Key Insights

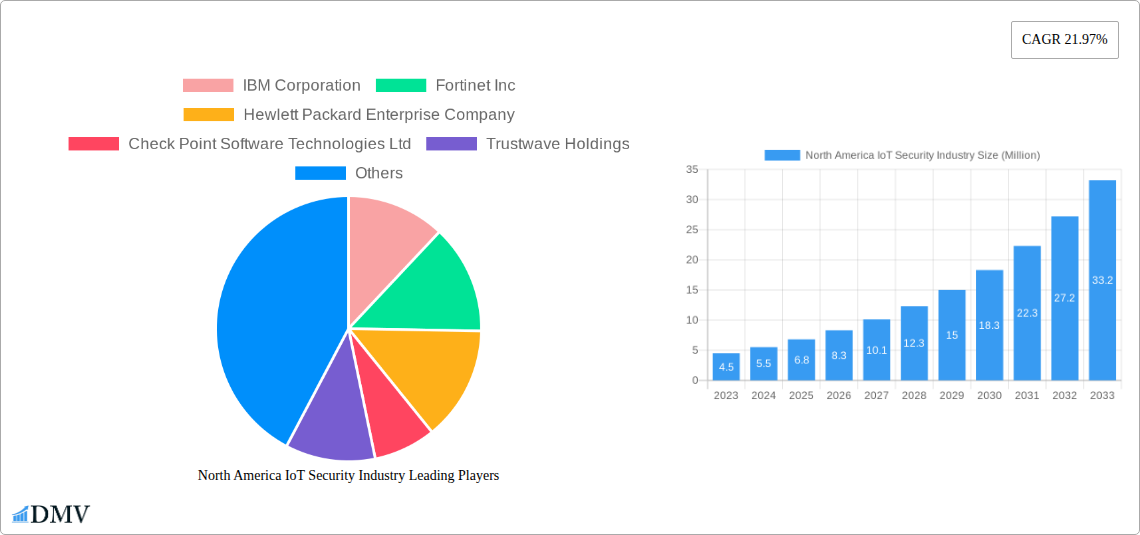

The North America Internet of Things (IoT) Security market is poised for significant expansion, projected to reach a substantial value of $9.79 billion. This impressive growth is fueled by an exceptional Compound Annual Growth Rate (CAGR) of 21.97%, indicating a dynamic and rapidly evolving landscape. Key drivers propelling this surge include the escalating adoption of IoT devices across diverse sectors, coupled with the increasing sophistication of cyber threats targeting these connected systems. Organizations are recognizing the critical need to safeguard sensitive data and operational integrity as the number of connected devices proliferates. This heightened awareness is driving demand for robust IoT security solutions and services, encompassing network and endpoint security measures designed to protect against vulnerabilities. The market's robust growth is further supported by ongoing technological advancements, such as AI-powered threat detection and blockchain for secure data management, which are enhancing the efficacy of existing security frameworks.

North America IoT Security Industry Market Size (In Million)

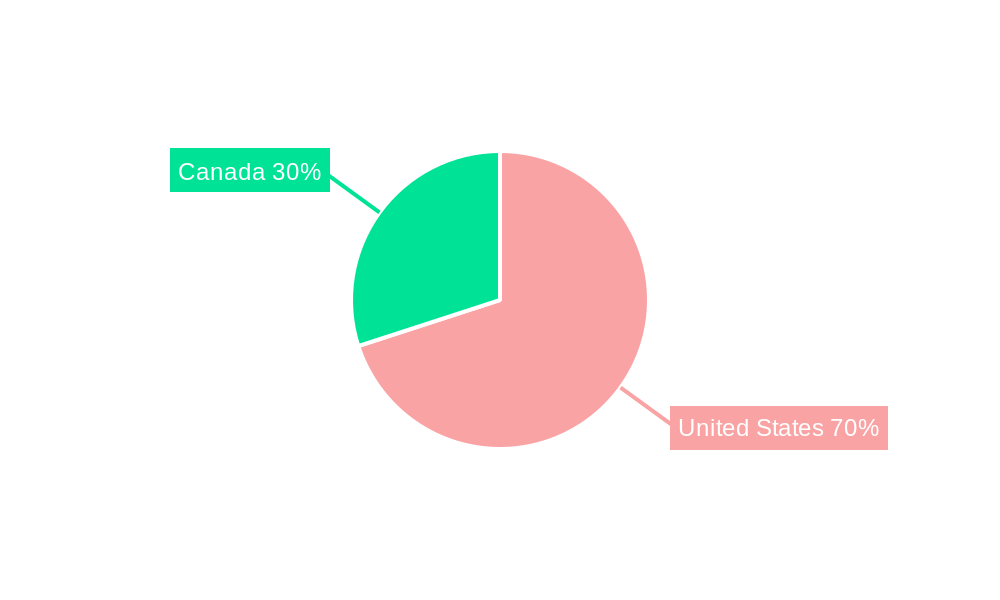

The market's trajectory is further shaped by key trends, including the growing emphasis on device lifecycle management and the implementation of zero-trust security models for IoT environments. The expanding use of IoT in critical infrastructure sectors like energy and power, government, and healthcare underscores the imperative for advanced security protocols to prevent disruptions and ensure public safety. While the market demonstrates immense promise, potential restraints such as the complexity of securing legacy IoT systems and the shortage of skilled cybersecurity professionals could pose challenges. However, the overall outlook remains overwhelmingly positive, with substantial opportunities anticipated across various end-user industries including Automotive, Manufacturing, and BFSI. The United States and Canada, as key geographical regions, are expected to be major contributors to this market's robust growth, driven by significant investments in digital transformation and smart technologies.

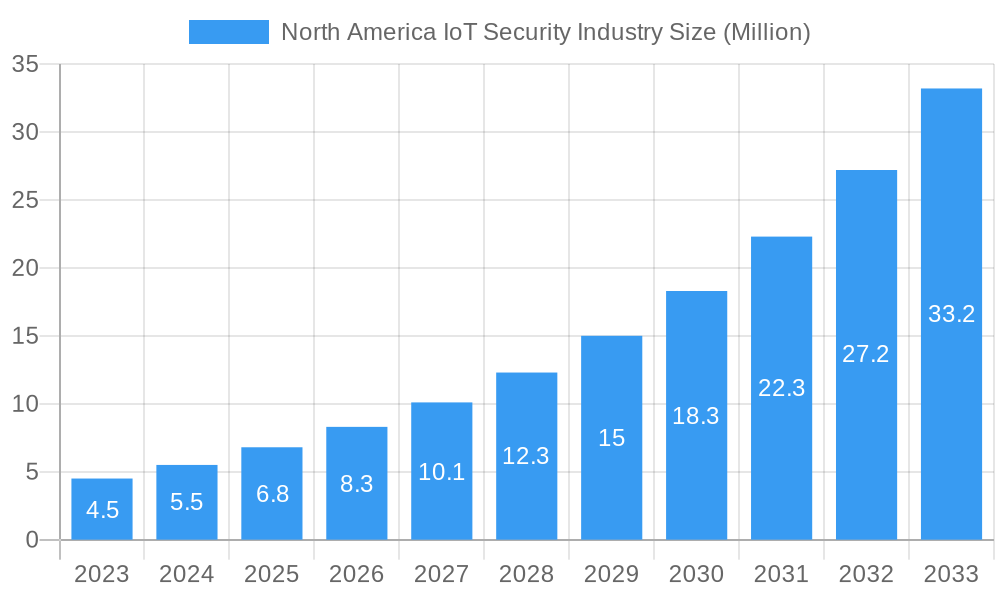

North America IoT Security Industry Company Market Share

This comprehensive report offers an in-depth analysis of the North America IoT Security Industry, exploring its current composition, future trajectory, and key drivers. Covering the study period of 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, this report delves into the intricate market dynamics shaped by evolving threats and technological advancements. We provide granular insights into segments like Network Security and End-point Security, solutions spanning Software and Services, and the diverse End-user Industries including Automotive, Healthcare, Government, Manufacturing, Energy and Power, Retail, and BFSI. Discover how leading companies such as IBM Corporation, Fortinet Inc, and Cisco Systems Inc are navigating this rapidly expanding IoT security market.

North America IoT Security Industry Market Composition & Trends

The North America IoT Security Industry is characterized by a moderate market concentration, with key players like IBM Corporation, Fortinet Inc, and Hewlett Packard Enterprise Company holding significant shares. Innovation catalysts are primarily driven by the escalating sophistication of cyber threats targeting interconnected devices and the increasing adoption of IoT across various sectors. Regulatory landscapes are evolving, with a growing emphasis on data privacy and security standards, influencing investment decisions and product development. While substitute products exist in broader cybersecurity domains, specialized IoT security solutions are gaining prominence. End-user profiles are increasingly sophisticated, demanding robust, scalable, and cost-effective security measures. Mergers and acquisitions (M&A) activities, with estimated deal values in the hundreds of millions to over a billion dollars, are shaping the competitive landscape, enabling companies to expand their portfolios and market reach. The market share distribution within the Network Security and End-point Security segments is dynamic, reflecting ongoing technological advancements and strategic partnerships.

North America IoT Security Industry Industry Evolution

The North America IoT Security Industry has witnessed a transformative evolution throughout the historical period of 2019–2024 and is poised for substantial growth in the forecast period of 2025–2033. Market growth trajectories have been consistently upward, fueled by the exponential proliferation of Internet of Things (IoT) devices across industries, ranging from industrial automation to smart homes. This surge in connected devices has, in turn, created a more expansive attack surface, necessitating robust and adaptive security measures. Technological advancements have played a pivotal role in this evolution. Early IoT security solutions often relied on traditional IT security paradigms, which proved insufficient for the unique challenges posed by IoT, such as device heterogeneity, resource constraints, and distributed architectures. The industry has since seen the emergence of specialized IoT security platforms and services, incorporating features like device authentication, data encryption, behavioral analytics, and vulnerability management. Shifting consumer demands, particularly a heightened awareness of data privacy and security breaches, have further accelerated the adoption of advanced IoT security solutions. Governments are also playing an increasingly active role through policy initiatives and mandates, further driving the market. Adoption metrics for IoT security solutions have shown a significant upward trend, with a projected compound annual growth rate (CAGR) in the high double digits during the forecast period. This growth is underpinned by substantial investments in R&D by leading companies and increasing market penetration in sectors like Healthcare and Manufacturing, where the stakes of security breaches are exceptionally high. The shift towards cloud-based IoT security services is another key trend, offering scalability and cost-efficiency.

Leading Regions, Countries, or Segments in North America IoT Security Industry

The United States stands as the dominant force within the North America IoT Security Industry, driven by its robust technological infrastructure, significant investments in R&D, and a thriving ecosystem of tech companies and startups. This dominance is further amplified by strong government initiatives aimed at bolstering cybersecurity defenses for critical infrastructure and burgeoning smart city projects. Canada also represents a significant market, with increasing adoption of IoT in its manufacturing and energy sectors, supported by government incentives for digital transformation.

Key Drivers for Dominance:

United States:

- High Investment Trends: Significant venture capital funding and corporate R&D expenditure exceeding hundreds of millions annually, particularly in cybersecurity innovation.

- Regulatory Support: Proactive government policies and cybersecurity frameworks encouraging the adoption of secure IoT practices.

- Large-Scale IoT Deployments: Widespread implementation of IoT in sectors like Healthcare, Manufacturing, Energy and Power, and Government creates a constant demand for advanced security solutions.

- Technological Hubs: Presence of leading technology companies and research institutions fostering innovation.

Canada:

- Growing IoT Adoption: Increasing deployment of IoT in sectors like Manufacturing and Energy and Power, leading to a demand for associated security.

- Government Support: Initiatives to promote digitalization and cybersecurity in businesses.

Dominant Segments:

- Type of Security: Network Security remains a critical segment due to the vast interconnectedness of IoT devices, with a projected market size in the billions of dollars. End-point Security is rapidly gaining traction as the number of individual IoT devices escalates, demanding specialized protection.

- Solution: Software-based solutions are leading, offering advanced analytics, threat detection, and policy management. Services, including managed security services and consulting, are also experiencing substantial growth, projected to reach billions of dollars in revenue.

- End-user Industry: The Manufacturing sector exhibits the highest adoption rate due to the rise of Industry 4.0 and smart factories, followed closely by Healthcare (for patient monitoring and medical device security) and Government (for critical infrastructure protection). The Automotive industry is also a significant contributor with the increasing prevalence of connected vehicles.

North America IoT Security Industry Product Innovations

Product innovations in the North America IoT Security Industry are centered on developing proactive and intelligent defense mechanisms. Key advancements include AI-powered threat detection platforms that can identify zero-day exploits and anomalous device behavior in real-time, offering unparalleled protection for Network Security and End-point Security. Furthermore, there's a growing focus on secure-by-design principles in IoT device manufacturing and the development of lightweight, efficient encryption algorithms suitable for resource-constrained IoT devices. Companies are also introducing integrated software suites that offer comprehensive security management across diverse IoT ecosystems, from edge devices to cloud platforms, with a significant portion of the market value in the billions of dollars.

Propelling Factors for North America IoT Security Industry Growth

The North America IoT Security Industry's growth is propelled by a confluence of factors. The exponential increase in IoT device deployment across all sectors creates a vast and lucrative market for security solutions, with projected market growth in the tens of billions of dollars. The escalating sophistication and frequency of cyberattacks specifically targeting IoT infrastructure necessitate advanced protective measures. Government mandates and regulations aimed at enhancing cybersecurity for critical infrastructure and sensitive data are further driving adoption. Moreover, the growing awareness among businesses and consumers about the potential consequences of IoT security breaches, including financial losses and reputational damage, is a significant catalyst. Technological advancements, such as AI and machine learning in threat detection and blockchain for secure data management, are also fueling innovation and market expansion.

Obstacles in the North America IoT Security Industry Market

Despite robust growth, the North America IoT Security Industry faces several obstacles. The sheer diversity and heterogeneity of IoT devices present a significant challenge for standardization and comprehensive security management. The lack of skilled cybersecurity professionals with specialized IoT security expertise creates a talent gap, hindering effective deployment and maintenance of security solutions. Furthermore, the cost of implementing advanced security measures can be a barrier for smaller businesses and less mature IoT deployments. Supply chain disruptions can impact the availability of critical security hardware and software components. Finally, regulatory fragmentation across different jurisdictions can create compliance complexities for businesses operating in multiple regions.

Future Opportunities in North America IoT Security Industry

Emerging opportunities within the North America IoT Security Industry are vast and evolving. The expansion of 5G networks promises to enable a new wave of high-bandwidth, low-latency IoT applications, creating a parallel demand for enhanced security measures. The growing adoption of AI in various industries will lead to more sophisticated IoT deployments that require advanced security analytics and proactive threat mitigation strategies. The increasing focus on edge computing for real-time data processing presents opportunities for developing specialized edge security solutions. Furthermore, the development of secure IoT platforms and frameworks for emerging sectors like autonomous vehicles and smart grids offers significant growth potential. The demand for managed IoT security services is also expected to surge, as organizations seek expert assistance in navigating complex security landscapes.

Major Players in the North America IoT Security Industry Ecosystem

- IBM Corporation

- Fortinet Inc

- Hewlett Packard Enterprise Company

- Check Point Software Technologies Ltd

- Trustwave Holdings

- Cisco Systems Inc

- Symantec Corporation

- AT&T Inc

- Palo Alto Networks Inc

- Intel Corporation

Key Developments in North America IoT Security Industry Industry

- January 2023: KORE, a leading provider of Internet of Things (IoT) solutions and worldwide IoT connectivity-as-a-service (CaaS), chose Amazon Web Services (AWS) to streamline the deployment, management, and security of large-scale IoT solutions. KORE has introduced its OmniSIM SAFE solution, powered by AWS IoT Core, to address security challenges associated with Massive IoT and large-scale IoT deployments. This development highlights the increasing importance of cloud infrastructure in securing vast IoT ecosystems.

- February 2022: Check Point Software Technologies Ltd., a global leader in cybersecurity solutions, announced the acquisition of Spectral, a prominent innovator in developer-centric security tools. This strategic move by Check Point expands its cloud offering, Check Point CloudGuard, with a developer-focused security platform, providing a comprehensive suite of cloud application security features, including Infrastructure as Code (IaC) scanning and detection of hardcoded secrets. This acquisition signifies the growing trend of integrating security earlier in the development lifecycle for cloud-native IoT applications.

Strategic North America IoT Security Industry Market Forecast

The North America IoT Security Industry is projected for sustained and robust growth, driven by the escalating interconnectedness of devices and the increasing sophistication of cyber threats. The forecast period of 2025–2033 is expected to see significant expansion, with market revenue reaching tens of billions of dollars. Key growth catalysts include the widespread adoption of 5G technology, enabling new and more complex IoT deployments, and the continuous innovation in AI-powered security solutions that offer proactive threat detection and mitigation. The increasing regulatory focus on data privacy and security will further incentivize businesses to invest in comprehensive IoT security strategies. Emerging opportunities in sectors like autonomous transportation and advanced healthcare monitoring will also contribute to market expansion, creating a highly dynamic and opportunity-rich landscape for security providers.

North America IoT Security Industry Segmentation

-

1. Type of Security

- 1.1. Network Security

- 1.2. End-point Security

-

2. Solution

- 2.1. Software

- 2.2. Services

-

3. End-user Industry

- 3.1. Automotive

- 3.2. Healthcare

- 3.3. Government

- 3.4. Manufacturing

- 3.5. Energy and Power

- 3.6. Retail

- 3.7. BFSI

- 3.8. Others End-user Industries

-

4. Geography

- 4.1. United States

- 4.2. Canada

North America IoT Security Industry Segmentation By Geography

- 1. United States

- 2. Canada

North America IoT Security Industry Regional Market Share

Geographic Coverage of North America IoT Security Industry

North America IoT Security Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Data Breaches; Emergence of Smart Cities

- 3.3. Market Restrains

- 3.3.1 Growing Complexity among Devices

- 3.3.2 coupled with the Lack of Ubiquitous Legislation

- 3.4. Market Trends

- 3.4.1. Increasing Number of Data Breaches is Anticipated to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America IoT Security Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Security

- 5.1.1. Network Security

- 5.1.2. End-point Security

- 5.2. Market Analysis, Insights and Forecast - by Solution

- 5.2.1. Software

- 5.2.2. Services

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive

- 5.3.2. Healthcare

- 5.3.3. Government

- 5.3.4. Manufacturing

- 5.3.5. Energy and Power

- 5.3.6. Retail

- 5.3.7. BFSI

- 5.3.8. Others End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type of Security

- 6. United States North America IoT Security Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Security

- 6.1.1. Network Security

- 6.1.2. End-point Security

- 6.2. Market Analysis, Insights and Forecast - by Solution

- 6.2.1. Software

- 6.2.2. Services

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Automotive

- 6.3.2. Healthcare

- 6.3.3. Government

- 6.3.4. Manufacturing

- 6.3.5. Energy and Power

- 6.3.6. Retail

- 6.3.7. BFSI

- 6.3.8. Others End-user Industries

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Type of Security

- 7. Canada North America IoT Security Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Security

- 7.1.1. Network Security

- 7.1.2. End-point Security

- 7.2. Market Analysis, Insights and Forecast - by Solution

- 7.2.1. Software

- 7.2.2. Services

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Automotive

- 7.3.2. Healthcare

- 7.3.3. Government

- 7.3.4. Manufacturing

- 7.3.5. Energy and Power

- 7.3.6. Retail

- 7.3.7. BFSI

- 7.3.8. Others End-user Industries

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Type of Security

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 IBM Corporation

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Fortinet Inc

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Hewlett Packard Enterprise Company

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Check Point Software Technologies Ltd

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Trustwave Holdings

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Cisco Systems Inc

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Symantec Corporation

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 AT&T Inc

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Palo Alto Networks Inc

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Intel Corporation

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.1 IBM Corporation

List of Figures

- Figure 1: North America IoT Security Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America IoT Security Industry Share (%) by Company 2025

List of Tables

- Table 1: North America IoT Security Industry Revenue Million Forecast, by Type of Security 2020 & 2033

- Table 2: North America IoT Security Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 3: North America IoT Security Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: North America IoT Security Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: North America IoT Security Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America IoT Security Industry Revenue Million Forecast, by Type of Security 2020 & 2033

- Table 7: North America IoT Security Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 8: North America IoT Security Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: North America IoT Security Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: North America IoT Security Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: North America IoT Security Industry Revenue Million Forecast, by Type of Security 2020 & 2033

- Table 12: North America IoT Security Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 13: North America IoT Security Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: North America IoT Security Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: North America IoT Security Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America IoT Security Industry?

The projected CAGR is approximately 21.97%.

2. Which companies are prominent players in the North America IoT Security Industry?

Key companies in the market include IBM Corporation, Fortinet Inc, Hewlett Packard Enterprise Company, Check Point Software Technologies Ltd, Trustwave Holdings, Cisco Systems Inc, Symantec Corporation, AT&T Inc, Palo Alto Networks Inc, Intel Corporation.

3. What are the main segments of the North America IoT Security Industry?

The market segments include Type of Security, Solution, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Data Breaches; Emergence of Smart Cities.

6. What are the notable trends driving market growth?

Increasing Number of Data Breaches is Anticipated to Drive the Market.

7. Are there any restraints impacting market growth?

Growing Complexity among Devices. coupled with the Lack of Ubiquitous Legislation.

8. Can you provide examples of recent developments in the market?

January 2023: KORE, a leading provider of Internet of Things (IoT) solutions and worldwide IoT connectivity-as-a-service (CaaS), chose Amazon Web Services (AWS) to streamline the deployment, management, and security of large-scale IoT solutions. KORE has introduced its OmniSIM SAFE solution, powered by AWS IoT Core, to address security challenges associated with Massive IoT and large-scale IoT deployments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America IoT Security Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America IoT Security Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America IoT Security Industry?

To stay informed about further developments, trends, and reports in the North America IoT Security Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence