Key Insights

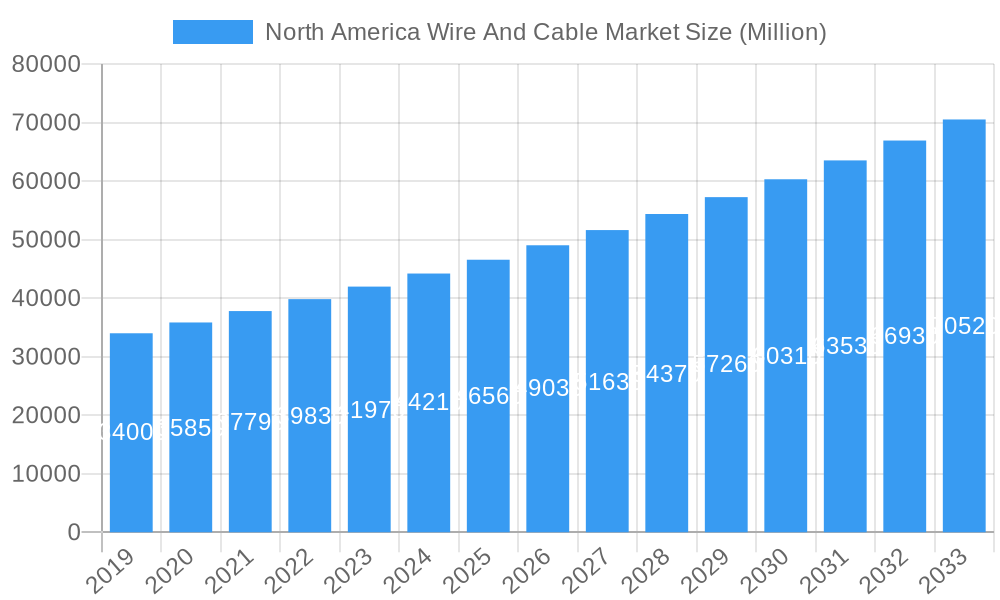

The North America wire and cable market is poised for robust growth, projected to reach a substantial market size of approximately $45,000 million by 2025, driven by a compound annual growth rate (CAGR) of 5.80%. This expansion is fueled by escalating demand from key end-user industries, including the ever-growing construction sector, encompassing both residential and commercial projects, and the dynamic telecommunications industry, vital for IT and telecom infrastructure. The ongoing need for modernizing power grids and the deployment of advanced digital networks are significant catalysts. Furthermore, the surge in renewable energy installations, particularly solar and wind farms, necessitates extensive cabling solutions, directly impacting market expansion. The "Other" end-user industry segment also contributes, likely encompassing automotive, industrial automation, and healthcare, all of which are increasingly reliant on sophisticated wiring and cabling.

North America Wire And Cable Market Market Size (In Billion)

The market’s trajectory is further shaped by specific cable types. Fiber optic cables are witnessing exceptional demand due to the global push for high-speed internet and 5G deployment. Power cables, essential for energy transmission and distribution, continue to be a core segment, especially with grid modernization initiatives. Low voltage energy cables are crucial for a wide array of applications from smart homes to industrial controls. Signal and control cables are indispensable for automation and data transfer in various sectors. However, potential restraints such as fluctuating raw material prices, particularly copper and aluminum, and the increasing complexity of supply chains could pose challenges. Nevertheless, the overarching trends of digitalization, electrification, and infrastructure development across North America create a fertile ground for continued innovation and market penetration by leading companies.

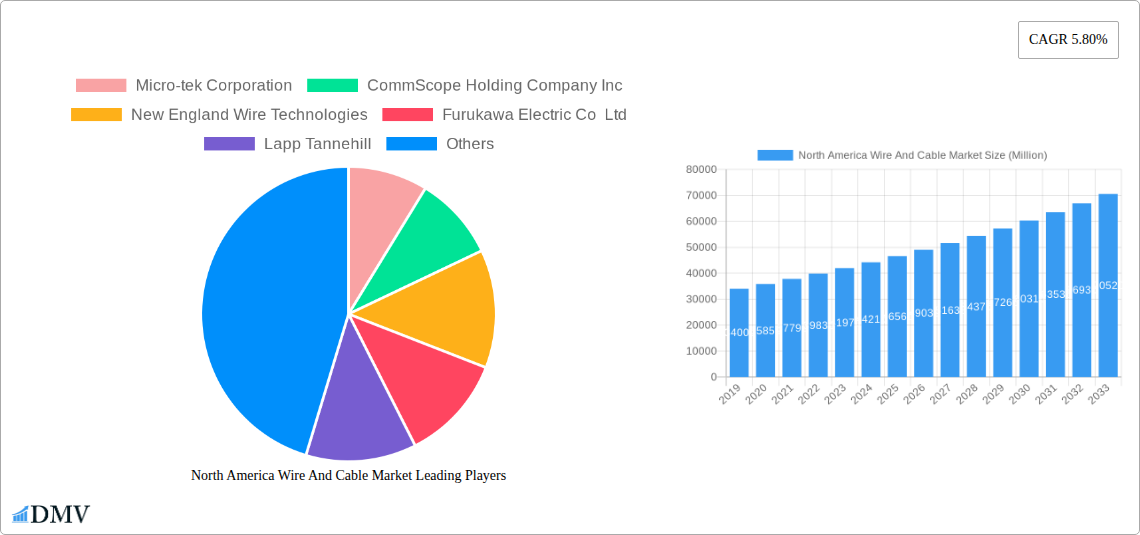

North America Wire And Cable Market Company Market Share

This in-depth report offers a definitive analysis of the North America Wire and Cable Market, providing unparalleled insights into its dynamics, growth drivers, and future trajectory. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on this critical industrial sector. We meticulously examine market composition, industry evolution, leading segments, product innovations, growth factors, obstacles, and emerging opportunities, underpinned by detailed historical data from 2019 to 2024.

North America Wire And Cable Market Composition & Trends

The North America Wire and Cable Market is characterized by a moderately consolidated landscape, with key players strategically vying for market share through innovation and capacity expansion. Market concentration is influenced by the significant capital investment required for manufacturing and the increasing demand for high-performance, specialized cables. Innovation catalysts are primarily driven by the rapid advancements in the telecommunications sector, particularly the rollout of 5G networks and the growing adoption of electric vehicles (EVs), necessitating advanced fiber optic cables and power cables. Regulatory landscapes, such as evolving environmental standards and infrastructure development initiatives, also play a crucial role in shaping market trends. Substitute products, while present in lower-specification applications, struggle to compete with the performance and reliability of advanced wire and cable solutions in critical infrastructure and high-bandwidth communication. End-user profiles are diverse, with the Construction (Residential and Commercial) and Telecommunications (IT and Telecom) sectors being dominant consumers. Mergers and acquisitions (M&A) activities are a key strategy for market consolidation and expansion, with deal values often reaching hundreds of millions of dollars. For instance, the market share distribution sees major players like Prysmian Group and CommScope Holding Company Inc. holding significant portions, driven by their comprehensive product portfolios and global reach.

North America Wire And Cable Market Industry Evolution

The North America Wire and Cable Market has undergone a profound evolution, driven by relentless technological advancements and shifting consumer demands. Historically, the market was primarily dominated by basic power and control cables catering to industrial and residential needs. However, the advent of the digital age and the exponential growth in data transmission have propelled the demand for sophisticated fiber optic cables. The increasing reliance on interconnected devices, the expansion of broadband internet, and the global push towards digital transformation have fundamentally reshaped the market. Technological advancements have led to the development of cables with enhanced data carrying capacity, improved signal integrity, and superior durability. For example, the transition from traditional copper infrastructure to fiber optics has been a significant growth trajectory, with adoption metrics for fiber optic deployment steadily increasing across North America. Furthermore, the burgeoning electric vehicle market has spurred innovation in high-voltage power cables and specialized charging infrastructure solutions, contributing to a projected compound annual growth rate (CAGR) of approximately 6.5% over the forecast period. The power sector's modernization, including grid upgrades and the integration of renewable energy sources, further accentuates the demand for robust and efficient power transmission and distribution cables, demonstrating a sustained growth in the Power Cable segment. Consumer demand has shifted towards higher bandwidth, lower latency, and greater reliability, pushing manufacturers to invest heavily in research and development. The market's evolution is a testament to its adaptability, consistently responding to the demands of a technologically advancing and increasingly connected world, with a projected market size exceeding USD 75 Billion by 2033.

Leading Regions, Countries, or Segments in North America Wire And Cable Market

The United States stands as the dominant country within the North America Wire and Cable Market, driven by substantial investments in infrastructure, telecommunications, and renewable energy projects. Its vast geographical expanse and high population density create an insatiable demand for advanced connectivity solutions. The Telecommunications (IT and Telecom) end-user industry is a primary driver of this dominance, fueled by the ongoing nationwide rollout of 5G networks and the critical need for high-speed internet access in both urban and rural areas. Federal initiatives aimed at bridging the digital divide, such as the "Internet for All" program, directly translate into increased demand for Fiber Optic Cables.

Key drivers for the United States' leadership include:

- Massive Infrastructure Spending: Significant government and private sector investments in upgrading power grids, expanding broadband networks, and modernizing transportation systems directly benefit the wire and cable industry.

- Technological Hub: The presence of leading technology companies and a robust research and development ecosystem fosters innovation and accelerates the adoption of cutting-edge wire and cable solutions.

- Regulatory Support for Broadband Expansion: Policies and funding mechanisms designed to promote universal broadband access create a favorable environment for the deployment of fiber optic infrastructure.

- Growth in Renewable Energy: The burgeoning solar and wind power sectors require extensive cabling for energy transmission and distribution, further bolstering demand for Power Cables.

- Electric Vehicle (EV) Infrastructure Development: The rapid growth of the EV market necessitates the deployment of charging stations, which in turn requires specialized high-voltage cables.

The Fiber Optic Cable segment, in particular, is experiencing exceptional growth due to these factors. The demand for higher bandwidth to support data-intensive applications, cloud computing, and the Internet of Things (IoT) is pushing the adoption of fiber optics over traditional copper solutions. Additionally, the Power Cable segment continues to be a cornerstone of the market, with ongoing grid modernization projects and the increasing integration of distributed energy resources requiring reliable and efficient power transmission solutions. The Construction (Residential and Commercial) sector also remains a significant contributor, with new construction and renovation projects demanding a wide range of electrical and telecommunication cabling. The synergy between these key segments and the proactive policy environment in the United States positions it as the undisputed leader in the North American Wire and Cable Market.

North America Wire And Cable Market Product Innovations

Product innovations in the North America Wire and Cable Market are revolutionizing connectivity and power delivery. Manufacturers are focusing on developing cables with enhanced performance metrics, such as higher data transmission speeds for Fiber Optic Cables, improved thermal management for high-power applications, and increased durability for harsh environmental conditions. Innovations in Signal and Control Cable technology are enabling greater automation and efficiency in industrial settings. Specific advancements include the development of ultra-low loss fiber optic cables for extended reach communication and fire-retardant, halogen-free cables to meet stringent safety regulations. The unique selling proposition of these new products lies in their ability to support the ever-increasing bandwidth demands of modern applications, reduce signal degradation, and ensure reliable performance in demanding operational environments.

Propelling Factors for North America Wire And Cable Market Growth

Several key factors are propelling the growth of the North America Wire and Cable Market. The relentless expansion of the Telecommunications (IT and Telecom) sector, driven by 5G deployment and the demand for high-speed internet, is a primary catalyst, necessitating massive investments in Fiber Optic Cables. The ongoing Construction (Residential and Commercial) boom, coupled with significant infrastructure upgrades in the power sector, is fueling demand for Power Cables and Low Voltage Energy cables. Furthermore, government initiatives promoting digitalization and smart city development are creating new avenues for market expansion. The increasing adoption of electric vehicles (EVs) is also a significant growth driver, spurring demand for specialized high-voltage cables and charging infrastructure solutions.

Obstacles in the North America Wire And Cable Market Market

Despite robust growth, the North America Wire and Cable Market faces several obstacles. Fluctuations in raw material prices, particularly copper and aluminum, can impact profit margins and lead to price volatility. Stringent regulatory compliance and the need for continuous investment in advanced manufacturing technologies represent significant capital barriers. Supply chain disruptions, exacerbated by geopolitical events and logistical challenges, can hinder timely delivery and increase operational costs. Intense competition among a large number of manufacturers, including established global players and emerging regional suppliers, can also lead to pricing pressures, particularly in the Other cable types segment.

Future Opportunities in North America Wire And Cable Market

The North America Wire and Cable Market is poised for significant future opportunities. The continued expansion of 5G networks and the burgeoning IoT ecosystem will drive sustained demand for high-performance Fiber Optic Cables. The increasing focus on renewable energy integration, including the development of smart grids and energy storage solutions, presents substantial growth potential for advanced Power Cables. The accelerating adoption of electric vehicles and the associated charging infrastructure development will create new markets for specialized cabling. Emerging opportunities also lie in the development of smart cables with embedded sensor technologies for real-time monitoring and data acquisition, as well as in the growing demand for sustainable and recyclable cable solutions.

Major Players in the North America Wire And Cable Market Ecosystem

- Micro-tek Corporation

- CommScope Holding Company Inc

- New England Wire Technologies

- Furukawa Electric Co Ltd

- Lapp Tannehill

- Prysmian Group

- Aba Industry Inc (Wonderful Hi-tech company)

- Encore Wire

- EIS Wire and Cable

- Daburn Electronics & Cable and Polytron Devices

- Dacon Systems Inc

- Fujikura Ltd

- TE Connectivity

- Southwire Company LLC

- Amphenol Corporation

- Leoni AG

- Belden Incorporated

- American Wire Group

- Coherent Corporatio

- Corning Incorporated

- Amercable Incorporated (Nexans)

Key Developments in North America Wire And Cable Market Industry

- July 2023: CommScope announced plans to invest USD 60.3 million to expand its fiber cable manufacturing in North Carolina. Through this facility, the aim was to meet US supply demands driven by federal initiatives to bring 'Internet for All' to underserved and rural broadband markets. This development is critical for bolstering the supply of essential Fiber Optic Cables and supporting national broadband expansion goals.

- August 2023: Southwire Company LLC announced a strategic partnership with the University of West Georgia (UWG) to elevate sustainability initiatives. Through this collaboration, both organizations aim to create a more sustainable and prosperous future not only for Southwire and UWG but for the entire region. The company strives to ensure that every product it develops helps improve productivity, increase safety, save time, reduce manpower, and save money - both on and off the job site. This initiative highlights a growing trend towards sustainable manufacturing practices and a focus on ESG (Environmental, Social, and Governance) principles within the industry, impacting the development of eco-friendly Power Cables and other wire products.

Strategic North America Wire And Cable Market Market Forecast

The strategic forecast for the North America Wire and Cable Market is exceptionally positive, driven by a confluence of technological advancements, robust infrastructure investment, and supportive government policies. The ongoing digital transformation, coupled with the widespread adoption of 5G and the expansion of cloud computing, will continue to fuel demand for high-capacity Fiber Optic Cables. The transition to renewable energy sources and the electrification of transportation will create sustained growth opportunities for Power Cables and specialized EV charging infrastructure solutions. Emerging markets like smart grids, industrial automation, and the Internet of Things (IoT) will further diversify the demand landscape. Continuous innovation in cable materials and manufacturing processes, focusing on enhanced performance, durability, and sustainability, will be key to capitalizing on future market potential. The market is projected to experience a CAGR of approximately 6.8% from 2025 to 2033, reaching an estimated value exceeding USD 80 Billion by the end of the forecast period.

North America Wire And Cable Market Segmentation

-

1. Cable Type

- 1.1. Low Voltage Energy

- 1.2. Power Cable

- 1.3. Fiber Optic Cable

- 1.4. Signal and Control Cable

- 1.5. Other

-

2. End-user Industry

- 2.1. Construction (Residential and Commercial)

- 2.2. Telecommunications (IT and Telecom)

- 2.3. Power In

- 2.4. Other

North America Wire And Cable Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

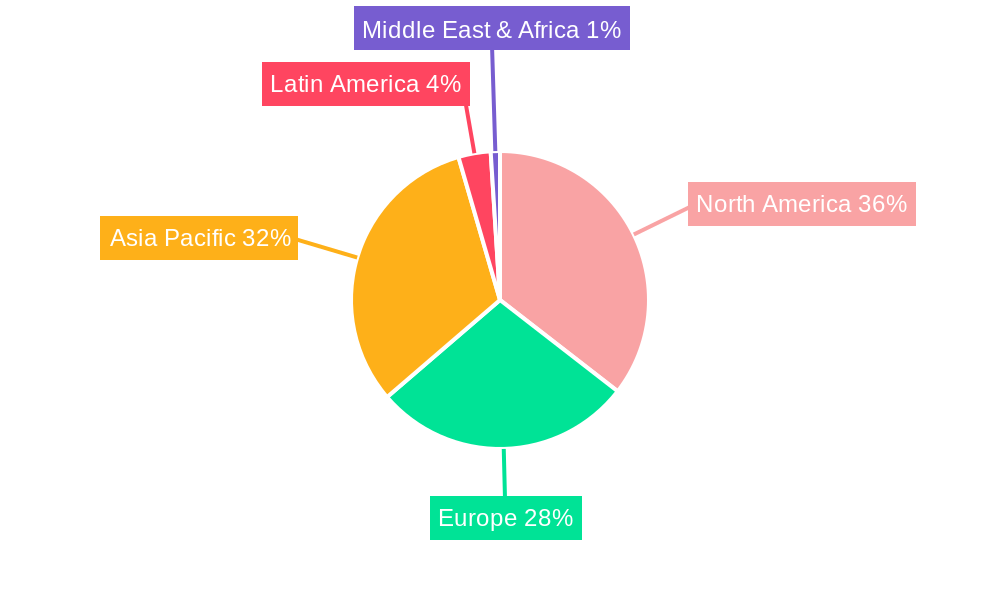

North America Wire And Cable Market Regional Market Share

Geographic Coverage of North America Wire And Cable Market

North America Wire And Cable Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Investments in Infrastructure; Deployment of Smart Grid Infrastructure

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation and Associated Complexities

- 3.4. Market Trends

- 3.4.1. Construction Industry to be the Largest End User

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Wire And Cable Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Cable Type

- 5.1.1. Low Voltage Energy

- 5.1.2. Power Cable

- 5.1.3. Fiber Optic Cable

- 5.1.4. Signal and Control Cable

- 5.1.5. Other

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Construction (Residential and Commercial)

- 5.2.2. Telecommunications (IT and Telecom)

- 5.2.3. Power In

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Cable Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Micro-tek Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CommScope Holding Company Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 New England Wire Technologies

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Furukawa Electric Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lapp Tannehill

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Prysmian Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Aba Industry Inc (Wonderful Hi-tech company)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Encore Wire

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 EIS Wire and Cable

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Daburn Electronics & Cable and Polytron Devices

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Dacon Systems Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Fujikura Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 TE Connectivity

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Southwire Company LLC

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Amphenol Corporation

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Leoni AG

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Belden Incorporated

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 American Wire Group

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Coherent Corporatio

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Corning Incorporated

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 Amercable Incorporated (Nexans)

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.1 Micro-tek Corporation

List of Figures

- Figure 1: North America Wire And Cable Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Wire And Cable Market Share (%) by Company 2025

List of Tables

- Table 1: North America Wire And Cable Market Revenue undefined Forecast, by Cable Type 2020 & 2033

- Table 2: North America Wire And Cable Market Volume K Unit Forecast, by Cable Type 2020 & 2033

- Table 3: North America Wire And Cable Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: North America Wire And Cable Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 5: North America Wire And Cable Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: North America Wire And Cable Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: North America Wire And Cable Market Revenue undefined Forecast, by Cable Type 2020 & 2033

- Table 8: North America Wire And Cable Market Volume K Unit Forecast, by Cable Type 2020 & 2033

- Table 9: North America Wire And Cable Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 10: North America Wire And Cable Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 11: North America Wire And Cable Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: North America Wire And Cable Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States North America Wire And Cable Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States North America Wire And Cable Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada North America Wire And Cable Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Wire And Cable Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Wire And Cable Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico North America Wire And Cable Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Wire And Cable Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the North America Wire And Cable Market?

Key companies in the market include Micro-tek Corporation, CommScope Holding Company Inc, New England Wire Technologies, Furukawa Electric Co Ltd, Lapp Tannehill, Prysmian Group, Aba Industry Inc (Wonderful Hi-tech company), Encore Wire, EIS Wire and Cable, Daburn Electronics & Cable and Polytron Devices, Dacon Systems Inc, Fujikura Ltd, TE Connectivity, Southwire Company LLC, Amphenol Corporation, Leoni AG, Belden Incorporated, American Wire Group, Coherent Corporatio, Corning Incorporated, Amercable Incorporated (Nexans).

3. What are the main segments of the North America Wire And Cable Market?

The market segments include Cable Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Investments in Infrastructure; Deployment of Smart Grid Infrastructure.

6. What are the notable trends driving market growth?

Construction Industry to be the Largest End User.

7. Are there any restraints impacting market growth?

High Cost of Installation and Associated Complexities.

8. Can you provide examples of recent developments in the market?

July 2023 - CommScope announced plans to invest USD 60.3 million to expand its fiber cable manufacturing in North Carolina. Through this facility, the aim was to meet US supply demands driven by federal initiatives to bring 'Internet for All' to underserved and rural broadband markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Wire And Cable Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Wire And Cable Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Wire And Cable Market?

To stay informed about further developments, trends, and reports in the North America Wire And Cable Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence