Key Insights

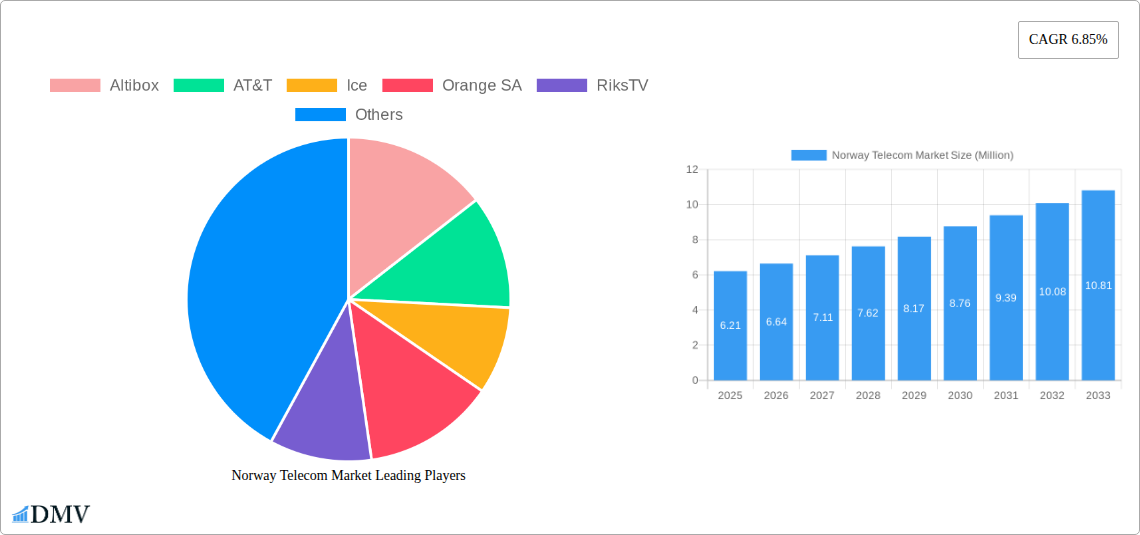

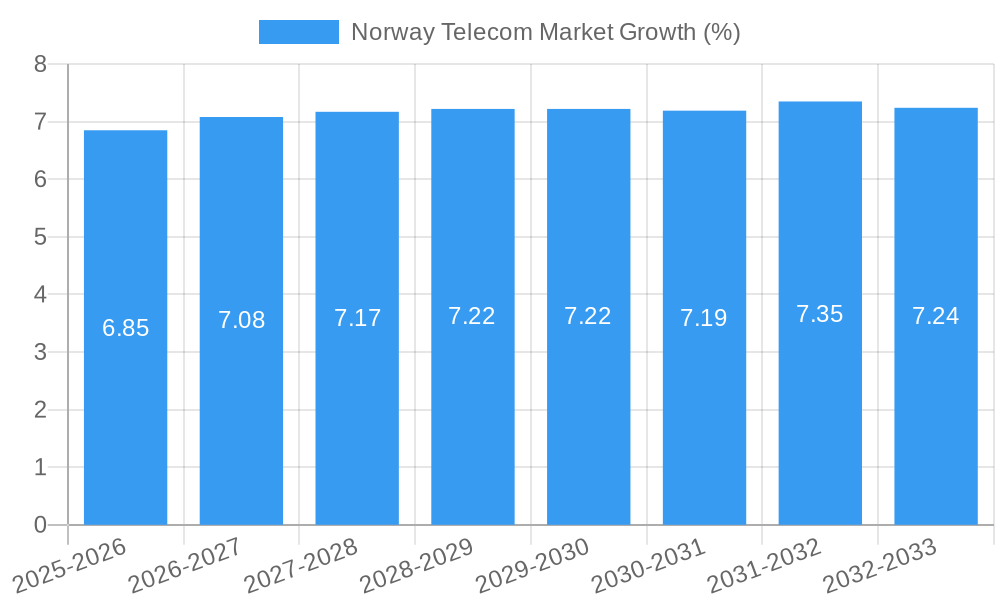

The Norwegian telecommunications market is poised for steady growth, projected to reach approximately USD 6.21 million by 2025 and expand at a Compound Annual Growth Rate (CAGR) of 6.85% through 2033. This robust expansion is underpinned by a confluence of accelerating demand for high-speed data services, the widespread adoption of Over-The-Top (OTT) entertainment platforms, and the continued evolution of Pay-TV offerings. Key drivers fueling this upward trajectory include the increasing penetration of 5G networks, enabling faster and more reliable mobile connectivity, and the growing consumer reliance on digital services for communication, entertainment, and productivity. Furthermore, ongoing investments in fiber optic infrastructure are critical in enhancing broadband speeds and capacity, catering to the ever-increasing data consumption patterns of both residential and business users. The market's segmentation, encompassing voice services (both wired and wireless), data, and OTT/Pay-TV services, highlights a diversified demand landscape where each segment contributes to the overall market vitality.

The Norwegian telecom landscape is characterized by dynamic competition among established players like Telenor Group, Telia Company AB, and Altibox, alongside international giants such as AT&T and Verizon Communications Inc. These companies are actively innovating and investing in network upgrades and service diversification to capture market share. Emerging trends include the convergence of services, with providers bundling mobile, broadband, and streaming options to enhance customer value and loyalty. The increasing popularity of remote work and online education further accentuates the need for dependable and high-performance internet services. While the market benefits from strong underlying demand, potential restraints could stem from intense price competition, significant capital expenditure requirements for network modernization, and evolving regulatory landscapes that might influence service pricing and deployment strategies. Nevertheless, the overarching trend points towards a resilient and growing telecom sector in Norway, driven by technological advancements and sustained consumer and business needs for advanced connectivity.

Dive deep into the dynamic Norway telecom market with this exhaustive report, offering unparalleled insights into market composition, industry evolution, and future projections. Covering the extensive study period from 2019 to 2033, with a specific focus on the base year 2025 and the forecast period 2025-2033, this analysis is your definitive guide to understanding Norwegian telecommunications. We meticulously examine key segments including Voice Services (Wired, Wireless), Data Services, and OTT and Pay-TV Services, identifying critical trends, competitive landscapes, and strategic opportunities.

Norway Telecom Market Market Composition & Trends

The Norway telecom market exhibits a moderately concentrated structure, with Telenor Group and Telia Company AB holding significant market shares across various segments. Innovation is primarily driven by investments in 5G infrastructure, fiber optic expansion, and the increasing adoption of cloud-based solutions. Regulatory landscapes, guided by bodies like the Norwegian Communications Authority (Nkom), focus on ensuring fair competition, consumer protection, and universal service obligations. Substitute products, particularly over-the-top (OTT) communication apps, are influencing traditional voice and messaging services. End-user profiles range from individual consumers seeking high-speed data and entertainment to enterprises demanding secure and reliable communication solutions. Mergers and acquisitions (M&A) activity, while not intensely high, are strategic, often aimed at consolidating market presence or acquiring specialized technological capabilities. For instance, recent moves suggest an increasing emphasis on partnerships to enhance cloud infrastructure.

- Market Share Distribution: Dominant players like Telenor and Telia command substantial portions of the mobile and broadband markets.

- Innovation Catalysts: 5G deployment, IoT solutions, and advanced data center investments are key drivers.

- Regulatory Landscape: Focus on consumer rights, data privacy (GDPR), and ensuring universal broadband access.

- Substitute Products: The rise of OTT services continues to challenge traditional telco revenue streams.

- End-User Profiles: Diverse, from mobile-first consumers to enterprise-grade connectivity needs.

- M&A Activities: Strategic acquisitions for niche technologies or market consolidation.

Norway Telecom Market Industry Evolution

The Norway telecom industry has undergone significant evolution, transitioning from basic connectivity to a sophisticated digital ecosystem. The historical period (2019-2024) witnessed a steady increase in broadband penetration and mobile data consumption, driven by the growing demand for digital services and remote work capabilities. Technological advancements, particularly in the rollout of 5G networks and the expansion of fiber optic infrastructure, have been pivotal. These advancements have enabled higher speeds, lower latency, and greater capacity, supporting the burgeoning demand for video streaming, online gaming, and the Internet of Things (IoT). Consumer demands have shifted dramatically, with a strong preference for convergent services offering bundled entertainment, communication, and internet access. The rise of Over-The-Top (OTT) platforms has also reshaped the competitive landscape, pushing traditional Pay-TV providers to innovate and offer more flexible, on-demand content. The base year 2025 marks a crucial point where the full impact of 5G is expected to be realized, fostering new applications and services.

The forecast period (2025-2033) anticipates sustained growth, propelled by the continued build-out of ultra-fast broadband and the widespread adoption of 5G use cases across various sectors, including smart cities, autonomous systems, and advanced healthcare. The market is expected to witness a CAGR of approximately 4.5% during this period, reaching an estimated market size of over USD 12 Billion by 2033. Key growth trajectories include the expansion of IoT connectivity for industrial applications and smart homes, as well as the increasing demand for enterprise-grade cloud and cybersecurity solutions. Shifting consumer demands will continue to favor personalized and seamless digital experiences, pushing telcos to invest further in data analytics and AI-driven services. Adoption metrics for 5G services are projected to exceed 70% by 2030, signifying a significant shift in the mobile communication paradigm. Furthermore, the integration of AI and machine learning in network management and customer service is expected to become a standard practice, enhancing operational efficiency and customer satisfaction.

Leading Regions, Countries, or Segments in Norway Telecom Market

Within the Norway telecom market, Data Services have emerged as the dominant segment, driven by insatiable consumer and enterprise demand for high-speed internet access and data-intensive applications. The widespread adoption of smartphones, the proliferation of streaming services, and the increasing reliance on cloud-based solutions for both personal and professional use have cemented Data Services' leading position. This dominance is further bolstered by significant investments in fiber optic network expansion across the country, ensuring consistent and high-quality connectivity.

- Data Services Dominance:

- Key Drivers: The ubiquitous need for high-speed internet for entertainment, remote work, and digital services.

- Investment Trends: Significant public and private sector investment in fiber optic infrastructure expansion, particularly in urban and suburban areas, ensures high penetration rates.

- Technological Advancements: The ongoing rollout of 5G networks provides enhanced mobile broadband capabilities, further fueling data consumption.

- Consumer Demand: A strong preference for seamless streaming, online gaming, and cloud-based productivity tools.

- Enterprise Needs: Businesses rely heavily on robust data connectivity for cloud computing, big data analytics, and digital transformation initiatives.

While Voice Services (Wired, Wireless), particularly wireless, remain essential components of the telecom offering, their growth trajectory is increasingly overshadowed by the data segment. Wireless voice services continue to benefit from the extensive mobile network coverage provided by major operators. However, the revenue contribution from voice is gradually being supplemented, and in some cases supplanted, by data-centric plans and bundled service packages.

OTT and Pay-TV Services represent a dynamic and evolving segment. While traditional Pay-TV providers face competition from a growing array of OTT streaming platforms, the overall demand for video content remains robust. Telcos are increasingly integrating these services into their offerings, often through partnerships or by developing their own OTT solutions, to create bundled packages that enhance customer loyalty and reduce churn. This segment is characterized by rapid innovation in content delivery and user experience, with a growing emphasis on personalized recommendations and on-demand access. The Norwegian government's commitment to universal broadband access also indirectly supports the growth of these services by ensuring a broader audience can access them.

Norway Telecom Market Product Innovations

The Norway telecom market is witnessing innovative advancements primarily focused on enhancing network capabilities and delivering richer user experiences. Key product innovations include the strategic rollout of 5G networks, offering significantly higher speeds and lower latency, enabling new applications like enhanced mobile broadband, mission-critical communications, and massive IoT deployments. Operators are also heavily investing in fiber optic expansion, ensuring gigabit-speed internet access for households and businesses, crucial for supporting high-definition streaming and cloud services. Furthermore, there's a growing emphasis on convergent service offerings, bundling mobile, broadband, and entertainment services into attractive packages. Innovations in cloud-native network architectures and AI-powered network management are improving efficiency and reliability. The development of secure and sovereign cloud solutions, like Telenor's initiative with AWS, caters to the stringent security needs of Norwegian enterprises.

Propelling Factors for Norway Telecom Market Growth

Several key factors are propelling the growth of the Norway telecom market. Technologically, the ongoing 5G network deployment and the extensive fiber optic infrastructure expansion are fundamental drivers, enabling higher speeds, lower latency, and greater capacity. Economically, increased demand for digital services, fueled by remote work trends and a digitally savvy population, drives revenue growth. Government initiatives promoting digitalization and universal broadband access create a favorable environment for investment and adoption. Furthermore, the growing adoption of Internet of Things (IoT) solutions across industries and the increasing demand for cloud-based services by both consumers and enterprises are significant growth catalysts. The competitive landscape, with established players and new entrants, also spurs innovation and service enhancement.

Obstacles in the Norway Telecom Market Market

Despite its growth, the Norway telecom market faces several obstacles. High infrastructure investment costs, particularly for rural broadband and advanced 5G deployment, can be a significant barrier. Intense market competition among major players can lead to price wars and pressure on profit margins. Regulatory complexities and evolving compliance requirements, such as data privacy laws and security mandates, add operational burdens. Supply chain disruptions, as seen globally, can impact the timely deployment of new equipment and technologies. Furthermore, cybersecurity threats pose a constant challenge, requiring continuous investment in robust security measures to protect networks and customer data. The need to manage spectrum allocation and availability also presents a challenge for expansion.

Future Opportunities in Norway Telecom Market

The Norway telecom market is ripe with future opportunities. The continued expansion of 5G services beyond urban centers will unlock new revenue streams through enhanced mobile broadband, private networks for industries, and advanced IoT applications. The growing demand for cloud computing and edge computing solutions, particularly among enterprises seeking data sovereignty and low latency, presents a significant opportunity for telcos to offer integrated services. The digitalization of public services and the development of smart city initiatives will require robust and interconnected telecommunications infrastructure. Furthermore, the increasing focus on sustainability and green technology in data centers and network operations creates opportunities for telcos to lead in eco-friendly solutions. Emerging trends like metaverse technologies and advanced augmented reality (AR)/virtual reality (VR) applications will necessitate higher bandwidth and lower latency, further driving network upgrades and service innovation.

Major Players in the Norway Telecom Market Ecosystem

- Altibox

- AT&T

- Ice

- Orange SA

- RiksTV

- Telenor Group

- Telia Company AB

- Teletopia Interactive AS

- Verizon Communications Inc

- Voiped Telecom

Key Developments in Norway Telecom Market Industry

- June 2024: Telenor Group partnered with Amazon Web Services (AWS) to bolster its cloud capabilities. Telenor is capitalizing on its investment in Skygard, an energy-efficient data center being developed in Norway in collaboration with its partners. In a move underlining its commitment, Telenor is injecting approximately USD 9.51 million into its sovereign cloud initiative, utilizing both AWS's advanced infrastructure and the capabilities of Skygard's data center. The collaboration aims to provide solutions for Norwegian enterprises, emphasizing meeting their stringent sovereignty and security needs.

- April 2024: The Norwegian Government has put forth amendments to the Electronic Communications Act, proposing a series of changes. These changes encompass mandating data centers to register, bolstering consumer rights by ensuring transparent and non-discriminatory subscriber agreements, guaranteeing equal communication services for individuals with disabilities, providing a three-month grace period of free email access post-switching email providers, mandating GDPR-compliant consent for cookies, emphasizing universal broadband access, and fortifying security measures for electronic communication services and networks.

Strategic Norway Telecom Market Market Forecast

- June 2024: Telenor Group partnered with Amazon Web Services (AWS) to bolster its cloud capabilities. Telenor is capitalizing on its investment in Skygard, an energy-efficient data center being developed in Norway in collaboration with its partners. In a move underlining its commitment, Telenor is injecting approximately USD 9.51 million into its sovereign cloud initiative, utilizing both AWS's advanced infrastructure and the capabilities of Skygard's data center. The collaboration aims to provide solutions for Norwegian enterprises, emphasizing meeting their stringent sovereignty and security needs.

- April 2024: The Norwegian Government has put forth amendments to the Electronic Communications Act, proposing a series of changes. These changes encompass mandating data centers to register, bolstering consumer rights by ensuring transparent and non-discriminatory subscriber agreements, guaranteeing equal communication services for individuals with disabilities, providing a three-month grace period of free email access post-switching email providers, mandating GDPR-compliant consent for cookies, emphasizing universal broadband access, and fortifying security measures for electronic communication services and networks.

Strategic Norway Telecom Market Market Forecast

The strategic Norway telecom market forecast indicates a period of sustained growth and transformation through 2033. Key growth catalysts include the continued rollout of 5G and fiber optic networks, which will underpin the expansion of data-intensive services and enable new technological frontiers. The increasing adoption of IoT devices and solutions across various sectors, from smart homes to industrial automation, will drive demand for connectivity and specialized services. Furthermore, the emphasis on digitalization and cloud adoption by Norwegian businesses and government entities presents a significant market potential for integrated telecommunications and IT solutions. The market's trajectory will be shaped by strategic investments in advanced infrastructure, a focus on cybersecurity, and the ability of operators to innovate and deliver personalized, value-added services that cater to evolving consumer and enterprise needs. The forecast suggests a robust CAGR, driven by these fundamental growth engines and the supportive regulatory environment.

Norway Telecom Market Segmentation

-

1. Services

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and

- 1.3. OTT and Pay-TV Services

-

1.1. Voice Services

Norway Telecom Market Segmentation By Geography

- 1. Norway

Norway Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.85% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for 5G; Growth of IoT Usage in Telecom

- 3.3. Market Restrains

- 3.3.1. Rising Demand for 5G; Growth of IoT Usage in Telecom

- 3.4. Market Trends

- 3.4.1. Wireless Voice Services to Gain a Prominent Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Norway Telecom Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and

- 5.1.3. OTT and Pay-TV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Norway

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Altibox

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AT&T

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ice

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Orange SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 RiksTV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Telenor Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Telia Company AB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Teletopia Interactive AS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Verizon Communications Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Voiped Telecom*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Altibox

List of Figures

- Figure 1: Norway Telecom Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Norway Telecom Market Share (%) by Company 2024

List of Tables

- Table 1: Norway Telecom Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Norway Telecom Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Norway Telecom Market Revenue Million Forecast, by Services 2019 & 2032

- Table 4: Norway Telecom Market Volume Billion Forecast, by Services 2019 & 2032

- Table 5: Norway Telecom Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Norway Telecom Market Volume Billion Forecast, by Region 2019 & 2032

- Table 7: Norway Telecom Market Revenue Million Forecast, by Services 2019 & 2032

- Table 8: Norway Telecom Market Volume Billion Forecast, by Services 2019 & 2032

- Table 9: Norway Telecom Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Norway Telecom Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Norway Telecom Market?

The projected CAGR is approximately 6.85%.

2. Which companies are prominent players in the Norway Telecom Market?

Key companies in the market include Altibox, AT&T, Ice, Orange SA, RiksTV, Telenor Group, Telia Company AB, Teletopia Interactive AS, Verizon Communications Inc, Voiped Telecom*List Not Exhaustive.

3. What are the main segments of the Norway Telecom Market?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for 5G; Growth of IoT Usage in Telecom.

6. What are the notable trends driving market growth?

Wireless Voice Services to Gain a Prominent Market Share.

7. Are there any restraints impacting market growth?

Rising Demand for 5G; Growth of IoT Usage in Telecom.

8. Can you provide examples of recent developments in the market?

June 2024: Telenor Group partnered with Amazon Web Services (AWS) to bolster its cloud capabilities. Telenor is capitalizing on its investment in Skygard, an energy-efficient data center being developed in Norway in collaboration with its partners. In a move underlining its commitment, Telenor is injecting approximately USD 9.51 million into its sovereign cloud initiative, utilizing both AWS's advanced infrastructure and the capabilities of Skygard's data center. The collaboration aims to provide solutions for Norwegian enterprises, emphasizing meeting their stringent sovereignty and security needs.April 2024: The Norwegian Government has put forth amendments to the Electronic Communications Act, proposing a series of changes. These changes encompass mandating data centers to register, bolstering consumer rights by ensuring transparent and non-discriminatory subscriber agreements, guaranteeing equal communication services for individuals with disabilities, providing a three-month grace period of free email access post-switching email providers, mandating GDPR-compliant consent for cookies, emphasizing universal broadband access, and fortifying security measures for electronic communication services and networks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Norway Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Norway Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Norway Telecom Market?

To stay informed about further developments, trends, and reports in the Norway Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence