry

- March 2022: Kyndryl, an IT infrastructure services provider, signed a five-year, USD 160 Million agreement with Motiva Enterprises. This agreement aims to streamline Motiva's IT services, accelerate its cloud journey, and establish the foundation for enterprise-wide digital transformation.

- October 2021: Emerson announced a multi-year agreement with BayoTech. The company will provide advanced software, automation technologies, and products to enable BayoTech to build hundreds of hydrogen units, accelerating the delivery of hydrogen globally.

Strategic Oil & Gas Digital Transformation Industry Market Forecast

The strategic Oil & Gas Digital Transformation Industry market forecast indicates a period of sustained and accelerated growth, driven by the intrinsic need for operational resilience and efficiency. Key growth catalysts include the continued maturation and widespread adoption of AI, IoT, and Big Data analytics, which are projected to unlock significant cost savings and productivity gains. The increasing demand for sustainable energy practices will further propel the adoption of digital solutions for emissions monitoring and optimization. Emerging opportunities in areas like digital twins and the integration of renewable energy sources present vast untapped market potential. Companies that strategically invest in digital transformation will be well-positioned to navigate market volatility and capitalize on future opportunities.

Oil & Gas Digital Transformation Industry Segmentation

-

1. Enabling Technologies

- 1.1. Big Data/Analytics and Cloud Computing

- 1.2. Internet of Things (IoT)

- 1.3. Artificial Intelligence

- 1.4. Industri

- 1.5. Extended Reality (AR, VR and MR)

- 1.6. Field Devices (Sensors, Motors, VFD etc.)

-

2. Oil and Gas Industry Activity

- 2.1. Upstream

- 2.2. Mid Stream

- 2.3. Downstream

Oil & Gas Digital Transformation Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of the Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Oil & Gas Digital Transformation Industry Regional Market Share

Geographic Coverage of Oil & Gas Digital Transformation Industry

Oil & Gas Digital Transformation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need to Implement Disruptive Technologies to Optimize Operations & Increase Safety; Regulatory Requirements

- 3.3. Market Restrains

- 3.3.1. ; Trade Tensions and Implementation Challenges

- 3.4. Market Trends

- 3.4.1. Downstream Sector is Expected to Witness Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oil & Gas Digital Transformation Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Enabling Technologies

- 5.1.1. Big Data/Analytics and Cloud Computing

- 5.1.2. Internet of Things (IoT)

- 5.1.3. Artificial Intelligence

- 5.1.4. Industri

- 5.1.5. Extended Reality (AR, VR and MR)

- 5.1.6. Field Devices (Sensors, Motors, VFD etc.)

- 5.2. Market Analysis, Insights and Forecast - by Oil and Gas Industry Activity

- 5.2.1. Upstream

- 5.2.2. Mid Stream

- 5.2.3. Downstream

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Enabling Technologies

- 6. North America Oil & Gas Digital Transformation Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Enabling Technologies

- 6.1.1. Big Data/Analytics and Cloud Computing

- 6.1.2. Internet of Things (IoT)

- 6.1.3. Artificial Intelligence

- 6.1.4. Industri

- 6.1.5. Extended Reality (AR, VR and MR)

- 6.1.6. Field Devices (Sensors, Motors, VFD etc.)

- 6.2. Market Analysis, Insights and Forecast - by Oil and Gas Industry Activity

- 6.2.1. Upstream

- 6.2.2. Mid Stream

- 6.2.3. Downstream

- 6.1. Market Analysis, Insights and Forecast - by Enabling Technologies

- 7. Europe Oil & Gas Digital Transformation Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Enabling Technologies

- 7.1.1. Big Data/Analytics and Cloud Computing

- 7.1.2. Internet of Things (IoT)

- 7.1.3. Artificial Intelligence

- 7.1.4. Industri

- 7.1.5. Extended Reality (AR, VR and MR)

- 7.1.6. Field Devices (Sensors, Motors, VFD etc.)

- 7.2. Market Analysis, Insights and Forecast - by Oil and Gas Industry Activity

- 7.2.1. Upstream

- 7.2.2. Mid Stream

- 7.2.3. Downstream

- 7.1. Market Analysis, Insights and Forecast - by Enabling Technologies

- 8. Asia Pacific Oil & Gas Digital Transformation Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Enabling Technologies

- 8.1.1. Big Data/Analytics and Cloud Computing

- 8.1.2. Internet of Things (IoT)

- 8.1.3. Artificial Intelligence

- 8.1.4. Industri

- 8.1.5. Extended Reality (AR, VR and MR)

- 8.1.6. Field Devices (Sensors, Motors, VFD etc.)

- 8.2. Market Analysis, Insights and Forecast - by Oil and Gas Industry Activity

- 8.2.1. Upstream

- 8.2.2. Mid Stream

- 8.2.3. Downstream

- 8.1. Market Analysis, Insights and Forecast - by Enabling Technologies

- 9. Latin America Oil & Gas Digital Transformation Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Enabling Technologies

- 9.1.1. Big Data/Analytics and Cloud Computing

- 9.1.2. Internet of Things (IoT)

- 9.1.3. Artificial Intelligence

- 9.1.4. Industri

- 9.1.5. Extended Reality (AR, VR and MR)

- 9.1.6. Field Devices (Sensors, Motors, VFD etc.)

- 9.2. Market Analysis, Insights and Forecast - by Oil and Gas Industry Activity

- 9.2.1. Upstream

- 9.2.2. Mid Stream

- 9.2.3. Downstream

- 9.1. Market Analysis, Insights and Forecast - by Enabling Technologies

- 10. Middle East and Africa Oil & Gas Digital Transformation Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Enabling Technologies

- 10.1.1. Big Data/Analytics and Cloud Computing

- 10.1.2. Internet of Things (IoT)

- 10.1.3. Artificial Intelligence

- 10.1.4. Industri

- 10.1.5. Extended Reality (AR, VR and MR)

- 10.1.6. Field Devices (Sensors, Motors, VFD etc.)

- 10.2. Market Analysis, Insights and Forecast - by Oil and Gas Industry Activity

- 10.2.1. Upstream

- 10.2.2. Mid Stream

- 10.2.3. Downstream

- 10.1. Market Analysis, Insights and Forecast - by Enabling Technologies

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB Ltd*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Magseis Fairfield ASA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IBM Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Emerson Electric Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mitsubishi Electric Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Siemens AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Schneider Electric SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 WFS Technologies Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fanuc Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Omron Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Rockwell Automation Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Rohrback Cosasco Systems Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Yokogawa Electric Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Oil & Gas Digital Transformation Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Oil & Gas Digital Transformation Industry Revenue (billion), by Enabling Technologies 2025 & 2033

- Figure 3: North America Oil & Gas Digital Transformation Industry Revenue Share (%), by Enabling Technologies 2025 & 2033

- Figure 4: North America Oil & Gas Digital Transformation Industry Revenue (billion), by Oil and Gas Industry Activity 2025 & 2033

- Figure 5: North America Oil & Gas Digital Transformation Industry Revenue Share (%), by Oil and Gas Industry Activity 2025 & 2033

- Figure 6: North America Oil & Gas Digital Transformation Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Oil & Gas Digital Transformation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Oil & Gas Digital Transformation Industry Revenue (billion), by Enabling Technologies 2025 & 2033

- Figure 9: Europe Oil & Gas Digital Transformation Industry Revenue Share (%), by Enabling Technologies 2025 & 2033

- Figure 10: Europe Oil & Gas Digital Transformation Industry Revenue (billion), by Oil and Gas Industry Activity 2025 & 2033

- Figure 11: Europe Oil & Gas Digital Transformation Industry Revenue Share (%), by Oil and Gas Industry Activity 2025 & 2033

- Figure 12: Europe Oil & Gas Digital Transformation Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Oil & Gas Digital Transformation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Oil & Gas Digital Transformation Industry Revenue (billion), by Enabling Technologies 2025 & 2033

- Figure 15: Asia Pacific Oil & Gas Digital Transformation Industry Revenue Share (%), by Enabling Technologies 2025 & 2033

- Figure 16: Asia Pacific Oil & Gas Digital Transformation Industry Revenue (billion), by Oil and Gas Industry Activity 2025 & 2033

- Figure 17: Asia Pacific Oil & Gas Digital Transformation Industry Revenue Share (%), by Oil and Gas Industry Activity 2025 & 2033

- Figure 18: Asia Pacific Oil & Gas Digital Transformation Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Oil & Gas Digital Transformation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Oil & Gas Digital Transformation Industry Revenue (billion), by Enabling Technologies 2025 & 2033

- Figure 21: Latin America Oil & Gas Digital Transformation Industry Revenue Share (%), by Enabling Technologies 2025 & 2033

- Figure 22: Latin America Oil & Gas Digital Transformation Industry Revenue (billion), by Oil and Gas Industry Activity 2025 & 2033

- Figure 23: Latin America Oil & Gas Digital Transformation Industry Revenue Share (%), by Oil and Gas Industry Activity 2025 & 2033

- Figure 24: Latin America Oil & Gas Digital Transformation Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Oil & Gas Digital Transformation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Oil & Gas Digital Transformation Industry Revenue (billion), by Enabling Technologies 2025 & 2033

- Figure 27: Middle East and Africa Oil & Gas Digital Transformation Industry Revenue Share (%), by Enabling Technologies 2025 & 2033

- Figure 28: Middle East and Africa Oil & Gas Digital Transformation Industry Revenue (billion), by Oil and Gas Industry Activity 2025 & 2033

- Figure 29: Middle East and Africa Oil & Gas Digital Transformation Industry Revenue Share (%), by Oil and Gas Industry Activity 2025 & 2033

- Figure 30: Middle East and Africa Oil & Gas Digital Transformation Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Oil & Gas Digital Transformation Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Oil & Gas Digital Transformation Industry Revenue billion Forecast, by Enabling Technologies 2020 & 2033

- Table 2: Global Oil & Gas Digital Transformation Industry Revenue billion Forecast, by Oil and Gas Industry Activity 2020 & 2033

- Table 3: Global Oil & Gas Digital Transformation Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Oil & Gas Digital Transformation Industry Revenue billion Forecast, by Enabling Technologies 2020 & 2033

- Table 5: Global Oil & Gas Digital Transformation Industry Revenue billion Forecast, by Oil and Gas Industry Activity 2020 & 2033

- Table 6: Global Oil & Gas Digital Transformation Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Oil & Gas Digital Transformation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Oil & Gas Digital Transformation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Oil & Gas Digital Transformation Industry Revenue billion Forecast, by Enabling Technologies 2020 & 2033

- Table 10: Global Oil & Gas Digital Transformation Industry Revenue billion Forecast, by Oil and Gas Industry Activity 2020 & 2033

- Table 11: Global Oil & Gas Digital Transformation Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Germany Oil & Gas Digital Transformation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Oil & Gas Digital Transformation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Oil & Gas Digital Transformation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Oil & Gas Digital Transformation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Oil & Gas Digital Transformation Industry Revenue billion Forecast, by Enabling Technologies 2020 & 2033

- Table 17: Global Oil & Gas Digital Transformation Industry Revenue billion Forecast, by Oil and Gas Industry Activity 2020 & 2033

- Table 18: Global Oil & Gas Digital Transformation Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: China Oil & Gas Digital Transformation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Japan Oil & Gas Digital Transformation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: India Oil & Gas Digital Transformation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of the Asia Pacific Oil & Gas Digital Transformation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Global Oil & Gas Digital Transformation Industry Revenue billion Forecast, by Enabling Technologies 2020 & 2033

- Table 24: Global Oil & Gas Digital Transformation Industry Revenue billion Forecast, by Oil and Gas Industry Activity 2020 & 2033

- Table 25: Global Oil & Gas Digital Transformation Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Brazil Oil & Gas Digital Transformation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Argentina Oil & Gas Digital Transformation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Latin America Oil & Gas Digital Transformation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Oil & Gas Digital Transformation Industry Revenue billion Forecast, by Enabling Technologies 2020 & 2033

- Table 30: Global Oil & Gas Digital Transformation Industry Revenue billion Forecast, by Oil and Gas Industry Activity 2020 & 2033

- Table 31: Global Oil & Gas Digital Transformation Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: United Arab Emirates Oil & Gas Digital Transformation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Saudi Arabia Oil & Gas Digital Transformation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of Middle East and Africa Oil & Gas Digital Transformation Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oil & Gas Digital Transformation Industry?

The projected CAGR is approximately 17%.

2. Which companies are prominent players in the Oil & Gas Digital Transformation Industry?

Key companies in the market include Honeywell International Inc, ABB Ltd*List Not Exhaustive, Magseis Fairfield ASA, IBM Corporation, Emerson Electric Co, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, WFS Technologies Ltd, Fanuc Corporation, Omron Corporation, Rockwell Automation Inc, Rohrback Cosasco Systems Inc, Yokogawa Electric Corporation.

3. What are the main segments of the Oil & Gas Digital Transformation Industry?

The market segments include Enabling Technologies, Oil and Gas Industry Activity.

4. Can you provide details about the market size?

The market size is estimated to be USD 90.44 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need to Implement Disruptive Technologies to Optimize Operations & Increase Safety; Regulatory Requirements.

6. What are the notable trends driving market growth?

Downstream Sector is Expected to Witness Major Market Share.

7. Are there any restraints impacting market growth?

; Trade Tensions and Implementation Challenges.

8. Can you provide examples of recent developments in the market?

March 2022 - Kyndryl, an IT infrastructure services provider, signed a five-year, USD 160 million agreement with Motiva Enterprises, owner of North America's largest refinery. Under this agreement, Kyndryl is set to streamline Motiva's IT services, accelerate Motiva's cloud journey, and set the foundation for its enterprise-wide digital transformation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oil & Gas Digital Transformation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oil & Gas Digital Transformation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oil & Gas Digital Transformation Industry?

To stay informed about further developments, trends, and reports in the Oil & Gas Digital Transformation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence